Market Overview

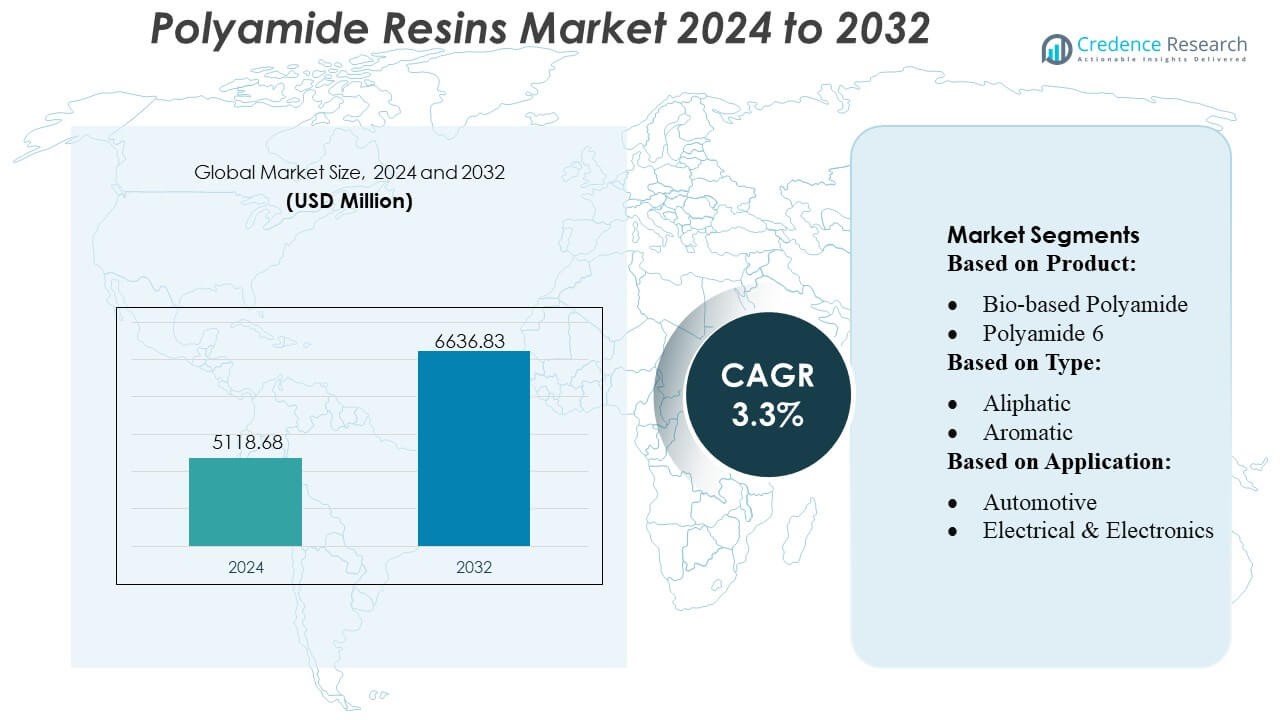

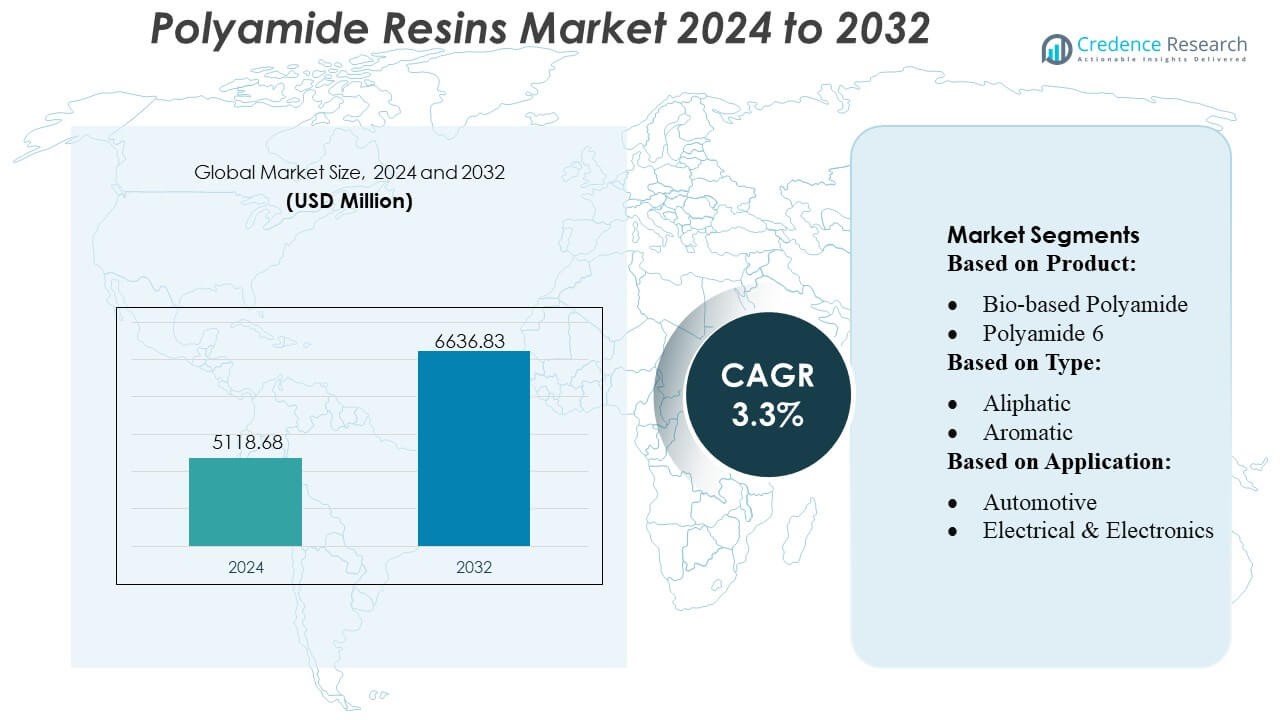

Polyamide Resins Market size was valued USD 5118.68 million in 2024 and is anticipated to reach USD 6636.83 million by 2032, at a CAGR of 3.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyamide Resins Market Size 2024 |

USD 5118.68 Million |

| Polyamide Resins Market, CAGR |

3.3% |

| Polyamide Resins Market Size 2032 |

USD 6636.83 Million |

The polyamide resins market is led by prominent players such as BASF SE, Toray Industries, Ascend Performance Materials LLC, Lanxess AG, AdvanSix Inc., Toyobo Co. Ltd., Domo Chemicals, Ashley Polymers Inc., Huntsman Corporation, and Ube Industries Ltd. These companies focus on innovation, high-performance product development, and strategic expansions to strengthen their global presence. They supply advanced polyamide grades for automotive, electronics, packaging, and industrial applications, leveraging R&D to enhance thermal stability, mechanical strength, and sustainability. Regionally, Asia-Pacific dominates the market with a 32% share, driven by rapid industrialization, growing automotive and electronics production, and increased demand in countries like China, India, and Japan. Strong local manufacturing capabilities and expanding infrastructure in the region position Asia-Pacific as the fastest-growing and most strategic market for polyamide resin suppliers globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The polyamide resins market size was valued at USD 5118.68 million in 2024 and is anticipated to reach USD 6636.83 million by 2032, growing at a CAGR of 3.3% during the forecast period.

- Demand is driven by automotive, electronics, and packaging sectors, with high-performance and lightweight polyamides supporting advanced applications and sustainability initiatives.

- Key trends include growth in bio-based and recyclable polyamides, increasing adoption in 3D printing, and development of nanocomposite grades for enhanced thermal and mechanical performance.

- The market is highly competitive, led by players such as BASF SE, Toray Industries, Ascend Performance Materials LLC, and Lanxess AG, focusing on R&D, product innovation, and strategic expansions.

- Regionally, Asia-Pacific dominates with a 32% share, supported by China, India, and Japan, while Europe and North America also hold significant shares, and production is expanding to meet growing industrial and consumer demand.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product

Polyamide 6 is the largest product segment, holding over 50% market share. Its popularity comes from strong mechanical properties, chemical resistance, and ease of processing, making it ideal for automotive, electronics, and industrial applications. Polyamide 66 follows, valued for its high heat resistance and rigidity, used in under-hood automotive parts and electrical components. Bio-based and Specialty Polyamides are growing fastest due to demand for sustainable and high-performance materials in aerospace, consumer goods, and industrial applications, despite having smaller current market share.

