Market Overview:

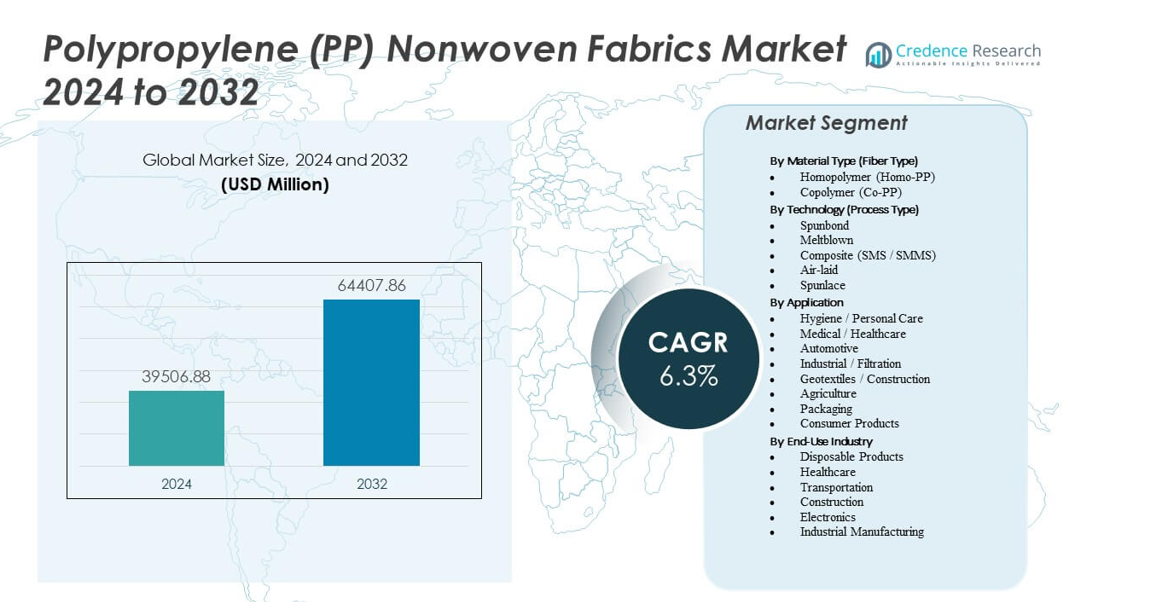

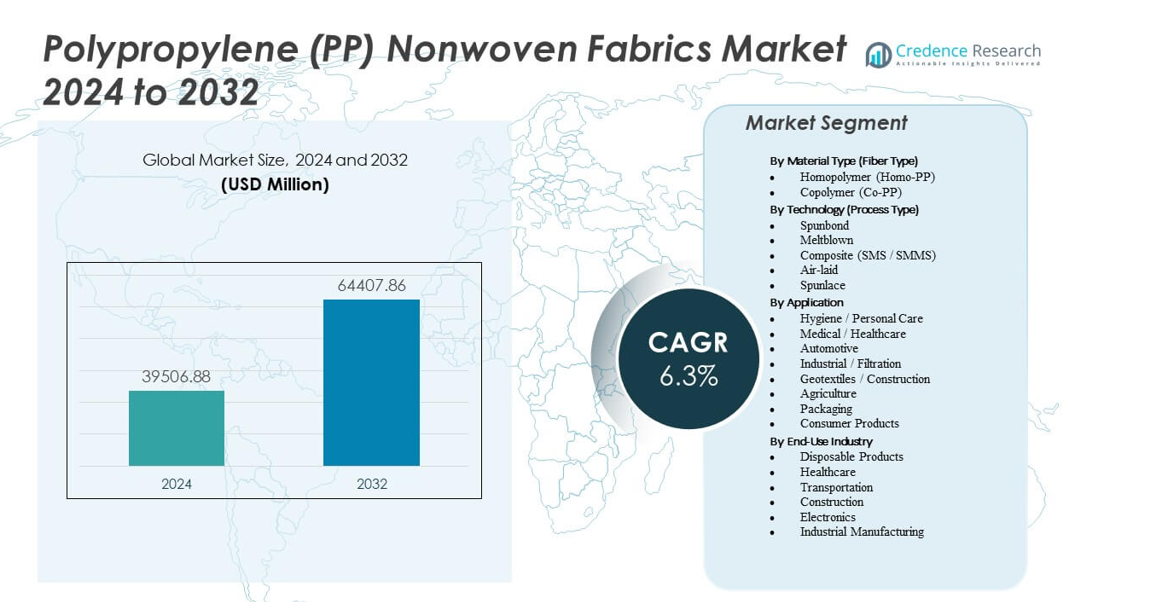

The Polypropylene (PP) Nonwoven Fabrics Market is projected to grow from USD 39,506.88 million in 2024 to an estimated USD 64,407.86 million by 2032, with a compound annual growth rate (CAGR) of 6.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polypropylene (PP) Nonwoven Fabrics Market Size 2024 |

USD 39,506.88 million |

| Polypropylene (PP) Nonwoven Fabrics Market, CAGR |

6.3% |

| Polypropylene (PP) Nonwoven Fabrics Market Size 2032 |

USD 64,407.86 million |

Rising demand for disposable hygiene and medical products drives strong market growth. Manufacturers increase capacity to meet expanding needs for masks, diapers, and surgical textiles. Automotive firms integrate PP nonwoven for lightweight interiors and acoustic insulation. It delivers strong resistance to chemicals and fluids, making it suitable for protective gear and filtration. Rapid urbanization and higher healthcare spending strengthen market penetration in emerging economies. Continuous technological improvements support enhanced softness, absorption, and durability across key applications.

Asia Pacific dominates production and consumption due to large manufacturing bases in China and India. North America and Europe maintain steady growth supported by healthcare and automotive sectors emphasizing quality and sustainability. Latin America shows potential through rising middle-class demand for hygiene and household goods. The Middle East and Africa display increasing adoption in medical and construction uses. It reflects rising investments from global players seeking to expand regional capacity. Competitive cost advantages and high output efficiency make Asia Pacific the growth center of the global industry.

Market Insights:

- The Polypropylene (PP) Nonwoven Fabrics Market is valued at USD 39,506.88 million in 2024 and projected to reach USD 64,407.86 million by 2032, growing at a CAGR of 6.3%.

- Strong demand for hygiene and medical products such as diapers, wipes, and surgical masks drives continuous market expansion.

