Market Overview:

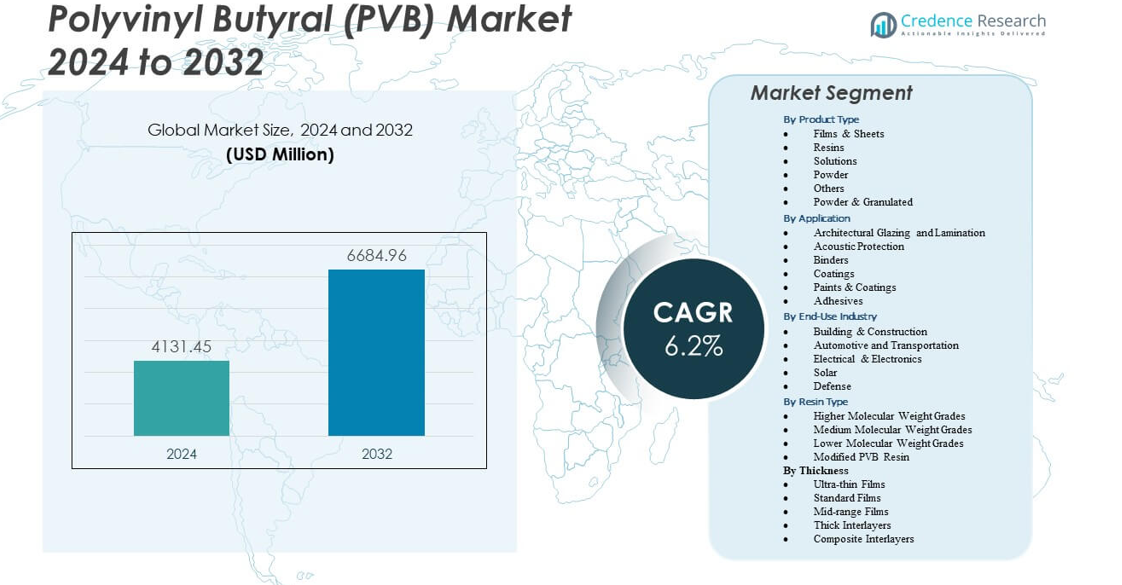

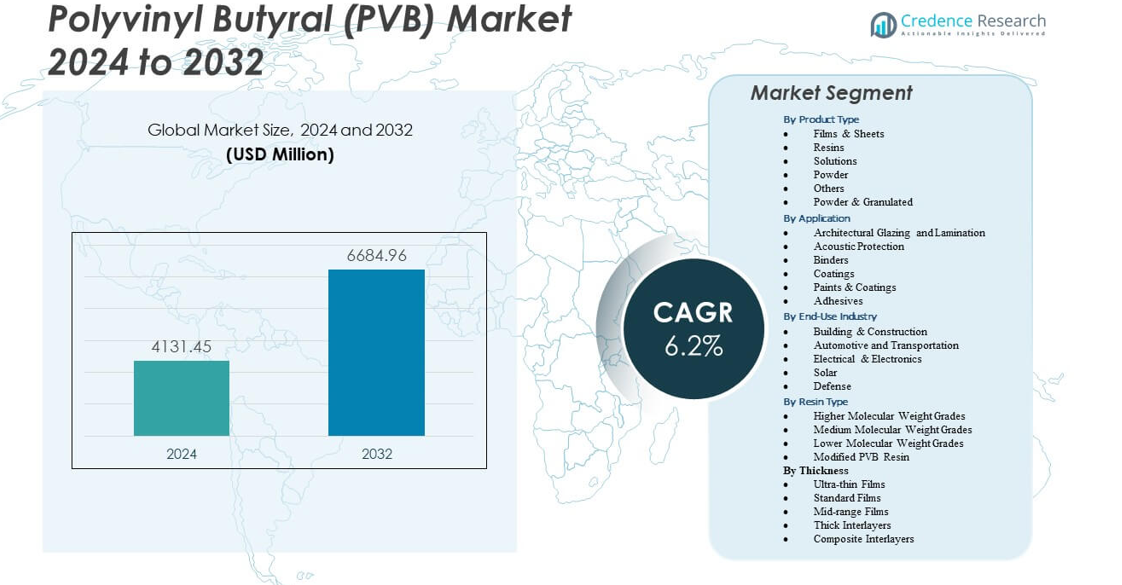

The Polyvinyl Butyral (PVB) Market is projected to grow from USD 4131.45 million in 2024 to an estimated USD 6684.96 million by 2032, with a compound annual growth rate (CAGR) of 6.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyvinyl Butyral (PVB) Market Size 2024 |

USD 4131.45 million |

| Polyvinyl Butyral (PVB) Market, CAGR |

6.2% |

| Polyvinyl Butyral (PVB) Market Size 2032 |

USD 6684.96 million |

Strong demand from automotive glazing, architectural façades, and solar encapsulation drives wider market consumption. Automakers rely on PVB to improve windshield safety, reduce cabin noise, and support lightweight glazing designs. Construction companies integrate laminated glass into façades, skylights, and interior partitions for superior safety and noise control. Solar module producers adopt PVB for strong bonding and long-term weather durability. Stricter building codes and safety norms strengthen industry reliance on high-performance PVB interlayers. Innovation in modified resin grades supports broader application potential.

Asia Pacific leads the global market due to strong automotive production, rapid urbanization, and high adoption of advanced construction materials. China, India, and Southeast Asia expand laminated glass use through infrastructure growth and rising safety standards. Europe follows with mature demand in automotive and commercial architectural glazing. North America shows steady adoption supported by replacement glazing, acoustic upgrades, and expansion in solar projects. Latin America and the Middle East & Africa emerge as developing markets with rising investment in urban development and transportation infrastructure.

Market Insights:

- The Polyvinyl Butyral (PVB) Market is projected to grow from USD 4131.45 million in 2024 to USD 6684.96 million by 2032, supported by a 6.2% CAGR during the forecast period.

- Rising demand for laminated safety glass in automotive and architectural sectors drives strong adoption of high-performance PVB interlayers.

- Market restraints include raw material fluctuations, processing complexity, and limited recycling pathways that challenge cost efficiency.

- Asia Pacific leads global usage due to strong automotive output and rapid construction growth, followed by Europe and North America with stable replacement and upgrade demand.

- Emerging regions such as Latin America and the Middle East & Africa expand consumption through infrastructure investments and wider acceptance of safety-grade glazing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Laminated Safety Glass Across Mobility and Infrastructure

The Polyvinyl Butyral (PVB) Market gains strength from rising use of laminated glass in vehicles and buildings. Automakers rely on PVB to improve windshield impact strength and noise reduction. Construction firms integrate laminated panels to meet strict safety rules. Urban expansion lifts demand for façades with higher durability. PVB enhances edge stability in complex glazing systems. Government norms support safer materials in public structures. Acoustic grades attract interest from high-end mobility and large buildings. Strong replacement rates in automotive glazing push steady consumption. The market moves toward engineered interlayers that improve clarity and resilience.

- For instance, Eastman’s Saflex® Clear PVB blocks over 99% of UV radiation up to 380 nm in standard laminated glass, improving occupant protection and long-term façade performance.

Expansion of Solar Photovoltaic Installations and Encapsulation Needs

Growth in global solar programs drives higher demand for encapsulation films, and the Polyvinyl Butyral (PVB) Market benefits from this shift. Solar firms use PVB to boost module durability under heat and moisture. Strong adhesion supports consistent long-term performance. Rapid rooftop installation pushes higher demand for weather-resistant films. Manufacturers focus on stable optical transmission across varied climates. Large solar parks require robust interlayers that tolerate mechanical stress. Energy transition policies support wider module adoption. Advances in panel design lift interest in PVB grades with enhanced thermal stability. PVB strengthens performance across emerging thin-film modules.

Increasing Adoption of Acoustic and High-Performance Glazing

Demand for acoustic comfort rises in vehicles and commercial structures, driving added interest in the Polyvinyl Butyral (PVB) Market. Acoustic grades lower noise transmission across busy urban zones. Automakers use them to improve passenger comfort in premium models. Commercial developers adopt high-grade glazing for airports, offices, and hospitality sites. PVB helps improve vibration damping in multi-layer structures. Architects select advanced interlayers to meet strict design goals. The material supports stronger UV screening across wide window spans. Innovation in acoustic sheets expands the design choices for modern buildings. The trend strengthens adoption across high-growth regions.

Shift Toward Energy-Efficient Building Materials and Green Design

Energy-efficient buildings push wider use of coated and laminated glass, placing the Polyvinyl Butyral (PVB) Market in a strong growth lane. PVB supports better insulation performance in multi-pane systems. Green codes encourage glazing strategies that reduce heat gain. Firms use PVB to deliver strong optical clarity with enhanced safety. Demand for daylight-optimized structures lifts interest in high-transmission grades. Government incentives support energy-efficient renovation programs. Builders adopt laminated façades for structural safety and energy control. The material improves aesthetic flexibility in complex urban designs. It strengthens sustainability goals across modern construction projects.

- For instance, Kuraray’s SentryGlas® interlayers provide a shear modulus more than 50 times higher than standard PVB, enabling thinner, lighter, and more energy-efficient façade structures without compromising safety.

Market Trends

Growth in Specialty PVB Grades Tailored for Advanced Architectural Designs

The Polyvinyl Butyral (PVB) Market reflects rising interest in specialty interlayers for complex façades. Color-stable grades support modern glass aesthetics. Architects use tinted and patterned variants for multi-purpose structures. High-rigidity sheets help form larger panels with improved safety. Edge stability enhancement remains a key trend across curtainwall setups. Designers seek interlayers that support curved and oversized glass. UV-blocking variants improve long-term visual performance. Demand grows for custom formulations that support premium architectural needs. These trends shape future adoption in high-value building projects.

Rising Integration of PVB in Next-Generation Mobility Platforms

Vehicle technology upgrades drive new trends within the Polyvinyl Butyral (PVB) Market. EV makers use laminated panels to lower cabin noise. Thin acoustic sheets support lightweight glazing strategies. Panoramic roofs rely on advanced interlayers that improve impact resistance. Smart dashboards use bonded layers for better clarity and sensing support. Autonomous platforms require improved optical performance for sensor zones. PVB also enhances HUD projection quality in selected models. Adoption rises in lightweight mobility concepts that favor safety without bulk. These patterns accelerate long-term development activity.

Advances in Encapsulation Materials for High-Durability Solar Modules

Solar manufacturing trends reshape expectations for encapsulation performance, strengthening the Polyvinyl Butyral (PVB) Market. Module makers seek films with strong thermal stability. High-moisture barrier grades gain traction across humid climates. Thin-film panels require interlayers that resist mechanical stress. Cleaner lamination cycles support faster production rates. Weather-durable sheets help improve module lifespan in outdoor environments. PVB maintains strong optical transmission under varied irradiation patterns. Firms test hybrid encapsulation stacks that combine PVB with new coatings. These advances expand adoption across global energy markets.

- For instance, Kuraray’s Solar PVB films provide water vapor transmission rates below 2 g/m²/day (38°C, 90% RH), supporting long-term durability in thin-film PV modules used in tropical climates.

Expansion of High-Clarity and Anti-Haze PVB for Premium Consumer and Industrial Uses

High-clarity applications show rising momentum across the Polyvinyl Butyral (PVB) Market. Anti-haze formulations help maintain visual precision in architectural glazing. Manufacturers target clarity improvements for large transparent areas. Specialty optics trends push PVB into niche industrial uses. Automotive displays need distortion-free bonding layers. Transparent safety partitions gain use across industrial settings. Innovations focus on optical stability under temperature shifts. Clarified grades support long-term surface quality. These trends strengthen adoption in modern consumer and commercial platforms.

- For instance, Sekisui’s S-LEC™ Clear PVB achieves haze levels below 0.4%, enabling premium visual performance in large-area glass and automotive display glazing.

Market Challenges Analysis

Volatile Raw Material Dynamics and Pressure on Production Economics

Producers in the Polyvinyl Butyral (PVB) Market face cost pressure from fluctuating raw materials. Supply swings in polyvinyl alcohol impact margins. Energy-intensive processing increases operational risk during peak cycles. Firms require stable feedstock flows to maintain production continuity. Price volatility challenges small producers that lack large procurement strength. Complex quality standards increase compliance costs. Scaling advanced grades demands investment in material engineering. Logistics gaps in emerging regions slow distribution. These factors raise barriers for new entrants.

Technical Constraints in Processing, Performance Variability, and Limited Substitution Options

The Polyvinyl Butyral (PVB) Market faces challenges linked to processing complexity and performance demands. Achieving uniform adhesion in laminated structures needs tight control. Variation in humidity resistance impacts long-term durability. Solar applications require strict optical stability standards. Acoustic layers need precise formulation to maintain noise control. Limited substitutes restrict flexibility for structural glazing. Recycling streams remain difficult due to interlayer separation issues. Firms invest in technologies to lower production defects. These constraints affect adoption across price-sensitive regions.

Market Opportunities

Rising Scope in Smart Mobility, Advanced Façades, and Solar Energy Growth Cycles

The Polyvinyl Butyral (PVB) Market gains strong opportunity from expanding smart mobility platforms. EV makers adopt advanced glazing for safety and noise control. Smart glass integration lifts interest in clear interlayers. Building designers use laminated façades to support sustainability goals. Solar programs expand demand for moisture-resistant encapsulation films. Growth in transit systems increases need for durable safety glass. Attractive renovation cycles support wider urban upgrades. Emerging regions scale infrastructure faster than before. These tailwinds open fresh adoption avenues.

Innovation in High-Performance Interlayers, Recycling Models, and Custom Engineered Grades

Manufacturers see opportunity through advanced PVB formulations that support diverse applications across the Polyvinyl Butyral (PVB) Market. Custom grades target optical stability and acoustic gains. High-rigidity sheets support curved and oversized designs. Improved adhesion behavior unlocks new solar module formats. Recycling advancements help recover interlayers through cleaner separation steps. Functional coatings expand performance in harsh climates. Digital fabrication tools improve design flexibility. Strong demand from high-value industries creates room for premium grade development. These innovations strengthen long-term market potential.

Market Segmentation Analysis:

Product Type Analysis

Films and sheets hold a central position in the Polyvinyl Butyral (PVB) Market due to their wide use in safety glass for buildings and vehicles. It supports strong clarity, impact resistance, and acoustic performance. Resins gain traction for coatings and adhesives that need stable bonding. Solutions deliver uniform film formation for specialty layers. Powder, powder and granulated formats offer controlled processing for engineered films and electronic materials. Others serve niche composite and structural needs across industrial applications.

- For instance, Eastman Chemical reports that Saflex® Structural PVB interlayers deliver significantly higher stiffness and shear strength than standard PVB grades, supporting improved load resistance and structural performance in laminated glass for architectural and safety applications.

Application Analysis

Architectural glazing leads application demand in the Polyvinyl Butyral (PVB) Market due to strong safety and acoustic requirements in modern buildings. It supports laminated façades, interior panels, and high-strength glass systems. Acoustic protection expands use in vehicles and dense urban sites. Binders maintain relevance for structural adhesion where chemical stability is needed. Coatings, paints, and adhesives hold growing roles in protective layers and niche bonding tasks.

End-Use Industry Analysis

Building and construction remains the largest end-use area in the Polyvinyl Butyral (PVB) Market due to rising demand for laminated façades and energy-efficient glazing. It drives adoption across commercial towers, airports, and residential upgrades. Automotive and transportation use PVB in windshields and roof systems to improve safety and noise control. Electrical and electronics adopt it for specialty films. Solar and defense sectors expand demand for durability and structural protection.

- For instance, Eastman Chemical’s Saflex Clear PVB interlayer blocks over 99% of UV light up to 380 nm when laminated with standard clear glass at a 0.76 mm interlayer thickness. It drives adoption across commercial towers, airports, and residential upgrades.

Resin Type Analysis

Higher molecular weight grades guide key performance areas for the Polyvinyl Butyral (PVB) Market due to strong adhesion and durability. It supports advanced laminates across safety and solar applications. Medium molecular weight grades deliver balanced flexibility and strength. Lower molecular weight grades suit coatings that need easy flow. Modified PVB resin gains interest for improved optical stability and niche design targets.

Thickness Analysis

Thickness categories shape adoption in the Polyvinyl Butyral (PVB) Market across multiple glazing formats. It supports ultra-thin films for lightweight panels and specialty electronics. Standard films remain common in automotive and building uses. Mid-range films serve façades that need balanced strength. Thick interlayers support structural and blast-resistant glazing. Composite interlayers deliver multi-functional performance across high-specification projects.

Segmentation:

By Product Type

- Films & Sheets

- Resins

- Solutions

- Powder

- Others

- Powder & Granulated

By Application

- Architectural Glazing and Lamination

- Acoustic Protection

- Binders

- Coatings

- Paints & Coatings

- Adhesives

By End-Use Industry

- Building & Construction

- Automotive and Transportation

- Electrical & Electronics

- Solar

- Defense

By Resin Type

- Higher Molecular Weight Grades

- Medium Molecular Weight Grades

- Lower Molecular Weight Grades

- Modified PVB Resin

By Thickness

- Ultra-thin Films

- Standard Films

- Mid-range Films

- Thick Interlayers

- Composite Interlayers

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific

Asia Pacific holds the largest 45% share of the Polyvinyl Butyral (PVB) Market due to high automotive output, rapid urban development, and strong investment in laminated architectural glass. It drives rising consumption of safety glazing in commercial towers and transport systems. China leads regional use through large-scale construction activity. India follows with rising demand for façades and noise-control glazing. Southeast Asia expands adoption through infrastructure upgrades and solar installations. The market benefits from strong manufacturing ecosystems that support stable resin and film supply chains.

Europe

Europe commands an estimated 25% share of the Polyvinyl Butyral (PVB) Market driven by strict safety codes and sustained demand for laminated glass in public buildings. It supports widespread use of acoustic and energy-efficient glazing across dense urban zones. Germany leads regional adoption due to strong architectural and automotive sectors. France and the U.K. show steady demand growth through renovation programs. Southern Europe expands use in commercial façades that need stronger UV resistance. The region maintains firm interest in premium grades with advanced clarity and low haze.

North America, Latin America, and Middle East & Africa

North America holds about 20% share of the Polyvinyl Butyral (PVB) Market supported by strong automotive replacement rates and higher adoption of acoustic glazing. It gains traction from rising investments in residential upgrades and solar projects. Latin America captures an estimated 5% share with growing use of safety glass in urban centers. The Middle East & Africa also hold 5% share driven by large infrastructure programs and high-performance façade requirements. It supports rising demand for heat-resistant and durable interlayers across commercial sites.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Eastman Chemical Company

- Kuraray Co., Ltd.

- Sekisui Chemical Co., Ltd.

- Chang Chun Group

- Everlam

- Anhui Wanwei Bisheng New Materials Co., Ltd.

- Kingboard Fogang Specialty Resin Co., Ltd.

- Tiantai Kanglai Industrial Co., Ltd.

- Zhejiang Pulijin Plastic Co., Ltd.

Competitive Analysis:

The Polyvinyl Butyral (PVB) Market reflects strong competition driven by global producers that focus on advanced interlayers for automotive, architectural, and solar applications. It shows clear differentiation based on clarity, adhesion quality, acoustic performance, and long-term durability. Leading companies invest in improved resin chemistry, process optimization, and acoustic grade development to strengthen their competitive positions. Firms with integrated production chains maintain cost advantages and secure steady supply for large-volume users. Regional players compete through pricing flexibility and custom film solutions tailored for construction and industrial projects. Innovation efforts target high-performance glazing, UV-stable layers, and encapsulation films for next-generation solar modules. Strategic partnerships expand distribution reach across fast-growing markets. Competitive intensity remains high due to increasing demand for engineered safety and acoustic solutions across global sectors.

Recent Developments:

- In November 2024, Eastman Chemical Company announced a significant investment to upgrade and expand extrusion capabilities for Saflex interlayers at its Ghent, Belgium facility, aimed at meeting rising demand for PVB products in automotive and architectural markets.

- In July 2024, Sekisui Chemical announced an 8-billion-yen investment to expand its PVB interlayer production capacity at its Rayong, Thailand facility, adding a new line for high-performance products focused on head-up displays, set to operate in the second half of 2026.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-Use Industry, Resin Type, Thickness. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for laminated safety glass will rise due to expanding construction and mobility projects.

- Architectural façades will adopt more advanced PVB interlayers that offer clarity and acoustic control.

- EV manufacturers will increase use of lightweight glazing, lifting demand for high-performance PVB films.

- Solar installations will drive wider use of encapsulation layers with stronger durability requirements.

- Producers will invest in modified resin grades that improve optical and bonding performance.

- Acoustic glazing will gain priority in dense urban centers due to rising noise reduction needs.

- Premium interlayers will see stronger adoption across airports, transit hubs, and high-value commercial sites.

- Advances in composite interlayers will support safety standards in both automotive and structural glazing.

- Emerging markets will expand PVB use through rapid urban growth and infrastructure upgrades.

- Supply chains will strengthen through regional film production and rising demand for engineered glass solutions.