Market Overview:

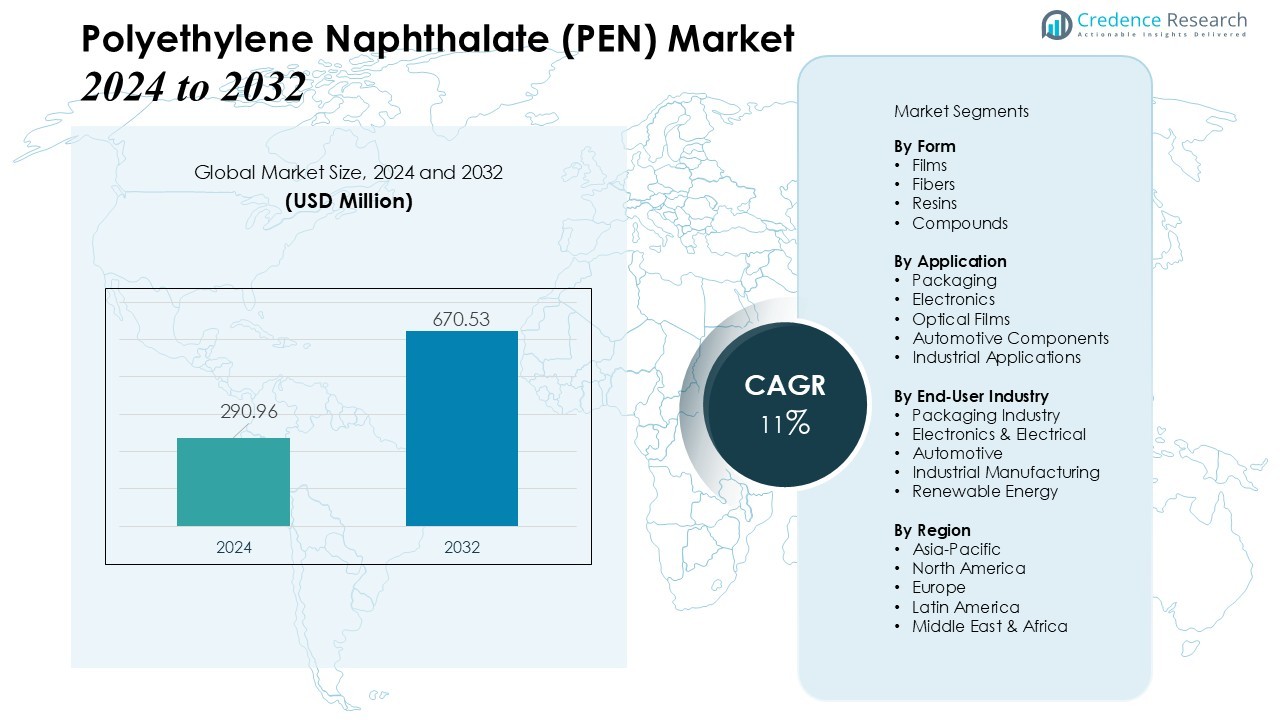

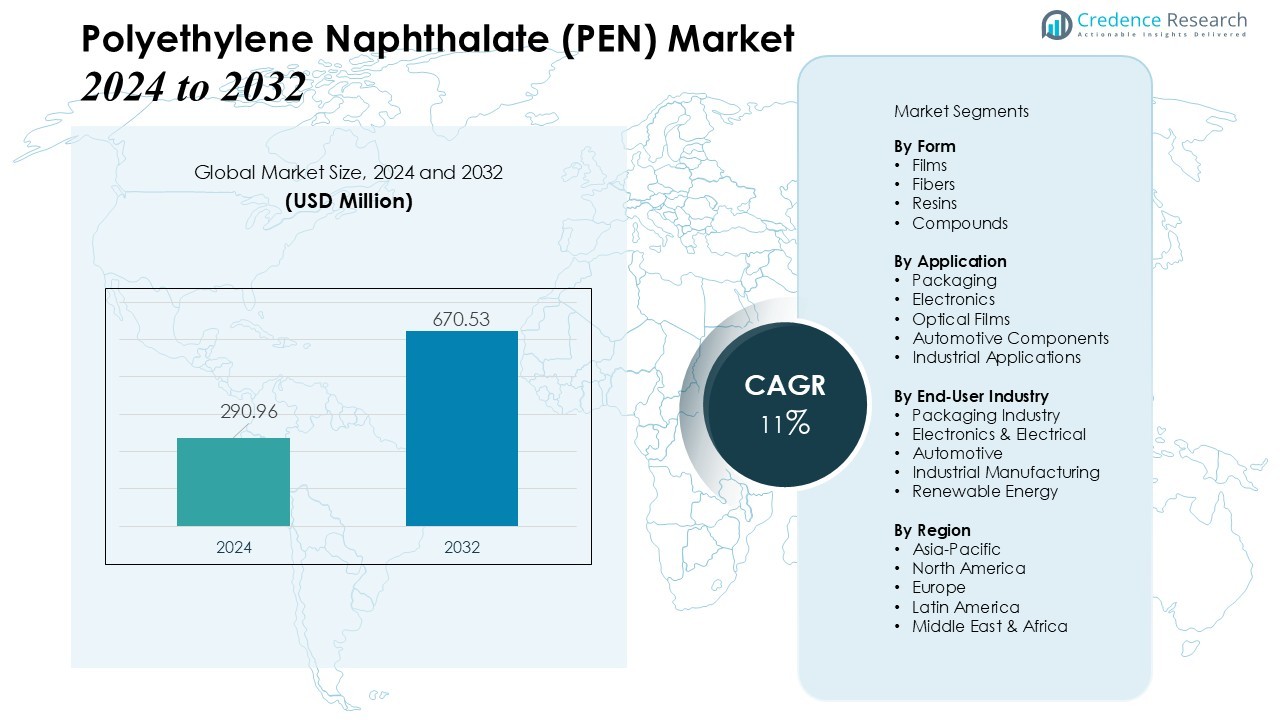

The Polyethylene Naphthalate (PEN) Market size was valued at USD 290.96 million in 2024 and is anticipated to reach USD 670.53 million by 2032, at a CAGR of 11% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyethylene Naphthalate (PEN) Market Size 2024 |

USD 290.96 Million |

| Polyethylene Naphthalate (PEN) Market, CAGR |

11% |

| Polyethylene Naphthalate (PEN) Market Size 2032 |

USD 670.53 Million |

Key market drivers include rising adoption of PEN in electronics, automotive, and food and beverage packaging due to its excellent chemical resistance and dimensional stability. The growing need for durable materials in high-temperature applications and advancements in flexible electronics further contribute to its rising popularity. Expanding use of PEN in optical films, high-frequency electronics, and specialty industrial applications also supports long-term market momentum. Additionally, sustainability initiatives encourage manufacturers to explore recyclable, high-performance polymers such as PEN.

Regionally, Asia-Pacific dominates the global PEN market, driven by strong manufacturing bases, rapid industrialization, and expanding electronics and packaging sectors in China, Japan, and South Korea. North America and Europe show steady growth, supported by technological innovation, increasing adoption of specialty polymers, and a strong focus on high-value applications such as aerospace, automotive electronics, and advanced packaging solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polyethylene Naphthalate (PEN) Market records strong growth momentum, rising from USD 290.96 million in 2024 to USD 670.53 million by 2032 at an 11% CAGR.

- Demand strengthens in electronics, automotive, and high-barrier food and beverage packaging due to PEN’s chemical resistance and dimensional stability.

- Advancements in flexible electronics and expanding use in optical films, high-frequency circuits, and specialty industrial components support long-term market expansion.

- Sustainability targets and interest in recyclable high-performance polymers encourage broader adoption across manufacturing and packaging sectors.

- Asia-Pacific remains the leading regional market, backed by strong industrial bases in China, Japan, and South Korea, while North America and Europe grow through innovation-driven, high-value applications.

Market Drivers:

Market Drivers:

Growing Demand for High-Performance Packaging Solutions

The Polyethylene Naphthalate (PEN) Market gains strong momentum from the packaging sector, particularly in applications requiring superior barrier protection against oxygen, moisture, and chemicals. Food and beverage manufacturers prefer PEN for its ability to extend product shelf life and maintain flavor integrity. It provides higher thermal resistance than PET, which supports hot-fill processes. Packaging converters shift to PEN to meet evolving standards for product safety and performance.

- For instance, SKC Co., a leading PEN producer, highlights that their PEN films achieve an oxygen transmission rate as low as 0.04 cc/m²/day, significantly enhancing shelf life and product protection compared to conventional PET.

Rising Adoption in Electronics and Electrical Components

Manufacturers in the electronics sector drive market growth as they incorporate PEN films into high-frequency circuits, capacitors, and advanced insulation materials. The Polyethylene Naphthalate (PEN) Market benefits from its dielectric properties and dimensional stability under heat. It supports miniaturization trends in consumer electronics. Demand increases from flexible printed circuits and emerging optoelectronic applications.

- For instance, Panasonic uses PEN films in some of its surface-mount film capacitors, which are designed to maintain functionality at temperatures up to 125°C.”

Expansion of Automotive and Industrial Applications

Automotive OEMs adopt PEN for under-the-hood components, sensors, and high-performance fibers due to its mechanical strength and resistance to harsh environments. The Polyethylene Naphthalate (PEN) Market responds to demand for lightweight materials that support fuel efficiency and performance standards. It performs reliably under thermal stress, making it suitable for engine proximity uses. Industrial sectors also rely on PEN for conveyor belts, filtration systems, and specialty coatings.

Growing Focus on Sustainable and High-Value Specialty Polymers

Sustainability trends encourage the shift toward recyclable materials with long life cycles, which positions PEN as a preferred option in multiple industries. The Polyethylene Naphthalate (PEN) Market gains attention from manufacturers aiming to reduce waste and adopt advanced polymer engineering. It aligns with regulatory pressure for environmentally responsible product development. Companies invest in PEN-based innovations to meet performance and sustainability targets.

Market Trends:

Increasing Use of PEN Films in High-Value Electronic and Optical Applications

The Polyethylene Naphthalate (PEN) Market reflects strong interest in advanced electronic and optical applications due to its superior dielectric strength, thermal stability, and dimensional precision. Manufacturers expand the use of PEN films in flexible displays, high-frequency circuits, and optoelectronic components that require consistent performance under elevated temperatures. It supports innovation in wearable electronics and smart devices, where lightweight and durable substrates are essential. Optical film producers integrate PEN into high-clarity, low-shrinkage applications for lenses and imaging systems. Demand grows in sensor technology, photovoltaic modules, and precision components. Manufacturers focus on improving film uniformity and thickness control to support next-generation electronics. Market participants position PEN as a reliable material for high-performance engineering applications.

- For instance, DuPont Teijin Films supplied 125-μm-thick Teonex Q65 PEN sheets for flexible low-voltage organic TFTs with contact resistance as low as 10 Ω·cm.

Rising Shift Toward Sustainable, High-Performance Polymers Across Industries

The Polyethylene Naphthalate (PEN) Market observes a clear trend toward sustainable and durable polymer solutions that meet regulatory and environmental expectations. It attracts interest from packaging, automotive, and industrial sectors seeking recyclable materials with extended service life and strong mechanical properties. Manufacturers invest in bio-based PEN development to support circular economy goals. Demand increases for high-barrier and heat-resistant packaging that supports safer food and beverage distribution. Automotive and industrial users adopt PEN fibers and components to reduce weight and enhance chemical resistance. Advances in polymer processing improve cost efficiency and expand the suitability of PEN for broader end-use categories. Companies pursue product optimization strategies to meet the rising preference for high-value specialty materials.

- For example, PEN film has significantly lower oxygen permeability than traditional PET film. It can offer a five-fold improvement in oxygen barrier properties when used as a passive barrier, or a dramatic enhancement of over 100 times when integrated with active oxygen scavengers in a blended film, significantly extending product shelf life and safety in packaging applications.

Market Challenges Analysis:

High Production Costs and Limited Economies of Scale

The Polyethylene Naphthalate (PEN) Market faces notable pressure from high production costs tied to complex polymerization processes and the expensive nature of raw materials. It competes with lower-cost alternatives such as PET, which holds stronger market penetration. Manufacturers struggle to achieve economies of scale due to smaller production volumes and limited global capacity. Cost sensitivity in packaging and electronics sectors restricts wider adoption of PEN-based solutions. Market participants evaluate pricing strategies that balance performance benefits with affordability. Investment requirements for processing upgrades also challenge small and mid-sized manufacturers. Competitive materials with comparable properties intensify the cost challenge further.

Restricted Application Scope and Technological Limitations

The Polyethylene Naphthalate (PEN) Market encounters constraints stemming from limited awareness and technical familiarity among end users. It requires specialized processing capabilities that many converters and electronics manufacturers have not yet integrated into their operations. Technical limitations in certain extreme-temperature environments also reduce adoption in advanced engineering applications. Substitutes with broader performance ranges, such as high-temperature polyamides and PEEK, attract interest from industries with demanding specifications. Market growth slows in regions with insufficient R&D investment or weak specialty polymer infrastructure. It depends on technological innovation and application development to overcome these constraints. Regulatory complexity in packaging and electronics further adds to market challenges.

Market Opportunities:

Rising Opportunities in Advanced Electronics and Optical Applications

The Polyethylene Naphthalate (PEN) Market benefits from expanding opportunities in electronics, optoelectronics, and high-performance film applications. It supports next-generation circuit design, flexible displays, and precision optical films that require superior dimensional stability. Demand strengthens in sensors, smart wearables, and lightweight electronic components. Manufacturers explore PEN’s potential in photovoltaic modules and imaging technologies with rising interest in energy-efficient materials. Growth in automated manufacturing encourages adoption of premium substrates with consistent performance. Companies invest in improved film quality and surface treatment technologies to enhance compatibility with advanced electronic systems. Market participants leverage material innovation to penetrate high-value technology segments.

Expanding Use in Sustainable Packaging and Industrial Applications

The Polyethylene Naphthalate (PEN) Market sees opportunities in sustainable, recyclable packaging that meets evolving regulatory requirements and consumer preferences. It offers high-barrier and heat-resistant properties that support premium food and beverage protection. Adoption increases in refillable packaging, sterilizable containers, and long-life product formats. Industrial sectors explore PEN fibers for filtration, conveyor systems, and safety materials due to its chemical resistance and durability. Automotive manufacturers evaluate PEN components for lightweight structures and under-the-hood applications. Advances in polymer processing expand the feasibility of PEN in broader use cases. Companies position PEN as a high-value material for industries seeking performance and sustainability together.

Market Segmentation Analysis:

By Form

The Polyethylene Naphthalate (PEN) Market shows strong demand across films, fibers, resins, and compounds, with films holding a dominant position due to extensive use in electronics, optical applications, and premium packaging. It provides high thermal stability and dimensional accuracy, which supports advanced film processing. Fibers gain adoption in industrial and automotive sectors that require durability and chemical resistance. Resins maintain relevance in specialty containers and engineering components. Compounds support customized applications where enhanced performance is essential.

- For instance, Toray Industries developed PEN films with superior thermal stability, shrinking at around 190°C compared to 130°C for PET films. It provides high thermal stability and dimensional accuracy, which supports advanced film processing.

By Application

PEN adoption grows across packaging, electronics, optical films, and automotive components. Packaging uses PEN for high-barrier structures that protect product quality in demanding environments. Electronics manufacturers rely on PEN for high-frequency circuits, insulation materials, and flexible substrates that require consistent performance. Optical and imaging applications use PEN for low-shrinkage films with high clarity and stability. Automotive applications expand through lightweight components, sensors, and heat-resistant parts that support modern vehicle efficiency.

- For instance, PAXXUS developed White Eclipse UV-blocking packaging using ultra-high barrier ClearFoil Z, achieving oxygen and moisture barrier performance comparable to aluminum foil while enabling RFID compatibility.

By End-Use Industry

Demand spans packaging, electronics, automotive, and industrial sectors with varying performance priorities. The Polyethylene Naphthalate (PEN) Market supports packaging manufacturers that need recyclable and heat-resistant materials for food and beverage applications. Electronics and electrical industries integrate PEN into precision films and components used in advanced devices. Automotive manufacturers implement PEN in under-the-hood parts, engineering fibers, and functional components. Industrial users adopt PEN for filtration systems, conveyor materials, and protective applications requiring durability and chemical resistance.

Segmentations:

By Form

- Films

- Fibers

- Resins

- Compounds

By Application

- Packaging

- Electronics

- Optical Films

- Automotive Components

- Industrial Applications

By End-Use Industry

- Packaging Industry

- Electronics & Electrical

- Automotive

- Industrial Manufacturing

- Renewable Energy

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads with Strong Manufacturing Ecosystem and Expanding End-Use Industries

Asia-Pacific holds 47% market share of the Polyethylene Naphthalate (PEN) Market and continues to strengthen its position through large-scale production and high consumption. The region maintains dominance through strong electronics manufacturing and extensive packaging demand. China, Japan, and South Korea drive growth through optical film usage, electronic component production, and advanced material processing. It benefits from investment in polymer technologies that support high-performance film development. Regional policies encourage adoption of sustainable materials across industrial and consumer segments. Expanding automotive and electrical sectors further enhance long-term growth potential.

North America Shows Steady Growth with Emphasis on High-Value Applications

North America holds 23% market share and demonstrates steady uptake of PEN driven by demand for high-performance engineering materials. The region leverages strong R&D infrastructure and early adoption of advanced polymers in electronics and aerospace. It gains traction in photovoltaic films, thermal-resistant components, and flexible substrates. Manufacturers focus on innovations that support high-frequency circuits and specialty fibers. Regulatory support for recyclable and durable materials shapes adoption across packaging and technology sectors. Demand strengthens in precision electronics requiring consistent performance under variable conditions.

Europe Focuses on Sustainability, Automotive Innovation, and Specialty Polymers

Europe holds 19% market share and advances its position through strong sustainability regulations and specialty polymer expertise. The region evaluates PEN for automotive electronics, lightweight structures, and high-barrier packaging applications. It benefits from mature processing infrastructure and close collaboration between material innovators and end-use industries. Demand rises in sectors adopting recyclable, high-performance materials aligned with environmental targets. Manufacturers integrate PEN into applications that require thermal stability and long service life. Growth opportunities improve as European industries invest in advanced polymer technologies.

Key Player Analysis:

- DuPont

- SKC

- Sumitomo Chemical

- Polyonics

- 3M

- KOLON Corp.

- SASA

- TORAY INDUSTRIES, INC.

- TEIJIN LIMITED.

Competitive Analysis:

The Polyethylene Naphthalate (PEN) Market features a competitive landscape dominated by global chemical producers, specialty polymer manufacturers, and advanced film suppliers. Leading companies focus on high-performance PEN grades that support electronics, packaging, and optical applications. It encourages continuous investment in material innovation, film-processing capabilities, and surface modification technologies. Competitors strengthen their positions through strategic partnerships with electronics manufacturers and packaging converters that demand consistent quality and technical support. Expansion into recyclable and bio-based PEN grades enhances brand differentiation in markets driven by sustainability goals. Firms also prioritize capacity expansion in Asia-Pacific, where strong demand and established manufacturing hubs create long-term growth opportunities. Competitive intensity remains high, driven by efforts to reduce production costs, improve product performance, and secure supply chain stability in end-use industries.

Recent Developments:

- In October 2025, SKC announced a merger with its subsidiary SK enpulse to bolster its chip back-end business, securing KRW 380 billion in funding.

- In November 2025, Sumitomo Chemical acquired Taiwan’s AUECC to expand its semiconductor chemicals portfolio and strengthen global supply chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Form, Application, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyethylene Naphthalate (PEN) Market will advance with rising demand for high-performance films in electronics, optical applications, and flexible circuit technologies.

- It will gain wider acceptance in premium packaging due to the need for strong barrier protection and extended product shelf life.

- Manufacturers will invest in improved film-processing technologies to deliver higher clarity, uniformity, and thermal stability.

- Adoption will expand in automotive electronics and lightweight components that require heat-resistant and durable materials.

- Global interest in recyclable, long-life polymers will strengthen opportunities for PEN in sustainability-driven industries.

- R&D efforts will focus on bio-based PEN grades that support circular economy goals and regulatory compliance.

- Industrial applications will grow through increased use of PEN in filtration systems, conveyor materials, and chemical-resistant components.

- Demand for PEN in photovoltaic modules and imaging technologies will increase due to its dimensional stability and optical performance.

- Regional manufacturing expansions in Asia-Pacific will reinforce supply chain efficiency and global market competitiveness.

- Strategic collaborations between material suppliers, electronics manufacturers, and packaging converters will accelerate product innovation and market penetration.

Market Drivers:

Market Drivers: