Market Overview:

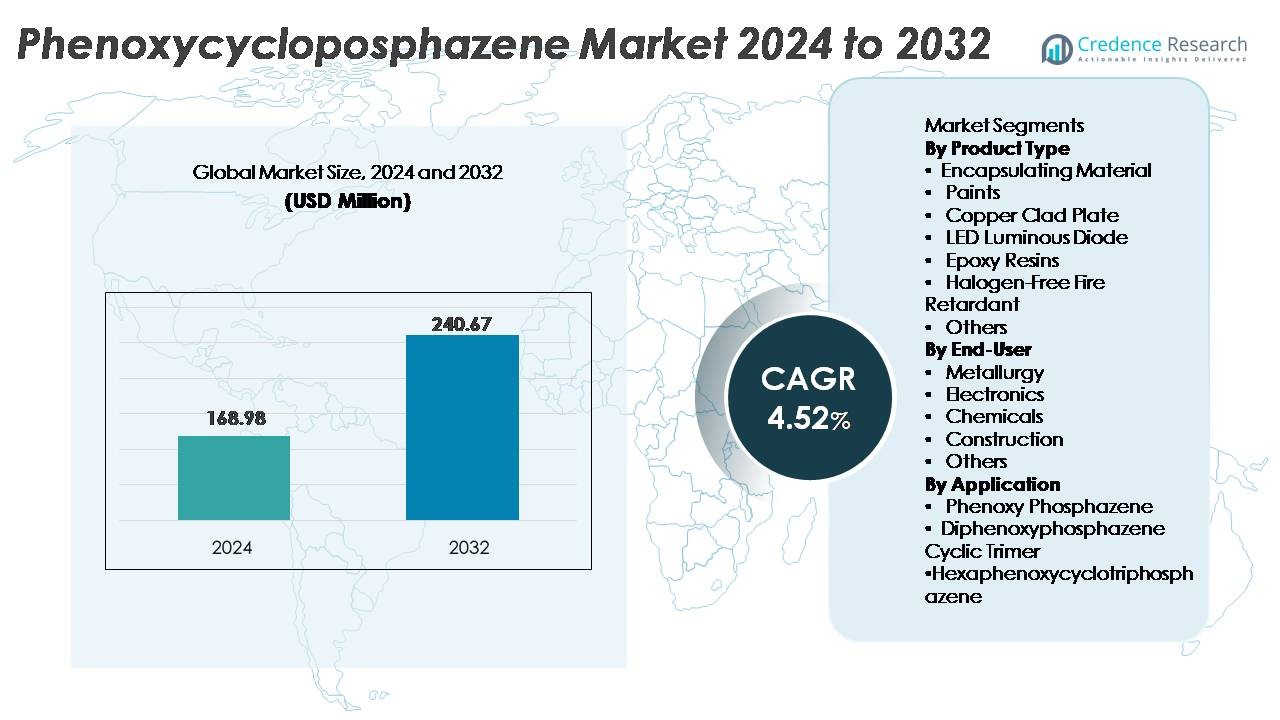

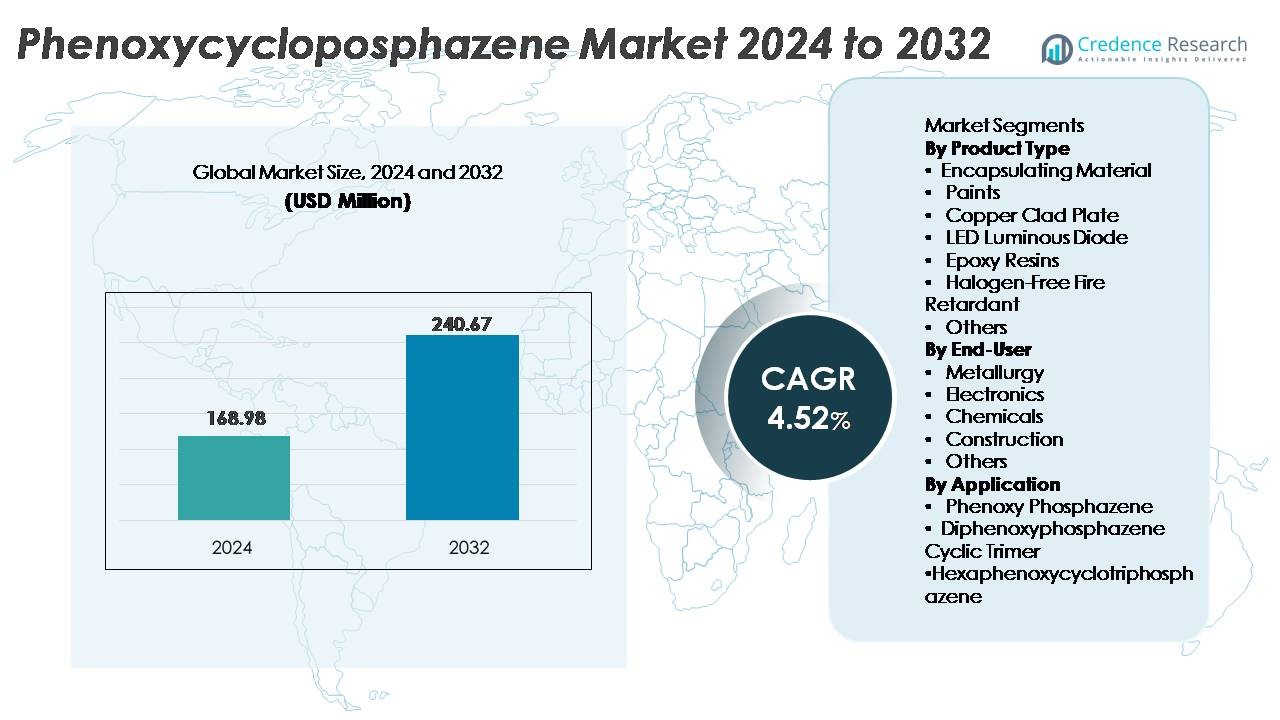

The Phenoxycyclophosphazene Market was valued at USD 168.95 million in 2024 and is projected to reach USD 240.67 million by 2032, exhibiting a CAGR of 4.52% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Phenoxycyclophosphazene Market Size 2024 |

USD 168.95 Million |

| Phenoxycyclophosphazene Market, CAGR |

4.52% |

| Phenoxycyclophosphazene Market Size 2032 |

USD 240.67 Million |

The phenoxycyclophosphazene market features a mix of global chemical leaders and specialized phosphorus–nitrogen compound producers, including Mitsubishi Chemical, DuPont, Jiangsu Yoke Technology, Qingdao Scienoc Chemical, Zibo Lanyan Chemical, Zibo Lanyin Chemical Co. Ltd., Tianjin Zhongxin Chemtech Co. Ltd., Weihai Jinwei ChemIndustry, Ozeki CO, and Zhangjiagang Xinyi Chemical. These companies compete through advancements in halogen-free flame-retardant technologies, high-purity synthesis capabilities, and integration with epoxy resin and copper-clad laminate manufacturers. Asia-Pacific leads the market with approximately 38% share, supported by its extensive electronics manufacturing base, followed by North America (~27%) and Europe (~24%), which emphasize regulatory compliance and high-performance material innovation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The phenoxycyclophosphazene market was valued at USD 168.95 million in 2024 and is projected to reach USD 240.67 million by 2032, growing at a CAGR of 4.52%.

- Market growth is driven by rising adoption of halogen-free flame retardants across electronics, copper-clad laminates, LED assemblies, and high-performance epoxy systems, with encapsulating materials emerging as the dominant product segment due to strong PCB and semiconductor packaging demand.

- Key trends include rapid expansion of high-frequency PCBs, 5G hardware, EV electronics, and LED thermal-resistant materials, supporting greater integration of phosphorus–nitrogen additives in advanced resin formulations.

- Competitive activity centers on high-purity production, regulatory-compliant flame-retardant chemistries, and partnerships between chemical suppliers and epoxy/laminate manufacturers, with major players strengthening positions through improved synthesis efficiency and application-specific product lines.

