Market Overview

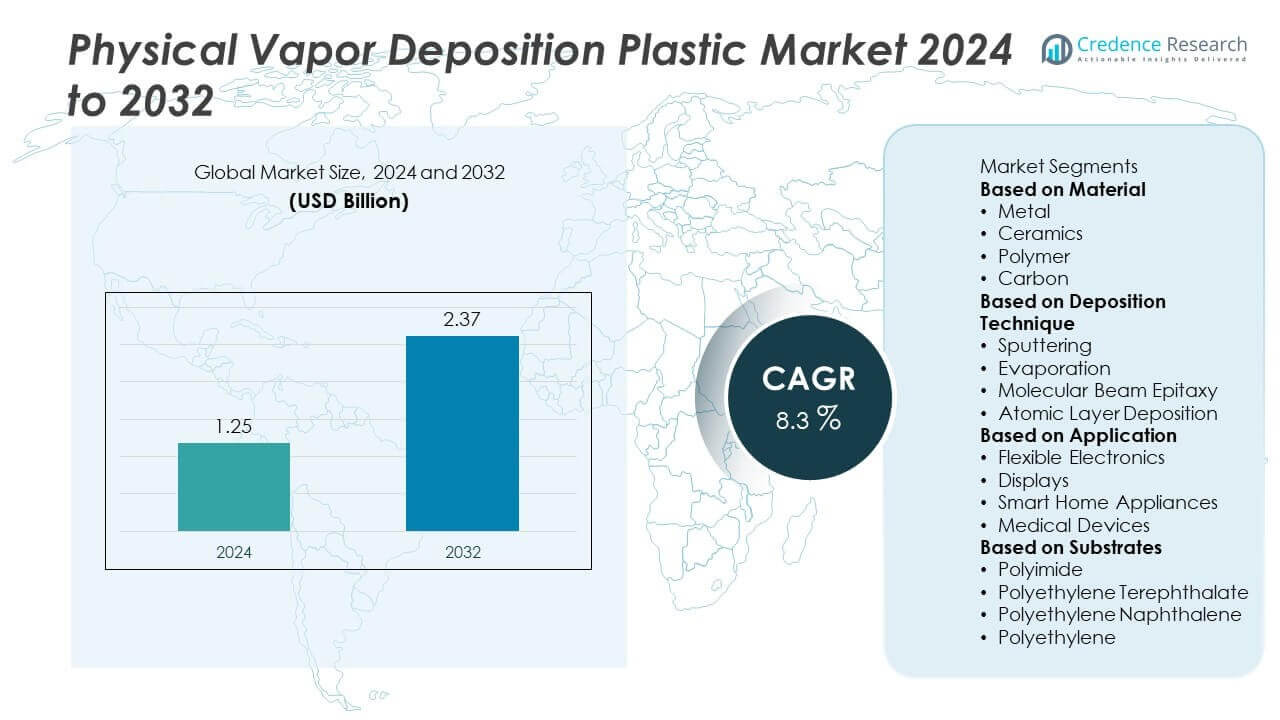

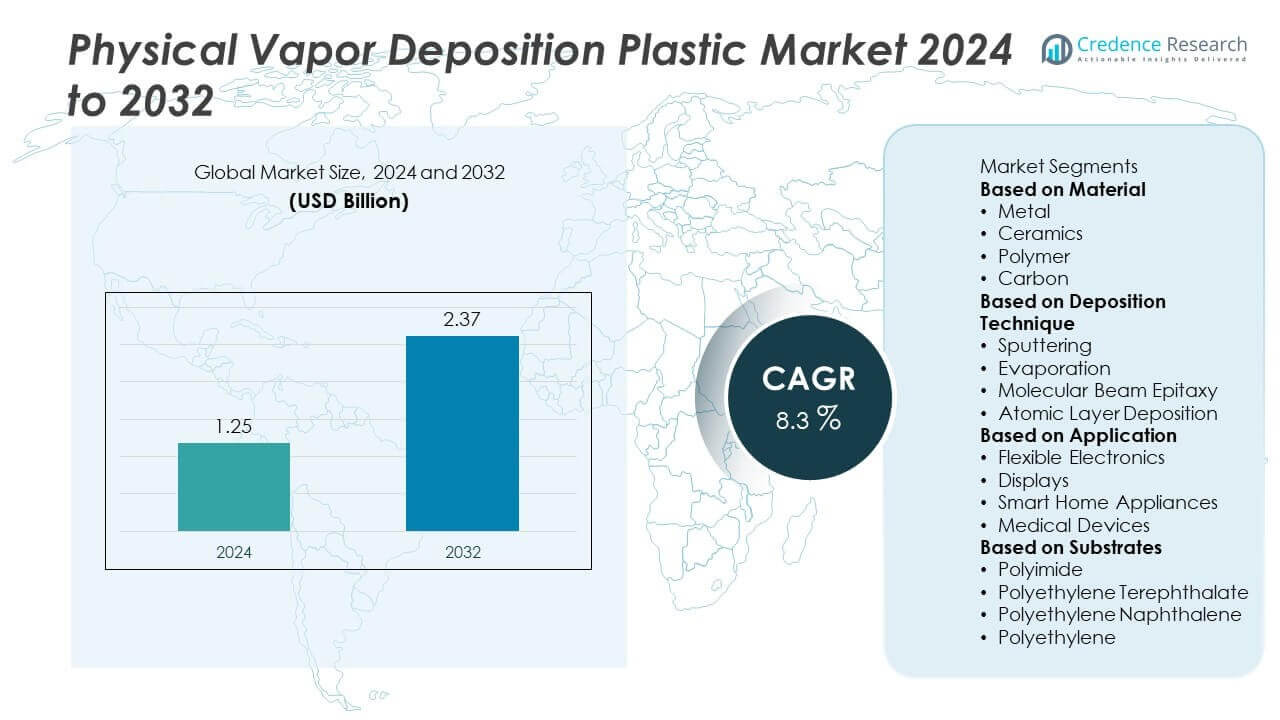

The Physical Vapor Deposition (PVD) Plastic Market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.37 billion by 2032, registering a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Physical Vapor Deposition (PVD) Plastic Market Size 2024 |

USD 1.25 Million |

| Physical Vapor Deposition (PVD) Plastic Market, CAGR |

8.3% |

| Physical Vapor Deposition (PVD) Plastic Market Size 2032 |

USD 2.37 Million |

The physical vapor deposition (PVD) on plastic market is driven by key players such as Leybold, Denton Vacuum, Veeco Instruments, PVD Products, Oerlikon, and Kurt J. Lesker, who focus on innovative coating technologies for automotive, electronics, and medical applications. These companies invest in low-temperature deposition systems, automation, and eco-friendly solutions to meet industry demand. North America leads the market with 37% share in 2024, supported by strong adoption in automotive interiors and consumer goods. Europe follows with 29% share, driven by strict environmental regulations, while Asia-Pacific holds 25% share and is the fastest-growing region due to expanding electronics and appliance production.

Market Insights

- The physical vapor deposition (PVD) on plastic market was valued at USD 1.25 billion in 2024 and is projected to reach USD 2.37 billion by 2032, growing at a CAGR of 8.3% during the forecast period.

- Rising demand for lightweight, durable, and decorative plastic components in automotive, electronics, and medical devices is driving market adoption, with metal coatings holding over 45% share due to superior durability and aesthetic appeal.

- Key trends include development of low-temperature deposition processes for heat-sensitive polymers, adoption of eco-friendly PVD technologies, and increasing use in flexible electronics and displays.

- The market is competitive with players like Leybold, Oerlikon, Veeco Instruments, and Kurt J. Lesker focusing on automation, modular coating systems, and partnerships to expand their global presence.

- North America leads with 37% share, followed by Europe at 29%, while Asia-Pacific holds 25% and is the fastest-growing region, supported by electronics manufacturing and automotive production.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material

Metal coatings dominate the physical vapor deposition on plastic market with over 45% share in 2024, driven by their superior durability, reflective properties, and ability to enhance wear and corrosion resistance. Metals such as aluminum, titanium, and chromium are widely used in automotive interiors, consumer electronics, and decorative applications. Ceramic coatings hold a growing share due to their excellent thermal stability and chemical resistance, making them suitable for medical devices and aerospace components. Polymer and carbon coatings are gaining traction for lightweight, specialty applications where flexibility and conductivity are critical.

