Market Overview:

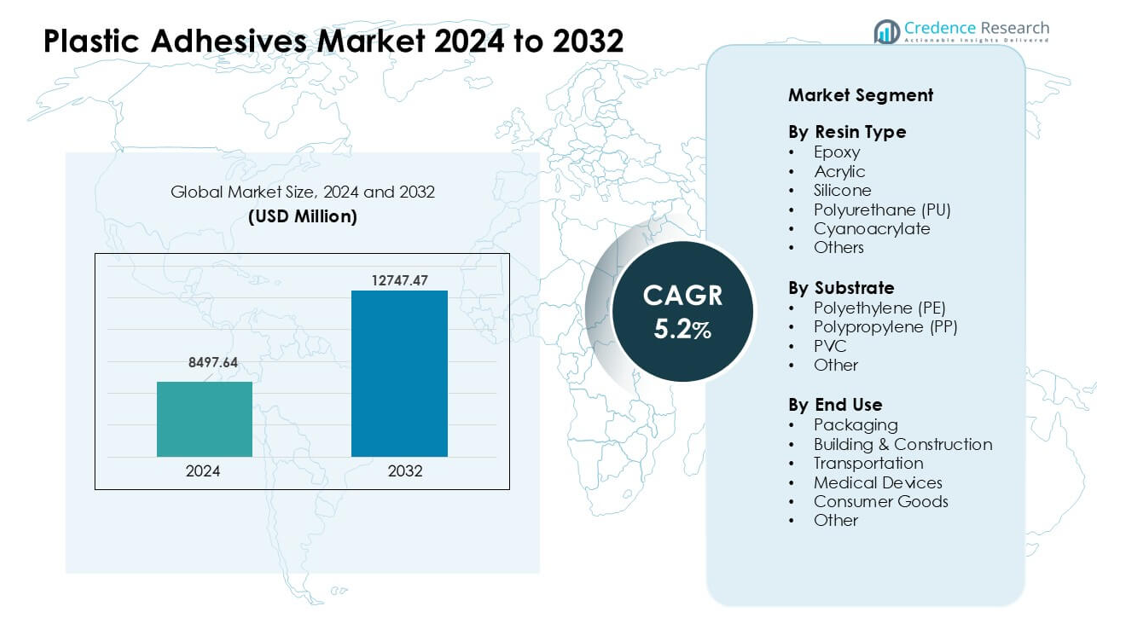

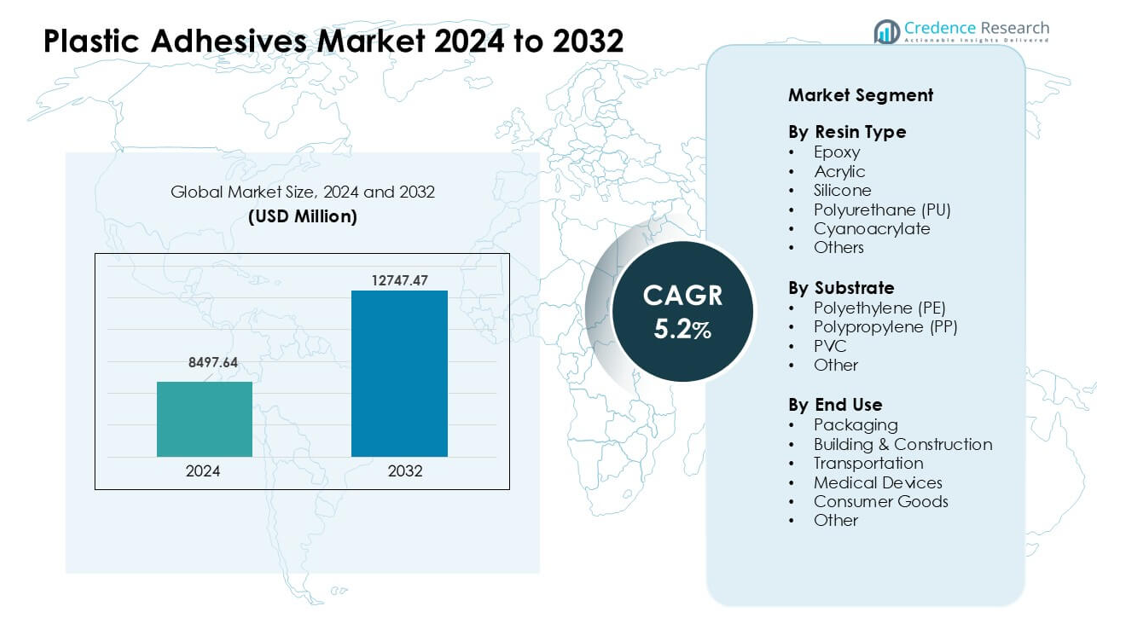

Plastic Adhesives Market was valued at USD 8497.64 million in 2024 and is anticipated to reach USD 12747.47 million by 2032, growing at a CAGR of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Plastic Adhesives Market Size 2024 |

USD 8497.64 million |

| Plastic Adhesives Market, CAGR |

5.2% |

| Plastic Adhesives Market Size 2032 |

USD 12747.47 million |

The Plastic Adhesives Market is driven by major players such as Henkel AG, 3M, Master Bond Inc, Dymax Corporation, Illinois Tool Works, Ashland Inc, Mapei S.P.A., H.B. Fuller, Arkema, and Dow Inc. These companies compete through advanced resin technologies, faster-curing systems, and solutions tailored for packaging, automotive, electronics, and medical applications. Their focus on low-VOC and recyclable adhesive chemistries supports growing sustainability needs across industries. North America led the global market in 2024 with about 34% share, supported by strong automotive production, expanding medical device manufacturing, and high adoption of premium adhesive technologies across major end-use sectors.

Market Insights:

- The Plastic Adhesives Market reached significant value at USD 8497.64 million in 2024 and is projected to grow steadily through 2032 at a strong CAGR of 5.2%, supported by rising use across packaging, automotive, and electronics sectors.

- Growth is driven by higher demand for lightweight plastics and strong adoption of epoxy and acrylic adhesives, with epoxy leading the resin segment at about 32% share due to strong structural bonding needs.

- Key trends include the shift toward low-VOC and recyclable adhesive chemistries, along with fast-curing systems suited for automated and high-speed production lines across major industries.