- Regionally, Asia-Pacific leads with ~38% share, followed by North America (~27%) and Europe (~24%), reflecting strong electronics manufacturing hubs and increasing adoption of halogen-free, high-reliability materials.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

Encapsulating materials represent the dominant product type, driven by their extensive use in electronic protection systems and high-performance polymer formulations. Their superior thermal stability, dielectric strength, and compatibility with epoxy systems make them essential for semiconductor encapsulation and PCB insulation. Copper-clad plates and epoxy resins also contribute significantly as manufacturers prioritize halogen-free flame-retardant solutions for advanced electronics. LED luminous diode applications continue expanding due to miniaturization trends, while halogen-free fire retardants gain momentum as regulatory frameworks promote safer, low-toxicity material adoption across electrical components.

- For instance, Mitsubishi Chemical produces various high-purity jER™ epoxy resinsand specialty epoxy resins for semiconductor encapsulants and electronic materials. These materials are designed for use in harsh and challenging environments, offering superior performance.

By End-User

Electronics emerge as the leading end-user segment, supported by the growing demand for high-temperature-resistant and halogen-free flame-retardant materials in PCBs, semiconductor packaging, and LED assemblies. The sector’s increasing adoption of advanced insulation materials drives consistent consumption of phenoxycyclophosphazene derivatives. Metallurgy and chemicals follow, driven by requirements for thermally stable additives and durable coating solutions. Construction applications grow steadily due to rising integration of flame-retardant materials in structural composites and infrastructure components. The others category includes niche industrial users adopting the material for specialized high-performance applications.

- For instance, Ajinomoto Fine Techno’s ABF GX-92R build-up film widely used in semiconductor substrates—delivers a glass-transition temperature of 153°C, a dielectric constant of 3.1 at 1 GHz, and supports line/space patterning down to 2 μm, illustrating the level of thermal and electrical performance demanded by electronics manufacturers who increasingly integrate phosphazene-based halogen-free flame-retardant systems.

By Application

Hexaphenoxycyclotriphosphazene holds the dominant market share as a preferred flame retardant and epoxy resin additive offering excellent thermal stability, high char yield, and halogen-free performance. Its widespread adoption in electronics, copper-clad laminates, and encapsulation systems drives strong market momentum. Phenoxy phosphazene also maintains substantial demand due to its compatibility with high-performance polymer matrices, while diphenoxyphosphazene cyclic trimer gains traction in specialty coatings and insulating materials. Across all three applications, regulatory emphasis on non-toxic, environmentally compliant flame retardants significantly accelerates substitution away from traditional halogenated alternatives.

Key Growth Drivers

Rising Demand for Halogen-Free Flame Retardants

The transition toward halogen-free flame-retardant technologies significantly drives the demand for phenoxycyclophosphazene derivatives. Regulatory frameworks across Europe, North America, and Asia increasingly restrict brominated and chlorinated additives due to toxicity and environmental hazards. Phenoxycyclophosphazene compounds deliver high char yield, thermal oxidative stability, and excellent flame-retardant behavior without releasing corrosive or hazardous by-products during combustion. These properties make them essential for high-performance electronics, automotive components, and industrial coatings. As OEMs prioritize materials that comply with RoHS, WEEE, and REACH, manufacturers accelerate the adoption of phosphorus–nitrogen frameworks. The superior compatibility of these compounds with epoxy resins and engineering plastics further broadens applications in PCBs, encapsulants, and structural composites. The continued focus on safe, sustainable, and high-performance flame retardants firmly positions phenoxycyclophosphazene as a critical material in next-generation product manufacturing.

- For instance, Clariant’s Exolit® OP 1400 a benchmark phosphorus–nitrogen halogen-free flame retardant used in engineering plastics achieves a limiting oxygen index (LOI) of approximately 35% in polyamide formulations and enables UL94 V-0 performance at 0.4 mm, demonstrating the level of high-efficiency, halogen-free flame-retardant capability that OEMs increasingly expect from high-performance organic phosphinate-based systemslike aluminum diethyl-phosphinate (DEPAL).