- For instance, Toyobo has developed a bio‑based high‑melting‑point polyamide resin derived from castor beans, marketed under the trade name Vyloamid®, produced at its Tsuruga plant with a capacity of 1,000 tons per year underscoring both sustainability and production scalability.

By Type

Aliphatic polyamides dominate the market due to their balance of strength, flexibility, and chemical resistance, widely used in automotive and engineering plastics. Aromatic polyamides hold a smaller share but grow steadily, driven by high-performance applications requiring excellent thermal stability and mechanical strength, such as aerospace, electronics, and protective materials. Growth is fueled by demand for durable, heat-resistant plastics in advanced industries.

- For instance, Ascend’s PA66 portfolio under the brand Vydyne includes flame‑retardant and compound variants; their star product line Starflam 500 achieves a UL94 V‑0 rating at 0.2 mm thickness while retaining PA66’s typical specific strength and ease of processing.

By Application

Engineering plastics lead with about 58% market share, driven by demand for lightweight, strong components in automotive, electronics, and machinery. Automotive applications follow, as polyamides replace metals in engine parts, air-intake systems, and EV components. Electrical & Electronics, Consumer Goods, Packaging, and Other applications are also growing steadily due to the need for heat-resistant, durable, and chemically stable materials in housings, connectors, appliances, and packaging solutions.

Key Growth Drivers

- Rising Demand in Automotive and Electronics Industries

The polyamide resins market is significantly driven by increasing demand in automotive and electronics sectors due to their superior mechanical strength, thermal stability, and lightweight properties. For instance, polyamide 6 and 66 are extensively used in engine components, connectors, and housings for electronic devices, enabling enhanced durability and heat resistance. Companies like BASF have scaled production to meet these industrial requirements, producing over 50,000 tons of engineering-grade polyamide annually to support OEMs in reducing weight while maintaining performance and compliance with evolving industry standards.

- For instance, BASF reports a global annual capacity of about 885,000 metric tons for its PA6 and PA66 polyamides, demonstrating robust supply capability.

- Advancements in High-Performance Polyamide Formulations

Technological innovation in polyamide resin formulations supports growth by offering enhanced thermal stability, chemical resistance, and dimensional precision. For instance, DSM Engineering Materials has developed high-flow PA66 grades capable of withstanding temperatures up to 280°C, facilitating applications in demanding automotive and electrical components. Such advancements allow manufacturers to replace metal parts, improving fuel efficiency in vehicles and energy efficiency in electronics, which in turn accelerates market adoption.

- For instance, Lanxess AG specially engineered polyamide‑66 compound Durethan AKV320ZXTS2 withstands continuous thermal exposure up to 230 °C without thermal‑stabilization gaps, even after 3,000 hours of ageing a capability that makes it suitable for turbocharged engine air‑ducts and under‑hood components.

- Expansion in Packaging and Consumer Goods Applications

The rising need for sustainable and high-performance packaging materials propels polyamide resin demand. For instance, Arkema’s Rilsan® polyamide grades are increasingly used in flexible packaging and food-contact films due to their barrier properties and recyclability, producing up to 40,000 tons annually. These applications leverage the material’s resistance to oxygen and moisture, extending product shelf life and supporting global trends toward lightweight, durable, and recyclable consumer goods packaging.

Key Trends & Opportunities

- Growth in Sustainable and Bio-Based Polyamides

Sustainability trends are driving opportunities for bio-based polyamide resins that reduce reliance on fossil fuels. For instance, Evonik’s VESTAMID® Terra, produced from castor oil, achieves high mechanical performance while lowering carbon footprint. This trend supports adoption in automotive, electronics, and consumer goods, creating a competitive advantage for manufacturers that can offer certified eco-friendly solutions and meet growing regulatory and consumer demands for sustainable materials.

