Market Overview:

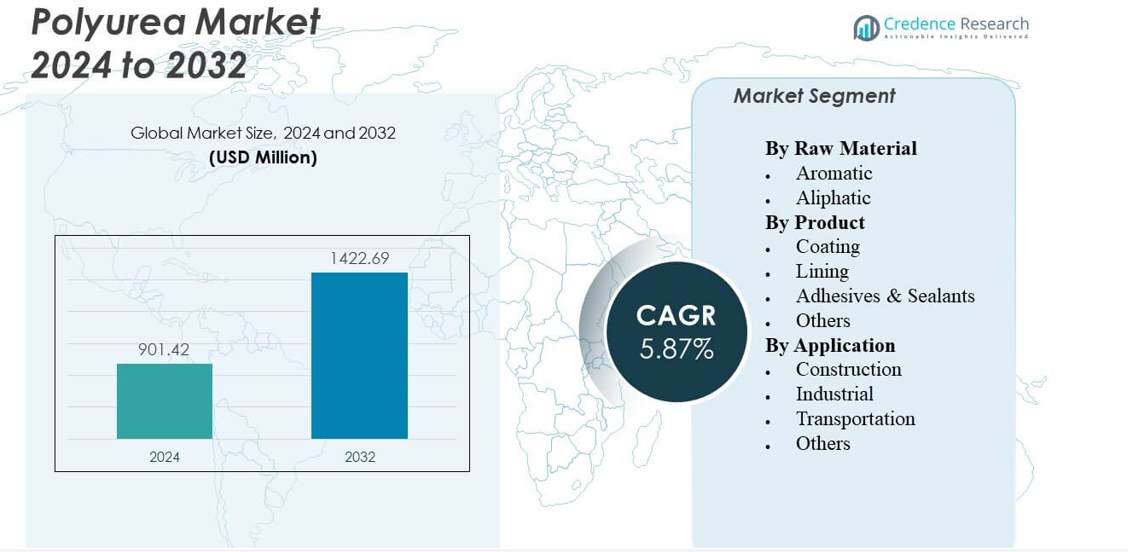

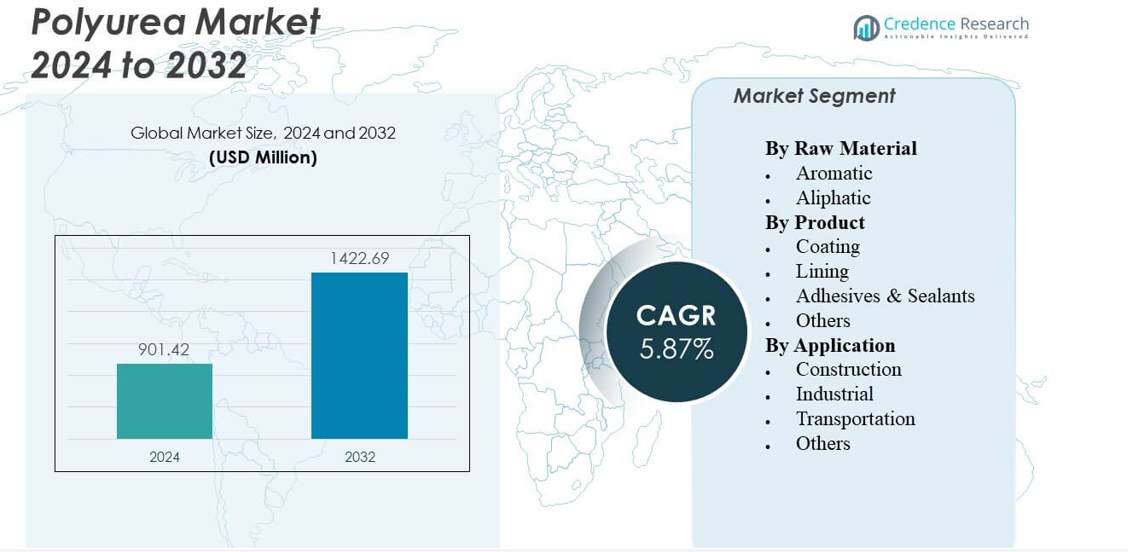

The Polyurea Market is projected to grow from USD 901.42 million in 2024 to an estimated USD 1422.69 million by 2032, with a compound annual growth rate (CAGR) of 5.87% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyurea Market Size 2024 |

USD 901.42 million |

| Polyurea Market, CAGR |

5.87% |

| Polyurea Market Size 2032 |

USD 1422.69 million |

Grows through rising infrastructure upgrades, strict durability needs, and wider acceptance of high-performance protective systems. Contractors rely on polyurea for quick turnaround during repair cycles. Industrial users adopt it for corrosion control in machinery, pipelines, and storage units. Automotive and marine sectors use these coatings for abrasion resistance and long-term protection. Strong adhesion and seamless application help reduce maintenance costs. Better application tools widen use across complex structures. The Polyurea Market benefits from stronger preference for coatings that deliver reliable service life.

Regional demand varies across development clusters. North America leads due to strong use in industrial repair and large-scale infrastructure projects. Europe follows due to strict quality rules and steady refurbishment needs in public assets. Asia Pacific emerges quickly due to rapid construction growth in China, India, and Southeast Asia. These regions adopt polyurea for roofing, flooring, and water systems that face high stress. Latin America expands use in industrial corridors, while the Middle East & Africa focus on protective applications in energy and construction hubs.

Market Insights:

- The Polyurea Market is projected to grow from USD 901.42 million in 2024 to USD 1422.69 million by 2032, supported by a 5.87% CAGR during the forecast period.

- Demand grows due to strong use in waterproofing, abrasion protection, and rapid-curing coatings across construction, industrial, and transportation projects.

- Growth faces restraints from high application sensitivity, skilled labor needs, and strict surface preparation requirements that limit wider adoption.

- North America leads the market due to strong industrial repair activity, while Asia Pacific shows the fastest expansion due to rising infrastructure development.

- Europe maintains steady demand through refurbishment cycles and strict durability standards, with emerging adoption across Latin America and the Middle East & Africa.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Need For High-Performance Protective Coatings

The Polyurea Market grows due to strong demand for fast-curing protective systems across sectors. Builders prefer polyurea because it forms seamless layers that resist moisture and abrasion. Industrial users rely on it for tanks, machinery, and pipelines that require strong chemical stability. Transport fleets use these coatings to protect cargo beds and heavy-duty parts. Contractors value short downtime during repair cycles. Infrastructure teams deploy polyurea on bridges and roofs to extend service life. Advanced spray tools improve coating precision across complex surfaces. Broader awareness strengthens adoption across new and replacement projects.

- For instance, Specialty Products Inc. (SPI) PTU-300 achieves a gel time of <5 seconds, supporting rapid film formation for high-performance industrial protection

Growing Adoption In Infrastructure Modernization Projects

Infrastructure upgrades push higher use due to strict durability needs in public assets. Engineers apply polyurea on tunnels, dams, and water reservoirs for long-term protection. It supports fast turnaround during maintenance work in busy urban zones. Municipal teams trust polyurea for resistance against thermal shock and heavy traffic loads. Industrial corridors adopt it to secure utility channels. Rising refurbishment work across older structures expands product use. Strong bond strength helps reduce structural fatigue over time. Wider design flexibility increases use across varied architectural layouts.

- For instance, Sika’s Sikalastic®-8800 demonstrates crack-bridging capability of >2 mm and high tensile performance verified under EN 1062-7, supporting infrastructure waterproofing requirements.

Expanding Use Across Automotive, Marine, And Industrial Sectors

Automotive firms use polyurea for bed liners and underbody coatings that face heavy wear. Marine operators apply these layers to protect vessels from corrosion and impact pressure. It helps industrial zones secure equipment in harsh chemical environments. Food and chemical plants choose polyurea for its hygienic, non-porous surface. Manufacturers use it for molds, rollers, and conveyors under constant stress. Repair teams value quick curing for minimal downtime. Better raw material quality strengthens performance across extreme conditions. Strong lifecycle efficiency drives sustained sectoral adoption.

Rising Preference For Durable Waterproofing And Leak-Proof Systems

Contractors use polyurea to control leakage in roofs, underground areas, and storage units. The Polyurea Market gains strong traction due to clear reliability benefits across wet conditions. Waterproofing crews value the material for crack-bridging and UV stability. It forms strong bonds with concrete, metal, and composites. Tank lining specialists pick polyurea to avoid coating failure under pressure shocks. Growing demand for long-lasting building envelopes shapes adoption. Cities invest in resilient protection to reduce repair cycles. Strong material consistency supports use across diverse climate zones.

Market Trends

Shift Toward Hybrid Polyurea Systems For Balanced Performance

Producers develop hybrid grades that blend polyurea and polyurethane traits for cost-effective results. These blends help users manage flexibility and hardness across wider tasks. It enables builders to optimize protection while keeping budgets stable. Industrial customers use hybrids for moderate-load environments that need reliable curing. Applicators gain wider control across temperature variations. Rising use of plural-component machines improves application stability. Hybrid systems support broader design freedom in construction. The Polyurea Market sees interest in balanced formulations with steady field performance.

- For example, Teknos confirms that TEKNODUR COMBI 3560 is designed to cure under ambient conditions and does not require traditional high-temperature oven curing. This curing approach helps reduce overall energy demand in industrial coating processes. The system supports fast handling and durable film performance in production environments.

Increased Integration Of Polyurea In Smart And Sustainable Construction

Green building goals encourage polyurea adoption for long-life structures. It supports reduced maintenance frequency in energy-efficient designs. Builders use these coatings to strengthen foundations exposed to humidity and heat shifts. Smart construction tools improve application monitoring on complex sites. Demand rises for systems that reduce material waste. Urban planners focus on coatings that support climate resilience. Growing innovation in low-VOC formulations aligns with environmental rules. New building models highlight the need for stable, long-term protection layers.

Rising Popularity Of Advanced Robotic And Automated Spray Technologies

Automation improves coating consistency on large structures and tight spaces. Robotics help workers complete tasks with fewer safety risks. It provides stable spray patterns that reduce defects during high-speed jobs. Industrial teams value automation for repeat cycles across big assets. Coating uniformity increases system life during heavy pressure loads. Automation lowers rework rates during infrastructure rehabilitation. The Polyurea Market benefits from robotic solutions that shorten project timelines. Growing digital tools help applicators manage cure profiles with higher accuracy.

- For instance, Graco Reactor E-XP2 proportioners can maintain temperature control within ±1°F during spraying, enabling consistent polyurea film formation on automated or semi-automated lines

Growing Use Of Polyurea In Specialty Segments And Niche Industrial Zones

Specialty users adopt polyurea for mining, energy, and defense needs. It strengthens surfaces exposed to explosives, saltwater, and high abrasion. New grades serve containment pits and hazardous material rooms. Equipment makers use these coatings to extend lifespan in extreme zones. Firefighting units use polyurea-lined containers for safer chemical storage. Demand expands from theme parks and stadiums for impact-resistant flooring. It gains presence across unique architectural designs that need high flexibility. The Polyurea Market adapts to niche needs through targeted formulations.

Market Challenges Analysis

High Application Sensitivity And Skilled Labor Requirements

The Polyurea Market faces challenges due to strict application conditions. Installers must control humidity, surface prep, and temperature to avoid defects. It needs trained workers who understand plural-component spray handling. Limited workforce skills slow adoption in new regions. Mistakes during spraying reduce coating strength and lifecycle. Variability in field conditions increases project risks. Equipment calibration creates added complexity for small contractors. Strong training needs create hurdles for rapid expansion.

Volatile Raw Material Supply And Compliance Constraints

Producers manage rising pressure from changing raw material supply chains. It depends on stable availability of isocyanates and amines. Regulatory checks on chemical safety create compliance burdens. Firms spend more time aligning with regional rules. High production costs limit adoption in budget-sensitive zones. Import delays disrupt project timelines in emerging markets. Supply instability affects long-term planning cycles. Firms adjust pricing strategies to protect margin stability.

Market Opportunities

Growing Demand Across Infrastructure, Energy, And Industrial Renewal Programs

The Polyurea Market gains opportunity through global investment in resilient structures. Governments invest in transport routes, water systems, and public buildings that need durable coatings. Energy hubs adopt polyurea for pipelines and secondary containment assets. It supports broad renewal projects that target asset longevity. Aging structures across cities offer strong replacement potential. Industrial growth creates long-term need for high-performance layers. Wider contractor awareness expands product uptake. New design rules highlight demand for extended lifecycle materials.

Advances In Formulation Innovation And Technology Integration

New formulations enhance UV stability, fire performance, and abrasion strength. It helps producers serve advanced sectors such as marine, defense, and EV manufacturing. Better curing control enables use across colder climates. Smart monitoring tools track spray quality during application. Robotics help maintain coating uniformity on large surfaces. Rising demand for sustainable, low-VOC options strengthens innovation. Material science upgrades unlock new specialty uses. Firms explore sector-specific blends to widen market reach.

Market Segmentation Analysis:

By Raw Material

Aromatic grades hold strong use in protective coatings where fast curing and high mechanical strength guide material choice. These grades serve concrete floors, containment zones, and industrial assets that operate in controlled environments. It delivers reliable chemical resistance across demanding workloads. Aliphatic grades gain traction due to strong UV stability and color retention. These grades support outdoor structures that face long sun exposure. Users adopt them for roofing, railings, and transport fleets. Designers pick aliphatic systems for projects that need stable appearance and long-term durability. The Polyurea Market grows through balanced use across both material classes.

By Product

Coating systems lead due to wide use across roofing, flooring, containment units, and heavy machinery. Users adopt them for abrasion strength and quick curing. It supports teams that need continuous protection in tough industrial zones. Lining products gain demand in chemical plants, water systems, and tank interiors. Sealants and adhesives serve repair tasks that need strong bonding on mixed substrates. Others include niche systems designed for advanced durability needs. Versatile performance keeps each product line relevant. The Polyurea Market benefits from strong uptake across varied protective roles.

- For example, BASF supplies a range of polyurea and high-performance protective coating systems designed for strong mechanical durability on concrete and steel. These systems undergo standardized testing to confirm resistance to abrasion, impact, and harsh environmental conditions. Their formulations support demanding industrial and infrastructure protection needs.

By Application

Construction leads due to strong demand for waterproofing, concrete protection, and roofing repair. It offers long service life across diverse building envelopes. Industrial users adopt these systems for corrosion control in machinery, secondary containment, and processing areas. Transportation adopts polyurea for bed liners, underbody parts, and bridge components. Other segments involve oil and gas zones and specialty protective areas. Each segment leverages strong curing speed and high resilience. The Polyurea Market grows through strong adoption across these varied work environments.

- For example, Fosroc Polyurea WCS delivers a gel time of 1–2 minutes and becomes walkable within 15–20 minutes, according to its technical datasheet. The system supports fast return-to-service in industrial environments that require durable waterproofing and corrosion protection.

Segmentation:

By Raw Material

By Product

- Coating

- Lining

- Adhesives & Sealants

- Others

By Application

- Construction

- Industrial

- Transportation

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America leads the Polyurea Market with an estimated 41% share due to strong use in industrial repair and infrastructure strengthening. Regional contractors prefer polyurea for fast curing and long-term durability across large public assets. It supports coating work in transport, utilities, and containment facilities. The U.S. drives most demand due to high maintenance cycles. Canada follows with upgrades in municipal structures. Mexico expands use in construction repair zones. The Polyurea Market gains stable growth across the region due to strong technical adoption.

Asia Pacific holds roughly 30% share and records the fastest growth due to heavy construction activity. China leads due to rapid modernization of industrial corridors. India increases use in roofing, flooring, and water infrastructure. It supports high-volume projects that need strong waterproofing and abrasion resistance. Southeast Asia adopts polyurea for transport and marine zones. South Korea and Japan invest in high-performance systems for advanced infrastructure. The Polyurea Market strengthens its position through rising urban development.

Europe captures close to 20% share driven by strict quality rules and strong refurbishment work. Germany and France lead use across civil structures and industrial plants. It supports demand for UV-stable systems in outdoor assets. Southern Europe applies polyurea across marine and coastal protection zones. Eastern Europe expands adoption through industrial renewal programs. Latin America holds about 5%, while the Middle East & Africa account for nearly 4% due to niche industrial and construction projects. The Polyurea Market gains reach across all emerging clusters.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alberts Spray Solutions, LLC

- Armorthane Inc.

- BASF SE

- Chemline, Inc.

- Covestro AG

- Dow Chemical Company

- Huntsman Corporation

- PPG Industries, Inc.

- Sika AG

- The Sherwin-Williams Company

- Rhino Linings Corporation

- Specialty Products Inc.

- Nukote Coating Systems

- Kukdo Chemical Co., Ltd.

- LINE-X Protective Coatings Inc.

- Teknos AB

- VersaFlex

Competitive Analysis:

The Polyurea Market features strong competition among established chemical producers, specialized coating formulators, and application service providers. Leading firms invest in raw material innovation to enhance UV stability, abrasion strength, and curing control. It pushes suppliers to refine aromatic and aliphatic systems for broader field use. Companies expand portfolios to serve construction, industrial, marine, and transport sectors with targeted solutions. Partnerships with equipment makers help firms offer integrated spray systems that improve application quality. Competitors focus on training programs to support applicators and reduce field errors. Global brands rely on certification programs to maintain trust in high-performance segments. Regional firms gain share through cost control and faster delivery cycles. The Polyurea Market continues to evolve through product launches, technology upgrades, and expansion into emerging demand clusters.

Recent Developments:

- In May 2024, ArmorThane announced the launch of an innovative polyurea coating designed specifically to enhance the longevity of RV roofs, aimed at revolutionizing the RV roof coating and repair market.

Report Coverage:

The research report offers an in-depth analysis based on Raw Material, Product and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise due to stronger use of fast-curing coatings in large infrastructure renewal programs.

- Adoption will increase in outdoor structures due to higher preference for UV-stable aliphatic systems.

- Product innovation will expand with new grades designed for marine, energy, and transport assets.

- Urban construction growth will drive wider use of waterproofing and long-life protection layers.

- Automated and robotic spray systems will improve coating precision across complex industrial sites.

- Global refurbishment of public assets will push steady demand for abrasion-resistant solutions.

- Polyurea will gain traction in high-load industrial zones due to long service life and stable curing.

- Sustainability rules will influence development of cleaner, low-VOC formulations with strong durability.

- Broader training programs for applicators will improve field performance and system reliability.

- The Polyurea Market will strengthen its footprint across emerging regions through diverse application needs.