- The competitive landscape features Henkel AG, 3M, H.B. Fuller, Arkema, Dow Inc, and others that invest in advanced formulations and sustainable solutions to strengthen product performance and compliance.

- North America led the market with around 34% share, followed by Asia Pacific at nearly 31%, while packaging remained the dominant end-use segment with about 41% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Resin Type

Epoxy led the resin segment in 2024 with about 32% share. Strong structural strength, thermal stability, and wide bonding range kept epoxy ahead in automotive, electronics, and construction projects. Acrylic grades grew due to fast curing needs in packaging and consumer goods, while polyurethane gained traction in flexible joints. Silicone held steady demand in high-temperature uses, and cyanoacrylates expanded in medical and small-component assembly. Rising use of lightweight plastics in transport and electronics supported strong demand for epoxy-based plastic adhesives.

- For instance, the global plastic‑adhesives market report indicates that epoxy‑based adhesives held a 32.45% revenue share in 2024.

By Substrate

Polypropylene (PP) dominated this segment in 2024 with nearly 38% share. PP held the lead because the material is widely used across automotive interior parts, packaging crates, caps, and consumer goods. Adhesive makers developed improved surface-treatment and primer systems to address PP’s low surface energy, supporting higher bonding strength. Polyethylene (PE) followed due to strong use in films and rigid containers. PVC adhesives gained traction in pipes, profiles, and medical components. Growth in food packaging and lightweight molded parts helped PP maintain its dominant spot.

- For instance, researchers have successfully increased adhesion strength on PP substrates by treating PP films with a side‑chain crystalline block copolymer (SCCBC); the modified PP achieved a tensile‑shear adhesion strength of 1.05 N/mm² (versus negligible adhesion for untreated PP).

By End Use

Packaging held the largest share in 2024 with about 41% share. This segment grew due to rising demand for flexible pouches, labels, laminates, and rigid containers across food, beverage, and personal care lines. Strong sealing strength, fast curing, and compliance with safety rules supported wider use of plastic adhesives. Building and construction used adhesives for panels, flooring, and insulation. Automotive and transport relied on bonding for trims and interior modules. Medical devices expanded due to sterile-grade applications. High packaged-goods demand kept packaging in the leading position.

Key Growth Drivers:

Rising Adoption of Lightweight Plastics in Key Industries

Demand for lightweight plastics increased across automotive, electronics, and consumer goods, which boosted the use of plastic adhesives. Manufacturers replaced mechanical fasteners with advanced bonding solutions that deliver lower weight, better design flexibility, and improved stress distribution. Automakers used adhesives to bond interior trims, lighting units, and under-the-hood parts, supporting fuel efficiency rules. Electronics brands adopted high-strength grades for compact assemblies in smartphones, appliances, and EV battery packs. Growth in flexible packaging and medical components added further momentum. Rising focus on durability, noise reduction, and multi-material bonding kept lightweight plastics a major driver for plastic adhesive consumption.

- For instance, a global strategic business report notes that plastic adhesives have become “essential enablers” in lightweight, multi‑material product assemblies across automotive, electronics, packaging, and medical device sectors especially where plastics like polyolefins or composites need bonding in place of mechanical fasteners.

Expansion of Packaging Demand Across Food, Beverage, and Personal Care

Packaging brands used more laminated films, rigid plastics, and multi-layer structures, which increased reliance on high-performance adhesive systems. Plastic adhesives supported fast sealing speeds, better shelf-life protection, and safe bonding for food-contact materials. Growth in e-commerce raised the need for durable packaging formats with strong tear and impact resistance. Personal care and pharmaceutical companies preferred plastic adhesives for tubes, labels, caps, and blister packages. Brands expanded use of recyclable and mono-material packaging, which increased the demand for adhesives designed for PP and PE substrates. Rising packaged-goods consumption worldwide kept packaging a critical growth engine for the market.

- For instance, in flexible and rigid packaging, adhesives enable bonding of low-surface-energy plastics like polyethylene and polypropylene a capability heavily emphasized in market reports as a key factor in the adhesives market’s expansion across packaging and consumer goods.

Advancements in Adhesive Chemistry and Bonding Technologies

New adhesive chemistries improved curing speed, surface compatibility, flexibility, and bonding strength, which drove wider adoption in high-performance applications. Epoxy and acrylic grades delivered stronger thermal and chemical resistance for automotive and industrial needs. Polyurethane systems expanded in flexible joints, while medical-grade cyanoacrylates supported sterile bonding in device assembly. Plasma and corona treatments improved adhesion on low-energy plastics like PP and PE. Automation in assembly lines increased demand for precision dosing systems and fast-curing adhesives. Industry shifts toward stronger, safer, and more versatile bonding solutions continued to push innovation, raising performance expectations across multiple end-use sectors.

Key Trends & Opportunities:

Growth of Eco-Friendly and Recyclable Adhesive Solutions

Sustainability trends encouraged producers to develop low-VOC, solvent-free, and recyclable adhesive formulations. Packaging brands shifted toward mono-material PE and PP structures, which required compatible adhesive systems that support recycling streams. Water-based and bio-based chemistries gained attention due to regulatory pressure on hazardous substances. Companies also explored adhesives that debond on command to support circular design in electronics and consumer goods. Rising investment in green materials and compliance with global sustainability targets positioned eco-friendly adhesive solutions as a major trend and long-term market opportunity.

- For instance, according to a report on the sustainable adhesives market, adhesives designed for debonding under specific conditions such as heat, moisture, or chemical triggers are increasingly used so that plastics, metals, glass and paper can be separated at end-of-life and recycled more easily.

