Market Overview:

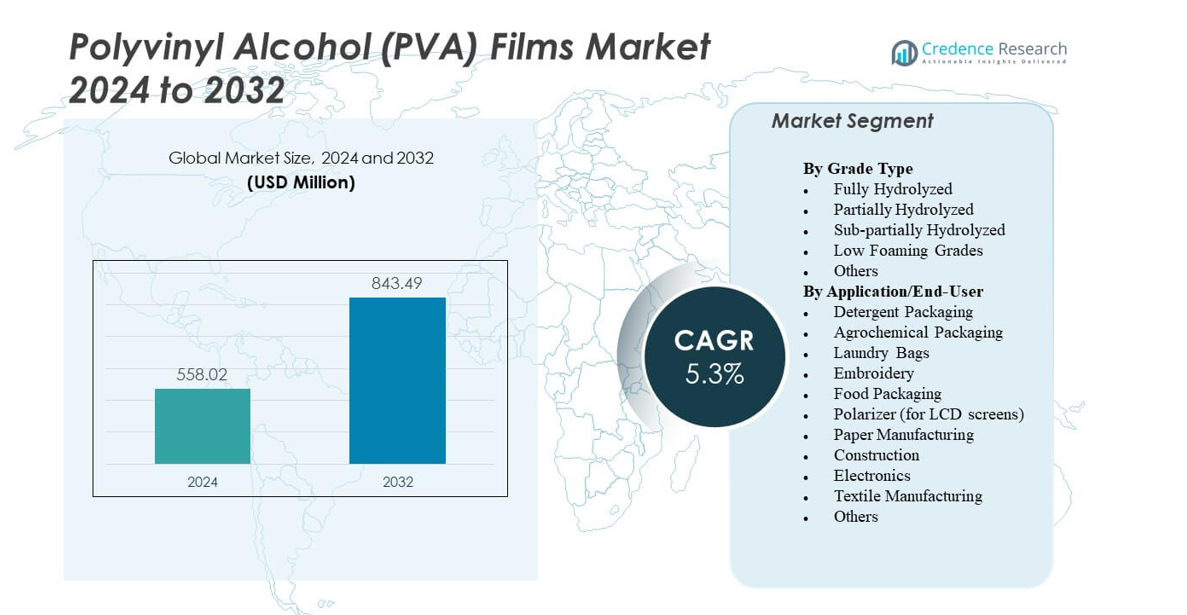

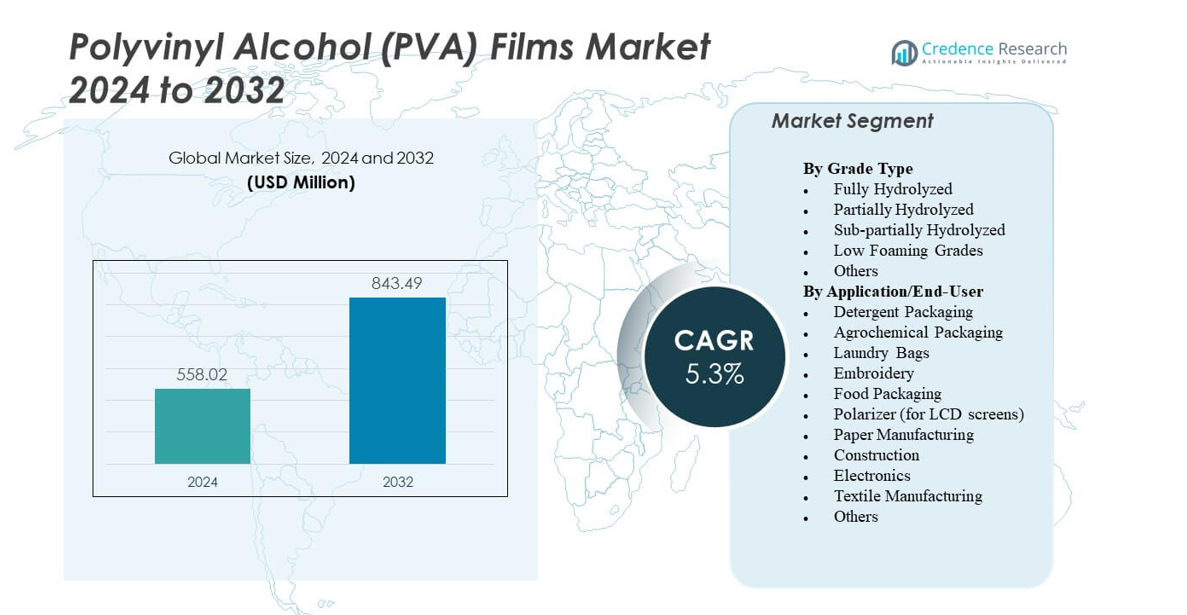

The Polyvinyl Alcohol (PVA) Films Market is projected to grow from USD 558.02 million in 2024 to an estimated USD 843.49 million by 2032, with a compound annual growth rate (CAGR) of 5.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyvinyl Alcohol (PVA) Films Market Size 2024 |

USD 558.02 million |

| Polyvinyl Alcohol (PVA) Films Market, CAGR |

5.3% |

| Polyvinyl Alcohol (PVA) Films Market Size 2032 |

USD 843.49 million |

Strong environmental awareness and packaging reforms propel the Polyvinyl Alcohol (PVA) Films Market. Manufacturers emphasize eco-friendly and recyclable alternatives to traditional plastics. Demand increases for water-soluble films in detergents, agrochemical dosing, and food packaging due to their safe dissolution and waste reduction benefits. Technological improvements in polymer blending enhance film durability and moisture resistance. Optical-grade films find wide use in LCD and LED displays, strengthening electronics applications. The market benefits from sustainability goals, corporate green initiatives, and expanding product utility in both consumer and industrial fields.

Asia Pacific dominates the Polyvinyl Alcohol (PVA) Films Market due to large-scale electronics, packaging, and textile production. China and Japan lead with high consumption in optical and polarizer films. North America grows steadily on the back of detergent pods and eco-safe packaging demand. Europe shows strong adoption driven by regulatory emphasis on biodegradable materials and advanced textile applications. Emerging regions such as Latin America and the Middle East & Africa gradually expand usage through rising industrial manufacturing and sustainability adoption programs.

Market Insights:

- The Polyvinyl Alcohol (PVA) Films Market is projected to grow from USD 558.02 million in 2024 to USD 843.49 million by 2032, registering a CAGR of 5.3% during the forecast period.

- Growing demand for biodegradable and water-soluble packaging materials boosts market expansion across detergent, agrochemical, and food sectors.

- Limited moisture resistance and higher production costs compared to traditional plastics restrain large-scale industrial adoption.

- Asia Pacific leads the global market, supported by strong manufacturing in China, Japan, and South Korea.

- North America and Europe experience steady growth, driven by sustainability policies and advanced consumer packaging applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Shift Toward Sustainable and Water-Soluble Packaging Solutions

The Polyvinyl Alcohol (PVA) Films Market grows due to strong preference for eco-friendly packaging formats. Manufacturers favor water-soluble films to replace single-use plastics in detergents, agrochemicals, and food packaging. It supports regulatory compliance and corporate sustainability goals. Detergent pods and unit-dose cleaning products expand commercial use. Producers develop high-strength films with improved dissolution rates to enhance performance. Consumers appreciate safety, convenience, and reduced plastic waste. Industrial applications broaden into controlled-release fertilizers and water-soluble bags. The transition toward greener solutions continue to drive film innovation. Global sustainability mandates reinforce this demand growth.

Expanding Use in Electronics and Optical Applications

Demand strengthens with rising electronics production, where PVA films act as critical polarizer layers. It provides uniform thickness and optical clarity required for LCD, LED, and OLED displays. Manufacturers in Japan, South Korea, and China increase investments in display film production. The films’ water solubility enables easy lamination and recycling within display modules. High adhesion and dimensional stability improve output consistency. Rising consumer electronics demand fuels bulk procurement of polarizer-grade PVA films. Advanced formulations enhance UV resistance and durability in long-use screens. Companies integrate precision coating and stretching systems to achieve optical-grade quality. This segment secures steady revenue growth across Asia Pacific hubs.

- For instance, cellulose nanocrystal (CNC)-reinforced PVA bio-nanocomposite films reduced water absorption capacity from 93% to 75% with increasing CNC content via hydrogen bonding interactions.

Increased Demand from Textile and Construction Industries

Textile industries employ PVA films for warp sizing, achieving reduced breakage and improved yarn efficiency. It ensures better weaving speeds and lower friction during processing. In construction, water-soluble PVA films find use in mold release agents and temporary protection films. The films degrade safely without leaving residue, reducing cleaning costs and waste. Growth in industrial manufacturing boosts film adoption for water-soluble casting applications. Builders favor the films for their biodegradable nature and operational ease. Advancements in polymer blending further increase heat and moisture stability. Regional manufacturers develop cost-efficient grades tailored for heavy-duty industrial use. The sector’s steady expansion continues to lift overall market penetration.

Support from Regulatory Frameworks and Biopolymer Research

Governments promote PVA film use through plastic reduction mandates and recycling regulations. It benefits from inclusion under biodegradable and compostable material standards. Continuous R&D supports bio-based PVA derived from renewable ethanol and natural polymers. This innovation strengthens alignment with green economy objectives. Universities and chemical firms co-develop catalysts to improve synthesis efficiency. These improvements lower production costs and energy use across large-scale plants. The Polyvinyl Alcohol (PVA) Films Market benefits from policy incentives in developed and emerging economies. It continues to attract funding from sustainability-driven investment programs. Strong institutional support drives long-term material substitution momentum.

- For instance, 5% TEMPO-oxidized cellulose nanofibril (TOCN) reinforced PVA films lowered water vapor permeability from 6.97 × 10^{-7} g/s·m·Pa to 2.82 × 10^{-7} g/s·m·Pa. This innovation strengthens alignment with green economy objectives.

Market Trends

Advancement in High-Performance Film Formulations

Producers focus on engineering PVA films with superior mechanical and moisture-resistant properties. Nanocomposite and copolymer modifications increase tensile strength while maintaining solubility. It allows broader application in packaging, optical films, and agriculture. Research centers test hybrid blends with starch and cellulose to enhance biodegradability. Improved moisture barriers expand shelf life in food and detergent applications. Controlled-release versions gain traction in pharmaceuticals and agrochemicals. Continuous material upgrades keep product lines competitive. Firms adopt cleaner production technologies to meet energy efficiency targets. These developments mark a transition toward next-generation PVA solutions.

Growing Integration in Detergent Pods and Cleaning Products

Water-soluble packaging remains a major consumption driver for PVA films. Producers supply advanced film grades for automatic washing capsules and disinfectant pouches. It ensures safe product handling and accurate dose delivery. Consumer brands promote sustainability through plastic-free labeling. Rising hygiene awareness after global health events strengthens capsule product demand. Manufacturers deploy multilayer structures for better seal integrity and storage stability. It enables films to perform across diverse humidity and temperature conditions. Retail growth across Asia and Europe supports continuous packaging innovation. The trend indicates lasting preference for eco-efficient packaging solutions.

- For instance, PVA/CS films reinforced with 0.5 wt% TOCNs reached peak tensile strength in blends like PVA/CS 25/75, surpassing unmodified versions. It ensures safe product handling and accurate dose delivery.

Increased Adoption of Smart Manufacturing and Automation Technologies

Automation reshapes the production efficiency of PVA films across global facilities. Robotic extrusion and continuous monitoring systems ensure precise film uniformity. Digital quality control reduces defects and waste in large-scale operations. AI-based analytics improve resin flow optimization and thickness calibration. The Polyvinyl Alcohol (PVA) Films Market leverages these tools for scalable production. Automated packaging lines integrate seamlessly with dissolvable film rolls. It shortens delivery time and reduces manual intervention. Firms also track performance data for predictive maintenance and downtime reduction. This shift enhances productivity and quality standards across the sector.

- For instance, freeze/thaw cycling produced PVA films with maximum stress of 46.2 MPa and Young’s modulus up to 9.8 GPa, without additives. Digital quality control reduces defects and waste in large-scale operations.

Rising Focus on Bio-Based and Renewable Feedstock Production

Manufacturers move toward renewable ethanol and sugarcane-derived raw materials for PVA synthesis. It supports circular economy objectives and reduces dependency on fossil inputs. Bio-based grades match conventional film performance in strength and clarity. Pilot-scale facilities test enzyme-based polymerization for energy-efficient production. Certification under ISCC PLUS and ASTM D6400 boosts global adoption confidence. R&D investments target scalable green chemistry methods. It improves lifecycle emissions metrics across packaging and textile sectors. The trend aligns with corporate sustainability strategies of leading producers. Growing consumer awareness accelerates adoption of renewable PVA film products.

Market Challenges Analysis

High Production Costs and Limited Feedstock Availability

The Polyvinyl Alcohol (PVA) Films Market faces pressure from fluctuating raw material costs. Vinyl acetate monomer prices directly influence total production expenditure. Dependence on petrochemical inputs restricts cost stability for large-scale producers. Bio-based alternatives remain expensive due to limited feedstock and supply chain inefficiencies. High energy use during polymerization further adds to operating costs. Developing cost-effective synthesis routes becomes critical for profitability. Regional players face difficulty competing with established multinational suppliers. Currency fluctuations also impact export margins across emerging economies. Addressing feedstock diversity and efficiency remains a key challenge.

Performance Limitations Under High-Moisture Environments

PVA films demonstrate high solubility, which restricts application in humid or wet storage conditions. Excessive moisture exposure can compromise film strength and sealing performance. Packaging for certain foods and chemicals demands improved barrier control. Manufacturers test copolymer blends, but trade-offs with solubility persist. Handling during logistics becomes complex due to film’s sensitivity to water. Quality consistency requires strict temperature and humidity regulation. End-users hesitate to adopt films for long-term outdoor exposure. Continuous research is needed to enhance hydrophobic modifications. Technical barriers still limit full replacement of traditional polymers.

Market Opportunities

Expansion in Sustainable Packaging and Consumer Goods

Growing demand for biodegradable packaging presents major growth avenues for PVA film suppliers. It supports brand differentiation in detergents, agrochemicals, and healthcare products. Emerging consumer preference for zero-waste formats accelerates innovation. Companies introduce tailored solutions for unit-dose packaging and single-use capsules. The Polyvinyl Alcohol (PVA) Films Market benefits from policy-backed environmental incentives. Film producers partner with FMCG brands to scale eco-friendly packaging rollouts. Global retailers prioritize dissolvable packaging in private-label products. Development of antimicrobial and odor-resistant variants opens new product lines. Rising collaboration with biopolymer firms creates opportunities for high-value innovations.

Emerging Demand in Medical, Optical, and Agricultural Applications

Healthcare industries adopt PVA films for water-soluble drug capsules, wound dressings, and surgical packaging. It ensures biocompatibility and minimal residue post-dissolution. Optical film use expands with display growth in consumer electronics and automotive displays. Agriculture adopts biodegradable mulch films and seed wraps using PVA blends. These applications replace traditional polyethylene films prone to microplastic generation. Research into nanocomposite reinforcement enhances tensile and chemical resistance. Producers target niche medical and industrial segments for premium-grade offerings. Strategic alliances with regional converters expand reach into developing markets. The opportunity landscape widens with the material’s versatility across high-growth sectors.

Market Segmentation Analysis:

By Grade Type

Fully hydrolyzed grades dominate the Polyvinyl Alcohol (PVA) Films Market due to their high tensile strength, strong adhesion, and resistance to solvents. They are widely used in polarizer films, construction, and textile applications where durability and clarity are vital. Partially hydrolyzed grades show the fastest growth driven by their flexibility, solubility, and suitability for detergent pods and agrochemical packaging. Sub-partially hydrolyzed grades serve niche uses in food coatings and temporary molds where controlled dissolution is required. Low foaming grades gain preference in automatic packaging lines that demand process stability. Other specialty grades address optical, biomedical, and composite film needs, supporting market diversity and innovation.

- For instance, PVA fibers with LiI addition and heat-treatment at 150°C achieved tensile strength of 1436 MPa.

By Application/End-User

Detergent packaging leads the Polyvinyl Alcohol (PVA) Films Market, accounting for a major share due to extensive use in water-soluble pods and capsules. Its demand expands with consumer focus on safe, pre-measured cleaning products. Agrochemical packaging follows, supported by use in controlled-release pesticides and fertilizer films. Laundry bags gain traction in hospitals and hospitality sectors for hygienic waste handling. Embroidery and textile applications grow with films used as dissolvable stabilizers and temporary backings. Food packaging uses increase in portioned edible films and biodegradable wraps. Polarizer films in LCD screens form a strong electronics segment, while construction and paper manufacturing employ PVA films for surface protection and water-resistant coatings.

- Laundry bags gain traction in hospitals and hospitality sectors for hygienic waste handling. For instance, PVA with 5 wt% HNTs increased tensile strength by 300% in films.

Segmentation:

By Grade Type

- Fully Hydrolyzed

- Partially Hydrolyzed

- Sub-partially Hydrolyzed

- Low Foaming Grades

- Others

By Application/End-User

- Detergent Packaging

- Agrochemical Packaging

- Laundry Bags

- Embroidery

- Food Packaging

- Polarizer (for LCD screens)

- Paper Manufacturing

- Construction

- Electronics

- Textile Manufacturing

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific dominates the Polyvinyl Alcohol (PVA) Films Market with a market share of around 46–48% in 2024. Strong manufacturing bases in China, Japan, and South Korea support large-scale production of polarizer films and water-soluble packaging. High consumption across electronics, textiles, and detergent pods drives regional strength. Continuous investment in optical-grade film facilities and biopolymer research sustains growth. Expanding consumer goods and agricultural packaging sectors in India and Southeast Asia also enhance market penetration. Government sustainability programs and plastic reduction mandates further boost adoption. Regional integration across the film value chain improves cost efficiency and export potential.

Europe accounts for nearly 24–26% of the global share due to its early adoption of biodegradable and water-soluble packaging solutions. Regulatory enforcement under the EU’s plastic waste directives accelerates the transition toward PVA-based alternatives. Major markets include Germany, France, and the U.K., where FMCG and detergent brands deploy eco-friendly pod films. The textile industry adopts PVA films for embroidery and water-soluble stabilizers. Technological advancements in film coating, curing, and recycling enhance regional competitiveness. Strong consumer awareness about sustainable packaging supports continued expansion. R&D programs focusing on renewable ethanol-derived PVA further reinforce Europe’s position.

North America holds around 19–21% of the market share, supported by demand from detergent, agriculture, and healthcare sectors. The U.S. leads with established production hubs and strategic partnerships across packaging and electronics. Adoption grows through innovations in pod-based packaging and water-soluble laundry bags. Rising investment in clean-label products strengthens market outlook. Canada and Mexico contribute through export-oriented manufacturing and low-cost logistics networks. Latin America represents 6–7%, while the Middle East & Africa collectively account for 4–5%, driven by emerging industrial packaging and construction applications. It continues to find steady demand in developing economies with growing sustainability goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Kuraray Co., Ltd.

- Mitsubishi Chemical Group Corporation

- Aicello Corporation

- Sekisui Chemical Co., Ltd.

- Nippon Synthetic Chemical Industry Co., Ltd.

- MonoSol LLC

- Chang Chun Group

- Jiangmen Proudly Water-Soluble Plastic Co., Ltd.

- Foshan Polyva Materials Co., Ltd.

- BASF SE

- LG Chem

- Nitto Denko Corporation

Competitive Analysis:

The Polyvinyl Alcohol (PVA) Films Market features a moderately consolidated landscape led by global and regional manufacturers. Key players include Kuraray Co., Ltd., Sekisui Chemical Co., Ltd., Aicello Corporation, Nippon Gohsei, Arrow Coated Products Ltd., and Cortec Corporation. These firms focus on product differentiation through film thickness, solubility, and barrier strength. Strategic investments target bio-based raw materials and water-soluble product expansion. Partnerships with detergent, electronics, and optical film companies enhance downstream integration. Asian producers maintain cost advantage through optimized polymerization and energy-efficient processing. European firms lead in certified biodegradable grades. Global competition centers on sustainability, manufacturing precision, and diversified end-user applications, driving continuous R&D and innovation across the sector.

Recent Developments:

- In November 2025, Sekisui Chemical enforced a patent injunction against Kuraray Europe following a Munich District Court ruling on April 17, 2025, related to polyvinyl alcohol film technology.

- In October 2024, Mitsubishi Chemical Group expanded its production facility for OPL Film optical PVOH film at its Central Japan-Ogaki Plant in Gifu Prefecture, Japan, boosting single-line capacity to 27 million square meters per year with operations starting in the second half of fiscal year 2027 to meet demand from larger liquid crystal displays.

- In January 2024, Colorcon, Inc. launched a new titanium dioxide-free, high-opacity film coating system for pharmaceutical tablets based on polyvinyl alcohol, offering strong adhesion, fast processing, and moisture protection amid EU regulatory changes on TiO2.

Report Coverage:

The research report offers an in-depth analysis based on Grade Type and Application/End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Polyvinyl Alcohol (PVA) Films Market will advance through strong adoption of sustainable and water-soluble packaging solutions across major consumer goods sectors.

- Continuous R&D in bio-based PVA synthesis will drive greener film production with improved cost efficiency.

- Expanding detergent and cleaning pod demand will sustain consistent volume growth across household applications.

- Electronics and display manufacturing will increase consumption of optical-grade PVA films in Asia Pacific.

- Film producers will focus on enhanced tensile strength and solubility balance to widen industrial usage.

- Global packaging regulations will push companies toward biodegradable PVA-based alternatives in FMCG and agriculture.

- Medical, pharmaceutical, and food applications will emerge as premium niches for high-performance grades.

- Automation and smart manufacturing systems will raise production yield and ensure quality consistency.

- Strategic collaborations between polymer manufacturers and end-user industries will enhance product integration.

- Regional diversification and bio-feedstock availability will shape long-term competitive advantages across global suppliers.