- For instance, Oerlikon Balzers develops PVD coatings for plastic automotive interior components, which are an environmentally friendly alternative to chrome plating. Its ePD (embedded PVD for Design parts) technology provides functional and decorative metallic-looking surfaces that enhance durability and include excellent corrosion resistance.

By Deposition Technique

Sputtering leads the market with over 50% share in 2024, favored for its precision, scalability, and ability to create uniform thin films on complex plastic geometries. This technique is extensively used in displays, flexible electronics, and automotive components. Evaporation follows as a cost-effective solution for decorative and functional coatings, while molecular beam epitaxy is preferred for research and high-performance electronic applications requiring atomic-level control. Atomic layer deposition, though holding a smaller share, is growing rapidly due to its ability to produce highly conformal coatings, especially in medical and microelectronic applications where precision is crucial.

- For instance, the Kurt J. Lesker Company offers advanced magnetron sputtering systems capable of depositing highly uniform thin films on various substrates for applications like flexible display manufacturing.

By Application

Displays account for over 40% share in 2024, making them the largest application segment, driven by the growing demand for OLED and flexible displays in smartphones, tablets, and wearables. Flexible electronics represent a fast-growing segment as PVD coatings enhance conductivity and mechanical stability for next-generation electronic devices. Smart home appliances and medical devices are adopting PVD coatings for their aesthetic appeal, scratch resistance, and biocompatibility. Automotive interiors benefit from PVD finishes that offer lightweight decorative surfaces with excellent durability, supporting the trend toward premium and sustainable interior designs.

Key Growth Drivers

Rising Demand for Lightweight and Durable Components

The shift toward lightweight materials in automotive, electronics, and consumer goods is driving adoption of PVD coatings on plastics. These coatings provide excellent wear resistance, corrosion protection, and decorative finishes without increasing component weight. Automakers are increasingly replacing metal parts with coated plastic alternatives to improve fuel efficiency and meet emission targets. The growing emphasis on sustainability and performance is boosting the demand for PVD-coated plastics, making this segment a key driver for market growth across multiple high-volume applications.

- For instance, a low-temperature Physical Vapor Deposition (PVD) coating system, similar to those manufactured by AJA International, can deposit titanium nitride (TiN) or titanium oxynitride layers on heat-sensitive polymers like polycarbonate.

Growth of Flexible Electronics and Displays

Flexible displays, OLED panels, and wearable electronics rely heavily on PVD coatings for barrier protection, conductivity, and optical quality. PVD enables precise and uniform coatings on plastic substrates, ensuring durability and performance under bending and flexing conditions. The rising popularity of foldable smartphones, smartwatches, and advanced consumer electronics is accelerating demand. With continuous investment in display miniaturization and high-resolution technologies, the need for PVD-coated plastics will remain strong throughout the forecast period.

- For instance, manufacturers use high-throughput sputtering systems from companies like Veeco to deposit ultra-thin, uniform indium tin oxide (ITO) coatings on flexible plastic substrates, enabling the production of next-generation foldable touchscreens.

Expanding Applications in Medical and Consumer Devices

PVD-coated plastics are widely used in medical devices, surgical tools, and consumer appliances due to their biocompatibility, sterilization resistance, and premium finish. Coatings can incorporate antimicrobial properties, enhancing patient safety and hygiene. Demand is also rising in smart home appliances and high-end consumer products where aesthetics and durability are essential. The expansion of healthcare infrastructure and growing disposable incomes are expected to further boost adoption of PVD coatings in these sectors, supporting market growth over the next decade.

Key Trends & Opportunities

Adoption of Eco-Friendly Coating Solutions

Global regulations are encouraging industries to shift from electroplating and solvent-based coatings to environmentally friendly PVD processes. PVD generates minimal waste, eliminates hazardous chemicals, and supports compliance with REACH and RoHS standards. This shift helps manufacturers reduce their carbon footprint while improving product sustainability. The trend aligns with corporate ESG commitments, making eco-friendly coatings a significant opportunity for companies focusing on green manufacturing and brand differentiation.

- For instance, Oerlikon introduced its new INVENTA PVD coating system featuring Advanced Arc Technology (AAT), which operates with zero volatile organic compound (VOC) emissions, and reduces energy consumption by approximately 20%. PVD technology inherently has zero VOCs and is compliant with REACH and RoHS regulations. Oerlikon’s system also enables coatings on heat-sensitive plastic substrates below 120°C.

Advances in Deposition Techniques

Technological innovations in sputtering, atomic layer deposition, and hybrid PVD methods are enabling ultra-thin, defect-free coatings on complex plastic geometries. These advancements improve coating adhesion, surface uniformity, and scalability, making the technology viable for mass production. The development of low-temperature processes is particularly beneficial for heat-sensitive polymers, expanding the range of applications. This creates growth opportunities in electronics, automotive interiors, and medical devices where performance and aesthetics are critical.

- For instance, Semicore Equipment manufactures and supplies Physical Vapor Deposition (PVD) systems, including sputtering and evaporation coaters, that are used to apply ultra-thin films for medical applications on various 3D components. Semicore has also engineered custom PVD solutions for coating large, complex 3D parts to achieve high uniformity.

Key Challenges

High Equipment and Process Costs

PVD technology requires substantial capital investment for equipment and infrastructure, making it challenging for smaller manufacturers to adopt. The processes also involve higher operational costs, cleanroom requirements, and skilled labor, which increase production expenses. In cost-sensitive markets, traditional coating methods may remain preferred, slowing overall adoption. Vendors are focusing on developing modular, cost-efficient PVD systems to address this barrier and expand accessibility across industries.

Adhesion and Thermal Limitations on Plastics

Ensuring proper adhesion of PVD coatings on plastic substrates remains a challenge due to differences in surface energy and thermal expansion. High processing temperatures can deform heat-sensitive plastics, reducing yield and coating performance. This limits the choice of polymer substrates and may require additional surface treatments or adhesion-promoting layers. Continued innovation in low-temperature deposition processes and advanced surface preparation techniques is crucial to overcoming these limitations and ensuring consistent quality.

Regional Analysis

North America

North America leads the physical vapor deposition on plastic market with over 37% share in 2024, driven by strong demand from automotive, consumer electronics, and medical device industries. The United States dominates regional consumption with high adoption of PVD coatings for decorative trims, functional electronics, and healthcare applications. Investment in advanced coating technologies and sustainability initiatives accelerates market growth. The presence of key PVD equipment manufacturers and early adoption of innovative deposition techniques ensure North America remains a hub for technology advancement and continues to lead in product innovation and mass-production capabilities.

Europe

Europe holds around 29% share in 2024, supported by demand from premium automotive interiors, aerospace components, and home appliances. Countries such as Germany, France, and Italy are key contributors due to strong manufacturing bases and stringent environmental regulations favoring eco-friendly coating technologies like PVD. European companies are adopting sustainable decorative finishes to replace electroplating and meet REACH compliance. Continuous investment in R&D and focus on lightweight, high-performance materials further strengthen market presence. Growth is also supported by expanding applications in medical devices and smart consumer goods, making Europe a significant market for PVD on plastics.

Asia-Pacific

Asia-Pacific accounts for over 25% share in 2024 and is the fastest-growing regional market. Rapid industrialization, large-scale electronics manufacturing, and rising automotive production in China, Japan, and South Korea drive demand. The growing penetration of smartphones, wearables, and home appliances accelerates adoption of PVD coatings for both functional and decorative applications. Government support for domestic manufacturing and investment in advanced coating facilities are boosting regional capacity. Increasing focus on sustainability and miniaturization of devices will continue to fuel growth, positioning Asia-Pacific as a major contributor to global PVD on plastic demand by 2032.

Latin America

Latin America captures around 6% share in 2024, led by Brazil and Mexico with growing demand in automotive and consumer electronics sectors. Rising adoption of premium interior finishes and decorative coatings in vehicles drives market growth. Expansion of domestic appliance production and increasing consumer spending on high-end products support PVD adoption. Local manufacturers are exploring cost-effective deposition solutions to enhance product aesthetics and durability. Although growth is slower compared to other regions, infrastructure investments and rising interest from multinational coating service providers are expected to strengthen the regional market in the coming years.

Middle East & Africa

The Middle East & Africa hold around 3% share in 2024, with demand concentrated in Gulf Cooperation Council (GCC) countries and South Africa. Growth is supported by rising investments in automotive aftermarket products, decorative coatings, and consumer goods. The region is gradually adopting PVD technology for luxury interiors and electronic device components. Limited manufacturing capacity and high equipment costs currently restrain market penetration, but increasing industrialization and focus on premium product aesthetics are expected to drive demand. Strategic partnerships with global coating providers will help accelerate technology transfer and market development in the forecast period.

Market Segmentations:

By Material

- Metal

- Ceramics

- Polymer

- Carbon

By Deposition Technique

- Sputtering

- Evaporation

- Molecular Beam Epitaxy

- Atomic Layer Deposition

By Application

- Flexible Electronics

- Displays

- Smart Home Appliances

- Medical Devices

By Substrates

- Polyimide

- Polyethylene Terephthalate

- Polyethylene Naphthalene

- Polyethylene

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the physical vapor deposition on plastic market features key players such as Leybold, Denton Vacuum, Veeco Instruments, PVD Products, Oerlikon, Kurt J. Lesker, Semicore Equipment, Satis Vacuum, AJA International, and Plasmet. These companies focus on delivering advanced PVD equipment and coating technologies tailored for automotive, electronics, medical, and consumer goods applications. Strategic initiatives include developing energy-efficient, low-temperature deposition systems to expand compatibility with heat-sensitive plastic substrates. Partnerships with manufacturers and research institutes help accelerate process innovation and broaden application scope. Leading players are also investing in automation, modular coating systems, and environmentally friendly processes to meet sustainability requirements and reduce operational costs. Competition in the market is driven by technological differentiation, coating quality, and cost efficiency, with major players aiming to expand their global footprint and strengthen after-sales support to capture growing demand across North America, Europe, and rapidly expanding Asia-Pacific markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Oerlikon debuted a high-throughput PVD system with pulse magnetron sputtering sources delivering 20 kW power and layer uniformity better than ±2% across substrates up to 2 meters wide.

- In July 2025, PVD Products introduced an enhanced roll-to-roll PVD coating line capable of depositing multi-layer dielectric coatings at speeds up to 50 meters per minute, with in-situ spectroscopic thickness monitoring, accelerating production of flexible plastic films used in wearable and optical sensor industries.

- In May 2025, Veeco Instruments announced significant orders for its advanced AP300™ Lithography systems designed for next-generation packaging which complement their PVD plastic coating capabilities.

- In March 2025, Kurt J. Lesker launched a compact batch PVD system tailored for small plastic components in medical devices, offering full digital plasma diagnostics and a deposition rate control precision of ±0.5 nm/min.

Report Coverage

The research report offers an in-depth analysis based on Material, Deposition Technique, Application, Substrates and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for PVD coatings on plastics will rise with growth in automotive interiors and electronics.

- Low-temperature deposition technologies will enable wider adoption on heat-sensitive plastic substrates.

- Flexible electronics and advanced display manufacturing will drive significant market expansion.

- Medical device applications will grow as PVD coatings improve biocompatibility and durability.

- Automation and modular PVD systems will enhance production efficiency for manufacturers.

- Sustainable and eco-friendly coating solutions will become a key focus for suppliers.

- Asia-Pacific will see the fastest growth supported by large-scale electronics and appliance production.

- Partnerships between PVD equipment makers and OEMs will accelerate process innovation.

- Decorative coatings will gain traction in premium consumer goods and smart appliances.

- R&D investment in multi-layer and functional coatings will strengthen product performance and market competitiveness.