Market Overview:

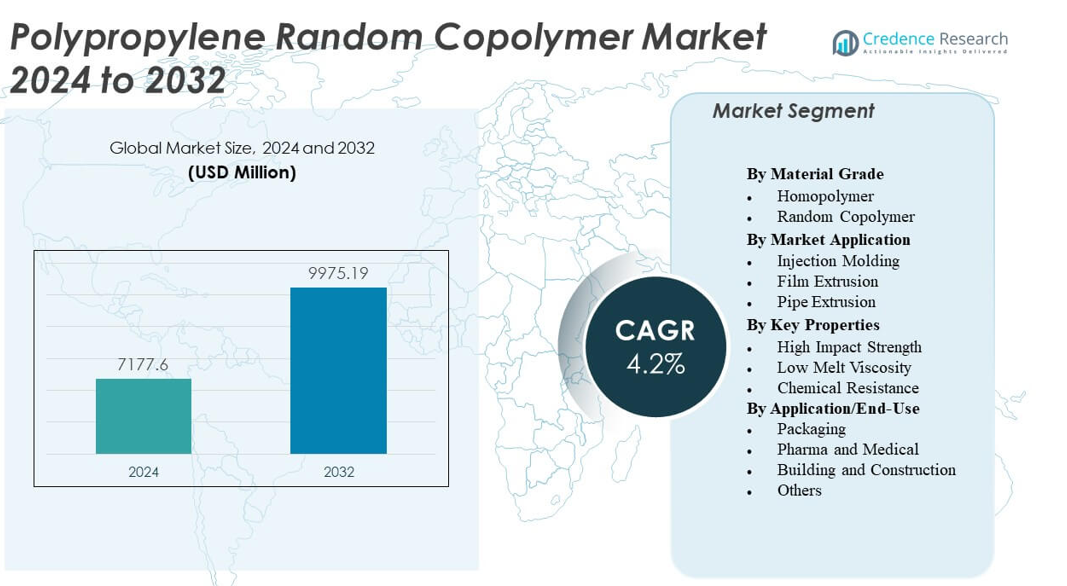

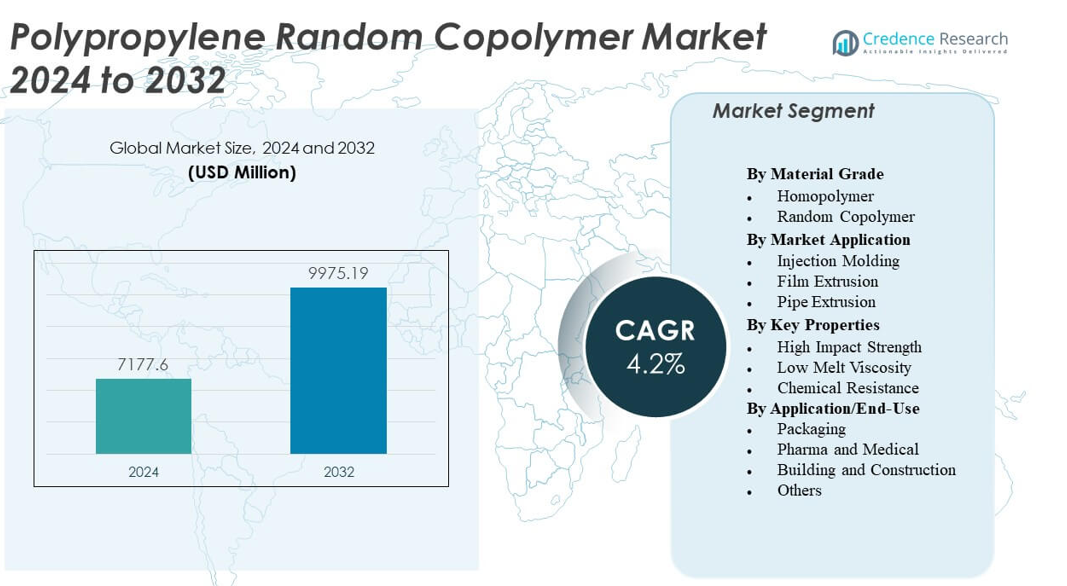

The Polypropylene Random Copolymer Market is projected to grow from USD 7177.6 million in 2024 to an estimated USD 9975.19 million by 2032, with a compound annual growth rate (CAGR) of 4.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polypropylene Random Copolymer Market Size 2024 |

USD 7177.6 million |

| Polypropylene Random Copolymer Market, CAGR |

4.2% |

| Polypropylene Random Copolymer Market Size 2032 |

USD 9975.19 million |

Market drivers include rising demand for clear packaging formats in food, retail, and healthcare channels. Medical producers rely on random copolymers for hygienic components that need transparency and chemical stability. Thin-wall applications gain support due to fast-cycle molding and strong visual performance. Film producers adopt these grades to maintain clarity and improve shelf appeal. Construction demand rises through PP-R pipes used in plumbing networks. Consumer goods gain value through durable, lightweight parts that reduce material load. Brands use these polymers to build safer and more efficient packaging lines. It keeps demand steady across industrial clusters.

Asia Pacific leads the market due to strong packaging and medical manufacturing hubs across China, India, and Southeast Asia. Europe shows stable growth supported by advanced healthcare production and strict quality norms. North America holds steady demand driven by food packaging, consumer goods, and appliance components. Latin America emerges through rising needs in retail packaging and basic healthcare supplies. The Middle East and Africa see gradual improvement with infrastructure development and new processing investments. Regional adoption

Market Insights:

- The Polypropylene Random Copolymer Market is projected to grow from USD 7177.6 million in 2024 to USD 9975.19 million by 2032, supported by a 4.2% CAGR during the forecast period.

- Demand rises due to strong use in transparent packaging, medical components, thin-wall products, and film applications that need clarity and clean processing behavior.

- Market restraints include regulatory pressure on polymer waste, volatility in propylene supply, and competition from alternative clear materials that influence grade selection.

- Asia Pacific leads due to large packaging and healthcare production bases, while Europe and North America maintain stable demand through advanced manufacturing.

- Emerging growth comes from Latin America and the Middle East & Africa, supported by rising construction activity, expanding consumer markets, and improved processing capacity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Need For High-Clarity And Flexible Packaging Solutions

Strong demand for clear containers drives wider use of the Polypropylene Random Copolymer Market. Brands prefer grades that deliver low haze and clean visual appeal. Packaging firms adopt these polymers to improve shelf impact in retail zones. Many converters shift to random copolymers to reduce weight in thin-wall designs. Food packaging gains stronger output through reliable thermal resistance. Medical packaging benefits from stable sterilization tolerance. Producers enhance flow properties to support fast-cycle molding. It continues to gain steady traction in regulated packaging lines.

- For instance, LyondellBasell’s Moplen RP348N random copolymer offers a melt flow rate of 11 g/10 min and a density of 0.90 g/cm³, supporting high clarity in thin-wall food containers and clear ISBM bottles. These properties enable strong optical quality and stable processing in demanding packaging formats.

Rising Adoption In Medical Devices And Laboratory Supplies

Healthcare producers turn toward random copolymers for safe, transparent components. The Polypropylene Random Copolymer Market gains relevance due to strict performance needs. Medical firms prefer these grades for chemical stability and reliable contact safety. Syringe barrels and labware gain clarity without stress cracking. Faster molding cycles help support heavy hospital demand. Producers develop purer resin grades to meet global compliance norms. Many device makers upgrade materials to maintain steady quality. It supports better performance across many disposable systems.

Expansion Of Consumer Goods And Household Product Manufacturing

Consumer brands use random copolymers for lightweight and durable goods. The Polypropylene Random Copolymer Market sees strong pull from appliances and homeware makers. Producers design grades that balance toughness with good gloss. Many firms aim to cut total material use without losing strength. Faster mold filling helps boost mass manufacturing output. Product designers choose these materials to meet safety needs. End users prefer goods that resist cracking during long use. It strengthens long-term adoption across daily-use segments.

Improved Process Efficiency In Injection And Blow Molding Lines

Advanced molding systems push wider adoption of random copolymers in global plants. The Polypropylene Random Copolymer Market benefits from stable melt flow and smooth finishing. Many processors shift to these grades to reduce cycle time. Improved thermal control enables tighter dimensional accuracy. Firms upgrade machinery to run higher-output molds. Reliable resin stability supports continuous production hours. Producers offer technical support to minimize downtime in busy facilities. It enhances operational performance across industrial hubs.

- For instance, Daqing Petrochemical reports PP-R copolymers engineered with broader molecular weight distribution that deliver melt flow rates near 3 g/10 min, supporting higher melt strength in pipe extrusion. This structure improves stability during extrusion and enhances performance in injection-molded fittings.

Market Trends

Shift Toward Sustainable And Circular Polymer Portfolios

Producers boost supply of recycled and bio-based variants that fit circular goals. The Polypropylene Random Copolymer Market aligns with global moves toward greener packaging. Brands aim to cut carbon footprint across several product lines. Resin makers improve traceability through certified feedstock streams. Many converters adopt cleaner grades to meet buyer policies. Thin-gauge packaging gains support from energy-efficient molding. Supply chains redesign workflows to reduce waste. It strengthens sustainability momentum across major sectors.

Growth Of Advanced Food-Contact And Heat-Stable Grades

Food brands demand polymers that protect product stability during transport. The Polypropylene Random Copolymer Market expands through upgraded heat-resistant grades. Producers enhance odor control and improve extractables performance. Thermoforming lines adopt these materials for rigid trays. Hot-fill packaging gains stronger hold due to safer handling traits. Firms strengthen compliance with global food-contact standards. Processors pick grades that maintain shape under wide temperature swings. It raises quality confidence for long-run supply programs.

- For instance, Serac Asia’s BluStream® module uses low-energy electron-beam technology to decontaminate caps at rates reaching 600 units per minute, supporting extended-shelf-life packaging. The system delivers dry, chemical-free sterilization suitable for sensitive food and beverage lines.

Rising Use In Transparent Pharmaceutical And Diagnostic Packaging

P

harma firms prefer clear polymers that support product inspection. The Polypropylene Random Copolymer Market gains traction in diagnostic and drug-contact components. Many suppliers provide medical-grade variants with strict purity. Hospitals use these materials for sterile packs and sample containers. New molding lines focus on clarity and precision. Cold-chain units adopt these grades for reliable integrity. Product traceability demands push better labeling adhesion. It improves quality assurance across sensitive supplies.

Integration Of Random Copolymers In Smart Consumer Electronics

Electronics makers pick these polymers for aesthetic surfaces and tight fits. The Polypropylene Random Copolymer Market benefits from rising smart-home device output. Many brands shift to lightweight housings for mobile accessories. Producers enhance gloss and durability in premium casings. Flexible parts support hinge points in compact devices. Firms seek materials that resist stress in daily use. Advanced molding delivers sleek, smooth finishes. It supports design freedom in competitive electronics segments.

- For instance, ACG develops lightweight aluminum packaging structures that support reduced material use while maintaining essential barrier performance for pharmaceutical and device applications. These solutions help manufacturers improve sustainability without compromising protection.

Market Challenges Analysis

Volatile Raw Material Dynamics And Regulatory Compliance Pressure

The Polypropylene Random Copolymer Market faces uncertainty due to fluctuating feedstock supply. Producers manage tight margins caused by unstable propylene pricing. Many plants endure cost swings that disrupt planning cycles. Regulatory norms push higher purity, raising operational demands. Compliance checks increase documentation and quality testing loads. Smaller processors struggle with certification costs. Environmental rules push upgrades across production lines. It raises burdens for firms with limited capital flexibility.

Competition From Alternative Clear Polymers And Material Substitution Risks

Clear resins like PET and polycarbonate compete for share in premium packaging. The Polypropylene Random Copolymer Market experiences pressure when buyers switch for specific traits. Some applications need higher rigidity than random copolymers provide. Product designers look for clarity levels that exceed normal PP thresholds. Substitution risk grows when price gaps widen. Many converters maintain dual-material strategies across plants. Firms review long-term portfolios to reduce dependency. It heightens competitive tension across several segments.

Market Opportunities

Expansion Potential In High-Growth Medical And Diagnostic Applications

Rising use of transparent devices creates new growth windows for the Polypropylene Random Copolymer Market. Hospitals demand safer and more stable components. Labs expand procurement of clear sample tools. Device makers launch compact designs that rely on lightweight polymers. Growth in self-care kits boosts demand for durable parts. Sterile packaging gains wider global deployment. Firms invest in precision molding capacity to meet strict needs. It unlocks sustained potential across healthcare zones.

Rising Opportunities In Lightweight Packaging And Eco-Efficient Designs

Brands seek lighter materials that cut transport load without lowering strength. The Polypropylene Random Copolymer Market gains from this transition toward optimized packaging. Many firms shift to thin-wall parts that lower total resin use. Retail brands upgrade pack design for better shelf clarity. Cleaner production routes support eco-efficient labeling claims. Reusable packs open new design paths for converters. Improved process control raises throughput quality. It creates favorable conditions across consumer-driven areas.

Market Segmentation Analysis:

By Material Grade

Homopolymer and random copolymer grades shape demand patterns across the Polypropylene Random Copolymer Market. Homopolymer grades support applications that need stiffness, thermal stability, and structural strength. Random copolymer grades gain stronger pull due to clarity, flexibility, and clean visual appeal. Packaging producers choose random copolymers to achieve low haze and balanced toughness. Medical and labware suppliers prefer these grades for safe contact and high transparency. Homopolymers maintain relevance in rigid parts that need consistent durability. Both segments support broad use across industrial and consumer channels. It creates clear value separation between clarity-focused and strength-focused applications.

- For instance, LyondellBasell’s Moplen HP500N homopolymer grade provides a tensile modulus near 1400 MPa, yield stress around 35 MPa, and a deflection temperature under load close to 95°C. These properties support injection-molded rigid parts that need high stiffness and reliable thermal stability.

By Market Application

Injection molding, film extrusion, and pipe extrusion define major processing routes for the Polypropylene Random Copolymer Market. Injection molding leads due to fast cycles, thin-wall capability, and design freedom in consumer goods and medical components. Film extrusion gains momentum through lightweight packaging films that offer clarity and safe handling. Food brands use these films to support visibility and product confidence. Pipe extrusion grows in plumbing and hot-water systems where thermal stability matters. Many construction projects favor PP-R pipes due to long service life and safe flow behavior. Each process supports distinct performance needs. It strengthens widespread adoption across factories.

By Key Properties

High impact strength, low melt viscosity, and chemical resistance guide material selection across the Polypropylene Random Copolymer Market. Grades with high impact strength support applications exposed to repeated handling and stress. Low melt viscosity options help processors run high-speed cycles with detailed shapes. Chemical-resistant variants protect components used with cleaners, solvents, and diagnostic fluids. Medical and lab goods rely on property stability to maintain safety. Packaging firms pick low-viscosity grades for thin-wall production. These traits improve performance in both standard and specialized applications. It delivers consistent efficiency across technical workflows.

- For instance, ExxonMobil produces polypropylene random copolymer grades with published properties that align with impact strength values near 4 kJ/m² and melt flow indices around 12 g/10 min under standard test conditions. These characteristics support packaging that needs clarity and dependable toughness during repeated handling.

By Application/End-Use

Packaging, pharma and medical, building and construction, and other sectors anchor demand in the Polypropylene Random Copolymer Market. Packaging stays dominant due to transparency needs in food, retail, and e-commerce formats. Pharma and medical users adopt random copolymers for syringes, labware, and sterile packaging. Building and construction demand rises through PP-R pipes and fittings used in plumbing networks. Other sectors such as automotive, electronics, and consumer goods use these materials for lightweight design and safe handling. Each end-use benefits from clarity, durability, and stable processing. It ensures strong relevance across diverse industrial chains.

Segmentation:

By Material Grade

- Homopolymer

- Random Copolymer

By Market Application

- Injection Molding

- Film Extrusion

- Pipe Extrusion

By Key Properties

- High Impact Strength

- Low Melt Viscosity

- Chemical Resistance

By Application/End-Use

- Packaging

- Pharma and Medical

- Building and Construction

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific holds the largest share of the Polypropylene Random Copolymer Market, accounting for nearly 48% of global demand. Strong packaging output supports heavy consumption across China, India, and Southeast Asia. Medical device production strengthens clarity-grade adoption in major hubs. Manufacturers widen capacity to serve rising thin-wall molding needs. Infrastructure expansion boosts pipe-grade demand across urban zones. It continues to grow due to cost-efficient production and large converter networks.

Europe captures around 27% of total share due to its advanced healthcare and high-spec packaging sectors. Medical device makers rely on random copolymers for safe and transparent components. Packaging firms adopt these grades to meet strict quality norms. Sustainability policies push interest in cleaner and recyclable PP variants. Regional producers invest in better processing lines to support complex product formats. The Polypropylene Random Copolymer Market holds steady presence across Germany, Italy, and the U.K., and it maintains stable long-term adoption.

North America secures about 19% share supported by strong food packaging, consumer goods, and appliance manufacturing. Healthcare growth increases demand for medical-grade copolymers with strict purity. Construction activity drives uptake of PP-R plumbing systems. Latin America contributes roughly 4%, driven by gradual growth in consumer packaging. The Middle East & Africa hold nearly 2% share through rising building applications and regional processing upgrades. The Polypropylene Random Copolymer Market gains diversified growth across these emerging clusters, and it maintains stable supply patterns.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- LyondellBasell Industries N.V.

- SABIC

- ExxonMobil Chemical

- INEOS Group

- Borealis AG

- Braskem SA

- Formosa Plastics Corporation

- TotalEnergies

- Reliance Industries

- Chevron Phillips Chemical

- LG Chem

- Sumitomo Chemical

- China Petrochemical Corporation (SINOPEC)

- China National Petroleum Corporation

Competitive Analysis:

The Polypropylene Random Copolymer Market features strong competition between global resin producers and regional converters that focus on high-clarity and specialty-grade output. Large players invest in catalyst innovation to improve flow, transparency, and purity across demanding applications. Many firms expand footprint in Asia Pacific to access high-volume packaging and medical consumption. Product portfolios shift toward sustainable and energy-efficient variants to meet regulatory expectations. Technical service teams support processors with guidance on molding cycles, film extrusion behavior, and pipe performance. Competition increases as suppliers target thin-wall packaging and medical components with upgraded reactor technologies. Regional converters strengthen position through cost-effective production and quick delivery cycles. It moves toward performance-driven innovation where clarity, toughness, and process efficiency influence long-term leadership.

Recent Developments:

- In October 2025, LyondellBasell launched Pro-Fax EP648R, a new polypropylene impact copolymer designed for high-performance demands in various industries, though related to broader polypropylene advancements.

- In October 2025, LyondellBasell unveiled a new polypropylene impact copolymer named Pro-Fax EP648R, reflecting ongoing innovation in the polypropylene random copolymer market.

- In March 2025, LyondellBasell Industries announced an investment to expand propylene production capacity at its Channelview Complex near Houston. Groundbreaking and construction are expected to start in the third quarter of 2025, with the plant projected to begin operations in late 2028.

- In May 2024, LyondellBasell completed the acquisition of a 35% interest in Saudi Arabia’s National Petrochemical Industrial Company (NATPET) from Alujain Corporation. This strategic move boosts LyondellBasell’s polypropylene capabilities in the region.

Report Coverage:

The research report offers an in-depth analysis based on Material Grade, Market Application, Key Properties and Application/End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand is expected to rise through stronger use of transparent packaging across food and healthcare.

- Medical and diagnostic applications will expand due to interest in high-purity and safe-contact components.

- Thin-wall molding will gain wider traction as brands prefer lighter and durable product formats.

- Film extrusion grades will grow through increasing need for clear and flexible packaging layers.

- Pipe-grade materials will advance with steady infrastructure upgrades in global construction.

- Sustainability trends will push producers to develop cleaner and energy-efficient grade portfolios.

- Process optimization will improve factory throughput and reduce cycle times for converters.

- Advanced catalyst systems will support higher clarity, smoother flow, and stable output.

- Regional manufacturing hubs will expand capacity to support fast-moving consumer and medical markets.

- Global supply networks will shift toward performance-focused solutions that strengthen long-term demand for the Polypropylene Random Copolymer Market.