Growth of Electronics Miniaturization and High-Performance Materials

The electronics sector emerges as a major contributor to market expansion as devices become smaller, more thermally dense, and increasingly reliant on advanced insulation materials. Phenoxycyclophosphazene compounds enhance thermal resistance, dielectric properties, and flame-retardant behavior in copper-clad laminates, semiconductor packaging, and LED assemblies. As miniaturization accelerates, PCBs require materials with ultra-low dielectric constants, reduced flammability, and stable performance under high-frequency operation. These compounds meet the requirements for 5G hardware, high-speed servers, electric vehicle control systems, and industrial automation electronics. Continuous innovation in multilayer laminates and high-Tg epoxy systems also strengthens adoption. With electronic complexity rising, manufacturers depend on phenoxycyclophosphazene derivatives to achieve thinner, safer, and more reliable components, supporting robust long-term market growth.

- For instance, Panasonic’s MEGTRON 6 laminate widely used in high-speed servers and network equipment delivers a dielectric constant of 3.36 at 1 GHz and a dissipation factor of 0.002 at 1 GHz, while achieving a glass-transition temperature above 200°C, illustrating the stringent electrical and thermal performance standards that drive manufacturers to integrate phenoxycyclophosphazene-enhanced halogen-free flame-retardant systems for thinner, safer, and more reliable electronic components.

Increasing Application in Advanced Resin Formulations and Composites

Phenoxycyclophosphazene compounds play a critical role in engineering resin formulations, especially in epoxy, phenolic, and polyurethane matrices used across aerospace, construction, electrical insulation, and industrial machinery. Their ability to enhance flame retardancy, mechanical strength, heat deformation resistance, and chemical stability makes them ideal for next-generation composite structures. Growing demand for lightweight materials in transportation and infrastructure boosts interest in phosphorus–nitrogen additives that maintain performance without compromising structural integrity. Resin formulators also value their compatibility with reinforcement fibers and their ability to deliver high char formation during fire exposure. As high-performance composite markets expand globally, phenoxycyclophosphazene emerges as a preferred additive driving reliability and regulatory compliance across critical applications.

- For instance, Hexcel’s aerospace-grade 8552 carbon/epoxy prepreg widely used in primary aircraft structures provides a glass-transition temperature of approximately 190°C (DMA) and achieves an interlaminar shear strength of about 72 MPa after cure, demonstrating the performance thresholds of high-end resin systems where phosphazene-based flame-retardant modifiers like phenoxycyclophosphazene support enhanced thermal stability and fire-safe composite behavior.

Key Trends & Opportunities

Expansion of Halogen-Free PCB and Semiconductor Material Technologies

A major trend shaping the market is the rapid advancement of halogen-free PCB substrates and semiconductor packaging materials. As high-frequency and high-power applications increase, electronics manufacturers demand materials that exhibit stable dielectric behavior, low smoke emissions, and high thermal resistance. Phenoxycyclophosphazene derivatives meet these requirements and integrate seamlessly into multilayer copper-clad laminates, prepregs, and solder mask formulations. With 5G infrastructure, EV power electronics, IoT devices, and high-speed computing systems expanding, opportunities for advanced flame-retardant additives are growing. Manufacturers also invest in eco-efficient PCB production, reinforcing demand for halogen-free, phosphorus–nitrogen flame retardants as core components in next-generation electronic platforms.

Rising Innovation in High-Temperature and High-Frequency Applications

The market benefits from increasing innovation in materials designed for extreme environments, including aerospace electronics, industrial automation, renewable energy systems, and high-frequency RF components. Phenoxycyclophosphazene offers a unique combination of thermal endurance, flame retardancy, and low dielectric constants, enabling its integration into specialized coatings, potting materials, and insulation systems. The shift toward materials that maintain structural and electrical stability at elevated temperatures creates strong opportunities for advanced phosphazene chemistry. As industries adopt high-power modules, wide-bandgap semiconductors (SiC, GaN), and heat-intensive control systems, the need for thermally stable flame-retardant additives is expected to grow rapidly.

Increasing Use in LED Systems and Energy-Efficient Electronics

Energy-efficient electronics, particularly LED lighting systems, create substantial opportunities for materials that ensure long-term reliability under continuous thermal stress. Phenoxycyclophosphazene compounds enhance the stability of LED encapsulants, circuit assemblies, and heat-resistant polymer housings. Their resistance to yellowing, thermal degradation, and fire hazards supports their integration in advanced lighting modules used in automotive, industrial, residential, and commercial applications. As global policies encourage low-energy lighting adoption, manufacturers invest in materials that maintain lumen performance, thermal control, and safety standards, generating long-term opportunities for high-performance, halogen-free additives.

Key Challenges

High Production Costs and Technical Complexity

Despite strong performance benefits, phenoxycyclophosphazene compounds face cost-related challenges that limit widespread adoption. Their synthesis involves multi-step phosphorus–nitrogen chemistry, stringent purification requirements, and controlled reaction environments to maintain structural uniformity. These factors increase manufacturing costs compared to conventional flame retardants. Additionally, the need for advanced processing equipment and specialized expertise restricts market entry for smaller suppliers. High R&D investment is required to tailor properties for diverse applications such as high-Tg epoxies, LED encapsulants, and high-speed laminates. Cost-driven barriers often push manufacturers to evaluate alternative phosphorus-based compounds, presenting a significant competitive challenge.

Formulation Compatibility and Performance Optimization Barriers

Integration of phenoxycyclophosphazene compounds into complex polymer systems requires precise formulation techniques to achieve optimal dispersion, adhesion, and curing behavior. In epoxy and composite systems, issues such as viscosity changes, altered curing kinetics, and compatibility constraints can limit performance if not properly managed. For high-frequency electronic substrates, ensuring consistent dielectric properties and thermal stability presents additional challenges. Manufacturers must perform extensive testing to validate performance under varying processing temperatures, humidity conditions, and mechanical loads. These technical complexities slow adoption cycles and require long development timelines, constraining market acceleration for certain end-use industries.

Regional Analysis:

North America

North America holds around 27% of the phenoxycyclophosphazene market, driven by strong adoption in high-performance electronics, semiconductor packaging, and aerospace-grade composite materials. The U.S. leads demand due to advanced PCB manufacturing, stringent flame-retardant regulations, and widespread use of halogen-free materials in industrial applications. Growth is reinforced by innovations in high-frequency substrates used in 5G, EV power modules, and defense electronics. Canada contributes through chemical manufacturing and increasing investments in electronic component assembly. The region’s mature regulatory environment and strong focus on material safety continue to foster consistent demand for phosphorus–nitrogen flame-retardant chemistries.

Europe

Europe accounts for approximately 24% of the market, supported by rigorous environmental regulations such as REACH and a strong shift toward halogen-free flame-retardant systems. Germany, France, and the UK dominate consumption due to well-established electronics, automotive, and industrial composite sectors. The region’s strong focus on circular materials and low-toxicity formulations accelerates the adoption of phosphazene-based additives in coatings, encapsulants, and copper-clad laminates. Expanding EV manufacturing and renewable energy infrastructure further boost material demand. European OEMs increasingly rely on phenoxycyclophosphazene derivatives to meet strict fire-safety standards for electrical and structural components.

Asia-Pacific

Asia-Pacific leads the global market with around 38% share, driven by its dominant role in electronics manufacturing, PCB production, LED assembly, and semiconductor fabrication. China, Japan, South Korea, and Taiwan form the core demand cluster due to massive output of copper-clad laminates, high-Tg epoxy systems, and halogen-free substrates for high-speed electronics. Rapid industrialization, growing EV adoption, and expanding 5G and IoT infrastructure further accelerate consumption of phosphorus–nitrogen flame-retardant materials. Strong regional investments in chemical synthesis and resin formulation offer cost advantages, making Asia-Pacific the fastest-growing market for phenoxycyclophosphazene derivatives.

Latin America

Latin America represents roughly 6% of the market, with growth driven by expanding electronics assembly operations, construction activities, and chemical manufacturing. Brazil and Mexico lead demand due to increasing imports of high-performance materials used in electrical insulation, coatings, and polymer compounding. Growing investments in automotive electronics and industrial machinery also support consumption of advanced flame-retardant additives. Although local production capacities remain limited, the region shows rising interest in halogen-free formulations as safety regulations tighten. Infrastructure expansion and modernization of electrical systems help sustain moderate demand growth across key end-user sectors.

Middle East & Africa

The Middle East & Africa region accounts for approximately 5% of the market, with demand primarily concentrated in construction, industrial coatings, and electrical infrastructure. Countries such as the UAE and Saudi Arabia invest heavily in high-performance materials to support large-scale infrastructure and energy projects requiring enhanced fire safety and heat-resistant components. Growth in electronics assembly in parts of North Africa also contributes modestly to consumption. Although adoption levels remain lower than in other regions, increasing regulatory emphasis on safe building materials and expanding industrial diversification initiatives support steady long-term demand for phenoxycyclophosphazene compounds.

Market Segmentations:

By Product Type

- Encapsulating Material

- Paints

- Copper Clad Plate

- LED Luminous Diode

- Epoxy Resins

- Halogen-Free Fire Retardant

- Others

By End-User

- Metallurgy

- Electronics

- Chemicals

- Construction

- Others

By Application

- Phenoxy Phosphazene

- Diphenoxyphosphazene Cyclic Trimer

- Hexaphenoxycyclotriphosphazene

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the phenoxycyclophosphazene market is characterized by a concentrated group of specialty chemical manufacturers focused on high-purity phosphorus–nitrogen compounds and advanced flame-retardant technologies. Leading players compete on material performance, regulatory compliance, and formulation compatibility with high-end epoxy resins, copper-clad laminates, and semiconductor-grade substrates. Companies emphasize innovation in halogen-free flame-retardant systems, offering products with superior char yield, thermal stability, and dielectric properties tailored for electronics, LED assemblies, and high-frequency PCBs. Strategic partnerships with resin formulators, PCB manufacturers, and electronic material suppliers enable deeper integration across the value chain. Continuous investment in R&D, scaling capabilities, and high-precision synthesis technologies strengthens competitive positioning. Players also focus on expanding global distribution networks, especially in Asia-Pacific, where electronics manufacturing clusters drive the highest consumption. Compliance with REACH, RoHS, and UL fire-safety standards further differentiates suppliers, reinforcing customer trust in high-reliability applications such as aerospace electronics, automotive systems, and industrial equipment.

Key Player Analysis:

- Mitsubishi Chemical

- Qingdao Scienoc Chemical

- Zibo Lanyan Chemical

- Tianjin Zhongxin Chemtech Co. Ltd.

- Jiangsu Yoke Technology

- Weihai Jinwei ChemIndustry

- Ozeki CO

- DuPont

- Zhangjiagang Xinyi Chemical

- Zibo Lanyin Chemical Co. Ltd.

Recent Developments:

- In April 2025, Mitsubishi Chemical announced an expansion of its production capacity for flame-retardant compounds derived from polyolefins and thermoplastic elastomers in China and France. This expansion involves adding new production lines to address the rising demand for these compounds used as cable sheathing materials in various sectors.

- In September 2023, Mitsubishi Chemical introduced XANTAR™ XF Series, a next-generation halogen-free flame-retardant polycarbonate blend incorporating new proprietary phosphorus–nitrogen synergy technology Although not phenoxycyclophosphazene-specific, this development demonstrates MCG’s ongoing innovation in P–N chemistries that overlap with phosphazene-type additives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product type, End-User, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for phenoxycyclophosphazene will rise as industries accelerate the shift toward halogen-free flame-retardant systems across electronics and advanced composites.

- Adoption will strengthen in high-frequency PCBs and 5G infrastructure as manufacturers seek materials with stable dielectric performance and high thermal resistance.

- Semiconductor packaging and LED applications will expand usage due to the need for high-purity, thermally durable encapsulation materials.

- The market will benefit from growing investment in electric vehicles, particularly in power electronics and battery safety components.

- Resin formulators will increasingly integrate phosphorus–nitrogen additives to enhance char formation and structural stability in high-temperature environments.

- Asia-Pacific will continue to lead global consumption, supported by large-scale electronics and PCB manufacturing clusters.

- Europe and North America will grow steadily as regulatory frameworks tighten around safe, low-toxicity flame retardants.

- Manufacturers will focus on improving synthesis efficiency and scalability to reduce production costs.

- Custom-engineered grades will gain traction for aerospace, industrial automation, and high-energy systems.

- Collaborative R&D between chemical producers and electronic material developers will accelerate innovation in next-generation flame-retardant chemistries.

Market Segmentation Analysis:

Market Segmentation Analysis: