Market Overview

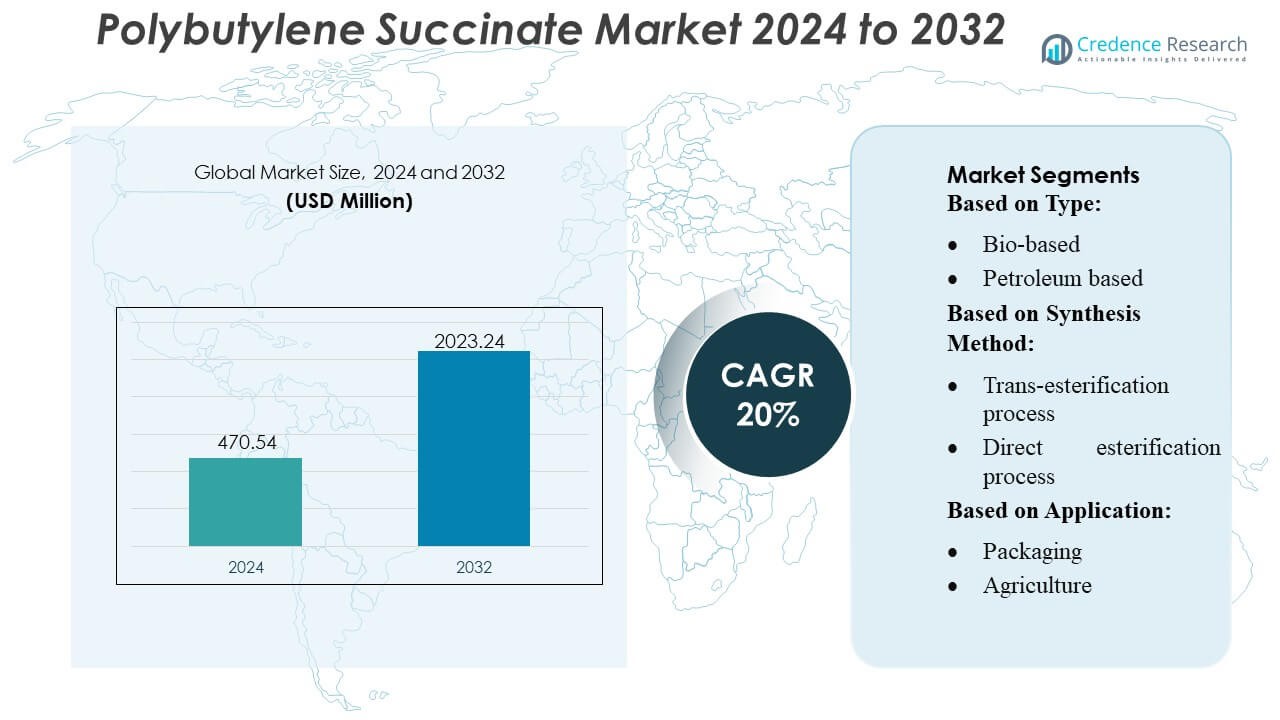

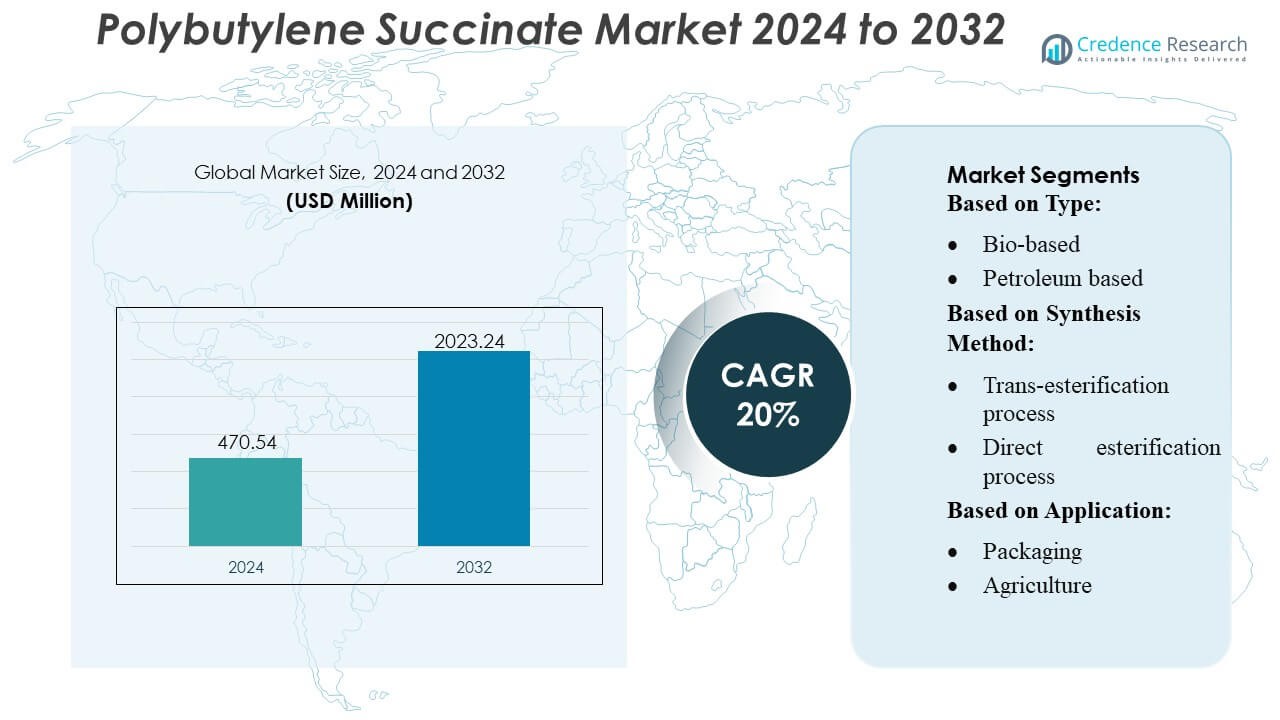

Polybutylene Succinate Market size was valued USD 470.54 million in 2024 and is anticipated to reach USD 2023.24 million by 2032, at a CAGR of 20% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polybutylene Succinate Market Size 2024 |

USD 470.54 Million |

| Polybutylene Succinate Market, CAGR |

20% |

| Polybutylene Succinate Market Size 2032 |

USD 2023.24 Million |

The Polybutylene Succinate Market features a competitive landscape shaped by major producers that focus on bio-based polymer innovation, energy-efficient synthesis methods, and capacity expansion across packaging, agriculture, and medical applications. Leading companies emphasize high-purity PBS grades, improved biodegradability, and scalable production platforms to strengthen their positions in global supply chains. Asia-Pacific remains the dominant regional market with an exact 42% share, supported by strong bioplastics manufacturing clusters, government-led sustainability initiatives, and rapid demand growth from packaging converters and agricultural film producers. This regional leadership influences pricing dynamics, accelerates technology adoption, and drives collaborative R&D efforts across the value chain.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Polybutylene Succinate (PBS) Market was valued at USD 470.54 million in 2024 and is projected to reach USD 2023.24 million by 2032, reflecting a 20% CAGR, driven by strong bio-based polymer adoption.

- Growing demand for biodegradable packaging and agricultural films fuels market expansion, supported by advancements in high-purity PBS grades and energy-efficient fermentation technologies that enhance commercial viability.

- Competitive intensity increases as major producers expand capacities and invest in scalable bio-succinate platforms, while companies in Asia-Pacific benefit from integrated bioplastics clusters and cost-effective feedstock access.

- Market restraints emerge from higher production costs compared to conventional plastics and limited global composting infrastructure, which affects adoption across cost-sensitive segments such as flexible packaging.

- Asia-Pacific dominates with a 42% regional share, driven by government sustainability mandates, while packaging remains the leading application segment with the highest share, reinforced by rapid uptake among converters and film manufacturers.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Type

Bio-based Polybutylene Succinate (PBS) dominates the market with an estimated 58% share, supported by rising demand for biodegradable polymers and regulatory pressure to reduce reliance on fossil-based plastics. Its adoption strengthens as FMCG, packaging, and agricultural-film manufacturers shift toward low-carbon materials with improved compostability and reduced end-of-life impact. Petroleum-based PBS maintains relevance due to its cost efficiency and consistent performance, but sustainability mandates and brand-level commitments accelerate the transition to bio-based grades. Overall demand benefits from expanding biorefinery capacities and technological improvements enabling higher mechanical strength and thermal stability.

- For instance, GC and its joint venture partner Mitsubishi Chemical Corporation (PTTMCC) operate a BioPBS polymerization plant in Rayong, Thailand, with an annual capacity of 20,000 tons.

By Synthesis Method

The direct esterification process leads the market with around 62% share, driven by its operational simplicity, lower production cost, and ability to deliver high-purity PBS suitable for packaging, mulch films, and industrial applications. Its energy-efficient workflow and reduced catalyst requirements enhance productivity, making it preferred among large-scale polymer manufacturers. The trans-esterification process grows steadily as it offers flexibility in using diverse feedstocks and supports specialty-grade PBS with tailored molecular weights. Rising investments in optimized catalysts and continuous-flow processing further strengthen adoption across both methods while supporting sustainability-driven polymer innovation.

- For instance, BioPBS™ exhibits physical properties that make it suitable for a wide variety of applications: for example, the FZ-grade resin has a density of 1.26 g/cm³, a melting point of 115 °C, a yield stress of 40 MPa, and strain at break of 170% (for standard FZ71 grade under ISO 527-2).

By Application

Packaging represents the largest application segment with approximately 46% market share, supported by accelerating demand for compostable films, bags, trays, and thermoformed containers. Regulatory restrictions on conventional plastics and the need for renewable, food-contact-safe materials drive extensive integration of PBS in single-use and flexible packaging formats. Agriculture follows with increased use in biodegradable mulch films that reduce soil contamination and disposal costs. Medical, textile, and other industrial uses gain traction through PBS’s excellent biocompatibility, durability, and suitability for melt-processing, enabling expanded adoption in sutures, hygiene products, and eco-engineered fibers.

Key Growth Drivers

1. Rising Demand for Biodegradable and Compostable Packaging

Growing regulatory pressure to reduce plastic waste drives strong demand for biodegradable alternatives such as Polybutylene Succinate. Brands in FMCG, retail, and food packaging adopt PBS for its certified compostability, suitability for single-use applications, and compatibility with existing film-processing lines. Government bans on conventional plastics in Europe and parts of Asia further accelerate adoption. Its favorable mechanical properties, heat resistance, and odor-neutral characteristics strengthen its acceptance as a sustainable replacement for polyethylene and polypropylene in high-volume packaging formats.

- For instance, Bunge has signed an MoU with Chevron Corporation companies explicitly stated in their press releases that through this joint venture, they “anticipate approximately doubling the combined capacity of the facilities from 7,000 tons per day.

2. Expanding Bio-Based Feedstock Availability

Increasing global investment in bio-refineries and fermentation technologies enhances access to renewable feedstocks required for bio-based PBS production. Manufacturers benefit from improved process economics and reduced environmental footprint, aligning with corporate sustainability targets. Bio-succinic acid derived from sugarcane, corn, and biomass drives large-scale cost optimization and supports premium positioning of bio-based PBS. Strategic collaborations between polymer producers and agricultural processors further strengthen supply chains, enabling stable production capacity expansion and supporting the transition away from petroleum-based polymer grades.

- For instance, Manuelita Aceites y Energía reports that its Colombian palm-based biodiesel operations achieved lifecycle greenhouse-gas (GHG) savings of up to 83 % compared with fossil diesel.

3. Growing Adoption Across Agriculture and Medical Applications

Agriculture and medical sectors rapidly integrate PBS due to its biodegradability, biocompatibility, and safe degradation pathways. Mulch films made from PBS reduce soil contamination and eliminate collection costs, supporting sustainable farming practices. In medical applications, PBS offers strong performance in absorbable components, hygiene products, and controlled-degradation items. Its melt-processability enables manufacturers to develop precise, high-quality medical-grade parts. Broader acceptance of eco-friendly materials across these regulated sectors reinforces long-term PBS consumption and diversifies demand beyond mainstream packaging.

Key Trends & Opportunities

1. Growth of Bio-Based PBS and Carbon-Neutral Production

A major trend centers on the shift toward bio-based PBS driven by decarbonization goals and rising interest in renewable materials. Producers explore carbon-neutral manufacturing pathways using bio-succinic acid and low-emission polymerization techniques. Investments in lifecycle assessment optimization and renewable energy integration create opportunities for premium, low-carbon polymer grades. This trend opens doors for brand differentiation in consumer goods, textiles, and specialty packaging, where companies increasingly market sustainability-linked product claims supported by verifiable carbon-reduction data.

- For instance, biodiesel (B100) compared to conventional diesel show significant reductions in various emissions, including up to a 47% reduction in particulate matter, a 67% reduction in unburned hydrocarbons, and a 48% reduction in carbon monoxide.

2. Advancements in High-Performance and Functional PBS Grades

Manufacturers develop next-generation PBS grades with enhanced thermal resistance, improved impact strength, and controlled biodegradation rates to support broader industrial applications. Blending with PBAT, PLA, and starch-based polymers creates new opportunities in flexible packaging and extrusion-coated materials. Modified grades suitable for injection molding, thermoforming, and 3D printing further expand design possibilities. These advancements position PBS as a versatile biopolymer that can compete more effectively with conventional plastics in performance-critical uses, supporting long-term market penetration.

- For instance, Ecodiesel de Colombia S.A. operates its primary biodiesel facility in Barrancabermeja, Santander.The plant has an annual production capacity of approximately 120,000 metric tons (or a slightly older figure of 115,000 tons/year is also commonly cited).

3. Increasing Use in Textile, Fiber, and Nonwoven Applications

A rising opportunity emerges in textile and fiber markets as PBS-based fibers gain traction for their softness, biodegradability, and compatibility with melt-spinning technologies. Apparel, hygiene, and industrial nonwoven manufacturers explore PBS as a sustainable alternative to polyester and polypropylene. Demand accelerates as brands pursue circularity goals and introduce eco-engineered fiber products. The expansion of PBS use in functional fabrics, disposable textiles, and agricultural nets reflects a broader shift toward bio-based polymer adoption across specialty fiber applications.

Key Challenges

1. High Production Costs Compared to Conventional Plastics

Despite strong sustainability benefits, PBS faces cost-related challenges due to expensive feedstocks, limited large-scale production, and relatively high conversion costs. Petroleum-based competitors such as PP, PE, and PET benefit from established supply chains and lower raw material prices, creating competitive pressure. Manufacturers must address cost limitations through economies of scale, optimized catalysts, and integration with bio-refinery networks. Wider commercial viability depends on reducing production cost gaps and achieving cost parity with commodity plastics across high-volume applications.

2. Limited Global Manufacturing Capacity and Supply Chain Gaps

The market’s growth is constrained by limited PBS production capacity concentrated in select regions. Fragmented supply chains, dependence on specific bio-based feedstocks, and regional availability challenges hinder rapid scale-up. Fluctuations in succinic acid supply can disrupt price stability and lead to production delays. Manufacturers and downstream processors face challenges securing consistent volumes for long-term contracts. To support broad adoption, the industry must expand regional capacities, diversify feedstock sources, and develop more resilient, integrated supply frameworks.

Regional Analysis

North America

North America accounts for 28% of the Polybutylene Succinate (PBS) market, supported by strong regulatory emphasis on biodegradable materials and growing adoption of compostable packaging solutions. The region benefits from advanced biopolymer R&D, supportive industrial composting infrastructure, and expanding corporate sustainability mandates among FMCG and retail brands. Demand strengthens through initiatives encouraging replacement of conventional plastics in food service, agriculture films, and consumer goods packaging. Strategic collaborations between material innovators and packaging converters accelerate commercialization of high-purity, bio-based PBS grades. Rising investment in circular economy frameworks further widens opportunities for regional producers and importers.

Europe

Europe leads the global PBS market with 34% share, driven by stringent EU waste-reduction directives, single-use plastic bans, and aggressive decarbonization targets. The region shows high acceptance of biodegradable polymers across packaging, agriculture, and consumer applications due to strong policy backing and mature composting systems. Rapid substitution of conventional polyolefins in food packaging and disposable products boosts consumption, while government incentives accelerate adoption of bio-based feedstocks. Collaboration between polymer producers and sustainability-focused brands supports development of high-performance PBS formulations. Continuous advancements in industrial compostability certification strengthen demand across Western and Northern Europe.

Asia-Pacific

Asia-Pacific holds the largest 38% share of the Polybutylene Succinate market, supported by large-scale production capacities, expanding packaging industries, and increasing interest in biodegradable solutions across China, Japan, South Korea, and Southeast Asia. Growing government initiatives targeting plastic reduction, combined with rapid urbanization and rising e-commerce packaging needs, significantly accelerate PBS adoption. Manufacturers invest heavily in bio-based production technologies and competitive cost structures, strengthening regional export capabilities. Strong presence of polymer R&D clusters and strategic partnerships with FMCG brands further enhance PBS integration into food packaging, agricultural films, and consumer goods applications.

Latin America

Latin America captures 6% of the PBS market, with growth fueled by rising awareness of plastic pollution and increasing adoption of biodegradable packaging across retail and agriculture sectors. Countries such as Brazil, Mexico, and Chile promote compostable materials to support waste-management goals, creating favorable demand for PBS-based films and consumer packaging. Limited domestic production encourages import-driven supply, but expanding partnerships between local converters and global polymer manufacturers improve availability. Growing demand for eco-friendly packaging in food service and fresh produce distribution strengthens the region’s market potential.

Middle East & Africa

The Middle East & Africa region accounts for 4% of the PBS market, characterized by gradual adoption of biodegradable materials driven by sustainability targets and waste-management reforms, particularly in GCC nations. Emerging demand from food packaging, agriculture, and consumer goods supports market expansion, although limited local manufacturing keeps dependency on imports high. Government-led initiatives promoting circular economy practices accelerate interest in bio-based solutions. Increasing collaboration between regional packaging converters and international biopolymer suppliers enhances market accessibility, while rising awareness of environmental impacts encourages the shift from conventional plastics to biodegradable alternatives.

Market Segmentations:

By Type:

- Bio-based

- Petroleum based

By Synthesis Method:

- Trans-esterification process

- Direct esterification process

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Polybutylene Succinate market players such as Ernesto Ventos S.A., GC Innovation America, Kawasaki Kasei Chemicals Ltd., PTT MCC Biochem Co., Ltd., The Chemical Company, Anhui Sealong Biotechnology Co., Ltd., Dow Chemicals, Parchem, Mitsubishi Chemical Corporation, and BASF SE. the Polybutylene Succinate market features a mix of global chemical manufacturers, regional biopolymer producers, and specialized distributors that compete through advancements in bio-based feedstocks, catalyst optimization, and scalable production technologies. Companies focus on improving material purity, compostability performance, and cost efficiency to address rising demand from packaging, agriculture, medical, and consumer goods sectors. Strategic priorities include expanding integrated supply chains, strengthening collaborations with packaging converters, and accelerating commercialization of high-performance PBS grades. Market participants invest in R&D to develop heat-resistant, food-contact-compliant, and fully biodegradable formulations, while also enhancing distribution reach to support growing adoption across established and emerging regions.

Key Player Analysis

- Ernesto Ventos S.A.

- GC Innovation America

- Kawasaki Kasei Chemicals Ltd.

- PTT MCC Biochem Co., Ltd.

- The Chemical Company

- Anhui Sealong Biotechnology Co., Ltd.

- Dow Chemicals

- Parchem

- Mitsubishi Chemical Corporation

- BASF SE

Recent Developments

- In October 2024, Pfanstiehl, Inc., a manufacturer of injectable excipients, cGMP bioprocessing components, and active pharmaceutical ingredients (APIs), introduced High Purity Low Endotoxin Low Metals (HPLE-LMTM) Succinic Acid. The product serves pharmaceutical, biopharmaceutical, and injectable applications.

- In September 2024, Lygos and CJ BIO announced a partnership to build a large-scale biorefinery in Fort Dodge, Iowa, for producing sustainable chemicals like biodegradable polyaspartates and bio-based malonates, starting at 40,000 MT/yr with plans to expand to 100,000 MT/yr, leveraging CJ BIO’s fermentation expertise and Fort Dodge’s bio-industrial infrastructure for a circular economy approach.

- In June 2024, BASF launched ecoflex® F Blend C1200 BMB, a new biomass-balanced (BMB) compostable biopolymer (PBAT), significantly cutting fossil resource use by replacing them with renewable feedstocks from organic waste at the start of the value chain, achieving a 60% lower product carbon footprint (PCF) than the standard grade through a certified biomass balance approach.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Synthesis Method, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as demand for biodegradable and compostable packaging accelerates across global FMCG and retail sectors.

- Bio-based feedstock development will strengthen supply stability and reduce reliance on petroleum-derived raw materials.

- Producers will invest in advanced catalyst systems to improve PBS purity, thermal resistance, and processing performance.

- Regulatory pressure targeting single-use plastics will boost adoption in food service, agricultural films, and consumer packaging.

- Strategic partnerships between polymer manufacturers and converters will accelerate commercialization of specialty PBS grades.

- Industrial composting infrastructure growth will support wider acceptance of PBS-based products.

- Cost optimization through large-scale production will enhance competitiveness against conventional plastics.

- Integration of PBS into multi-functional and mono-material packaging formats will increase market penetration.

- Emerging economies will adopt PBS faster as sustainability awareness and environmental regulations strengthen.

- Continuous R&D activity will drive innovations in medical, textile, and high-performance industrial applications.

Market Segmentation Analysis:

Market Segmentation Analysis: