Market Overview:

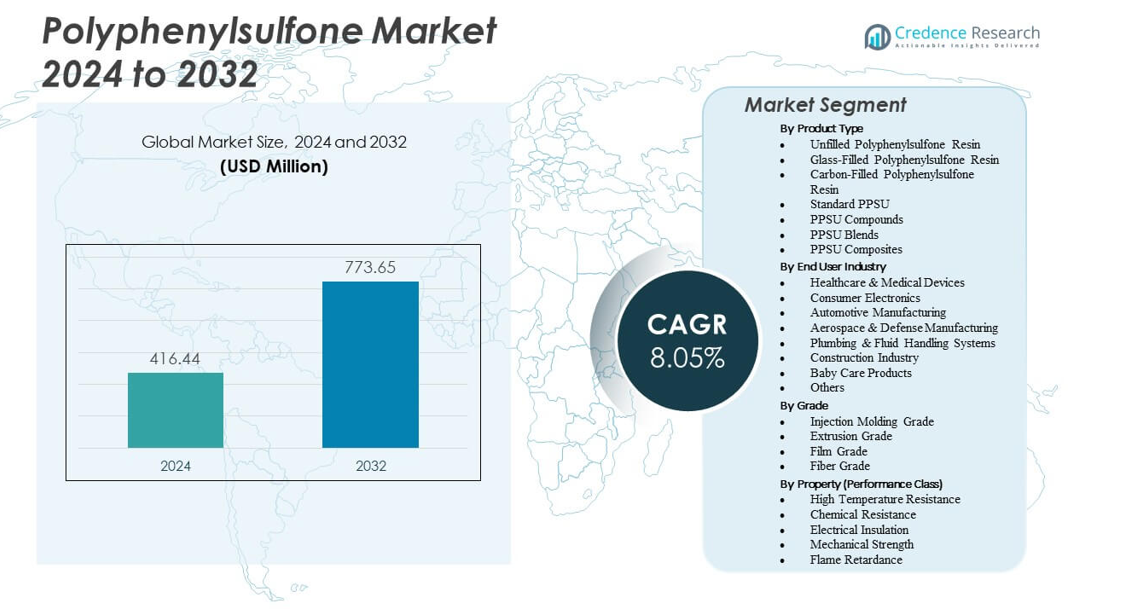

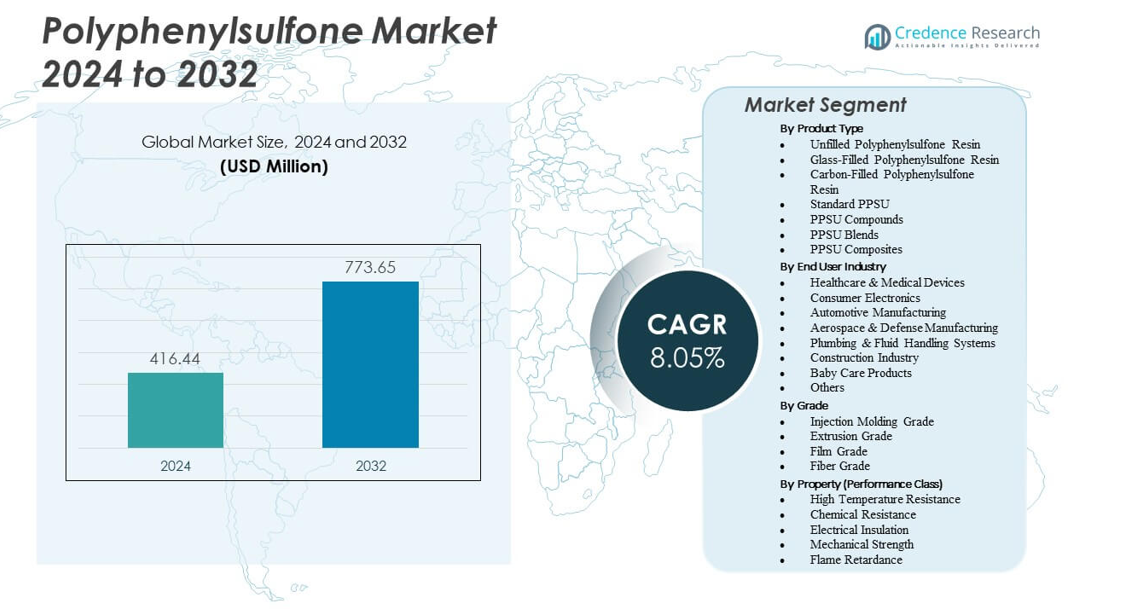

The Polyphenylsulfone Market is projected to grow from USD 416.44 million in 2024 to an estimated USD 773.65 million by 2032, with a compound annual growth rate (CAGR) of 8.05% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyphenylene Ether Alloy (PPE) Market Size 2024 |

USD 416.44 million |

| Polyphenylene Ether Alloy (PPE) Market, CAGR |

8.05% |

| Polyphenylene Ether Alloy (PPE) Market Size 2032 |

USD 773.65 million |

Market drivers reflect rising use of PPSU in medical devices, reusable surgical tools, and sterilizable components that must endure repeated cycles. Aerospace designers adopt the polymer for flame-safe interiors and heat-stable fittings. Electronics manufacturers rely on its insulation strength and impact resistance for durable housings. Plumbing and fluid-handling players use PPSU for high-pressure fittings that demand reliable tolerance. It supports precision needs in industrial automation as engineers shift to materials that withstand tough mechanical loads. Strong focus on hygiene, safety, and product life enhances adoption. Expanding use across complex systems supports wider market penetration.

Regional dynamics show North America leading due to its strong healthcare base, established aerospace production, and wide adoption of high-performance polymers. Europe follows with robust demand from medical device clusters and advanced automotive manufacturing. Asia Pacific emerges as a fast-growing hub due to expanding electronics production, rising industrial capacity, and growing medical manufacturing activity. China, India, and South Korea invest in advanced processing systems that support PPSU use across multiple sectors. Latin America and the Middle East & Africa show gradual expansion tied to healthcare modernization and industrial upgrades.

Market Insights:

- The Polyphenylsulfone Market is set to grow from USD 416.44 million in 2024 to USD 773.65 million by 2032, supported by a steady 8.05% CAGR driven by rising interest in high-performance polymers.

- Strong demand from medical devices, reusable surgical tools, and sterilizable components fuels market momentum, supported by PPSU’s toughness and stability under repeated cleaning cycles.

- Key restraints include higher production costs, complex processing needs, and limited global suppliers, which slow wider adoption across cost-sensitive industries.

- North America leads the market due to strong healthcare and aerospace infrastructure, while Europe maintains solid demand from automotive and medical device clusters.

- Asia Pacific shows rapid expansion driven by rising electronics manufacturing, growing medical production, and broader industrial upgrades across China, India, and South Korea.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Need For High-Performance Polymers Across Regulated Sectors

The Polyphenylsulfone Market grows due to strong demand in medical devices, aerospace parts, and high-pressure fluid systems. Engineers prefer PPSU for its hydrolysis resistance and toughness under repeated stress. The polymer supports sterilizable components used in surgical tools and hospital equipment. It offers reliability where frequent cleaning cycles create mechanical strain on devices. Aerospace suppliers adopt PPSU for flame-resistant interiors and lightweight parts. Fluid-handling systems use it to retain stability under continuous heat exposure. Producers expand supply to meet rising global quality standards. Strong emphasis on durable polymers pushes deeper market penetration.

Growing Use Of Reusable And Sterilizable Medical Instruments

Healthcare facilities adopt PPSU to meet rising interest in reusable tools and safer device handling. The material withstands multiple autoclave cycles without losing impact strength. It supports transparent housings that allow clinicians to inspect internal components. Medical manufacturers shift to PPSU for connectors, sterilization trays, and dental units. It offers consistent performance during long-term use under harsh cleaning agents. The Polyphenylsulfone Market gains traction from hospitals that seek lower contamination risks. Growing investments in infection-control programs promote wider usage. Stable supply chains help producers support rising healthcare procurement needs.

- For instance, BASF’s Ultrason P PPSU grade endures more than 1,000 autoclave cycles at 134°C while retaining over 90% of initial impact strength for sterilization trays and dental instruments.

Increasing Adoption In Water Treatment And Membrane Filtration Systems

Filtration companies select PPSU for high-pressure membrane housings due to its thermal and chemical resistance. It supports components that must operate under continuous flow stress. Water treatment plants integrate PPSU parts where reliability reduces downtime. It offers a strong alternative to metals in corrosive environments. The polymer maintains clarity for inspection windows and cartridge housings. The Polyphenylsulfone Market benefits from rising infrastructure upgrades across many regions. Municipal programs prefer durable materials that extend system lifespan. Global focus on clean water solutions strengthens long-term adoption.

Expansion Of High-End Industrial Manufacturing Requiring Heat-Stable Materials

Industrial sectors adopt PPSU for parts exposed to heat, aggressive fluids, and mechanical load. It supports reliable function in valves, manifolds, and analytical equipment. Manufacturers choose PPSU to reduce failure rates during intense production cycles. The material improves efficiency in systems requiring consistent dimensional stability. Chemical plants integrate PPSU components for prolonged service life. Rising upgrades in advanced factories promote stronger interest in high-performance plastics. The Polyphenylsulfone Market gains importance as industries shift toward premium engineered materials. Broad industrial modernization fuels steady long-term demand.

- For instance, glass-fiber-reinforced PPSU grades offered by Syensqo provide higher tensile strength than standard unfilled PPSU and maintain strong thermal and chemical resistance, supporting demanding uses in chemical processing valves and industrial fluid-handling systems.

Market Trends

Shift Toward Transparent High-Strength Polymers For Advanced Component Design

Producers develop PPSU grades with improved clarity for diagnostic housings and precision instruments. It supports visibility in components that require internal monitoring. Transparent polymers gain favor in premium product designs across healthcare and lab systems. Designers adopt PPSU to improve usability and safety in technical devices. The Polyphenylsulfone Market reflects this trend as end users seek higher design freedom. It encourages suppliers to expand specialized transparent variants. Strong adoption in imaging tools fuels continued innovation. Market participants prioritize optical quality without compromising strength.

Rising Integration Of PPSU In Next-Generation Mobility Applications

Automotive and electric mobility platforms adopt PPSU for lightweight, heat-resistant parts. It replaces metals in connectors, coolant circuits, and sensor housings. Designers push toward materials that reduce weight while sustaining durability. PPSU supports EV architectures where thermal loads rise. The Polyphenylsulfone Market gains visibility through new mobility engineering needs. It improves compatibility with high-voltage components and thermal safety requirements. Tier-1 suppliers invest in advanced PPSU grades for electrical platforms. Mobility trends guide broader demand for engineered polymers.

- For instance:Solvay’s Radel® PPSU R-5000 maintains mechanical integrity through 500 steam sterilization cycles equivalent to high-heat exposure, with glass transition temperature shifts under 1.4% and no significant tensile loss.

Growth Of Customized Compounding And Specialty PPSU Grades

Manufacturers launch tailored PPSU compounds to meet strict performance targets. It drives interest in blends that enhance flow, color stability, and chemical resistance. Customization helps address niche applications in analytical devices and aerospace interiors. Producers strengthen R&D pipelines to support highly specific customer needs. The Polyphenylsulfone Market gains value as engineered variants enter commercial use. It encourages long-term supplier partnerships across technical sectors. Rising specialization leads to broader formulation diversity. Improved consistency in processed parts supports wider market confidence.

- For instance, Ensinger’s TECASON P (PPSU) grades deliver tensile strengths in the range of 81–84 MPa and maintain strong chemical and thermal resistance, supporting demanding applications in medical devices, fluid-handling components, and technical equipment.

Increasing Use Of PPSU In Consumer Durables And Premium Home Appliances

Consumer brands adopt PPSU for premium cookware handles, baby bottles, and heat-stable appliance parts. It offers shatter resistance and clarity suited for high-use products. Designers use PPSU to meet rising expectations for strength and safety. The Polyphenylsulfone Market expands through lifestyle-driven upgrades in household goods. It supports long-lasting components in fast-growing home appliance categories. Manufacturers highlight PPSU for its resistance to boiling water and detergents. Product portfolios expand toward durable, high-value consumer items. Market awareness strengthens as brands promote performance benefits.

Market Challenges Analysis

High Production Costs And Limited Supplier Base Constraining Wider Use

The Polyphenylsulfone Market faces challenges linked to expensive raw materials and complex processing. PPSU requires strict thermal control during molding and extrusion steps. It demands high capital investment for advanced tooling and production systems. Limited global suppliers restrict large-scale cost optimization. It creates pricing pressure for small manufacturers that depend on niche applications. Engineers sometimes shift to lower-cost alternatives when budgets tighten. Certification requirements raise development time for regulated industries. High production costs reduce adoption speed across emerging markets.

Technical Barriers In Mass Adoption Across Competitive Engineering Plastics

PPSU competes with PEEK, PSU, and high-grade polyamides in many engineering settings. Substitution risk rises where comparable performance exists. It faces challenges in segments that demand extreme chemical or fatigue resistance. Processing PPSU requires trained operators to prevent dimensional issues. Competing materials offer broader color stability or lower density. The Polyphenylsulfone Market navigates these concerns while sustaining interest in core sectors. It expands only where performance benefits outweigh processing difficulty. Market growth depends on better education among design engineers.

Market Opportunities

Expansion In Advanced Healthcare Infrastructure And Next-Generation Medical Tools

Hospitals invest in reusable and high-precision devices that require stronger material performance. PPSU supports tools that endure sterilization without losing structural stability. It enables transparent diagnostic parts for real-time inspection. Medical players seek safer and more hygienic materials for new procedure sets. The Polyphenylsulfone Market can gain momentum through rapid healthcare modernization. It meets strict standards that drive long-term adoption across surgical and dental systems. Growing global health spending promotes more device innovation. Improved supply capacity strengthens opportunities in regulated environments.

Rising Potential Across High-Growth Filtration, EV Platforms, And Industrial Upgrades

Water treatment expansion creates strong demand for PPSU membrane housings and pressure components. EV manufacturers evaluate PPSU for thermal-safe connectors and coolant line parts. It supports precise, durable components in next-generation electronics. Industrial automation encourages use of PPSU for long-life valves and monitoring units. The Polyphenylsulfone Market benefits from cross-sector innovation that favors high-performance polymers. It aligns with sustainability efforts that promote longer service life. New application development increases revenue potential for global suppliers. Wider acceptance boosts long-term growth prospects.

Market Segmentation Analysis:

By Product Type

The Polyphenylsulfone Market expands through diverse product types that support varied technical needs. Unfilled grades gain use in transparent housings and medical trays that require clarity and strength. Glass-filled PPSU supports higher rigidity for automotive and aerospace structures. Carbon-filled variants offer improved dimensional stability and support demanding thermal loads. Standard PPSU holds steady adoption in healthcare tools and reusable components. PPSU compounds help producers tailor flow, color, and mechanical balance. PPSU blends extend performance into new industrial tasks. PPSU composites strengthen adoption where high mechanical loads shape design choices.

- For instance, Solvay’s Radel PPSU unfilled grades withstand over 1,000 steam sterilization cycles at 132°C while retaining more than 85% of mechanical properties like total energy at 55.3 J.

By End User Industry

End user industries create broad demand patterns across the Polyphenylsulfone Market. Healthcare and medical devices lead due to strong use in sterilizable surgical tools. Consumer electronics adopt PPSU for heat-safe and impact-resistant housings. Automotive manufacturing integrates it into connectors and under-hood parts. Aerospace and defense sectors rely on the polymer for flame-safe cabin elements. Plumbing systems benefit from PPSU fittings that support high-pressure flow. Construction players value durable components for harsh environments. Baby care products gain traction through PPSU bottles with strong safety profiles. Other sectors adopt it for water treatment and food processing systems.

By Grade

Grades shape performance depth across the Polyphenylsulfone Market. Injection molding grades dominate due to strong use in precision medical and electronic parts. Extrusion grades support pipes, profiles, and structural components. Film grades help producers create thin, durable sheets for technical applications. Fiber grades serve niche uses where strength and heat resistance guide material choice. Each grade strengthens design flexibility for engineers. It aligns production capability with tight tolerances. Broader grade availability supports steady market adoption.

- For instance, injection molding grades dominate precision parts with tensile strength of 70-75 MPa and flexural modulus up to 2,600 MPa.

By Property (Performance Class)

Performance classes create structured demand within the Polyphenylsulfone Market. High temperature resistance drives strong use in aerospace and automotive parts. Chemical resistance supports medical devices exposed to harsh cleaning agents. Electrical insulation enables stable use in connectors and circuit housings. Mechanical strength improves function in fluid systems and load-bearing parts. Flame retardance supports safety-critical designs in transport interiors. These properties shape PPSU’s long-term relevance. It helps producers meet strict regulatory requirements. Performance classes guide material selection across advanced industries.

Segmentation:

By Product Type

- Unfilled Polyphenylsulfone Resin

- Glass-Filled Polyphenylsulfone Resin

- Carbon-Filled Polyphenylsulfone Resin

- Standard PPSU

- PPSU Compounds

- PPSU Blends

- PPSU Composites

By End User Industry

- Healthcare & Medical Devices

- Consumer Electronics

- Automotive Manufacturing

- Aerospace & Defense Manufacturing

- Plumbing & Fluid Handling Systems

- Construction Industry

- Baby Care Products

- Others (Food & Beverage Processing, Water Treatment Systems)

By Grade

- Injection Molding Grade

- Extrusion Grade

- Film Grade

- Fiber Grade

By Property (Performance Class)

- High Temperature Resistance

- Chemical Resistance

- Electrical Insulation

- Mechanical Strength

- Flame Retardance

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America leads the Polyphenylsulfone Market with an estimated 38% share, driven by strong demand from healthcare, aerospace, and high-end industrial systems. Hospitals adopt PPSU for reusable devices that support strict sterilization needs. Aerospace suppliers use PPSU for flame-safe interior parts. Manufacturers in the U.S. expand production to support engineered plastics demand. It benefits from mature regulatory systems that favor high-performance materials. Growth remains steady due to continuous investment in advanced processing technologies.

Europe holds roughly 32% share, shaped by strong demand from medical device producers and major automotive manufacturers. The region focuses on high-precision components that align well with PPSU’s mechanical and thermal profile. Aerospace programs in Germany and France add momentum through broader use of flame-safe polymers. Healthcare firms adopt reusable devices to reduce waste and meet strict hygiene rules. The Polyphenylsulfone Market gains steady support from producers that prioritize engineering-grade materials. It grows across nations that upgrade manufacturing bases. R&D strength across key industries supports stable adoption.

Asia Pacific secures about 22% share, with fast expansion driven by rising medical manufacturing, electronics output, and industrial upgrades. China and India invest in advanced molding and extrusion systems that support PPSU use. Consumer electronics producers adopt PPSU for heat-resistant housings. Automotive growth across regional hubs drives stronger demand for stable polymers. The Polyphenylsulfone Market shows significant potential across this region due to a broader shift toward lightweight, durable materials. It gains momentum where local producers scale technical capacity. Latin America and the Middle East & Africa share the remaining 8%, shaped by gradual adoption and rising healthcare investment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Solvay SA

- SABIC

- Evonik Industries

- RTP Company

- Ensinger GmbH

- Quadrant Engineering Plastics

- Röchling Group

- Sumitomo Chemical Co., Ltd.

- Westlake Plastics Company

- NYTEF Plastics

- Mitsubishi Chemical Corporation

- Polymer Dynamix

Competitive Analysis:

The Polyphenylsulfone Market features a concentrated competitive landscape driven by a limited number of global producers. Key players invest in specialty grades that support medical devices, aerospace interiors, and industrial fluid systems. They focus on consistent resin purity, stable melt flow, and compliance with global standards. Leading firms expand compounding capabilities to meet niche performance needs across engineering applications. It encourages strong supplier–customer partnerships in regulated sectors that demand high reliability. Market participants also strengthen technical support to improve design integration and shorten qualification cycles. Competition centers on resin quality, global supply stability, and the ability to meet strict certification norms. Partnerships with molders and OEMs help producers enhance long-term presence in high-value segments.

Recent Developments:

- In April 2025, Syensqo launched White Radel, a new medical-grade polyphenylsulfone (PPSU) product designed for biopharmaceutical systems, surgical instruments, and medical devices, offering a whiter appearance than traditional grades.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, End User Industry, Grade and Property. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing demand for sterilizable devices will strengthen PPSU use across medical systems.

- Expanding aerospace interiors will push wider adoption of high-temperature PPSU parts.

- Rising electronics production will support heat-resistant housings and precision components.

- Automotive expansion toward lightweight designs will drive selection of durable PPSU grades.

- Strong penetration in plumbing systems will increase due to stable performance under pressure.

- Advancements in compounding will create new PPSU blends for niche applications.

- Higher investment in reusable medical tools will push broader material standardization.

- Regional manufacturing growth will support competitive resin supply chains.

- Sustainability programs will promote long-life materials that reduce replacement cycles.

- Long-term innovation in molding and extrusion technology will improve PPSU design flexibility.