Market Overview:

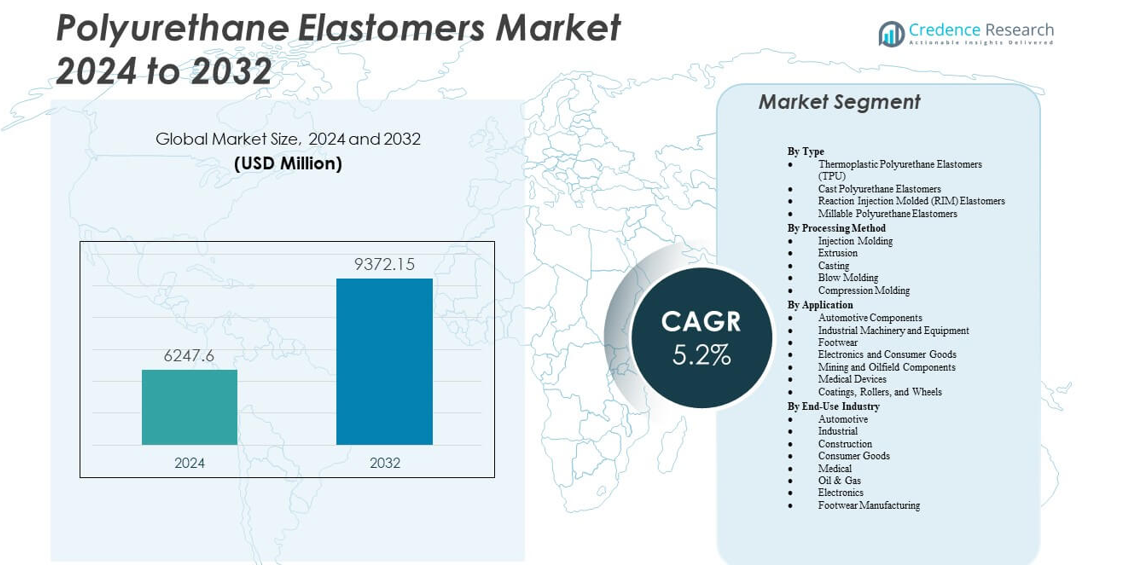

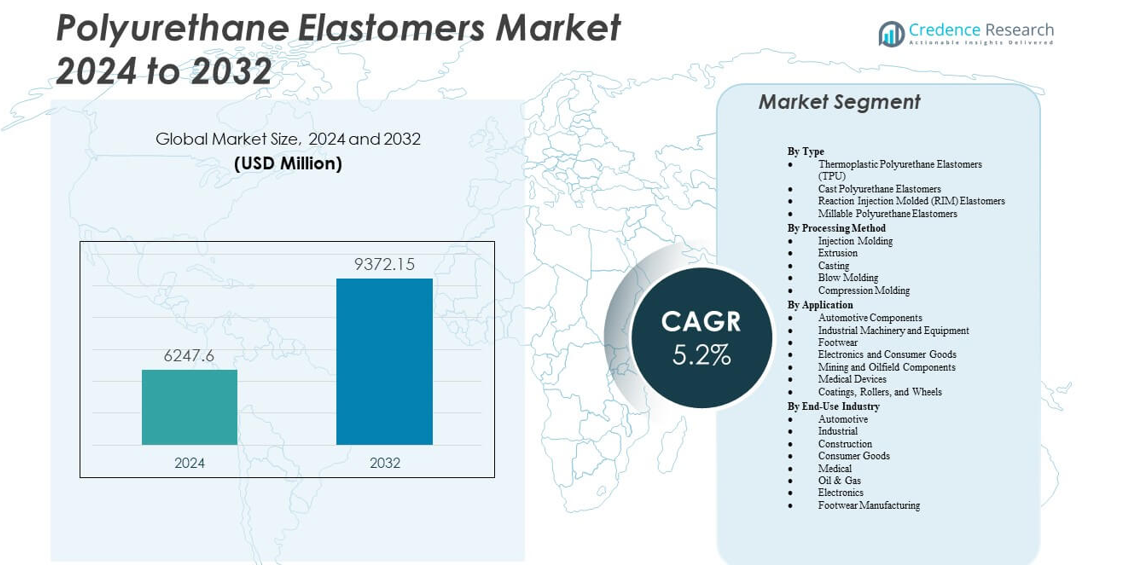

The Polyurethane Elastomers Market is projected to grow from USD 6,247.6 million in 2024 to an estimated USD 9,372.15 million by 2032, with a compound annual growth rate (CAGR) of 5.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyurethane Elastomers Market Size 2024 |

USD 6,247.6 million |

| Polyurethane Elastomers Market, CAGR |

5.2% |

| Polyurethane Elastomers Market Size 2032 |

USD 9,372.15 million |

Demand rises due to growing need for high-performance polymers that withstand repeated stress and extreme conditions. Automotive manufacturers use elastomers for bushings, mounts, and suspension parts, which improve stability and noise control. Industrial machinery plants select durable rollers, liners, and couplings to extend maintenance cycles. Footwear companies use these materials for midsoles and outsoles due to rebound and comfort benefits. Electronics makers apply flexible housings and protective parts across new device categories. Mining and heavy-equipment users pick high-wear grades for harsh sites. These shifts strengthen overall industry adoption.

Asia Pacific leads due to strong manufacturing networks across China, India, Japan, and Southeast Asia. The region benefits from expanding automotive output, large footwear clusters, and rapid machinery production. Europe follows with demand driven by advanced engineering capabilities in Germany, France, and Italy. North America maintains steady growth due to industrial machinery, mining, and automotive suppliers. Latin America emerges through rising activity in Brazil’s industrial corridors. The Middle East and Africa expand gradually with construction and oilfield investments that support wider material use.

Market Insights:

- The Polyurethane Elastomers Market is projected to grow from USD 6,247.6 million in 2024 to USD 9,372.15 million by 2032, supported by a 5.2% CAGR.

- Demand rises due to strong use across automotive parts, machinery components, footwear, electronics, and mining equipment.

- Growth faces restraints from raw material price volatility and strict environmental rules that increase compliance pressure for producers.

- Asia Pacific leads due to strong manufacturing networks and expanding automotive and footwear industries across major economies.

- Europe and North America maintain steady demand, while Latin America and the Middle East & Africa show gradual adoption linked to industrial and construction growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Use of High-Performance Materials in Automotive and Machinery

The Polyurethane Elastomers Market gains momentum due to steady demand for durable parts across mobility and industrial sectors. Automakers adopt elastomers for bushings, wheels, seals, and noise-control parts. Machinery manufacturers prefer them for rollers and couplings that face repeated stress. Producers improve fatigue resistance to support long service life. Buyers value energy return and abrasion strength across tough duty cycles. Industrial users expect consistent behavior under wide temperatures. These gains strengthen confidence in engineered polymers. The sector benefits from broader material upgrades across production environments.

- For instance, Covestro’s Desmopan TPU grades for automotive provide abrasion resistance up to 100,000 cycles in bushings and seals. Machinery manufacturers prefer them for rollers and couplings that face repeated stress.

Rapid Growth in Footwear and Consumer Goods Production

Global footwear brands drive strong adoption due to comfort, rebound, and wear-resistance needs. The Polyurethane Elastomers Market benefits from advanced midsoles and outsoles that offer better cushioning. Sports brands expand use in high-impact shoes. Casual footwear lines pick elastomers to improve daily comfort. Consumer goods makers apply them in grips, wheels, and protective casings. Rising lifestyle shifts increase interest in ergonomic designs. Producers innovate lightweight grades to meet high-volume output. These shifts create stronger pull from fashion and utility markets.

- For instance, Lubrizol’s Estane® TPU grades in the 85A–95A Shore hardness range provide strong resilience and high tear strength suitable for athletic footwear, supporting durable and responsive performance in sports shoe soles. Sports brands expand use in high-impact designs.

Expansion of Protective Materials Across Industrial Environments

Rising safety needs strengthen use in mining, oil, heavy machinery, and material-handling fields. The Polyurethane Elastomers Market supports rollers, liners, screens, and parts that face high wear. Industrial firms trust these materials for impact and tear strength. Harsh environments push demand for grades with chemical tolerance. Plants adopt elastomers to cut downtime and repairs. Buyers value stable behavior under vibration and shock. Performance upgrades extend equipment durability. The trend encourages larger replacement cycles across wide sites.

Broader Adoption Across Electronics and Automation Components

Electronics producers use elastomers for flexible housings, grips, and vibration-control parts. The Polyurethane Elastomers Market aligns with rising automation and compact device needs. Component makers rely on tight tolerance and shape stability. Protection of sensitive modules drives stronger uptake. Robotics firms demand materials that withstand continuous motion. Wearable device production encourages softer, skin-friendly grades. Energy absorption supports safe handling of sensitive tools. The trend expands reach in precision-driven product lines.

Market Trends

Shift Toward Thermoplastic Polyurethane (TPU) for Faster Processing

The Polyurethane Elastomers Market tracks a clear shift toward TPU for its fast molding and recyclability edge. Producers scale TPU lines to meet quick-cycle manufacturing. Buyers pick TPU for footwear, electronics, and automotive trims. Its melt-process design supports high-volume automation. Manufacturers gain efficiency through shorter cooling cycles. TPU blends unlock new softness and strength ranges. Rising manufacturing flexibility drives wider adoption. The trend strengthens demand for thermoplastic grades.

- For instance, BASF’s Elastollan TPU grades for automotive seals offer high temperature resistance up to 125°C and excellent abrasion resistance in injection molding processes.

Integration of Bio-Based and Low-Emission Formulations

Sustainability drives interest in cleaner chemistries across global supply chains. The Polyurethane Elastomers Market sees rising demand for renewable feedstocks. Producers develop grades with better emission profiles. Buyers adopt low-toxicity systems to meet compliance needs. Interest grows across footwear, consumer goods, and industrial parts. Green transitions reshape sourcing strategies. Bio-content offerings help firms meet brand goals. The trend supports long-term environmental plans.

Growing Use of Elastomers in 3D Printing and Customized Parts

Manufacturers explore elastomer compatibility with additive processes to meet design freedom goals. The Polyurethane Elastomers Market benefits from interest in flexible printed parts. Prototyping teams gain faster development cycles. Custom footwear and wearable components use printed elastomer shapes. Industrial users print gaskets, seals, and vibration pads on demand. Better print accuracy supports new applications. Producers refine viscosity profiles for smoother printing. These gains expand advanced manufacturing usage.

Rising Focus on Smart Materials and High-Functionality Systems

Innovation pushes interest toward elastomers with embedded conductivity, sensing ability, or adaptive traits. The Polyurethane Elastomers Market aligns with demand for smarter components. Electronics and automotive firms test grades for motion tracking and pressure response. Wearable devices require high-flex materials. Industrial automation seeks responsive components for improved safety. Producers explore multi-layer constructions. Functional upgrades help firms meet next-generation design needs. This trend creates new growth paths in premium material classes.

- For instance, BASF’s Elastollan® HPM ester TPU grades provide a Shore hardness range of 60A to 55D, offering strong heat stability and improved setting behavior that supports high-performance automotive components and advanced wearable devices.

Market Challenges Analysis

Rising Raw Material Sensitivities and Supply Chain Pressures

The Polyurethane Elastomers Market faces strong challenges from volatile isocyanate and polyol costs. Producers struggle with shifting supply flows across regions. Buyers demand stable pricing for long contracts. Environmental rules increase compliance complexity. Firms track stricter chemical management norms. Production delays affect delivery timelines. Market players adjust sourcing models to reduce disruptions. These pressures limit flexibility for many mid-scale producers.

Technical and Processing Barriers Across Diverse Applications

Performance expectations increase across automotive, mining, footwear, and electronics. The Polyurethane Elastomers Market must balance hardness, flexibility, and thermal stability. Designers expect tight dimensional control. Processing variation in cast and thermoplastic systems creates quality risks. Producers refine formulations to maintain consistency. Equipment upgrades push investment needs. Training gaps in molding lead to defects. These hurdles slow adoption for niche and precision applications.

Market Opportunities

Expansion Potential in High-Growth Industrial and Mobility Applications

Rising automation and electric mobility create strong openings for advanced elastomers. The Polyurethane Elastomers Market can supply high-load components for EV suspensions, wheels, gaskets, and mounts. Industrial machinery requires enhanced wear life. Robotics firms seek flexible and resilient parts. Energy and mining sites need liners and screens that cut downtime. Strong durability unlocks entry into premium categories. Custom engineering strengthens supplier leverage. These areas offer long-term scale opportunities.

Growth Prospects in Sustainability, Recycling, and Next-Gen Processing

Producers can tap new value through bio-based formulations and circular pathways. The Polyurethane Elastomers Market gains room for recyclable TPU systems. Footwear and consumer brands seek closed-loop material models. Cleaner chemistries support regulatory goals in major regions. Additive manufacturing unlocks customized shapes. Smart materials open entry into advanced electronics. Firms that innovate in low-emission systems build strong competitive edges. These shifts create wide growth potential across future product lines.

Market Segmentation Analysis:

By Type

The Polyurethane Elastomers Market expands through steady use of TPU, cast elastomers, RIM systems, and millable grades. TPU gains strong acceptance due to fast processing and recyclability. Cast elastomers support heavy-duty parts that face impact and abrasion. RIM systems deliver low-density structures that suit automotive and equipment housings. Millable elastomers perform well in seals and gaskets. Each type serves different stress and flexibility needs. Producers refine compositions to maintain long-term durability. These differences define clear performance roles across industrial settings.

- For instance, Forward AM’s Ultrasint® TPU01 delivers 88 Shore A hardness and around 280% elongation at break, enabling production of resilient 3D-printed parts with strong flexibility and impact absorption. Cast polyurethane elastomers support heavy-duty components that operate under high abrasion and repeated mechanical stress.

By Processing Method

The Polyurethane Elastomers Market relies on injection molding, extrusion, casting, blow molding, and compression molding. Injection molding supports high-volume parts with tight tolerance. Extrusion creates continuous profiles for seals and industrial strips. Casting suits large rollers and heavy components. Blow molding enables hollow structures in protective parts. Compression molding helps shape tough components with strong bonding. Each method supports unique geometry and load needs. Firms pick methods that match production cycles and equipment setups.

By Application

The Polyurethane Elastomers Market gains value through automotive components, machinery parts, footwear, electronics, mining tools, medical devices, and rollers. Automotive makers use elastomers for bushings, mounts, and wheels. Machinery plants prefer them for rollers and couplings. Footwear brands use them for midsoles and outsoles. Electronics firms apply them in flexible housings. Mining sites depend on liners and screens. Medical tools need soft-touch components. Rollers support print, textile, and material-handling lines.

- For instance, Forward AM’s Ultrasint® TPU01 shows a compression set near 20%, supporting durable shape recovery under continuous load in functional printed parts. Each method supports unique geometry and load needs, and firms pick processing routes that align with production cycles and equipment layouts.

By End-Use Industry

The Polyurethane Elastomers Market serves automotive, industrial, construction, consumer goods, medical, oil and gas, electronics, and footwear sectors. Automotive gains strength in suspension and NVH parts. Industrial users pick durable grades for equipment. Construction values coatings and seal components. Consumer goods rely on comfort and grip features. Medical devices require biocompatible parts. Oil and gas operations need heavy-wear liners. Electronics benefit from flexible housings. Footwear firms rely on cushioning layers for comfort and rebound.

Segmentation:

By Type

- Thermoplastic Polyurethane Elastomers (TPU)

- Cast Polyurethane Elastomers

- Reaction Injection Molded (RIM) Elastomers

- Millable Polyurethane Elastomers

By Processing Method

- Injection Molding

- Extrusion

- Casting

- Blow Molding

- Compression Molding

By Application

- Automotive Components

- Industrial Machinery and Equipment

- Footwear

- Electronics and Consumer Goods

- Mining and Oilfield Components

- Medical Devices

- Coatings, Rollers, and Wheels

By End-Use Industry

- Automotive

- Industrial

- Construction

- Consumer Goods

- Medical

- Oil & Gas

- Electronics

- Footwear Manufacturing

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific holds the largest share of the Polyurethane Elastomers Market, accounting for nearly 45% of global demand. Strong manufacturing bases in China, India, and Southeast Asia drive steady growth. Automotive clusters expand output and lift use of high-performance elastomers. Footwear hubs in Vietnam and Indonesia support wide adoption across midsole and outsole production. Industrial machinery demand increases due to rapid plant expansion. Rising investment in electronics strengthens material use across housings and flexible parts. The region maintains clear leadership through scale and diversified applications.

Europe secures about 25% of the global share and maintains strong technical demand across automotive and industrial fields. The Polyurethane Elastomers Market benefits from established OEMs in Germany, Italy, and France. Producers follow strict quality norms that lift use of premium grades. Machinery and equipment makers rely on fatigue-resistant formulations. Construction firms use coatings, sealants, and rollers across major sites. Demand for sustainable and low-emission materials shapes product choices. The region supports stable long-term consumption through mature industries.

North America holds nearly 20% of the market, supported by strong adoption across industrial machinery, mining, and heavy-equipment segments. It gains steady traction from automotive and energy applications. U.S. producers focus on durable grades for harsh field conditions. Electronics and medical device manufacturers rely on precision parts that meet tight tolerance needs. Latin America accounts for 6%, driven by Brazil’s industrial growth. The Middle East & Africa hold about 4%, supported by oilfield tools and construction equipment. Both emerging regions gain momentum through expanding manufacturing bases.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Dow Inc.

- Covestro AG

- Huntsman Corporation

- Wanhua Chemical Group Co., Ltd.

- Lubrizol Corporation

- Mitsui Chemicals Inc.

- Trelleborg AB

- Stepan Company

- INOAC CORPORATION

Competitive Analysis:

The Polyurethane Elastomers Market features strong competition from global chemical firms that focus on performance differentiation, process efficiency, and customized solutions. Leading producers invest in advanced TPU and cast elastomer technologies to serve fast-cycle manufacturing and heavy-duty applications. Firms expand portfolios with high-wear, low-emission, and recyclable grades to meet new regulatory and sustainability demands. Many players strengthen supply chains to support global customers across automotive, machinery, mining, and footwear sectors. Product development centers improve fatigue strength, rebound, and thermal stability to meet rising technical expectations. Strategic partnerships with OEMs help producers align materials with new product platforms. Regional players compete through cost efficiency and tailored formulations for local industries. The competitive field shifts toward value-added solutions, strong application support, and wider material versatility.

Recent Developments:

- In October 2025, Wanhua Chemical partnered with ENGEL and Hitech Co., Ltd. to sign a strategic cooperation agreement at the K Exhibition in Germany, focusing on advancing polyurethane innovation across the automotive manufacturing value chain.

- In April 2025, BASF showcased sustainable innovations for the polyurethanes industry at PU TECH 2025, introducing the Elastopan Ultra portfolio of super lightweight, high-performance materials tailored for the athleisure segment and Loop PU solutions with recycled content for footwear, automotive, and synthetic leather applications.

- In March 2025, BASF launched biomass balance grades of Elastoflex polyurethane systems for the North American furniture industry, certified under REDcert2 and produced at sites like Livonia, Michigan, offering up to 75% reduced product carbon footprint compared to conventional flexible polyurethane foam.

- In February 2025, in BASF announced the construction of a new Cellasto® microcellular polyurethane plant in Dahej, India, to expand capacity for local automotive NVH requirements

Report Coverage:

The research report offers an in-depth analysis based on Type, Processing Method, Application and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-performance polymers strengthens due to rising use across mobility and industrial fields.

- Growth improves as footwear brands expand adoption of durable and lightweight elastomer grades.

- Production efficiency gains emerge through wider use of thermoplastic variants in fast-cycle lines.

- Sustainability targets push stronger interest in low-emission and renewable-content formulations.

- Electronics and automation sectors lift demand for flexible housings and vibration-control parts.

- Mining and heavy industries continue to shift toward longer-life wear components.

- Medical and consumer goods producers adopt softer, skin-friendly grades for comfort-driven designs.

- Advanced manufacturing benefits from elastomers that support customized and complex geometries.

- Innovation accelerates through smarter material systems designed for next-generation devices.

- Global supply chains diversify, lifting opportunities for regional producers in growth markets.