Market Overview:

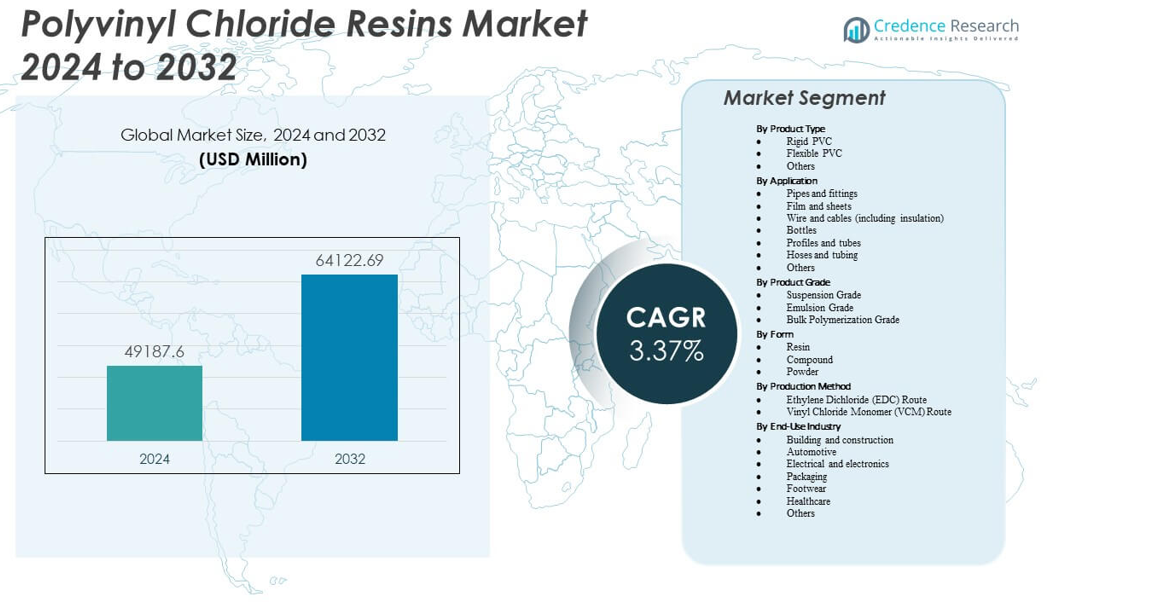

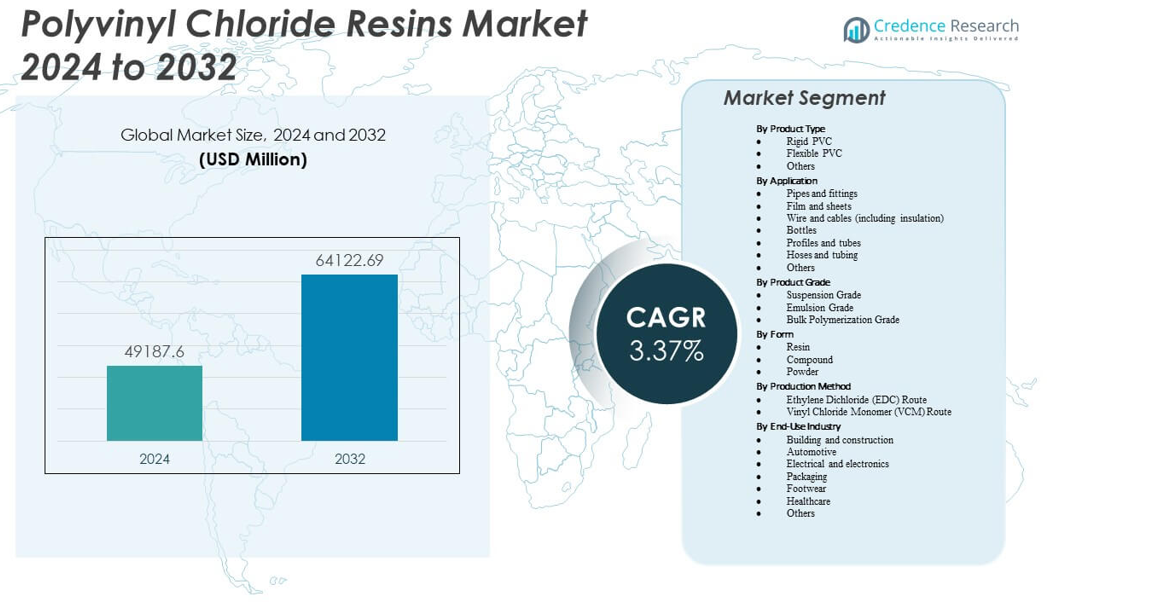

The Polyvinyl Chloride Resins Market is projected to grow from USD 49187.6 million in 2024 to an estimated USD 64122.69 million by 2032, with a compound annual growth rate (CAGR) of 3.37% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Polyvinyl Chloride Resins Market Size 2024 |

