Market Overview:

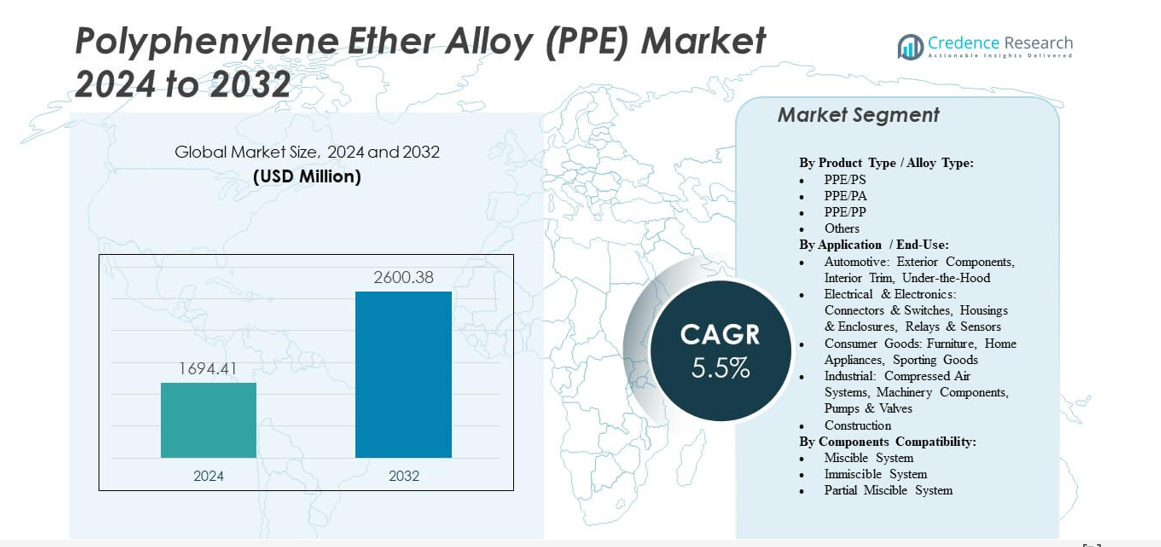

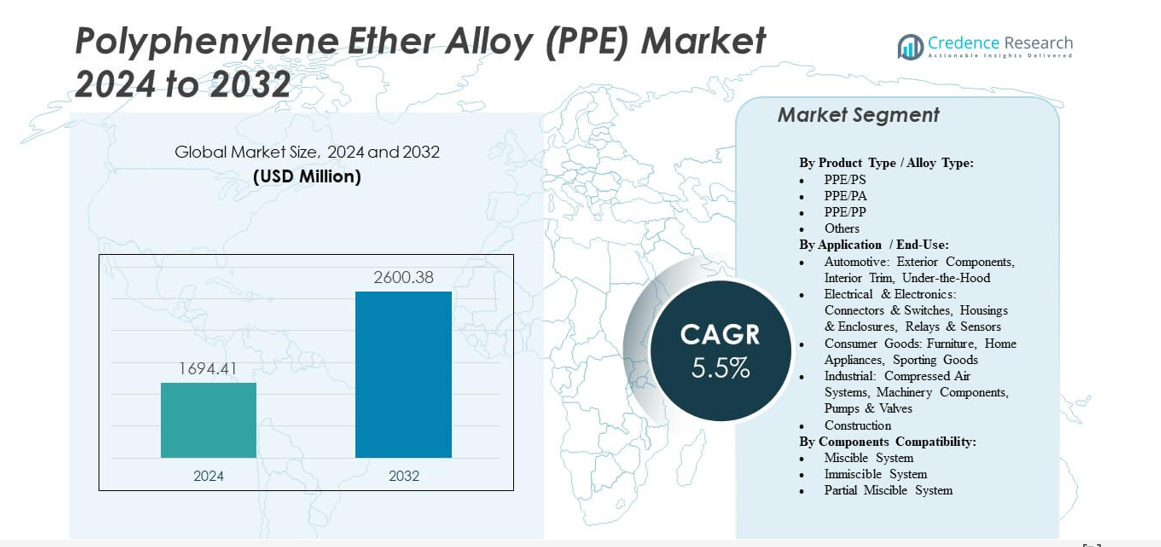

The Polyphenylene Ether Alloy (PPE) Market is projected to grow from USD 1,694.41 million in 2024 to an estimated USD 2,600.38 million by 2032, with a compound annual growth rate (CAGR) of 5.5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyphenylene Ether Alloy (PPE) Market Size 2024 |

USD 1,694.41 million |

| Polyphenylene Ether Alloy (PPE) Market, CAGR |

5.5% |

| Polyphenylene Ether Alloy (PPE) Market Size 2032 |

USD 2,600.38 million |

Growing demand for lightweight materials and energy-efficient solutions drives the market forward. Automotive manufacturers use PPE alloys to replace metals in body components and under-the-hood systems to improve fuel economy. Electronics producers adopt these polymers for housings and connectors due to their insulation and flame-retardant properties. The focus on sustainable product design and stricter emission norms enhances the material’s use across industries. Continuous advancements in compounding technology and recycling methods strengthen market penetration.

Asia Pacific leads the market with strong growth in automotive and electronics manufacturing, supported by rising industrial investments in China, Japan, and India. North America and Europe maintain significant shares due to established automotive infrastructure and stringent environmental standards. Emerging regions such as Latin America and the Middle East are expanding their presence through growing construction and industrial output. The shift toward localized production and sustainable materials continues to shape global market dynamics.

Market Insights:

- The Polyphenylene Ether Alloy (PPE) Market is valued at USD 1,694.41 million in 2024 and is expected to reach USD 2,600.38 million by 2032, registering a CAGR of 5.5%.

- Growing demand for lightweight, heat-resistant materials in automotive and electronics industries fuels steady adoption.

- High production costs and raw material dependency restrain faster market penetration in price-sensitive regions.

- Asia Pacific leads global demand driven by industrialization and strong automotive manufacturing, while North America and Europe show stable, high-value consumption.

- Technological innovation, sustainability initiatives, and recyclable PPE formulations will open new growth avenues for global manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Use of Lightweight Polymers Across Automotive and Electrical Sectors

Automotive and electrical industries drive demand for durable yet lightweight materials. The Polyphenylene Ether Alloy (PPE) Market gains strength from its ability to replace metals in key parts. Automakers reduce fuel use and improve efficiency by shifting toward PPE-based components. Its heat resistance and dimensional stability make it ideal for under-the-hood and interior applications. Electrical makers depend on PPE alloys for switch housings and circuit parts. High flow properties simplify molding complex shapes with lower production waste. Safety regulations encourage the replacement of conventional plastics with high-performance options. Strong focus on performance sustainability sustains market growth.

Rising Focus on Energy Efficiency and Emission Reduction in Manufacturing

Governments worldwide push stricter emission norms that influence design choices. The Polyphenylene Ether Alloy (PPE) Market benefits from manufacturers choosing materials that meet eco-design rules. PPE alloys provide weight reduction and fuel efficiency without compromising mechanical strength. OEMs integrate these polymers in vehicles, appliances, and machinery to align with carbon-neutral targets. Its stability supports recycling and reprocessing for circular economy goals. Lower production energy needs make it preferred over metal casting. Sustainable sourcing practices increase acceptance among leading automotive and electronics brands. Policy support ensures long-term integration of PPE alloys into mass production.

- For instance, Mitsubishi Gas Chemical’s Iupiace PPE/PA grades with PA6 offer deflection temperatures of 130-160°C at 0.45 MPa while maintaining low specific gravity for weight reduction in vehicle parts.

Expanding Electronics Production Driving High-Temperature Resistant Polymers

Rapid growth in consumer and industrial electronics boosts polymer adoption. The Polyphenylene Ether Alloy (PPE) Market grows through its application in precision casings and connectors. Engineers rely on its dielectric strength and chemical resistance under continuous load. PPE alloys help maintain performance under high voltage and temperature stress. Manufacturers choose it for thin-wall electronic housings with durable insulation. Demand strengthens in data storage, telecom, and semiconductor equipment manufacturing. Compact device designs push materials to withstand higher heat exposure. It ensures reliability where both strength and heat stability are essential.

Increased Infrastructure Investment and Industrial Modernization Initiatives

Infrastructure development in construction, power, and transport stimulates polymer demand. The Polyphenylene Ether Alloy (PPE) Market finds adoption in protective panels, cable conduits, and mechanical fittings. Urbanization creates higher demand for energy-efficient materials in public utilities. PPE alloys offer durability and insulation in harsh environments, reducing maintenance cycles. Growth in renewable power systems also strengthens demand for heat-resistant housings. Governments promote industrial modernization that supports engineered material usage. Its versatility makes it suitable across multiple infrastructure applications. Strong industrial upgrades sustain adoption in large-scale projects globally.

- For instance, BASF’s Ultradur PPE blends deliver flexural modulus of 2600 MPa for durable industrial fittings in harsh environments.

Market Trends

Shift Toward Sustainable and Circular Material Manufacturing Practices

Manufacturers emphasize sustainable production within the Polyphenylene Ether Alloy (PPE) Market. Firms explore renewable raw materials and recycling-integrated designs. Recycled PPE alloys gain importance in eco-friendly automotive interiors and consumer goods. Industry collaborations aim to achieve zero-waste processing with closed-loop systems. Global corporations test bio-based feedstocks to cut fossil dependence. Brand strategies now highlight environmental performance and recyclability. Eco-certifications drive procurement from government and corporate buyers. These sustainability shifts redefine the long-term growth pattern of PPE alloy production.

- For instance, SABIC launched XENOY T2NX2500UV resin containing 21% recycled PET content for painted automotive exterior applications with heat and impact performance.

Technological Integration Enhancing Polymer Performance Characteristics

Research teams improve polymer blends for enhanced mechanical and electrical efficiency. The Polyphenylene Ether Alloy (PPE) Market evolves with additives improving strength, gloss, and chemical endurance. Engineers design new grades compatible with automated molding and 3D manufacturing. It helps industries meet tight tolerance and mass customization requirements. Modern PPE formulations offer smoother flow and reduced moisture absorption. Firms invest in advanced compounding systems that ensure uniformity and quality. Integration of nanofillers further enhances toughness without weight gain. Continuous innovation positions PPE alloys as future-ready materials in complex engineering.

Growing Use of PPE Alloys in Electric Vehicles and Battery Components

The electric vehicle wave reshapes global polymer demand structures. The Polyphenylene Ether Alloy (PPE) Market gains traction from rising EV production. PPE alloys serve in battery enclosures, busbars, and thermal management units. It resists high voltage arcs and chemical reactions within power systems. Weight optimization remains key to extending vehicle range. Suppliers develop flame-retardant and UV-stable grades for exterior and interior modules. Industry leaders form partnerships to scale PPE alloy supply for EV platforms. This automotive electrification trend strengthens long-term demand sustainability.

- For instance, Covestro introduced Bayblend PPE/PC grades with heat deflection temperature of 140°C for EV battery housings and structural components.

Expanding Demand from Emerging Economies and Localization of Supply Chains

Emerging economies drive the next growth wave through large industrial bases. The Polyphenylene Ether Alloy (PPE) Market benefits from localized production in Asia-Pacific and Latin America. Regional manufacturers expand compounding capacity to meet domestic demand. Firms build new logistics and distribution centers for faster delivery. Import substitution policies encourage homegrown polymer technology development. PPE alloy adoption rises in domestic electrical and building sectors. Trade liberalization helps streamline material access for global OEMs. Regional ecosystem strengthening ensures better price competitiveness for PPE products.

Market Challenges Analysis

High Cost Structure and Limited Raw Material Availability

Cost factors hinder wider usage across price-sensitive industries. The Polyphenylene Ether Alloy (PPE) Market faces challenges in balancing performance with affordability. Raw materials like bisphenol-based resins and specialty additives remain costly. Production depends on complex blending and compounding processes that raise operational expenses. Supply chain volatility affects pricing and delivery timelines. Smaller manufacturers struggle to match cost efficiency of large chemical firms. Limited sourcing regions restrict flexibility during disruptions. These factors restrain full-scale substitution of conventional plastics with PPE alloys.

Processing Complexity and Compatibility Issues with Other Polymers

PPE alloys require controlled temperature and pressure during molding. The Polyphenylene Ether Alloy (PPE) Market faces barriers due to processing sensitivity. Its blending with other resins like polystyrene or polyamide demands precise formulation balance. Unstable rheology can cause warpage or surface defects in molded parts. Equipment upgrades are necessary for consistent production output. End-users often need specific tooling adjustments for PPE compatibility. Technicians require specialized training to manage high-performance polymer handling. These challenges increase initial investment for new adopters, slowing rapid transition.

Market Opportunities

Growing Penetration in High-Value Electrical and Electronic Applications

Electronics manufacturing expansion opens new application frontiers. The Polyphenylene Ether Alloy (PPE) Market will gain traction in EV chargers, sensors, and smart devices. PPE’s dielectric stability ensures secure performance under compact configurations. The shift toward miniaturized electronics amplifies the need for heat-resistant plastics. Major brands seek safer materials that maintain mechanical integrity under thermal load. High adoption in 5G infrastructure and advanced metering units will widen demand. It enables component downsizing while sustaining long service life. These dynamics present lucrative growth opportunities for suppliers.

Strategic Alliances and R&D Investments in Advanced Polymer Grades

Manufacturers prioritize innovation to maintain global competitiveness. The Polyphenylene Ether Alloy (PPE) Market benefits from strategic collaborations among resin producers and end-users. Firms invest in R&D to enhance compatibility with recycled polymers and high-speed molding. Partnerships with automotive and electronics OEMs promote tailored material development. Pilot projects focus on next-generation PPE blends with higher tensile strength. Regional partnerships help secure raw material supply for consistent output. Joint ventures enable technology sharing for process efficiency improvement. Sustained R&D support ensures continuous product differentiation and new market entry.

Market Segmentation Analysis:

By Product Type / Alloy Type

The Polyphenylene Ether Alloy (PPE) Market includes PPE/PS, PPE/PA, PPE/PP, and other blends. PPE/PS dominates due to its balance of strength, dimensional stability, and cost efficiency in automotive and electronic parts. PPE/PA offers excellent chemical and heat resistance, making it suitable for under-the-hood and industrial machinery uses. PPE/PP blends gain attention for lightweight structures in consumer and electrical products. Other custom alloys provide tailored performance in niche applications. It continues to evolve through improved formulations that enhance mechanical strength and thermal tolerance.

- For instance, PPE/PS blends achieving a coefficient of thermal expansion of 29 × 10^{-6} K^{-1} for precise electronics components. PPE/PA offers excellent chemical and heat resistance, making it suitable for under-the-hood and industrial machinery uses,

By Application / End-Use

The Polyphenylene Ether Alloy (PPE) Market serves multiple end-use sectors, including automotive, electrical, consumer, industrial, and construction. Automotive remains a leading segment supported by demand for durable and lightweight exterior and under-the-hood parts. Electrical and electronics use PPE alloys for insulation, connectors, and housings needing superior heat resistance. Consumer goods manufacturers rely on PPE for appliance and furniture components requiring rigidity and gloss retention. Industrial users adopt it for pumps, valves, and air systems exposed to harsh conditions. Construction grows steadily due to rising use in structural fittings and protective panels.

- For instance, PPE alloys exhibiting heat deflection temperatures of 100°C in headlamp housings. Electrical and electronics use PPE alloys for insulation, connectors, and housings needing superior heat resistance.

By Components Compatibility

The Polyphenylene Ether Alloy (PPE) Market classifies by miscible, immiscible, and partial miscible systems. Miscible systems dominate due to uniform polymer blending and stable performance in molded parts. Immiscible types support applications needing distinct phase properties for flexibility or impact absorption. Partial miscible systems find use where controlled interface balance improves mechanical adaptability. It continues to expand through material innovations that enhance cross-compatibility between resin families. This segmentation provides manufacturers flexibility to select alloys based on cost, process stability, and performance needs.

Segmentation:

By Product Type / Alloy Type:

- PPE/PS

- PPE/PA

- PPE/PP

- Others

By Application / End-Use:

- Automotive: Exterior Components, Interior Trim, Under-the-Hood

- Electrical & Electronics: Connectors & Switches, Housings & Enclosures, Relays & Sensors

- Consumer Goods: Furniture, Home Appliances, Sporting Goods

- Industrial: Compressed Air Systems, Machinery Components, Pumps & Valves

- Construction

By Components Compatibility:

- Miscible System

- Immiscible System

- Partial Miscible System

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds around 32% share of the global Polyphenylene Ether Alloy (PPE) Market due to its advanced automotive, aerospace, and industrial manufacturing base. Strong demand for lightweight and high-performance materials sustains regional dominance. The United States leads consumption supported by strict emission norms and large-scale EV production. Canada contributes through rising investments in energy and industrial equipment sectors. It benefits from mature infrastructure and established polymer compounding facilities. High adoption in electrical and electronics industries strengthens market continuity across the region.

Europe accounts for nearly 28% market share driven by its advanced engineering standards and environmental compliance regulations. Automotive OEMs in Germany, France, and the U.K. lead in using PPE alloys for interior and engine components. Increasing focus on energy efficiency and emission control keeps demand steady. The region’s well-developed R&D infrastructure fosters innovation in specialty grades of PPE alloys. It continues to favor recyclable, low-emission materials that align with EU sustainability goals. Eastern Europe also gains traction with growing industrial activity and export-oriented manufacturing.

Asia Pacific dominates with about 34% share, making it the fastest-growing region in the Polyphenylene Ether Alloy (PPE) Market. Expanding automotive and electronics manufacturing in China, Japan, South Korea, and India fuels demand. Low production costs and local polymer capacity attract global suppliers. It benefits from rapid industrialization and infrastructure development, enhancing consumption in machinery and construction. Latin America and the Middle East & Africa collectively account for nearly 6% share, supported by emerging industrial bases. These regions show gradual growth with improving economic conditions and foreign investments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SABIC (Saudi Arabia)

- Asahi Kasei Corporation (Japan)

- Mitsubishi Chemical Corporation (Japan)

- BASF SE (Germany)

- RTP Company (U.S.)

- Sumitomo Chemical Co., Ltd. (Japan)

- LG Chem, Ltd. (South Korea)

- INEOS Styrolution Group GmbH (Germany)

- LyondellBasell Industries Holdings BV (Netherlands)

Competitive Analysis:

The Polyphenylene Ether Alloy (PPE) Market features a moderately consolidated structure with key global players controlling most of the supply. Major companies include SABIC, Mitsubishi Engineering-Plastics, Asahi Kasei, LG Chem, and RTP Company. These firms focus on product innovation, advanced compounding technology, and strategic collaborations to enhance their global footprint. It emphasizes lightweight formulations with improved mechanical and thermal stability for automotive and electronic uses. Continuous R&D investment supports the development of recyclable and sustainable PPE alloy grades that meet industry-specific standards. Regional players in Asia expand capacity to meet domestic demand and reduce import dependency. Partnerships between material producers and OEMs strengthen supply chain resilience and customization flexibility. Competitive advantage depends on process efficiency, product quality, and application diversification across industries such as automotive, construction, and electricals. Firms adopting vertical integration in resin sourcing and molding gain higher margins and faster market response.

Recent Developments:

- In March 2025, Teijin Limited announced a strategic partnership with Toray Industries to co-develop PPE-grade polyphenylene ether alloys tailored for high-temperature applications in the Polyphenylene Ether Alloy (PPE) market.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application and Components Compatibility. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyphenylene Ether Alloy (PPE) Market will expand through growing demand for lightweight materials across automotive and electrical industries.

- Rising EV production and power electronics integration will strengthen adoption in high-voltage and thermal applications.

- Manufacturers will focus on sustainability through recyclable and bio-based PPE alloy formulations.

- Continuous R&D will drive innovation in heat-resistant and impact-modified grades for next-generation components.

- Asia Pacific will remain the growth engine due to expanding industrial and automotive manufacturing capacity.

- Integration of advanced compounding and automation will improve cost efficiency and production speed.

- OEM collaborations will increase material standardization across electronics and transport sectors.

- High investments in infrastructure and renewable energy projects will expand industrial PPE alloy use.

- Companies will pursue vertical integration to secure raw materials and reduce supply chain dependency.

- Global competition will shift toward eco-certified, high-performance PPE alloy solutions with lower carbon footprints.