- For instance, AdvanSix introduced 100 % post‑industrial recycled (PIR) grades under its Aegis® PA6 resins and Capran® BOPA films reclaiming unreacted caprolactam from waste streams and re‑allocating it into fully recycled nylon.

- Increasing Adoption of Polyamide in 3D Printing

Additive manufacturing presents a significant opportunity as polyamide powders gain popularity in industrial 3D printing due to high tensile strength, chemical resistance, and thermal stability. For instance, EOS has developed PA12 powders with particle sizes of 50–100 µm optimized for selective laser sintering (SLS), enabling rapid prototyping and functional end-use parts. The expansion of 3D printing in automotive, aerospace, and medical industries is expected to drive consistent demand for high-quality polyamide powders.

- For instance, DOMO’s Sinterline® Technyl® PA6 powders designed for Selective Laser Sintering (SLS) have enabled continuous 3D‑printed parts production for automotive and industrial applications.

- Integration of Nanotechnology for Enhanced Properties

Nanocomposite polyamide resins offer enhanced strength, thermal conductivity, and barrier performance, opening avenues in electronics, automotive, and packaging. For instance, Solvay has successfully incorporated nanofillers into PA66 matrices, achieving a 30% improvement in mechanical strength and heat resistance. Such innovations create opportunities for high-performance applications, positioning polyamides as a versatile alternative to metals and conventional polymers in advanced engineering and industrial uses.

Key Challenges

- Volatility in Raw Material Prices

Polyamide resin production is heavily dependent on petrochemical-derived raw materials such as caprolactam and adipic acid, exposing manufacturers to price volatility. Fluctuating feedstock costs can impact profit margins and disrupt supply chains. For instance, sudden increases in caprolactam prices by 20–25% in 2024 forced several manufacturers, including Lanxess, to adjust production schedules and product pricing, highlighting the market’s vulnerability to crude oil and intermediate chemical supply fluctuations.

- Intense Competition and Technological Barriers

The polyamide resins market faces intense competition from alternative engineering plastics such as PBT, PET, and high-performance composites, which offer comparable mechanical and thermal properties. For instance, substitution in automotive electrical components by PBT blends reduces demand for conventional PA66 grades. Additionally, the development of advanced polyamide grades requires significant R&D investment, creating barriers for smaller players and challenging manufacturers to continuously innovate while maintaining cost-efficiency and performance standards.

Regional Analysis

North America

North America holds a significant share of the polyamide resins market, accounting for approximately 25%, driven by the robust automotive, electronics, and packaging sectors. High adoption of engineering-grade polyamides in lightweight automotive components and electronic housings has fueled demand. For instance, BASF and DuPont have expanded PA66 and PA12 production to meet OEM requirements for durable, high-temperature resistant materials. The presence of stringent environmental regulations and growing investment in electric vehicles further supports market growth, encouraging manufacturers to develop high-performance and sustainable polyamide solutions that align with regional compliance standards and consumer expectations.

Europe

Europe represents a leading market with a share of around 28%, attributed to strong industrial adoption and advanced manufacturing infrastructure. Countries like Germany, France, and Italy drive demand for polyamide resins in automotive, aerospace, and industrial applications. For instance, DSM and Arkema have developed high-temperature PA66 grades for automotive and electrical components, producing tens of thousands of tons annually. The region also focuses on bio-based and recyclable polyamides to meet sustainability targets. Rising investments in lightweight vehicles, electronics miniaturization, and renewable packaging solutions continue to expand polyamide applications, positioning Europe as a technologically advanced and innovation-driven market.

Asia-Pacific

Asia-Pacific dominates the polyamide resins market with a market share of about 32%, led by China, India, and Japan, due to rapid industrialization, urbanization, and automotive production. For instance, Sinopec and Toray Industries produce large volumes of PA6 and PA66, exceeding 100,000 tons annually to meet industrial and consumer demands. The growing electronics, packaging, and textile sectors further support adoption. Rising government initiatives for lightweight vehicles, electronic miniaturization, and sustainable packaging contribute to market expansion. Increasing foreign direct investments, combined with regional manufacturing capabilities, position Asia-Pacific as the fastest-growing and most strategic market for polyamide resin producers globally.

Latin America

Latin America holds a moderate market share of around 8%, driven by demand in automotive, construction, and consumer goods. Brazil and Mexico are the primary contributors, where manufacturers increasingly utilize polyamide resins in durable automotive components and electrical devices. For instance, Braskem has scaled PA6 production to supply regional OEMs and industrial users. Despite economic volatility, infrastructure development, rising industrialization, and a growing electronics sector present opportunities for market growth. Import dependence on high-performance polyamides encourages local production expansion, positioning Latin America as an emerging market with steady growth potential within the global polyamide resins landscape.

Middle East & Africa

The Middle East & Africa accounts for approximately 7% of the global polyamide resins market, driven by automotive, oil & gas, and construction applications. The region primarily relies on imports from Asia and Europe, while local production capacities remain limited. For instance, SABIC supplies PA6 and PA66 resins across the region, supporting electrical, automotive, and industrial applications. Rising industrialization, expanding automotive production in countries like Saudi Arabia and UAE, and growing demand for durable consumer goods are expected to boost regional adoption. However, price sensitivity and supply chain dependencies remain key factors affecting market penetration.

Market Segmentations:

By Product:

- Bio-based Polyamide

- Polyamide 6

By Type:

By Application:

- Automotive

- Electrical & Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The polyamide resins market players such as Toyobo Co. Ltd., Ascend Performance Materials LLC, BASF SE, Lanxess AG, AdvanSix Inc., Domo Chemicals, Toray Industries, Inc., Ashley Polymers Inc., Huntsman Corporation, Ube Industries Ltd. The polyamide resins market is highly competitive, characterized by continuous innovation, product differentiation, and strategic investments in research and development. Companies focus on developing high-performance, lightweight, and heat-resistant polyamide grades to meet growing demand in automotive, electronics, packaging, and industrial applications. Expansion of production capacities, adoption of sustainable and bio-based polyamides, and integration of advanced technologies such as nanocomposites and 3D-printing-compatible formulations are key strategies to maintain market leadership. Intense competition drives manufacturers to optimize supply chains, enhance product quality, and develop tailored solutions for emerging applications, ensuring resilience in a dynamic market landscape and supporting long-term growth opportunities globally.

Key Player Analysis

- Toyobo Co. Ltd.

- Ascend Performance Materials LLC

- BASF SE

- Lanxess AG

- AdvanSix Inc.

- Domo Chemicals

- Toray Industries, Inc.

- Ashley Polymers Inc.

- Huntsman Corporation

- Ube Industries Ltd.

Recent Developments

- In February 2025, Toray Industries announced a new damping nylon resin using NANOALLOY technology, offering superior vibration absorption (4x butyl rubber), high-temp strength, and better moldability for EVs, electronics, and industrial parts, aiming for commercial.

- In January 2025, Avient Corporation expanded its Nymax REC recycled nylon production to Istanbul, Turkey, to better serve Middle Eastern customers, offering high-performance, eco-friendly materials (20-100% recycled content) with comparable strength to virgin nylon, reducing transport impact and supporting sustainability goals for industries needing durable, REACH-compliant polymers.

- In July 2024, LyondellBasell (LYB) launched Schulamid ET100 a polyamide compound for automotive interiors like door frames, featuring high flow for thin-wall parts, good aesthetics, and potential for lighter, paint-free designs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for polyamide resins will grow steadily due to expansion in automotive and electronics sectors.

- Lightweight and high-performance polyamides will drive adoption in electric vehicles and advanced electronics.

- Bio-based and sustainable polyamide grades will gain traction, supporting eco-friendly manufacturing trends.

- Growth in 3D printing and additive manufacturing will create new opportunities for polyamide powders.

- Packaging and consumer goods sectors will increasingly adopt polyamide resins for durability and barrier properties.

- Nanocomposite and high-temperature polyamide grades will enable advanced industrial applications.

- Regional production capacities will expand in Asia-Pacific to meet rising industrial demand.

- Research and development will focus on improving mechanical, thermal, and chemical resistance properties.

- Industry players will pursue strategic collaborations and joint ventures to enhance market reach.

- Regulatory and environmental compliance will shape product development and drive sustainable innovations.

Market Segmentation Analysis:

Market Segmentation Analysis: