Market Overview:

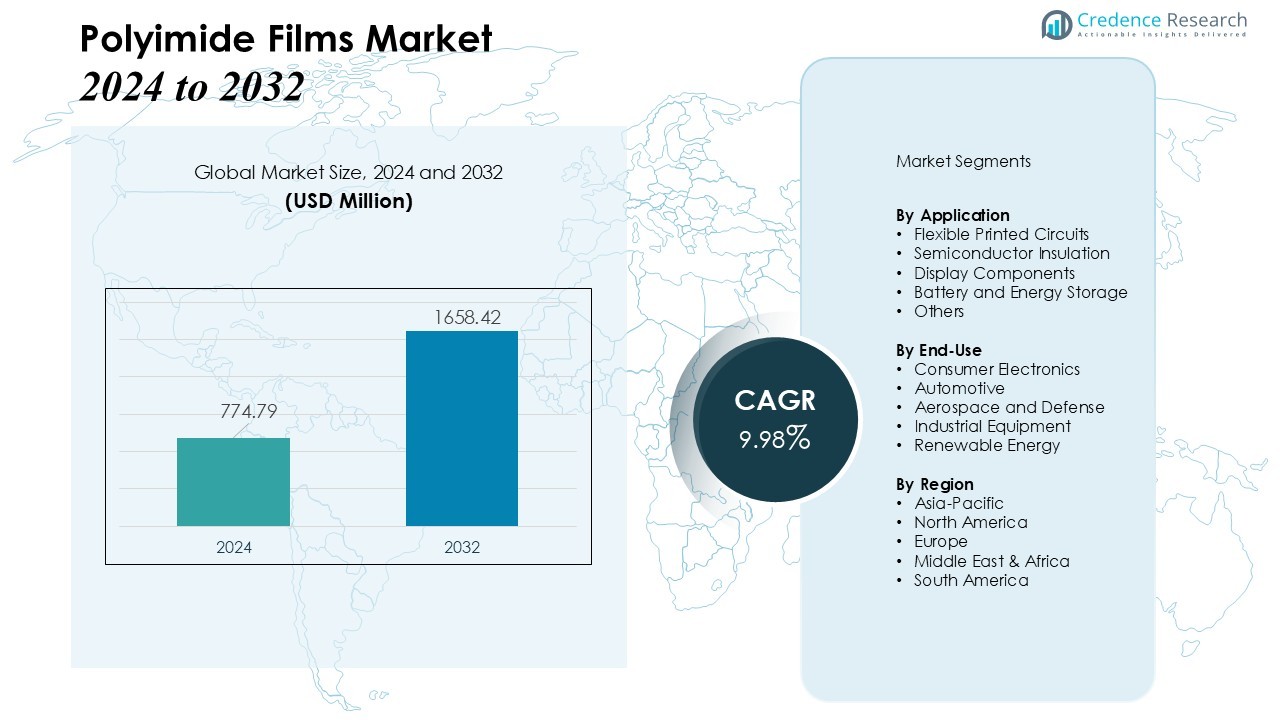

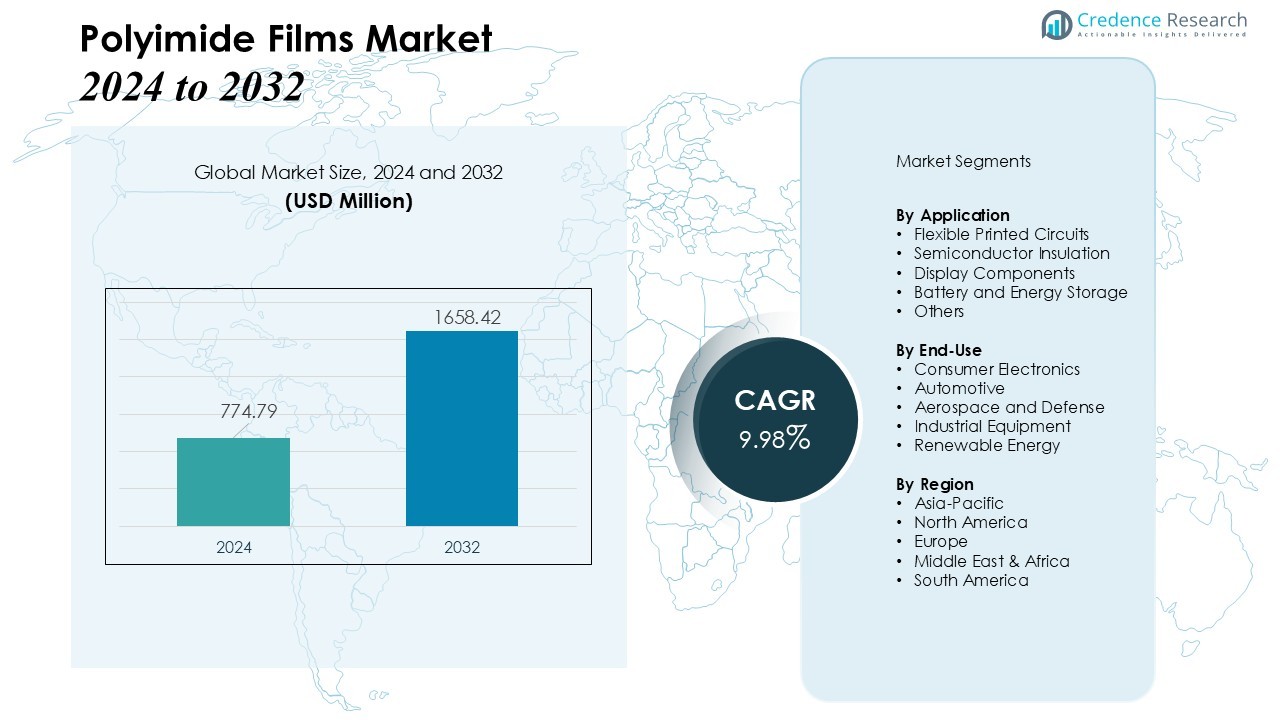

The Polyimide Fiber Market size was valued at USD 535.62 million in 2024 and is anticipated to reach USD 791.35 million by 2032, at a CAGR of 5% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyimide Fiber Market Size 2024 |

USD 535.62 Million |

| Polyimide Fiber Market, CAGR |

5% |

| Polyimide Fiber Market Size 2032 |

USD 791.35 Million |

Key market drivers reinforce the industry’s upward trajectory. Rapid industrialization, growing demand for advanced heat-resistant materials, and expanding use of protective clothing in aerospace, automotive, and electronics sectors drive steady consumption. It gains additional momentum from rising investments in energy-efficient solutions and the increasing need for lightweight, high-strength fibers across manufacturing environments. Continuous innovation in fiber engineering further supports its penetration into technically demanding applications.

Regional analysis highlights strong growth across Asia-Pacific, driven by rapid manufacturing expansion, increasing production capacities, and high demand from electronics and industrial sectors. North America maintains a significant share due to established aerospace and defense industries, while Europe benefits from stringent safety standards and rising adoption of advanced protective materials. Emerging economies in Latin America and the Middle East also show rising potential as industrial infrastructure strengthens.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polyimide Fiber Market grows from USD 535.62 million in 2024 to USD 791.35 million by 2032, driven by a steady CAGR of 5% supported by rising demand for high-temperature resistant materials across industrial applications.

- Rising industrialization strengthens adoption of polyimide fibers due to their stable thermal performance, high durability, and suitability for aerospace, automotive, and heavy-duty environments.

- Expanding use in advanced protective clothing boosts market momentum, supported by strong demand for flame-retardant, lightweight, and non-toxic materials that enhance worker safety standards.

- Increasing reliance on polyimide fibers in electronics and electrical systems accelerates demand, driven by the need for superior dielectric strength, heat insulation, and chemical resistance in compact device architectures.

- Automotive and aerospace industries reinforce long-term growth by integrating lightweight, high-strength fibers to improve fuel efficiency, structural stability, and compliance with strict emission regulations.

- High production costs and complex processing remain key constraints, as manufacturers require advanced equipment, skilled labor, and controlled manufacturing conditions to ensure consistent fiber quality.

- Asia Pacific leads with 54% market share supported by high manufacturing capacity, while North America and Europe sustain strong demand through aerospace, defense, and regulatory-driven industrial applications.

Market Drivers:

Market Drivers:

Rising Demand for High-Temperature Resistant Materials

The Polyimide Fiber Market grows due to expanding use in environments that require dependable heat resistance. It delivers stable performance under extreme temperatures, which strengthens its value across aerospace, automotive, and industrial sectors. Manufacturers use it to enhance safety standards in equipment exposed to continuous thermal stress. The preference for materials with extended service life reinforces steady adoption across multiple applications.

- For Instance, High-performance polyimide fiber typically provides long-term usability at temperatures up to 260°C or 300°C, and some specialized versions can withstand short-term exposure to temperatures as high as 500°C or even 700°C in demanding applications like aerospace, high-voltage insulation systems, and protective clothing.

Growing Use in Advanced Protective Clothing and Industrial Safety Gear

Strong demand for high-performance protective apparel supports market momentum. The Polyimide Fiber Market benefits from its flame-retardant, lightweight, and non-toxic properties, which elevate worker safety in chemical plants, metal processing units, and firefighting operations. It helps manufacturers design garments that meet stringent regulatory requirements. Expanding awareness of workplace safety drives broader integration of these fibers into protective product lines.

- For instance, polyimide fibers resist ignition up to 50 kW/m² heat flux without producing ignitable gases, enabling reliable performance in high-risk industrial environments.

Increasing Adoption Across Electronics and Electrical Applications

Rising complexity in electronic devices fuels the need for insulation materials that ensure reliability. The Polyimide Fiber Market supports this demand through its excellent dielectric strength, low thermal conductivity, and chemical resistance. It enhances the performance of cables, circuit components, and high-temperature insulation systems. The push for compact and durable electronics strengthens long-term opportunities.

Innovation in Lightweight Materials for Automotive and Aerospace Applications

The automotive and aerospace industries seek lightweight, high-strength materials to improve fuel efficiency and structural performance. The Polyimide Fiber Market gains traction as it offers a favorable strength-to-weight ratio and superior thermal stability. It enables manufacturers to meet strict emission norms while maintaining durability standards. Rising investments in advanced composites support wider use of polyimide fibers in next-generation components.

Market Trends:

Advancement in High-Performance Material Applications

The Polyimide Fiber Market expands with rapid innovation across industries that rely on high-temperature and flame-resistant materials. It gains traction in aerospace, automotive, and heavy industrial segments due to rising focus on operational safety and efficiency. Manufacturers increase production capacity to meet the growing need for durable fibers that withstand mechanical stress and chemical exposure. The trend toward lightweight components in transportation strengthens demand for polyimide-based solutions. Companies invest in advanced processing technologies to enhance fiber strength, flexibility, and heat tolerance. Product diversification accelerates market penetration across new application areas, including filtration systems, thermal insulation, and industrial protective gear.

- For instance, Teijin developed advanced polyimide fibers featuring thermal stability from -200°C to over 300°C, enabling use in extreme aerospace environments.

Shift Toward Sustainable and Energy-Efficient Manufacturing

Sustainability continues to shape growth patterns within the Polyimide Fiber Market, supported by stricter global policies addressing energy use and emissions. It aligns with industry preferences for materials that offer long service life and minimal environmental impact during operation. Manufacturers explore eco-efficient production methods that reduce waste generation and optimize resource utilization. The demand for low-maintenance and high-durability fibers reinforces its appeal in long-cycle applications such as electronics, industrial equipment, and aerospace systems. Companies introduce advanced formulations that improve thermal and electrical performance while lowering overall operational costs. The transition toward energy-conscious industrial systems strengthens adoption of polyimide fibers across emerging and established markets.

- For instance, SRI International developed a PBO fiber (brand name Zylon®) with continuous thermal stability at up to 300°C – 350°C, which is used in aerospace components

Market Challenges Analysis:

High Production Costs and Complex Manufacturing Processes

The Polyimide Fiber Market faces persistent challenges linked to high production costs and intricate manufacturing requirements. It demands specialized equipment, controlled processing conditions, and advanced chemical formulations, which increase capital expenditure for producers. Limited availability of skilled labor and technical expertise further restricts large-scale adoption. Manufacturers encounter difficulties in maintaining consistent quality due to the fiber’s sensitivity to temperature and process variations. These constraints limit participation from small and medium-sized enterprises and slow down capacity expansion in emerging regions. The financial burden reduces cost competitiveness compared to alternative high-performance fibers.

