Market Overview

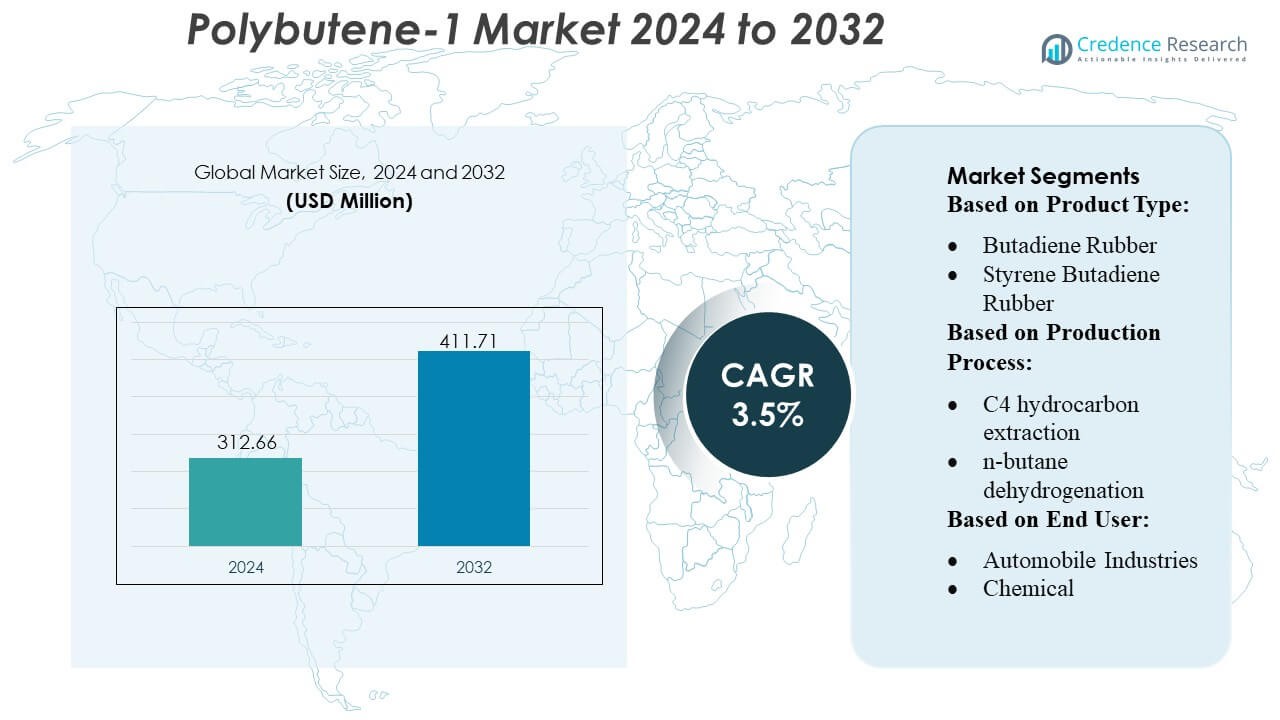

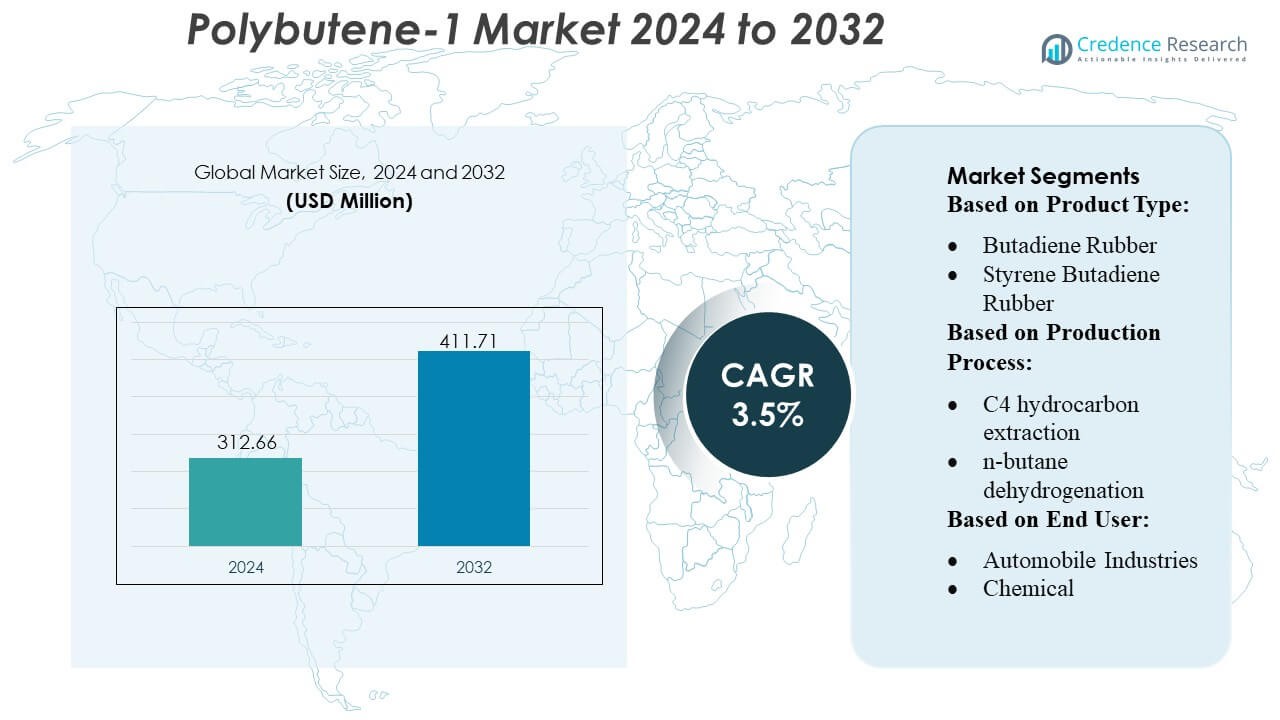

Polybutene-1 Market size was valued USD 312.66 million in 2024 and is anticipated to reach USD 411.71 million by 2032, at a CAGR of 3.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polybutene-1 MarketSize 2024 |

USD 312.66 Million |

| Polybutene-1 Market, CAGR |

3.5% |

| Polybutene-1 Market Size 2032 |

USD 411.71 Million |

The Polybutene-1 Market is shaped by a mix of global petrochemical manufacturers and specialty polymer producers that compete through advanced catalyst technologies, integrated C4 processing, and continuous improvements in product purity and performance. These companies focus on expanding capacity for high-efficiency PB-1 grades used in piping, automotive adhesives, and flexible packaging applications, while investing in recyclable mono-material solutions to meet sustainability mandates. Asia-Pacific emerges as the leading region with an exact 30% market share, supported by strong infrastructure development, large-scale polymer production, and rapid expansion of end-use industries such as construction, automotive, and packaging.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polybutene-1 market was valued at USD 312.66 million in 2024 and is projected to reach USD 411.71 million by 2032, growing at a 3.5% CAGR, driven by rising demand across piping, packaging, and adhesive applications.

- Market growth is propelled by increasing adoption of high-purity PB-1 grades in pressure piping and hot-melt adhesives, supported by advanced catalyst technologies and expanding capacity among global petrochemical players.

