Market Overview

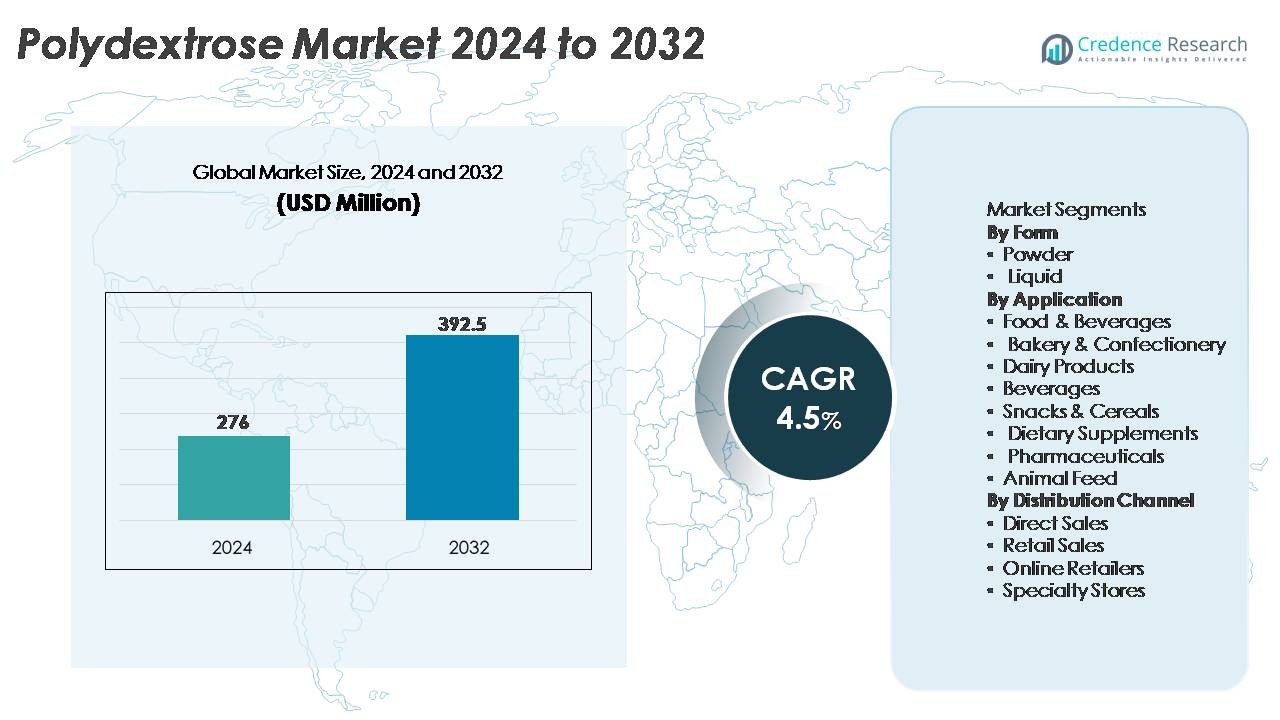

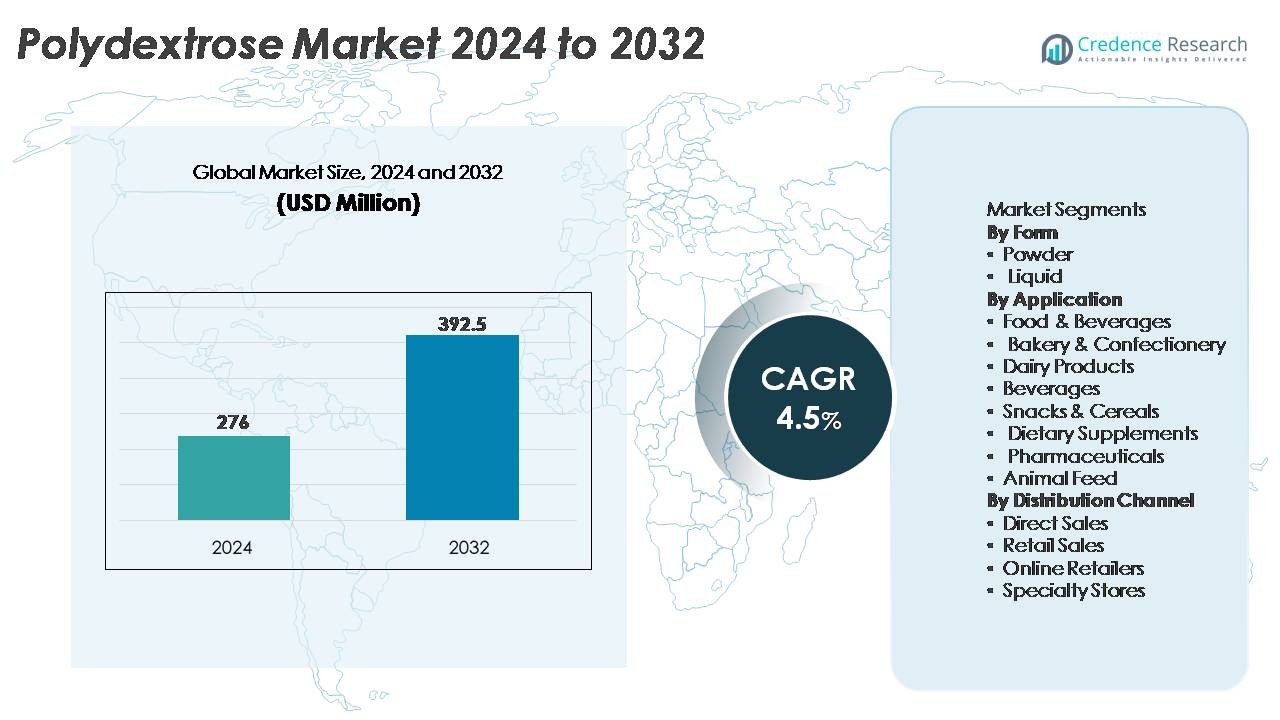

The global polydextrose market was valued at USD 276 million in 2024 and is projected to reach USD 392.5 million by 2032, expanding at a CAGR of 4.5% during the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polydextrose Market Size 2024 |

USD 276 Million |

| Polydextrose Market, CAGR |

4.5% |

| Polydextrose Market Size 2032 |

USD 392.5 Million |

The polydextrose market is characterized by strong participation from global ingredient manufacturers and regionally focused suppliers, with companies such as Henan Tailijie Biotech Co., Ltd, Ingredion, Devson Impex Private Limited, Tate & Lyle, Foodchem International Corporation, Shandong Bailong Chuangyuan Bio-tech Co., Ltd, RAJVI ENTERPRISE, Van Wankum Ingredients, DuPont, and Cargill actively competing through capacity expansion, cost-efficient fermentation technologies, and diversified end-use portfolios. Asia Pacific leads the market with approximately 34% share, driven by large-scale food processing, growing nutrition-focused consumer bases, and increasing domestic manufacturing capabilities. North America and Europe follow, supported by mature functional food sectors and stringent sugar-reduction initiatives that continue to propel the adoption of polydextrose across bakery, beverages, supplements, and pharmaceutical applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global polydextrose market was valued at USD 276 million in 2024 and is projected to reach USD 392.5 million by 2032, expanding at a CAGR of 4.5% during the forecast period.

- Market growth is driven by increasing demand for low-calorie, sugar-reduced, and fiber-fortified foods, supported by rising obesity and diabetes incidence and clean-label reformulation initiatives across bakery, beverages, snacks, and nutraceuticals.

- Key trends include the expansion of plant-based and functional nutrition, where polydextrose is preferred for prebiotic benefits, texture improvement, and fat-replacement properties, particularly within dietary supplements and fortified snacks.

- The competitive landscape features global and regional manufacturers emphasizing cost-efficient production, improved solubility, and strategic partnerships, while challenges include formulation limitations at high inclusion levels and regulatory variations on fiber claims.

- Asia Pacific leads with 34% share, followed by North America at 32% and Europe at 29%, while powder form dominates the segment with the highest usage due to processing stability and broad application compatibility.

Market Segmentation Analysis:

By Form

Polydextrose is primarily distributed in powder form, which holds the dominant market share owing to its superior stability, longer shelf life, and compatibility with dry-blend food formulations. Powdered polydextrose is widely incorporated in reduced-calorie bakery mixes, instant beverages, confectionery powders, and nutritional supplements, enabling manufacturers to replace sugar and fat without compromising texture. Meanwhile, the liquid segment grows steadily, driven by its adoption in ready-to-drink beverages and dairy applications due to higher dispersibility and uniform sweetness, particularly across large-scale industrial processing lines.

- For instance,Tate & Lyle produces PROMITOR® Soluble Fibresat its facility in Boleráz, Slovakia, where a major investment in new capacity was completed in May 2024 to meet global demand for dietary fibres.

By Application

Food & beverages represent the leading application segment, supported by escalating demand for fiber-enriched, low-calorie, and sugar-reduced packaged foods. Polydextrose is extensively used across bakery & confectionery products and snacks & cereals, where it enhances moisture retention, bulking, and mouthfeel. The dietary supplements segment also expands rapidly as consumers increasingly seek digestive-health products featuring soluble fibers. Pharmaceuticals utilize polydextrose as a stabilizer and excipient in controlled-release formulations, while its inclusion in animal feed gains traction for improving gut microflora and nutrient absorption.

- For instance,Cargill incorporates polydextrose and other soluble fibers in its sugar-reduced chocolate and bakery prototypes developed at its Minneapolis-area R&D facilities, which contain state-of-the-art pilot lines for formulation testing and customer trials.

By Distribution Channel

The direct sales channel accounts for the largest share, driven by strong B2B supply contracts with food ingredient manufacturers, nutraceutical companies, and pharmaceutical processors, ensuring consistent bulk procurement and pricing advantages. Retail and specialty stores support offline purchases for small-scale formulators and end-use customers seeking functional ingredients. The online retailer segment experiences notable growth, fueled by digital ordering platforms and expanded availability of polydextrose in packaged supplement and clean-label ingredient formats, catering to SMEs, private-label brands, and rapid doorstep fulfillment demand.

Key Growth Drivers

Growing Demand for Low-Calorie and Sugar-Reduced Food Products

The global shift toward reduced-sugar diets continues to accelerate the demand for polydextrose as a low-calorie bulking agent and soluble fiber. Food manufacturers increasingly reformulate beverages, dairy products, confectionery, and bakery lines to comply with evolving sugar taxation, front-of-pack labeling regulations, and consumer preference for cleaner nutrition. Polydextrose enables calorie reduction without altering mouthfeel, texture, and palatability, making it one of the preferred ingredients in the functional food space. Rising obesity and diabetes prevalence encourages consumers to adopt sugar-restricted diets, increasing the penetration of fiber-enhanced and low-glycemic products. The ingredient also supports clean-label formulation, replacing artificial sweeteners or fillers and offering a natural functional benefit that aligns with wellness-driven purchasing behavior. Its versatility across hot- and cold-processed foods and its synergy with natural sweeteners further strengthen adoption, making reduced-sugar reformulation a key growth accelerator.

- For instance, Ingredion’s Idea Labs Innovation Center in Bridgewater, New Jersey conducts sensory and viscosity profiling for fiber-enriched beverages using benchtop rheometers calibrated for shear rates up to 1,000 s⁻¹, enabling high-precision compatibility testing of polydextrose with natural sweeteners including stevia and monk-fruit extract.

Rising Integration of Dietary Fiber in Functional Foods and Nutraceuticals

Polydextrose benefits from expanding consumer demand for gut-health-focused products featuring digestion-supportive and prebiotic characteristics. As digestive wellness becomes mainstream, manufacturers emphasize added soluble fiber claims in snacks, cereals, bars, and powdered beverages. Polydextrose is widely valued for its ability to increase fiber content cost-effectively without compromising taste or formulation consistency. Rapid growth of nutraceuticals, weight-management blends, and satiety-focused supplements drives market expansion, as polydextrose supports appetite regulation and balanced energy intake. Its stability across diverse pH conditions, processing temperatures, and packaging formats enables broad industry adoption. The trend toward preventive health and self-directed nutrition, particularly in urban markets, further accelerates demand, positioning polydextrose as a functional ingredient of strategic importance for innovation-led product portfolios.

- For instance, DuPont (now IFF) conducted clinical evaluations on its Litesse® polydextrose, tracking fermentation and SCFA production in human gut models that showed measurable prebiotic responses within test groups of 60 adult participants, supporting its positioning in digestive-health nutraceuticals.

Expanding Application Scope Across Food, Pharmaceuticals, and Animal Nutrition

The utility of polydextrose beyond traditional food and beverage uses fuels sustained market growth. Pharmaceutical manufacturers incorporate the ingredient as an excipient, stabilizer, and filler in controlled-release formulations due to its water solubility and low hygroscopic nature. The compound’s favorable safety profile and non-cariogenic properties support its use in pediatric and geriatric formulations. Meanwhile, the animal feed sector adopts polydextrose to enhance gut microflora, nutrient absorption, and digestive comfort, especially in high-performance livestock diets. Its functionality as a fiber source that supports gastrointestinal well-being aligns with industry efforts to reduce antibiotics and improve feed efficiency. This widening application spectrum diversifies revenue streams, mitigates risk from single-sector dependency, and supports long-term market resilience.

Key Trends & Opportunities

Clean-Label, Plant-Based, and Natural Ingredient Positioning

Clean-label and plant-based reformulation trends present significant opportunity for polydextrose manufacturers, as brands shift from artificial components toward natural functional enhancers. Consumers increasingly prioritize short, transparent ingredient lists with functional benefits and fewer synthetic additives. Polydextrose aligns with this preference by functioning as a natural bulking agent and fiber source that aids mouthfeel improvement and fat replacement. Growth in vegan bakery, dairy alternatives, and plant-derived meal solutions creates new formulation opportunities. Emerging markets, where processed food penetration is rising, offer an expanding customer base for clean-label functional formulations. This trend encourages producers to invest in ingredient traceability, non-GMO certification, and sustainable sourcing, enhancing premium pricing potential and market differentiation.

- For instance, Tate & Lyle confirmed that its STA-LITE® Polydextrose is produced through a proprietary thermal polymerization process using glucose, sorbitol, and citric acid without chemical catalysts, validated through its ingredient transparency program that documents more than 200 parameters per batch for clean-label compliance.

R&D Opportunities in Prebiotic, Weight-Management, and Personalized Nutrition Products

Opportunities are growing for polydextrose in prebiotic diet programs, satiety-enhancing foods, and personalized nutrition solutions. As clinical research underscores the relationship between soluble fiber, gut microbiota, and metabolic health, product developers seek to incorporate polydextrose into bars, shakes, capsules, and fortified staples. Weight-management programs increasingly leverage fiber ingredients to moderate post-meal glucose response and extend fullness, improving consumer adherence. Personalized nutrition applications including microbiome-based supplement packs position polydextrose as a tailored solution for digestive support. Customized formulations for senior nutrition, sports endurance, and metabolic wellness create multi-segment expansion potential, supported by rising investments from startups and established functional-food brands.

- For instance, a DuPont (now IFF) human-clinical study conducted in Finland involved 54 participants consuming Litesse® polydextrose daily, demonstrating increased production of short-chain fatty acids specifically butyrate within a controlled trial period, confirming its prebiotic effect in metabolic and gut-health formulations.

Key Challenges

Formulation Complexities and Sensory Limitations

Although polydextrose performs well across diverse formulations, its inclusion can pose sensory challenges, particularly at higher concentrations. Some products may experience variations in sweetness perception, slight flavor masking, or changes in viscosity that require adjustments with complementary sweeteners or stabilizers. Beverage applications may face solubility and dispersion concerns depending on pH and temperature variables. These formulation nuances increase R&D costs, prolong testing cycles, and limit adoption for brands lacking technical expertise. Regulatory pressures to maintain clean-label status may also restrict the use of additional flavor modulators, complicating product development for certain categories. Addressing these challenges requires robust formulation expertise and collaborative development with ingredient suppliers.

Regulatory Compliance and Ingredient Labeling Restrictions

The polydextrose market faces evolving regulatory landscapes that govern fiber claims, food labeling, and health-related messaging. Jurisdictions vary on whether polydextrose qualifies as dietary fiber under official definitions, creating uncertainty for product labeling and marketing communication. Regulatory tightening around sugar claims, fiber fortification labeling, and probiotic positioning necessitates continuous monitoring and documentation. Failure to comply can lead to reformulation mandates, product recall, or loss of consumer trust. Additionally, import regulations for functional ingredients and tariff fluctuations create added complexity for manufacturers operating globally. Companies must maintain strategic alignment with regional standards while investing in regulatory consulting to navigate policy variations effectively.

Regional Analysis

North America

North America holds approximately 32% of the global polydextrose market, supported by strong demand for low-calorie beverages, fiber-fortified snacks, and clean-label confectionery. The U.S. leads consumption with widespread penetration of functional foods and active reformulation by major FMCG brands to comply with sugar-reduction mandates. High adoption of nutraceuticals, sports nutrition powders, and diabetic-friendly products strengthens market growth. Rising obesity and diabetes rates accelerate fiber enrichment programs, while mature pharmaceutical manufacturing adds sustained momentum for excipient applications. Growing e-commerce supplement sales further expand regional distribution opportunities.

Europe

Europe accounts for around 29% of the polydextrose market, driven by strict regulatory frameworks supporting sugar taxes, mandatory nutritional labeling, and calorie-reduction commitments for packaged food manufacturers. The region sees high consumer demand for natural functional ingredients and digestive health supplements, particularly within Germany, the U.K., and France. Europe remains a strategic hub for bakery and confectionery innovation, where polydextrose is applied as a bulking agent and fat replacer. Strong R&D and clinical positioning of soluble fiber in metabolic health reinforce demand. Sustainability-driven purchasing behavior supports premium, clean-label formulations, creating steady long-term growth potential.

Asia Pacific

Asia Pacific represents the largest and fastest-growing regional segment, holding approximately 34% market share, supported by rapid urbanization, lifestyle changes, and rising consumption of packaged foods. Increased health consciousness and a growing diabetic population drive adoption of reduced-sugar bakery, dairy alternatives, and beverage products. China and India lead market expansion due to expanding domestic ingredient manufacturing capabilities and cost-efficient processing. Functional nutraceuticals and fortified traditional foods gain traction, creating opportunities in satiety, digestion, and weight-management categories. Investments in food ingredient parks, export-oriented production, and private-label supplements contribute substantially to regional momentum.

Latin America

Latin America contributes around 3% of the global polydextrose market, with demand growing gradually as governments enforce sodium and sugar-reduction legislation across packaged foods. Brazil and Mexico remain key consumption markets driven by expanding bakery, confectionery, and ready-to-drink beverage industries. Rising obesity prevalence fosters fiber enrichment initiatives in mainstream brands, while improved retail penetration supports consumer awareness. Price sensitivity and dependence on imports present short-term constraints, yet expanding supplement consumption and private-label manufacturing offer measurable opportunity.

Middle East & Africa

The Middle East & Africa hold approximately 2% of the polydextrose market, with early-stage adoption led by multinational food processors and growing premium retail distribution. The UAE and South Africa drive consumption through increasing demand for fortified snacks, sugar-free confectionery, and functional beverages aligned with health and wellness trends. Expanded hospitality, tourism-driven food services, and international brand entry accelerate reformulations. However, limited local manufacturing and import cost exposure remain challenges. Rising awareness of digestive health and adoption of fiber-fortified dietary supplements indicate steady medium-term growth.

Market Segmentations:

By Form

By Application

- Food & Beverages

- Bakery & Confectionery

- Dairy Products

- Beverages

- Snacks & Cereals

- Dietary Supplements

- Pharmaceuticals

- Animal Feed

By Distribution Channel

- Direct Sales

- Retail Sales

- Online Retailers

- Specialty Stores

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the polydextrose market features a mix of global food ingredient manufacturers, specialty chemical companies, and nutraceutical suppliers focused on capacity expansion, cost optimization, and formulation innovation. Major participants emphasize purity levels, improved solubility, and compatibility with sugar-reduction and fiber-fortification requirements across multiple applications. Strategic partnerships with FMCG brands, private-label supplement producers, and pharmaceutical formulators strengthen supply chain stability and recurring revenue streams. Market players prioritize clean-label positioning, non-GMO validation, and plant-based sourcing to align with evolving customer expectations. Additionally, investments in regional production facilities particularly in Asia-Pacific support lower logistics costs and strengthen market access. R&D initiatives centered on prebiotic functionality, improved sensory performance, and pH stability are shaping product differentiation strategies. Competitive activities include mergers, acquisitions, and licensing agreements, enabling leading companies to expand their footprint in high-growth dietary supplement and functional food segments while defending market share against emerging low-cost manufacturers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Henan Tailijie Biotech Co., Ltd

- Ingredion

- Devson Impex Private Limited

- Tate & Lyle

- Foodchem International Corporation

- Shandong Bailong Chuangyuan Bio-tech Co., Ltd

- RAJVI ENTERPRISE

- Van Wankum Ingredients

- DuPont

- Cargill

Recent Developments

- In October 2025, Van Wankum reaffirmed polydextrose’s versatility in a public communication highlighting its use across multiple applications including beverages, dairy, confectionery, nutritional products, syrups, and desserts, offering a clean-label fiber solution.

- In 2025, Foodchem continues to list polydextrose among its standard offerings. According to its product catalog, Foodchem supplies polydextrose with minimum order quantity of 500 kg, and loading quantity for a full 20′ container (FCL) is 18 metric tons.

- In 2025, RAJVI ENTERPRISE According to their publicly accessible product page, RAJVI ENTERPRISE offers polydextrose powder with a stated production capacity of 100 metric tons per month.

Report Coverage

The research report offers an in-depth analysis based on Form, Application, Distribution channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Polydextrose adoption will increase as manufacturers accelerate sugar- and calorie-reduction reformulations across mainstream food categories.

- Demand will expand in functional nutrition products supporting digestive wellness and satiety enhancement.

- Improved processing technologies will enhance solubility, stability, and sensory performance for broader application compatibility.

- Prebiotic functionality will gain stronger scientific validation, strengthening market positioning in gut-health solutions.

- Growth of plant-based and clean-label product lines will boost polydextrose usage as a natural bulking and fiber ingredient.

- Online retail penetration of nutrition and supplement products will create new distribution efficiencies.

- Asia Pacific will strengthen its lead through rising ingredient manufacturing capacity and consumption of fortified foods.

- Collaborations between ingredient suppliers and FMCG brands will accelerate product innovation and faster reformulation cycles.

- Regulatory alignment on dietary fiber claims will improve global messaging and labeling consistency.

- Expansion into pharmaceutical excipients and animal nutrition will diversify market revenue opportunities.