Market Overview:

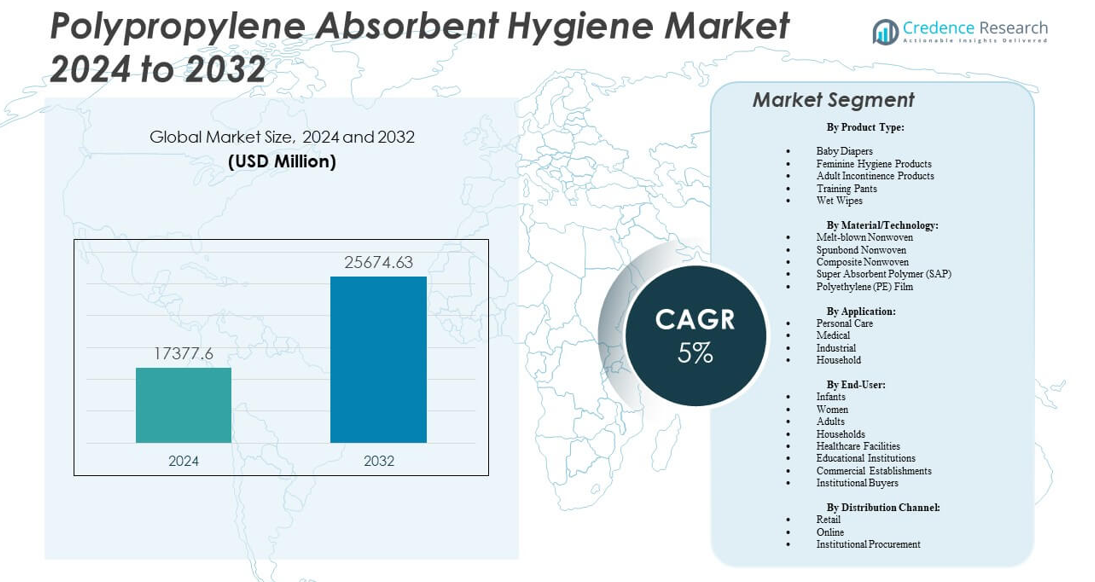

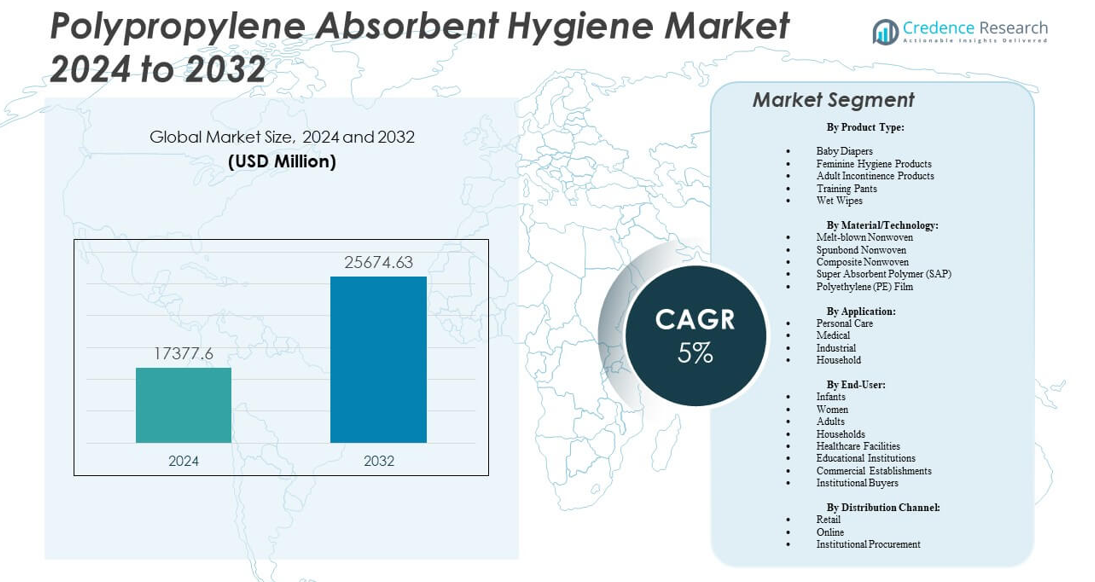

The Polypropylene Absorbent Hygiene Market is projected to grow from USD 17,377.6 million in 2024 to an estimated USD 25,674.63 million by 2032, with a compound annual growth rate (CAGR) of 5% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polypropylene Absorbent Hygiene Market Size 2024 |

