Market Overview:

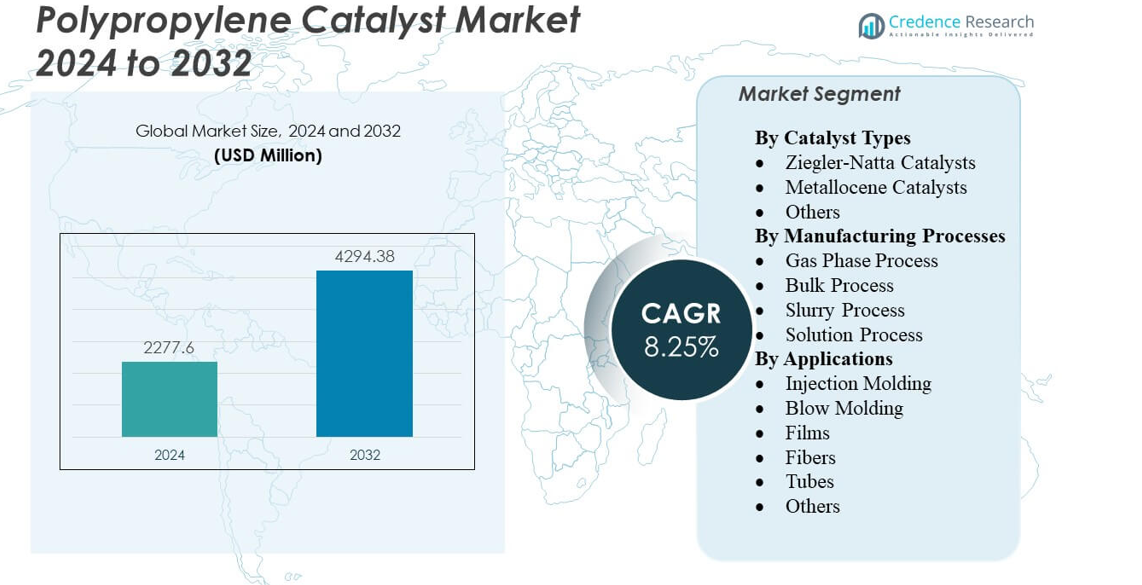

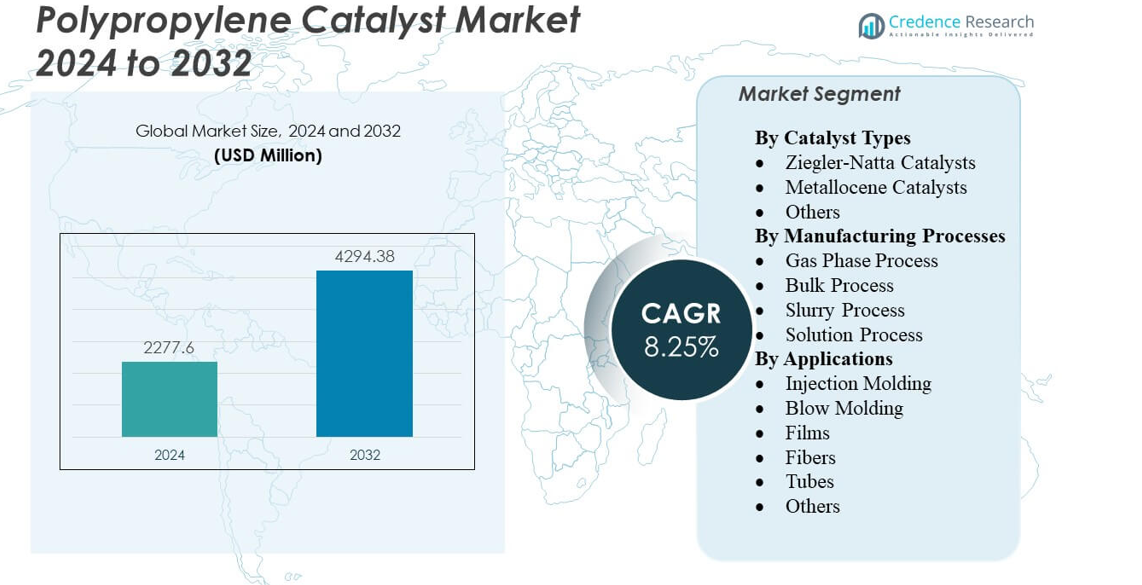

The Polypropylene Catalyst Market is projected to grow from USD 2277.6 million in 2024 to an estimated USD 4294.38 million by 2032, with a compound annual growth rate (CAGR) of 8.25% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polypropylene Catalyst Market Size 2024 |

USD 2277.6 million |

| Polypropylene Catalyst Market, CAGR |

8.25% |

| Polypropylene Catalyst Market Size 2032 |

USD 4294.38 million |

Market drivers shape steady advancement for producers and converters. Rising preference for high-performance polypropylene grades pushes users to adopt advanced catalyst systems that support clarity, stiffness, and purity needs. Strong focus on process optimization encourages plants to upgrade catalyst lines for better stability and controlled polymerization behavior. Automotive and medical applications enhance demand for clean and durable resin types. Packaging growth supports wider use in film and rigid container segments. Producers invest in R&D to match shifting application profiles. Technology innovations raise product differentiation across the catalyst spectrum.

Regional dynamics highlight varied momentum across global hubs. Asia Pacific leads due to strong polypropylene capacity in China, India, Japan, and South Korea, supported by broad packaging and mobility industries. North America shows stable progress through integrated refining networks and technology-driven catalyst upgrades. Europe maintains strength in premium resin markets tied to medical, automotive, and regulatory-driven applications. Latin America and the Middle East emerge with new complexes and rising conversion demand. Global expansion and modernization efforts reinforce long-term catalyst consumption

Market Insights:

- The Polypropylene Catalyst Market is projected to grow from USD 2277.6 million in 2024 to USD 4294.38 million by 2032, supported by a CAGR of 8.25%.

- Demand rises due to stronger need for high-performance polypropylene grades that require advanced catalyst systems.

- Growth faces restraints linked to regulatory pressure, residue control limits, and high development costs for next-generation catalyst technologies.

- Asia Pacific leads due to large polypropylene capacity, while North America and Europe maintain steady demand through mature industrial bases.

- Emerging regions such as Latin America and the Middle East expand catalyst use through new complexes and rising polymer conversion activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Performance Polypropylene Grades

Growing preference for stronger polypropylene grades drives steady catalyst adoption across major plants. Producers upgrade systems to meet higher purity needs in films and molded parts. Packaging units seek catalysts with stable yield and narrow molecular weight distribution. Automotive firms prefer cleaner grades for weight reduction programs. Healthcare applications demand resins with low extractables. The Polypropylene Catalyst Market benefits from wider conversion demand. It supports reliable output across upstream and downstream chains. Rising use of advanced reactor setups strengthens catalyst use.

- For instance, LyondellBasell has developed advanced diether catalysts used in Spheripol polypropylene plants to improve resin consistency and reduce reactor fouling. These catalysts support higher operational stability and help optimize production efficiency across large commercial units.

Shift Toward Improved Process Efficiency Across Production Lines

Producers aim to cut operating losses through efficient catalyst types that boost reactor output. Modern designs help reduce residue levels in polymer streams. Plants favor systems that offer faster activation during cycles. Consistent particle size distribution improves resin quality. Industrial users need stable catalysts that sustain high volumes without performance drops. The Polypropylene Catalyst Market gains traction through these process gains. It helps improve energy balance across many production hubs. Higher efficiency targets continue to reshape catalyst preferences.

- For instance, Clariant’s fourth-generation PolyMax® 600 Series catalysts demonstrated up to a 25% reduction in reactor fouling during commercial PP runs, improving throughput stability.

Growing Adoption of Metallocene and Post-Metallocene Catalyst Systems

Demand for specialized polypropylene grades pushes users toward metallocene and post-metallocene solutions. These systems offer narrow property variation in advanced film and fiber lines. Producers rely on them to deliver clarity and tensile strength. Catalysts support lighter packaging formats without quality loss. Automotive users need impact-resistant grades for complex applications. The Polypropylene Catalyst Market benefits from these technology upgrades. It gains support from steady diversification in reactor operations. Strong interest in tailored materials raises adoption.

Expansion of Polypropylene Capacity Across Emerging Regions

Large plants in Asia Pacific and the Middle East increase catalyst use through new units. Operators build integrated complexes that support sustainable production routes. Strong downstream activity prompts higher catalyst intake. Producers in fast-growing regions focus on improving resin value. Local converters demand better performance in films and rigid products. The Polypropylene Catalyst Market grows due to these capacity shifts. It strengthens industry participation across global hubs. New investments raise long-term catalyst consumption.

Market Trends

Higher Focus on Catalyst Customization for Niche Polypropylene Grades

Catalyst makers design specialized systems to target niche grades for fibers and films. Custom solutions improve melt behavior across many processing lines. Packaging firms need unique clarity and stiffness levels. Medical users prefer grades with enhanced cleanroom compatibility. Producers work on tailored kinetics to improve output control. The Polypropylene Catalyst Market aligns with this shift in customization. It supports wider product portfolios in competitive sectors. Strong interest in tailored grades reshapes catalyst development.

- For instance, W. R. Grace’s CONSISTA non-phthalate catalysts are engineered to improve isotacticity control in polypropylene production, supporting clearer and stiffer resins for packaging and film applications. These catalysts help producers achieve better processing efficiency and enhanced mechanical performance across high-volume product lines.

Rising Integration of Digital Control and Automation in Catalyst Use

Producers deploy digital tools that track catalyst behavior during production cycles. Automated systems improve dosing accuracy for consistent polymer quality. Plants monitor cycle stability with real-time sensors. Predictive tools help reduce downtime in dense production zones. Users optimize settings to maintain resin performance. The Polypropylene Catalyst Market gains visibility through digital adoption. It aligns with improved precision targets across modern plants. Automation strengthens control over process variables.

Growing Emphasis on Cleaner and Low-Residue Catalyst Technologies

Global producers shift toward cleaner catalyst routes to reduce polymer contamination. Low-residue designs help improve safety across sensitive applications. Packaging and healthcare sectors demand higher purity standards. Producers refine activation methods to reduce impurity profiles. Environmental rules push firms to redesign catalyst mixes. The Polypropylene Catalyst Market adapts to these cleaner routes. It supports long-term sustainability goals in polymer supply. Demand for safer catalyst options rises each year.

Stronger Movement Toward Circular and Renewable Polypropylene Pathways

Producers explore catalysts that support recycling and renewable feedstock streams. Advanced systems help enhance melt flow for circular polymers. Film and fiber makers adopt solutions that support recycled blends. Clean processing improves resin integrity during reuse cycles. Brands aim to raise recycled content in packaging. The Polypropylene Catalyst Market aligns with these circular goals. It supports renewable programs across major resin makers. New pathways encourage steady catalyst innovation.

- For instance, Grace’s polypropylene catalyst technologies, including advanced non-phthalate systems, support strong copolymer capability and broad grade versatility across films and fibers. These catalysts help producers improve processing efficiency and enable performance targets aligned with modern sustainability needs in packaging and textile applications.

Market Challenges Analysis

Complexity in Achieving Consistent Catalyst Performance Across Diverse Applications

Producers face difficulty in maintaining uniform behavior across many polypropylene grades. Catalyst performance varies due to feedstock quality shifts. Plants must handle wide property targets in films, fibers, and molded parts. Reactor design changes add operational strain. Users prefer systems that keep variation low, which raises development pressure. The Polypropylene Catalyst Market works to meet these strict demands. It supports continuous testing cycles to improve stability. Tough performance targets limit easy optimization.

Regulatory Pressures and Rising Sustainability Compliance Requirements

Global rules push producers toward safer catalyst routes with lower toxic profiles. Compliance needs raise development timelines. Plants must redesign systems to reduce emissions and waste. Clean technology upgrades require heavy investments. Market shifts toward renewable feedstocks add complexity. The Polypropylene Catalyst Market adapts to these evolving rules. It balances cost and performance targets across regions. High compliance needs restrict rapid adoption.

Market Opportunities

Expansion of High-Value Polypropylene Applications Across Key Sectors

New uses in medical devices, advanced packaging, and lightweight automotive parts create fresh catalyst demand. Producers work on systems that improve resin certainty for critical applications. Better control over molecular structure opens doors for new designs. Film makers seek tailored flow behavior for next-gen formats. Growth in healthcare and electric mobility adds long-term demand. The Polypropylene Catalyst Market gains new opportunity in these shifts. It supports innovation across diverse supply chains. Expanding end-use cases fuel catalyst upgrades.

Growing Investments in Next-Generation Catalyst Platforms

R&D teams explore catalyst architectures that boost output and material precision. New forms help cut residue levels in sensitive resin streams. Plants test hybrid systems to reach unique property targets. Producers adopt advanced modeling tools to refine catalyst reactions. Global integration of large complexes lifts long-term investment cycles. The Polypropylene Catalyst Market benefits from these technical advances. It aligns with global demand for cleaner polymers. Rising innovation improves future market potential.

Market Segmentation Analysis:

By Catalyst Types

Ziegler-Natta catalysts dominate due to strong use across packaging, construction, and agriculture. Producers prefer them for cost stability and broad grade flexibility. Metallocene catalysts gain traction due to narrow molecular weight distribution and reliable control in premium films and fibers. Users adopt these grades for clarity, stiffness, and purity targets. Others include advanced systems developed for specialty polymers. The Polypropylene Catalyst Market benefits from diversification across catalyst families. It supports performance shifts across major resin categories. Growing demand for tailored materials strengthens long-term catalyst use.

- For instance, LyondellBasell’s Avant ZN catalysts support production of polypropylene grades with melt flow rates exceeding 60 g/10 min in commercial operations, enabling high-output film and molding applications.

By Manufacturing Processes

Gas phase processes lead due to clean output and low manual handling. Producers pick this route for stable flows and efficient mass production. Bulk processes follow due to strong yield behavior in large reactors. Slurry systems remain relevant for controlled polymerization in select facilities. Solution processes help create specialty grades that need narrow structural variation. The Polypropylene Catalyst Market supports each process based on operational goals. It helps plants match reactor design with catalyst performance. Diverse setups improve global production flexibility.

- For instance, Grace’s UNIPOL PP gas-phase technology operates reactors exceeding 450 kilotonnes per year, using optimized catalysts that reduce fines generation and improve run length stability.

By Applications

Injection molding leads due to strong demand from automotive, appliances, and medical products. Blow molding follows due to container and packaging needs. Films gain steady growth from flexible packaging expansion. Fibers support textile and hygiene product production. Tubes hold relevance in industrial and fluid-handling systems. Others include custom items produced for niche markets. The Polypropylene Catalyst Market enables precise grade control across these applications. It aligns catalyst choice with property targets across sectors.

Segmentation:

By Catalyst Types

- Ziegler-Natta Catalysts

- Metallocene Catalysts

- Others

By Manufacturing Processes

- Gas Phase Process

- Bulk Process

- Slurry Process

- Solution Process

By Applications

- Injection Molding

- Blow Molding

- Films

- Fibers

- Tubes

- Others

By Regions

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe

North America holds roughly 22% share due to strong polypropylene production and advanced catalyst adoption in packaging and automotive sectors. Producers in the U.S. invest in cleaner catalyst systems that improve resin performance. Europe accounts for nearly 18% share driven by premium polymer demand in medical and regulated industries. Local firms focus on catalysts that support low-residue grades for sensitive applications. Regional sustainability rules push users toward next-generation systems. The Polypropylene Catalyst Market gains support from these mature industrial bases. It maintains steady progress through consistent demand across downstream sectors.

Asia Pacific

Asia Pacific leads with nearly 48% share driven by large polypropylene capacity in China, India, Japan, and South Korea. Producers expand integrated petrochemical complexes to meet rising polymer demand. Strong growth in packaging, mobility, and consumer goods drives heavy catalyst use. Regional firms adopt both Ziegler-Natta and metallocene systems to improve resin properties. Technology upgrades support reliable output across new production lines. The Polypropylene Catalyst Market benefits from this fast expansion cycle. It gains long-term momentum from strong investment activity in major economies.

Latin America and Middle East & Africa

Latin America holds close to 7% share driven by expanding polymer conversion industries in Brazil and Mexico. Local users seek catalysts that improve yield and lower operational cost. Middle East & Africa account for nearly 5% share supported by new petrochemical complexes in GCC countries. Regional firms focus on building competitive capacity through integrated refining networks. Emerging converters demand better resin grades for packaging and infrastructure uses. The Polypropylene Catalyst Market gains traction through rising production footprints. It expands with new industrial zones entering the global supply chain.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The competitive landscape features catalyst producers that focus on technology advancement, portfolio expansion, and deeper integration with polypropylene resin makers. Leading companies refine Ziegler-Natta systems to boost consistency in large reactors, while metallocene suppliers target higher value segments in films, fibers, and medical applications. Firms invest in low-residue and high-activity catalyst families to support quality needs across regulated industries. Many players align with sustainability goals by developing catalysts that enable efficient use of recycled or renewable feedstocks. Partnerships between catalyst developers and polymer producers improve process optimization across regions. The Polypropylene Catalyst Market strengthens competitive pressure through steady innovation cycles. It encourages suppliers to enhance technical support, scale pilot testing, and diversify application-focused catalyst grades. Companies gain advantage through strong integration, wider regional presence, and rapid commercialization of next-generation platforms.

Recent Developments:

- In May 2024, LyondellBasell completed acquisition of a 35% stake in National Petrochemical Industrial Company (NATPET) of Saudi Arabia from Alujain. This expands LYB’s core polypropylene business and access to advantaged feedstocks.

Report Coverage:

The research report offers an in-depth analysis based on Catalyst Types, Manufacturing Processes and Applications. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced catalyst grades will rise due to stronger production needs in key downstream sectors.

- Cleaner catalyst systems will gain traction as more producers target low-residue polymer grades.

- Metallocene platforms will expand in premium applications that require narrow molecular weight distribution.

- Digital tools will improve control over catalyst performance across large reactors in major complexes.

- New complexes in emerging regions will widen global catalyst consumption across expanding supply chains.

- Firms will invest in R&D to improve activation behavior and stability across shifting feedstock conditions.

- Growth in lightweight automotive components will support steady need for high-performance polypropylene.

- Packaging converters will seek catalysts that enhance clarity, stiffness, and process speed in film lines.

- Sustainability programs will push producers toward catalyst paths that align with circular polymer goals.

- Global players will strengthen partnerships to expand technical support and improve grade flexibility.