- Major trends include the shift toward recyclable mono-material packaging, integration of PB-1 in flexible films, and investments in energy-efficient C4 processing to improve material consistency and performance.

- Competitive dynamics intensify as leading manufacturers focus on product purity, backward integration, and specialty grade development, while restraints include volatility in C4 feedstock availability and limited global production bases.

- Asia-Pacific holds a 30% regional share, dominating due to strong construction and packaging growth, while the piping segment accounts for the largest application share supported by ongoing infrastructure expansion.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The Polybutene-1 Market remains dominated by Butadiene Rubber, capturing an estimated 31% share due to its strong tensile strength, resilience, and compatibility with high-performance polymer blends. Its widespread adoption in automotive components and industrial goods strengthens its leadership. Styrene Butadiene Rubber and Acrylonitrile Butadiene Rubber follow, supported by applications in tires, seals, and impact-resistant plastics. Rising demand for Nitrile Butadiene Rubber in gloves and industrial hoses further accelerates consumption. The segment benefits from expanding elastomer formulation research, which enhances durability, heat resistance, and chemical stability across multiple high-stress applications.

- For instance, Hansol Chemical expanded its semiconductor-grade hydrogen peroxide production capacity by 30 % to reach 127 000 tonnes per annum, with the expansion set to start full operations.

By Production Process

C4 hydrocarbon extraction leads the Polybutene-1 production landscape with an estimated 36% share, driven by its cost-efficient feedstock utilization and ability to deliver high-purity butene streams required for premium-grade polymers. n-butane dehydrogenation follows as a preferred method for large-volume producers seeking improved yield and continuous processing efficiencies. Processes based on ethanol and butenes are gaining traction due to growing demand for alternative and cleaner feedstocks. Increasing integration of advanced catalyst technologies and optimized reaction pathways strengthens process reliability and output consistency, supporting rising consumption across industrial and specialty polymer applications.

- For instance, Arkema executed a 2.5-fold increase in organic peroxide production capacity at its Changshu (China) site, a project which involved the installation and commissioning of its most efficient and environmentally friendly technology for such grades.

By End-User

The Automobile Industries segment dominates the market with an estimated 34% share, driven by Polybutene-1’s suitability for fuel-system components, hot-melt adhesives, and lightweight polymer formulations. Its excellent creep resistance, sealing performance, and fatigue strength make it integral to modern automotive engineering. Plastics and Polymers and Chemical Industries also show strong uptake due to demand for impact modifiers, lubricant additives, and flexible packaging materials. Building & Construction and Consumer Products adopt Polybutene-1 for piping systems, films, and durable goods. Healthcare applications continue to expand with rising usage in medical packaging and specialty tubes.

Key Growth Drivers

1. Rising Adoption in Automotive Lightweighting

Polybutene-1 demand grows steadily as automotive OEMs prioritize lightweight materials to enhance fuel efficiency and EV battery performance. The polymer’s high creep resistance, excellent sealability, and fatigue strength make it ideal for fuel-system components, under-the-hood parts, and hot-melt adhesives. Automakers integrate Polybutene-1 into multilayer tanks, flexible tubing, and structural assemblies that require long-term dimensional stability. Increasing replacement of metal and rigid plastics with lightweight polyolefin solutions further accelerates adoption, positioning Polybutene-1 as a critical enabler of next-generation mobility and emissions-reduction strategies.

- For instance, Kemira will invest in an expansion of paper and board chemical capacity at its Wellgrow site in Thailand, with the expansion is expected to bring the total estimated annual capacity of the Wellgrow site to approximately 100,000 tons after completion.

2. Expanding Use in Flexible Packaging and Film Applications

The market benefits from growing global production of flexible packaging, where Polybutene-1 improves seal integrity, tear resistance, and optical clarity. Packaging converters utilize it as a performance modifier in cast and blown films, enabling enhanced hot-tack properties and faster line throughput. Rising consumer demand for durable, puncture-resistant packaging for food, personal care, and e-commerce shipments strengthens consumption. Its compatibility with polyethylene and polypropylene also supports blend optimization, allowing converters to deliver lightweight, recyclable films aligned with sustainability mandates and brand-owner packaging guidelines.

- For instance, Tokyo Chemical Industry (TCI) offers an extensive catalogue of more than 30,000 to 31,000 high-quality organic reagents for research and commerce. These reagents are suitable for applications ranging from benchtop R&D to bulk industrial chemistry.

3. Increasing Penetration in Pressure Piping and Construction Systems

Growth in modern infrastructure and residential development reinforces Polybutene-1 adoption in pressure piping, plumbing systems, and heating networks. The material offers superior flexibility, hydrostatic strength, scale resistance, and long-term service life, making it well-suited for hot-and-cold-water pipes and underfloor heating systems. Construction contractors prefer Polybutene-1 for its easy installation, corrosion resistance, and low maintenance requirements. As countries upgrade aging water-distribution networks and invest in green buildings, demand rises for durable pipe materials that enhance efficiency and reduce lifecycle costs.

Key Trends & Opportunities

1. Rising Shift Toward Sustainable and Recyclable Polyolefin Solutions

A strong opportunity emerges from the increasing shift toward recyclable mono-material packaging and low-carbon polymer solutions. Polybutene-1’s compatibility with widely recycled polyolefins positions it as a key modifier for eco-engineered films and rigid packaging. Producers invest in bio-based feedstocks, advanced catalysts, and energy-efficient production routes, enabling improved sustainability profiles. Brand-owners prioritize circular packaging frameworks, which boosts demand for Polybutene-1 in recyclable flexible structures, multilayer downgauging, and lightweighting initiatives across FMCG, healthcare, and industrial packaging sectors.

- For instance, Shandong Huatai Interox joint venture with Solvay expansion is expected to bring the total annual production of photovoltaic-grade hydrogen peroxide to 48,000 tons (48 kilotons).

2. Advancements in Catalyst Technologies and Polymer Modification

Ongoing innovations in metallocene and Ziegler-Natta catalysts create opportunities for manufacturing high-purity, narrow-molecular-weight-distribution Polybutene-1 grades that enhance mechanical and thermal properties. These developments support expanded applications in high-performance pipes, adhesives, and specialty films. Improvements in polymer modification enable tailored stiffness, clarity, and sealability, allowing converters to replace costlier engineering plastics. As producers adopt precision catalytic systems and continuous-flow production designs, the market experiences improved output consistency, productivity gains, and broader end-use integration in industrial and consumer segments.

- For instance, OCI’s established Iksan plant has a hydrogen peroxide production capacity of 85,000 metric tons per year. The Gwangyang plant, built as part of the P&O Chemical joint venture (with POSCO Future M), began commercial production in October 2022 and has an annual capacity of 50,000 metric tons.

Key Challenges

1. Feedstock Volatility and Supply Constraints

The market faces challenges from fluctuating butene and hydrocarbon feedstock prices, driven by crude oil dynamics, refinery operating rates, and geopolitical disruptions. Supply tightness directly affects production economics for Polybutene-1, prompting margin pressure for converters and manufacturers. Seasonal variations in refinery output and competition from alternative chemical pathways intensify volatility. Companies must balance long-term contracts, integrated sourcing, and process optimization to manage supply uncertainty while sustaining competitive pricing across downstream applications.

2. Competition from Alternative Polymers and Elastomers

Polybutene-1 competes with polyethylene, polypropylene, and specialty elastomers that offer lower cost, broader availability, or established supply chains. In certain applications such as piping or packaging, advanced PP random copolymers and PE-based blends provide strong mechanical performance at competitive prices. This availability limits Polybutene-1 penetration in cost-sensitive markets. To retain share, producers must emphasize material differentiation, promote lifecycle benefits, and develop application-specific grades that demonstrate superior fatigue strength, sealing performance, or environmental durability relative to competing polymers.

Regional Analysis

North America

North America holds an estimated 34% market share, supported by strong adoption of Polybutene-1 in automotive components, pressure piping systems, and high-performance packaging films. The region benefits from well-established polymer manufacturing infrastructure and consistent investments in lightweight automotive materials aimed at improving fuel efficiency and EV performance. Demand also grows across HVAC systems, underfloor heating networks, and plumbing due to the material’s superior creep resistance and long-term hydrostatic strength. Rising interest in recyclable mono-material packaging and R&D expansion by major resin producers further reinforce the region’s leadership position.

Europe

Europe accounts for approximately 28% market share, driven by strong regulatory emphasis on recyclable packaging, energy-efficient construction materials, and sustainable polymer systems. Polybutene-1 gains traction in hot-and-cold-water piping, radiant heating networks, and pressure fittings, supported by the region’s stringent building performance standards. Packaging converters increasingly utilize the material to meet EU directives on lightweighting and circular economy targets. Automotive manufacturers also incorporate Polybutene-1 for sealing systems and lightweight structural components. Continuous investments in catalyst innovation and expansion of high-purity polyolefin production capacity strengthen Europe’s role as a key technology-driven market.

Asia-Pacific

Asia-Pacific leads in consumption growth and maintains an estimated 30% market share, supported by rapid expansion of automotive manufacturing, construction activity, and flexible packaging production. Countries such as China, India, Japan, and South Korea drive large-scale demand for Polybutene-1 in pressure piping, hot-melt adhesives, and multilayer films. Infrastructure modernization, increasing urbanization, and rising household construction fuel adoption of PB-1 in plumbing, heating, and water-distribution systems. Strong integration of petrochemical complexes, cost-competitive production, and growing investments in catalyst-based polymer technologies position Asia-Pacific as the fastest-expanding regional market.

Latin America

Latin America represents about 5% market share, with demand centered in Brazil, Mexico, and Argentina across automotive, consumer goods, and flexible packaging applications. The region increasingly adopts Polybutene-1 for plumbing networks, hot-water systems, and modified polyolefin blends used in industrial films. Infrastructure upgrades and expansion of residential construction support steady uptake in pressure piping and heating applications. However, market penetration remains moderate due to limited production capacity and reliance on imported resin. Growth is reinforced by rising packaging manufacturing capability and increasing use of lightweight polyolefins in FMCG and e-commerce logistics.

Middle East & Africa

The Middle East & Africa region holds an estimated 3% market share, driven by the growing construction pipeline, expansion of petrochemical industries, and adoption of Polybutene-1 in water-distribution and plumbing applications. Countries such as Saudi Arabia, UAE, and South Africa expand usage in hot-and-cold-water piping, underfloor heating, and polymer modification for films. Proximity to feedstock resources and strong petrochemical integration enable cost-effective distribution across regional manufacturing clusters. However, demand growth remains gradual due to slower industrialization in parts of Africa. Increasing infrastructure investments and diversification into specialty polymers support long-term opportunities.

Market Segmentations:

By Product Type:

- Butadiene Rubber

- Styrene Butadiene Rubber

By Production Process:

- C4 hydrocarbon extraction

- n-butane dehydrogenation

By End User:

- Automobile Industries

- Chemical

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Polybutene-1 Market players such as Versalis S.p.A., LANXESS, LyondellBasell Industries Holdings B.V., Evonik Industries AG, Royal Dutch Shell Plc, Borealis AG, LG Chem, Ineos Group AG, Eni S.p.A., and China Petroleum & Chemical Corporation. the Polybutene-1 Market is shaped by established petrochemical manufacturers and specialty polymer producers that focus on catalyst innovation, feedstock integration, and the development of high-performance PB-1 grades. Companies invest in advanced C4 extraction technologies and continuous production processes to enhance purity, melt-flow consistency, and mechanical stability across applications such as piping systems, flexible packaging, and hot-melt adhesives. The market remains highly technology-driven, with strong emphasis on recyclable mono-material solutions and lightweight polymer formulations that meet evolving regulatory and sustainability requirements. Strategic capacity expansions, application-specific product development, and global supply-chain optimization continue to strengthen competitiveness across major regions.

Key Player Analysis

- Versalis S.p.A.

- LANXESS

- LyondellBasell Industries Holdings B.V.

- Evonik Industries AG

- Royal Dutch Shell Plc

- Borealis AG

- LG Chem

- Ineos Group AG

- Eni S.p.A.

- China Petroleum & Chemical Corporation

Recent Developments

- In December 2024, Polestar and MBA Polymers UK partnered to advance the UK’s circular economy for EVs, focusing on using high-quality post-consumer recycled plastics in luxury vehicle interiors, aiming to reduce waste and carbon footprint by creating closed-loop systems for automotive plastics, noted Recycling Today.

- In October 2024, Bridgestone announced it received a nearly $9.3 million federal grant from the U.S. Department of Energy for a new pilot plant in Akron, Ohio, focusing on making sustainable tire rubber (butadiene) from ethanol, a greener alternative to fossil fuels, in partnership with the Pacific Northwest National Laboratory (PNNL).

- In January 2024, LyondellBasell partnered with MSI Technology, LLC, to distribute its Polybutene-1 (PB-1) resins for North American consumer packaging, leveraging MSI’s technical sales and existing portfolio to boost easy-open packaging and film performance, a strategic expansion of their existing relationship that also covers LyondellBasell’s Plexar products.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Production Process, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand growth due to rising adoption of PB-1 in pressure piping and advanced plumbing systems.

- Automotive lightweighting requirements will accelerate usage in sealing systems, hot-melt adhesives, and under-the-hood components.

- Flexible packaging converters will increasingly incorporate PB-1 to enhance sealability, clarity, and downgauging performance.

- Catalyst innovations will enable production of higher-purity, narrow-distribution PB-1 grades with improved mechanical efficiency.

- Infrastructure modernization in emerging economies will expand PB-1 consumption in water distribution and heating networks.

- Recyclability-driven packaging mandates will increase PB-1 use in mono-material sustainable film structures.

- Global petrochemical integration will strengthen feedstock security and support stable PB-1 supply.

- Specialty blends combining PB-1 with PP and PE will gain traction for performance enhancement.

- Construction sector expansion will fuel adoption in radiant heating and durable piping applications.

- Increased R&D investments will support new PB-1 applications across healthcare, industrial goods, and consumer products.

Market Segmentation Analysis:

Market Segmentation Analysis: