Market Overview:

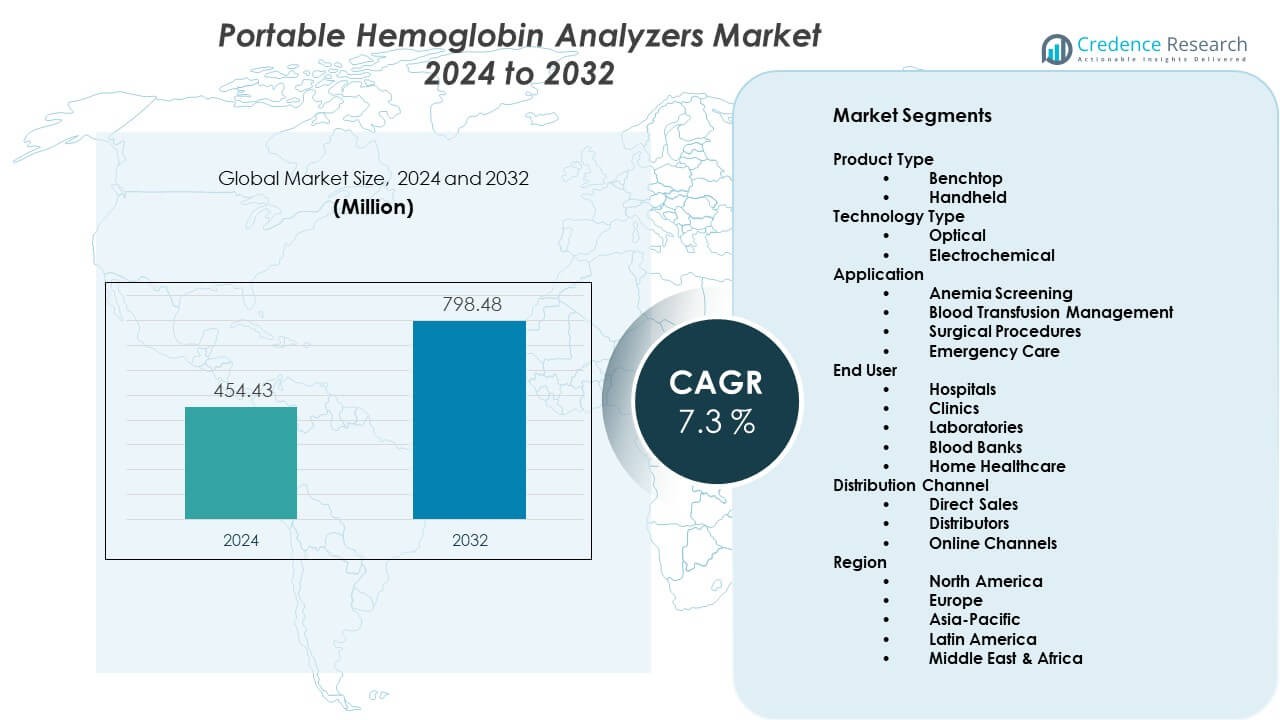

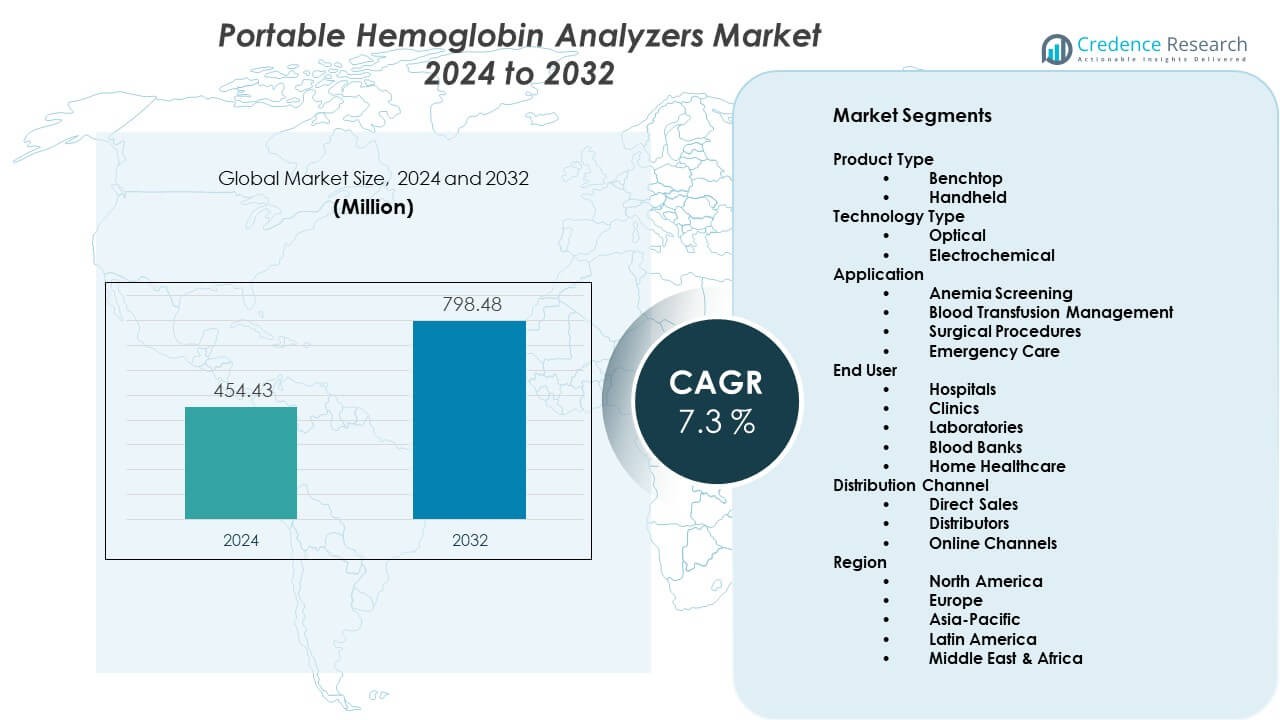

The Portable Hemoglobin Analyzers Market is projected to grow from USD 454.43 million in 2024 to an estimated USD 798.48 million by 2032. The market is expected to record a CAGR of 7.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Hemoglobin Analyzers Market Size 2024 |

USD 454.43 Million |

| Portable Hemoglobin Analyzers Market, CAGR |

7.3% |

| Portable Hemoglobin Analyzers Market Size 2032 |

USD 798.48 Million |

Demand growth comes from wider screening programs and faster clinical workflows. Portable analyzers deliver quick hemoglobin readings with small blood samples. Primary care centers use them for routine checks. Emergency care teams rely on rapid testing support. Maternal and child health programs drive steady demand. Home healthcare adoption also expands device use. Technological progress improves accuracy and battery life. Digital displays and data storage support clinical decisions. These factors sustain strong replacement and new purchase cycles.

North America leads the market due to strong primary care access and early technology adoption. The United States drives demand through outpatient testing and home care growth. Europe follows with strong focus on preventive screening. Countries like Germany and the United Kingdom invest in decentralized diagnostics. Asia Pacific shows fast growth due to rising anemia rates. India and China expand rural testing programs. Latin America and Africa emerge through public health initiatives and mobile care units.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The market grew from USD 454.43 million in 2024 to USD 798.48 million by 2032, at 7.3% CAGR.

- North America leads with 35%, Europe holds 28%, and Asia-Pacific has 25%, driven by strong care access.

- Asia-Pacific is the fastest-growing region with 25% share, supported by large populations and screening programs.

- Product type share favors handheld analyzers at about 60%, while benchtop systems hold near 40%.

- End-user share centers on hospitals at roughly 45%, followed by clinics at about 25%.

Market Drivers:

Rising Need For Rapid Point-of-Care Blood Testing Across Care Settings

The Portable Hemoglobin Analyzers Market benefits from strong demand for fast diagnostic support. Hospitals seek quicker triage and treatment decisions. Clinics prefer on-site testing to avoid lab delays. Emergency units rely on immediate hemoglobin data. Field healthcare programs value portability and speed. Screening camps use compact devices for high patient volumes. Physicians trust instant readings for clinical action. This driver supports steady device procurement.

- For instance, EKF Diagnostics’ DiaSpect™ Hb analyzer delivers results in about 2 seconds using a 10 µL blood sample, supporting rapid point-of-care testing.

Expansion Of Maternal, Child, And Anemia Screening Programs Worldwide

Public health programs focus on early anemia detection. Governments promote routine hemoglobin checks for women. Child health initiatives depend on rapid screening tools. Rural clinics require portable diagnostic solutions. Outreach programs favor devices with minimal infrastructure needs. Portable analyzers improve coverage in remote regions. Healthcare workers manage higher screening efficiency. This factor strengthens long-term demand.

- For instance, HemoCue® Hb 801 provides hemoglobin results in under 5 seconds with a 10 µL capillary sample, supporting large-scale maternal and child screening programs.

Growth In Decentralized And Primary Care Diagnostic Infrastructure

Primary care centers expand diagnostic capabilities. Decentralized care reduces pressure on hospitals. Portable analyzers fit well in small clinics. Physicians manage routine tests during consultations. Home healthcare providers also adopt compact tools. Reduced sample handling improves patient comfort. Workflow efficiency supports clinical adoption. This trend drives consistent market growth.

Technological Improvements Supporting Accuracy And Ease Of Use

Manufacturers enhance sensor precision and reliability. Devices now require smaller blood samples. User-friendly interfaces reduce training needs. Battery performance supports extended field use. Digital displays improve reading clarity. Memory features support patient data tracking. Improved consistency builds clinician confidence. Technology progress sustains purchasing momentum.

Market Trends:

Integration Of Digital Displays And Data Storage Capabilities

Portable analyzers adopt advanced display features. Clear screens support faster result interpretation. Data storage enables patient record continuity. Clinics track trends across multiple visits. Digital interfaces reduce manual entry errors. Healthcare staff value simplified documentation. This trend improves workflow quality. Adoption rises across outpatient settings.

- For instance, Masimo Pronto® devices can store multiple patient readings and are marketed with a manufacturer-reported accuracy around ±1.0 g/dL under controlled study conditions; however, independent clinical studies often report wider limits of agreement, with one meta-analysis finding 95% limits of agreement of ±2.9 g/dL in general patient populations, indicating high variability in real-world clinical use.

Rising Preference For Compact And Lightweight Diagnostic Devices

Healthcare providers favor space-efficient equipment. Smaller devices suit crowded clinical environments. Mobile teams prefer lightweight designs. Transport ease supports outreach services. Compact form factors improve usability. Storage and handling become simpler. This design focus shapes new product launches. Market acceptance continues to expand.

- For instance, EKF Diagnostics’ DiaSpect™ Hb weighs about 180 grams, enabling single-hand operation during mobile screening activities.

Shift Toward Battery-Powered And Low-Maintenance Solutions

Facilities seek equipment with minimal upkeep. Battery operation supports uninterrupted testing. Power-independent devices suit rural clinics. Maintenance simplicity reduces operational costs. Staff manage devices without technical support. Reliable uptime supports care continuity. This trend influences purchasing decisions. Manufacturers respond with durable designs.

Increasing Adoption In Home Healthcare And Community Care Models

Home healthcare expands diagnostic needs. Nurses require portable testing tools. Community care centers prefer rapid screening devices. Patient comfort improves with near-patient testing. Reduced hospital visits support care efficiency. Portable analyzers align with home care workflows. Demand grows in aging populations. This trend reshapes end-user profiles.

Market Challenges Analysis:

Accuracy Concerns Compared To Central Laboratory Analyzers

The Portable Hemoglobin Analyzers Market faces accuracy scrutiny. Clinicians compare results with lab standards. Variations affect clinical confidence. Calibration needs raise operational concerns. Environmental conditions influence readings. Training gaps increase error risk. Quality assurance remains essential. These factors slow adoption in critical care.

Regulatory Compliance And Cost Sensitivity In Emerging Markets

Regulatory approval processes remain complex. Manufacturers meet strict diagnostic standards. Certification timelines delay product entry. Cost sensitivity limits adoption in low-income regions. Budget constraints affect public healthcare purchases. Import regulations add pricing pressure. Distribution challenges impact availability. These barriers affect market penetration speed.

Market Opportunities:

Expansion Of Screening Programs In Emerging Economies

Emerging markets increase preventive healthcare focus. Governments fund anemia screening initiatives. Portable analyzers suit large population programs. Rural outreach creates strong demand potential. Local manufacturing reduces device costs. Training programs support workforce readiness. This opportunity supports long-term expansion. Market players gain scale advantages.

Product Innovation Tailored For Remote And Resource-Limited Settings

Manufacturers develop rugged device designs. Extended battery life suits remote use. Simplified operation supports non-specialist users. Affordable models attract public health buyers. Connectivity features support centralized monitoring. Innovation improves competitive positioning. Market differentiation strengthens revenue potential. These opportunities drive future growth.

Market Segmentation Analysis:

Product Type

Benchtop analyzers serve hospitals and laboratories that require stable, high-throughput testing. These systems support routine screening and transfusion workflows. Handheld analyzers address mobility needs across clinics and outreach programs. Compact design supports rapid testing in remote settings. Handheld devices gain preference in emergency and home care use. This segment benefits from ease of transport and quick setup. The Portable Hemoglobin Analyzers Market sees balanced demand across both formats.

- For instance, Abbott’s i-STAT system uses cartridge-based electrochemical sensing and requires only a few drops of whole blood to deliver rapid critical care results, including hematocrit and hemoglobin parameters, at the bedside.

Technology Type

Optical technology dominates due to consistent accuracy and ease of calibration. Many providers trust optical systems for routine testing. Electrochemical technology supports low sample volume requirements. This approach suits portable and battery-operated devices. Cost efficiency improves adoption in primary care settings. Technology choice depends on clinical needs and operating environment.

Application

Anemia screening represents a major application across preventive care programs. Blood transfusion management relies on quick hemoglobin confirmation. Surgical procedures require preoperative and postoperative monitoring. Emergency care depends on fast results during trauma assessment. Each application values speed and reliability. Diverse use cases strengthen market stability.

End User

Hospitals remain key users due to high patient flow. Clinics favor portable devices for routine checks. Laboratories use analyzers for decentralized testing support. Blood banks depend on accurate donor screening. Home healthcare expands device use beyond facilities. End-user diversity supports steady demand.

Distribution Channel

Direct sales serve large healthcare institutions. Distributors expand regional reach and service support. Online channels attract smaller clinics and home users. Channel mix improves market accessibility.

Segmentation:

Product Type

Technology Type

Application

- Anemia Screening

- Blood Transfusion Management

- Surgical Procedures

- Emergency Care

End User

- Hospitals

- Clinics

- Laboratories

- Blood Banks

- Home Healthcare

Distribution Channel

- Direct Sales

- Distributors

- Online Channels

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Portable Hemoglobin Analyzers Market, accounting for nearly 35% of global revenue. The United States leads due to strong primary care infrastructure. Hospitals adopt point-of-care testing to support fast clinical decisions. Clinics rely on portable analyzers for routine screening. Home healthcare expansion supports steady device demand. Canada contributes through preventive health programs. High technology adoption sustains regional leadership.

Europe

Europe represents about 28% of the global market share. Countries like Germany, the United Kingdom, and France drive adoption. Public healthcare systems emphasize early anemia detection. Hospitals integrate portable analyzers into outpatient services. Blood banks use these devices for donor screening. Regulatory standards support product quality and trust. This region shows stable and mature demand patterns.

Asia-Pacific, Latin America, And Middle East & Africa

Asia-Pacific accounts for around 25% of global market share. China and India lead due to large patient populations. Japan and South Korea support demand through advanced diagnostics. Rising anemia prevalence drives screening programs. Latin America holds nearly 7% share, led by Brazil and Mexico. Middle East & Africa contributes about 5%, driven by public health initiatives. These regions offer strong long-term growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Abbott

- EKF Diagnostics

- HemoCue

- Masimo

- Siemens Healthineers

- Sysmex Corporation

- Roche

- Nova Biomedical

- Bio-Rad Laboratories

- URIT Medical Electronic

Competitive Analysis:

The Portable Hemoglobin Analyzers Market shows strong competition among global diagnostics firms and specialized device makers. Leading companies focus on accuracy, portability, and workflow efficiency. Product reliability and brand trust shape purchasing decisions across hospitals and clinics. Firms compete through technology upgrades and compact designs. Distribution reach and after-sales support strengthen positioning. Price sensitivity influences competition in emerging regions. It remains moderately consolidated, with established brands holding strong clinical acceptance.

Recent Developments:

- In December 2025, Sysmex Corporation announced the launch of the Automated Blood Coagulation Analyzer CN-700 in Japan. The product inherits the analytical technology and operability of the higher-end models CN-6000 and CN-3000 while achieving a more compact design. With the addition of this new model to the CN-Series, Sysmex stated it will contribute to the automation and improved efficiency of a wide range of medical facilities, including those in emerging markets.

- Patricia Industries’ subsidiary Advanced Instruments entered into a definitive agreement on March 19, 2025, to acquire Nova Biomedical from its founding shareholders for an enterprise value of USD 2.2 billion. The acquisition officially closed on July 10, 2025. Following the closing, Advanced Instruments and Nova Biomedical merged, creating a global life science tools platform that operates under the Nova Biomedical name, with a diversified portfolio of analytical instruments, reagents, and services. For the full year 2024, the combined business generated sales of USD 621 million.

- In February 2025, Bio-Rad Laboratories announced a binding offer to purchase all equity interests in Stilla Technologies, a French digital PCR company. The acquisition was completed on June 30, 2025. In July 2025, Bio-Rad announced the launch of four new Droplet Digital PCR (ddPCR) platforms, including the QX Continuum ddPCR system and the QX700 series. While primarily focused on digital PCR solutions for genomics research and applied science markets, these platforms complement Bio-Rad’s broader diagnostics portfolio.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Technology Type, Application, End User, Distribution Channel, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Point-of-care testing adoption will continue to expand across primary care.

- Home healthcare demand will support portable device usage.

- Technology upgrades will focus on accuracy and usability.

- Emerging markets will drive volume growth.

- Preventive screening programs will increase analyzer deployment.

- Compact and lightweight designs will gain preference.

- Battery efficiency will remain a product focus area.

- Distribution networks will expand in rural regions.

- Digital features will support clinical documentation.

- Competition will intensify around cost and service quality.