Market Overview:

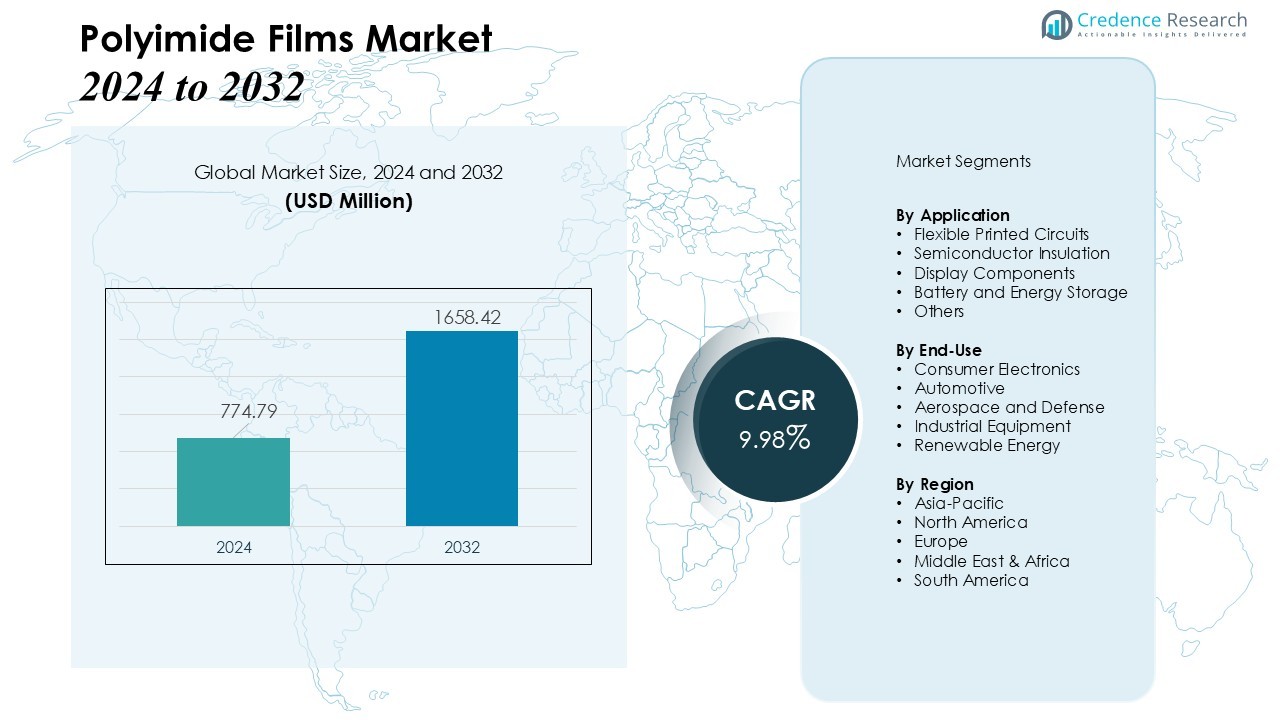

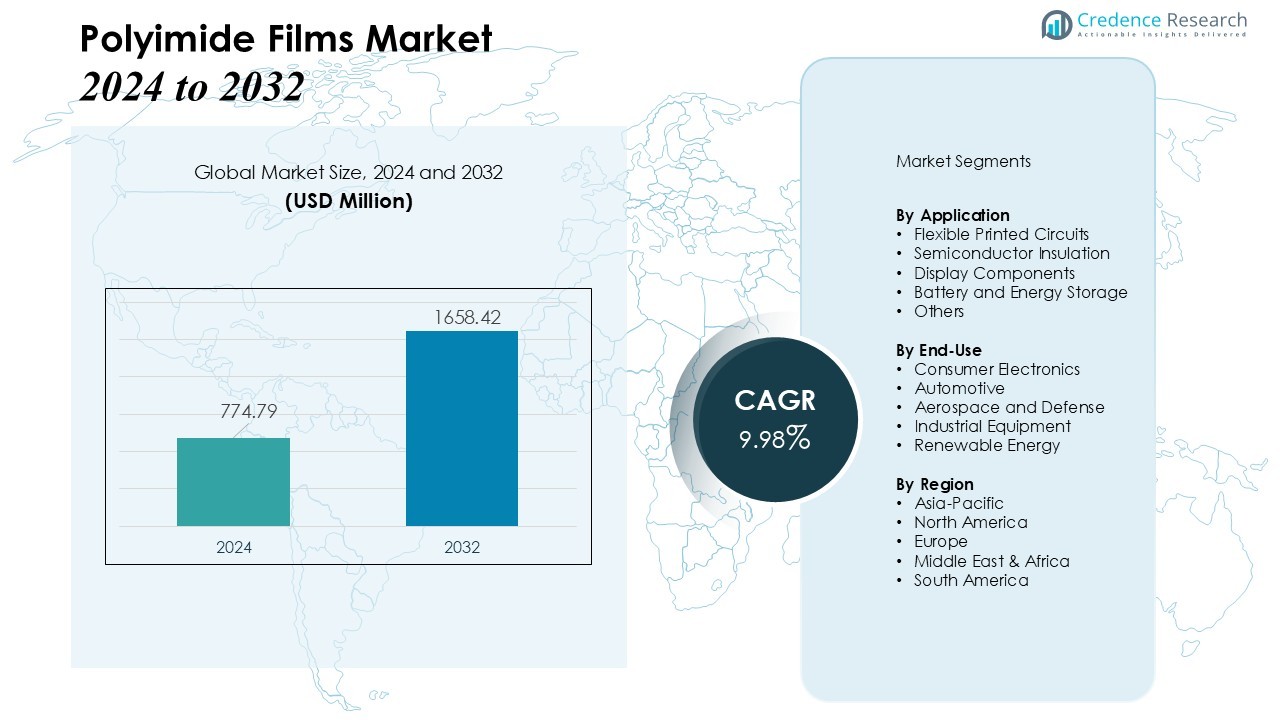

The Polyimide Films Market size was valued at USD 774.79 million in 2024 and is anticipated to reach USD 1658.42 million by 2032, at a CAGR of 9.98% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyimide Films Market Size 2024 |

USD 774.79 Million |

| Polyimide Films Market, CAGR |

9.98% |

| Polyimide Films Market Size 2032 |

USD 1658.42 Million |

Key market drivers include the rising prevalence of consumer electronics, especially compact and flexible devices such as smartphones, foldable displays, wearables, and tablets. Polyimide films offer superior thermal stability, electrical insulation, chemical resistance, and mechanical strength — making them ideal for flexible printed circuits, semiconductor insulation, and high-temperature applications. The increasing electrification of vehicles and growth in aerospace and renewable‑energy sectors further add to the demand by requiring lightweight, durable, and high-performance substrate materials.

From a regional perspective, the Asia‑Pacific region dominates the polyimide films market, accounting for the largest share in 2024. This dominance is driven by a dense electronics manufacturing ecosystem, growing automotive production, and increasing adoption of advanced consumer electronics across major economies in the region. Meanwhile, regions such as North America and Europe also contribute significantly, particularly in high‑reliability applications such as aerospace, defense, and advanced semiconductor packaging — where demand for high-temperature, high-performance films remains strong.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polyimide Films Market is valued at USD 774.79 million and is projected to reach USD 1658.42 million, registering a CAGR of 9.98% during the forecast period, reflecting strong growth potential.

- Rising demand from consumer electronics, including smartphones, foldable displays, tablets, and wearables, drives the adoption of polyimide films due to their thermal stability, electrical insulation, and mechanical strength.

- Expansion in automotive and electric vehicle sectors increases the need for lightweight, high-performance films for wiring harnesses, battery insulation, and thermal management applications.

- Aerospace, defense, renewable energy, and industrial electronics present high-value opportunities, where polyimide films ensure reliability, chemical resistance, and durability under extreme conditions.

- Asia-Pacific leads with 42% of the global market, followed by North America (28%) and Europe (22%), reflecting strong regional adoption in electronics, automotive, aerospace, and industrial applications.

Market Drivers:

Market Drivers:

Rapid Growth in Consumer Electronics Demand

The Polyimide Films Market benefits from strong adoption in consumer electronics, including smartphones, tablets, foldable devices, and wearables. It provides superior electrical insulation, thermal stability, and flexibility, which are essential for compact and high-performance devices. Rising demand for lightweight and durable electronic components drives manufacturers to integrate polyimide films into flexible circuits and display applications. This trend supports consistent growth in both established and emerging markets.

- For instance, PI Advanced Materials developed a 4-micrometer ultra-thin polyimide film specifically for smartphones and wearables, enabling thinner and more heat-resistant devices.

Expansion of Automotive and Electric Vehicle Applications

Automotive industry growth, particularly the shift toward electric vehicles, significantly influences market demand. Polyimide films enable lightweight wiring harnesses, battery insulation, and thermal management solutions, ensuring high reliability under extreme conditions. It helps automakers achieve improved energy efficiency, performance, and safety standards. Increasing production of electric vehicles globally enhances the need for advanced polymer-based materials like polyimide films.

- For instance, DuPont offers high-temperature Kapton® polyimide film specifically designed for electric vehicle battery applications, capable of withstanding short-term temperatures up to 400°C (752°F), which enhances battery safety and longevity”

Critical Role in Aerospace and Defense Sectors

The aerospace and defense sectors rely on materials that withstand extreme temperatures and mechanical stress. Polyimide films provide excellent chemical resistance, high tensile strength, and stability in harsh environments. It is used in wiring insulation, flexible circuits, and spacecraft components to ensure long-term performance and safety. This reliance strengthens the market position of polyimide films in high-value applications.

Adoption in Renewable Energy and Industrial Electronics

The growth of renewable energy systems and industrial electronics further supports market expansion. Polyimide films contribute to solar panel insulation, wind turbine components, and industrial sensors, where thermal and chemical resistance is critical. It enables efficient energy transmission and durability, meeting the stringent requirements of modern industrial applications. Increasing investments in clean energy infrastructure drive steady demand for polyimide-based solutions.

Market Trends:

Increasing Integration of Polyimide Films in Flexible Electronics

The Polyimide Films Market demonstrates a clear trend toward integration in flexible and wearable electronics. It provides exceptional thermal stability, mechanical strength, and electrical insulation, enabling manufacturers to develop compact and high-performance devices. Growing demand for foldable smartphones, smartwatches, and wearable medical devices drives innovation in polyimide film formulations. Companies focus on improving film thickness, flexibility, and dielectric properties to meet evolving consumer and industrial requirements. The trend highlights a shift toward miniaturized electronics without compromising durability and reliability. Rising research and development investments support continuous material improvements for next-generation applications.

- For instance, in 2019, Jiang et al. developed a flexible airflow sensor based on graphene/polyimide nanocomposites with a detection threshold of 0.5 m/s over a flow range of 0–20 m/s, demonstrating enhanced piezoresistive properties suitable for wearable sensing applications.

Expansion in High-Performance Industrial and Aerospace Applications

High-performance industrial and aerospace applications continue to shape market trends. Polyimide films deliver chemical resistance, dimensional stability, and high tensile strength, supporting use in wiring insulation, flexible circuits, and spacecraft components. It meets stringent operational standards under extreme temperatures and harsh environments, making it indispensable for aerospace, defense, and renewable energy sectors. Increasing adoption of electric vehicles and energy-efficient industrial equipment further drives market growth. Manufacturers prioritize customization and high-quality production to address specific performance needs. Collaborative partnerships between material producers and end-users accelerate technological advancements. Continuous focus on durability, lightweight design, and multifunctional properties defines the strategic direction of the market.

- For instance, polyimide films from manufacturers like those acquired by Applied Aerospace withstand temperatures up to 500 degrees Fahrenheit in wire insulation and thermal management for aircraft components.

Market Challenges Analysis:

High Production Costs Limiting Wider Adoption

The Polyimide Films Market faces challenges due to the high production costs associated with its advanced manufacturing processes. It requires specialized equipment, precise chemical handling, and strict quality control, which increase overall expenses. These costs can limit adoption, particularly in price-sensitive applications and emerging markets. Manufacturers must balance performance requirements with cost-effectiveness to maintain competitiveness. Volatility in raw material prices further adds pressure on profit margins. Companies focus on optimizing production techniques to reduce expenses while maintaining high-quality standards.

Limited Recycling and Environmental Concerns

Environmental concerns present another significant challenge for the market. Polyimide films are highly durable and resistant to degradation, making recycling and disposal difficult. It contributes to long-term environmental impact if proper waste management practices are not implemented. Increasing regulatory requirements regarding sustainable materials may affect market growth. The industry faces pressure to develop eco-friendly alternatives or improve recycling methods. Investment in research and development is essential to create sustainable solutions without compromising the material’s high-performance properties.

Market Opportunities:

Growing Demand in Electric Vehicles and Advanced Automotive Applications

The Polyimide Films Market presents significant opportunities in the electric vehicle and advanced automotive sectors. It provides high thermal stability, electrical insulation, and lightweight characteristics, which are critical for battery systems, wiring harnesses, and power electronics. Increasing global adoption of electric vehicles drives the need for durable and efficient materials. Manufacturers can capitalize on the growing focus on energy efficiency, safety, and performance in automotive design. Expansion in hybrid and autonomous vehicle technologies further enhances market potential. Investment in customized polyimide solutions for automotive applications can strengthen market presence. Rising collaborations between material producers and automotive manufacturers create opportunities for innovation and growth.

Expansion in Renewable Energy and Industrial Electronics

Opportunities also emerge in renewable energy and industrial electronics markets. Polyimide films offer chemical resistance, mechanical strength, and high-temperature stability, supporting use in solar panels, wind turbines, and industrial sensors. It enables efficient energy transmission, durability, and long-term performance in demanding applications. Growing investments in clean energy infrastructure and smart industrial systems increase demand for advanced polymer-based solutions. Companies can leverage these trends to develop specialized films tailored for energy-efficient and high-reliability applications. Innovation in multifunctional and high-performance films provides avenues for market differentiation. Expansion into emerging economies with increasing industrialization further strengthens growth prospects.

Market Segmentation Analysis:

By Application

The Polyimide Films Market is segmented by application into flexible printed circuits, semiconductor insulation, display components, battery and energy storage, and others. Flexible printed circuits lead the market due to high demand in consumer electronics and wearable devices, where thermal stability and flexibility are essential. Semiconductor insulation benefits from the films’ excellent electrical resistance and chemical durability. Display components, particularly for foldable smartphones and tablets, require thin, high-performance films to support advanced screen technologies. Battery and energy storage applications in electric vehicles and renewable energy systems create additional demand for lightweight and thermally stable materials.

- For instance, DuPont’s use of polyimide films (such as the Kapton® series) in flexible printed circuits has enabled circuit reliability at temperatures exceeding 250°C, while maintaining exceptional mechanical performance and flexibility for foldable smartphones, with these circuits operating efficiently over hundreds of thousands of bending cycles in modern devices.

By End-Use

End-use segmentation includes consumer electronics, automotive, aerospace and defense, industrial equipment, and renewable energy sectors. Consumer electronics account for the largest portion, driven by compact devices and wearable technologies requiring high-performance films. Automotive and electric vehicle applications rely on polyimide films for wiring insulation, battery safety, and thermal management, supporting efficiency and reliability. Aerospace and defense sectors demand films that withstand extreme temperatures and mechanical stress, ensuring long-term performance and safety. Industrial equipment and renewable energy applications benefit from chemical resistance and durability, meeting strict operational standards. It enables manufacturers across sectors to maintain high performance while reducing weight and improving energy efficiency.

- For instance, DuPont’s Kapton polyimide films enable flexible printed circuits in smartphones with dielectric breakdown strengths above 200 kV/mm

Segmentations:

By Application:

- Flexible Printed Circuits

- Semiconductor Insulation

- Display Components

- Battery and Energy Storage

- Others

By End-Use:

- Consumer Electronics

- Automotive

- Aerospace and Defense

- Industrial Equipment

- Renewable Energy

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Dominance of Asia-Pacific Driven by Electronics and Automotive Growth

Asia-Pacific holds 42% of the global Polyimide Films Market, driven by a dense electronics manufacturing ecosystem and strong automotive production. It benefits from high demand for smartphones, tablets, and wearable devices, where polyimide films are critical for flexible circuits, display components, and battery insulation. Rising investment in electric vehicles and renewable energy infrastructure strengthens demand further. Strong presence of key manufacturers and cost-efficient production capabilities reinforce the region’s leadership. Continuous technological advancements in electronic components support sustained growth.

North America’s Focus on Aerospace, Defense, and Advanced Electronics

North America accounts for 28% of the global market, supported by aerospace, defense, and semiconductor industries. It relies on high-performance polyimide films for wiring insulation, spacecraft components, and high-temperature industrial applications. It meets stringent operational standards, ensuring reliability under extreme conditions. Advanced research facilities and strong innovation in electronics and industrial equipment drive market development. Growing adoption of electric vehicles and renewable energy solutions further enhances demand. Manufacturers focus on producing customized and high-quality films for critical applications.

Europe’s Steady Growth Supported by Industrial and Automotive Applications

Europe holds 22% of the global market, driven by automotive, aerospace, and industrial sectors. It finds extensive use in insulation, flexible circuits, and energy-efficient industrial equipment. It helps manufacturers meet strict regulatory standards for safety, durability, and environmental compliance. Investment in electric vehicles, renewable energy, and smart industrial technologies increases demand for advanced films. Europe’s emphasis on quality, technological innovation, and sustainable solutions supports steady growth. Collaborative efforts between material producers and end-users promote product development and market expansion.

Key Player Analysis:

- DuPont

- Compagnie de Saint-Gobain

- Kolon Industries, Inc.

- KANEKA CORPORATION

- Taimide Tech. Inc.

- FLEXcon Company, Inc.

- Arakawa Chemical Industries Ltd.

- Anabond

- Goodfellow

- S.T Corporation

Competitive Analysis:

The Polyimide Films Market is highly competitive, characterized by the presence of both global and regional players focusing on product innovation and strategic collaborations. Leading companies invest heavily in research and development to improve film performance, durability, and thermal stability, catering to evolving demands in electronics, automotive, aerospace, and industrial applications. It faces competition based on product quality, customization, pricing, and technological advancements. Strategic partnerships, mergers, and acquisitions enable companies to expand their geographic footprint and strengthen supply chains. Regional players leverage cost-efficient production and proximity to key end-use markets to gain an advantage. Continuous innovation in flexible electronics, high-temperature applications, and energy-efficient solutions drives differentiation. Companies that can combine superior product performance with sustainable manufacturing practices are likely to maintain a strong competitive position in the global market.

Recent Developments:

- In September 2025, DuPont agreed to acquire Sinochem (Ningbo) RO Memtech Co., Ltd. to expand FilmTec™ reverse osmosis manufacturing in China.

- In August 2025, DuPont announced an agreement to divest its Aramids business, including Kevlar® and Nomex®, to Arclin for $1.8 billion, expected to close in Q1 2026.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Application, End-Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of flexible and wearable electronics will continue to drive demand for polyimide films.

- Expansion of electric vehicles will increase the need for lightweight, high-performance insulation and battery components.

- Growth in aerospace and defense applications will support demand for films that withstand extreme temperatures and mechanical stress.

- Renewable energy sectors, including solar and wind, will boost the use of polyimide films in energy-efficient systems.

- Technological advancements in display components, especially foldable and flexible screens, will create new application opportunities.

- Manufacturers will focus on developing thinner, stronger, and more durable films to meet evolving industrial requirements.

- Sustainable production methods and eco-friendly materials will become increasingly important for market competitiveness.

- Regional growth in Asia-Pacific, driven by electronics manufacturing and automotive expansion, will continue to lead the global market.

- Strategic collaborations, partnerships, and investments in research and development will accelerate innovation and product differentiation.

- Increasing demand for high-reliability components in industrial and medical electronics will sustain long-term market growth.

Market Drivers:

Market Drivers: