Market Overview

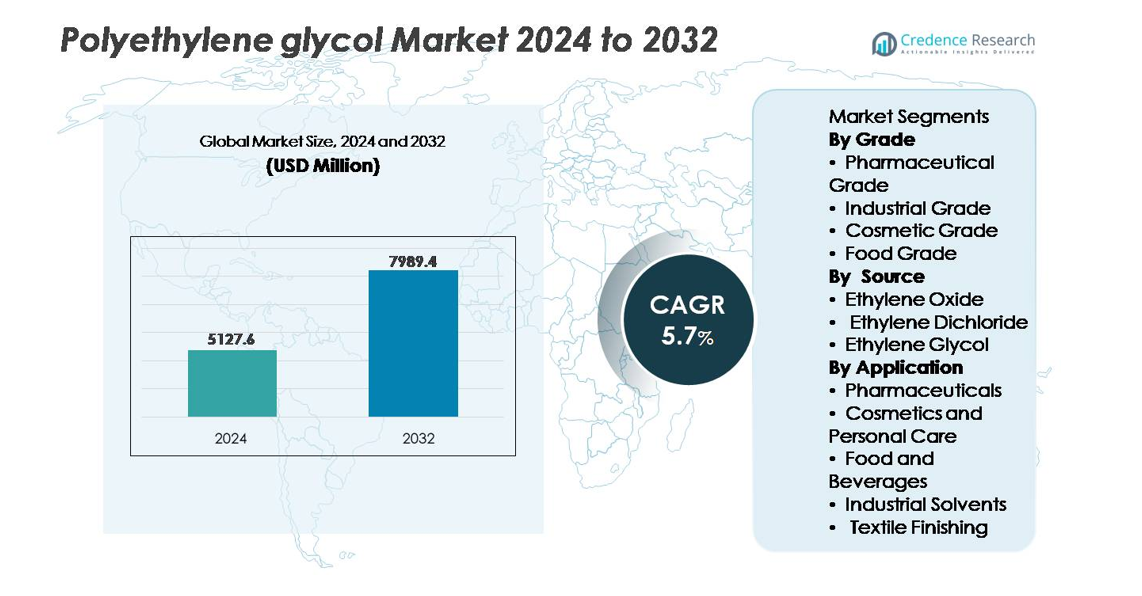

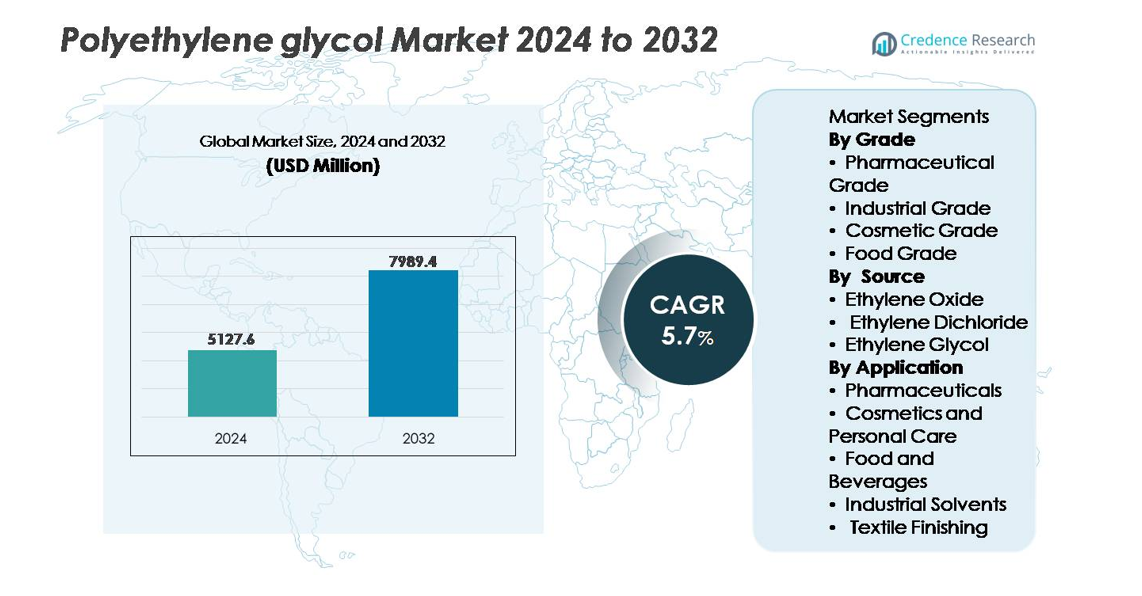

The global polyethylene glycol market was valued at USD 5,127.6 million in 2024 and is projected to reach USD 7,989.4 million by 2032, reflecting a CAGR of 5.7% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyethylene Glycol Market Size 2024 |

USD 5,127.6 million |

| Polyethylene Glycol Market, CAGR |

5.7% |

| Polyethylene Glycol Market Size 2032 |

USD 7,989.4 million |

The polyethylene glycol market is dominated by a mix of global chemical manufacturers and regional specialty producers, including Huntsman Corporation, BASF SE, Dow Chemicals, INEOS, Clariant, Croda International, AkzoNobel N.V., India Glycols, Liaoning Oxiranchem, and Jiangsu Haian Petrochemical Plant. Asia Pacific stands as the leading production and consumption hub, holding approximately 48% of the global market share, supported by large-scale pharmaceutical, cosmetics, and industrial manufacturing bases. North America and Europe follow, collectively accounting for about 44%, driven by demand for high-purity PEG grades used in biologics, drug delivery systems, and advanced personal care formulations. The competitive landscape increasingly emphasizes purity levels, molecular weight customization, and sustainable manufacturing innovation.

Market Insights

- The global polyethylene glycol market was valued at USD 5,127.6 million in 2024 and is projected to reach USD 7,989.4 million by 2032, reflecting a CAGR of 5.7%.

- Market growth is primarily driven by expanding pharmaceutical formulations, increasing PEG utilization in biologics and topical applications, and rising demand across cosmetics, personal care, and industrial processing.

- Key trends include customization of molecular weight PEG for drug delivery, rising investment in PEGylation technologies, and growing interest in bio-based PEG to support sustainable manufacturing.

- The market remains moderately consolidated with major players competing on purity grades, compliant production, and application-specific formulation support; strategic expansions and long-term supply contracts shape the competitive environment.

- Regionally, Asia Pacific leads with around 48% share, followed by North America and Europe jointly holding about 44%, while pharmaceutical grade PEG accounts for the dominant segment share, supported by regulated excipient demand and biologics-oriented applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Grade

Pharmaceutical grade polyethylene glycol holds the dominant market share, driven by its extensive use as a binder, plasticizer, and solubilizing agent in oral, ophthalmic, and injectable formulations. Its regulatory acceptance across USP, EP, and JP standards supports accelerated adoption in generics and biologics manufacturing. Industrial grade follows in demand for lubricants, coolants, and chemical intermediates, while cosmetic grade continues expanding in skin-conditioning products due to its non-irritant profile. Food-grade PEG maintains a niche position, primarily in food processing aids and packaging additives, restrained by strict compliance requirements.

- For instance, Clariant supplies Polyglykol 8000 P, a PEG with a mean molecular weight of 8,000 g/mol that meets IPEC-GMP standards for use in pharmaceutical excipients and drug processing.

By Source

Ethylene oxide remains the leading source for polyethylene glycol production, commanding the largest share due to its efficiency, high purity yield, and scalability for pharmaceutical and cosmetic-grade PEG. Its controlled polymerization process ensures consistent molecular weights essential for drug delivery and excipient functionality. Ethylene glycol contributes significantly as a cost-effective route for industrial applications but is less preferred for regulated uses. Ethylene dichloride represents the smallest share owing to environmental concerns and stricter emission standards, which continue to limit its utilization in modern PEG value chains.

- For instance, INEOS’ acquisition of LyondellBasell’s Bayport facility provides access to a 420,000-ton-per-year ethylene oxide unit and a 375,000-ton-per-year ethylene glycols unit, directly strengthening its PEG feedstock backbone.

By Application

Pharmaceuticals represent the dominant application segment, utilizing polyethylene glycol in laxatives, ointments, soft-gel coatings, and controlled-release systems, powered by rising chronic disease treatments and expanding biopharmaceutical pipelines. Cosmetics and personal care follow as PEG supports emulsification, moisture retention, and texture enhancement in creams, shampoos, and sun care formulations. In food and beverages, PEG is applied in processing aids and anti-foaming agents, while industrial solvents rely on PEG’s lubricity and chemical stability. Textile finishing demands PEG for fiber lubrication and antistatic properties, supporting efficiency in spinning and weaving operations.

Key Growth Drivers

Expanding Pharmaceutical and Biopharmaceutical Formulations

Polyethylene glycol (PEG) benefits significantly from the surge in pharmaceutical formulations, including oral dosage, injectables, topical applications, and controlled-release platforms. Its solubility enhancement, binding capacity, and tolerance profile position PEG as a preferred excipient across generics and specialty therapies. The rise of biologics and biosimilars fuels additional demand, particularly for PEGylation techniques that prolong half-life and improve bioavailability of therapeutic proteins. PEGylated drugs continue to gain approvals globally, reinforcing commercial visibility. Increasing population longevity, chronic disease prevalence, and healthcare expenditure collectively support the continued integration of PEG in advanced drug delivery, formulation stabilization, and biologic pipeline expansion.

- For instance, Nektar Therapeutics’ proprietary PEGylation platform has enabled PEG-modified proteins exceeding molecular weights of 20,000 g/mol to extend circulation time of biologics in oncology and immunology applications.

Growing Penetration in Cosmetic, Personal Care, and Dermatological Solutions

Rising consumer spending on skincare, dermo-cosmetics, and premium formulations drives the adoption of PEG as an emulsifier, moisturizer, and texture modifier. Its ability to enhance product feel, stabilize oil-water phases, and support non-greasy formulations enables PEG to align with evolving demand for lightweight, multifunctional products. PEG-based compounds play an important role in sunscreens, conditioners, cleansers, and anti-aging creams. The growing influence of clean beauty and ingredient transparency encourages manufacturers to reformulate using recognized and regulatory-compliant additives. With digital retail reshaping product cycles and customization trends advancing, PEG remains relevant across scalable manufacturing and specialized cosmetic product lines.

- For instance, Polyethylene glycol 6000 (PEG 6000) uses a polyethylene glycol with a molecular weight of 6,000 g/mol to improve viscosity stability and conditioning in haircare formulations from various suppliers. Croda International sells a similar product for home care and industrial uses called Renex™ PEG 6000.

Industrial Applications Supporting Process Efficiency and Specialty Manufacturing

Polyethylene glycol delivers performance advantages in industrial value chains, including lubricity, thermal stability, humectancy, and solvation. These characteristics make PEG integral to metalworking fluids, plasticizers, inks, resins, textile lubricants, and chemical processing aids. Demand accelerates with manufacturing automation, electronics assembly growth, and industrial equipment requiring precise thermal and mechanical stability. PEG’s compatibility with water-based systems also supports transition from solvent-heavy formulations. Its functional versatility across temperature resilience, viscosity modification, and anti-static performance reinforces its adoption in automotive coatings, adhesives, and textile finishing, aligning with productivity improvements and quality standardization across global industrial sectors.

Key Trends & Opportunities

Advancement in PEGylation and Biologic Drug Delivery Technologies

PEGylation creates opportunities in specialty drug delivery by improving molecular stability and reducing immunogenicity of biologics and peptides. Pharmaceutical innovators explore customized PEG chain lengths and architectures to fine-tune pharmacokinetics, enabling longer dose intervals and improved patient compliance. This trend expands into next-generation therapies including RNA-based medicines, antibody fragments, and gene delivery vectors. As biologics require enhanced shelf stability and controlled dispersion, PEG remains positioned as a critical enabling material. Increasing regulatory guidance specificity for modified excipients further promotes investment in PEG-based drug delivery innovation.

- For instance, Nektar Therapeutics has developed PEG polymers reaching molecular weights up to 40,000 g/mol for conjugation with peptide and protein therapeutics to extend systemic circulation time.

Sustainable Manufacturing and Bio-Based PEG Development

Sustainability-centered chemical production opens new pathways for bio-based PEG derived from renewable raw materials. With global directives on carbon reduction and lifecycle transparency, manufacturers explore green feedstock integration, energy-efficient polymerization methods, and low-VOC applications. Bio-based PEG offers opportunities in personal care, pharmaceuticals, and food processing where product labeling and environmental performance influence purchasing decisions. Technological advances in fermentation and catalytic conversion could improve cost competitiveness, increasing commercial viability. The shift toward circular polymers, packaging optimization, and end-of-life recyclability continues to frame bio-derived PEG as a strategic growth opportunity in the broader chemical sustainability landscape.

- For instance, India Glycols Limited produces bio-ethylene oxide and bio-ethylene glycol derived from molasses-based ethanol, enabling PEG production through renewable feedstock routes and supporting downstream PEG variants built on plant-based glycol inputs.

Key Challenges

Regulatory and Compliance Constraints Across End-Use Industries

Polyethylene glycol interacts with strict regulatory frameworks governing pharmaceuticals, food additives, and cosmetic ingredients. Variations in regional compliance standards, excipient certification, permissible concentration levels, and documentation requirements impose high validation costs. Manufacturers operating in multiple markets face complex approvals, stability testing obligations, and evolving ingredient labeling standards. Regulatory scrutiny intensifies for excipients used in biologics and pediatric formulations, increasing analytical testing expectations. These dynamics create market entry barriers, delay commercialization timelines, and increase operational overhead, particularly for small and mid-sized producers.

Feedstock Price Volatility and Supply Chain Dependence on Petrochemical Inputs

PEG production depends heavily on petrochemical derivatives such as ethylene oxide and ethylene glycol, exposing manufacturers to fluctuations in crude oil pricing, supply disruptions, and geopolitical risks. Instability in feedstock availability impacts production economics and margin predictability. Transportation costs, refinery maintenance cycles, and import dependence in emerging markets further compound volatility. These challenges influence the cost competitiveness of PEG against alternative polymers and additives. Unpredictable pricing also affects long-term contracts with pharmaceutical and industrial buyers, creating planning complexity and hindering capital investment for capacity expansion.

Regional Analysis

Asia Pacific

The Asia Pacific region leads the PEG market, commanding roughly 47%-48% of global revenue share in 2024. Rapid industrialization, growing pharmaceutical production, and rising demand for personal-care and cosmetic products drive this dominance. Expanding middle-class populations in key countries like China and India boost consumption of healthcare and skin-care items that use PEG. Additionally, growth in construction, textiles, and industrial manufacturing enhances demand for PEG in lubricants, solvents, and process aids making Asia Pacific the fastest-growing region for PEG globally.

North America

North America holds a significant share estimated at around 26%-28% in recent years. The region’s mature pharmaceutical sector, stringent regulatory standards, and high demand for high-purity PEG in medical formulations support strong adoption. Demand from personal care, cosmetics, and industrial segments such as specialty solvents and coatings further strengthens consumption. Technological innovation and regulatory compliance drive manufacturers to rely on PEG for drug delivery systems, topical applications, and industrial processes.

Europe

Europe accounts for approximately 18%-20% of the global PEG market share as of 2024. The demand is driven by regulatory emphasis on quality, biocompatibility, and increasingly, sustainability prompting adoption of high-purity and eco-conscious PEG variants. Growing demand in personal care, cosmetics, and pharmaceuticals under CE/REACH regulations sustains steady market consumption. Additionally, interest in “green chemistry” and bio-based PEG solutions particularly for cosmetics and healthcare creates opportunities for market expansion in the region.

Latin America (LAMEA)

Latin America (alongside Middle East & Africa) contributes a smaller slice of the global PEG market around 8%-9% in 2024. Growth in this region is modest due to lower industrial and pharmaceutical infrastructure compared with mature markets. However, demand exists in industries such as food processing, basic cosmetics, and light industrial applications, where PEG is used in solvents, processing aids, and personal-care products. As economic development and industrialization gradually improve, the region shows potential for incremental growth in PEG consumption.

Middle East & Africa

The Middle East & Africa region, though smaller in scale, constitutes part of the broad “LAMEA” category mentioned above contributing alongside Latin America to the roughly 8-9% market share. Demand in this region arises from industrial and chemical processing needs, basic personal care, and emerging pharmaceutical sectors. However, adoption levels remain constrained by lower per-capita consumption, variable regulatory frameworks, and limited high-purity PEG demand. As infrastructure and healthcare investments increase, this region may see gradual uptake, albeit at a slower pace compared to Asia Pacific or North America.

Market Segmentations:

By Grade

· Pharmaceutical Grade

- Industrial Grade

- Cosmetic Grade

- Food Grade

By Source

- Ethylene Oxide

- Ethylene Dichloride

- Ethylene Glycol

By Application

- Pharmaceuticals

- Cosmetics and Personal Care

- Food and Beverages

- Industrial Solvents

- Textile Finishing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the polyethylene glycol (PEG) market is characterized by the presence of established chemical producers, specialized polymer manufacturers, and integrated petrochemical companies competing on product purity, customization capability, and global distribution strength. Leading participants focus on pharmaceutical-grade and high-purity PEG production to address rising demand from biologics, topical formulations, and controlled-release drug systems, while also targeting specialty applications in cosmetics, industrial solvents, and textile finishing. Strategic initiatives include capacity expansion, feedstock optimization, bio-based PEG research, and long-term supply partnerships with pharmaceutical and personal-care brands. Competitive differentiation increasingly relies on technical expertise, compliance with multi-regional regulatory standards, and ability to deliver consistent molecular weight PEG variants. Sustainability-centered innovation is emerging as a key competitive lever, with companies exploring green sourcing, reduced emissions, and recyclable formulations to align with evolving customer expectations and environmental policies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, BASF introduced a new reactive polyethylene glycol product Pluriol® A 2400 I-for use in construction-industry superplasticizers in Europe, thus expanding its PEG-related portfolio.

- In October 2024, Clariant unveiled a portfolio expansion of high-performance excipients for pharmaceuticals at a major industry trade show, explicitly targeting applications such as injectables and other sensitive formulations signalling its commitment to PEG and excipient-grade polymer supply.

- In May 2024, INEOS completed acquisition of the ethylene oxides & derivatives business from LyondellBasell including the associated upstream feedstock capacity enhancing INEOS’s access to ethylene oxide/ethylene glycol feedstocks that are critical for PEG production.

Report Coverage

The research report offers an in-depth analysis based on Grade, Source, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-purity PEG will rise as biologics, biosimilars, and injectable therapies gain wider clinical adoption.

- PEGylation technologies will continue evolving to improve therapeutic stability and controlled drug release.

- Cosmetic and personal-care producers will integrate PEG into multifunctional, performance-centric formulations.

- Bio-based and sustainably sourced PEG alternatives will gain traction as environmental standards tighten.

- Industrial automation will increase consumption of PEG-based lubricants, solvents, and processing aids.

- Customized molecular weight PEG grades will expand precision applications in pharmaceuticals and specialty chemicals.

- Regulatory alignment across regions will shape competitive positioning and certification requirements.

- Strategic partnerships between chemical suppliers and pharma companies will accelerate formulation innovation.

- Emerging markets will contribute incremental growth driven by healthcare expansion and industrialization.

- Digital commerce and rapid product development cycles will fuel PEG demand in personal-care consumer brands.