Market Overview

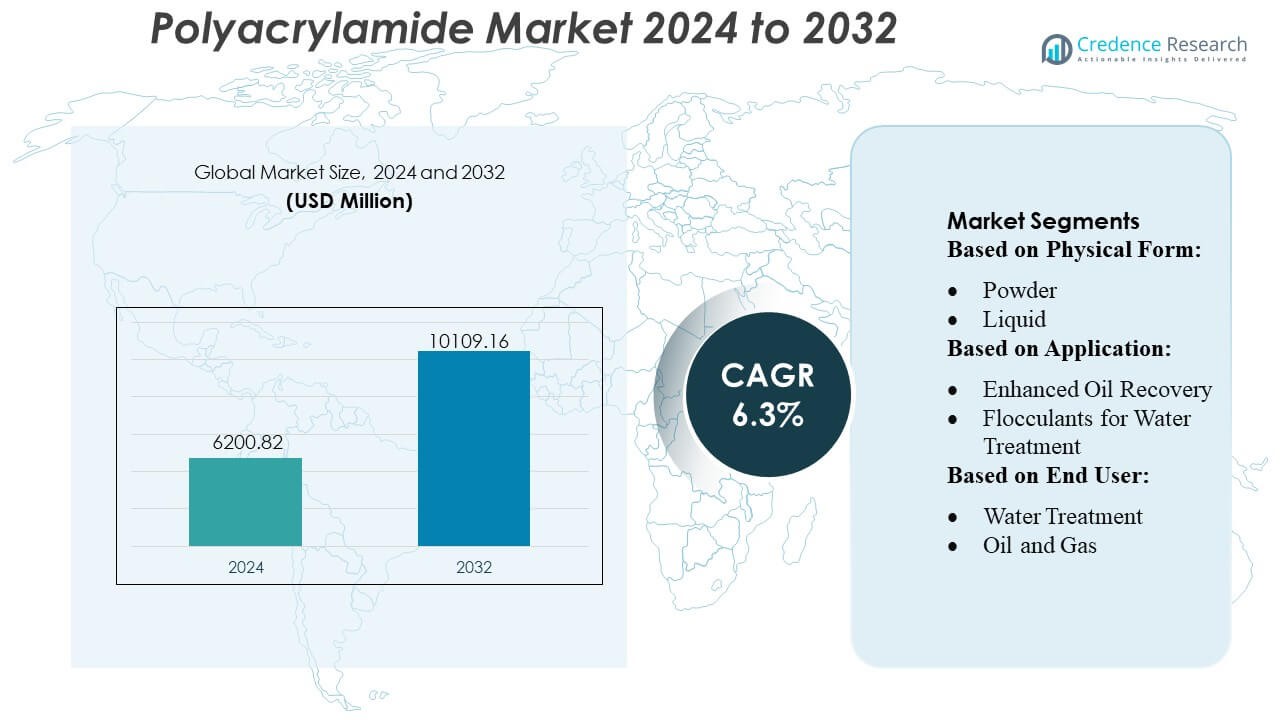

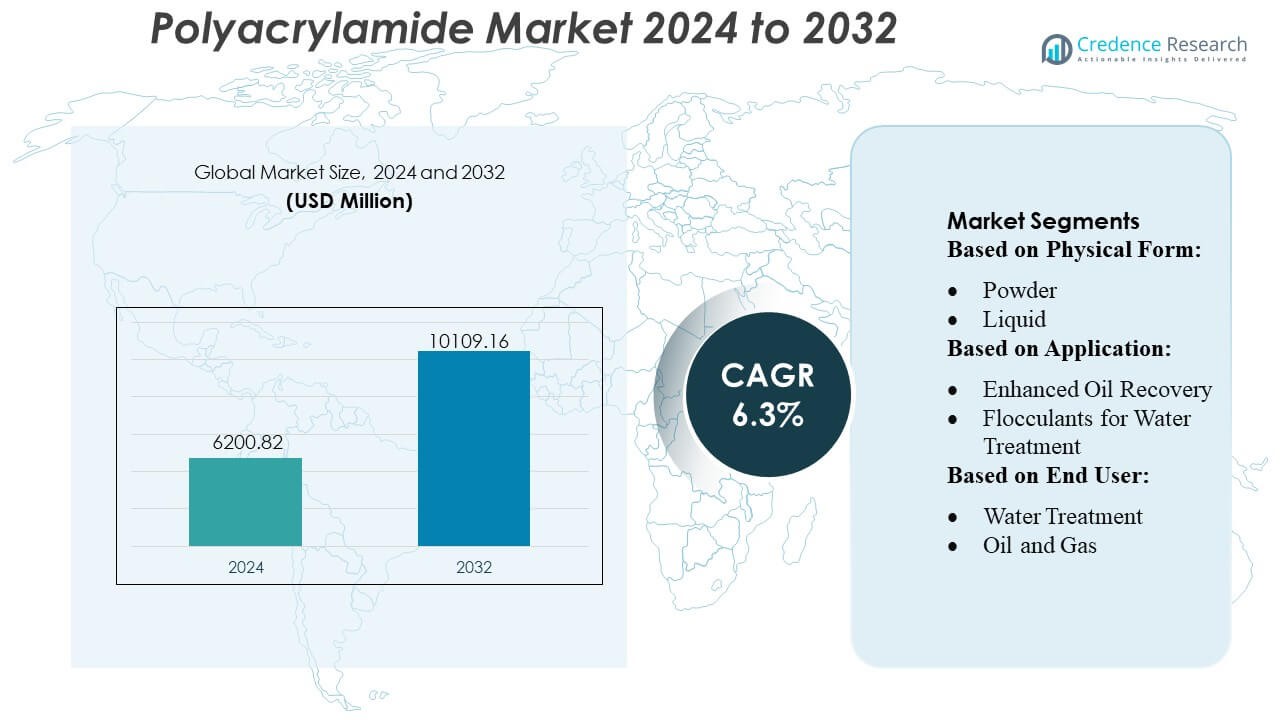

Polyacrylamide Market size was valued USD 6200.82 million in 2024 and is anticipated to reach USD 10109.16 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyacrylamide Market Size 2024 |

USD 6200.82 Million |

| Polyacrylamide Market, CAGR |

6.3% |

| Polyacrylamide Market Size 2032 |

USD 10109.16 Million |

The global polyacrylamide market is dominated by a handful of major producers — including SNF Group, Kemira Oyj, BASF SE, Solenis LLC and Ashland Inc. — each maintaining robust production and distribution networks across key industrial end‑use segments such as wastewater treatment, mining, oil recovery, pulp & paper and textiles. Among these, SNF Group remains widely recognized as the global leader in polyacrylamide supply. Regionally, the Asia-Pacific zone leads the market, capturing approximately 44.5% of global market share in 2024. This regional dominance is driven by accelerating industrialization, expanding water‑treatment infrastructure and rising demand in oil, mining and urban wastewater processing across countries such as China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global polyacrylamide market was valued at USD 6,200.82 million in 2024 and is projected to reach USD 10,109.16 million by 2032, growing at a CAGR of 6.3% during the forecast period.

- Rising demand for efficient water treatment solutions and enhanced oil recovery drives market growth, with industrial applications in mining, pulp & paper, and textiles further supporting expansion.

- Key market trends include the adoption of high-performance, environmentally friendly polyacrylamides and increased use in wastewater treatment chemicals with higher flocculation efficiency.

- The market is dominated by major players such as SNF Group, Kemira Oyj, BASF SE, Solenis LLC, and Ashland Inc., who maintain extensive production and distribution networks to serve diverse industrial end-users.

- Regionally, Asia-Pacific leads with approximately 44.5% of the global market share in 2024, driven by rapid industrialization, expanding water treatment infrastructure, and growing demand in China, India, and other emerging economies, while cationic and anionic polyacrylamides hold the largest segment shares across applications.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Physical Form

Powder polyacrylamide leads the market with the largest share, supported by its easy handling, long storage stability, and wide use in municipal and industrial water treatment. Its dominance is driven by lower transportation cost and high efficiency in solid–liquid separation, making it the preferred choice for large-scale facilities. Liquid and emulsion forms continue to grow as industries adopt faster-dissolving products for oilfield operations and process industries that require quick activation and consistent performance.

- For instance, Haldor Topsoe A/S reported an h-index of 173, reflecting its scientific leadership in catalysis, and invested nearly DKK 700 million in R&D during 2023 to advance its heterogeneous catalyst technologies.

By Application

Flocculants for water treatment represent the dominant application segment, driven by rising demand for wastewater treatment in municipal utilities and industrial plants. Stricter environmental regulations and increasing water reuse practices strengthen this segment’s leadership. Enhanced oil recovery also grows steadily as oil producers use polyacrylamide to improve viscosity, reduce flow resistance, and boost extraction from mature fields, supporting higher operational efficiency in the energy sector.

- For instance, Dongying Kechuang reports an annual throughput of 60,000 tons of polyacrylamide across its production lines, underlining its capacity to supply large-scale water‑treatment facilities reliably.

By End-User

Water treatment remains the leading end-user segment due to the large volume of wastewater generated by urbanization, manufacturing, and power generation. Its dominance is supported by continuous investments in treatment infrastructure and compliance requirements for discharge standards. The oil and gas industry follows as a key end-user, using polyacrylamide extensively in drilling fluids, EOR operations, and produced-water treatment, which strengthens demand as companies seek better process efficiency and reduced operational losses.

Key Growth Drivers

Rising Demand for Water and Wastewater Treatment

Increasing urbanization, industrial activity, and stricter environmental regulations are driving the need for efficient water and wastewater treatment solutions. Polyacrylamide plays a central role as a flocculant, helping municipalities and industries manage sludge, reduce contaminants, and improve water recycling. As water scarcity intensifies in many regions, utilities continue to expand treatment capacities, which strengthens long-term demand for polyacrylamide across both developed and emerging markets.

- For instance, CLARITY™ digital service portal has been adopted at more than 80 plants worldwide, serving over 380 active users in 28 countries, enabling real-time monitoring and performance optimization of catalyst systems.

Growing Use in Enhanced Oil Recovery (EOR)

The expansion of enhanced oil recovery operations remains a major growth driver for the polyacrylamide market. Oil producers rely on polyacrylamide to increase the viscosity of injected water, improve sweep efficiency, and extract more oil from mature reservoirs. Rising global energy demand and continued reliance on existing fields support increased adoption of polymer flooding, making polyacrylamide a critical material in boosting production efficiency and extending the operating life of aging oil assets.

- For instance, Arkema SA reports that its Siliporite® molecular sieves now offer a service life of 4–5 years when used in highdemand petrochemical separation applications, supporting prolonged catalyst stability.

Increasing Adoption in Pulp, Paper, and Industrial Processes

The pulp and paper sector uses polyacrylamide extensively to improve fiber retention, enhance drainage, and streamline wastewater operations. Its role extends across mining, textiles, and chemical processing, where it helps optimize solid–liquid separation and improve process efficiency. Industries seeking reduced operating costs, improved product quality, and compliance with environmental norms continue to integrate polyacrylamide into production lines, reinforcing its importance across multiple industrial applications.

Key Trends & Opportunities

Shift Toward Eco-Friendly and Low-Toxicity Formulations

Growing emphasis on sustainability is encouraging the development of polyacrylamide variants with lower residual monomer content and improved environmental performance. These formulations support compliance with stricter regulatory standards in water treatment and food-related industries. Manufacturers developing safer, greener products are positioned to access high-value markets, creating opportunities for differentiated offerings and long-term competitive advantage.

- For instance, UOP LLC (Honeywell) recently launched its MTO-600 catalyst formulation, which achieves “up to 10% lower coke yield” and “at least 1% improved methanol consumption” compared to its previous MTO-100 version.

Growing Use in Mining, Soil Management, and Water Reuse

Polyacrylamide is increasingly applied in mining operations for tailings treatment, sediment control, and water recovery. In agriculture, it helps improve soil structure and reduce erosion. Its rising use in water recycling systems also aligns with global sustainability goals. As mining activity expands and governments promote soil conservation and water reuse, new opportunities emerge for polyacrylamide in high-growth, regulation-driven sectors.

- For instance, Nebula® bulk metal catalyst commercialised more than ten years ago has been deployed across over 60 refineries with more than 130 unit cycles, according to the company’s 2016 announcement.

Key Challenges

Environmental Concerns and Residual Monomer Limitations

Polyacrylamide faces regulatory challenges related to residual acrylamide content, which raises environmental and health concerns. Applications involving drinking water and food-related effluents require strict compliance, increasing pressure on manufacturers to improve purification and quality control. These conditions add cost burdens and slow adoption in sensitive sectors, making regulatory compliance a persistent challenge.

Raw Material Price Volatility and Supply-Chain Risks

Polyacrylamide production depends on petrochemical feedstocks, making it vulnerable to fluctuations in crude oil prices and disruptions in chemical supply chains. Sudden changes in raw material availability can increase production costs and affect profit margins for manufacturers. These supply-side uncertainties also impact pricing stability for end users, particularly in cost-sensitive water treatment and industrial segments.

Regional Analysis

North America

North America holds about 28% of the global polyacrylamide market. The region’s strong share comes from mature wastewater treatment systems, strict environmental rules, and high use in enhanced oil recovery. Industries such as mining, chemicals, and paper also support steady demand. Continuous upgrades to municipal treatment plants and increasing focus on water reuse keep polyacrylamide consumption stable across the region.

Asia Pacific

Asia Pacific accounts for the largest share, around 50% of the global market. Rapid industrial growth, expanding cities, and major investments in wastewater treatment drive strong demand in China, India, and Southeast Asia. High usage in mining, manufacturing, and oil and gas further strengthens the region’s dominance. Government initiatives to improve water quality and industrial compliance continue to support rapid market expansion.

Europe

Europe represents roughly 22% of the market, supported by strict environmental regulations and well-developed wastewater treatment networks. The region maintains steady demand from sectors such as paper, chemicals, mining, and municipal water treatment. Increased focus on safer, low-toxicity polymers also drives adoption. Although growth is moderate, Europe remains a stable and regulation-driven market for polyacrylamide.

Latin America

Latin America holds about 6% of the global market. Growing investment in water treatment, mining operations, and industrial development in countries like Brazil, Mexico, and Chile drives demand. Rising environmental awareness and infrastructure improvements support market growth. While the region’s overall share is smaller, stronger regulatory focus and industrial expansion create ongoing opportunities.

Middle East & Africa

The Middle East & Africa region accounts for around 6% of global demand. Water scarcity and reliance on desalination and wastewater treatment make polyacrylamide essential. The oil and gas sector uses it heavily for enhanced oil recovery, while mining activities also support consumption. As governments invest more in water infrastructure and industrial projects, steady growth is expected across the region.

Market Segmentations:

By Physical Form:

By Application:

- Enhanced Oil Recovery

- Flocculants for Water Treatment

By End User:

- Water Treatment

- Oil and Gas

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global polyacrylamide market is highly competitive, with key players including Dongying Kechuang Biochemical Industrial Co., Ltd., Ashland Inc., Shandong Polymer Bio-Chemicals Co., Ltd., Kemira, ZL EOR Chemicals Ltd., BASF SE, Black Rose Industries Ltd., Xitao Polymer Co., Ltd., Anhui Jucheng Fine Chemical Co., Ltd. (CJCC), and SNF Group. The global polyacrylamide market is highly competitive, driven by continuous innovation and the development of high-performance polymer solutions. Companies focus on enhancing product quality, expanding production capacities, and improving distribution networks to meet growing demand across water treatment, oil & gas, and industrial applications. Emphasis on eco-friendly and low-residual monomer formulations is increasing, aligning with stricter environmental regulations and sustainability goals. Strategic initiatives such as partnerships, mergers, and acquisitions are shaping the market, while differentiation through technical support, customized solutions, and advanced applications remains critical for maintaining a competitive edge in this dynamic and rapidly evolving industry.

Key Player Analysis

- Dongying Kechuang Biochemical Industrial Co., Ltd.

- Ashland Inc.

- Shandong Polymer Bio-Chemicals Co., Ltd.

- Kemira

- ZL EOR Chemicals Ltd.

- BASF SE

- Black Rose Industries Ltd.

- Xitao Polymer Co., Ltd.

- Anhui Jucheng Fine Chemical Co., Ltd. (CJCC)

- SNF Group

Recent Developments

- In May 2025, ZL Group, established in 1995, is a Canadian-invested company with a headquarters in Canada and manufacturing facilities worldwide that specializes in the production of polyacrylamide and polymer dispersion equipment for the oil and gas industry.

- In August 2024, BASF’s Fourtiva is a new FCC catalyst using AIM and MFT tech to boost high-octane gasoline components, maximizing butylene, naphtha octane, and LPG olefins while cutting coke/dry gas, helping refiners boost profits and meet market demands for cleaner fuel.

- In April 2024, Clariant, a specialty chemical manufacturer emphasizing sustainability, announced the release of CATOFIN 312, its most recent catalyst for propane dehydrogenation. The new catalyst has a 20% longer life and is more selective.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Physical Form, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Polyacrylamide demand will continue to grow due to increasing investments in wastewater treatment and water reuse projects.

- Enhanced oil recovery applications will expand, driven by the need to improve extraction from mature oilfields.

- Industrial sectors such as paper, mining, and chemicals will sustain steady consumption for solid-liquid separation and process efficiency.

- Eco-friendly and low-residual monomer formulations will see higher adoption due to stricter environmental regulations.

- Emerging markets in Asia Pacific, Latin America, and the Middle East will drive overall market growth.

- Innovation in high-performance and specialty polymers will create opportunities in technical and industrial applications.

- Government initiatives focused on water conservation and environmental compliance will support long-term demand.

- Agricultural applications like soil conditioning and erosion control will increasingly contribute to market expansion.

- Companies will focus on expanding production capacity and optimizing distribution networks to meet rising demand.

- Strategic collaborations, mergers, and acquisitions will shape the competitive landscape and support global market penetration.

Market Segmentation Analysis:

Market Segmentation Analysis: