Market Overview:

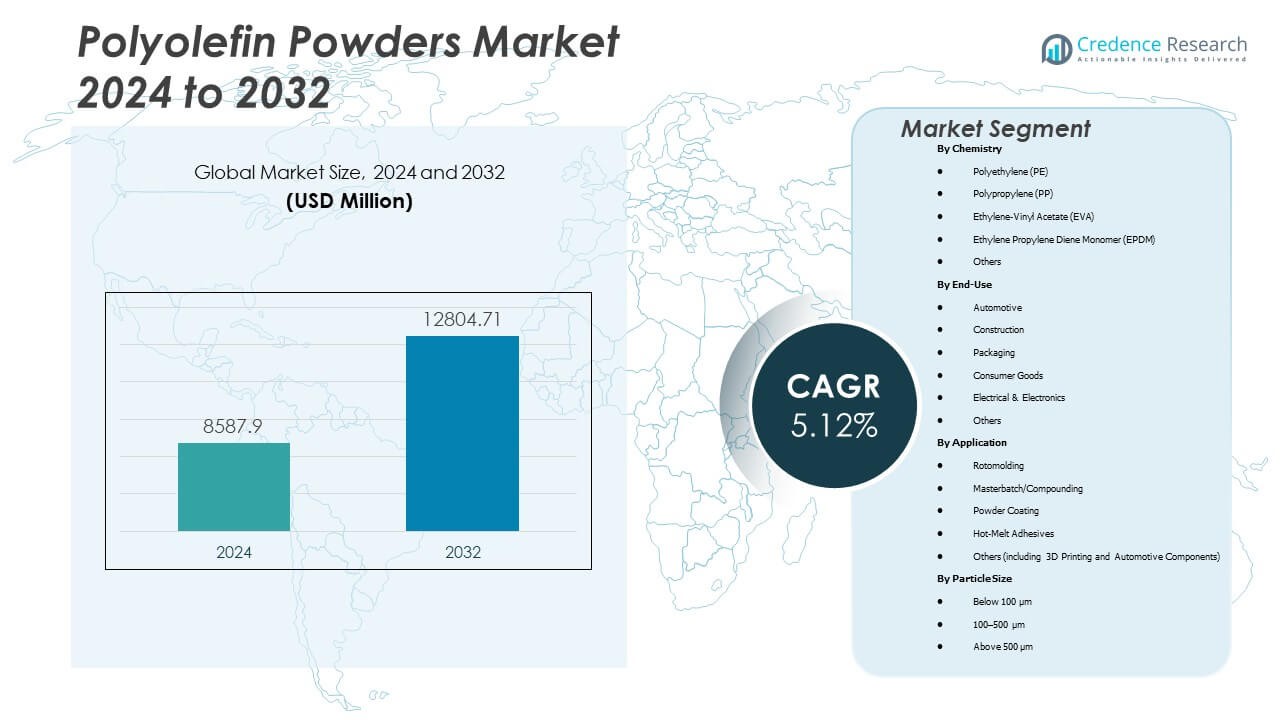

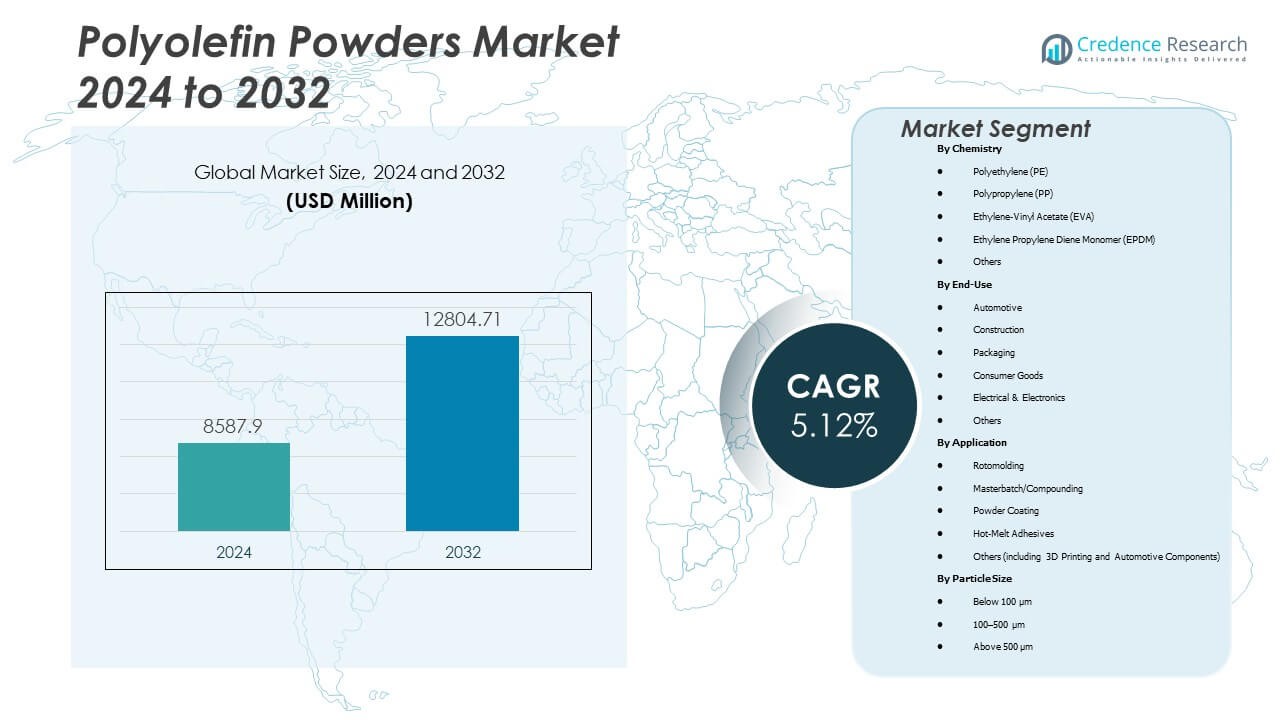

The Polyolefin Powders Market is projected to grow from USD 8,587.9 million in 2024 to an estimated USD 12,804.71 million by 2032, with a compound annual growth rate (CAGR) of 5.12% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyolefin Powders Market Size 2024 |

USD 8,587.9 Million |

| Polyolefin Powders Market, CAGR |

5.12% |

| Polyolefin Powders Market Size 2032 |

USD 12,804.71 Million |

Strong demand from automotive, packaging, and construction industries drives the market forward. Manufacturers adopt polyolefin powders for lightweight parts, durable coatings, and recyclable materials. The shift toward sustainable plastics strengthens industry adoption, supported by environmental regulations and green initiatives. Continuous advancements in polymerization and coating technologies enhance performance and product quality. It gains momentum as producers focus on energy-efficient and low-emission materials for industrial use.

Asia-Pacific leads the market due to its strong manufacturing base and expanding industrial applications in China, India, and Southeast Asia. North America and Europe maintain steady growth supported by high standards for product quality and recycling efficiency. Emerging regions like Latin America and the Middle East show rising demand through infrastructure and consumer goods expansion. Growing regional investments and technology transfers strengthen global competition. It continues to evolve as countries enhance production capacity and embrace sustainability-focused development strategies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Polyolefin Powders Market is projected to rise from USD 8,587.9 million in 2024 to USD 12,804.71 million by 2032, growing at a CAGR of 5.12 %.

- Expanding automotive and construction industries drive high demand for durable and lightweight polymer coatings.

- Strong environmental policies accelerate the shift toward recyclable and low-emission polyolefin materials.

- Rising adoption of powder-based coating technologies improves manufacturing efficiency and cost performance.

- Technological advances in polymerization and material blending enhance quality consistency and product versatility.

- Increasing consumer preference for eco-friendly packaging strengthens long-term market penetration.

- Asia-Pacific leads due to rapid industrial growth, while North America and Europe maintain strong production bases.

Market Drivers

Rising Demand from Automotive and Industrial Applications

The Polyolefin Powders Market expands through rising demand from automotive and industrial sectors. Lightweight materials improve fuel efficiency and meet emission standards. Powder coatings offer better corrosion resistance and surface finishing for components. Car makers use these powders for under-the-hood and exterior applications. Industrial manufacturers rely on them for pipes, tanks, and molded parts. Growth in automation drives large-scale adoption of plastic-based parts. End users prefer powders for faster processing and smooth finish quality. The market benefits from sustained automotive production and modernization of manufacturing systems.

Expanding Use in Packaging and Consumer Goods

The packaging sector contributes strongly to market growth with demand for durable and recyclable materials. Polyolefin powders enable thin-walled containers, caps, and closures with improved flexibility. Consumer goods manufacturers prefer them for strong adhesion and cost efficiency. Increasing awareness of plastic waste management supports transition toward recyclable polyolefin-based products. Retail packaging focuses on moisture protection and product safety. Food-grade applications strengthen adoption in storage solutions and kitchenware. It finds new use in toys and personal care packaging due to regulatory compliance. Demand for high-quality finishes boosts product design standards in multiple industries.

- For instance, Borealis launched a recycled linear low-density polyethylene (rLLDPE) grade under their Borcycle M portfolio suitable for flexible packaging, offering 85% post-consumer content while preserving performance.

Technological Advancements in Polymer Processing

Continuous improvements in polymerization and compounding technologies boost production efficiency. Manufacturers optimize powder morphology and molecular weight for uniformity. Modern reactors and catalysts enhance quality control across large batches. Integration of advanced grinding and spray-cooling systems supports finer particle structures. It enhances flow behavior in coating and molding operations. Research institutions develop customized powder grades for additive manufacturing. These innovations reduce production waste and energy consumption. Growing partnerships between polymer producers and equipment suppliers ensure stable product development pipelines.

- For instance, Axalta’s powder-coating product family includes powders processed via ambient and cryogenic grinding from 200 microns up to 1500 microns showing controlled powder-resin processing capabilities.

Growing Emphasis on Environmental Sustainability

Regulatory pressure for low-emission materials drives green innovation. Polyolefin powders meet environmental standards with recyclable content and low volatile emissions. Producers invest in bio-based polyethylene and polypropylene grades. Government incentives encourage sustainable plastic manufacturing across Europe and Asia. It supports corporate commitments toward circular economy models. Sustainable packaging adoption by FMCG brands improves market recognition. End users choose materials that align with extended producer responsibility programs. Shifting consumer behavior toward low-carbon products strengthens long-term adoption potential.

Market Trends

Shift Toward High-Performance Polyolefin Grades

The Polyolefin Powders Market sees rising preference for high-performance materials. Advanced grades withstand higher temperatures and chemical exposure. These properties suit heavy-duty coatings and 3D printing. Manufacturers target niche applications in oil and gas, aerospace, and defense. Product innovation focuses on enhancing tensile strength and impact resistance. Additive blending improves UV stability and surface quality. It enables longer service life and reduced maintenance. Demand for specialty powders reflects industry trends toward customized performance materials.

Integration of Digital Manufacturing and Additive Technologies

Digitalization transforms production processes through 3D printing and smart factory adoption. Polyolefin powders gain traction in rapid prototyping and lightweight design. Automation systems ensure consistent quality and low production errors. Manufacturers integrate data analytics for predictive maintenance. It supports flexible manufacturing and smaller batch customization. Additive manufacturing broadens product development speed across automotive and consumer industries. Global OEMs use polymer powders to lower material waste. Technological convergence creates new value chains in material supply and engineering design.

- For instance, Alpha Powders (a specialty polymer-powder startup) introduced a spherodization process for recycled plastic, producing powders suitable for powder-bed fusion 3D printing improving flowability and print quality.

Regional Expansion and Localization of Supply Chains

Manufacturers expand regional production facilities to meet rising domestic demand. Asia-Pacific dominates supply networks for low-cost raw materials and labor. North American producers localize production to reduce logistics cost and tariff impact. Europe strengthens recycling and bio-based polymer initiatives. It aligns market expansion with localized sustainability policies. Growing regional collaborations foster cross-border raw material sourcing. Investments in R&D hubs enhance technical support and application development. Localization improves market resilience against raw material volatility and supply disruption.

Rising Focus on Circular Economy and Recyclability

Recycling initiatives reshape product development strategies in polymer industries. Polyolefin powders support closed-loop production systems. Manufacturers collaborate with recyclers to improve collection and reprocessing rates. It drives adoption in packaging, agriculture, and consumer goods. Product labeling promotes awareness of recyclable materials. R&D efforts target improved melt flow and mechanical retention after recycling. Industrial users adopt sustainable sourcing certifications to meet compliance. Demand for recyclable powders continues to define long-term market differentiation.

- For instance, Borealis’ Borcycle M solution converts post-consumer plastic waste into high-quality recycled polyolefins, enabling use in new products while lowering environmental footprint

Market Challenges Analysis

Raw Material Price Volatility and Supply Chain Constraints

Fluctuating crude oil prices create cost instability in resin production. Feedstock shortages affect polyethylene and polypropylene availability. Manufacturers face challenges in maintaining stable margins under volatile energy markets. It pressures downstream producers to adjust formulations or sourcing strategies. Transport delays and shipping costs increase delivery lead times. Supply chain dependency on petrochemical hubs limits flexibility for small firms. Currency fluctuations add financial burden for exporters. Industry players focus on strategic partnerships and inventory management to minimize disruptions.

Stringent Environmental Regulations and Waste Management Issues

Government restrictions on single-use plastics limit growth in several regions. Compliance with emission standards requires costly equipment upgrades. Waste management and recycling infrastructure remain underdeveloped in emerging markets. It affects large-scale adoption of eco-friendly polyolefin powder grades. Producers must redesign formulations to meet biodegradable criteria. Certification processes delay product commercialization. Industry stakeholders invest in recycling collaborations to meet policy targets. Rising operational costs challenge competitiveness against alternative materials like biopolymers.

Market Opportunities

Growth in Additive Manufacturing and Coating Technologies

The Polyolefin Powders Market gains strong opportunities from additive manufacturing. Increasing use in laser sintering and rotational molding expands application reach. Industrial automation enhances powder flow consistency for precision parts. Aerospace and defense sectors explore lightweight thermoplastic alternatives. It provides higher performance with lower processing temperature. New coating systems improve adhesion on metal and composite surfaces. Investments in advanced surface technologies drive niche opportunities. Strategic alliances between polymer producers and 3D printing firms foster material innovation.

Emergence of Bio-Based and Recyclable Polyolefin Materials

Bio-based polyolefin developments reshape the sustainability landscape. Producers explore renewable feedstocks like ethanol and sugarcane derivatives. Recyclable grades meet global standards for green certification. It helps companies meet carbon neutrality commitments. Chemical recycling technologies recover polymer chains with high purity. Governments support eco-innovation through subsidies and R&D incentives. Expanding circular economy frameworks enhance material traceability. The market benefits from increasing demand for low-carbon packaging and industrial coatings across major economies.

Market Segmentation Analysis:

By Chemistry

The Polyolefin Powders Market is segmented by chemistry into Polyethylene (PE), Polypropylene (PP), Ethylene-Vinyl Acetate (EVA), Ethylene Propylene Diene Monomer (EPDM), and others. Polyethylene dominates the segment due to its wide application in coatings, packaging, and molding. PP follows closely with strong demand in automotive and consumer goods sectors. EVA powders find growing use in adhesives and flexible coatings. EPDM serves industrial uses that require heat and chemical resistance. Other chemistries like polybutene and elastomers enhance material diversity for niche applications.

- For instance, INEOS Group offers its Eltex® P powders in PE and PP grades. Their technical data sheet notes these powders enable “very good dispersion of additives, pigments or fillers,” making them suitable for masterbatch, compounding, and wood-plastic composite applications.

By End-Use

End-use industries include automotive, construction, packaging, consumer goods, electrical and electronics, and others. Automotive remains the largest contributor, using powders for coatings, molded parts, and interiors. Construction follows with applications in tanks, flooring, and insulation. Packaging gains share from recyclable and lightweight plastic solutions. Consumer goods and electronics sectors benefit from durable and aesthetic finishes. It strengthens demand across household, electrical, and industrial product categories.

By Application

Applications cover rotomolding, masterbatch/compounding, powder coating, hot-melt adhesives, and others. Rotomolding leads the category with usage in tanks, containers, and industrial parts. Masterbatch and compounding expand with demand for color and additive dispersions. Powder coatings deliver uniform surfaces for metals and plastics. Hot-melt adhesives support flexible bonding across packaging and construction. It finds new scope in 3D printing and automotive component production, driven by design flexibility.

- For instance, ExxonMobil Chemical offers high-performance polyethylene resins (Exceed™ line) suitable for rotomolding, enabling production of tough, weather-resistant tanks and containers. Their documentation reports enhanced environmental stress-crack resistance and improved impact strength in rotomolded products.

By Particle Size

Particle size segmentation includes below 100 µm, 100–500 µm, and above 500 µm. Powders between 100–500 µm dominate due to balanced flow and coating performance. Smaller particles below 100 µm support high-precision printing and thin coatings. Larger particles above 500 µm serve specialized industrial molding. It supports varied process requirements and enhances material versatility across manufacturing applications.

Segmentation:

By Chemistry

- Polyethylene (PE)

- Polypropylene (PP)

- Ethylene-Vinyl Acetate (EVA)

- Ethylene Propylene Diene Monomer (EPDM)

- Others

By End-Use

- Automotive

- Construction

- Packaging

- Consumer Goods

- Electrical & Electronics

- Others

By Application

- Rotomolding

- Masterbatch/Compounding

- Powder Coating

- Hot-Melt Adhesives

- Others (including 3D Printing and Automotive Components)

By Particle Size

- Below 100 µm

- 100–500 µm

- Above 500 µm

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific Dominance and Rapid Growth

The Asia-Pacific region leads the polyolefin powders market, holding around 45–50 % of global revenue share. Industrialization, urbanization, and expanding manufacturing in China, India, and Southeast Asia drive high demand. Growing automotive, packaging, and construction sectors fuel powder usage. It benefits from lower labor costs, local resin supply, and supportive government policies. Rising consumer goods production and infrastructure projects reinforce demand stability. Manufacturers increasingly locate production and distribution in this region to serve domestic and export markets.

North America and Europe Maintain Solid Share

North America and Europe together account for a significant portion of remaining market share North America leads in some coatings-focused segments with about 30–38 % share of powder coatings markets. Strong demand from automotive, appliances, and consumer goods supports stable consumption. Advanced manufacturing infrastructure and stringent environmental regulations encourage adoption of recyclable, low-emission powders. It supports demand for high-performance grades and specialty applications including industrial coatings and 3D printing. Regional suppliers leverage R&D and regulatory compliance to maintain competitiveness.

Emerging Markets in Latin America, Middle East & Africa Gaining Traction

Latin America and Middle East & Africa show gradual but growing adoption of polyolefin powders. Infrastructure development, rising industrialization, and increasing consumer demand steer growth. Local manufacturing hubs and improving supply chains support wider availability. Manufacturers target these regions for cost-effective production and export. Demand for packaging, construction materials, and consumer goods rise with economic growth. These regions offer long-term potential for market expansion even though current share remains modest.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The polyolefin powders market features several global producers competing on product quality, cost and geographic reach. Major players focus on polyethylene and polypropylene powders due to broad end-use across coatings, molding, and packaging. Companies differentiate through advanced polymerization technologies and tailored powder grades for specific applications. Leading firms invest in R&D to develop powders with uniform particle size, improved flow properties, and enhanced recyclability. The competition intensifies around regional manufacturing presence Asia-Pacific suppliers gain advantage from lower production costs and proximity to raw material sources. Firms in North America and Europe emphasize sustainability, regulatory compliance and high-performance grades for premium applications. It drives a balance between cost-efficiency and value-added differentiation. Overall, competition remains moderate no single firm dominates globally enabling regional specialists and global players to coexist.

Recent Developments:

- In September 2025, Borealis announced that its new compounding line for recycled polyolefins (rPO) in Beringen is now fully operational. The facility uses its Borcycle M technology to process post-consumer and virgin polyolefins for applications in mobility, consumer goods, appliances and energy sectors.

- In March 2025 LyondellBasell announced it will expand propylene production capacity at its Channelview complex near Houston. The new facility planned to start operations around 2028 aims to support increased demand for polypropylene (PP) and related polyolefins.

- In January, 2025, LyondellBasell said IOCL selected its Hostalen ACP technology for a new 500 kta HDPE plant in Paradip, India. This agreement extends their partnership and supports production of high-density polyethylene resins for various applications.

Report Coverage:

The research report offers an in-depth analysis based on Chemistry, End-Use, Application and Particle Size. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyolefin Powders Market will expand steadily with rising demand across automotive, packaging, and construction sectors.

- Sustainable material innovation will shape new product development to meet recycling and emission standards.

- Increased adoption of advanced processing technologies will enhance product consistency and efficiency.

- Growth in additive manufacturing and coating applications will strengthen usage across industrial sectors.

- Companies will invest in bio-based and recyclable polyolefins to align with global sustainability goals.

- Regional capacity expansions in Asia-Pacific will sustain long-term competitive supply chains.

- Strategic mergers and partnerships will improve market positioning and technology sharing among key producers.

- The transition toward lightweight materials in transportation will boost powder applications for performance parts.

- Emerging markets in Latin America and the Middle East will witness industrial growth driving powder consumption.

- Digital manufacturing trends and R&D collaborations will continue redefining material standards and end-user expectations.