USD 49187.6 million |

| Polyvinyl Chloride Resins Market, CAGR |

3.37% |

| Polyvinyl Chloride Resins Market Size 2032 |

USD 64122.69 million |

Market drivers reflect rising global investment in plumbing networks, urban expansion, and renovation cycles that lift PVC pipe and profile demand. Electrical upgrades strengthen the need for insulation grades used in wiring and cable systems. Healthcare sectors increase use of flexible PVC tubing due to reliability and clarity. Packaging firms adopt PVC films for product protection and durability. Product innovations improve stability, weather resistance, and processing efficiency. The Polyvinyl Chloride Resins Market benefits from steady procurement across major industrial and consumer applications. Circular material strategies encourage producers to refine formulation choices.

Asia Pacific leads due to strong manufacturing bases and continuous infrastructure development within China, India, and Southeast Asia. North America maintains stable demand supported by renovation activity and adoption in healthcare, power, and building applications. Europe advances through regulated construction standards and strong automotive and medical sectors. Emerging regions in Latin America and the Middle East expand faster due to water distribution upgrades, urban projects, and rising cable requirements. The Polyvinyl Chloride Resins Market gains broad regional support as diverse economies strengthen pipe, profile, and cable-based applications.

Market Insights:

- The Polyvinyl Chloride Resins Market is projected to rise from USD 49187.6 million in 2024 to USD 64122.69 million by 2032, supported by a 3.37% CAGR.

- Strong demand from construction, electrical insulation, and medical tubing industries drives steady adoption across global markets.

- Supply fluctuations, regulatory pressure on additives, and raw material volatility create restraint for producers and downstream converters.

- Asia Pacific leads due to large manufacturing bases and rapid infrastructure growth, while North America and Europe maintain stable industrial demand.

- Emerging regions strengthen market activity with rising urban development, water management upgrades, and expanding cable installations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Strong Acceleration in Global Infrastructure Projects and Utility Expansion Supporting Large-Scale Resin Consumption

Urban growth lifts demand for PVC pipes, conduits, and profiles used in water networks. Governments push sewer upgrades that increase resin use in pressure pipes. Builders rely on PVC window and door frames for durability and energy control. Utility firms expand cable networks that require stable PVC insulation grades. The Polyvinyl Chloride Resins Market gains strength from heavy infrastructure investment. Contractors use PVC sheets and boards for flexible project needs. Water scarcity pushes nations to replace old networks with PVC lines. Rising industrial zones need safe fluid movement systems. Steady growth in construction drives intense resin procurement.

- For instance, Eland Cables specifies that many of its PVC-insulated and sheathed cables are rated for continuous operation at 70°C and meet recognised flame-retardant test standards such as BS EN 60332-1-2. PVC materials remain widely used across cable and conduit applications that support infrastructure development. This reinforces steady resin demand in utility and construction sectors.

Rising Penetration of PVC in Healthcare, Pharmaceutical, and Single-Use Medical Applications

Healthcare systems adopt flexible PVC tubing for fluid delivery and respiratory care. Producers supply medical grades with strict purity and clarity requirements. Hospitals use PVC bags for blood storage and drug infusion. Regulatory approvals support expanding use in sterile environments. The Polyvinyl Chloride Resins Market benefits from a strong pipeline of medical device production. Specialty film converters create barrier layers for diagnostics. Device makers choose PVC for softness and kink resistance. Rising global procedures increase tubing demand. Strong hygiene needs drive interest in reliable medical polymers.

Growing Cable, Wiring, and Electrical Insulation Requirements from Power Grid Expansion Worldwide

Power utilities strengthen cable networks to support rising loads. PVC insulation remains vital due to flame resistance and flexible processing. Manufacturers rely on stable electrical grades for low-voltage wiring. Rural electrification programs create fresh cable demand. The Polyvinyl Chloride Resins Market gains steady traction across electrical sectors. Smart home growth drives wiring upgrades in residential buildings. Data centers expand structured cabling that uses PVC jackets. Telecom providers improve network layouts requiring safe insulation materials. Electrotechnical firms value PVC for stable field performance.

- For instance, Triumph Cable’s standard PVC grades provide insulation resistance ≥500 MΩ·km and dielectric withstand of 2-3 kV for 300V-rated cables in power grid applications.

High Adoption of PVC in Consumer Goods, Packaging Films, and Durable Household Products

Producers design PVC films for clear packaging and long shelf life. Consumer brands use PVC sheets for label stock and protective wraps. Home goods firms use rigid PVC for panels and furniture parts. The Polyvinyl Chloride Resins Market gains support from stable household demand. Packaging converters rely on resin grades that maintain tear strength. Outdoor items such as mats and covers use UV-modified PVC grades. Appliance makers adopt PVC for housing components. Demand rises in hobby products and decor items. Stable material pricing supports wider use in consumer applications.

Market Trends

Shift Toward Bio-Based Stabilizers, Low-Additive Formulations, and Environment-Focused Resin Innovations

Producers invest in stabilizers free from heavy metals. Firms redesign PVC compounds for cleaner indoor air in buildings. It aligns with sustainability commitments across global supply chains. The Polyvinyl Chloride Resins Market observes rising traction for safer additives. Manufacturers improve transparency and odor control in premium grades. Packaging firms explore low-migration options for sensitive goods. Compounding lines shift toward eco-optimized masterbatches. Regulators push markets toward cleaner formulations. Environmental reporting drives steady reformulation cycles.

- For instance, Platinum Industries Ltd. reported a strong shift toward lead-free calcium-zinc stabilizers, with lead-free products forming over 70% of its PVC stabilizer sales. The company created dedicated production lines to prevent cross-contamination and support regulatory-compliant PVC formulations. This transition strengthens adoption of safer stabilizer systems in key PVC applications.

Expansion of Automation, Digital Process Control, and Smart Monitoring in PVC Production Plants

Resin plants deploy advanced control systems to stabilize batch quality. Firms upgrade reactors with predictive modules for improved yield. Energy tracking tools support higher operational efficiency. The Polyvinyl Chloride Resins Market gains benefits from digital plants. Automation reduces variation in polymer chains. Producers use advanced analytics for capacity planning. Smart systems reduce downtime during resin transitions. Online inspection tools enhance particle uniformity. Digital adoption strengthens long-term supply reliability.

Rapid Use of PVC Profiles and Engineered Compounds in Fast-Growth Modular and Prefabricated Building Systems

Developers shift toward modular assembly to speed project timelines. PVC profiles offer light weight and easier handling in compact sites. Prefab housing units integrate PVC floors, panels, and trims. It supports faster housing delivery in dense markets. The Polyvinyl Chloride Resins Market gains visibility in new building models. Suppliers create reinforced PVC boards for structural parts. Builders value moisture resistance in PVC indoor components. Modular schools and clinics expand use. Production consistency appeals to large contractors.

- For instance, Astral Pipes manufactures lead-free PVC and uPVC pipes using calcium-zinc stabilizer systems to meet health and safety standards. The company highlights the use of non-toxic formulations across its plumbing and drainage product lines. This shift supports wider industry movement toward safer PVC stabilizer technologies.

Wider Adoption of Advanced PVC Compounds for Electric Vehicles, Lightweight Interiors, and Smart Mobility Components

EV makers use PVC coatings for cable systems. Auto interiors integrate soft-touch PVC skins. Vehicle trims use scratch-resistant PVC films for long life. The Polyvinyl Chloride Resins Market progresses through new mobility needs. Producers supply heat-stable grades for under-hood wiring. It supports safety in high-voltage environments. OEMs refine cabin noise control using specialty PVC layers. E-bikes and scooters integrate PVC housing parts. Growth in smart mobility lifts advanced material demand.

Market Challenges Analysis

Intensifying Environmental Pressure, Additive Restrictions, and Complex Compliance Requirements Impacting Resin Producers

Regulators tighten rules for additives used in PVC. Producers face strict audits for stabilizers and plasticizers. The Polyvinyl Chloride Resins Market handles rising compliance duties across regions. Firms invest in new chemistries that demand long qualification cycles. Packaging sectors navigate detailed safety frameworks for sensitive goods. It drives cost pressure across global supply chains. Negative perception of plastics influences procurement choices. Brands seek cleaner labels that need reformulated resins. Disposal concerns influence policy debates in many markets.

Volatile Raw Material Dynamics, Energy Cost Spikes, and Supply Disruptions Delaying Production Efficiency

Chlor-alkali feedstock swings disrupt resin planning. Energy peaks raise operating costs in major producing nations. The Polyvinyl Chloride Resins Market faces risks from geopolitical tensions. Logistics delays complicate regional availability. Producers reduce exposure with diversified plants. It challenges margin stability across contract cycles. Equipment downtime influences order backlogs. Buyers need stable supply despite disruptions. Market fragmentation increases competitive strain for suppliers.

Market Opportunities

Rising Scope for High-Performance PVC Compounds in Water Management, Green Buildings, and Advanced Construction Systems

Governments launch projects targeting reliable water distribution networks. Builders prefer long-life PVC pipes for leak control. The Polyvinyl Chloride Resins Market gains strong potential through improved building codes. Green building programs favor PVC profiles designed for efficiency. It supports adoption of high-insulation windows and doors. Infrastructure agencies seek durable materials for drainage and stormwater systems. Smart cities create demand for engineered PVC components. Producers offer compounds with higher heat stability. New applications emerge in lightweight roofing and cladding.

Emerging Expansion of PVC in Automation Equipment, Renewable Energy Components, and Industrial Safety Systems

Solar farms require PVC cable insulation for stable outdoor performance. Automation equipment uses PVC parts due to predictable molding behavior. The Polyvinyl Chloride Resins Market opens pathways in high-tech manufacturing. Renewable projects need safe wiring for control systems. It supports broader electrification in remote areas. Protective films for industrial machinery use advanced PVC grades. Producers develop flame-retardant variants for safety devices. Robotics firms adopt PVC for covers and housings. Material innovation creates fresh revenue channels.

Market Segmentation Analysis:

By Product Type

Rigid PVC leads the Polyvinyl Chloride Resins Market due to strong preference in pipes, profiles, and structural parts. Flexible PVC supports medical tubing, wire insulation, and consumer items with high adaptability. The others category includes specialty variants that target technical uses in regulated sectors. It maintains demand strength through diversified performance needs across construction, medical, and electrical fields. Growth continues through material upgrades that improve stability and clarity. Producers focus on strengthening formulation control to meet evolving standards.

- For instance, Formosa Plastics’ S-65 grade suspension PVC resin is listed with a K-value in the mid-60 range and is widely used in rigid pipe extrusion due to its balanced flow and strength profile. The resin’s properties support stable processing across high-volume extrusion lines. This performance makes it a preferred option in pressure and non-pressure pipe applications.

By Application

Pipes and fittings dominate due to heavy use in water networks and plumbing systems. Film and sheets gain traction across packaging and industrial laminates. Wire and cables maintain steady growth driven by power grid expansion. Bottles retain value in niche liquid packaging. Profiles and tubes support building projects and furniture parts. Hoses and tubing meet flexible transport needs across sectors. The Polyvinyl Chloride Resins Market benefits from wide functional reach across these applications.

By Product Grade

Suspension grade holds the largest share due to broad utility in rigid and flexible forms. Emulsion grade supports coatings, flooring, and specialty films. Bulk polymerization grade remains limited but valuable in select applications. It supports consistent flow across high-volume processing lines through stable quality requirements. Producers refine grade purity to meet downstream performance targets.

By Form

Resin dominates supply chains due to direct use in compounding. Compounds offer tailored properties for converters. Powder retains distinct use in specialty production. The Polyvinyl Chloride Resins Market gains flexibility through these forms, and it supports efficient material flow across diverse end-use sectors.

By Production Method

The EDC route leads due to established global capacity and integrated upstream operations. The VCM route maintains relevance in regions favoring localized production. It ensures secure resin availability through strategic feedstock selection. Producers balance both routes to manage cost and reliability.

By End-Use Industry

Building and construction holds the largest share through high demand for pipes, profiles, and flooring. Automotive uses PVC for interior trims and sealing systems. Electrical and electronics rely on insulation grades for safe cable design. Packaging supports film and sheet needs. Footwear uses PVC for soles and molded parts. Healthcare increases demand for tubing and medical bags. The Polyvinyl Chloride Resins Market gains resilience through this broad industrial base.

- For instance, Formosa Plastics reports that several of its suspension PVC resins demonstrate tensile yield strength values reaching the 7,000-plus PSI range in standard testing, supporting their use in molded and extruded parts. These mechanical properties help maintain structural reliability across industrial applications. Stable electrical-grade PVC compounds further support safe cable insulation requirements in regulated sectors.

Segmentation:

By Product Type

- Rigid PVC

- Flexible PVC

- Others

By Application

- Pipes and fittings

- Film and sheets

- Wire and cables (including insulation)

- Bottles

- Profiles and tubes

- Hoses and tubing

- Others

By Product Grade

- Suspension Grade

- Emulsion Grade

- Bulk Polymerization Grade

By Form

By Production Method

- Ethylene Dichloride (EDC) Route

- Vinyl Chloride Monomer (VCM) Route

By End-Use Industry

- Building and construction

- Automotive

- Electrical and electronics

- Packaging

- Footwear

- Healthcare

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The Polyvinyl Chloride Resins Market secures its largest share in Asia Pacific with nearly 52% driven by strong construction activity and high PVC pipe usage. China leads due to large-scale manufacturing capacity and heavy infrastructure spending. India expands demand through water distribution upgrades and housing programs. Japan and South Korea hold steady shares through stable electrical and automotive sectors. It strengthens further with rising healthcare and packaging needs. Southeast Asian countries gain momentum through industrial expansion and urban projects.

North America holds nearly 18% of the global share, supported by strong renovation cycles and mature plumbing and electrical systems. The United States dominates regional

consumption with high use of PVC pipes in municipal and irrigation networks. Canada maintains steady demand through infrastructure maintenance and commercial building upgrades. It gains traction through strong adoption of medical-grade PVC in healthcare manufacturing. Growth remains stable due to robust cable insulation usage. Demand from automotive interiors and consumer goods adds further support.

Europe accounts for nearly 16% of the market share, supported by regulated construction frameworks and advanced manufacturing sectors. Germany leads adoption across

pipes, windows, and cable systems. France, Italy, and the UK expand consumption through green building standards that support energy-efficient PVC profiles. It progresses through healthcare, automotive, and specialty film applications. Eastern Europe gains share through infrastructure upgrades. Latin America holds nearly 9%, while Middle East & Africa secure around 5% driven by urban expansion, water management needs, and cable installation projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Chemplast Sanmar

- INEOS

- LG Chem

- Shin-Etsu Chemical

- Solvay

- SCG Chemicals

- Westlake

- Formosa Plastics

- Lotte Chemical

- Vinnolit GmbH

- Hanwha Solutions

- Cires

Competitive Analysis:

Key players compete on capacity expansion, integration strength, material innovation, and long-term supply contracts. The Polyvinyl Chloride Resins Market reflects strong activity from firms that invest in high-efficiency reactors and cleaner additive systems. Producers enhance value through cost control across upstream chlor-alkali operations. It supports stable resin availability in regions with high construction and manufacturing needs. Companies expand specialty PVC grades for medical, automotive, and wire and cable uses to secure higher-margin segments. Strategic moves include partnerships with converters for product development and faster market reach. Firms strengthen ESG positions through energy-efficient plants and reduced-emission stabilizers. Global competition remains intense due to regional supply shifts, price swings, and regulatory pressure. Producers that invest in scale, logistics, and technical service maintain stronger competitive positions across diverse end-use industries.

Recent Developments:

- In November 2025, the Sanmar Group signed a long-term supply agreement with TA’ZIZ (UAE) for feedstocks EDC and VCM to support its PVC operations across India and Egypt

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Product Grade, Form, Production Method and End Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand strengthens through rising construction activity and wider PVC pipe adoption worldwide.

- Healthcare use expands as flexible grades gain traction in medical tubing and fluid systems.

- Electrical insulation demand grows with grid upgrades and telecom network expansion.

- Packaging converters seek improved clarity and durability in next-generation PVC films.

- Compounders invest in cleaner stabilizer systems that support regulatory compliance.

- Producers focus on digital process control to enhance yield and quality consistency.

- Automotive interiors adopt soft-touch PVC variants that support design flexibility.

- Modular building trends lift interest in lightweight PVC profiles and engineered sheets.

- Emerging regions accelerate usage across water management and urban infrastructure.

- Global suppliers expand capacity to secure competitive positions in high-growth sectors.