Market Overview:

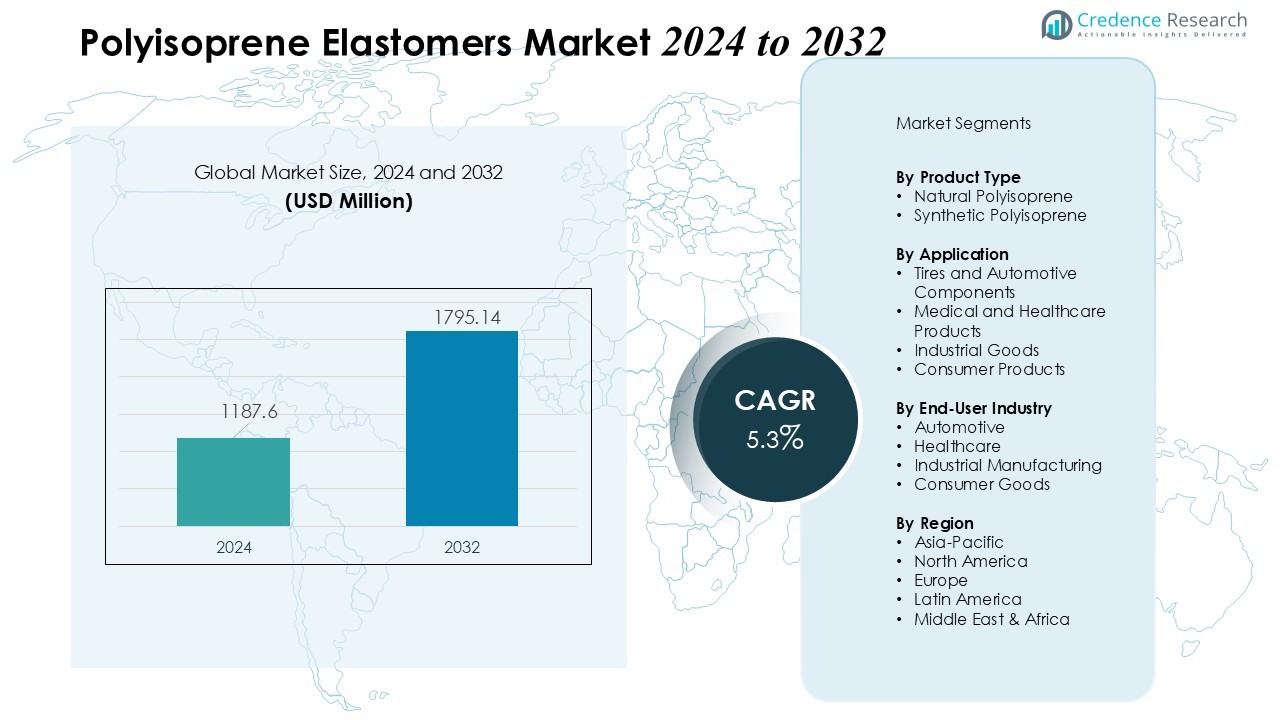

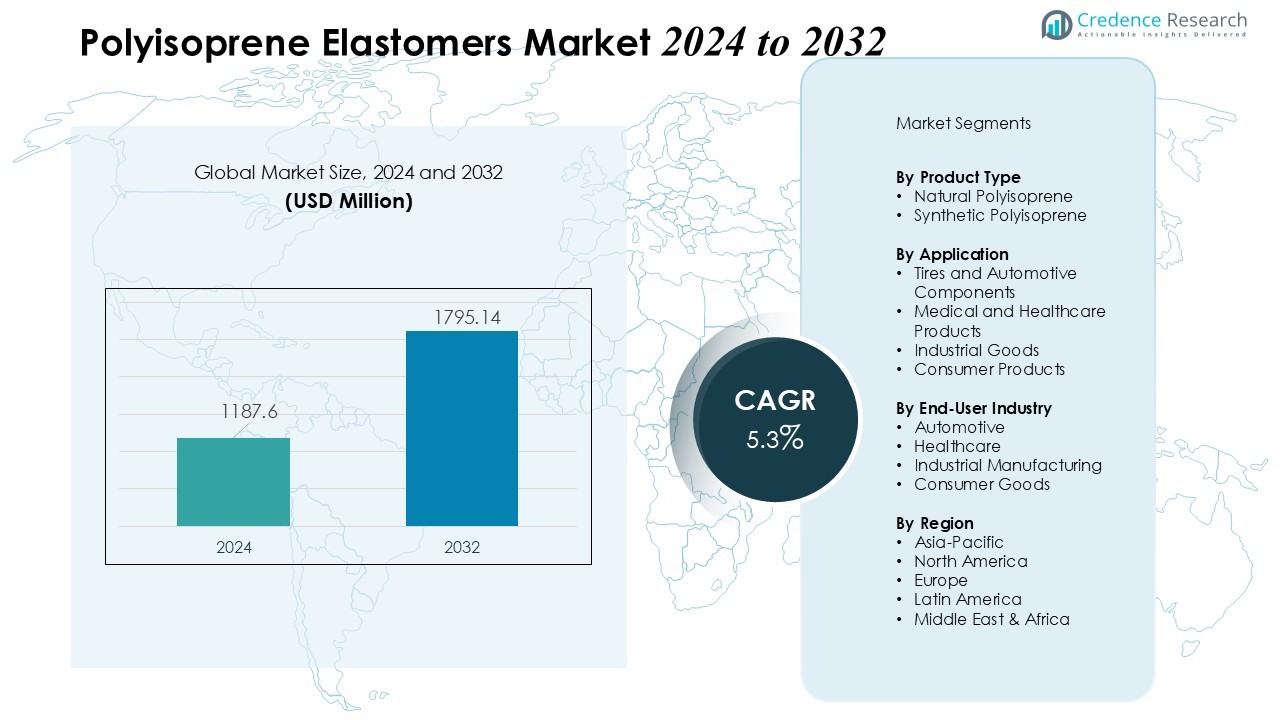

The Polyisoprene Elastomers Market size was valued at USD 1187.6 million in 2024 and is anticipated to reach USD 1795.14 million by 2032, at a CAGR of 5.3% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyisoprene Elastomers Market Size 2024 |

USD 1187.6 Million |

| Polyisoprene Elastomers Market, CAGR |

5.3% |

| Polyisoprene Elastomers Market Size 2032 |

USD 1795.14 Million |

Growth stems from increasing demand across diverse end‑use sectors. In the automotive industry, polyisoprene elastomers are preferred for tires, belts, hoses, and seals due to their excellent elasticity, abrasion resistance, and durability. Meanwhile, the medical and healthcare segment drives demand for latex‑free products such as surgical gloves, tubing, and medical devices, benefiting from polyisoprene’s hypoallergenic and biocompatible properties. Furthermore, growing footwear, consumer‑goods, and industrial rubber goods production supports steady uptake of polyisoprene elastomers.

Regionally, the market exhibits differentiated dynamics. The Asia-Pacific region, notably countries like China, India, and Japan, leads growth on account of rapid industrialization, rising automotive production, and expanding healthcare infrastructure, making it the fastest‑growing regional market. Meanwhile, North America and Europe continue to represent significant shares, driven by well‑established automotive and medical sectors, as well as increasing adoption of sustainable and high‑performance elastomer solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market was valued at USD 1,187.6 million in 2024 and is projected to reach USD 1,795.14 million by 2032, driven by rising demand across automotive, healthcare, consumer goods, and industrial sectors.

- Automotive and tire manufacturing dominate consumption due to polyisoprene’s high elasticity, abrasion resistance, durability, and ability to enhance tire grip, making it a preferred material for tires, belts, hoses, seals, and vibration-dampening components.

- Healthcare applications are expanding, with growing demand for latex-free, hypoallergenic, and biocompatible products such as surgical gloves, tubing, catheters, and medical devices. Polyisoprene provides safety, sterility, and reliable performance for medical-grade applications.

- Sustainability trends and regulatory pressures encourage adoption of bio-based polyisoprene from renewable feedstocks, while consumer and industrial sectors increasingly use it in footwear, molded goods, belts, and hoses, leveraging its mechanical strength, flexibility, and wear resistance.

- Asia-Pacific leads global growth with 38% market share, driven by industrialization, automotive production, and healthcare infrastructure, while North America (28%) and Europe (22%) maintain strong positions due to established automotive and medical sectors, high adoption of sustainable elastomers, and technological advancements in production processes.

Market Drivers:

Market Drivers:

Robust Demand from Automotive and Tire Manufacturing

The Polyisoprene Elastomers Market gains momentum from surging automotive production globally. Manufacturers choose polyisoprene for tires, seals, gaskets, hoses and vibration‑dampening components due to its high elasticity, abrasion resistance, and durability under varying temperature and load conditions. It performs reliably under stress and contributes to improved tire grip and wear resistance, making it a preferred elastomer in tire and auto component manufacturing.

- For instance, Bridgestone’s IR2200 synthetic polyisoprene grade delivers consistent molecular weight distribution for high-performance tires, achieving superior tear strength under dynamic stress.

Expanding Healthcare and Medical‑Grade Applications

Healthcare demands drive growth of polyisoprene elastomers because it offers biocompatibility and lacks proteins associated with natural‑rubber latex allergies. It finds increasing use in medical gloves, surgical tubing, catheters, seals and other devices requiring safety, sterility, and hypoallergenic properties. Rising global healthcare infrastructure and safety standards make it a trusted alternative to traditional latex.

- For instance, KRATON IR0307 provides sterilization resistance withstanding cleanroom processing for catheters and IV tubing.

Growing Preference for Sustainable and Eco‑Friendly Materials

Sustainability concerns and regulatory push for environmentally responsible materials encourage adoption of polyisoprene over petroleum‑derived elastomers. Bio‑based polyisoprene variants, derived from renewable feedstocks, align with industry and consumer demand for greener solutions while maintaining high performance for automotive, medical, and consumer‑goods applications.

Diversifying Usage in Consumer Goods and Industrial Products

Manufacturers increasingly leverage polyisoprene for footwear soles, molded goods, industrial belts, hoses and various consumer products that demand elasticity, comfort, and durability. Its mechanical strength, flexibility, and wear resistance make it suitable for a broad spectrum of applications beyond tires and medical devices. This diversification enhances the overall market stability and growth prospects.

Market Trends:

Shift Toward Bio‑Based and Sustainable Polyisoprene Solutions

The polyisoprene elastomers market increasingly embraces bio‑based polyisoprene derived from renewable feedstocks such as biomass or sugarcane, replacing traditional petrochemical‑based elastomers. Suppliers and customers support green sourcing and carbon‑neutral production targets. Continuous development of bio‑isoprene supply chains and greener raw‑material procurement signals heightened environmental standards across industries. This shift helps companies meet regulatory, environmental, social, and governance (ESG) objectives while retaining the performance characteristics required for high-quality elastomer products.

- For instance, Visolis scaled up its bio-isoprene monomer production by 50-fold using proprietary fermentation technology from biomass. Suppliers and customers support green sourcing and carbon-neutral production targets.

Advances in Processing Technologies and Broader Application Scope

Manufacturers apply advanced processing technologies — including improved polymerization methods, automated compounding, and continuous vulcanization — to enhance product consistency, quality, and performance. These improvements allow polyisoprene elastomers to meet increasingly strict demands from sectors like automotive, aerospace, health care, and consumer goods. It results in a widening application base: from tires and industrial components to medical gloves, molded goods, footwear, and specialty rubber items. The expanding usage underlines a trend toward versatile, high-performance elastomer solutions across diverse industries.

- For Instance, Zeon Corporation utilizes solution polymerization to produce polyisoprene elastomers, offering various grades with controlled Mooney viscosity to ensure superior uniformity and processability for demanding applications like tire compounds.

Market Challenges Analysis:

Fluctuating Raw Material Prices and Supply Constraints

The Polyisoprene Elastomers Market faces challenges from volatility in raw material prices, particularly natural rubber and synthetic isoprene feedstocks. Supply disruptions due to geopolitical tensions, climate impacts on rubber plantations, and fluctuations in petroleum-based inputs affect production costs and operational stability. It compels manufacturers to optimize sourcing strategies, manage inventory efficiently, and explore alternative feedstocks without compromising product quality. Cost pressures may limit profit margins and slow adoption in price-sensitive end-use sectors.

Stringent Regulatory Standards and Environmental Compliance

Strict regulations governing chemical use, emissions, and product safety pose ongoing challenges for the Polyisoprene Elastomers Market. It requires manufacturers to implement rigorous testing, quality assurance, and eco-friendly production processes to meet regional and international standards. Compliance increases operational complexity and raises production expenses, particularly for medical and food-contact applications. Companies must balance innovation, performance, and sustainability while navigating these regulatory frameworks to maintain market competitiveness and customer trust.

Market Opportunities:

Expanding Demand in Healthcare and Medical‑Grade Products

The Polyisoprene Elastomers Market stands to benefit from rising demand for allergy‑free, biocompatible materials in medical devices and protective equipment. Hospitals and clinics increase their procurement of medical gloves, catheters, tubing, and other disposable products that avoid latex‑related sensitivities. It meets regulatory and consumer requirements for safer, hypoallergenic alternatives. Growing awareness of hygiene, infection control, and the expansion of healthcare infrastructure globally create sustained demand. Manufacturers who scale production and focus on medical‑grade polyisoprene stand to gain significantly.

Opportunity in Sustainable and Bio‑Based Elastomer Solutions, Automotive, and Consumer Goods

Shifts toward sustainable materials and stricter environmental norms open opportunities for bio‑based polyisoprene derived from renewable feedstocks. It appeals to stakeholders seeking lower carbon footprint and compliance with green procurement policies. Use in high‑performance applications — such as tires and components for electric vehicles (EVs) — offers growth potential, especially when polyisoprene helps reduce rolling resistance and improve durability. Growing demand in footwear, consumer goods, industrial belts, hoses, and molded rubber products further broadens the application base. Manufacturers that innovate in production technologies and sustainable sourcing can capture a larger share across diverse end‑use industries.

Market Segmentation Analysis:

By Product Type

The Polyisoprene Elastomers Market comprises natural polyisoprene and synthetic polyisoprene products. Synthetic variants hold significant demand due to consistent quality, controlled properties, and reduced allergenic concerns. It delivers superior performance for industrial, automotive, and medical applications where durability, elasticity, and precision are critical. Natural polyisoprene retains steady demand for applications requiring high resilience and cost-effectiveness. Product segmentation enables manufacturers to target diverse industry requirements efficiently.

- For instance, RJ Global’s RJ614-30 natural polyisoprene compound attains 30 Shore A durometer with excellent tensile strength and high elongation for medical devices.

By Application

Application segments include tires and automotive components, medical and healthcare products, industrial goods, and consumer products. Tires and automotive parts dominate demand because polyisoprene ensures durability, abrasion resistance, and vibration damping. It also finds increasing use in medical gloves, tubing, catheters, and surgical equipment due to its biocompatibility and hypoallergenic properties. Industrial belts, hoses, molded goods, and footwear represent additional application areas where elasticity and wear resistance are key.

- For instance, Zeon Chemicals produces synthetic polyisoprene rubber (Nipol IR) used in automotive tires, which, like natural rubber, possesses high tensile strength (typically up to 23-25 MPa) enabling superior durability in various applications, including potentially for electric vehicle (EV) tires.

By End-User Industry

End-user industries encompass automotive, healthcare, industrial manufacturing, and consumer goods. Automotive leads the market by volume, leveraging polyisoprene in tires, gaskets, seals, and vibration-dampening components. It also supports the healthcare sector with latex-free products and medical devices. Industrial manufacturers use it in belts, hoses, and molded parts to ensure longevity and performance. Consumer goods benefit from footwear soles, elastic components, and molded items, highlighting polyisoprene’s versatility across multiple sectors.

Segmentations:

By Product Type

- Natural Polyisoprene

- Synthetic Polyisoprene

By Application

- Tires and Automotive Components

- Medical and Healthcare Products

- Industrial Goods

- Consumer Products

By End-User Industry

- Automotive

- Healthcare

- Industrial Manufacturing

- Consumer Goods

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads Growth with Strong Automotive and Healthcare Demand

Asia-Pacific holds 38% of the global Polyisoprene Elastomers Market. Rapid industrialization, expanding automotive production, and growing healthcare infrastructure drive high demand for polyisoprene-based products. It finds extensive use in tires, automotive components, medical gloves, and tubing. Countries like China, India, and Japan contribute significantly to market expansion due to large manufacturing bases and rising consumer awareness of quality and safety standards. Increasing investments in electric vehicles and sustainable manufacturing further bolster regional growth.

North America Maintains Strong Presence through Advanced Industrial and Medical Applications

North America accounts for 28% of the global Polyisoprene Elastomers Market. Well-established automotive and healthcare sectors support high adoption of premium elastomer products. It serves demand for medical-grade devices, industrial belts, footwear, and specialty rubber products. Stringent safety and quality regulations ensure consistent demand for hypoallergenic and biocompatible polyisoprene. Technological advancements in production processes enhance performance and support product diversification.

Europe Driven by Automotive Innovation and Sustainability Trends

Europe contributes 22% of the global Polyisoprene Elastomers Market. High automotive production in Germany, France, and Italy drives demand, alongside increasing focus on sustainable and bio-based polyisoprene to meet environmental regulations. It also supports medical, industrial, and consumer-goods applications due to established manufacturing and research infrastructure. Manufacturers in the region prioritize eco-friendly production and high-performance elastomer solutions to address evolving market needs.

Key Player Analysis:

- Goodyear Tire & Rubber Company

- ExxonMobil Corporation

- Sinopec Corporation

- Kraton Corporation

- JSR Corporation

- Zeon Corporation

- Kuraray Co., Ltd.

- Asahi Kasei Corporation

- Sumitomo Rubber Industries, Ltd.

- Lion Elastomers

- Versalis S.p.A.

- Sibur Holding

- LG Chem Ltd.

- Nizhnekamskneftekhim PJSC

- Eni S.p.A.

- Synthos S.A.

Competitive Analysis:

The Polyisoprene Elastomers Market features a mix of global chemical manufacturers and regional producers competing on product quality, innovation, and sustainability. Leading players focus on expanding production capacities, developing bio-based and high-performance elastomers, and strengthening distribution networks to capture market share. It faces competition in pricing, supply reliability, and technological advancement, with companies investing in research and development to enhance material properties for automotive, healthcare, and industrial applications. Strategic partnerships, mergers, and acquisitions allow players to broaden geographic presence and access new end-use segments. Firms also emphasize regulatory compliance and eco-friendly production to meet growing environmental and safety standards. Continuous product innovation, combined with strong customer relationships and operational efficiency, defines competitive positioning and drives the ability to capitalize on emerging market opportunities globally.

Recent Developments:

- In May 2025, Goodyear Tire & Rubber Company announced the sale of its chemical business.

- In May 2025, Nizhnekamskneftekhim announced updates related to its operations under Sibur.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-User Industry and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and ITALY economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for bio-based and sustainable polyisoprene will increase across automotive, healthcare, and consumer sectors.

- Expansion of electric vehicle production will drive the need for high-performance elastomer components.

- Medical and healthcare applications will grow, with emphasis on latex-free and hypoallergenic products.

- Manufacturers will invest in advanced polymerization and processing technologies to enhance product quality.

- Adoption of polyisoprene in industrial belts, hoses, and molded goods will expand across manufacturing sectors.

- Emerging economies in Asia-Pacific and Latin America will offer significant growth opportunities.

- Regulatory compliance and environmental standards will influence product development and manufacturing practices.

- Strategic partnerships, mergers, and acquisitions will shape competitive dynamics and global market reach.

- Focus on research and innovation will lead to specialized polyisoprene grades for niche applications.

- Market players will leverage digitalization, automation, and supply chain optimization to improve efficiency and meet evolving customer demands.

Market Drivers:

Market Drivers: