Market Overview:

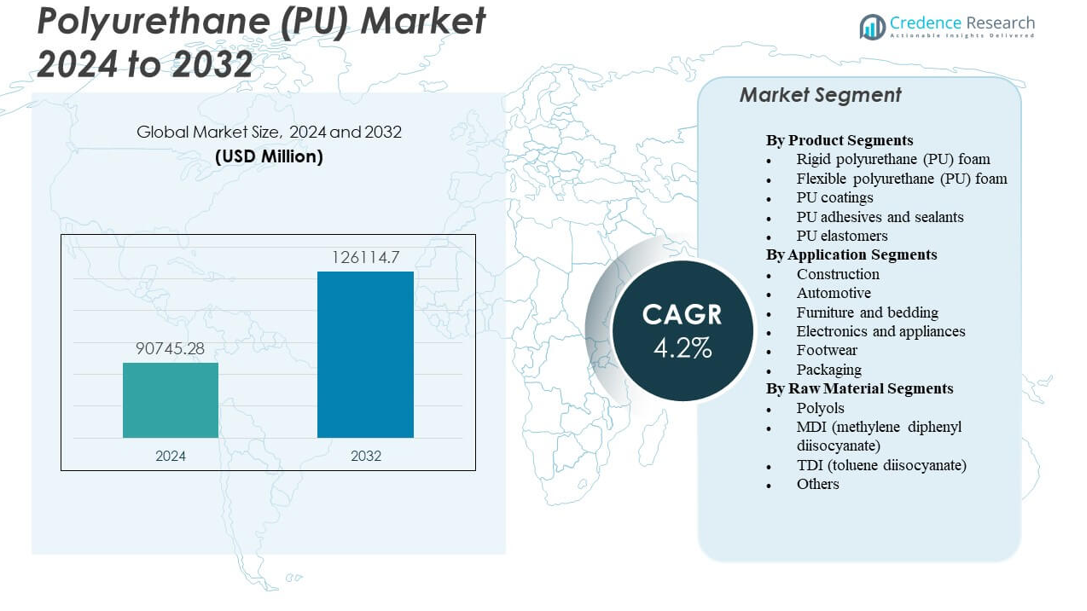

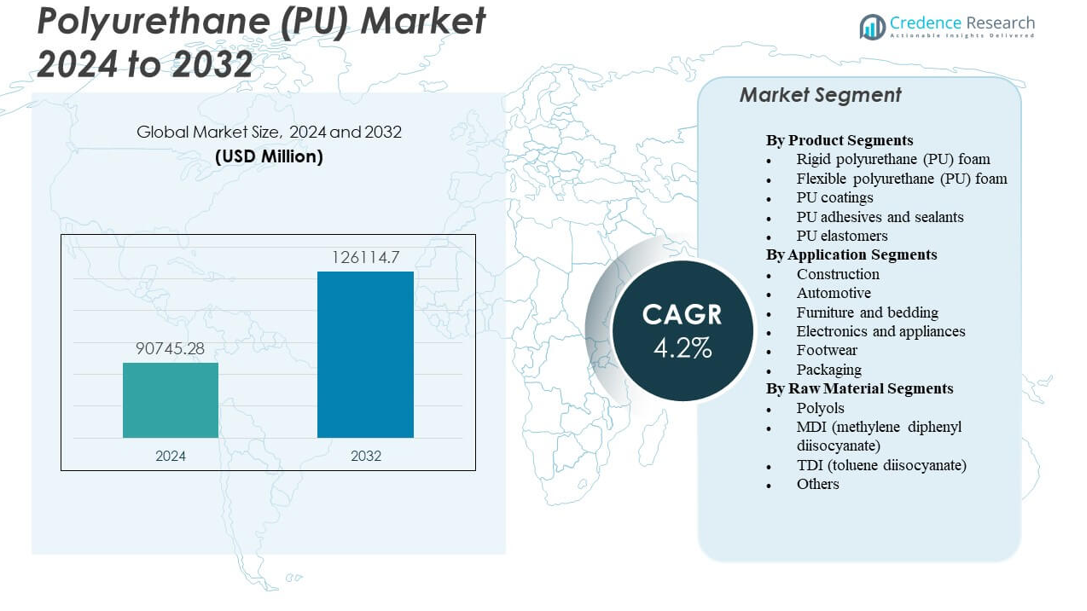

The Polyurethane (PU) Market is projected to grow from USD 90745.28 million in 2024 to an estimated USD 126114.7 million by 2032, with a compound annual growth rate (CAGR) of 4.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyurethane (PU) Market Size 2024 |

USD 90745.28 million |

| Polyurethane (PU) Market, CAGR |

4.2% |

| Polyurethane (PU) Market Size 2032 |

USD 126114.7 million |

The Polyurethane (PU) Market gains momentum from expanding use of rigid and flexible foams across buildings, mobility systems, and consumer goods. Producers upgrade formulations to improve durability, thermal stability, and comfort performance. Automotive makers increase PU use in seating, interiors, and lightweight modules that support energy efficiency. Furniture and bedding suppliers rely on PU for reliable cushioning and long-term resilience. Appliance and electronics makers adopt PU for noise control and insulation needs. Adhesives, sealants, and coatings strengthen demand through industrial infrastructure activity. Broad industry adoption supports stable long-term growth.

Regional growth remains led by Asia Pacific, supported by strong industrial output, construction expansion, and high automotive production. China, India, and Southeast Asia drive wide PU adoption due to rapid urban development and manufacturing scale. Europe follows with strong demand tied to strict insulation standards and advanced engineering applications. North America maintains steady use across housing upgrades, appliances, and transport systems. Latin America and the Middle East & Africa emerge as developing markets with rising construction activity and expanding consumer industries. Global demand remains balanced across mature and emerging regions.

Market Insights:

- The Polyurethane (PU) Market is projected to grow from USD 90745.28 million in 2024 to USD 126114.7 million by 2032, at a 4.2% CAGR.

- Strong demand from construction, automotive, furniture, and appliances drives market expansion.

- Volatile raw materials, strict emission rules, and recycling challenges restrain wider adoption.

- Asia Pacific leads due to rapid industrial growth, while Europe and North America show stable demand.

- Emerging regions such as Latin America and the Middle East & Africa gain traction through expanding construction and consumer sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Construction, Automotive, and Industrial Systems

Strong adoption in construction boosts insulation, roofing, and structural uses that lift the Polyurethane (PU) Market. Builders prefer PU foams for energy savings and long-term stability. Automotive makers shift toward PU seating, interior trims, and lightweight modules that support better comfort. Appliance producers use rigid PU to meet efficiency laws for cooling systems. Furniture firms scale flexible foam lines for bedding and cushioning needs. Coatings grade PU gains demand from infrastructure repair activity. The market benefits from broad versatility across end-user groups. It maintains stable growth due to constant industrial application range.

- For example, BASF’s Elastopor® H rigid PU foam systems are engineered for high-performance insulation and are known for low thermal conductivity values. A thermal conductivity around 022 W/(m·K) aligns with published performance ranges for advanced PU rigid foams used in energy-efficient building applications.

Shift Toward High-Performance Materials Across Consumer and Technical Sectors

Producers upgrade PU grades to improve thermal stability, mechanical strength, and durability across many systems. Consumers prefer PU-based comfort goods that maintain shape and long-term softness. Electronics and appliance plants adopt PU for noise control and vibration reduction. Flexible foams remain vital for mattresses and seating designs. Coatings and adhesives benefit from improved bonding strength. Footwear brands pick PU midsoles for impact control and wear resistance. The Polyurethane (PU) Market gains strong traction from performance-oriented demand patterns. It supports wider industrial upgrades that require reliable polymers.

- For example, Covestro’s Desmopan® TPU grades include reinforced variants designed for strong mechanical performance in automotive interiors. Reinforced TPU materials commonly reach tensile strengths near 50 MPa, which aligns with published ranges for glass-fiber-enhanced TPU used in durable interior components.

Growing Focus on Energy Efficiency and Sustainability Targets Worldwide

Government rules push higher insulation use across residential and commercial projects. Producers invest in low-emission PU systems to meet strict regulatory norms. Interest in bio-based PU alternatives grows due to rising sustainability goals. Foam makers cut VOC levels to meet green building standards. Demand for rigid PU panels rises due to strong thermal resistance traits. Transport sectors move toward lightweight PU modules to improve efficiency. The Polyurethane (PU) Market gains steady support from global energy-saving goals. It enables industries to meet evolving environmental expectations.

Expansion of Manufacturing Capacity and Advanced Processing Technologies

Producers install automated lines to improve yield, quality, and material control. Investments in high-pressure foam machines improve throughput. Formulators create PU blends with better curing behavior and stability. Coating suppliers design PU systems that offer long wear and chemical resistance. Footwear plants deploy PU casting units for consistent product output. Automotive suppliers expand PU molding operations for advanced seating designs. The Polyurethane (PU) Market benefits from enhanced plant infrastructure. It gains momentum through better global supply strength.

Market Trends

Rising Adoption of Bio-Based and Low-Emission PU Formulations

Bio-based feedstock use expands due to strong environmental priorities worldwide. Producers introduce PU systems with reduced carbon footprints. Coatings and foams shift toward low-VOC formulations to meet health rules. Green building programs encourage wider use of sustainable PU grades. Furniture brands pick renewable foam options for eco-focused consumers. Adhesive suppliers adopt safer PU chemistries. The Polyurethane (PU) Market reflects a clear trend toward clean production shifts. It aligns global operations with sustainability expectations.

Growth in PU Use for Smart Appliances, EVs, and High-Tech Products

EV makers use PU for lightweight battery covers, insulation blocks, and acoustic layers. Appliance brands integrate PU to meet stricter noise rules. Smart device makers adopt PU coatings for scratch resistance. HVAC systems use PU for improved efficiency and airflow control. EV interiors use PU for comfort and reduced vibration levels. Robotics units use PU buffers for safe operation. The Polyurethane (PU) Market gains traction across next-generation product lines. It supports rising technical sophistication in consumer and industrial designs.

Expansion of PU Elastomers and Coatings in Industrial and Protective Uses

PU elastomers gain wider use in mining, oil, heavy machinery, and rollers. Their abrasion strength improves lifespan in tough environments. PU coatings protect steel structures and floors from heavy wear. Pipeline and marine systems gain PU linings for corrosion control. Industrial wheels and gears use PU for shock resistance. Tooling applications rely on PU for flexible mold production. The Polyurethane (PU) Market shows strong interest in resilient elastomer systems. It reflects steady movement toward protective polymer technologies.

- For instance, Covestro’s Desmodur® elastomer systems achieve abrasion loss below 80 mm³ in DIN wear tests, supporting long-life rollers and industrial wheels. It reflects steady movement toward protective polymer technologies.

Growing Demand for Lightweight, Flexible, and Customizable Foam Products

Producers design advanced foams that improve comfort and load-bearing strength. Bedding and furniture firms request personalized density profiles. Automakers adopt foam structures that improve seating ergonomics. Sports brands use PU foams for helmets, pads, and footwear. Packaging designers use PU inserts for protective cushioning. Aviation and rail sectors explore lightweight PU interiors. The Polyurethane (PU) Market sees strong interest in ergonomic and flexible foam technologies. It supports design freedom across many high-use categories.

- For instance, BASF’s Elastoflex® flexible foams reach compression hardness values above 4.0 kPa, supporting comfort-focused applications in bedding and automotive seating. It supports design freedom across many high-use categories.

Market Challenges Analysis

Environmental Regulations, Raw Material Volatility, and Emission Control Pressures

Strict rules target VOC levels, forcing producers to adjust PU formulations. Compliance pushes cost pressure across many operations. Raw material swings in isocyanates and polyols affect planning cycles. Some regions face limited access to stable feedstock supply. Waste management rules restrict open disposal of PU waste. Recycling complexity limits large-scale recovery. The Polyurethane (PU) Market faces higher scrutiny due to environmental impact. It adapts through technical upgrades and improved sourcing steps.

Technical Limitations, Recycling Barriers, and Competitive Material Substitution

Mechanical recycling for PU remains difficult due to complex structures. Chemical recycling needs high investment and strict control steps. Competing materials like expanded polystyrene or rubber attract buyers in price-sensitive markets. OEMs compare PU with alternative foams during cost reviews. Product failures tied to moisture sensitivity push strict testing. Manufacturers struggle to balance cost with performance in certain grades. The Polyurethane (PU) Market deals with competitive pressure from substitutes. It responds by developing improved and more durable variants.

Market Opportunities

Expansion of Bio-Based PU, Green Chemistry, and Sustainable Manufacturing Pathways

Bio-polyols create new scope for renewable PU materials. Producers scale facilities to meet global sustainability goals. Buildings shift toward eco-certified insulation solutions. Furniture and bedding firms adopt green foam lines for better branding appeal. Governments push low-emission products across major sectors. Coatings and adhesives upgrade to safer chemistries. The Polyurethane (PU) Market gains long-term opportunity in cleaner production models. It builds relevance in sustainability-driven industries.

Growth in High-Performance Foams, EV Components, and Advanced Industrial Uses

High-strength foams support next-wave transportation, aerospace, and logistics systems. EV makers expand PU demand for acoustics, insulation, and interiors. Industrial machinery uses PU elastomers for tough operating environments. Construction projects adopt PU panels for structural and thermal performance. Sports brands design protective gear with advanced PU blends. Appliance brands need better PU for energy rules. The Polyurethane (PU) Market benefits from rising interest in durable, lightweight, and technical materials. It moves toward broader integration across fast-growing sectors.

Market Segmentation Analysis:

By Product Segments

Rigid polyurethane foam holds strong relevance in the Polyurethane (PU) Market due to its wide use in insulation and structural panels. Demand rises across construction and refrigeration where thermal efficiency matters. Producers improve foam density to support long-term durability. It gains steady traction from energy-focused building rules. Flexible polyurethane foam maintains strong use across furniture, bedding, and automotive seating. Users prefer it for comfort, resilience, and design freedom. PU coatings scale across industrial and consumer sectors that need protective surfaces. PU adhesives and sealants support construction and manufacturing tasks that require strong bonding. PU elastomers grow across machinery, footwear, and industrial parts where durability is essential.

- For instance, Henkel Loctite achieving lap shear strength of 2170 psi after 1 hour. PU elastomers grow across machinery, footwear, and industrial parts where durability is essential, for instance Nagase polyurethane products with elongation at break of 300 to 700%.

By Application Segments

Construction remains a core application within the Polyurethane (PU) Market, driven by insulation boards, spray foams, and energy-efficient systems. Builders adopt PU for stable thermal performance and lower energy loss. Automotive applications gain momentum through seating, interiors, and lightweight modules. It benefits vehicle makers seeking efficiency and comfort improvements. Furniture and bedding producers use PU for cushioning and structural support. Electronics and appliances adopt PU for insulation, noise control, and protective housings. Footwear makers use PU for soles and performance-driven midsoles. Packaging firms rely on PU structures for shock absorption and product safety.

By Raw Material Segments

Polyols serve as core feedstocks across the Polyurethane (PU) Market, supporting flexibility, density control, and performance tuning in many products. MDI holds strong demand through its essential use in rigid foams and coatings. Producers adopt MDI-based systems for strength and low thermal conductivity. TDI remains important for flexible foams used across furniture and bedding. It supports mass production in comfort-focused goods. Other raw materials, including specialty isocyanates and additives, enable advanced formulations for industrial and technical PU systems.

- For instance, BASF polyols in rigid foam with temperatures up to +200°C. MDI holds strong demand through its essential use in rigid foams and coatings,

Segmentation:

By Product Segments

- Rigid polyurethane (PU) foam

- Flexible polyurethane (PU) foam

- PU coatings

- PU adhesives and sealants

- PU elastomers

By Application Segments

- Construction

- Automotive

- Furniture and bedding

- Electronics and appliances

- Footwear

- Packaging

By Raw Material Segments

- Polyols

- MDI (methylene diphenyl diisocyanate)

- TDI (toluene diisocyanate)

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific holds the largest share of the Polyurethane (PU) Market, accounting for around 45% of global demand. Strong manufacturing bases in China, India, South Korea, and Southeast Asia support continuous PU consumption across construction and automotive supply chains. Producers expand capacity to meet rising local demand for insulation and comfort products. It gains support from urban growth, industrial activity, and wider appliance use. Europe follows with nearly 25% share driven by strict insulation rules and strong automotive programs. The region maintains stable adoption due to its mature industrial base and high-quality standards.

North America represents close to 20% share supported by housing upgrades, appliance demand, and advanced PU systems for transport and industrial uses. Producers benefit from strong chemical supply chains that ensure consistent output. It maintains healthy adoption across insulation, furniture, and automotive parts. PU foam penetration remains high due to performance needs in comfort and energy-focused applications. Canada and the U.S. show steady interest in premium PU grades. Strong innovation cycles support regional competitiveness in advanced foams and coatings.

Latin America holds roughly 6% share and shows steady growth led by construction and consumer goods sectors. Brazil drives the bulk of demand for flexible foams, coatings, and construction-grade PU systems. It gains momentum from expanding middle-class consumption and infrastructure plans. The Middle East & Africa follow with around 4% share supported by building upgrades, industrial uses, and appliance growth. Energy-efficient materials gain wider acceptance across new projects. Regional diversification improves PU demand across emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Covestro AG

- Dow

- Huntsman International LLC

- Wanhua Chemical Group

- Carpenter Co.

- DIC Corporation

- INOAC Corporation

- LANXESS

- Mitsui Chemicals Inc.

Competitive Analysis:

Key players in the Polyurethane (PU) Market operate in a competitive environment shaped by innovation, capacity expansion, and regional growth patterns. Leading companies invest in advanced foams, elastomers, adhesives, and coatings to meet evolving industrial needs. It pushes producers to focus on energy-efficient insulation, lightweight automotive components, and long-life protective systems. Global chemical firms strengthen their portfolios with bio-based PU and low-emission formulations that support sustainability goals. Mergers and partnerships help companies secure raw materials, expand production lines, and enter new application markets. Competitors also upgrade technical service networks to support OEMs in furniture, electronics, transport, and construction. Regional players focus on cost efficiency, flexible production, and rapid delivery models. The market maintains strong rivalry across product innovation, pricing strategies, and application-specific technical expertise.

Recent Developments:

- In June 2025, Colson Group acquired ESCO Plastics, a Houston-based manufacturer of custom-molded polyurethane parts, to bolster its U.S. manufacturing capabilities and urethane expertise for casters and wheels.

- In April 2025, BASF SE led sustainable innovations at the PU TECH 2025 event, showcasing a range of advanced high-performance polyurethane solutions across various industries. BASF introduced a synthetic leather solution called Haptex for automotive seats and a portfolio called Elastopan®Ultra tailored for the athleisure segment.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application and Raw Material. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced insulation systems will expand due to wider use of PU in modern buildings.

- Automotive suppliers will adopt more PU foams for comfort, weight reduction, and interior upgrades.

- Rigid PU panels will gain momentum in energy-focused construction projects across key markets.

- Bio-based PU grades will grow as producers align with global sustainability goals and cleaner chemistry.

- PU elastomers will see higher use in machinery, transport, and industrial wear applications.

- Electronics and appliance makers will integrate more PU for noise control and protective structures.

- Furniture and bedding brands will rely on PU foams to support comfort, durability, and design freedom.

- Global producers will expand capacity to meet rising demand across emerging economies.

- PU coatings will secure greater relevance in infrastructure protection and industrial surfaces.

- Packaging and logistics sectors will explore lightweight PU systems for safer and stable cushioning.