Intense Competition from Substitute Materials and Market Fragmentation

The Polyimide Fiber Market confronts competition from aramid fibers, carbon fibers, and other advanced materials that offer strong performance at lower cost in certain applications. It struggles to differentiate in segments where comparable thermal or mechanical properties exist across substitutes. Market fragmentation creates pressure on pricing strategies, particularly in industrial and protective clothing segments. Manufacturers face hurdles in building long-term customer loyalty due to frequent evaluation of alternative materials by end users. Regulatory variations across regions add complexity to product approvals and certification processes. These issues collectively restrict rapid market penetration in cost-sensitive industries.

Market Opportunities:

Expansion in Aerospace, Electronics, and High-Temperature Industries

The Polyimide Fiber Market holds strong opportunities across sectors that require durable, heat-resistant, and lightweight materials. It benefits from rising demand for advanced composites used in aircraft components, electronic insulation, and industrial filtration systems. Manufacturers gain new prospects through the development of fibers with enhanced tensile strength and improved thermal endurance. The shift toward miniaturized electronics creates openings for high-performance insulation solutions. Increased investment in space exploration programs strengthens the need for materials capable of surviving extreme atmospheric conditions. These factors support steady long-term growth potential across high-technology industries.

Growing Adoption in Protective Clothing and Energy-Efficient Applications

The Polyimide Fiber Market advances with rising interest in flame-retardant and chemical-resistant protective apparel. It enables manufacturers to introduce lightweight garments that meet strict safety benchmarks across metal processing, chemical plants, and firefighting services. Expanding emphasis on workplace safety opens new avenues for fiber integration in industrial gear. The movement toward energy-efficient systems increases demand for materials with superior thermal insulation properties. Manufacturers explore opportunities in renewable energy equipment where durability and heat stability remain critical. These trends highlight a wide scope for product development and market diversification.

Market Segmentation Analysis:

By Type

Meta-polyimide fibers lead demand due to strong thermal stability, reliable flame resistance, and cost-efficient production suited for industrial filtration, protective apparel, and electronics insulation. Para-polyimide fibers follow with higher tensile strength and superior dimensional stability that support advanced aerospace and automotive applications. The Polyimide Fiber Market benefits from both categories, supported by continuous improvements in polymer chemistry and performance optimization. It meets stringent safety and durability requirements across high-temperature environments. Broader adoption depends on material consistency, certification, and compatibility with evolving manufacturing standards.

- For instance, DuPont’s Nomex® meta-aramid fiber exhibits a breaking tenacity of 5.0 g/d and a tensile modulus of 125 g/d, confirming its dependable mechanical performance under thermal stress conditions.

By Application

Protective clothing represents a major application segment, driven by strict worker safety regulations in chemical plants, metal processing units, and firefighting operations. Aerospace and automotive applications hold strong traction due to rising integration of lightweight and heat-resistant materials. Electrical and electronics use grows steadily because polyimide fibers offer high dielectric strength and stable insulation under thermal stress. Industrial filtration gains wider use in harsh operating environments that demand long service life and mechanical integrity. Each application segment enhances market visibility across high-performance sectors.

- For instance, DuPont’s Nomex protective fabric offers exceptional thermal resistance and durability, withstanding temperatures up to 370°C while maintaining mechanical strength, extensively used in firefighting gear.

By End-User Industry

Aerospace and defense dominate demand through continuous requirements for thermal stability, structural performance, and material reliability. Automotive manufacturers increase usage to meet emission norms and improve fuel efficiency through lightweight engineering. Electronics and electrical industries rely on polyimide fibers for safe insulation in compact and high-power devices. Industrial manufacturing integrates the material into filtration systems, insulation products, and heat-resistant components. Each end-user group shapes long-term adoption patterns by prioritizing performance, compliance, and operational efficiency.

Segmentations:

By Type

- Meta-Polyimide Fiber

- Para-Polyimide Fiber

By Application

- Protective Clothing

- Aerospace Components

- Automotive Components

- Electrical & Electronics

- Industrial Filtration

- Firefighting Gear

- Insulation Materials

By End-User Industry

- Aerospace & Defense

- Automotive

- Electronics & Electrical

- Industrial Manufacturing

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific regional performance — high-volume manufacturing hub

Asia Pacific holds 54% of market revenue in 2024. China and Japan lead consumption through strong electronics, semiconductor packaging, and aerospace ecosystems. The Polyimide Fiber Market gains steady momentum in this region because integrated production networks support material availability and cost efficiency. It benefits from sustained capital expenditure in semiconductor fabs and advanced display lines that require heat-stable fiber solutions. Companies strengthen competitiveness by expanding capacity and securing long-term supply partnerships. Governments support industrial upgrading that improves adoption across high-performance applications.

North America regional outlook — technology and defence-driven demand

North America holds 35% of market revenue in 2024. The U.S. drives growth through aerospace, defence, industrial filtration, and advanced electronics that depend on high-temperature materials. It relies on certified fiber grades that meet strict aviation and military specifications, reinforcing the region’s premium market positioning. Manufacturers maintain a strong focus on product validation, reliability testing, and material traceability. Market expansion links closely with defence spending cycles, satellite programs, and commercial aircraft production plans. Regional suppliers continue to invest in R&D to enhance fiber performance in extreme-temperature environments.

Europe regional dynamics — regulatory compliance and specialty applications

Europe holds 25% of market revenue in 2024. Germany, France, and the UK support stable demand through automotive electrification, industrial filtration, and high-value insulation applications. It benefits from technology upgrades that improve material durability, efficiency, and regulatory compliance. Companies prioritize sustainability, long-term OEM approvals, and lifecycle-focused material development. Growth momentum builds through stricter performance standards in industrial systems and expanded use in energy-efficient manufacturing lines. Regional manufacturers strengthen supply reliability through collaborative partnerships with automotive and industrial OEMs.

Key Player Analysis:

- DuPont

- Kolon Industries

- Teijin Ltd.

- Evonik Industries

- Ube Industries

- Mitsui Chemicals

- Toray Industries

- Solvay

- Kaneka Corporation

- Saint-Gobain

- Ensinger

- Jiangsu Shino New Materials Technology Co. Ltd.

Competitive Analysis:

The Polyimide Fiber Market features a competitive landscape shaped by global chemical companies, specialized fiber manufacturers, and integrated material producers. Leading players strengthen market presence through capacity expansion, process optimization, and development of advanced high-temperature fiber grades. It gains strategic momentum from firms that focus on aerospace and automotive certifications, which create strong entry barriers for new competitors. Companies invest in R&D to improve tensile strength, thermal resistance, and long-term durability to secure contracts in high-performance applications. Partnerships with electronics, industrial filtration, and defense sectors support consistent demand and reinforce supplier credibility. Pricing competition remains visible in cost-sensitive segments, while premium-grade fibers command strong margins in aerospace and protective clothing markets. Firms aim to differentiate through quality consistency, regulatory compliance, and reliable supply chains, enabling sustained competitive advantage across global markets.

Recent Developments:

- In October 2025, DuPont prepared for its Electronics spin-off, focusing the remaining company on healthcare, water, construction, industrials, aerospace, printing, packaging, and automotive markets.

- In November 2025, DuPont broke ground on a new MOLYKOTE lubricants manufacturing plant in China.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyimide Fiber Market will expand steadily due to growing demand for high-temperature resistant materials in aerospace, automotive, and electronics applications.

- Advanced protective clothing and industrial safety gear will drive adoption across chemical plants, metal processing units, and firefighting operations.

- Continuous innovation in fiber engineering will enhance tensile strength, thermal stability, and chemical resistance, enabling entry into technically demanding applications.

- Lightweight and high-strength fiber solutions will support automotive and aerospace sectors in improving fuel efficiency and structural performance.

- Electronics and electrical industries will increasingly rely on polyimide fibers for insulation, heat management, and durability in compact device architectures.

- Manufacturers will invest in advanced processing technologies to maintain product consistency and expand production capacities.

- Strategic partnerships with aerospace, defense, and industrial OEMs will strengthen market penetration and long-term supply reliability.

- Regulatory compliance and sustainability initiatives will influence product development and adoption across global markets.

- Emerging economies in Asia-Pacific, Latin America, and the Middle East will offer growth opportunities through expanding industrial infrastructure.

- Focus on R&D and next-generation fiber applications will drive innovation, enabling polyimide fibers to meet evolving performance and safety requirements.

Market Drivers:

Market Drivers: