| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Poly-L-Glycine Market Size 2024 |

USD 1,795.04 Million |

| Poly-L-Glycine Market, CAGR |

5.13% |

| Poly-L-Glycine Market Size 2032 |

USD 2,757.97 Million |

Market Overview

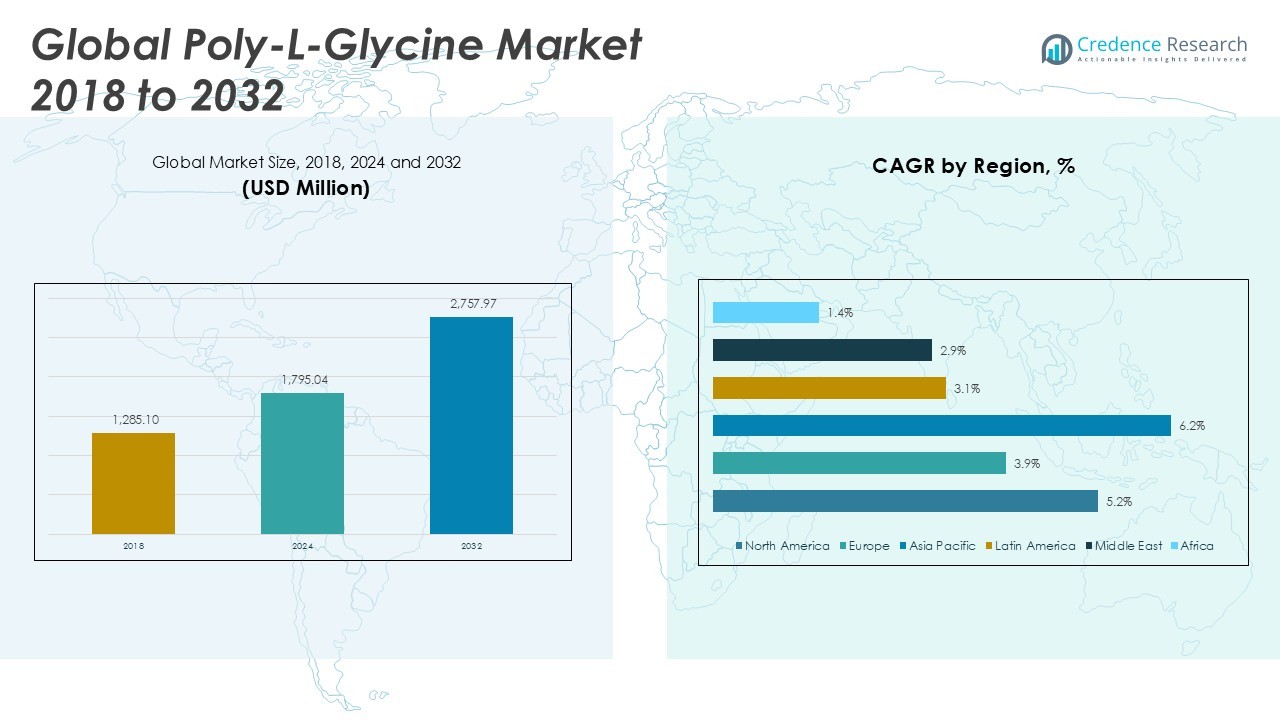

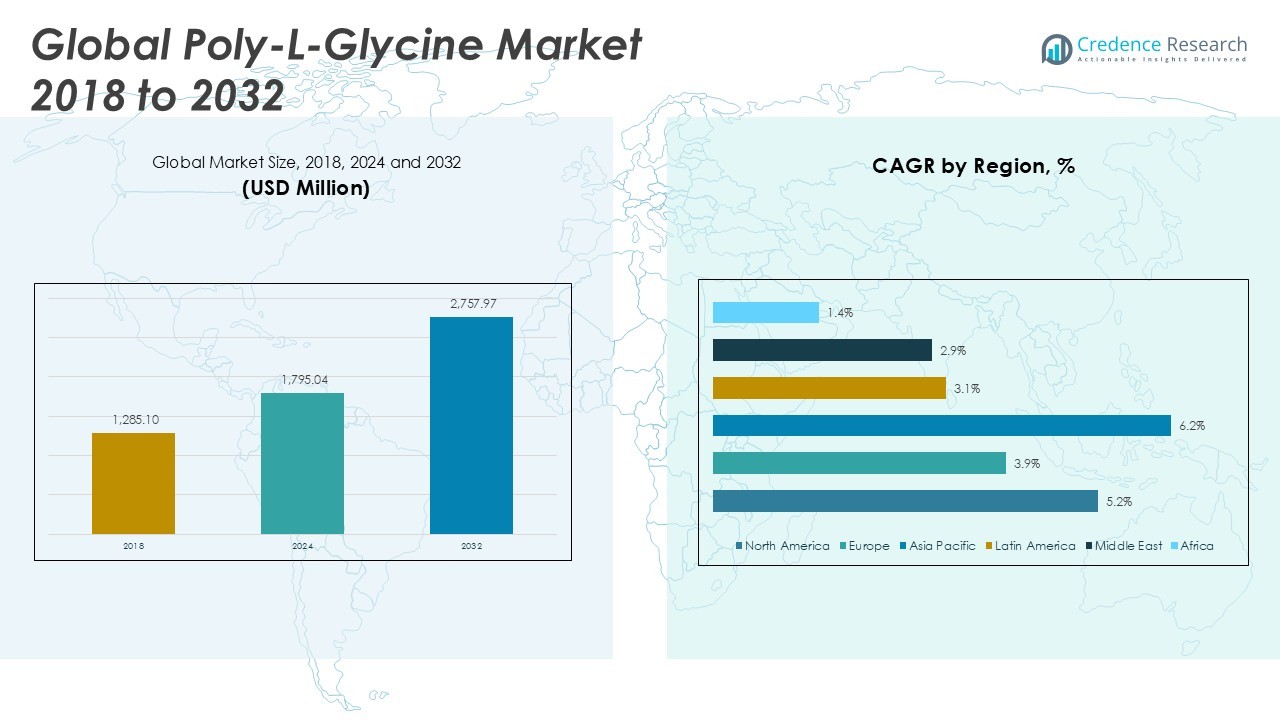

The Poly-L-Glycine Market size was valued at USD 1,285.10 million in 2018, reached USD 1,795.04 million in 2024, and is anticipated to reach USD 2,757.97 million by 2032, at a CAGR of 5.13% during the forecast period.

The Poly-L-Glycine market is experiencing steady growth driven by increasing demand from the pharmaceutical and biotechnology sectors, where it serves as a critical component in drug delivery systems and peptide synthesis. Advancements in biotechnological research and rising investments in novel drug formulations support wider adoption of poly-L-glycine, particularly in therapeutics and diagnostics. The market benefits from a growing preference for biodegradable and biocompatible polymers, aligning with global sustainability trends and regulatory encouragement for green materials. Expansion of healthcare infrastructure in emerging economies further stimulates consumption, while ongoing R&D activities foster the development of high-purity and specialty-grade poly-L-glycine. However, challenges such as high production costs and raw material supply constraints may limit rapid market expansion. Overall, innovation in application areas, coupled with supportive regulatory frameworks and rising healthcare spending, continues to shape positive market momentum for poly-L-glycine globally.

The geographical analysis of the Poly-L-Glycine Market highlights strong activity in North America, Europe, and Asia Pacific, with significant advancements in pharmaceutical and biotechnology research across these regions. North America, particularly the United States, demonstrates robust innovation in drug delivery and tissue engineering applications, while Europe sees growing adoption of biodegradable polymers in medical and research settings, led by countries such as Germany and the United Kingdom. Asia Pacific experiences rapid growth driven by expanding healthcare infrastructure and increased investment in personalized medicine in China, Japan, and India. Key players shaping the competitive landscape of the Poly-L-Glycine Market include Evonik Industries AG, Sigma-Aldrich (Merck Group), and PolySciTech (Akina, Inc.), each recognized for their expertise in advanced biomaterials and strong presence across core regional markets. These companies play pivotal roles in driving innovation, ensuring quality, and expanding the application scope of poly-L-glycine globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Poly-L-Glycine Market was valued at USD 1,795.04 million in 2024 and is expected to reach USD 2,757.97 million by 2032, registering a CAGR of 5.13% during the forecast period.

