Market Overview:

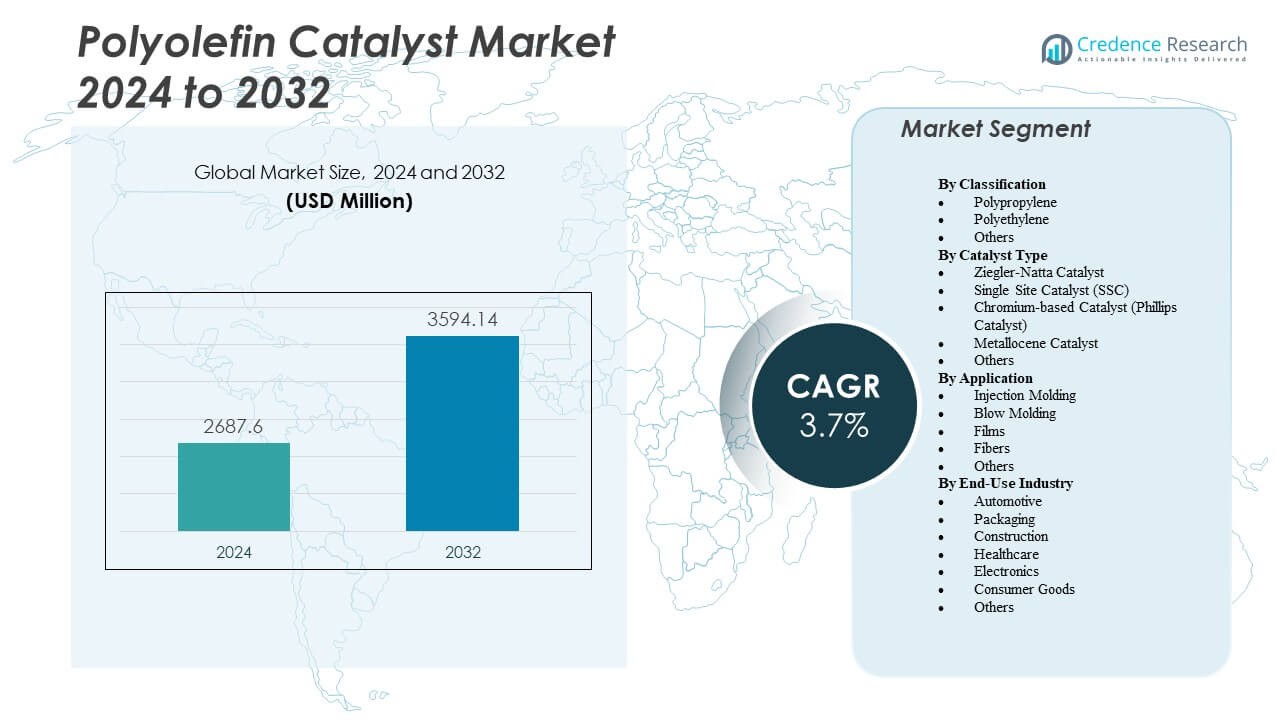

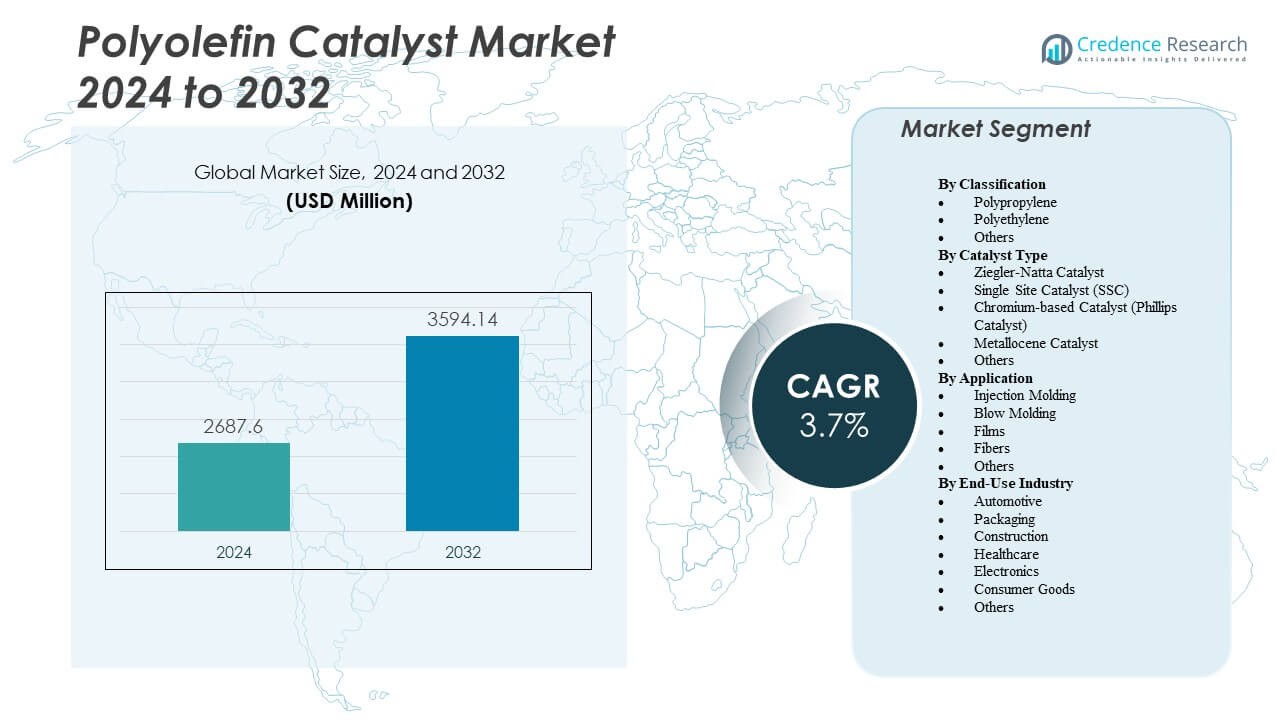

The Polyolefin Catalyst Market is projected to grow from USD 2,687.6 million in 2024 to an estimated USD 3,594.14 million by 2032, with a compound annual growth rate (CAGR) of 3.7% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyolefin Catalyst Market Size 2024 |

USD 2,687.6 Million |

| Polyolefin Catalyst Market, CAGR |

3.7% |

| Polyolefin Catalyst Market Size 2032 |

USD 3,594.14 Million |

Rising demand for lightweight and durable plastics drives market expansion across packaging, automotive, and consumer goods sectors. Manufacturers adopt advanced catalyst technologies, such as metallocene and single-site catalysts, to improve polymer performance and process efficiency. It supports large-scale production of polypropylene and polyethylene, offering better mechanical strength, flexibility, and recyclability. Strong research investments and sustainability initiatives continue to advance catalyst innovation globally.

Asia-Pacific dominates due to extensive polymer manufacturing capacity and growing industrialization in China and India. North America and Europe maintain steady demand supported by established petrochemical infrastructures and innovation-driven operations. It also gains traction in the Middle East and Latin America through expanding refining and polymerization projects. Regional industrial growth, trade integration, and environmental compliance collectively strengthen the global catalyst ecosystem.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polyolefin Catalyst Market is projected to grow from USD 2,687.6 million in 2024 to USD 3,594.14 million by 2032, at a CAGR of 3.7%.

- Rising use of lightweight polymers in packaging and automotive components drives strong global demand.

- Manufacturers focus on advanced catalysts like metallocene and single-site systems to enhance polymer quality.

- High R&D costs and complex catalyst formulations restrain smaller producers from competing effectively.

- Sustainability initiatives and recyclable polyolefins encourage the adoption of eco-friendly catalyst technologies.

- Asia-Pacific leads the market with expanding polymer production capacity in China and India.

- North America and Europe show steady growth, while the Middle East and Latin America emerge as rising markets.

Market Drivers

Rising Demand from Packaging and Automotive Applications

The Polyolefin Catalyst Market benefits from expanding demand in packaging and automotive industries. Lightweight plastics enable better fuel efficiency and cost savings for manufacturers. Growing adoption of polypropylene and polyethylene drives the use of high-performance catalysts. It helps producers meet higher output targets with precise control over molecular structures. Flexible packaging and durable films require improved clarity and strength, further supporting catalyst innovation. Advancements in metallocene and Ziegler-Natta catalysts optimize polymerization efficiency. These catalysts deliver superior mechanical and thermal properties. Expanding logistics and e-commerce sectors further increase polyolefin demand globally.

- For instance, W.R. Grace & Co. expanded licenses for its UNIPOL® polypropylene process technology and CONSISTA® catalysts with Bharat Petroleum Corporation Limited (BPCL), supporting new reactor units with capacities of 400 kilotons per annum in Kochi and 550 KTA in Bina.

Shift Toward Energy-Efficient and Sustainable Manufacturing

Producers invest in catalyst technologies that reduce emissions and improve productivity. The Polyolefin Catalyst Market supports energy-efficient polymerization processes that minimize waste. Refiners and chemical plants adopt low-temperature catalyst systems to lower energy use. It promotes sustainable operations and reduces dependency on fossil-based feedstocks. Green catalyst innovations enhance recyclability of polymers, meeting global sustainability goals. Continuous R&D aims to balance process efficiency with environmental performance. Governments encourage cleaner chemical synthesis through funding and regulatory support. This transition strengthens competitiveness while aligning with decarbonization targets.

Technological Advancements Enhancing Polymer Quality

New catalyst formulations offer better control over polymer structure and distribution. The Polyolefin Catalyst Market evolves with next-generation metallocene and single-site catalysts. These systems enable production of specialty polymers with superior elasticity and transparency. It empowers manufacturers to design customized materials for films, fibers, and coatings. Integration of digital process monitoring improves reaction stability and precision. R&D investments by global firms target consistent quality and reduced catalyst consumption. Such developments help produce polymers suited for high-end industrial applications. Advanced catalyst systems continue to reshape polyolefin production dynamics.

- For instance, Sinopec Catalyst Co. Ltd. produces advanced metallocene and Ziegler-Natta catalysts enabling precise polymer structure control for superior elasticity in films, fibers, and coatings.

Growing Industrialization and Infrastructure Expansion

Rapid industrial growth in emerging economies increases demand for polyolefins. The Polyolefin Catalyst Market benefits from rising consumption in pipes, cables, and building materials. It helps producers meet large-scale construction requirements with durable and lightweight polymers. Expanding petrochemical capacities in Asia and the Middle East sustain strong catalyst sales. Manufacturers invest in modern catalyst plants to supply expanding polymer markets. Increased focus on high-performance infrastructure materials drives steady innovation. Industrial growth reinforces catalyst production and deployment efficiency. This trend supports long-term stability for global polyolefin manufacturers.

Market Trends

Increasing Use of Single-Site and Metallocene Catalysts

Manufacturers adopt single-site catalysts for uniform polymer properties and high purity. The Polyolefin Catalyst Market shows strong movement toward metallocene-based production. These catalysts allow precise molecular control, improving mechanical performance. It enhances film strength, flexibility, and barrier resistance. Growing applications in packaging and healthcare boost this shift. Producers replace traditional Ziegler-Natta catalysts with advanced systems. Research focuses on improving catalyst lifetime and recyclability. This ongoing transition redefines competitive advantage within polymer manufacturing.

Focus on Circular Economy and Recyclable Polyolefins

Sustainability trends reshape polymer production and catalyst development. The Polyolefin Catalyst Market aligns with circular economy objectives by supporting recyclable resin grades. It drives innovation in catalysts compatible with chemical recycling technologies. Producers develop formulations that retain polymer integrity after multiple use cycles. Growing interest in green chemistry influences process optimization. Collaborative programs between industry and academia promote recycling efficiency. Companies seek certifications for environmentally responsible catalyst solutions. This movement strengthens global commitment to low-waste production systems.

- For instance, ExxonMobil, LyondellBasell, and Cyclyx International are jointly developing a circularity center in Greater Houston. The facility is designed to process up to 150,000 metric tons of waste plastics annually to create recycled feedstock for advanced and mechanical recycling projects.

Integration of Digitalization in Catalyst Production

Automation and analytics enhance efficiency across catalyst manufacturing lines. The Polyolefin Catalyst Market benefits from smart production control systems. Digital tools improve precision in polymerization reactions and reduce downtime. It enables real-time monitoring of catalyst activity and quality consistency. AI-driven modeling helps predict performance under varying conditions. Major producers implement machine learning to optimize process parameters. Predictive maintenance reduces operational costs while enhancing output quality. Digital integration transforms catalyst management and resource utilization efficiency.

Expansion of Polyolefin Applications Beyond Traditional Sectors

Demand extends beyond packaging and automotive toward electronics and healthcare. The Polyolefin Catalyst Market supports the creation of specialty grades for these industries. It enables lightweight, chemical-resistant polymers used in medical devices and consumer electronics. Catalyst innovation provides better temperature and impact resistance. Rising investments in specialty films and composites reinforce growth momentum. Manufacturers tailor catalysts for precision molding and flexible applications. Enhanced product properties attract high-value markets worldwide. This broadening application base strengthens long-term market resilience.

- For instance, LyondellBasell’s catalyst technologies support the production of high-performance polymers with strong chemical resistance, widely used in medical devices and consumer electronics. The company focuses on developing advanced materials that enhance durability and lightweight performance across these sectors.

Market Challenges Analysis

High Production Costs and Complex Catalyst Formulations

Developing advanced catalyst systems involves substantial R&D expenditure. The Polyolefin Catalyst Market faces cost pressures due to complex formulations and testing. It requires high-purity raw materials and precise reaction control. Small-scale producers struggle to match efficiency achieved by large firms. Price volatility of feedstocks also impacts catalyst manufacturing margins. Limited access to proprietary catalyst technologies creates competitive barriers. Producers must balance innovation with cost control for sustainable profitability. Managing operational efficiency remains a constant challenge for the industry.

Regulatory Constraints and Environmental Compliance Issues

Stringent environmental laws increase compliance costs for catalyst producers. The Polyolefin Catalyst Market experiences tighter monitoring of emissions and waste disposal. It demands cleaner synthesis routes that comply with regional safety norms. Regulatory delays can slow the launch of innovative catalyst types. Manufacturers must ensure safe handling of metal-based components during production. Shifting international standards require continuous adaptation and certification. Balancing environmental goals with industrial productivity poses strategic difficulty. Long-term success depends on proactive environmental risk management.

Market Opportunities

Rising Demand for Advanced Catalysts in Emerging Economies

Developing nations create new opportunities for catalyst manufacturers. The Polyolefin Catalyst Market benefits from petrochemical expansion in Asia Pacific and the Middle East. It enables local polymer industries to adopt high-efficiency catalysts. Governments promote industrial growth through investment-friendly policies. Increasing construction and consumer product demand strengthen polymer consumption. Producers can expand through joint ventures and regional partnerships. Technological transfer programs support knowledge sharing in catalyst design. These developments open new revenue channels for global players.

Innovation in Sustainable and Bio-Based Catalyst Technologies

Growing interest in renewable chemistry creates fresh prospects for innovation. The Polyolefin Catalyst Market explores bio-based catalyst solutions that lower carbon emissions. It supports global efforts toward sustainable polymer manufacturing. Companies focus on hybrid catalyst systems integrating natural precursors. Such products reduce dependency on metal-based components and minimize waste. Research institutions collaborate with industry to commercialize green catalyst prototypes. Adopting eco-friendly catalysts enhances brand reputation and regulatory compliance. These innovations pave the way for long-term competitive differentiation.

Market Segmentation Analysis:

By Classification

The Polyolefin Catalyst Market is categorized into polypropylene, polyethylene, and others. Polypropylene leads due to its extensive use in automotive parts, packaging films, and textiles. It delivers high stiffness, chemical resistance, and thermal stability, which enhances performance across industries. Polyethylene, including HDPE and LLDPE, follows closely, supported by its demand in containers, pipes, and stretch films. It benefits from innovations in metallocene catalysts that improve clarity and flexibility. The others segment covers specialty copolymers used in niche industrial applications.

- For instance, Borealis’ Borstar technology produces bimodal polyethylene grades with enhanced mechanical properties in multi-reactor processes.

By Catalyst Type

The market includes Ziegler-Natta, Single Site Catalyst (SSC), Chromium-based (Phillips), Metallocene, and other catalyst types. The Ziegler-Natta catalyst dominates due to its cost-effectiveness and proven reliability in large-scale polymer production. The Polyolefin Catalyst Market experiences rapid growth in SSC and metallocene catalysts, which enhance molecular uniformity and polymer strength. It supports producers aiming for high-performance materials. Chromium-based catalysts retain demand for HDPE production, offering consistent polymer weight distribution. Other catalysts address customized formulations for specialty resins.

By Application

Key applications include injection molding, blow molding, films, fibers, and others. Injection molding holds strong adoption for producing precision components in automotive and consumer goods. The Polyolefin Catalyst Market benefits from expanding blow molding applications in packaging and industrial containers. Film manufacturing sees high catalyst usage for lightweight packaging materials with superior mechanical strength. It also supports fiber production for textiles and geotextiles. Other uses include coatings, adhesives, and high-strength polymer compounds.

By End-Use Industry

End-use industries include automotive, packaging, construction, healthcare, electronics, consumer goods, and others. Packaging remains the largest sector due to growing demand for flexible films and containers. The Polyolefin Catalyst Market gains traction in automotive manufacturing through lightweight materials that reduce emissions. It supports construction applications such as pipes and insulation layers. Healthcare uses sterile, high-purity polymers for medical devices. Electronics and consumer goods benefit from durability and design flexibility. Other industries continue to adopt catalysts for advanced polymer applications.

- For instance, metallocene-catalyzed isotactic polypropylene achieves lower melting temperatures around 150-160°C compared to Ziegler-Natta types, aiding processability in auto parts.

Segmentation:

By Classification

- Polypropylene

- Polyethylene

- Others

By Catalyst Type

- Ziegler-Natta Catalyst

- Single Site Catalyst (SSC)

- Chromium-based Catalyst (Phillips Catalyst)

- Metallocene Catalyst

- Others

By Application

- Injection Molding

- Blow Molding

- Films

- Fibers

- Others

By End-Use Industry

- Automotive

- Packaging

- Construction

- Healthcare

- Electronics

- Consumer Goods

- Others

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Leads Global Demand

The Polyolefin Catalyst Market finds its largest share in Asia-Pacific, which holds over half of global demand. Rapid industrial growth and expanding polymer production in countries such as China and India drive this dominance. Local demand from packaging, automotive, and construction sectors sustains strong catalyst consumption. It benefits from broad petrochemical infrastructure and rising disposable incomes that increase polymer usage across sectors. Manufacturers in the region continue to scale up catalyst supply to support growing polyolefin output. Continuous expansion in downstream industries ensures Asia-Pacific retains a leading position over the forecast period.

Significant Share from North America and Europe

North America and Europe contribute substantial proportions to the global polyolefin-catalyst demand. Mature polymer industries and stable demand in automotive, packaging, and medical applications support steady catalyst uptake. It benefits from established regulatory frameworks and advanced manufacturing technologies that emphasise efficiency and quality. Catalyst suppliers in these regions often focus on high-performance formulations for specialty applications. Demand remains relatively stable though growth is slower compared to Asia-Pacific. Market players target innovations and sustainability to maintain competitiveness in these mature markets.

Emerging Potential in Latin America and Middle East & Africa

Latin America and Middle East & Africa present growing opportunities for catalyst suppliers, although their current share remains modest compared to leading regions. Expanding petrochemical investments, infrastructure development and rising polymer consumption in construction, packaging and consumer-goods sectors support gradual growth. Suppliers increasingly explore these regions to capture early-stage demand. It fosters diversification and opens new revenue streams outside traditional strongholds. Growing urbanization and industrialization will likely push catalyst demand upward over the next decade.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- R. Grace & Co.

- LyondellBasell Industries N.V.

- Clariant AG

- Sinopec (China Petroleum Corporation)

- Mitsui Chemicals Inc.

- Evonik Industries AG

- Albemarle Corporation

- Toho Titanium Co. Ltd.

Competitive Analysis:

The Polyolefin Catalyst Market remains concentrated among a few large chemical firms. Leading companies include W.R. Grace & Co., LyondellBasell Industries N.V., Clariant AG, Sinopec (China Petroleum Corporation), Mitsui Chemicals Inc., Evonik Industries AG, Albemarle Corporation, and Toho Titanium Co. Ltd. These firms dominate due to strong R&D capabilities, proprietary catalyst technologies, and global distribution networks. They invest continuously in process innovation to improve polymerization efficiency and resin quality. It helps them maintain leadership in both Ziegler-Natta and metallocene catalyst categories. Strategic collaborations with petrochemical producers enhance production scalability and regional reach. Rising focus on eco-friendly catalyst systems further supports competitive differentiation and brand positioning in sustainability-driven markets.

Recent Developments:

- In June 2024, W. R. Grace & Co., a leader in polyolefin catalyst technologies, announced that Bharat Petroleum Corporation Limited (BPCL) expanded its licenses for Grace’s UNIPOL® polypropylene process technology. BPCL plans to implement this technology along with CONSISTA® catalysts in new reactor units located in Kochi, Kerala, and Bina, Madhya Pradesh, with capacities of 400 kilotons per annum (KTA) and 550 KTA respectively.

Report Coverage:

The research report offers an in-depth analysis based on Classification, Catalyst Type, Application and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyolefin Catalyst Market will advance through continuous innovation in metallocene and single-site catalyst systems.

- Sustainable manufacturing will drive demand for energy-efficient and low-emission catalyst technologies.

- Expansion of polymer capacity in Asia-Pacific will strengthen regional leadership in catalyst adoption.

- Integration of digital tools and automation will enhance process monitoring and production optimization.

- Catalyst developers will prioritize recyclability and compatibility with circular economy principles.

- Strategic partnerships between chemical producers and polymer manufacturers will improve supply stability.

- Growing applications in automotive lightweight materials and flexible packaging will sustain long-term demand.

- Research on bio-based and hybrid catalysts will open new opportunities for green polymer synthesis.

- Investment in petrochemical infrastructure across emerging economies will create fresh catalyst markets.

- The market will maintain steady growth through efficiency-driven innovation and regional diversification.