Market Overview:

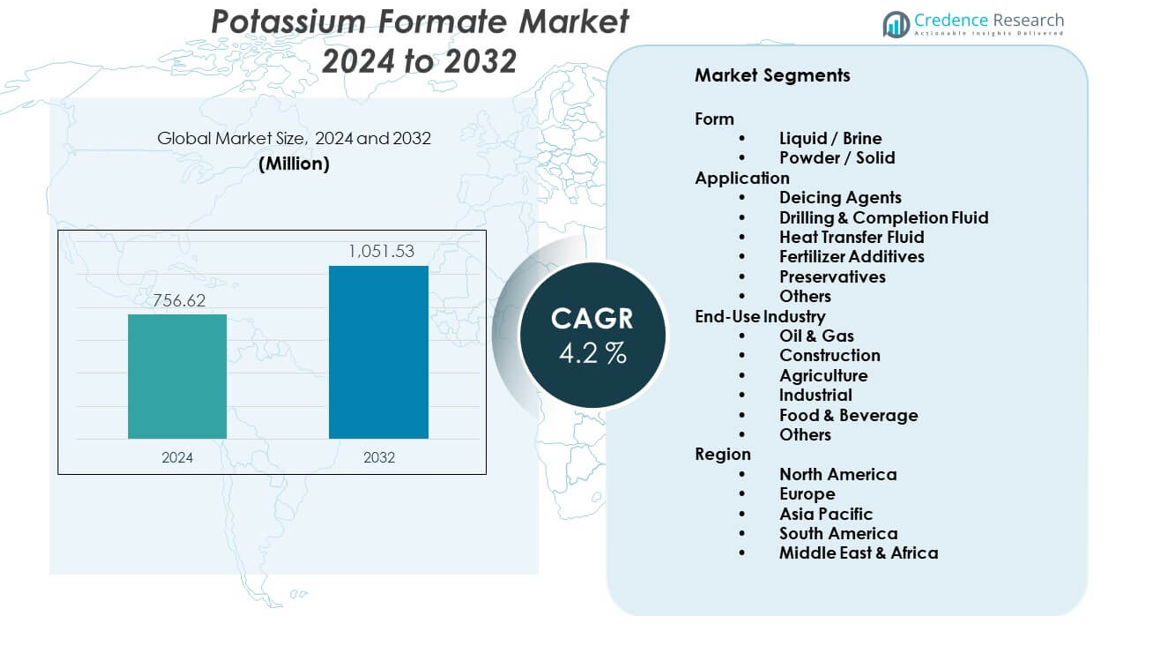

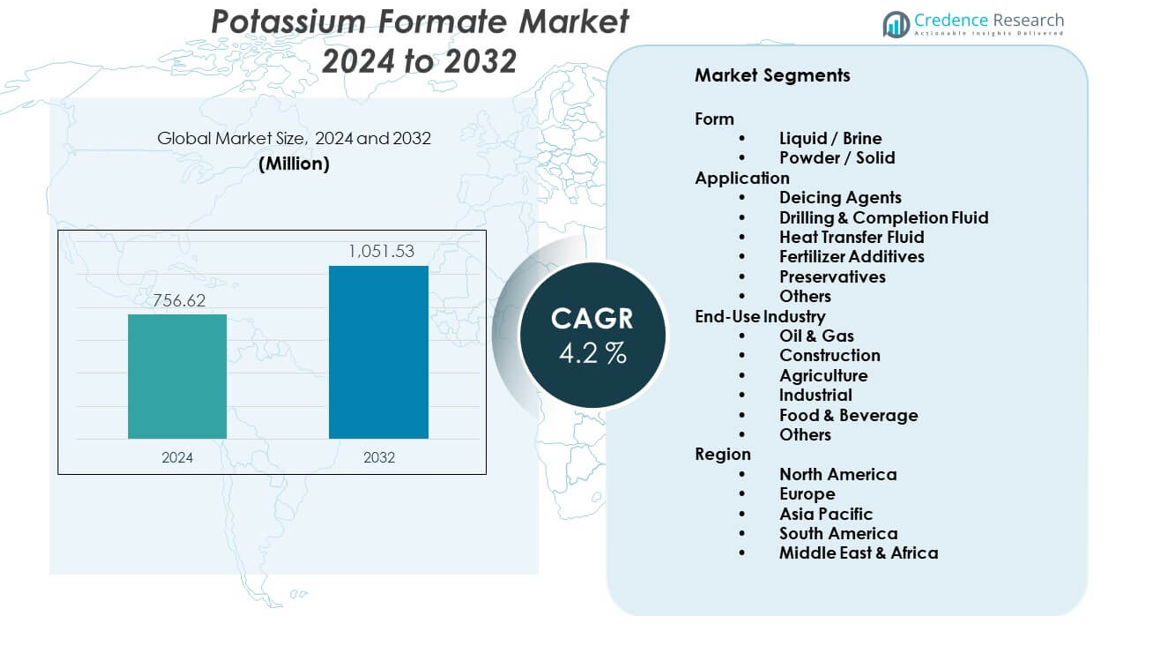

The Potassium Formate Market is projected to grow from USD 756.62 million in 2024 to an estimated USD 1,051.53 million by 2032, with a compound annual growth rate (CAGR) of 4.2% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Potassium Formate Market Size 2024 |

USD 756.62 million |

| Potassium Formate Market, CAGR |

4.2% |

| Potassium Formate Market Size 2032 |

USD 1,051.53 million |

Rising focus on sustainable chemicals and reduced environmental impact drives potassium formate adoption. The compound’s low toxicity and rapid biodegradability make it a preferred choice in oilfield drilling, where fluid performance and safety are key. Industries rely on it for stable freezing-point depression and non-corrosive properties. Increasing energy exploration in harsh environments fuels consumption. Technological improvements in formate brine production enhance purity and efficiency, while regulatory pressure against chloride-based alternatives accelerates the market’s industrial acceptance.

Europe leads the market due to its strong environmental regulations and mature oilfield operations. Norway and the U.K. show consistent usage in offshore drilling and runway de-icing. North America follows with high adoption in oil and gas fields across the U.S. and Canada. Asia-Pacific is emerging rapidly, driven by industrial expansion and winter maintenance programs in China and South Korea. Latin America and the Middle East present growing opportunities, supported by enhanced oil recovery activities and industrial process cooling demand.

Market Insights:

- The Potassium Formate Market was valued at USD 756.62 million in 2024 and is projected to reach USD 1,051.53 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- North America leads with about 35% share due to strong oil and gas activity, Europe follows with nearly 30% supported by strict environmental rules, and Asia Pacific holds around 22% driven by industrial expansion and infrastructure growth.

- Asia Pacific is the fastest-growing region with roughly 22% share, supported by rising energy projects, expanding industrial base, and growing demand for safer deicing and process fluids.

- By application, drilling and completion fluids account for about 45% share, while deicing agents contribute nearly 30%, reflecting dependence on oilfield operations and winter infrastructure safety.

- By form and end use, liquid or brine form holds close to 70% share, and oil and gas represents about 50% of total demand due to operational efficiency and performance needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand From Oilfield Drilling And Completion Fluid Applications

Energy producers rely on high-density brines for safe drilling operations. Potassium formate supports well control under high pressure conditions. The compound delivers stable performance at extreme temperatures. Oilfield operators value low formation damage during drilling cycles. Reduced corrosion protects drilling equipment and pipelines. Environmental compliance strengthens material preference in sensitive zones. The Potassium Formate Market gains traction from offshore exploration growth. It supports operational efficiency and safety standards.

- For instance, BASF reports potassium formate brines operate above 1.6 sg density and remain stable beyond 150 °C in wells.

Growing Preference For Environmentally Safer De-Icing And Anti-Icing Solutions

Airports seek alternatives to chloride-based runway chemicals. Potassium formate offers effective ice control with lower metal corrosion. Municipal authorities adopt safer products for bridges and roads. Reduced impact on soil and groundwater improves regulatory acceptance. Aviation authorities support materials with predictable performance. Infrastructure operators focus on lifecycle cost reduction. The Potassium Formate Market benefits from winter safety investments. It aligns with sustainable infrastructure policies.

- For instance, Avinor uses potassium formate deicers at Oslo Airport, reporting over 80% lower corrosion than urea products.

Expanding Use In Industrial Heat Transfer And Cooling Systems

Industries require reliable fluids for temperature control systems. Potassium formate ensures stable thermal performance. Chemical plants favor non-flammable heat transfer solutions. Low vapor pressure improves system safety. Equipment lifespan improves through reduced corrosion risk. Process industries value consistent fluid quality. The Potassium Formate Market sees wider industrial penetration. It supports continuous process reliability.

Regulatory Push Toward Low Toxicity Industrial Chemicals

Governments enforce stricter chemical safety standards. Industries replace hazardous salts with safer compounds. Potassium formate meets many environmental compliance needs. Worker safety rules drive procurement decisions. Reduced disposal risk lowers compliance costs. Manufacturers favor materials with clear safety profiles. The Potassium Formate Market aligns with regulatory trends. It supports long-term chemical substitution strategies.

Market Trends:

Shift Toward High-Purity Grades For Specialized Industrial Applications

End users demand consistent chemical purity levels. High-purity grades support sensitive oilfield operations. Manufacturing controls improve product specification accuracy. Quality assurance gains strategic importance. Industrial buyers value batch-to-batch reliability. Supplier differentiation strengthens through purity standards. The Potassium Formate Market reflects this quality-driven shift. It supports premium product positioning.

- For instance, Perstorp supplies potassium formate with purity above 99%, supported by ISO-certified batch testing.

Increasing Adoption In Airport And Aviation Ground Operations

Airports standardize safer runway maintenance chemicals. Potassium formate gains preference for predictable ice melting. Aircraft safety requirements influence material selection. Reduced corrosion protects aircraft components. Ground crews value easier handling characteristics. Aviation regulators promote safer chemical usage. The Potassium Formate Market expands within aviation infrastructure. It benefits from global air traffic recovery.

- For instance, Munich Airport reports potassium formate use reduced aircraft aluminum corrosion rates during winter operations.

Process Optimization And Cost Efficiency In Formate Production

Producers invest in efficient synthesis methods. Energy-efficient processes reduce operating costs. Supply stability improves through capacity optimization. Manufacturers focus on consistent output quality. Process control technology enhances yield reliability. Buyers seek long-term supply agreements. The Potassium Formate Market reflects producer efficiency focus. It supports competitive pricing strategies.

Growing Integration Into Multi-Functional Industrial Fluid Systems

Industries prefer fluids with multiple performance benefits. Potassium formate supports cooling and corrosion control. System simplification reduces operational complexity. Maintenance teams value fewer chemical inputs. Integrated solutions improve plant efficiency. Product versatility increases adoption rates. The Potassium Formate Market gains from multifunctional demand. It supports system-level optimization trends.

Market Challenges Analysis:

Raw Material Cost Sensitivity And Supply Chain Dependence

Production relies on stable potassium and formic acid supply. Price volatility affects manufacturing margins. Supply disruptions increase procurement risks. Producers face pressure to manage cost exposure. Buyers monitor price stability closely. Limited sourcing options create negotiation challenges. The Potassium Formate Market faces input cost uncertainty. It demands careful supply chain planning.

Limited Awareness Outside Core Industrial End-Use Segments

Adoption remains concentrated in specific industries. Many sectors lack technical knowledge of benefits. Market education requires sustained effort. Sales cycles extend due to qualification processes. Buyers hesitate without performance benchmarks. Substitute chemicals maintain strong familiarity. The Potassium Formate Market faces slower diversification. It needs broader industry outreach.

Market Opportunities:

Expansion Into Emerging Infrastructure And Cold Climate Economies

Developing regions invest in transport infrastructure. Cold climate cities need safer de-icing agents. Regulatory frameworks evolve toward sustainable chemicals. Public agencies seek proven alternatives. Industrial growth increases fluid demand. Early supplier entry builds long-term relationships. The Potassium Formate Market can expand geographically. It supports infrastructure modernization needs.

Innovation In Customized Formulations For Niche Applications

End users request tailored chemical performance. Customized blends improve application efficiency. Specialty formulations address unique operating conditions. Collaboration between producers and users increases. Technical service becomes a value driver. Product differentiation strengthens competitive positioning. The Potassium Formate Market benefits from customization trends. It encourages solution-based selling strategies.

Market Segmentation Analysis:

Form Analysis

Liquid or brine form leads due to easy handling and direct system use. This form supports oilfield fluids and deicing operations. High solubility ensures consistent performance in cold conditions. Operators prefer faster deployment without extra processing. Powder or solid form serves controlled dosing needs. This variant supports storage efficiency and long transport routes. Industrial users value precise blending options. Both forms meet distinct operational requirements.

Application Analysis

Deicing agents represent a major application due to safety needs. Airports and roads rely on predictable ice control performance. Drilling and completion fluid use supports high-pressure well operations. Heat transfer fluid demand comes from stable thermal behavior. Fertilizer additives improve nutrient delivery efficiency. Preservatives support niche industrial and chemical uses. Other applications include specialty process fluids. Application diversity supports steady demand.

- For instance, Statoil reported potassium formate drilling fluids reduced formation damage in North Sea wells.

End-Use Industry Analysis

Oil and gas dominates consumption due to drilling fluid demand. Construction uses focus on winter maintenance and infrastructure safety. Agriculture applies potassium formate in specialty fertilizer blends. Industrial users adopt it for cooling and process fluids. Food and beverage use remains limited to specific preservative roles. Other industries contribute smaller volumes. The Potassium Formate Market reflects varied sector needs. It supports balanced demand across industries.

Segmentation:

Form

- Liquid / Brine

- Powder / Solid

Application

- Deicing Agents

- Drilling & Completion Fluid

- Heat Transfer Fluid

- Fertilizer Additives

- Preservatives

- Others

End-Use Industry

- Oil & Gas

- Construction

- Agriculture

- Industrial

- Food & Beverage

- Others

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds the largest share of the Potassium Formate Market, accounting for about 35% of global demand. Strong oil and gas activity supports drilling and completion fluid usage. Airports and municipalities drive steady demand for deicing agents. Regulatory support favors low-toxicity chemicals. Industrial users rely on stable heat transfer solutions. The United States leads regional consumption. Canada contributes through cold climate infrastructure needs.

Europe

Europe represents nearly 30% of the global market share. Strict environmental regulations shape product adoption. Offshore drilling in the North Sea supports oilfield demand. Airports across Northern Europe rely on safer runway deicing agents. Industrial process applications remain stable across Germany and France. Sustainability policies influence procurement decisions. The region shows mature but consistent demand patterns.

Asia Pacific, South America, and Middle East & Africa

Asia Pacific holds around 22% of the market share. China and South Korea lead due to industrial growth and infrastructure expansion. Cold region logistics support deicing demand in select countries. South America accounts for about 7% share, led by oilfield activity in Brazil. Middle East & Africa contributes nearly 6% share. Energy projects drive regional consumption. The Potassium Formate Market shows long-term growth potential across emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

Competition in the Potassium Formate Market centers on product quality, supply reliability, and oilfield expertise. Leading players focus on high-purity grades for drilling and deicing uses. Strong ties with oil and gas operators support stable demand. Companies invest in process control to ensure consistent output. Global distribution networks strengthen customer reach. Product differentiation relies on safety and performance standards. Mid-sized suppliers compete through niche applications. The Potassium Formate Market remains moderately consolidated. It favors players with technical support capabilities.

Recent Developments:

- In March 2025, Perstorp Holding AB (Sweden) launched the Neptem™ range of emulsifiers specifically designed for waterborne alkyd technology. This new product portfolio represents high-performance, low-VOC emulsification solutions that enable a seamless transition from solvent-based to waterborne alkyd resins. The Neptem™ emulsifiers deliver uncompromised performance by ensuring waterborne alkyds match or exceed the quality of traditional solvent-based systems while supporting the industry’s shift toward sustainable, low-emission coatings with reduced greenhouse gas emissions.

- In February 2025, Thermo Fisher Scientific Inc. (US) announced a definitive agreement to acquire Solventum’s Purification & Filtration business for approximately USD 4.1 billion in cash. This strategic acquisition, expected to close by the end of 2025, enhances Thermo Fisher’s bioproduction capabilities and expands its filtration technology offerings. The Solventum business, which generated approximately USD 1 billion in revenue during 2024 with approximately 2,500 employees globally, provides purification and filtration solutions used in biologics manufacturing, medical technologies, and industrial applications. Upon closing, this business will become part of Thermo Fisher’s Life Sciences Solutions segment, broadening the company’s capabilities in both upstream and downstream workflows for biologics development and manufacturing.

- In November 2024, Perstorp Holding AB (Sweden) achieved a significant sustainability milestone by obtaining International Sustainability and Carbon Certification (ISCC) PLUS as a trader with storage in the US. This certification enables customers in the United States to access mass-balanced renewable and recycled raw materials with verified sustainability benefits, strengthening Perstorp’s commitment to environmentally responsible chemical production and expanding market opportunities for sustainable potassium formate solutions.

Report Coverage:

The research report offers an in-depth analysis based on Form, Application, End-Use Industry, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will rise from offshore and complex drilling projects.

- Environmental compliance will favor low-toxicity chemicals.

- Airport deicing adoption will remain steady.

- Industrial heat transfer use will expand gradually.

- Asia Pacific will attract new production capacity.

- Custom formulations will support niche demand.

- Supply chain efficiency will gain priority.

- Strategic partnerships will shape competition.

- Product purity standards will strengthen.

- Long-term contracts will support market stability.