Market Overview:

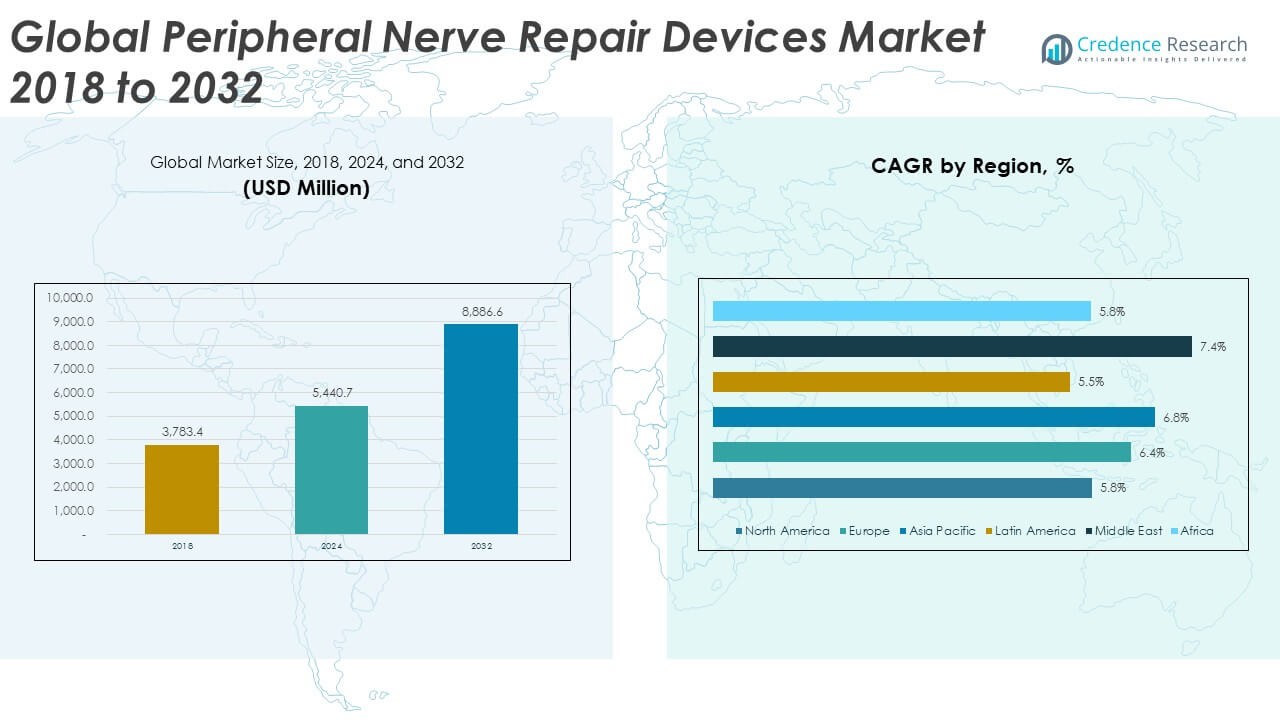

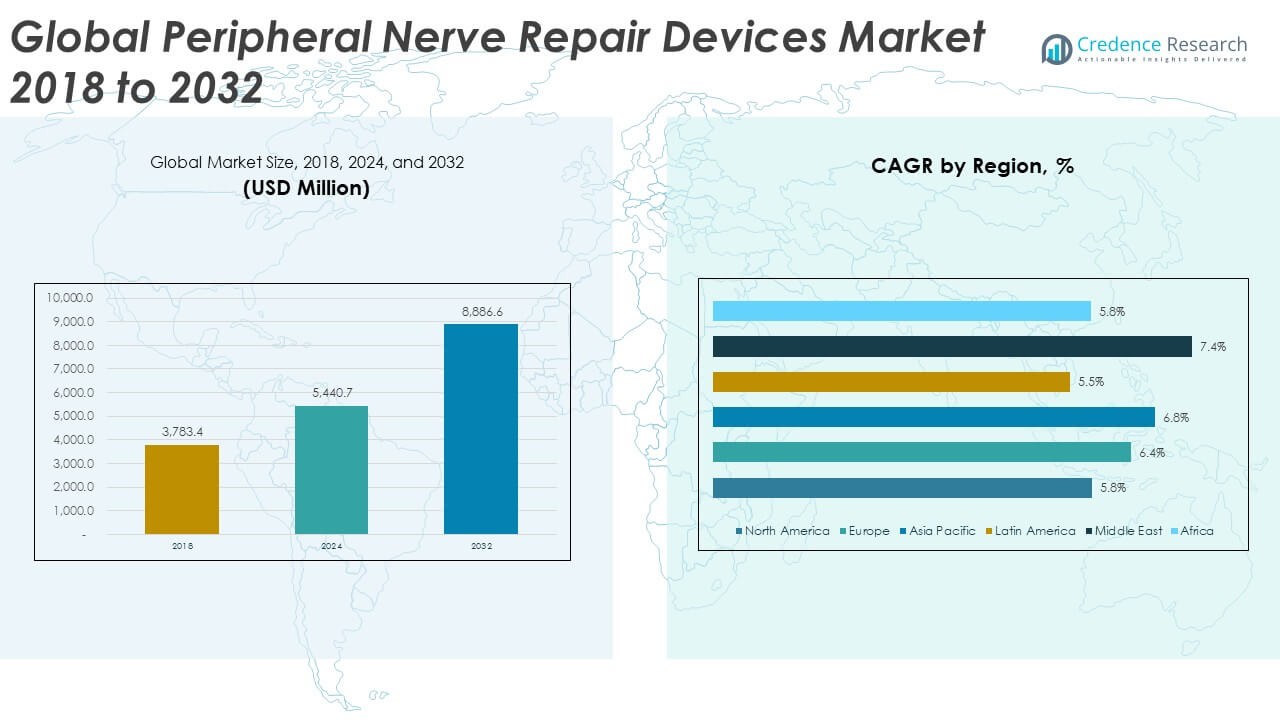

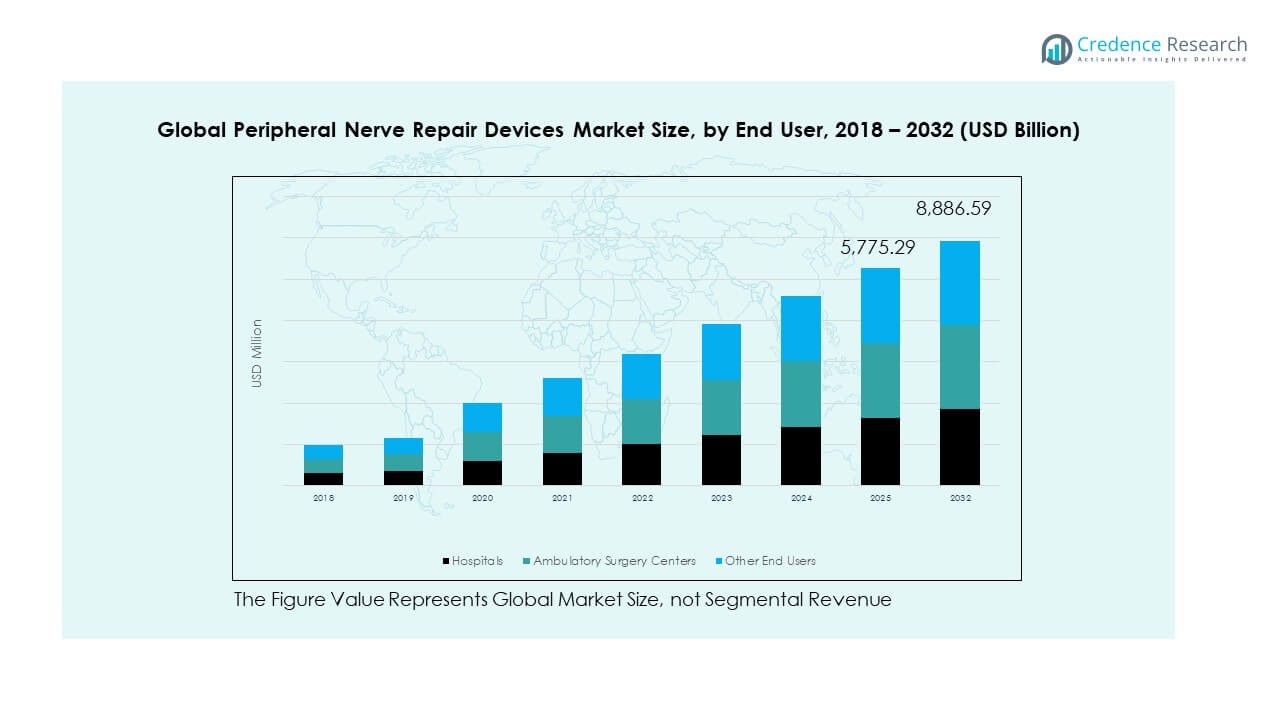

The Global Peripheral Nerve Repair Devices Market size was valued at USD 3,783.4 million in 2018 to USD 5,440.7 million in 2024 and is anticipated to reach USD 8,886.6 million by 2032, at a CAGR of 6.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Peripheral Nerve Repair Devices Market Size 2024 |

USD 5,440.7 Million |

| Peripheral Nerve Repair Devices Market, CAGR |

6.35% |

| Peripheral Nerve Repair Devices Market Size 2032 |

USD 8,886.6 Million |

Growth in this market is driven by rising incidences of nerve injuries caused by trauma, surgeries, and chronic diseases such as diabetes. Increasing adoption of bioengineered nerve grafts and advanced conduits enhances the success rate of nerve regeneration procedures. Technological advancements in microsurgery, growing awareness among healthcare professionals, and expanding access to reconstructive procedures also support market growth. Continuous innovation in biomaterials and the growing preference for minimally invasive techniques further accelerate demand.

North America dominates the market due to strong healthcare infrastructure and significant research funding in nerve regeneration. Europe follows with increasing adoption of advanced surgical techniques and strong presence of medical device manufacturers. Asia Pacific is an emerging region, driven by improving healthcare systems, rising patient awareness, and higher investments in healthcare innovation. Latin America and the Middle East & Africa are showing gradual growth with expanding access to modern treatment facilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Peripheral Nerve Repair Devices Market was valued at USD 3,783.4 million in 2018, reached USD 5,440.7 million in 2024, and is projected to reach USD 8,886.6 million by 2032, expanding at a CAGR of 6.35%.

- Europe leads with a 27% share, driven by strong R&D activity and well-established surgical expertise, followed by Asia Pacific at 30%, supported by healthcare advancements, and North America at 24%, benefiting from high technology adoption and robust reimbursement frameworks.

- Asia Pacific is the fastest-growing region with a CAGR of 6.8%, fueled by rising healthcare investments, expanding surgical capabilities, and increasing adoption of regenerative medical technologies across China, Japan, and India.

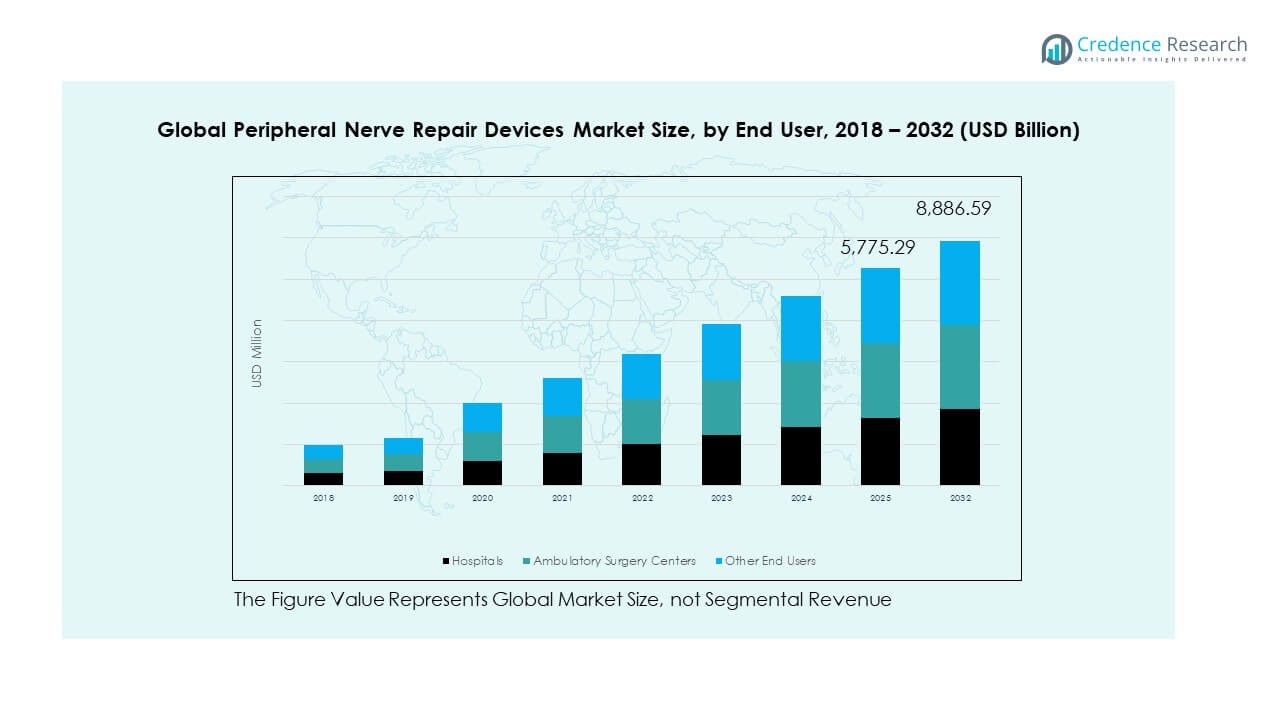

- Hospitals account for approximately 55% of the market share, attributed to advanced infrastructure, skilled professionals, and high surgical volumes for trauma and reconstructive procedures.

- Ambulatory Surgery Centers represent around 30% of the share, supported by growing demand for cost-effective outpatient surgeries and improved recovery outcomes, while other end users hold the remaining 15%.

Market Drivers:

Rising Incidence of Traumatic Nerve Injuries

Growing road accidents, sports injuries, and surgical complications are increasing peripheral nerve damage cases globally. The Global Peripheral Nerve Repair Devices Market is driven by rising patient demand for faster recovery and better surgical outcomes. Surgeons are adopting bioengineered conduits and grafts to enhance nerve regeneration and reduce long-term disability. Higher prevalence of chronic diseases such as diabetes also contributes to nerve injuries requiring repair. Hospitals are investing in advanced nerve repair systems to improve treatment success rates. It is gaining attention in trauma centers focusing on reconstructive surgery. Research funding for neuroregenerative medicine continues to increase, supporting market growth. The growing burden of peripheral neuropathies strengthens the need for innovative repair devices.

