Market Overview

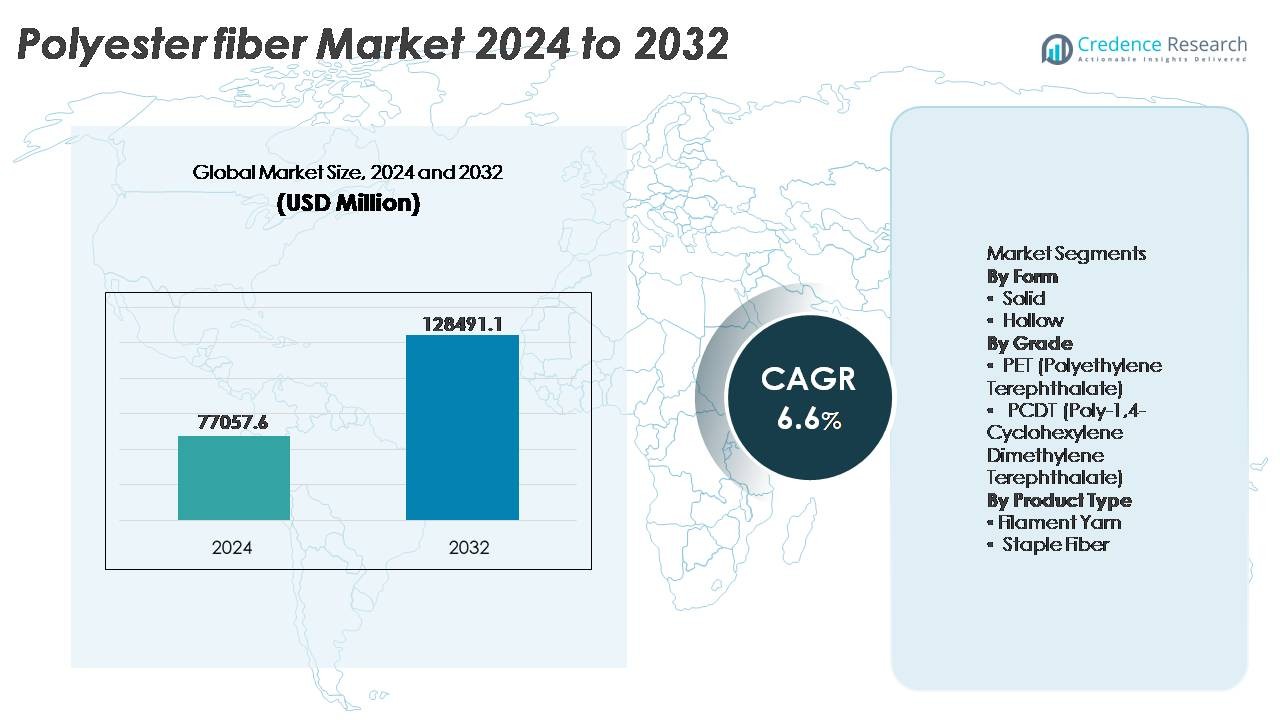

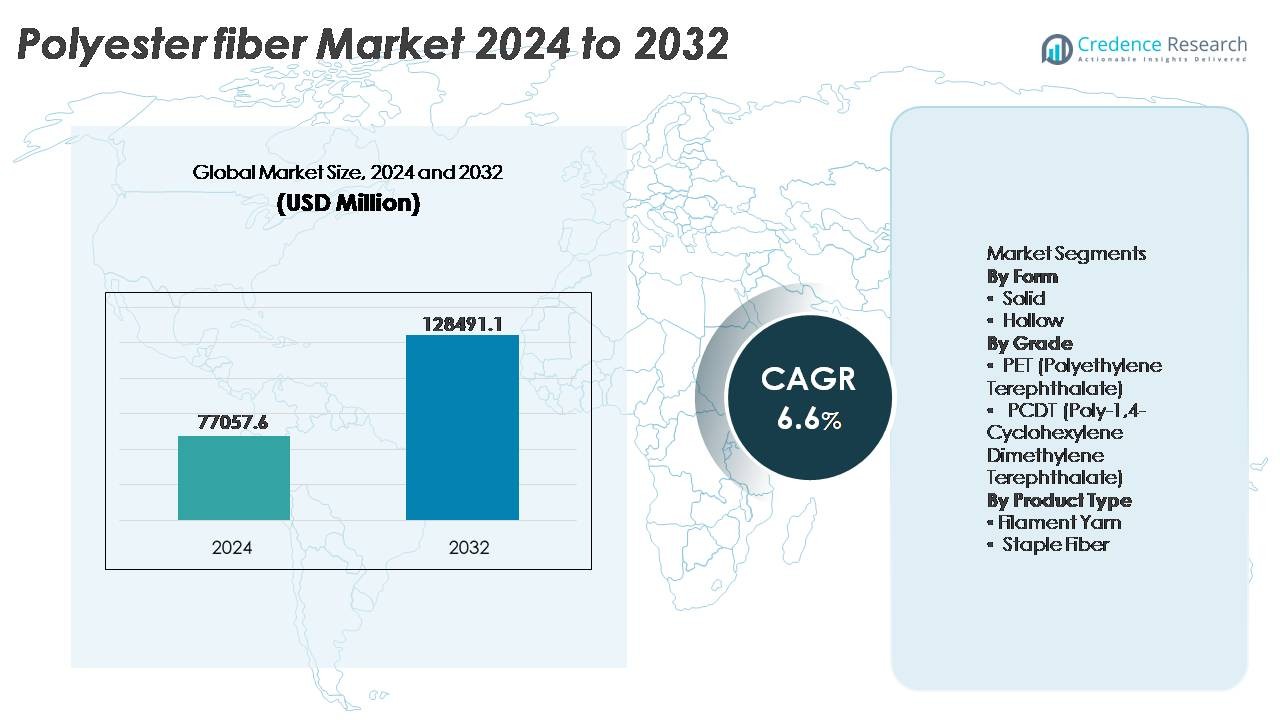

The polyester fiber market was valued at USD 77,057.6 million in 2024 and is projected to reach approximately USD 128,911.1 million by 2032, reflecting a CAGR of 6.6% during the forecast period (2025-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyester Fiber Market Size 2024 |

USD 77,057.6 Million |

| Polyester Fiber Market, CAGR |

6.6% |

| Polyester Fiber Market Size 2032 |

USD 128,911.1 Million |

The polyester fiber market is shaped by leading global and regional manufacturers, including Sinopec Yizheng Chemical Fibre, Reliance Industries Limited, Indorama Ventures, Toray Industries, Tongkun Holding Group, Zhejiang Hengyi Group, Sanfame Group, Far Eastern New Century Corporation, Alpek Polyester, and ADVANSA, each leveraging scale, integrated feedstock production, and expanding recycled fiber capabilities to strengthen competitive positioning. Asia Pacific remains the dominant production and consumption hub, commanding over 65% of the global market share, supported by extensive textile manufacturing ecosystems in China, India, and Southeast Asia. North America and Europe follow as key markets for technical and recycled polyester applications, driven by sustainability compliance and demand for performance-grade fibers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global polyester fiber market was valued at USD 77,057.6 million in 2024 and is projected to reach USD 128,911.1 million by 2032, expanding at a CAGR of 6.6% during the forecast period.

- Market growth is driven by rising demand from apparel, home furnishing, and technical textile industries, supported by cost-effective production, material durability, and versatility across weaving, knitting, and nonwoven applications.

- Key trends include increasing adoption of recycled polyester (rPET), development of bio-based alternatives, and rising demand for high-tenacity and functional fibers in automotive, medical, and industrial filtration sectors.

- Competitive dynamics are shaped by integrated manufacturers and sustainability-focused producers, where companies expand capacity, secure feedstock, and invest in circular recycling to reduce dependency on virgin PET supply.

- Asia Pacific dominates the market with over 65% share, while PET fiber accounts for the leading segment; North America and Europe maintain a combined 22% share driven by technical textile and recyclable-grade product demand.

Market Segmentation Analysis:

By Form

Solid polyester fiber represents the dominant sub-segment, capturing the largest market share due to its extensive use in apparel, home furnishings, and industrial textiles. Its high tensile strength, wrinkle resistance, and cost-effectiveness enable large-scale manufacturing for garments, bed linens, and automotive interiors. Solid fibers exhibit superior color retention and withstand repeated washing, making them preferred by textile processors. Hollow fibers continue to gain traction, primarily in insulation products, pillows, and bedding where air-trapping capabilities improve thermal efficiency; however, their adoption remains focused on niche, value-added applications.

- “For instance, Zhejiang Hengyi Group operates high-viscosity solid polyester fiber production across integrated PTA-PET lines with an aggregate capacity exceeding 10 million tons per year of polyester products (including fiber and bottle chips), supported by 13.5 million tons per year of PTA capacity.

By Grade

PET fiber holds the leading market share in the polyester fiber segment, driven by widespread adoption in packaging textiles, clothing, and technical fabrics. Its durability, recyclability, and lightweight characteristics support high-volume production across global supply chains. PET also benefits from established recycling infrastructure, improving sustainability positioning. In contrast, PCDT fiber serves more specialized applications including drapery and high-end interior fabrics due to superior elasticity and resilience, but its higher cost and limited production scale restrict broader market penetration, keeping PET as the primary growth-driven fiber grade.

- For instance, “Indorama Ventureshas made significant investments in its global recycling operations, with a goal to expand its annual rPET bale input capacity to 750,000 tons by 2025. The company’s operations include chemical recycling assets, such as joint ventures with partners to scale up depolymerization units capable of processing PET waste feedstock into purified monomers designated for fiber-grade or food-grade polymerization.”

By Product Type

Filament yarn leads the product type segmentation, attributed to its capacity to produce smooth, continuous, and high-strength fabrics used in sportswear, fashion apparel, and technical textiles. Its uniform structure allows for enhanced sheen, fabric drape, and performance characteristics that appeal to high-value consumer and industrial applications. Staple fiber remains essential in carpets, nonwoven fabrics, and cushioning, particularly where bulk and texture are required. However, filament yarn maintains market dominance due to efficiency in weaving and knitting operations, lower material waste, and growing demand for premium, lightweight textile solutions.

Key Growth Drivers

Expanding Demand from Apparel and Home Furnishing Industries

The polyester fiber market benefits significantly from rising demand across apparel and home furnishing sectors, fueled by population growth, urban lifestyle shifts, and expanding retail penetration. Polyester’s versatility, moisture resistance, and affordability position it as a preferred fabric in casualwear, sportswear, and fast-fashion supply chains. The fiber’s adaptability to diverse processing techniques including texturizing, dyeing, and blending supports large-scale garment production while meeting evolving design trends. In the home furnishings segment, polyester is widely used in upholstery, bedsheets, curtains, and carpets due to its strength and easy maintenance. Additionally, polyester’s ability to mimic natural fibers like cotton and silk at a lower cost stimulates consumer adoption in price-sensitive markets. E-commerce apparel sales and brand-driven customization further accelerate consumption. As global textile manufacturers prioritize durable and recyclable fibers with lower production costs, polyester’s performance characteristics and established manufacturing ecosystem reinforce its market growth trajectory.

- For instance, Reliance Industries Limited operates one of the world’s largest polyester textile operations, with fiber and yarn production capacity exceeding 2.5 million tons annually, supported by continuous polymerization and high-speed texturizing lines enabling bulk volume apparel-grade filament for global fashion and sportswear brands.

Technological Advancements and High-Performance Fiber Development

Advancements in polymer chemistry, fiber customization, and additive integration propel polyester fiber market expansion by enhancing product capability and unlocking premium applications. Innovations such as bio-based PET, flame-retardant grades, low-pill fibers, and anti-microbial coatings cater to evolving end-user requirements, especially in healthcare, protective clothing, automotive interiors, and industrial filtration. High-tenacity polyester fibers deliver excellent dimensional stability and abrasion resistance, positioning them as alternatives to nylon in ropes, seatbelts, tire cords, and conveyor belts. Improvements in fiber spinning, melt processing, and digital finishing techniques reduce material loss and shorten production cycles, making manufacturing more cost-efficient. Additionally, advances in recycling such as chemical depolymerization and enzymatic conversion enable closed-loop circularity, expanding polyester’s sustainability appeal. These ongoing innovations create a favorable environment for differentiated, high-margin products, encouraging investment and expanding the addressable market beyond conventional textile applications.

- For instance,”Indorama Ventures produces high-tenacity polyester tire-cord fibers engineered with excellent tensile strength and thermal resistance suitable for high-speed radial tires, supported by integrated spinning, Twisting, and Heat-setting (TTH) lines distributed across its global polyester industrial fiber facilities.”

Growth in Recycling and Circular Economy Adoption

The push toward circular manufacturing is a major growth catalyst, with recycled polyester (rPET) emerging as a strategic material for sustainability-focused industries. Governments and brands commit to recycling targets, reduced carbon footprints, and waste diversion, driving demand for recycled PET fibers sourced from bottles, packaging waste, and textile scraps. Mechanical and chemical recycling technologies improve recyclate quality, enabling rPET to perform comparably to virgin fibers in apparel and industrial uses. Brands in fast fashion, sportswear, and luxury textiles adopt rPET collections to meet sustainability reporting and consumer expectations. Additionally, textile-to-textile recycling initiatives reduce reliance on landfill and incineration, supporting environmental objectives. Cost efficiencies derived from waste utilization attract manufacturers, and collaboration among recyclers, brands, and municipalities strengthens material availability. The growing integration of post-consumer and post-industrial recyclates positions recycled polyester as a mainstream material in next-generation textile production.

Key Trends & Opportunities

Rise of Sustainable and Bio-Based Polyester Fibers

Sustainability commitments and rising consumer awareness present opportunities for bio-based and low-carbon polyester fibers. Manufacturers are developing fibers using renewable feedstocks such as bio-based MEG, recycled ocean plastics, and agricultural waste derivatives. Government-backed environmental regulations and green certification programs encourage adoption of sustainable materials. The shift from “fast fashion volume” to “responsible fashion value” supports demand for traceable, ethically sourced fibers. Advances in chemical recycling producing virgin-quality rPET allow premium applications including performance apparel and medical-grade fabrics. Market players investing in circular design models, biodegradable additives, and carbon-neutral manufacturing processes stand to gain a competitive edge. Partnerships among brands, recyclers, and technology companies accelerate commercialization. As industries create eco-labeled products and expand low-impact textile collections, the sustainable polyester fiber segment becomes a major opportunity frontier for scale, differentiation, and compliance advantages.

- For instance, Indorama Ventures has implemented industrial-scale bottle-to-fiber circular systems supporting recycled polyester fiber production across nine internationally certified ISCC+ sites, enabling traceable supply capability for technical, apparel, and specialty textile applications.

Expansion of Technical Textile Applications

The rise of technical textiles presents a significant opportunity, with polyester fibers increasingly utilized in geotextiles, industrial filtration, automotive components, and medical fabric manufacturing. Attributes including high tenacity, heat resistance, chemical stability, and dimensional accuracy make polyester suitable for demanding operating conditions. Infrastructure projects drive consumption of geotextiles for reinforcement, drainage, separation, and erosion control. In automotive applications, polyester-based fabrics support lightweighting initiatives, replacing heavier materials and improving fuel efficiency. Meanwhile, demand for antimicrobial and liquid-barrier polyester fabrics grows in healthcare environments. Industrial filters, conveyor belts, ropes, and safety equipment also incorporate engineered polyester fibers to improve service life and durability. As automation and mechanized construction expand, so does the need for industrial-grade fibers. The broadening scope of high-performance textile solutions forms a sustained growth channel for polyester fiber manufacturers targeting value-added product categories.

- For instance, Indorama Ventures produces industrial-grade polyester tire-cord fibers engineered with tensile strength grades up to 9.0 grams per denier and controlled thermal shrinkage for high-speed radial tire applications, supported through integrated spinning and heat-setting lines across its industrial fiber division.

Customized, Functional, and Smart Textiles

The adoption of smart and functional textiles enhances growth potential, driven by integration of sensor-embedded fibers, conductive coatings, and phase-changing materials. Polyester fiber serves as a stable substrate for electronic layering and functional finishes, enabling applications in wearable devices, biometric monitoring uniforms, and adaptive climate-control clothing. Outdoor and sports apparel brands increasingly invest in moisture-wicking, UV-protection, anti-odor, and quick-dry finishes to meet performance expectations. Personalization and micro-collection manufacturing models fuel demand for flexible fiber engineering. The defense and aerospace industries experiment with signal-responsive polyester textiles to improve surveillance, thermal management, and protective gear design. These innovations support premium pricing models, expanding margins amid competitive pressure. As Industry 4.0 technologies converge with textile production such as digital printing and nanocoatings polyester’s modification compatibility positions it at the forefront of the functional and intelligent textile revolution.

Key Challenges

Environmental Impact and Resource Dependency

The environmental footprint of polyester fiber production remains a substantial challenge due to dependence on petroleum-derived feedstocks and energy-intensive processes. High carbon emissions, microplastic shedding, and end-of-life waste management issues drive scrutiny from policymakers and environmental groups. While recycling supports circularity, global recycling infrastructure remains inconsistent, limiting material recovery volumes. Mechanical recycling results in quality degradation over multiple cycles, necessitating chemical recycling advancements that are expensive and not yet globally scalable. The textile industry faces mounting pressure to eliminate microplastic release into waterways through pre-treatment, filtration, or fiber modification. Compliance with evolving environmental regulations increases operational costs, particularly for small and mid-sized manufacturers. Addressing environmental concerns while maintaining scale and affordability requires coordinated investment in green chemistry, renewable feedstocks, and waste collection ecosystems.

Volatility in Raw Material Prices and Supply Chain Disruptions

Polyester fiber production is vulnerable to price fluctuations in crude oil derivatives, especially PTA and MEG, which form the essential raw material base. Geopolitical tensions, refinery outages, trade restrictions, and transportation bottlenecks create unpredictability in supply and pricing. Manufacturers often struggle to balance production costs with competitive pricing strategies in a margin-conscious textile industry. Reliance on imports for feedstock compounds risk for emerging economies. Disruptions during global crises, port congestions, or logistics failures amplify lead times, affecting downstream garment manufacturers and retailers operating under rapid product cycles. Inventory misalignment and overproduction risk rise due to demand volatility in fashion-driven markets. To mitigate these challenges, manufacturers increasingly pursue vertical integration, flexible sourcing strategies, recycling-based feedstock generation, and digital supply chain visibility to enhance resilience and cost efficiency.

Regional Analysis

Asia Pacific

Asia Pacific holds the dominant share of the polyester fiber market, accounting for over 65% of global consumption, driven by strong textile manufacturing bases in China, India, Vietnam, and Indonesia. The region benefits from cost-effective labor, large-scale weaving and spinning capacity, and the availability of PTA and MEG feedstocks. China remains the largest producer and consumer, supported by vertically integrated supply chains and surging demand for apparel, home textiles, and industrial-grade fibers. Government-backed expansion in technical textiles, infrastructure, and export-led garment production further reinforces Asia Pacific’s leadership. Increasing adoption of recycled polyester also elevates the region’s sustainability positioning.

Europe

Europe represents approximately 12% of the polyester fiber market, driven by advanced technical textile demand in automotive, geotextiles, filtration, and industrial applications. The region emphasizes sustainability, prompting manufacturers to prioritize recycled and bio-based polyester solutions aligned with EU recycling targets and carbon compliance frameworks. Germany, Italy, and France lead consumption due to robust automotive and performance apparel industries. Import dependency remains notable; however, investments in closed-loop textile recycling and circular design help reduce reliance on virgin feedstock. Premium-grade filament and performance fibers find steady demand from sportswear and specialty textile brands seeking durability, moisture control, and extended product lifecycles.

North America

North America accounts for nearly 10% of the polyester fiber market, supported by strong demand for automotive textiles, hygiene nonwovens, and home furnishings. The United States drives most consumption, particularly in carpet manufacturing, industrial fiber composites, and technical geotextiles used in roadway reinforcement and soil stabilization. The region experiences rapid momentum in recycled polyester initiatives, accelerated by brand commitments to sustainable apparel and packaging. While manufacturing is less concentrated compared to Asia, adoption of chemical recycling technologies expands strategic domestic capacity. The rise of reshoring strategies and material traceability requirements strengthens regional investment opportunities across value-added polyester applications.

Latin America

Latin America holds around 7% market share, with Brazil and Mexico leading fiber consumption across apparel, workwear, and home décor segments. Growing retail fashion penetration, expanding urban populations, and increasing participation of domestic textile manufacturers contribute to steady polyester demand. Import reliance on feedstocks and fibers persists; however, regional producers are gradually investing in recycling infrastructure to supply rPET for branded apparel and packaging. The automotive sector in Mexico and Brazil creates opportunities for polyester-based nonwoven and interior components. Currency volatility, trade fluctuations, and energy costs remain structural hurdles, yet rising manufacturing competitiveness positions the region for moderate long-term expansion.

Middle East & Africa

The Middle East & Africa region captures approximately 6% of the polyester fiber market, supported by the presence of petrochemical feedstock suppliers and expanding textile processing clusters, particularly in Turkey, Egypt, and the UAE. Demand is driven by increasing apparel consumption, infrastructure projects requiring geotextiles, and the development of localized garment manufacturing for export. Turkey acts as a regional hub for polyester filament, supplying European and North African markets. While growth potential is significant, logistical challenges, uneven industrialization, and limited recycling ecosystems restrict broader adoption. Investments in industrial parks and trade-linked manufacturing partnerships improve regional market prospects.

Market Segmentations:

By Form

By Grade

- PET (Polyethylene Terephthalate)

- PCDT (Poly-1,4-Cyclohexylene Dimethylene Terephthalate)

By Product Type

- Filament Yarn

- Staple Fiber

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The polyester fiber market is characterized by a highly competitive landscape, driven by the presence of vertically integrated chemical producers, global textile manufacturers, and regional specialty fiber suppliers. Major companies focus on capacity expansion, cost-optimized feedstock sourcing, and the development of high-performance and recycled polyester products to strengthen portfolio differentiation. Collaboration with apparel brands, automotive OEMs, and technical textile manufacturers accelerates adoption of rPET and value-added fibers. Competitive advantage increasingly stems from circular economy capabilities, including chemical recycling, textile waste sourcing, and closed-loop production agreements. Market players also invest in advanced spinning technologies, digital color management, and functional coating solutions to support premium-grade applications. However, pricing pressures, fluctuating raw material costs, and shifting sustainability regulations intensify competition across global markets. As demand evolves toward durable, traceable, and eco-efficient polyester fibers, innovation, supply chain integration, and sustainability-driven production frameworks define the strategic priorities shaping competitive momentum.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sinopec Yizheng Chemical Fibre Limited Liability Company (China)

- Far Eastern New Century Corporation (Taiwan)

- Reliance Industries Limited (India)

- Tongkun Holding Group (China)

- Alpek Polyester (Mexico)

- Toray Industries, Inc. (Japan)

- Indorama Ventures Public Company Limited (Thailand)

- Zhejiang Hengyi Group Co., Ltd (China)

- ADVANSA (Turkey)

- Sanfame Group (China)

Recent Developments

- In March 2025 – ADVANSA’s ADVAtex is a 100% recycled polyester fiber made from pre-consumer textile waste. It reduces reliance on virgin materials while maintaining quality. The process transforms textile waste into durable fibers for furniture and mattresses, addressing global textile waste challenges. Certified by GRS and Oeko-Tex.

- In September 2024, Indorama joined a consortium of seven companies (across five countries) to establish what the press release called the “world’s first supply chain for more sustainable polyester fiber,” using CO₂-derived raw materials, renewable and bio-based feedstocks instead of purely fossil-based ones.

- In June 2024,Toray launched new “Toraysee™” cleaning cloths made with polyester fiber that gently remove fingerprints and sebum without scratching surfaces. This indicates continued fiber-to-product integration and use of polyester fiber for specialty applications beyond textiles.

Report Coverage

The research report offers an in-depth analysis based on Form, Grade, Product type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for polyester fiber will continue rising, supported by growth in apparel, home décor, and technical textile applications.

- Recycled polyester will expand as brands and manufacturers adopt circular production and sustainability targets.

- Chemical recycling technologies will advance, enabling higher-quality, closed-loop polyester fiber output.

- Bio-based polyester alternatives will gain traction as companies work to reduce dependence on fossil-based feedstocks.

- High-tenacity and performance-grade fibers will see greater adoption in automotive, aerospace, and industrial applications.

- Digital manufacturing and automated spinning will improve operational efficiency and reduce waste.

- Smart and functional textiles will open new opportunities in healthcare and wearable electronics.

- Capacity expansion in Asia will strengthen supply chain dominance and cost leadership.

- Regulatory pressures on microplastics and waste management will drive innovation in fiber modification.

- Market competition will increasingly favor vertically integrated producers focused on sustainability and specialty fiber solutions.