- Rising environmental concerns and strict plastic waste regulations restrain market growth, pushing producers toward recyclable PP grades.

- Asia Pacific leads global production with robust manufacturing capacity in China and India, supported by lower costs and export strength.

- North America and Europe maintain stable demand, focusing on sustainable production and high-performance applications in healthcare and automotive sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand for Hygiene and Medical Applications

The Polypropylene (PP) Nonwoven Fabrics Market expands strongly due to increasing hygiene product use. Rising birth rates and higher disposable incomes boost diaper and sanitary napkin consumption. Healthcare sectors depend on PP nonwoven fabrics for medical gowns, masks, and wipes. It delivers excellent filtration, softness, and cost-efficiency for disposable products. Manufacturers focus on ensuring better comfort and fluid resistance in clinical use. Rapid awareness about hygiene supports product expansion across developing countries. Consumer preference for single-use protective items enhances market penetration. Innovation in spunbond and meltblown processes supports consistent performance in hygiene goods.

Rising Adoption in Automotive and Construction Sectors

Automotive producers use PP nonwoven fabrics for lightweight interiors, carpets, and insulation panels. It enables weight reduction and fuel efficiency in vehicles. Construction sectors employ nonwoven fabrics for roofing, geotextiles, and insulation layers. PP-based solutions offer high tensile strength and chemical resistance in demanding conditions. Growing infrastructure development across Asia-Pacific and the Middle East fuels consumption. Sustainable, recyclable PP variants gain attention for green construction goals. Demand strengthens from OEMs seeking durable and easy-to-process materials. Expanding industrialization promotes broader application in insulation and soundproofing materials.

- For instance, Asahi Kasei developed PP nonwoven-based electret filters achieving 99.97% filtration efficiency at 0.3-micron particles for automotive cabin air applications. It enables weight reduction and fuel efficiency in vehicles.

Advancements in Production Technology and Fabric Performance

Manufacturers focus on developing advanced meltblown and spunbond lines for uniform quality. Automation and AI integration enhance precision during fiber distribution. It reduces production waste and improves consistency across product batches. New polymer blends deliver higher softness and breathability in end-use applications. Firms upgrade filtration fabrics for healthcare and industrial segments. Technological upgrades support mass customization for consumer and industrial needs. Increased R&D investments from global players improve product diversity. Integration of sustainable additives further enhances product value and market reach.

Rising Environmental Awareness and Sustainability Focus

Growing consumer concern for environmental safety drives interest in recyclable nonwoven fabrics. Companies shift to eco-friendly polypropylene grades for minimal carbon footprint. It improves sustainability credentials in hygiene and medical products. Governments encourage waste reduction by supporting recyclable packaging and textile initiatives. Producers emphasize closed-loop recycling systems to reuse polymer materials. The market aligns with circular economy targets by reducing landfill waste. Adoption of bio-based polypropylene resins expands green product portfolios. These efforts strengthen brand reputation and consumer loyalty across global markets.

- For instance, Freudenberg Performance Materials advanced sustainability through closed-loop recycling systems, recovering over 90% of production waste for reuse in nonwoven products. Companies shift to eco-friendly polypropylene grades for minimal carbon footprint.

Market Trends

Expansion of Smart Nonwoven Fabrics for Technical Applications

The Polypropylene (PP) Nonwoven Fabrics Market observes rising development of smart fabrics for filtration and sensors. Integration of nanofibers enhances material responsiveness and durability. Smart PP fabrics find growing use in filtration, energy storage, and biomedical patches. It supports continuous innovation for functional performance in high-end applications. Advanced coatings improve conductivity and anti-bacterial characteristics. Manufacturers integrate electronic elements within fabric structures to add value. Smart production lines enhance precision for niche industrial use. This shift highlights a move toward multifunctional and adaptive textile solutions.

- For instance, Ahlstrom-Munksjö’s Nano GT filter media, layered with electrospun nanofibers, achieves ePM1 80% efficiency (ISO16890) for fine dust protection in gas turbines while delivering low pressure drop.

Shift Toward Bio-Based and Recycled Polypropylene Grades

Sustainability dominates the market with bio-based polypropylene gaining importance. Firms explore recycled polymer sources to cut carbon emissions. It aligns with corporate sustainability goals and circular economy policies. Eco-friendly nonwoven fabrics attract strong demand from hygiene and packaging industries. Global manufacturers introduce polypropylene grades compatible with mechanical recycling. Brand owners promote low-impact materials to meet consumer awareness. These efforts reshape sourcing strategies across the value chain. Investment in green polymer chemistry supports long-term growth for sustainable products.

Digitalization and Automation in Manufacturing Processes

Digital transformation improves efficiency in PP nonwoven fabric production. Smart monitoring systems ensure better fiber consistency and reduced defects. It increases yield and reduces operational downtime in high-speed lines. Automated inspection tools support quality assurance across diverse product ranges. Robotics integration enhances scalability for hygiene and filtration product categories. Real-time analytics allow predictive maintenance to limit waste. Automation drives competitiveness among global producers seeking higher throughput. This trend improves supply reliability and production economics across the industry.

- For instance, Berry Global’s nonwoven facilities achieved zero-waste-to-landfill status across multiple sites, supported by automated processes minimizing operational waste.

Customization and Innovation for End-Use Diversification

End-users demand tailored PP nonwoven fabrics for comfort, texture, and functionality. It fuels customization in fiber density, bonding technique, and surface finishes. Consumer goods and automotive brands specify advanced product properties. Nonwoven producers expand R&D to design differentiated materials for high-performance sectors. The shift toward premium hygiene and protective textiles shapes innovation pipelines. New surface treatments improve fabric feel and moisture control. Broader application potential in filtration, packaging, and apparel enhances growth prospects. This movement ensures sustained relevance across emerging and mature markets.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Pressure

The Polypropylene (PP) Nonwoven Fabrics Market faces constraints from volatile polypropylene resin costs. Crude oil price instability directly influences raw material expenses. It limits profit margins for manufacturers dependent on bulk polymer supply. Supply chain disruptions increase delivery lead times and logistics costs. Regional imbalance in resin availability raises procurement challenges. Smaller producers struggle to compete against integrated global players. Maintaining price competitiveness becomes difficult under fluctuating input costs. Continuous monitoring and strategic sourcing are vital to manage financial exposure.

Environmental Regulations and Waste Disposal Limitations

Rising scrutiny over plastic waste disposal impacts market perception. Regulatory frameworks in Europe and North America demand recycling compliance. It forces producers to adopt cleaner technologies and biodegradable solutions. Limited recycling infrastructure in developing nations constrains circular use. Nonwoven waste disposal remains a key concern in single-use hygiene products. Companies invest in eco-design to meet green certification requirements. Compliance costs increase production complexity for large-scale facilities. Addressing these barriers requires stronger policy alignment and technological innovation.

Market Opportunities

Emerging Applications Across Healthcare, Filtration, and Agriculture

The Polypropylene (PP) Nonwoven Fabrics Market benefits from expanding use in diverse industries. Medical and healthcare applications require high barrier protection and breathability. It supports innovation in surgical drapes, masks, and wound-care products. Filtration systems use PP fabrics for air and liquid purification. Agricultural sectors adopt them for crop protection, moisture control, and weed barriers. Growth in these domains enhances the need for durable, high-performance materials. Technological advances enable targeted properties to match application demands. Continuous R&D creates opportunities for premium nonwoven fabric solutions.

Growing Investment in Regional Manufacturing and Sustainability Initiatives

Asia-Pacific, Latin America, and the Middle East attract rising investment in nonwoven facilities. It helps reduce import dependency and ensures cost-effective local production. Global firms collaborate with regional partners for technology sharing and workforce training. Sustainability programs encourage renewable energy use in fabric manufacturing. Green product certification builds credibility in export markets. Digital monitoring supports efficient energy use and reduced waste generation. Local capacity expansion strengthens global competitiveness for key players. This momentum fosters inclusive growth across emerging economies and sustainable manufacturing practices.

Market Segmentation Analysis:

By Material Type (Fiber Type)

The Polypropylene (PP) Nonwoven Fabrics Market shows strong preference for homopolymer due to its superior tensile strength and process stability. Homopolymer supports high-speed production and consistent fiber quality in hygiene and packaging applications. Copolymer grades gain traction where improved softness, flexibility, and thermal resistance are required. It enhances comfort in medical and personal care products. Manufacturers use copolymers for superior bonding and better drape in end-use goods. The balance between cost and performance keeps both variants relevant across diverse sectors.

- For instance, BASF Procom® D 1118 homopolymer PP exhibits a tensile strength at yield of 16.0 MPa and elongation at break of ≥50%, supporting high-speed production in hygiene and packaging applications.

By Technology (Process Type)

Spunbond technology dominates due to its scalability and low production cost. It supports mass manufacturing for diapers, filters, and automotive linings. Meltblown gains share for filtration and medical barrier applications needing fine fibers. Composite types such as SMS and SMMS enhance durability through layered structures. Air-laid and spunlace methods target specialized hygiene and industrial uses where softness and absorption matter. It offers flexibility in texture, weight, and function. Continuous process innovation expands performance limits for each technology segment.

- For instance, spunbonded nonwoven substrates demonstrate an average tensile modulus of 83,100 N/m width (58.8 g/tex), enabling mass manufacturing for diapers, filters, and automotive linings.

By Application

Hygiene and personal care remain major revenue generators, supported by high disposable product use. Medical applications rise with demand for nonwoven gowns, masks, and drapes. Automotive firms adopt PP nonwovens for lightweight interiors and insulation. Industrial and filtration uses expand due to strong air and liquid treatment needs. Construction and geotextiles use nonwovens for stability and erosion control. Agriculture benefits from ground covers and crop protection layers. Packaging and consumer goods extend PP nonwoven adoption through versatile material use.

By End-Use Industry

Disposable products dominate volume share due to wide consumer hygiene adoption. Healthcare follows closely with strong medical textile integration. Transportation uses PP nonwoven for weight reduction and design flexibility. Construction applies it for sound insulation and waterproofing layers. Electronics integrate nonwoven liners for precision cleaning and protective wraps. Industrial manufacturing depends on PP nonwoven for durable filter and surface protection materials. Each industry segment reinforces steady consumption across global production chains.

Segmentation:

By Material Type (Fiber Type)

- Homopolymer (Homo-PP)

- Copolymer (Co-PP)

By Technology (Process Type)

- Spunbond

- Meltblown

- Composite (SMS / SMMS)

- Air-laid

- Spunlace

By Application

- Hygiene / Personal Care

- Medical / Healthcare

- Automotive

- Industrial / Filtration

- Geotextiles / Construction

- Agriculture

- Packaging

- Consumer Products

By End-Use Industry

- Disposable Products

- Healthcare

- Transportation

- Construction

- Electronics

- Industrial Manufacturing

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific dominates the Polypropylene (PP) Nonwoven Fabrics Market with around 48% market share driven by high consumption in hygiene and medical applications. China, India, and Japan lead regional output with strong manufacturing bases and rising consumer demand for disposable products. Expanding healthcare infrastructure and urbanization boost production volumes across the region. It benefits from low-cost labor, integrated polymer supply chains, and strong export potential. Southeast Asian nations continue scaling capacity to meet internal and export requirements. Local producers focus on process upgrades and sustainability initiatives to remain competitive.

Europe holds around 23% market share, driven by advanced healthcare systems and stringent environmental standards. Germany, France, and the U.K. lead production with focus on quality and eco-friendly PP nonwovens. The market emphasizes recyclable materials for hygiene and automotive sectors. It gains momentum from industrial innovations and high consumer awareness. Investments in meltblown and composite lines strengthen domestic supply resilience. Regional policies encouraging circular economy practices support industry expansion. European producers prioritize material innovation to meet sustainability goals while maintaining competitive pricing.

North America accounts for approximately 18% market share, supported by strong demand in healthcare and filtration industries. The U.S. dominates regional output through automation and product specialization. It relies on domestic polymer sources and high-end manufacturing standards. Latin America holds around 6% market share, led by Brazil and Mexico focusing on hygiene and packaging sectors. The Middle East & Africa together contribute about 5%, with growth centered on expanding industrial and medical applications. Global producers invest strategically in these regions to capture untapped potential and strengthen supply networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The Polypropylene (PP) Nonwoven Fabrics Market features a mix of global leaders and regional players competing on cost, innovation, and product diversity. Major companies such as Kimberly-Clark, Berry Global, Toray Industries, and Freudenberg dominate high-volume supply for hygiene and healthcare applications. It emphasizes technological leadership, material innovation, and sustainable production capabilities. Firms invest in advanced spunbond and meltblown lines to enhance efficiency and fabric quality. Mergers and capacity expansions improve distribution strength across key regions. Regional players like Fibertex Nonwovens and Suominen target niche industrial and filtration applications through tailored solutions. The market remains competitive with continuous R&D investment and focus on recyclable, high-performance nonwoven fabrics.

Recent Developments:

- In April 2024, HG Nonwoven Machinery Co. Ltd., a Chinese company specializing in nonwoven fabric machinery, launched its newest meltblown production line capable of producing bicomponent polypropylene (PP), polyethylene (PE), and PET nonwoven fabrics.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Technology, Application and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polypropylene (PP) Nonwoven Fabrics Market will continue expanding through stronger demand in hygiene and medical products.

- Sustainable nonwoven innovations will accelerate due to recycling initiatives and eco-friendly material adoption.

- Advancements in spunbond and meltblown technologies will improve efficiency and fiber consistency.

- Growth in automotive and construction applications will support wider industrial use of nonwoven fabrics.

- Healthcare infrastructure development in emerging economies will drive higher consumption of disposable nonwovens.

- Customization in texture, weight, and bonding methods will create new product opportunities.

- Rising e-commerce activity will increase packaging applications using lightweight PP nonwovens.

- Manufacturers will prioritize automation and AI-driven production systems for improved productivity.

- Strategic partnerships and capacity expansions will strengthen regional manufacturing networks.

- Shifting consumer preference toward hygiene and safety will maintain stable long-term growth momentum.