Adoption of Automation and High-Speed Production Lines

Manufacturers upgraded to automation in automotive, electronics, and packaging plants, increasing the need for adhesives that cure quickly and maintain consistent quality. Robotic dispensing systems improved precision, reduced waste, and ensured repeatability in high-volume operations. Fast-curing acrylic, hot-melt, and UV-curable adhesives supported this shift, enabling higher throughput levels. Smart factories used sensors and digital monitoring tools to optimize adhesive flow and bonding strength. As more industries adopt Industry 4.0 systems, adhesive suppliers will gain new opportunities by offering products tailored for automated, high-speed workflows.

- For instance, automated adhesive dispensing systems have been shown to deliver “pinpoint accuracy,” ensuring uniform bead size, placement, and volume even on complex geometries increasing consistency and reducing waste compared to manual application.

Key Challenges:

Bonding Challenges with Low-Surface-Energy Plastics

Common plastics like polyethylene and polypropylene pose bonding difficulties due to low surface energy, which limits adhesive wetting and penetration. Manufacturers often need extra steps such as plasma, flame, or corona treatment to improve adhesion, which adds cost and slows production. Specialized primers increase reliability but raise chemical-handling concerns. Although newer adhesive formulations improved compatibility, achieving stable long-term bonding remains difficult in heavy-duty or high-temperature environments. These performance constraints limit the use of standard adhesives and require ongoing innovation to meet demanding industrial needs.

Regulatory Pressure on Chemicals and VOC Emissions

The market faces strict global rules targeting volatile organic compounds, hazardous solvents, and chemicals with health risks. Compliance increases formulation complexity and raises production costs for adhesive manufacturers. Many traditional adhesives contain substances restricted under EU REACH, U.S. EPA standards, and regional packaging safety rules. Producers must invest in R&D to create safer alternatives without compromising strength or curing speed. Industries like food packaging and medical devices require rigorous testing, which slows product approvals. These regulatory pressures remain a major challenge and influence future product development strategies.

Regional Analysis:

North America

North America led the Plastic Adhesives Market in 2024 with about 34% share. Strong demand came from automotive lightweighting, medical device production, and high-performance packaging. U.S. automakers used epoxy and polyurethane systems for interior and structural bonding, while electronics firms adopted fast-curing acrylics for compact assemblies. Growth in e-commerce supported wider use of laminated and flexible packaging. The region also advanced sustainable adhesive technologies due to rising VOC regulations. Strong R&D spending and a high concentration of premium adhesive manufacturers helped North America maintain its leadership position across industrial and consumer applications.

Europe

Europe held nearly 28% share in 2024, driven by strict environmental rules, expanding electric vehicle production, and strong packaging innovation. Germany, France, and the U.K. used high-performance adhesives for EV battery packs, medical devices, and precision electronics. The EU’s circular economy targets pushed demand for recyclable and solvent-free adhesive systems, especially for PP and PE packaging lines. Growth in construction renovation and lightweight composites also supported consumption. Strong regulatory pressure encouraged companies to shift toward greener chemistries, keeping Europe a key region for advanced and eco-focused adhesive technologies.

Asia Pacific

Asia Pacific accounted for about 31% share in 2024 and grew fastest due to rapid industrialization, strong electronics manufacturing, and high plastic production volumes. China, Japan, South Korea, and India used large quantities of acrylic, epoxy, and polyurethane adhesives for smartphones, appliances, transport components, and packaging films. Expanding automotive plants and rising EV output continued to boost demand. The region also benefited from strong e-commerce packaging needs and large-scale consumer goods production. Competitive manufacturing costs and increased investment in automation positioned Asia Pacific as the strongest growth engine in the global market.

Latin America

Latin America held around 4% share in 2024, supported by growing packaging, automotive aftermarket, and building construction activities. Brazil and Mexico adopted more plastic adhesives in food packaging, household goods, and interior automotive trims. Demand for durable and cost-effective adhesive solutions increased as manufacturers expanded local production capacity. Growth in healthcare packaging and basic medical devices also contributed to steady uptake. Infrastructure upgrades and rising consumption of packaged goods helped maintain moderate growth. Limited technology investment compared to major regions restrained faster expansion but kept the market stable.

Middle East & Africa

Middle East & Africa captured nearly 3% share in 2024, driven by rising construction spending, industrial diversification, and steady packaging demand. Gulf nations used plastic adhesives for panels, insulation systems, and interior applications in large building projects. Growth in food and beverage packaging supported wider adoption of laminating and sealing adhesives. South Africa expanded use in automotive assembly and consumer goods manufacturing. The region’s shift toward local production of plastics and packaging materials created new opportunities, although slower technology adoption and economic volatility limited broader uptake across industrial sectors.

Market Segmentations:

By Resin Type

- Epoxy

- Acrylic

- Silicone

- Polyurethane (PU)

- Cyanoacrylate

- Others

By Substrate

- Polyethylene (PE)

- Polypropylene (PP)

- PVC

- Other

By End Use

- Packaging

- Building & Construction

- Transportation

- Medical Devices

- Consumer Goods

- Other

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The Plastic Adhesives Market features strong competition among leading companies such as Henkel AG, 3M, Master Bond Inc, Dymax Corporation, Illinois Tool Works, Ashland Inc, Mapei S.P.A., H.B. Fuller, Arkema, and Dow Inc. These companies focus on advanced resin chemistries, including epoxy, polyurethane, acrylic, and silicone systems that support high-strength bonding across packaging, automotive, medical, and electronics uses. Major players invest in faster-curing, low-VOC, and recyclable adhesive solutions to meet tightening global regulations and sustainability goals. Many firms expand production in Asia Pacific and strengthen partnerships with automotive and packaging OEMs. Growing demand for multi-material bonding and lightweight structures drives continuous R&D activity. Companies also enhance their portfolios with digital dispensing tools, surface-preparation technologies, and application-specific adhesive grades. This competitive environment pushes innovation and reinforces the market’s shift toward high-performance and eco-friendly bonding systems.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Henkel AG

- 3M

- Master Bond Inc

- Dymax Corporation

- Illinois Tool Works

- Ashland Inc

- Mapei S.P.A.

- B. Fuller

- Arkema

- Dow Inc

Recent Developments:

- In August 2025, Henkel AG Announced a new generation of phthalate-free PVC-based Darex COV sealants for pail & drum applications (improved health/environment credentials).

- In May 2025, Master Bond Inc. Announced new product releases (example: EP3HTSDA-2Med, a one-part silver-filled electrically conductive epoxy that passed ISO 10993-5; news release dated 05/19/2025). Master Bond’s May 2025 news stream also highlights UV/LED and dual-cure adhesives engineered for bonding challenging substrates.

- In June 2024, Dow Inc. Dow announced that three of its adhesive systems used with polyethylene film packaging received formal recognition from the Association of Plastic Recyclers for compatibility with PE film recycling. This validation supports brand owners and converters in designing plastic packaging structures that maintain strong adhesion while remaining recyclable in established PE streams.

Report Coverage:

The research report offers an in-depth analysis based on Resin Type, Substrate, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-strength adhesives will rise as industries shift toward lightweight plastic components.

- Adoption of recyclable and low-VOC adhesive systems will grow due to strict sustainability rules.

- Fast-curing chemistries will expand to support automated and high-speed production lines.

- Use of bonding solutions for EV battery modules and interior parts will increase.

- Medical device makers will adopt more biocompatible and sterile-grade adhesive formulations.

- Packaging brands will move toward mono-material structures that require advanced PP and PE bonding.

- Surface-activation technologies like plasma and corona treatment will see wider use.

- Manufacturers will invest in digital dispensing tools for precise and consistent adhesive application.

- Asia Pacific will gain stronger momentum as a key manufacturing hub for electronics and plastics.

- Companies will expand R&D to create adhesives compatible with circular design and easy disassembly.