USD 17,377.6 million |

| Polypropylene Absorbent Hygiene Market, CAGR |

5% |

| Polypropylene Absorbent Hygiene Market Size 2032 |

USD 25,674.63 million |

The market experiences strong growth due to rising hygiene awareness, urbanization, and expanding disposable income. Increasing demand for baby diapers, feminine hygiene products, and adult incontinence items strengthens consumption patterns worldwide. Manufacturers focus on comfort, absorbency, and eco-friendly materials to meet changing preferences. Rapid innovation in nonwoven fabric technologies enhances product performance and safety. Growing healthcare spending and aging demographics drive product usage in hospitals and personal care settings. E-commerce and organized retail channels improve product accessibility across both developed and emerging markets.

North America leads the Polypropylene Absorbent Hygiene Market due to high consumer awareness and established hygiene infrastructure. Europe follows with demand supported by strong regulatory standards and advanced healthcare systems. Asia-Pacific emerges as the fastest-growing region driven by rising birth rates, expanding urban populations, and increasing female workforce participation. Countries such as China, India, and Indonesia register strong product adoption through economic growth and improved retail reach. Latin America and the Middle East & Africa show steady expansion driven by better sanitation awareness and investment in localized manufacturing. It gains momentum globally with improving product availability and consumer lifestyle upgrades.

Market Insights:

- The Polypropylene Absorbent Hygiene Market is valued at USD 17,377.6 million in 2024 and expected to reach USD 25,674.63 million by 2032, growing at a CAGR of 5%.

- Growing hygiene awareness, urbanization, and disposable income drive strong demand for baby diapers, feminine hygiene, and adult incontinence products.

- High production costs and environmental concerns linked to non-biodegradable polypropylene limit market expansion.

- North America leads with around 40% share due to advanced hygiene infrastructure and purchasing power, followed by Europe at nearly 30%.

- Asia-Pacific records the fastest growth supported by population rise, retail expansion, and increasing adoption of disposable hygiene products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Hygiene Awareness and Evolving Consumer Lifestyle Patterns

The Polypropylene Absorbent Hygiene Market expands through growing hygiene consciousness among consumers worldwide. Urbanization, better education, and lifestyle modernization push higher adoption of sanitary products. Women’s hygiene, baby diapers, and adult incontinence items drive major consumption volumes. It benefits from increased disposable incomes and comfort-focused preferences. Governments and NGOs promote hygiene standards, improving product reach in rural regions. Premiumization trends encourage users to shift from traditional to disposable items. Continuous marketing campaigns enhance consumer understanding of personal care importance. Expanding product accessibility across both offline and online channels strengthens market penetration.

- For instance, Procter & Gamble’s EcoCare project achieved 10-25% material reduction by weight in the absorbent structure of baby diapers and period products while maintaining performance through innovative multilayer designs.

Technological Advancements in Nonwoven Fabric and Product Design

The Polypropylene Absorbent Hygiene Market gains momentum from innovation in nonwoven fabrics and absorbent cores. Companies use advanced melt-blown and spunbond technologies to improve comfort and fluid retention. Manufacturers integrate odor-control additives and breathable layers that boost user comfort. New absorbent cores offer thinner yet more efficient structures for better mobility. Automation in production reduces defects and enhances quality consistency. R&D investments enable biodegradable polypropylene variants that meet sustainability goals. It helps producers reduce dependency on traditional petrochemical feedstocks. Adoption of high-speed equipment supports mass production and cost reduction.

Expansion of Aging Population and Medical Hygiene Applications

The Polypropylene Absorbent Hygiene Market benefits from a global rise in elderly populations. Senior care products such as adult diapers and bed pads experience increased demand. Hospitals, clinics, and home care settings depend on absorbent materials for infection control. Polypropylene-based products ensure superior strength and quick liquid diffusion. Medical-grade hygiene supplies find use in wound dressings and surgical kits. Rising awareness about patient comfort drives product improvements. Companies introduce odor-neutralizing and antibacterial layers in premium ranges. It positions polypropylene hygiene products as vital components in healthcare systems.

- For instance, Essity’s ConfioAir Breathable Technology in adult incontinence products incorporates nonwoven polypropylene layers that enable 100% breathability, reducing skin irritation risks through optimized air flow.

Rising Penetration of E-Commerce and Retail Expansion

The Polypropylene Absorbent Hygiene Market strengthens through expanding e-commerce and organized retail networks. Online sales platforms make hygiene products accessible across remote and urban areas. Subscription-based diaper and hygiene packs gain popularity among working consumers. Retail chains increase product visibility through branded shelves and digital promotions. Manufacturers leverage data analytics to track consumer behavior and predict demand. Online education on product usage and hygiene habits fosters market expansion. It improves consumer trust and ensures repeat purchases. Retail partnerships enhance brand loyalty and regional market presence.

Market Trends

Sustainability and Shift Toward Eco-Friendly Hygiene Materials

The Polypropylene Absorbent Hygiene Market trends toward sustainability due to growing environmental awareness. Producers explore bio-based polypropylene and compostable fiber blends for hygiene items. Governments regulate plastic waste management, pushing greener materials adoption. Leading brands launch recyclable or partially degradable nonwovens. It encourages collaboration across packaging and raw material suppliers. Green certifications become essential for consumer trust. Rising eco-consciousness among millennials promotes biodegradable product lines. Manufacturers invest in closed-loop recycling and renewable resin sourcing initiatives.

- For instance, Borealis supplies Bornewables™ polypropylene grades derived from 100% waste vegetable oil to PFNonwovens Group for personal hygiene fabrics, certified under ISCC PLUS mass balance for renewable content claims.

Innovation in Product Customization and Smart Hygiene Solutions

The Polypropylene Absorbent Hygiene Market experiences innovation through smart hygiene solutions. Brands design gender-specific and age-specific products with targeted absorbency. Embedded wetness indicators improve convenience for caregivers. Lightweight, breathable designs enhance comfort in daily use. Manufacturers use AI-driven analytics to customize product designs based on consumer feedback. Intelligent packaging with QR-based product information increases user engagement. It enables companies to differentiate their offerings in competitive markets. Smart production methods improve efficiency and reduce material waste.

Growing Use of Polypropylene in Premium Diaper and Feminine Care Products

The Polypropylene Absorbent Hygiene Market grows through increasing use in premium diaper and feminine products. Polypropylene ensures durability, softness, and superior moisture management. Advanced fiber processing offers flexibility and smooth texture. Premium brands introduce skin-friendly topsheets made from hypoallergenic polypropylene blends. Growth in dual-income households supports higher spending on comfort-based products. It fuels demand for ultra-thin absorbent hygiene items with high retention. Producers innovate breathable back sheets and odor-control layers. Brand differentiation now centers on material softness and skin compatibility.

Integration of Circular Economy Practices and Waste Reduction Models

The Polypropylene Absorbent Hygiene Market aligns with circular economy frameworks to minimize waste. Manufacturers establish take-back programs for used hygiene products. Recycling technologies convert post-consumer nonwoven waste into reusable feedstock. Companies partner with waste management firms to create recovery pipelines. Governments offer incentives for sustainable material transition. It promotes long-term value creation through reduced carbon impact. R&D focuses on minimizing microplastic release during disposal. This transition improves corporate reputation and enhances stakeholder engagement.

- For instance, Procter & Gamble licenses dissolution recycling technology to PureCycle Technologies, enabling production of 3.4 million pounds of PureFive™ recycled polypropylene resin in Q2 2025 for potential hygiene packaging reuse.

Market Challenges Analysis

Environmental Concerns and Pressure to Reduce Plastic Footprint

The Polypropylene Absorbent Hygiene Market faces scrutiny over its plastic waste generation. Non-biodegradable polypropylene contributes to landfill accumulation, raising sustainability debates. Stringent government regulations limit single-use plastic production in several countries. Developing biodegradable polypropylene alternatives involves high cost and technical hurdles. Consumers increasingly demand eco-friendly products, forcing innovation investment. Recycling infrastructure remains inadequate in many developing regions. It slows adoption of circular economy principles. Balancing affordability and environmental compliance challenges both producers and policymakers.

Volatile Raw Material Prices and Supply Chain Dependence

The Polypropylene Absorbent Hygiene Market suffers from volatility in raw material prices. Fluctuations in crude oil impact polypropylene resin costs directly. Global supply chain disruptions affect feedstock availability and production stability. High transportation costs and trade restrictions hinder timely deliveries. Manufacturers struggle to maintain pricing stability amid rising input expenses. It creates pressure on profit margins for large and small producers. Dependency on petrochemical suppliers limits flexibility in sourcing. Developing localized supply chains becomes essential for long-term cost management.

Market Opportunities

Rising Adoption of Biodegradable Polypropylene and Green Manufacturing Initiatives

The Polypropylene Absorbent Hygiene Market creates opportunity through biodegradable and sustainable production innovation. Brands invest in bio-based polypropylene made from renewable feedstocks. Manufacturing processes adopt energy-efficient and low-emission technologies. Government incentives support green material research and development. It enables producers to tap into growing eco-conscious consumer segments. Collaborations with material science firms help improve product recyclability. Market leaders differentiate through transparent sustainability labeling. Adoption of closed-loop production strengthens brand image and customer retention.

Growing Demand Across Emerging Economies and Healthcare Expansion

The Polypropylene Absorbent Hygiene Market finds opportunity in emerging economies with rising healthcare awareness. Expanding hospital networks and improved sanitation drive material consumption. Governments promote national hygiene programs to improve public health outcomes. Affordable product lines target middle-income populations seeking basic hygiene solutions. It encourages foreign investment in local manufacturing facilities. Expansion of retail networks ensures strong market accessibility. International players form partnerships with regional distributors to improve supply efficiency. Rising awareness of infant and elderly care fuels long-term market growth.

Market Segmentation Analysis:

By Product Type

The Polypropylene Absorbent Hygiene Market expands across multiple product categories led by baby diapers and feminine hygiene products. Baby diapers hold the largest share, driven by rising birth rates and increased awareness of infant care. Feminine hygiene products such as sanitary napkins and panty liners record strong demand in both developed and emerging economies. Adult incontinence products gain traction with the growing elderly population and improved healthcare awareness. Training pants show steady adoption among toddlers in developed markets. Wet wipes continue to grow with increased personal care and household use. It benefits from innovation in comfort, fit, and fluid absorption efficiency.

- For instance, Kimberly-Clark’s Huggies Little Snugglers diapers use polypropylene for softness, durability, and protection, featuring 37% less leaks versus leading store brands.

By Material/Technology

The Polypropylene Absorbent Hygiene Market relies heavily on melt-blown, spunbond, and composite nonwovens. Spunbond nonwovens dominate due to their softness and breathability. Melt-blown variants support fluid retention layers in hygiene items. Composite nonwovens combine durability and flexibility for high-performance absorbent products. Super Absorbent Polymers (SAPs) improve liquid retention capacity, ensuring dryness and comfort. Polyethylene (PE) films act as protective barriers that prevent leakage. It achieves balance between softness, elasticity, and durability through material optimization.

By Application

Personal care dominates applications, covering baby, feminine, and adult hygiene segments. Medical applications follow, with usage in surgical drapes, gowns, and wound care pads. Industrial and household uses expand through cleaning wipes and protective wear. The Polypropylene Absorbent Hygiene Market benefits from material versatility supporting hygiene, safety, and convenience across diverse sectors. It ensures consistent quality, strength, and absorbency performance across applications.

- For instance, Huggies Little Snugglers diapers provide up to 100% leakproof and blowout protection using polypropylene layers.

By End-User

The Polypropylene Absorbent Hygiene Market caters to a broad consumer base, led by infants and women. Adults and healthcare facilities form strong secondary segments with rising incontinence and hygiene awareness. Households, educational institutions, and commercial establishments use hygiene supplies for cleaning and sanitation purposes. Institutional buyers, including hospitals and nursing homes, ensure steady bulk demand. It provides targeted solutions that address hygiene requirements across different demographic and professional environments.

By Distribution Channel

Retail distribution dominates the Polypropylene Absorbent Hygiene Market through supermarkets, pharmacies, and specialty stores. Online channels gain rapid traction with the rise of e-commerce and subscription-based hygiene product delivery. Institutional procurement remains vital for hospitals, schools, and nursing facilities. It benefits from digital marketing, improved accessibility, and brand visibility across global markets.

Segmentation:

By Product Type:

- Baby Diapers

- Feminine Hygiene Products

- Adult Incontinence Products

- Training Pants

- Wet Wipes

By Material/Technology:

- Melt-blown Nonwoven

- Spunbond Nonwoven

- Composite Nonwoven

- Super Absorbent Polymer (SAP)

- Polyethylene (PE) Film

By Application:

- Personal Care

- Medical

- Industrial

- Household

By End-User:

- Infants

- Women

- Adults

- Households

- Healthcare Facilities

- Educational Institutions

- Commercial Establishments

- Institutional Buyers

By Distribution Channel:

- Retail

- Online

- Institutional Procurement

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds a leading position in the global polypropylene absorbent hygiene market with roughly 40% market share. The region benefits from high disposable income and strong consumer hygiene awareness. Consumers in the U.S. and Canada increasingly prefer disposable diapers and adult incontinence products. Manufacturers leverage advanced production and strong retail networks to maintain dominance.

Europe follows with near 30% of global share. Markets such as Germany, France and the UK show steady demand, supported by aging populations and robust healthcare infrastructure. Consumers there emphasize quality, comfort and environmental standards for absorbent hygiene products. Regulatory focus on hygienic and sustainable products further drives adoption.

Asia-Pacific represents about 39.36% share worldwide in 2024, making it the fastest growing region. Rapid urbanization, rising middle-class incomes and growing birth rates in countries such as China and India fuel demand. Manufacturers expand capacity locally to meet rising demand for baby diapers and feminine hygiene items. Emerging markets across Southeast Asia also show strong uptake due to rising hygiene awareness and expanding retail channels

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Asahi Kasei Corporation

- Kimberly-Clark Corporation

- Essity AB

- DuPont de Nemours, Inc.

- Procter & Gamble (P&G)

- Mitsui Chemicals, Inc.

- Fibertex Nonwovens A/S

- Hengan International Group Co., Ltd.

- Global Nonwovens

- Georgia-Pacific Consumer Products LP

- C&S Paper Co., Ltd.

- CNC International Co., Ltd.

Competitive Analysis:

The polypropylene absorbent hygiene market features several established global and regional players with strong manufacturing and distribution capabilities. Leading firms such as Procter & Gamble, Kimberly‑Clark and Unicharm maintain strong presence through diversified product portfolios spanning baby diapers, adult incontinence and feminine hygiene. These companies leverage advanced nonwoven and super-absorbent polymer technologies to deliver superior fluid retention and comfort. Smaller and regional manufacturers compete by offering cost-effective products tailored to emerging markets. Some focus on local distribution networks and lower-cost manufacturing bases to capture value-sensitive segments. Competition intensifies around raw-material sourcing, production efficiency and regulatory compliance. Innovations in biodegradable materials and non-woven composites offer differentiation opportunities. Market players that invest in such innovations may gain competitive edge while those reliant on traditional polypropylene may face pressure from evolving consumer preferences and regulatory trends.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Material/Technology, Application, End-User and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polypropylene Absorbent Hygiene Market will continue expanding with strong demand for disposable hygiene products driven by lifestyle changes and urbanization.

- Product innovation will focus on lighter, softer, and more breathable materials improving user comfort and sustainability.

- Rising eco-awareness will accelerate development of biodegradable and bio-based polypropylene nonwovens.

- Growing aging populations will boost sales of adult incontinence products across developed and emerging economies.

- Digital retail channels will transform product accessibility through targeted marketing and subscription-based models.

- Manufacturers will focus on energy-efficient production and circular economy practices to reduce plastic waste.

- Healthcare infrastructure expansion will drive higher demand for medical hygiene supplies using polypropylene materials.

- Strategic partnerships between raw material suppliers and hygiene brands will improve supply chain resilience.

- Advanced polymer technologies will enhance product performance with improved absorbency and odor control.

- The market will see higher competition, with global brands expanding into regional markets through localized production.