- For instance, Axogen’s Avance Nerve Graft demonstrates a clinically verified 82% meaningful sensory and motor recovery rate in nerve gaps up to 70 mm according to multicenter registry studies and company product data.

Advancements in Biomaterials and Regenerative Technologies

Innovations in biomaterials are improving the design and performance of nerve repair devices. Biodegradable polymers and collagen-based scaffolds are becoming popular for their compatibility and regenerative potential. The Global Peripheral Nerve Repair Devices Market benefits from continuous R&D in tissue engineering and 3D printing. Medical device manufacturers are developing bioresorbable conduits that mimic natural nerve tissue. Surgeons prefer these materials due to reduced risk of immune response and improved healing outcomes. It is witnessing collaborations between biotech firms and academic institutes to develop synthetic grafts with growth factors. Enhanced material flexibility and biocompatibility are improving surgical efficiency. Adoption of nanotechnology in nerve repair design is also expanding clinical possibilities.

- For instance, Integra LifeSciences’ NeuraGen 3D Nerve Guide, launched March 2022, is a resorbable collagen tube with a proprietary inner matrix, clinically shown to match reversed autograft outcomes for nerve fiber density and myelinated axon count in independent animal and early human studies, supporting advanced material regeneration.

Growing Geriatric Population and Nerve-Related Disorders

The aging population is more prone to degenerative nerve conditions, neuropathies, and delayed healing. The Global Peripheral Nerve Repair Devices Market is expanding due to higher surgical needs among elderly patients. Increasing awareness about functional recovery and improved quality of life encourages earlier treatment. Hospitals and rehabilitation centers are upgrading surgical tools to support precision-based procedures. It benefits from the rising adoption of microsurgical devices suitable for delicate nerve reconstruction. Aging-related diseases such as Parkinson’s and diabetic neuropathy are boosting demand for nerve conduits. Government healthcare reforms are supporting accessibility to advanced treatments. The elderly population’s growing preference for minimally invasive recovery solutions enhances the market outlook.

Increased Clinical Success Rates and Surgeon Awareness

Improved clinical outcomes and higher success rates in nerve repair surgeries are building confidence among surgeons. The Global Peripheral Nerve Repair Devices Market benefits from structured medical training and workshops that expand expertise in microsurgical methods. Hospitals are establishing specialized units for peripheral nerve repair and regeneration. It is also supported by advancements in imaging and diagnostics that help surgeons achieve accurate nerve alignment. Rising awareness among patients about treatment benefits is driving higher adoption rates. Companies are sponsoring clinical studies to validate the long-term efficacy of bioengineered grafts. Medical conferences and symposiums continue to promote innovation in neurorepair. The focus on evidence-based outcomes is reinforcing trust in modern nerve repair devices.

Market Trends:

Integration of 3D Printing and Tissue Engineering

The convergence of 3D printing and regenerative medicine is transforming nerve repair solutions. The Global Peripheral Nerve Repair Devices Market is seeing greater adoption of customizable grafts and conduits made using 3D printing technologies. These products improve precision and patient-specific treatment outcomes. Hospitals are using bio-printed nerve guides that replicate natural tissue architecture. It helps in enhancing regeneration speed and reducing surgical complications. Start-ups are investing in tissue scaffolds embedded with cellular materials to boost nerve healing. R&D in bioprinting enables faster prototyping and cost-effective production. The trend supports personalized medicine, making treatments more efficient and scalable.

- For instance, clinical and animal trial results published in 2023 and 2024 show that 3D-printed collagen/polymer nerve conduits yield over 90% axonal regeneration and significantly improved functional recovery (measured by motor force and contracture angle) compared to conventional methods in verified peer-reviewed studies.

Shift Toward Minimally Invasive and Bioabsorbable Devices

The demand for minimally invasive surgical options is driving innovation in bioabsorbable devices. The Global Peripheral Nerve Repair Devices Market is shifting toward products that minimize scarring and eliminate the need for secondary surgeries. Surgeons are preferring flexible, absorbable conduits that naturally degrade after healing. This reduces postoperative complications and recovery time. Manufacturers are improving device strength and elasticity to match natural nerve properties. It reflects a broader healthcare trend favoring safer and patient-friendly solutions. Technological progress in polymer chemistry is fueling product innovation. The move toward bioabsorbable materials enhances surgical safety and patient comfort.

- For instance, NeuraGen 3D Nerve Guide by Integra LifeSciences offers resorbability and has undergone animal and pilot human studies confirming biocompatibility and reduction in scar tissue compared to non-absorbable alternatives, backed by peer-reviewed data and company reporting.

Rising Focus on Neuroregenerative Research and Stem Cell Integration

Neuroregenerative research is gaining traction with stem cell therapies playing a key role in nerve recovery. The Global Peripheral Nerve Repair Devices Market is witnessing integration of stem-cell-enhanced grafts that stimulate faster nerve regrowth. Hospitals are conducting trials on combining growth factors and scaffolds for advanced repair. It promotes higher recovery rates and functional restoration in severe injury cases. Academic collaborations are producing hybrid models combining biological and synthetic repair systems. Stem cell application in neuroprosthetics and biointerfaces continues to evolve. The approach improves nerve connectivity and responsiveness. Research-backed clinical validation supports commercial adoption of advanced regenerative technologies.

Growing Industry Collaborations and Product Portfolio Expansion

Strategic partnerships between medical device firms, research institutes, and hospitals are reshaping the competitive landscape. The Global Peripheral Nerve Repair Devices Market is marked by mergers, licensing agreements, and co-development projects. These collaborations accelerate innovation and shorten time-to-market for novel devices. It enables sharing of intellectual property and clinical data to enhance efficacy. Companies are diversifying product portfolios to meet specific injury complexities. Market participants are emphasizing surgeon training and post-surgical care integration. The growing use of AI and imaging tools in surgical planning also strengthens collaboration outcomes. A focus on patient-specific solutions drives competitive advantage and differentiation.

Market Challenges Analysis:

High Surgical Complexity and Limited Skilled Professionals

Peripheral nerve repair procedures require exceptional microsurgical expertise and precision. The Global Peripheral Nerve Repair Devices Market faces hurdles due to limited skilled surgeons capable of performing complex nerve reconstruction. Training programs are insufficient in many developing regions, affecting successful treatment outcomes. It struggles with long learning curves and high procedural times, discouraging widespread adoption. Hospitals in low-resource settings often lack specialized infrastructure for nerve repair. High cost of equipment and post-operative care further limits accessibility. Delayed diagnosis and poor referral systems worsen patient prognosis. Bridging the gap in specialized surgical training is crucial to overcome these challenges.

Cost Constraints and Regulatory Barriers in Product Commercialization

The high cost of nerve repair devices and related surgeries remains a key restraint. The Global Peripheral Nerve Repair Devices Market experiences regulatory hurdles delaying product approvals and market entry. Complex approval processes increase development costs for manufacturers. It faces price sensitivity in developing economies, where affordability is a major concern. Reimbursement challenges and uneven insurance coverage restrict access to advanced procedures. Small manufacturers struggle with high compliance costs and lengthy validation timelines. Regulatory discrepancies across countries limit international expansion. Addressing these economic and regulatory challenges is vital to sustain market growth.

Market Opportunities:

Emerging Role of Bioengineering and Smart Materials

The Global Peripheral Nerve Repair Devices Market is poised for growth with rapid advancements in bioengineering. Smart polymers, nanofibers, and bioactive coatings are revolutionizing nerve regeneration approaches. It creates new opportunities for precision-based repair and functional recovery. Research on electrically conductive materials supports better stimulation of nerve cells. Hospitals are showing interest in bioresponsive devices that enhance healing efficiency. These innovations open avenues for patient-specific treatment protocols. Collaborations between academic research centers and medical device firms strengthen innovation pipelines. The integration of intelligent materials can redefine the next generation of nerve repair solutions.

Expanding Healthcare Infrastructure and Rising Surgical Volumes

Growing healthcare investments and hospital expansions in developing regions offer strong market potential. The Global Peripheral Nerve Repair Devices Market benefits from the rising number of reconstructive surgeries and trauma care centers. It gains traction with improving access to skilled surgeons and better clinical facilities. Governments are promoting initiatives to enhance surgical care infrastructure. Growing awareness about advanced repair solutions among patients also supports adoption. International medical device firms are entering emerging economies with localized manufacturing strategies. Rising healthcare expenditure and technological diffusion ensure steady long-term demand. The improving surgical ecosystem strengthens market expansion across regions.

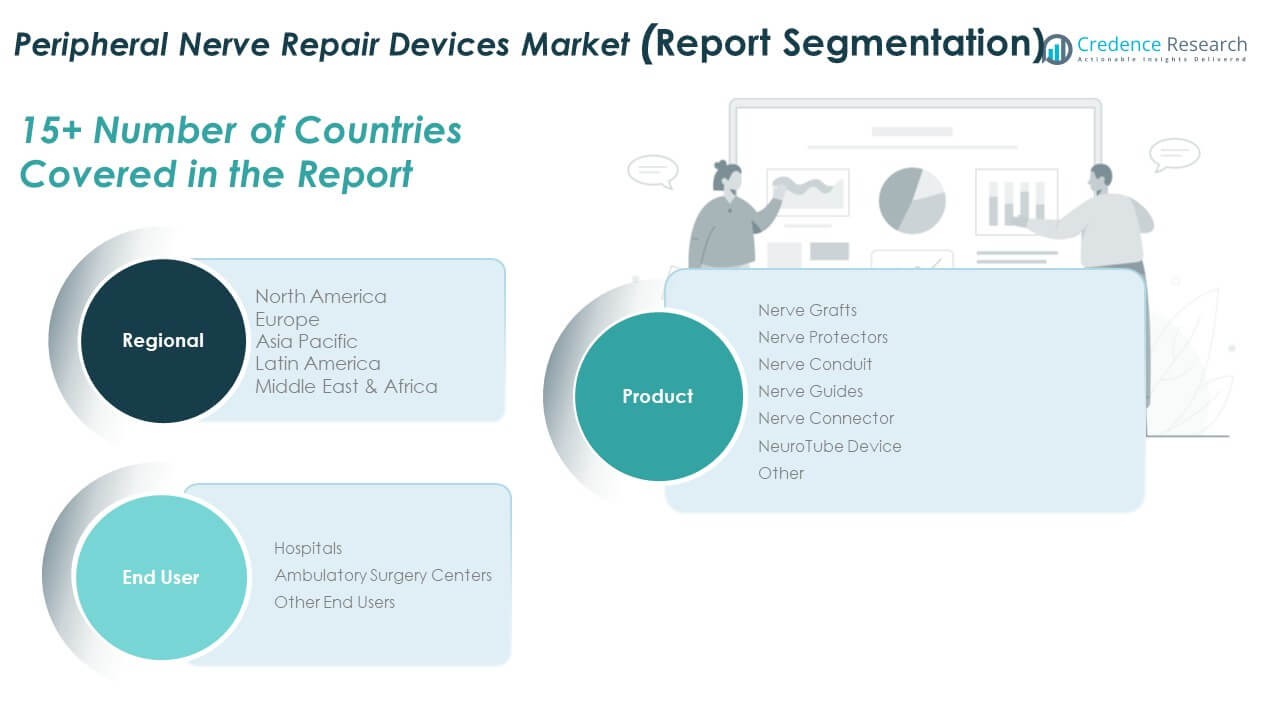

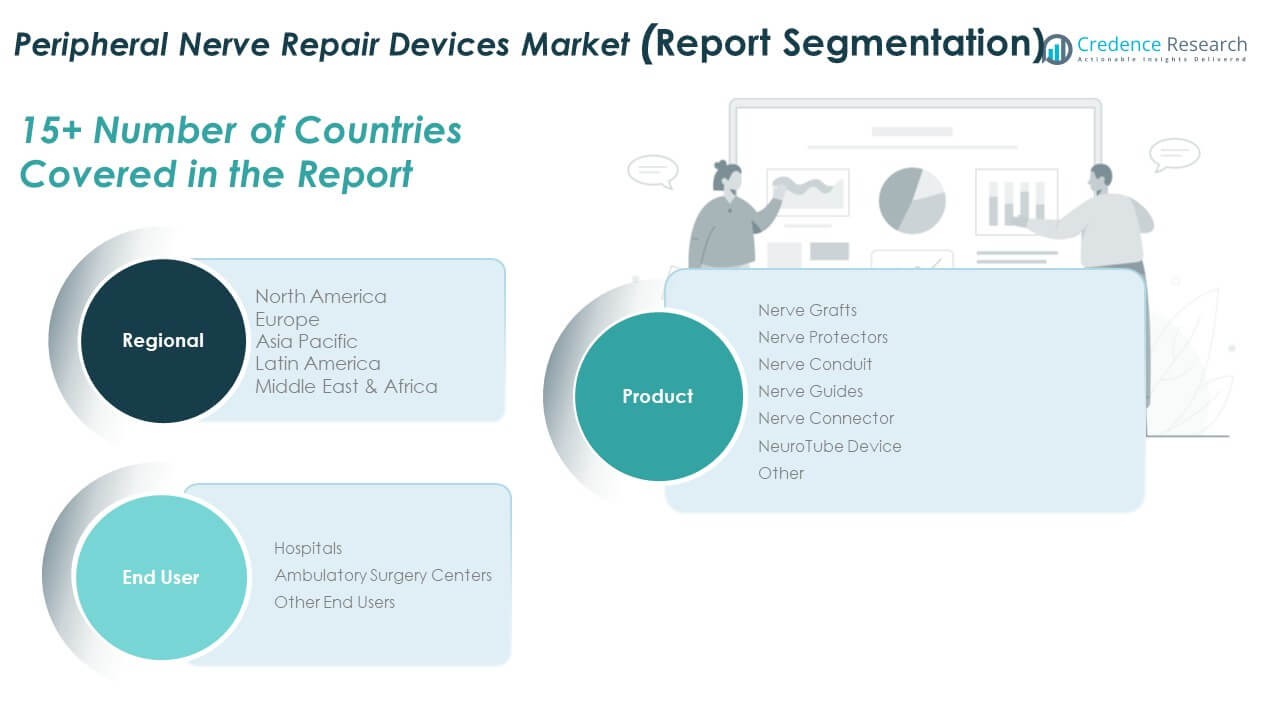

Market Segmentation Analysis:

By Product

The Global Peripheral Nerve Repair Devices Market is segmented into nerve grafts, nerve protectors, nerve conduits, nerve guides, nerve connectors, NeuroTube devices, and others. Nerve grafts hold a significant share due to their high success rate in bridging large nerve gaps and restoring functionality. Nerve protectors and conduits are gaining demand for their ability to prevent scar tissue formation and enhance regeneration. Nerve guides and connectors are preferred for shorter nerve gaps and simpler surgical applications. NeuroTube devices are witnessing increasing usage in microsurgical procedures where precision and biocompatibility are critical. It continues to evolve through advancements in bioengineered materials that improve flexibility and nerve regeneration performance.

- For instance, Axogen Avance Nerve Graft has been highlighted in both product literature and multicenter registry studies for its use in digital nerve injuries, with comparative trials showing superior sensory recovery versus synthetic conduits for gap lengths up to 70mm.

By End User

Based on end users, the market is categorized into hospitals, ambulatory surgery centers, and other end users. Hospitals dominate the segment due to the presence of advanced infrastructure, skilled professionals, and higher patient inflow for trauma and reconstructive surgeries. Ambulatory surgery centers are expanding their role with faster recovery protocols and cost-efficient outpatient procedures. Other end users, including specialty clinics and research institutions, are driving innovation through clinical trials and device testing. It benefits from increasing collaboration between healthcare facilities and device manufacturers to enhance surgical efficiency and treatment accessibility across patient categories.

Segmentation:

By Product

- Nerve Grafts

- Nerve Protectors

- Nerve Conduits

- Nerve Guides

- Nerve Connectors

- NeuroTube Device

- Others

By End User

- Hospitals

- Ambulatory Surgery Centers

- Other End Users

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Peripheral Nerve Repair Devices Market size was valued at USD 971.21 million in 2018 to USD 1,357.69 million in 2024 and is anticipated to reach USD 2,132.78 million by 2032, at a CAGR of 5.8% during the forecast period. North America holds around 24% of the global market share, supported by advanced healthcare infrastructure and a strong base of medical device manufacturers. The region benefits from high adoption of microsurgical technologies and extensive clinical research in nerve regeneration. The United States leads due to its robust reimbursement framework and ongoing innovation in bioengineered grafts. It gains momentum from the growing prevalence of trauma cases and diabetic neuropathy. Canada and Mexico are expanding their roles through improved surgical facilities and cross-border collaborations. Strong R&D funding and government support for regenerative therapies strengthen the regional market. The presence of key players and technological maturity sustains its competitive dominance.

Europe

The Europe Global Peripheral Nerve Repair Devices Market size was valued at USD 1,011.31 million in 2018 to USD 1,460.83 million in 2024 and is anticipated to reach USD 2,400.27 million by 2032, at a CAGR of 6.4% during the forecast period. Europe accounts for approximately 27% of the total market, driven by rising demand for advanced reconstructive surgeries and adoption of bioresorbable nerve repair solutions. Germany, the UK, and France lead with strong medical innovation and skilled surgical expertise. It benefits from favorable regulatory pathways and public healthcare funding supporting neuroregenerative research. The region’s collaboration between hospitals and device manufacturers accelerates clinical validation and adoption. Eastern Europe is witnessing gradual expansion due to modernizing healthcare infrastructure. Growing investments in rehabilitation and post-surgical care also enhance patient outcomes. The region continues to play a pivotal role in shaping global clinical standards for nerve repair.

Asia Pacific

The Asia Pacific Global Peripheral Nerve Repair Devices Market size was valued at USD 1,076.39 million in 2018 to USD 1,588.92 million in 2024 and is anticipated to reach USD 2,684.64 million by 2032, at a CAGR of 6.8% during the forecast period. Asia Pacific commands about 30% of the global market share, reflecting its rapid expansion in healthcare infrastructure and medical technology adoption. China, Japan, and India drive growth through increasing surgical procedures and government investments in advanced medical devices. It benefits from rising patient awareness and improving access to specialized treatments. The region is becoming a manufacturing hub for affordable, high-performance nerve repair products. Emerging economies are focusing on domestic production and regulatory alignment to attract foreign investments. The growth of medical tourism further supports demand for reconstructive surgeries. Continuous innovation and price competitiveness position Asia Pacific as the fastest-growing regional market.

Latin America

The Latin America Global Peripheral Nerve Repair Devices Market size was valued at USD 403.69 million in 2018 to USD 554.64 million in 2024 and is anticipated to reach USD 849.56 million by 2032, at a CAGR of 5.5% during the forecast period. Latin America contributes nearly 10% of the global share, with Brazil and Mexico leading the adoption of nerve repair technologies. The region benefits from expanding private healthcare sectors and rising trauma-related surgeries. It faces challenges related to limited surgical expertise and uneven access to specialized care. Growing medical collaborations with North American companies are improving device availability. Hospitals are increasingly investing in modern microsurgical equipment to enhance treatment outcomes. Government initiatives promoting healthcare modernization are strengthening the market environment. The gradual shift toward advanced reconstructive procedures supports sustainable market growth.

Middle East

The Middle East Global Peripheral Nerve Repair Devices Market size was valued at USD 231.17 million in 2018 to USD 353.41 million in 2024 and is anticipated to reach USD 622.95 million by 2032, at a CAGR of 7.4% during the forecast period. The region holds about 6% of the total market, supported by rising investments in specialized medical facilities. GCC countries dominate due to well-developed hospital infrastructure and expanding healthcare expenditure. It benefits from government-led initiatives to enhance surgical capabilities and attract international medical expertise. Hospitals are incorporating advanced neuroregenerative technologies to improve treatment precision. Partnerships between global manufacturers and regional distributors are expanding market accessibility. The rise in diabetic neuropathy and trauma cases is fueling clinical demand. Continuous technological upgrades and high-value healthcare projects strengthen regional growth potential.

Africa

The Africa Global Peripheral Nerve Repair Devices Market size was valued at USD 89.67 million in 2018 to USD 125.21 million in 2024 and is anticipated to reach USD 196.39 million by 2032, at a CAGR of 5.8% during the forecast period. Africa represents nearly 3% of the global share, with South Africa leading due to relatively advanced healthcare infrastructure. The region faces limited access to skilled surgeons and advanced medical equipment. It is gradually improving through international aid and healthcare modernization programs. Growing awareness of nerve injury treatments and rehabilitation is fostering market development. Local governments are focusing on enhancing surgical training and infrastructure. Partnerships with global device manufacturers are increasing product availability. The rising prevalence of diabetes and road accidents creates a need for improved nerve repair services across the continent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Orthocell Ltd

- Axogen Inc.

- Synovis Micro Companies Alliance, Inc.

- Stryker

- Medovent GmbH

- Integra LifeSciences Corporation

- Polyganics

- Baxter International, Inc.

- Polyganics BV

- Renerva, LLC

- Toyobo Co., Ltd.

Competitive Analysis:

The Global Peripheral Nerve Repair Devices Market is highly competitive, with key players focusing on innovation, product portfolio expansion, and clinical validation. Major companies such as Axogen Inc., Stryker, Integra LifeSciences, Baxter International, and Polyganics dominate through advanced graft technologies and strong global distribution networks. It is characterized by continuous R&D investments targeting bioengineered and resorbable nerve conduits that enhance regeneration efficiency. Strategic mergers and collaborations help manufacturers strengthen market positioning and technology access. Competitive advantage often relies on proprietary materials, regulatory approvals, and surgeon training programs aimed at improving adoption rates.

Recent Developments:

- In October 2025, Orthocell Ltd announced it had secured a $30 million capital raising through an institutional placement to accelerate the global commercialization of its flagship nerve repair product, Remplir™. The capital will be used to scale up Remplir’s rollout in the United States, advance clinical studies in prostate cancer surgery, and further develop additional applications in tendon and ligament repair. Notably, significant interest was shown by new US institutional investors, and the company’s US distribution now covers 25 states and 40% of the US population.

- In August 2025, Axogen Inc., a key player in peripheral nerve repair, received an extension from the US FDA for the review of its Biologics License Application for its Avance® Nerve Graft, pushing the new Prescription Drug User Fee Act (PDUFA) goal date to December 5, 2025. This update follows the submission of substantial new manufacturing data, and the company expects FDA feedback on product labeling in November 2025. Avance® Nerve Graft is a leading off-the-shelf nerve allograft for nerve injury repair, and the extension indicates a thorough review is underway for its expanded approval.

- In January 2025, Stryker revealed it would acquire Inari Medical, a California-based innovator of technologies for vascular and peripheral vascular conditions, for $4.9 billion. The acquisition, unanimously approved by both companies’ boards of directors, is set to expand Stryker’s neurovascular and peripheral vascular portfolio, supporting its commitment to providing advanced life-saving solutions in endovascular health.

Report Coverage:

The research report offers an in-depth analysis based on product and end-user segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing clinical validation of bioresorbable conduits will strengthen market penetration.

- Increasing investments in regenerative medicine will expand innovation pipelines.

- Adoption of 3D printing will enable patient-specific nerve repair solutions.

- Rising healthcare expenditure in developing nations will boost device accessibility.

- Collaborations between hospitals and manufacturers will enhance clinical outcomes.

- Advances in biomaterials will improve durability and nerve regeneration rates.

- Growing awareness of nerve repair procedures will expand patient reach.

- Technological integration with imaging systems will improve surgical precision.

- Expansion of outpatient microsurgeries will create new growth opportunities.

- Continued regulatory approvals will accelerate product commercialization worldwide.