Market Overview:

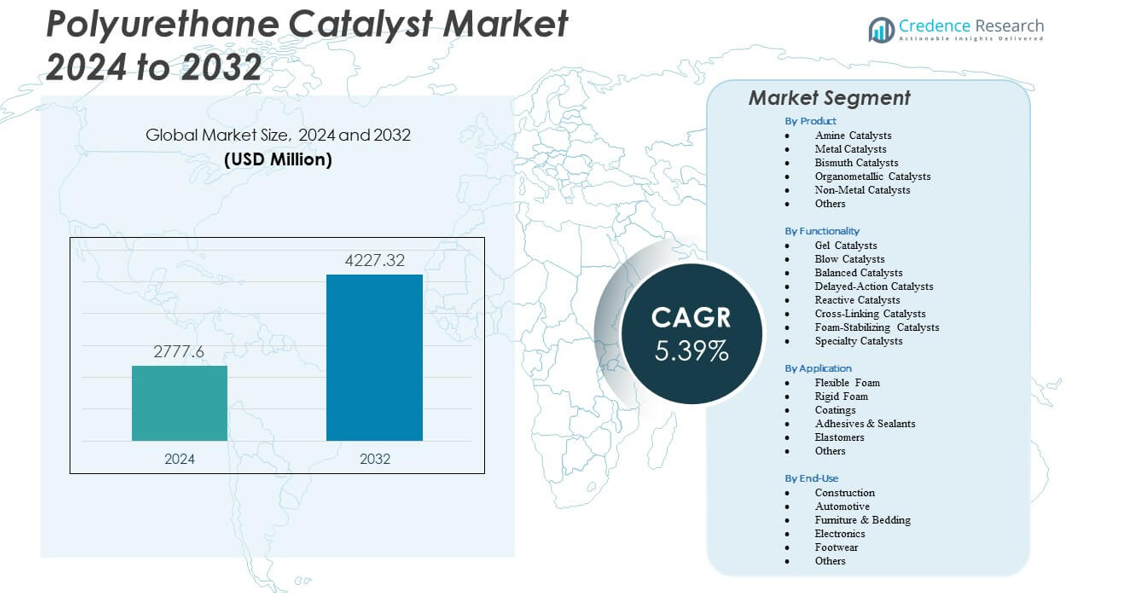

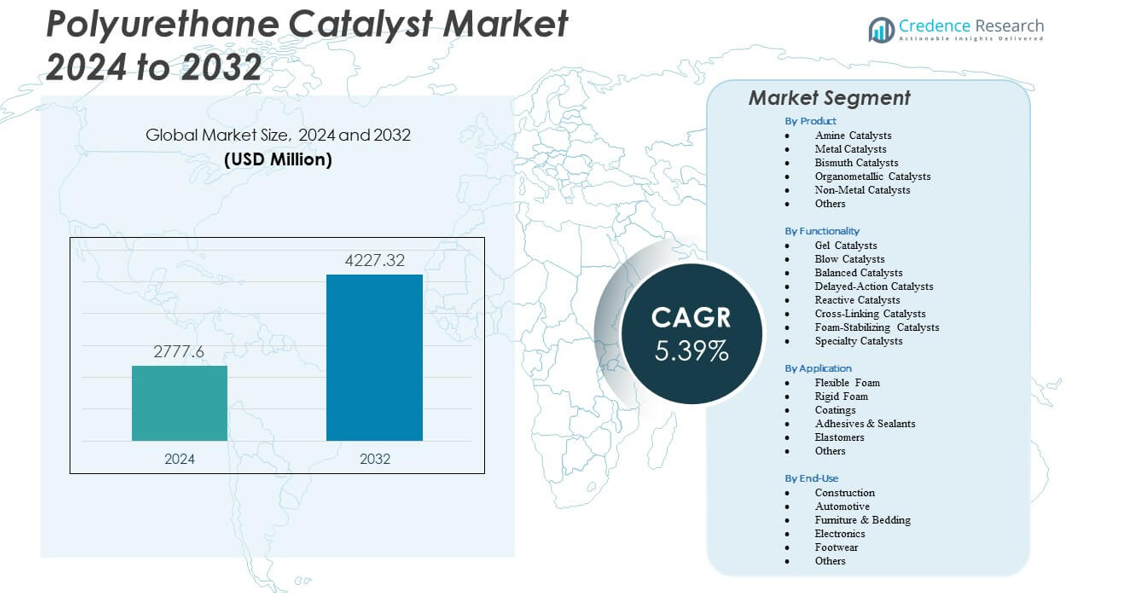

The Polyurethane Catalyst Market is projected to grow from USD 2,777.6 million in 2024 to an estimated USD 4,227.32 million by 2032, with a compound annual growth rate (CAGR) of 5.39% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyurethane Catalyst Market Size 2024 |

USD 2,777.6 million |

| Polyurethane Catalyst Market, CAGR |

5.39% |

| Polyurethane Catalyst Market Size 2032 |

USD 4,227.32 million |

Strong market drivers emerge from increasing demand for high-performance PU systems used across advanced industrial processes. Producers adopt catalysts that deliver precise curing behavior and allow flexible formulation adjustments. Growth in insulation materials strengthens demand for catalysts that support rigid foam efficiency. Automotive suppliers depend on catalyst systems that improve foam comfort and reduce weight in interior components. Furniture and bedding producers rely on fast-curing catalysts to support high-volume production. Sustainability efforts push development of safer and low-emission catalyst types. Innovation in reactive amines and metal alternatives supports long-term industry adoption.

Regional momentum remains varied across major economies due to differences in industrial output and infrastructure growth. North America leads through strong use of PU in insulation, appliances, and automotive interior parts. Europe maintains steady growth with regulations that encourage low-VOC catalysts and sustainable PU production. Asia Pacific emerges as the fastest-growing region due to rising manufacturing capacity in China, India, Japan, and South Korea. Latin America and the Middle East show moderate expansion supported by construction upgrades and industrial development. Each region strengthens demand through its focus on energy efficiency, mobility needs, and expanding consumer industries.

Market Insights:

- The Polyurethane Catalyst Market is projected to grow from USD 2,777.6 million in 2024 to USD 4,227.32 million by 2032, supported by a 39% CAGR driven by rising PU consumption across major industries.

- Demand grows due to increasing use of catalysts that improve curing control, enhance efficiency, and support high-performance PU materials in construction, automotive, furniture, and electronics.

- Restraints arise from strict environmental regulations, emission limits, and compliance needs that push producers to redesign catalyst systems and manage higher formulation costs.

- North America leads growth through strong adoption of PU insulation and automotive foams, while Europe advances sustainability-driven catalyst use supported by low-VOC requirements.

- Asia Pacific shows the fastest momentum due to large manufacturing hubs in China, India, Japan, and South Korea that expand output across foams, coatings, and elastomers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Performance PU Systems Across Major Industries

The Polyurethane Catalyst Market gains strong momentum from higher use of PU materials in construction, automotive, and electronics. Manufacturers need catalyst systems that deliver faster curing and consistent performance across large production lines. It supports precise control of foam density in insulation panels used in energy-efficient buildings. Automotive suppliers adopt tailored amine catalysts to reduce cycle times in seat foam production. Appliance makers depend on catalysts that help maintain uniform cell structures. Growth in flexible foam use lifts demand across furniture and bedding sectors. Catalyst producers invest in optimized formulations to meet new processing targets. Industry focus on durability keeps catalyst innovation steady.

- For instance, Evonik introduced negligible-emission polyurethane catalysts at PU China 2024 that comply with VDA 278 standards, enabling significant VOC reduction in automotive molded foam and insulation panels. These catalysts support cleaner production and help manufacturers meet strict emission requirements.

Shift Toward Low-Emission and Safer Catalyst Technologies

Growing pressure on manufacturers strengthens the shift toward cleaner catalyst solutions. The Polyurethane Catalyst Market moves toward systems that cut VOC output and meet stricter compliance rules. Producers design reactive amines that reduce emissions during foam formation. It aligns with sustainability goals set by global regulatory bodies. Rising interest in green chemistry pushes adoption of metal-free catalysts across sensitive applications. Coatings suppliers seek catalyst systems that support safer handling in production plants. New product launches focus on reducing workplace exposure to harmful emissions. Adoption of sustainable catalysts grows across developed and developing regions.

Expanding PU Adoption In EVs, Insulation and Lightweight Components

Growth in electric mobility drives wider PU use across battery housings, structural parts, and interior modules. The Polyurethane Catalyst Market supports this demand by enabling consistent curing in advanced foam and elastomer grades. It helps OEMs boost thermal stability in EV battery systems. Expanding building retrofits create new demand for PU insulation boards. Lightweight components in machinery and appliances require catalysts that deliver uniform mechanical strength. Major PU producers scale production to meet growing needs from global industries. New catalyst formulations help shorten production cycles. Rising technology integration lifts long-term catalyst demand.

Acceleration of High-Speed Manufacturing and Automation

High-speed PU molding and automated lines require catalyst systems with stable performance under continuous loads. The Polyurethane Catalyst Market benefits from this shift toward precision and efficiency. Producers rely on catalysts that maintain reactivity control under tight processing windows. It supports automated foam dispensing across automotive and packaging lines. Electronics firms adopt PU encapsulants that need catalysts tuned for delicate components. Rapid manufacturing cycles in furniture production increase demand for fast-reacting catalysts. Digital controls in PU processing drive interest in predictable catalyst behavior. Expansion of smart factories strengthens long-term adoption.

- For instance, Evonik’s POLYCAT® SA-1 delayed-action catalyst is reported to extend processing windows by about 30 seconds in high-volume automotive seat foam production. This capability supports consistent reactivity control during large-scale flexible foam manufacturing.

Market Trends

Growing Use of Metal-Free and Reactive Amine Catalysts

New regulatory frameworks encourage rapid movement toward safer catalyst families. The Polyurethane Catalyst Market observes wider interest in reactive amine systems with improved environmental profiles. It benefits industries needing reduced emissions across foams, elastomers, and coatings. Metal-free catalysts gain traction in electronics where purity standards remain strict. Producers refine formulations to meet performance targets in sensitive applications. Adoption rises across medical and specialty products. Suppliers highlight catalysts that limit migration risks in final components. Continuous R&D strengthens acceptance in global markets.

- For instance, San-Apro’s U-CAT 1102, an amine-based thermosensitive catalyst, demonstrates a 158-minute pot life at 2 parts usage in two-component polyurethane coatings. This performance supports precise workability and controlled curing in industrial PU coating systems.

Rapid Transition to Digitally-Controlled PU Production Lines

Automation reshapes catalyst design strategies worldwide. The Polyurethane Catalyst Market aligns with advanced metering systems that demand consistent reactivity. It supports high-speed processing in furniture, packaging, and automotive plants. Producers need catalysts adaptable to digital process controls. Smart monitoring tools push tighter quality control during PU foaming. Manufacturers choose catalysts with stable temperature behavior for precision workflows. Robotic systems in molding plants lift interest in uniform catalyst performance. Global producers optimize supply chains to support automation-driven growth.

Rising Penetration of PU In High-Temperature And Harsh-Environment Applications

Industrial sectors shift toward PU systems that withstand heat, chemicals, and mechanical stress. The Polyurethane Catalyst Market adapts by supplying catalysts that deliver structural stability. It drives adoption in mining, offshore, and heavy engineering environments. Coating producers use catalysts that improve abrasion resistance. Adhesive makers depend on high-performance catalyst blends for metal bonding. Aerospace parts integrate PU components that need consistent curing cycles. Electronics insulation materials require refined catalyst systems. Strong industrial modernization expands long-term catalyst trends.

Increased Innovation in Specialty Foam and Elastomer Formulations

Producers develop new PU foam structures for thermal, acoustic, and mechanical performance. The Polyurethane Catalyst Market supports such advances with tailored catalyst packages. It enables manufacturers to achieve finer cell structures in premium foams. Footwear firms adopt catalysts that improve resilience and comfort. Elastomer producers seek systems that deliver higher tear strength. Sports equipment makers integrate high-performance PU parts demanding stable curing. R&D centers focus on catalyst versatility for multi-density foams. Continuous improvements shape future product portfolios.

- For instance, Tosoh’s TOYOCAT®-DT amine catalyst provides balanced blow and gel times that support multi-density specialty foam production. This balance helps manufacturers achieve finer cell structures in premium foams and improves resilience in footwear applications.

Market Challenges Analysis

Regulatory Pressure, Emission Limits, And Compliance Restrictions

The Polyurethane Catalyst Market faces rising compliance pressure due to environmental rules across major regions. Producers must redesign catalyst families that meet strict emission limits. It creates higher formulation costs for manufacturers. Metal catalysts remain under scrutiny due to toxicity concerns. Disposal rules become tighter across industrial hubs. Supply chains experience delays when regulatory approvals slow product rollouts. Producers must adapt testing frameworks to match global standards. Continuous documentation needs increase operational burdens.

Volatile Raw Material Supply, Cost Instability, And Technical Constraints

Changing availability of key chemicals affects catalyst planning worldwide. The Polyurethane Catalyst Market deals with fluctuating prices for amines and metal compounds. It affects production consistency for global suppliers. Foam producers experience disruptions when catalyst variability affects reactivity. Technical constraints limit adoption in applications needing ultra-low emissions. Processing windows narrow when manufacturers shift to advanced PU grades. Smaller firms struggle to invest in advanced catalyst technologies. Global competition raises pressure on cost control.

Market Opportunities

Shift Toward Sustainable Catalyst Chemistry And Green PU Production

The Polyurethane Catalyst Market gains new opportunities from fast-growing interest in low-emission and metal-free systems. It aligns with global sustainability frameworks adopted by major industries. Producers develop catalysts that support biodegradable and bio-based PU systems. New markets open in medical devices requiring low-toxicity chemistry. Construction sectors push demand for green insulation materials. Regulatory agencies encourage rapid acceptance of safer catalyst routes. Suppliers expand portfolios built around sustainability-focused innovations. Long-term value creation grows across multiple regions.

Expansion of EV Manufacturing, Smart Appliances, And Industrial Automation

Growth in electric vehicles boosts interest in high-performance PU parts. The Polyurethane Catalyst Market benefits from catalyst systems designed for heat-resistant and lightweight components. It supports automation-driven production across global facilities. Smart appliance makers use PU foams that need precise catalyst behavior. Aerospace and electronics sectors rely on catalysts that enhance material stability. R&D teams explore catalysts tuned for next-generation elastomers. Industrial upgrades across emerging markets create broader demand pools. Producers gain opportunities through strategic regional expansion.

Market Segmentation Analysis:

By Product

The Polyurethane Catalyst Market shows steady growth across amine catalysts, metal catalysts, bismuth catalysts, organometallic catalysts, non-metal catalysts, and other specialty types. Demand for amine catalysts stays strong due to their wide use in flexible and rigid foams. Metal and bismuth catalysts gain interest in applications that need low emissions and safer chemistries. Organometallic catalysts support coating and adhesive production where controlled curing is vital. Non-metal catalysts expand in sensitive applications tied to environmental rules. Producers balance performance, reactivity, and handling needs across all product families. It reflects industry focus on both efficiency and compliance.

- For instance, Reaxis C739E50, a tin-based organometallic catalyst, is documented to deliver 3H pencil hardness in 2K waterborne polyurethane coatings, indicating strong film performance. This aligns with organometallic catalysts widely used in PU coatings and adhesives where controlled curing and hardness development remain critical requirements.

By Functionality

The Polyurethane Catalyst Market includes gel catalysts, blow catalysts, balanced catalysts, delayed-action catalysts, reactive catalysts, cross-linking catalysts, foam-stabilizing catalysts, and specialty catalyst groups. Gel and blow catalysts guide core foam structure and density targets. Balanced catalysts support lines that require stable reaction control. Delayed-action grades help producers manage longer processing windows. Reactive and cross-linking catalysts improve strength in elastomers and coatings. Foam-stabilizing catalysts support uniform cell formation across diverse foam types. Specialty catalysts address advanced performance demands in technical applications. It strengthens production capability across major sectors.

By Application

The Polyurethane Catalyst Market spans flexible foam, rigid foam, coatings, adhesives and sealants, elastomers, and other PU systems. Flexible foam leads due to broad use in furniture and automotive interiors. Rigid foam supports insulation in construction and refrigeration. Coatings adopt catalyst systems that improve film hardness and durability. Adhesives and sealants depend on catalysts that support controlled curing. Elastomers gain use in wheels, rollers, and industrial parts needing resilience. Other applications include encapsulants and specialty PU products. It supports wide industrial coverage across global markets.

- For instance, tertiary amine catalysts are widely reported to support 16–65 kg/m³ density ranges in water-blown flexible polyurethane foams, reflecting their strong control over blowing and gelling reactions. These catalysts help producers achieve stable cell structures and consistent foam quality across furniture and automotive applications.

By End-Use

The Polyurethane Catalyst Market serves construction, automotive, furniture and bedding, electronics, footwear, and other industrial users. Construction leads due to rising insulation demand across buildings. Automotive manufacturers adopt PU foams and elastomers for comfort, weight reduction, and durability. Furniture and bedding maintain strong use of flexible foams. Electronics rely on catalysts for encapsulation, sealing, and thermal protection. Footwear producers use PU for cushioning and performance. Other sectors include packaging and engineered goods. It supports diverse end-use requirements across global supply chains.

Segmentation:

By Product

- Amine Catalysts

- Metal Catalysts

- Bismuth Catalysts

- Organometallic Catalysts

- Non-Metal Catalysts

- Others

By Functionality

- Gel Catalysts

- Blow Catalysts

- Balanced Catalysts

- Delayed-Action Catalysts

- Reactive Catalysts

- Cross-Linking Catalysts

- Foam-Stabilizing Catalysts

- Specialty Catalysts

By Application

- Flexible Foam

- Rigid Foam

- Coatings

- Adhesives & Sealants

- Elastomers

- Others

By End-Use

- Construction

- Automotive

- Furniture & Bedding

- Electronics

- Footwear

- Others

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds a strong position with an estimated 32% market share driven by wide polyurethane use in construction insulation, automotive interiors, and appliance manufacturing. The Polyurethane Catalyst Market gains support from advanced production lines, strict quality standards, and high adoption of energy-efficient insulation materials. It benefits from the presence of major catalyst suppliers offering low-emission formulations. Demand rises across flexible and rigid foam applications due to strong housing upgrades. Automotive firms integrate tailored catalyst systems to improve foam durability. Growth stays steady across industrial, residential, and mobility sectors.

Europe maintains an estimated 27% share supported by strict environmental rules and strong innovation in sustainable catalyst systems. The region emphasizes low-VOC chemistries, metal-free catalysts, and higher process safety. The Polyurethane Catalyst Market expands through demand from building retrofits and advanced coatings used in industrial equipment. It benefits from strong OEM activity across automotive hubs in Germany, France, and the U.K. Producers adopt catalyst systems that align with circular economy goals. Interest in green construction materials strengthens long-term adoption across major economies.

Asia Pacific leads growth and holds the largest share at 34%, supported by strong output in China, India, Japan, and South Korea. The Polyurethane Catalyst Market advances through massive production of foams, coatings, adhesives, and elastomers used in manufacturing, electronics, and consumer goods. It gains traction from rapid urban growth and rising insulation needs in infrastructure. Manufacturers scale production to meet demand from automotive and appliance sectors. Local catalyst producers expand portfolios to meet regional performance targets. LatAm and MEA together account for 7% share and show stable growth through construction upgrades and industrial development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Evonik Industries AG

- BASF SE

- Huntsman International LLC

- Covestro AG

- Momentive Performance Materials Inc.

- The Shepherd Chemical Company

- Umicore Cobalt & Specialty Materials

- Tosoh Asia Pte. Ltd.

- Guangzhou Yourun Synthetic Material Co., Ltd.

- King Industries, Inc.

- Dow Chemical Company

- Air Products and Chemicals, Inc.

- LANXESS AG

- Dorf Ketal Chemicals India Private Limited

- KAO Corporation

- KPX Chemical Co., Ltd.

Competitive Analysis:

The Polyurethane Catalyst Market operates within a competitive landscape shaped by global chemical companies, specialized catalyst developers, and PU system houses. Leading producers focus on low-emission chemistries, improved reaction control, and sustainability-driven catalyst systems. It pushes firms to expand R&D capabilities that support safer and high-performance formulations. Key companies strengthen supply chains to serve flexible foam, rigid foam, coatings, and elastomer producers across major regions. Competitive strategies include portfolio diversification, technology partnerships, and capacity expansions in Asia and North America. Companies also invest in metal-free and reactive amine catalysts to address regulatory pressure. Product differentiation depends on reactivity stability, environmental compliance, and compatibility with high-speed manufacturing. Rising customer preference for tailored catalyst solutions drives ongoing innovation and market consolidation.

Recent Developments:

- In May 2025, Evonik Industries AG transitioned its remaining polyurethane (PU) additive production assets globally to green electricity, enhancing sustainability across its Comfort & Insulation business line serving automotive, construction, coatings, furniture, and consumer goods markets.

Report Coverage:

The research report offers an in-depth analysis based on Product, Functionality, Application and End-Use. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growth expands through wider adoption of cleaner catalyst systems used in advanced PU production.

- Demand rises for high-performance catalysts that support rapid curing in large-scale manufacturing lines.

- Sustainability trends push stronger movement toward metal-free and low-emission catalyst families.

- Innovation accelerates in specialty catalysts designed for EV components and thermal management parts.

- Construction activity lifts catalyst use due to rising interest in energy-efficient insulation materials.

- Automation increases demand for catalysts that maintain predictable reactivity under digital process control.

- Flexible and rigid foam applications continue creating stable opportunities for tailored catalyst solutions.

- Producers strengthen global supply chains to support expansion across diverse industrial sectors.

- New catalyst technologies gain traction in coatings, adhesives, and elastomers with higher performance needs.

- Market participants invest in R&D programs that enhance environmental safety and process efficiency.