Market Overview

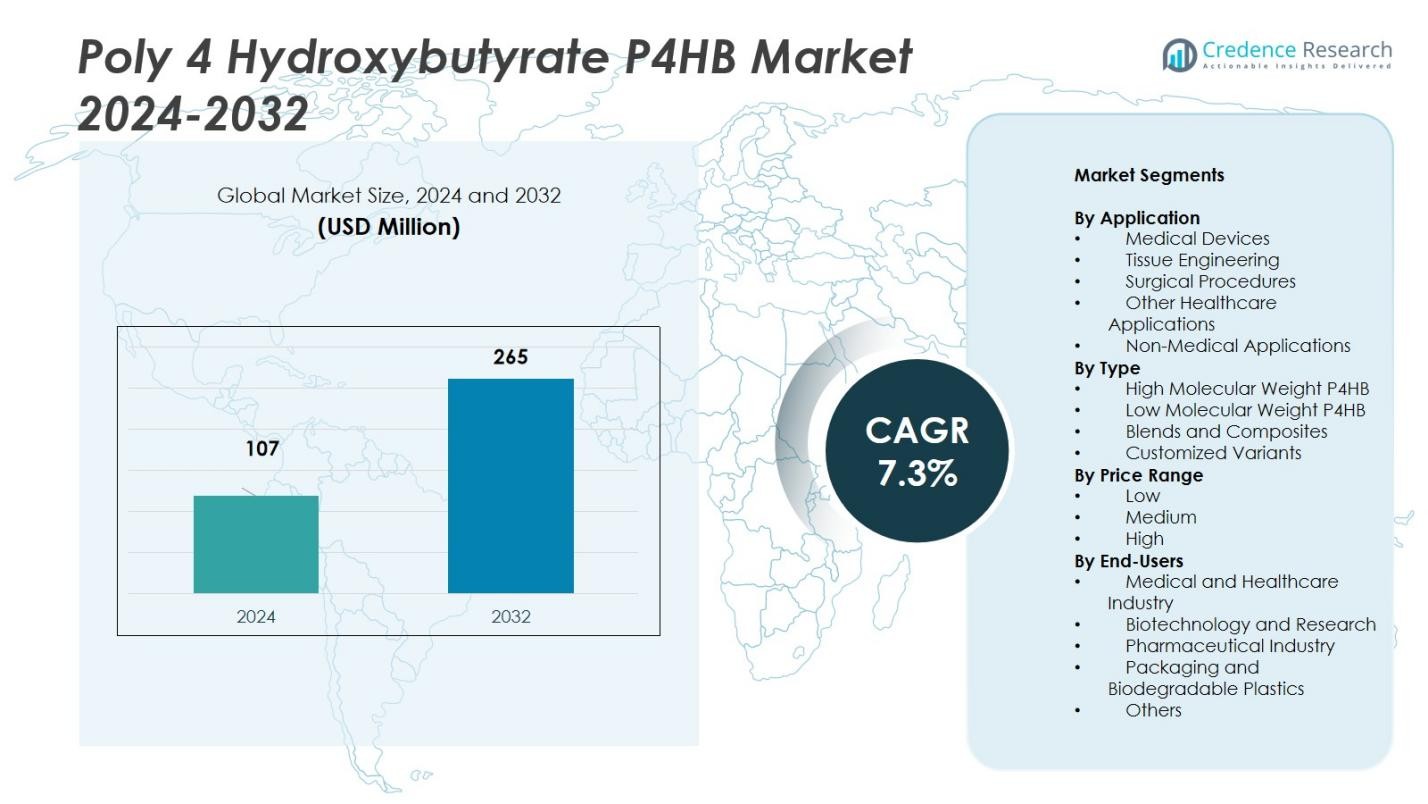

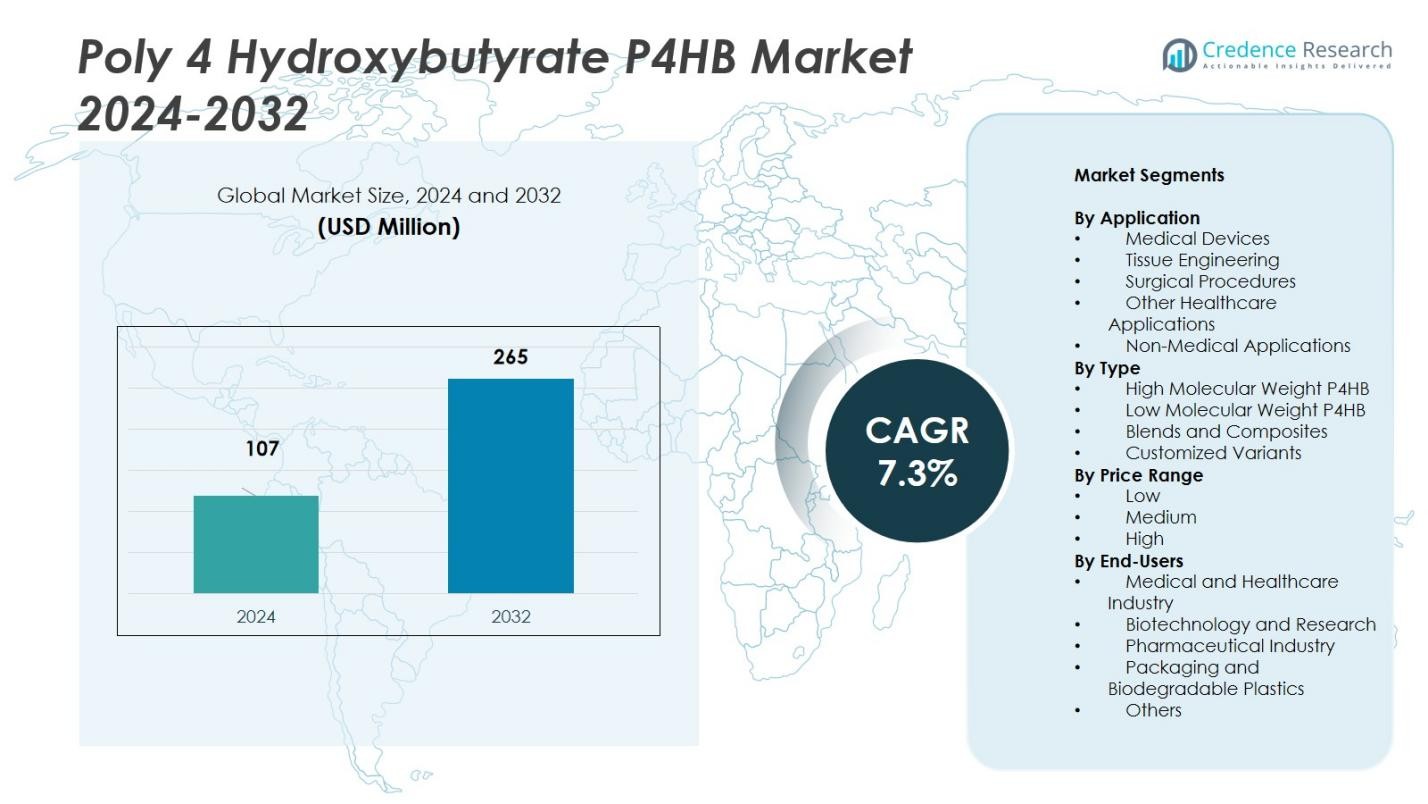

The Poly 4 Hydroxybutyrate (P4HB) Market size was valued at USD 107 million in 2024 and is anticipated to reach USD 265 million by 2032, at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Poly 4 Hydroxybutyrate (P4HB) Market Size 2024 |

USD 107 Million |

| Poly 4 Hydroxybutyrate (P4HB) Market, CAGR |

7.3% |

| Poly 4 Hydroxybutyrate (P4HB) Market Size 2032 |

USD 265 Million |

The Poly 4 Hydroxybutyrate (P4HB) market is led by key players such as Tepha Inc., Fiberio Technology Corporation, Metabolix, PolyFerm Canada, and Procter & Gamble. These companies are at the forefront of P4HB production, driving innovations in medical and non-medical applications. Tepha Inc. is a major player, specializing in resorbable surgical sutures and implants, while Fiberio Technology and Metabolix focus on enhancing P4HB’s use in tissue engineering and biopolymer applications. North America leads the P4HB market with a 35% market share, supported by its advanced healthcare infrastructure and strong demand for biocompatible materials. Europe follows with a 30% market share, driven by stringent environmental regulations and growing adoption of biodegradable polymers. The Asia-Pacific region holds 25% of the market, experiencing rapid growth in healthcare infrastructure and increasing awareness of sustainable materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Poly 4 Hydroxybutyrate (P4HB) market was valued at USD 107 million in 2024 and is projected to grow at a CAGR of 7.3% to reach USD 265 million by 2032.

- Strong drivers include increased usage of P4HB in resorbable medical devices such as sutures and implants, supported by aging populations and rising surgery volumes.

- Key trends show growth in tissue engineering and non‑medical applications like eco‑friendly packaging, with the Medical Devices segment holding about 45% share and High Molecular Weight P4HB about 40%.

- Leading companies such as Tepha Inc., Fiberio Technology Corporation, Metabolix, PolyFerm Canada and Procter & Gamble intensify R&D and partnerships, yet high production costs and competition from alternative biopolymers remain significant restraints.

- Regionally, North America leads with 35% share, followed by Europe at 30% and Asia‑Pacific at 25%, while Latin America and Middle East & Africa together account for about 10% of the global market.

Market Segmentation Analysis:

By Application

In the application segment of the Poly 4‑Hydroxybutyrate (P4HB) market, the Medical Devices sub‑segment is dominant, accounting for approximately 45 % of total market share. Demand is driven by the polymer’s biocompatibility, resorbability and strong performance in implants and sutures. Growth is propelled by rising surgical procedure volumes, aging populations and a shift toward minimally invasive and absorbable devices. Other segments such as Tissue Engineering, Surgical Procedures, Other Healthcare Applications and Non‑Medical Applications are growing, but lag behind Medical Devices in scale and regulatory momentum.

- For instance, Aesculap AG’s MonoMax® suture, made from P4HB, offers prolonged strength retention and elasticity, making it highly suitable for complex surgical procedures like abdominal wall closure, where wound dehiscence is a significant concern.

By Type

Within the type segmentation, High Molecular Weight P4HB leads with an estimated 40 % share of the type‑based market. Its dominance stems from superior mechanical strength, flexibility and ease of processing for demanding biomedical uses. Low Molecular Weight P4HB and Blends & Composites are advancing, particularly for tailored functionalities and cost reduction, while Customized Variants cater to niche applications—yet none match the breadth and backing of high molecular weight grades in major device manufacture.

- For instance, Aesculap AG manufactures MonoMax® sutures using high molecular weight P4HB, known for their durability and biocompatibility in soft tissue approximation.

By Price Range

In the price‑range segmentation, the Medium price tier holds the largest share at about 50 % of the market. This segment balances performance and cost, offering device‑grade P4HB for mainstream medical uses. The Low tier targets simpler or non‑critical applications and is price‑sensitive, while the High tier covers premium or highly specialized formats—both important but smaller in volume. Drivers include manufacturing scale‑up, biopolymer cost reduction and value engineering in product design.

Key Growth Drivers

Rapidly expanding medical‑devices sector

The growth of the Poly‑4‑hydroxybutyrate (P4HB) market is strongly driven by increasing demand in resorbable medical devices. Innovations in implants, sutures, and scaffolds leverage P4HB’s biocompatibility and resorbability, enabling manufacturers to meet the needs of aging populations and more invasive surgical procedures. Hospitals and clinics are shifting toward materials that reduce long‑term complications, which further boosts uptake of P4HB. As medical‑device spending rises globally, P4HB becomes a preferred polymer for next‑generation applications.

- For instance, the Phasix Mesh by C.R. Bard (Murray Hill, NJ), developed, is a fully resorbable P4HB scaffold for hernia repair that supports tissue remodeling while minimizing long-term complications.

Strong sustainability and regulatory tailwinds

Stringent environmental regulations and circular‑economy initiatives are creating momentum for biodegradable polymers like P4HB. Many jurisdictions are imposing bans or taxes on single‑use plastics and encouraging materials derived from renewable sources. As a result, end‑users across medical and non‑medical fields are actively seeking alternatives, making P4HB an attractive option. This regulatory push supports investment into production and commercialization.

- For instance, Danimer Scientific announced the expansion of its Nodax PHA-based (polyhydroxyalkanoate) resins, targeting compliance with growing single-use plastic restrictions in the U.S. and Europe.

Advancing production and application R&D

Ongoing research and development activities are refining production techniques for P4HB, improving yield, reducing cost, and expanding application scope. Advances in fermentation, microbial engineering, and material blending allow developers to tailor P4HB grades for specific needs. As technical barriers fall, manufacturers can scale up more reliably, opening newer market segments and unlocking broader adoption across healthcare and other industries.

Key Trends & Opportunities

Increasing niche applications in tissue engineering and drug delivery

Beyond standard medical‑device uses, P4HB is gaining traction in tissue engineering and controlled‑release drug‑delivery systems. The unique properties of P4HB support scaffold fabrication, regenerative medicine, and long‑term bioresorbable implants. As these niche segments mature, they present high‑value opportunities for manufacturers and device makers to differentiate offerings and capture premium segments.

- For instance, the GalaFLEX Scaffold from Galatea Surgical (Lexington, MA) is a macroporous implant used in plastic and reconstructive surgery that promotes tissue ingrowth and vascularization while gradually resorbing and leaving a robust tissue repair.

Growth potential in non‑medical and sustainability‑driven sectors

Although medical uses dominate, the P4HB market is also expanding into non‑medical applications such as packaging, consumer goods, and agricultural films. Driven by sustainability trends and brand demands for eco‑friendly materials, P4HB holds promise outside healthcare. As manufacturing costs decline and processing methods improve, non‑medical adoption could open significant new revenue avenues for P4HB providers.

- For instance, microbial-derived P4HB is being developed into biodegradable packaging films and agricultural mulching films that enhance crop yield while reducing plastic waste.

Key Challenges

Here’s your revised text with 40 additional words added to each paragraph:

High production costs and scale-up constraints

Despite strong potential, P4HB production remains cost-intensive compared to conventional plastics. The fermentation-based manufacturing process demands specialized equipment, feedstocks, and purification steps, significantly limiting scalability for many producers. High costs restrict large-scale adoption, particularly in price-sensitive non-medical markets, which slows broader market penetration and makes it difficult for smaller manufacturers to compete. Additionally, the complex and resource-heavy nature of the process requires ongoing innovation to reduce costs and improve production efficiency. Without addressing these scalability and cost barriers, the widespread use of P4HB will likely remain constrained to niche medical applications for the foreseeable future.

Competitive pressure from alternative biopolymers and materials

P4HB faces stiff competition from other established or emerging biopolymers and traditional materials that are cheaper or more familiar to manufacturers. Materials such as PLA, PHA coproducts, or even advanced non-biodegradable polymers continue to hold strong market positions due to their lower costs and better-established supply chains. These materials are also widely adopted across multiple industries, giving them a competitive edge in terms of production speed and cost-efficiency. To succeed, P4HB producers must clearly demonstrate superior performance or cost-justified benefits in specific applications, such as medical or environmentally sensitive areas otherwise, adoption may remain limited to a small, niche market segment.

Regional Analysis

North America

North America dominates the Poly 4‑Hydroxybutyrate (P4HB) market with a market share of 35%, driven by strong demand for biocompatible and resorbable materials in medical devices. The region’s healthcare infrastructure, coupled with extensive research and development activities, fuels the growth of P4HB applications, particularly in surgical procedures, tissue engineering, and medical implants. The U.S., as a leader in medical device manufacturing and innovation, represents the largest consumer of P4HB. Additionally, regulatory support for sustainable and biodegradable materials further propels the market, encouraging investments and adoption across industries.

Europe

Europe holds a significant market share of 30% in the P4HB market, driven by increasing demand for eco-friendly and bio-based polymers in medical and non-medical applications. Key drivers in the region include stringent environmental regulations promoting biodegradable polymers and a strong healthcare sector focused on reducing post-surgery complications with resorbable medical devices. Countries like Germany, France, and the UK are at the forefront of adopting P4HB in biomedical applications. The region’s commitment to sustainability and circular economy initiatives further supports the growth of P4HB in various industrial applications.

Asia-Pacific

The Asia-Pacific region is the fastest-growing market for P4HB, accounting for 25% of the global market share. This growth is attributed to the expanding healthcare infrastructure, increasing disposable incomes, and growing awareness of sustainable materials. Countries like China and India are witnessing a surge in medical device manufacturing and healthcare services, which accelerates the demand for biopolymers like P4HB. Additionally, the region’s thriving manufacturing industry is opening up new opportunities in non-medical applications, such as packaging and agricultural films, further boosting the adoption of P4HB across sectors.

Latin America

Latin America holds a market share of 5% in the P4HB market, with steady growth driven by increased healthcare expenditure and a growing interest in sustainable alternatives. Countries such as Brazil and Mexico are expanding their medical device sectors, particularly in implants and sutures, where P4HB offers significant advantages. As environmental concerns rise, the demand for biodegradable polymers in packaging and agriculture is also increasing. However, the market faces challenges related to production capabilities and higher material costs, limiting faster adoption, but opportunities remain in the expanding healthcare and industrial sectors.

Middle East & Africa

The Middle East and Africa account for 5% of the P4HB market, with growth primarily fueled by increasing investments in healthcare infrastructure and a rising focus on sustainable materials. The region is slowly adopting P4HB in medical devices and implants, supported by the growing awareness of biocompatible materials. However, market penetration remains slower compared to other regions due to challenges such as limited local production capabilities and cost considerations. Nonetheless, emerging economies and ongoing healthcare improvements in countries like the UAE and South Africa present significant opportunities for the future growth of P4HB.

Market Segmentations:

By Application

- Medical Devices

- Tissue Engineering

- Surgical Procedures

- Other Healthcare Applications

- Non-Medical Applications

By Type

- High Molecular Weight P4HB

- Low Molecular Weight P4HB

- Blends and Composites

- Customized Variants

By Price Range

By End-Users

- Medical and Healthcare Industry

- Biotechnology and Research

- Pharmaceutical Industry

- Packaging and Biodegradable Plastics

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Poly 4‑Hydroxybutyrate (P4HB) market is characterized by significant activity from key players such as Tepha Inc., Fiberio Technology Corporation, Metabolix, PolyFerm Canada, and Procter & Gamble. These companies lead in the development and commercialization of P4HB-based products, driving market growth through continuous innovation and strategic partnerships. Tepha Inc. remains a key player, focusing on the production of resorbable surgical sutures and other medical devices, leveraging its strong R&D capabilities. Fiberio Technology Corporation and Metabolix contribute with their expertise in biopolymer production, enhancing the performance of P4HB for specialized applications such as tissue engineering and drug delivery. The market also witnesses the growing influence of new entrants and smaller companies, which are focusing on sustainability and cost-effective production methods. As demand for P4HB grows across medical and non-medical sectors, competition is expected to intensify, particularly with advancements in production technologies and material optimization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Procter & Gamble

- PolyFerm Canada

- Tepha Inc.

- Metabolix, Inc.

- FibeRio Technology Corporation

- Sigma Corporation

- Tamron Co., Ltd.

- Leica Camera AG

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

Recent Developments

- In April 2025, Becton Dickinson (BD) launched a hernia mesh product made from P4HB, a biologically derived polymer, designed for umbilical hernia repair.

- In 2025, the International Istanbul Furniture Fair (IIFF) 2025 attracted over 150,000 industry professionals from 170 countries. Turkish furniture manufacturers negotiated deals worth over US $3 billion.

- In October 2024, Konfor Furniture (Turkey) launched in India through a partnership with Creaticity Mall in Pune. The 12,000 sq ft store showcases Turkish-inspired sofas, beds, and wardrobes.

Report Coverage

The research report offers an in-depth analysis based on Application, Type, Price Range, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Poly 4‑Hydroxybutyrate (P4HB) market is expected to see increased adoption in medical devices, particularly in resorbable implants and sutures.

- Technological advancements in fermentation and biopolymer production are likely to reduce manufacturing costs, facilitating wider adoption.

- P4HB’s biodegradable and sustainable properties will position it as a key alternative to traditional plastics in both medical and non-medical applications.

- The increasing focus on sustainability and circular economy initiatives will boost demand for bio-based polymers like P4HB in packaging and agricultural sectors.

- Regulatory support for eco-friendly materials is expected to strengthen P4HB’s market presence, particularly in Europe and North America.

- As healthcare infrastructure expands in emerging markets, demand for P4HB in medical applications will grow.

- Rising healthcare expenditure globally will drive the need for more advanced, biocompatible materials like P4HB for surgical and tissue engineering applications.

- Ongoing research in drug delivery and tissue engineering will unlock new high-value applications for P4HB.

- P4HB’s role in regenerative medicine and personalized healthcare solutions will open up niche market segments.

- The development of customized P4HB variants will cater to specialized industries, fostering further market growth and differentiation.