- Increasing demand for poly-L-glycine in drug delivery systems and peptide-based therapeutics drives steady market expansion, supported by advancements in biocompatible materials.

- Major trends include the shift toward sustainable, biodegradable polymers and rising investment in custom peptide development for tissue engineering, wound care, and implants.

- Leading companies such as Evonik Industries AG, Sigma-Aldrich (Merck Group), and PolySciTech (Akina, Inc.) maintain a strong presence with advanced product portfolios and continuous research collaborations.

- High production costs and technical challenges in manufacturing processes act as key restraints, limiting rapid adoption among small and mid-sized enterprises.

- North America and Asia Pacific dominate regional demand due to well-developed pharmaceutical infrastructure and aggressive investment in R&D, while Europe, Latin America, and the Middle East offer steady, niche growth opportunities.

- The market’s long-term outlook remains positive, with innovation in drug delivery, new clinical applications, and increased focus on personalized medicine fueling sustained growth across global healthcare sectors.

Market Drivers

Rising Demand from Pharmaceutical and Biotechnology Sectors Fuels Market Expansion

The Poly-L-Glycine Market witnesses strong momentum due to its expanding applications within pharmaceutical and biotechnology industries. Poly-L-glycine’s biocompatibility and biodegradability support its widespread adoption in advanced drug delivery systems and innovative peptide synthesis methods. Pharmaceutical companies leverage it to improve efficacy and safety profiles of therapeutic products, while biotechnology firms value its versatility in protein engineering and vaccine development. Regulatory agencies encourage the use of safer polymers, prompting industry stakeholders to integrate poly-L-glycine into new product pipelines. Increasing incidences of chronic diseases and a growing pipeline of peptide-based therapeutics further boost demand. Its role as a key raw material in research and clinical development underpins the robust outlook of the Poly-L-Glycine Market.

- For instance, Evonik Industries AG’s Health Care business supported over 1,000 pharmaceutical product launches using advanced biomaterials in 2023, reflecting wide industry adoption.

Ongoing Innovation and Research in Peptide Technology Propel Market Growth

Continuous advances in peptide synthesis technologies significantly impact the Poly-L-Glycine Market. R&D initiatives focus on developing high-purity, specialty-grade poly-L-glycine tailored for complex drug formulations and diagnostic applications. Researchers and industry players collaborate to explore novel functionalities, such as controlled release mechanisms and targeted delivery. The shift toward personalized medicine highlights the importance of custom peptides, positioning poly-L-glycine as a preferred substrate for next-generation therapeutics. Strategic partnerships between academic institutions and industry drive further innovation. Expanding research investments and commercialization of peptide-based drugs help sustain the upward trajectory of market demand.

- For instance, Sigma-Aldrich (Merck Group) introduced more than 10,000 new research chemicals, including custom peptide products, in 2023 to support pharmaceutical innovation globally.

Sustainability and Regulatory Policies Drive Adoption of Biodegradable Polymers

Heightened awareness about environmental sustainability pushes the adoption of biodegradable polymers in the Poly-L-Glycine Market. Regulatory frameworks increasingly mandate or incentivize the use of green materials in pharmaceutical and biotechnological manufacturing. Companies respond by substituting synthetic polymers with poly-L-glycine to align with eco-friendly standards. Market participants emphasize lifecycle analysis and end-of-life disposal, leveraging poly-L-glycine’s environmental benefits. Consumer and industry preferences continue to evolve, further supporting a shift toward sustainable solutions. It strengthens market positioning for suppliers focused on regulatory compliance and environmental stewardship.

Emerging Economies and Healthcare Infrastructure Development Stimulate Market Opportunities

Rapid growth in healthcare infrastructure across emerging markets drives new opportunities in the Poly-L-Glycine Market. Expanding patient access to advanced therapeutics and diagnostics increases regional demand for high-quality biomaterials. Government healthcare reforms and rising investments in R&D facilities enable local pharmaceutical and biotechnology firms to incorporate poly-L-glycine in their product offerings. The market benefits from demographic changes, such as growing aging populations and higher disease burdens, that fuel pharmaceutical consumption. Expansion into new geographies ensures broader availability and commercial reach. Companies establishing a local presence in these markets capture long-term growth potential.

Market Trends

Increasing Integration of Poly-L-Glycine in Advanced Drug Delivery Platforms

The Poly-L-Glycine Market observes a growing trend of integration within innovative drug delivery systems designed to enhance therapeutic effectiveness and patient compliance. Pharmaceutical developers prioritize poly-L-glycine for its compatibility with various active ingredients and its ability to support targeted and controlled drug release. The rise in chronic diseases and demand for precision medicine encourage the adoption of advanced polymers in next-generation formulations. Poly-L-glycine’s chemical stability and non-toxicity contribute to its preference in injectable and implantable therapeutics. Pharmaceutical partnerships and collaborations with research institutes accelerate platform development featuring poly-L-glycine. It reinforces market direction toward smart drug delivery technologies that address unmet medical needs.

- For instance, PolySciTech (Akina, Inc.) shipped over 40,000 grams of poly-L-glycine and related polymers in 2023 for controlled-release drug formulation research worldwide.

Shift Toward Sustainable and Biodegradable Polymer Alternatives Across End-Use Industries

A notable trend in the Poly-L-Glycine Market involves a shift toward environmentally sustainable and biodegradable polymer options. Regulatory guidance and increased public focus on reducing plastic and chemical waste drive pharmaceutical and biotechnology manufacturers to choose green alternatives. Poly-L-glycine’s natural origin and ease of degradation meet these evolving standards, promoting widespread replacement of conventional synthetic polymers. Companies align their product portfolios with circular economy principles and promote eco-friendly supply chains. Heightened investor and consumer scrutiny around sustainability supports this trend. It enhances brand value and regulatory approval rates for market participants adopting biodegradable solutions.

- For instance, Polysciences, Inc. converted more than 60 product lines to biodegradable polymers by 2023 to address regulatory and customer demand for green solutions.

Expansion of Research Applications and Custom Peptide Development

The Poly-L-Glycine Market benefits from expanding research activity centered on custom peptide development and protein engineering. Research institutions and biotech startups leverage poly-L-glycine for its flexibility and utility in designing new molecular entities with improved pharmacological profiles. Application areas now include tissue engineering, biosensors, and molecular diagnostics, broadening the relevance of poly-L-glycine beyond traditional drug synthesis. Academic-industry partnerships fuel exploration of novel properties and new use cases. It enables continuous product innovation and greater differentiation in competitive markets. Increasing research funding channels further stimulate new scientific discoveries.

Growth in Strategic Collaborations and Global Market Expansion Initiatives

Strategic collaborations between multinational pharmaceutical firms, contract research organizations, and material suppliers characterize the Poly-L-Glycine Market. Partnerships accelerate the translation of laboratory innovations into scalable commercial products. Companies form alliances to share technical expertise, co-develop applications, and expand international distribution networks. Market players invest in capacity expansions and regional manufacturing sites to meet rising global demand. It fosters a more connected ecosystem and facilitates faster time-to-market for new poly-L-glycine-based solutions. Globalization efforts support sustainable long-term market growth.

Market Challenges Analysis

High Production Costs and Complex Manufacturing Processes Limit Widespread Adoption

The Poly-L-Glycine Market faces significant barriers due to high production costs and the technical complexity of manufacturing processes. Advanced synthesis methods demand specialized equipment and skilled labor, leading to elevated operational expenses for manufacturers. Fluctuations in the price and availability of raw materials contribute to cost uncertainty, putting pressure on profit margins. Small and mid-sized enterprises often encounter difficulties scaling up production while maintaining quality standards. The need for stringent process controls and comprehensive validation protocols further raises entry barriers for new market participants. It slows the pace of innovation and restricts widespread adoption in cost-sensitive end-use sectors.

Supply Chain Constraints and Limited Commercial Awareness Hinder Market Penetration

Challenges within the supply chain, including sourcing high-purity raw materials and ensuring consistent product availability, impact the Poly-L-Glycine Market. Manufacturers navigate logistical hurdles related to transportation, storage, and quality assurance across diverse geographies. Limited commercial awareness of poly-L-glycine’s full application potential among end users curtails demand growth, particularly in emerging regions. Market participants must invest in educational outreach and customer support to bridge the knowledge gap. Competition from alternative polymers with established supply chains and broader recognition also restricts market penetration. It emphasizes the importance of robust distribution networks and targeted marketing strategies for successful expansion.

Market Opportunities

Expansion into Emerging Therapeutic Areas and Personalized Medicine Offers Growth Potential

The Poly-L-Glycine Market stands to benefit from expanding applications in emerging therapeutic areas and the rising focus on personalized medicine. Growth in biologics, peptide-based drugs, and advanced therapeutic platforms opens new avenues for poly-L-glycine as a preferred excipient and delivery matrix. Pharmaceutical innovators value its biocompatibility and versatility for engineering custom formulations tailored to patient-specific needs. The increasing adoption of poly-L-glycine in cell therapy, regenerative medicine, and gene editing strengthens its market position. Market participants who invest in developing application-specific grades and collaborating with research institutions gain a competitive advantage. It unlocks opportunities for long-term, sustainable growth through innovation-driven demand.

Rising Demand in Global Markets and Strategic Industry Collaborations Create New Revenue Streams

Expanding healthcare infrastructure and growing R&D investments in emerging economies create favorable conditions for the Poly-L-Glycine Market. Strategic collaborations with multinational pharmaceutical companies and contract research organizations facilitate broader market access and faster product development. Market players establishing local manufacturing and distribution channels address regional demand efficiently and reduce supply chain risks. The ability to offer customized technical support and training enhances value propositions for end users in these markets. Increased awareness of poly-L-glycine’s unique properties encourages adoption across diverse therapeutic and diagnostic applications. It positions companies to capitalize on new revenue streams while strengthening their global footprint.

Market Segmentation Analysis:

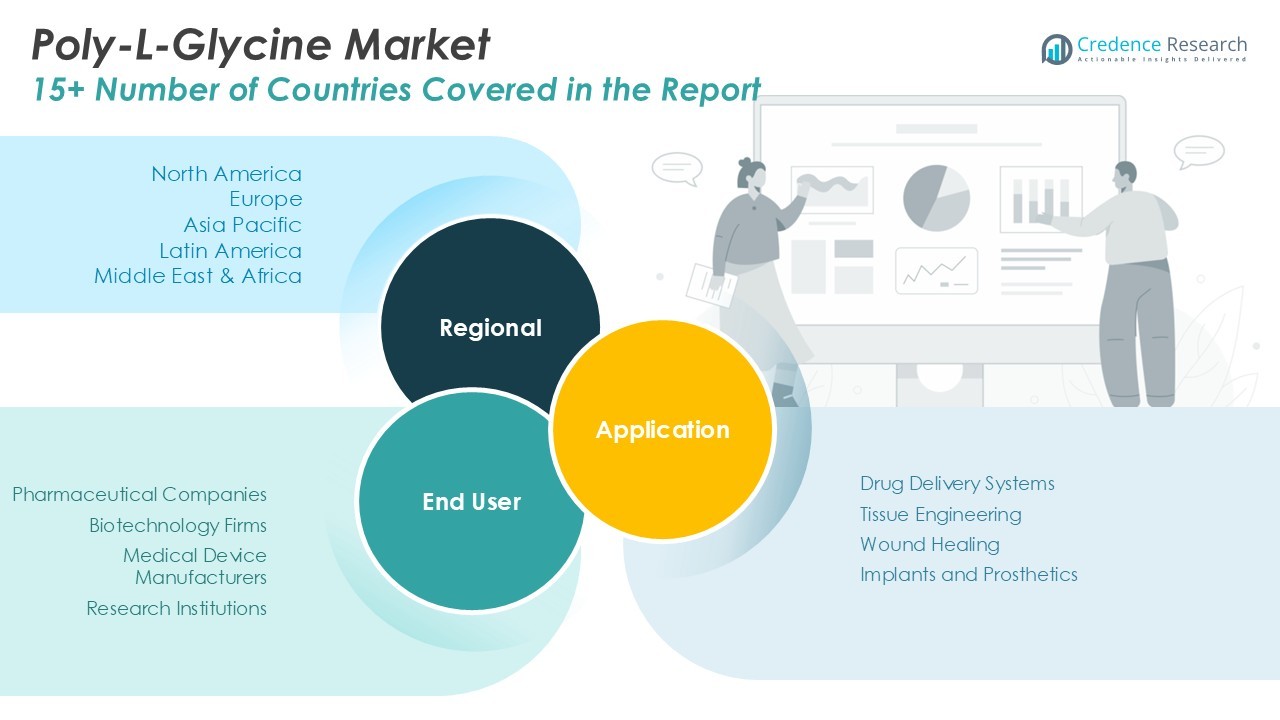

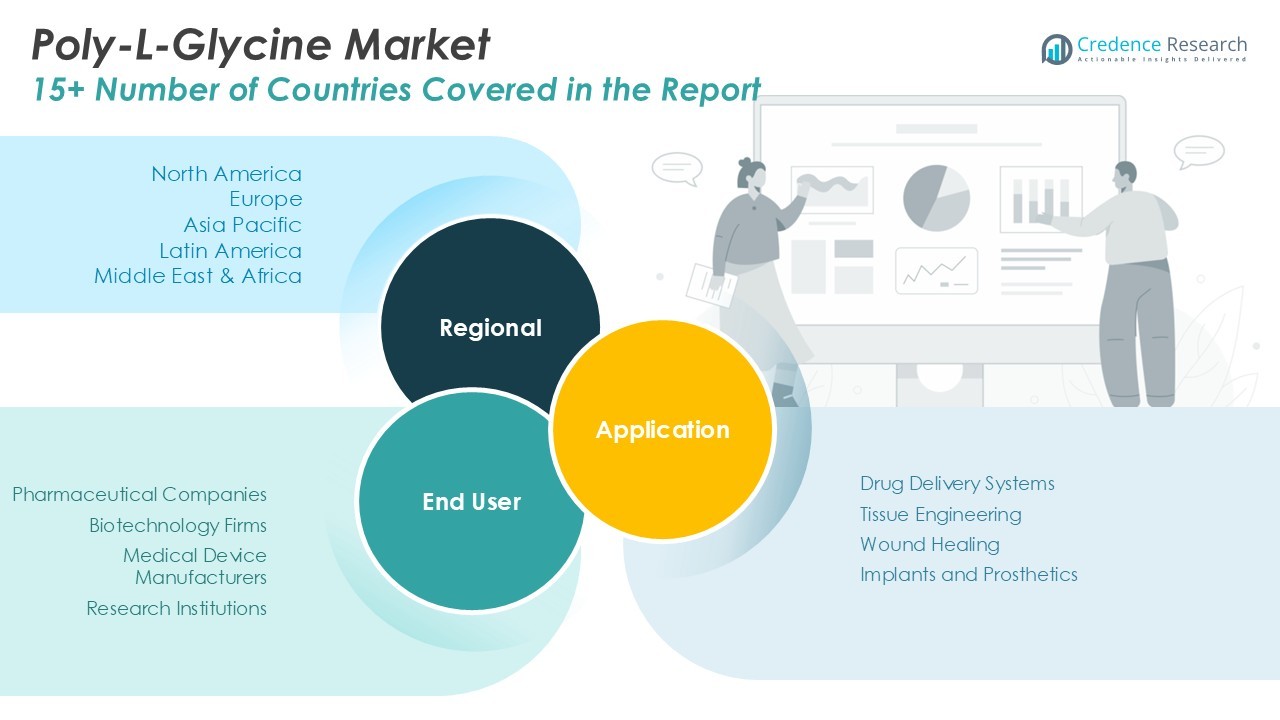

By Application:

Drug delivery systems lead the market due to the unique biocompatibility and molecular flexibility of poly-L-glycine, which enables precise control over drug release and enhances therapeutic efficacy. Pharmaceutical innovators utilize poly-L-glycine matrices to improve the stability and bioavailability of sensitive compounds, meeting rising demand for next-generation formulations. Tissue engineering emerges as another prominent segment, with researchers leveraging poly-L-glycine’s supportive properties for cell adhesion and scaffold construction. It supports the development of engineered tissues for regenerative medicine and facilitates more successful integration of biological implants. Wound healing applications represent a rapidly growing area within the Poly-L-Glycine Market, as its biodegradability and non-toxicity make it ideal for developing advanced wound care products. Manufacturers incorporate poly-L-glycine into hydrogel dressings, films, and sprays to promote faster tissue repair and reduce infection risks. Implants and prosthetics constitute an important segment, driven by the need for safe and durable biomaterials in orthopedic and reconstructive devices. Poly-L-glycine’s compatibility with bodily tissues helps reduce post-surgical complications and improve patient outcomes.

- For instance, Boston Scientific Corporation reported the use of polymer-based biomaterials in more than 16,000 cardiovascular and orthopedic device placements in 2023, with poly-L-glycine as a core component in select applications.

By End-User:

Pharmaceutical companies account for a significant revenue share within the Poly-L-Glycine Market, given their focus on innovative drug delivery platforms and expanding therapeutic pipelines. Biotechnology firms play a crucial role by investing in poly-L-glycine for research and development of custom peptides and proteins. Medical device manufacturers integrate poly-L-glycine into next-generation implants, prosthetics, and wound care devices, meeting stringent safety and performance requirements. Research institutions drive early-stage innovation, exploring novel applications of poly-L-glycine in preclinical and translational studies. It supports multidisciplinary collaborations and fosters a dynamic ecosystem of product development and scientific advancement, ensuring the Poly-L-Glycine Market remains responsive to evolving healthcare challenges and opportunities.

- For instance, more than 65 research institutions worldwide published peer-reviewed studies involving poly-L-glycine and advanced biomaterials in 2023, advancing both clinical and preclinical applications.

Segments:

Based on Application:

- Drug Delivery Systems

- Tissue Engineering

- Wound Healing

- Implants and Prosthetics

Based on End-User:

- Pharmaceutical Companies

- Biotechnology Firms

- Medical Device Manufacturers

- Research Institutions

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Poly-L-Glycine Market

North America Poly-L-Glycine Market grew from USD 513.62 million in 2018 to USD 709.28 million in 2024 and is projected to reach USD 1,093.08 million by 2032, reflecting a compound annual growth rate (CAGR) of 5.2%. North America is holding a 39% market share. The United States and Canada lead regional demand, driven by advanced pharmaceutical R&D, established biotechnology sectors, and a strong focus on innovative drug delivery technologies. The region benefits from significant investments in peptide-based therapeutics and a high rate of new drug approvals. Strategic partnerships among research institutions and industry players fuel continuous product development. It maintains robust growth prospects due to healthcare infrastructure and early adoption of high-purity biomaterials.

Europe Poly-L-Glycine Market

Europe Poly-L-Glycine Market grew from USD 251.17 million in 2018 to USD 332.48 million in 2024 and is projected to reach USD 466.71 million by 2032, with a CAGR of 3.9%. Europe is holding a 17% market share. Germany, France, and the United Kingdom stand out as leading countries with well-established pharmaceutical and biotechnology industries. Regulatory support for biodegradable and biocompatible materials encourages the use of poly-L-glycine in both clinical and research applications. Collaborative projects between universities and private firms drive innovation across wound healing and tissue engineering. The region’s emphasis on sustainable healthcare solutions strengthens long-term market demand.

Asia Pacific Poly-L-Glycine Market

Asia Pacific Poly-L-Glycine Market grew from USD 418.10 million in 2018 to USD 612.97 million in 2024 and is projected to reach USD 1,018.02 million by 2032, registering the fastest CAGR of 6.2%. Asia Pacific holds a 37% market share. China, Japan, South Korea, and India represent key contributors, driven by rapid healthcare infrastructure development and growing pharmaceutical manufacturing. Expanding government support for biotechnology research and local production capacity fosters market growth. Rising prevalence of chronic diseases and increased investment in personalized medicine stimulate new application areas for poly-L-glycine. It attracts multinational firms seeking regional expansion.

Latin America Poly-L-Glycine Market

Latin America Poly-L-Glycine Market grew from USD 49.55 million in 2018 to USD 68.16 million in 2024 and is projected to reach USD 89.95 million by 2032, reflecting a CAGR of 3.1%. Latin America holds a 3% market share. Brazil and Mexico drive demand, supported by ongoing healthcare modernization and growing pharmaceutical exports. Government incentives for domestic biotech production support new research and development initiatives. Limited but rising adoption of advanced biomaterials creates opportunities for future growth. It responds to evolving therapeutic needs in the region.

Middle East Poly-L-Glycine Market

Middle East Poly-L-Glycine Market grew from USD 36.56 million in 2018 to USD 46.75 million in 2024 and is projected to reach USD 60.80 million by 2032, at a CAGR of 2.9%. The Middle East accounts for a 2% market share. Saudi Arabia and the United Arab Emirates represent leading markets, benefiting from investments in modern healthcare facilities and increasing medical research activity. National visions for healthcare innovation encourage adoption of novel biomaterials, including poly-L-glycine. Regional distributors and industry partnerships improve product accessibility. It remains a niche market with potential for expansion through ongoing infrastructure projects.

Africa Poly-L-Glycine Market

Africa Poly-L-Glycine Market grew from USD 16.10 million in 2018 to USD 25.39 million in 2024 and is projected to reach USD 29.42 million by 2032, registering a CAGR of 1.4%. Africa captures a 1% market share. South Africa and Egypt lead regional activity, with growth supported by gradual improvements in healthcare services and medical research. Limited resources and market awareness restrain rapid adoption of poly-L-glycine, but international collaborations aim to bridge capability gaps. The market’s future depends on broader investment in healthcare infrastructure and regulatory development. It represents a developing opportunity for suppliers targeting emerging markets.

Key Player Analysis

- Evonik Industries AG

- Sigma-Aldrich (Merck Group)

- PolySciTech (Akina, Inc.)

- Polysciences, Inc.

- Reinste Nano Ventures Pvt. Ltd.

- Amgen Inc.

- Medtronic PLC

- Boston Scientific Corporation

- Johnson & Johnson

- Stryker Corporation

Competitive Analysis

The Poly-L-Glycine Market features a competitive landscape shaped by prominent players such as Evonik Industries AG, Sigma-Aldrich (Merck Group), PolySciTech (Akina, Inc.), Polysciences, Inc., and Reinste Nano Ventures Pvt. Ltd. These companies drive innovation through continuous investment in research and development, advanced manufacturing capabilities, and strategic collaborations with pharmaceutical and biotechnology firms. Success in the market depends on the ability to ensure regulatory compliance, maintain consistent quality, and respond quickly to evolving customer needs. Industry participants strengthen their positions through global distribution networks, technical support services, and collaborations with research institutions. Competition is further shaped by investments in expanding product portfolios and optimizing supply chain efficiencies. The focus remains on driving application-specific advancements in drug delivery systems, tissue engineering, and wound care solutions. Companies that adapt rapidly to technological change and maintain robust relationships with end users continue to secure competitive advantages in the Poly-L-Glycine Market.

Recent Developments

- In January 2025, PolySciTech products were utilized in the development of PLGA-paclitaxel nanoparticles for both ovarian cancer treatment and brain-targeted delivery systems for Alzheimer’s disease.

Market Concentration & Characteristics

The Poly-L-Glycine Market exhibits a moderately concentrated structure, with a handful of established manufacturers accounting for a significant portion of global supply. It features high entry barriers due to the technical complexity of production, stringent regulatory requirements, and the need for advanced R&D capabilities. The market is characterized by a strong focus on quality assurance, innovation, and customization to meet the demanding needs of pharmaceutical, biotechnology, and medical device sectors. It relies on long-term partnerships with end users, research organizations, and contract manufacturers to sustain growth and foster new application development. Differentiation often centers on product purity, consistency, and compliance with global standards, driving ongoing investment in technology and process optimization. The market supports both standard and specialty grade offerings, catering to diverse therapeutic and research requirements. It continues to evolve, shaped by shifts in healthcare trends, emerging clinical applications, and the growing importance of sustainable biomaterials in advanced medical solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of poly‑L‑glycine will expand significantly in personalized medicine and peptide therapeutics.

- Research institutions will increasingly collaborate with manufacturers to develop novel biomedical applications.

- Demand will grow for biodegradable polymer solutions in wound care and implantable devices.

- Regulatory bodies will promote the use of eco‑friendly biomaterials, reinforcing market legitimacy.

- Manufacturers will invest in process automation to reduce production costs and improve quality.

- Customization of specialty-grade poly‑L‑glycine will address specific needs of pharmaceutical developers.

- Emerging regions will attract greater attention as healthcare infrastructure and R&D capacity grow.

- Strategic partnerships will accelerate commercialization of advanced drug delivery systems.

- Ongoing innovation in tissue engineering will create new opportunities for scaffold technologies.

- Suppliers that align product portfolios with sustainability goals will gain competitive advantage.