Market Overview:

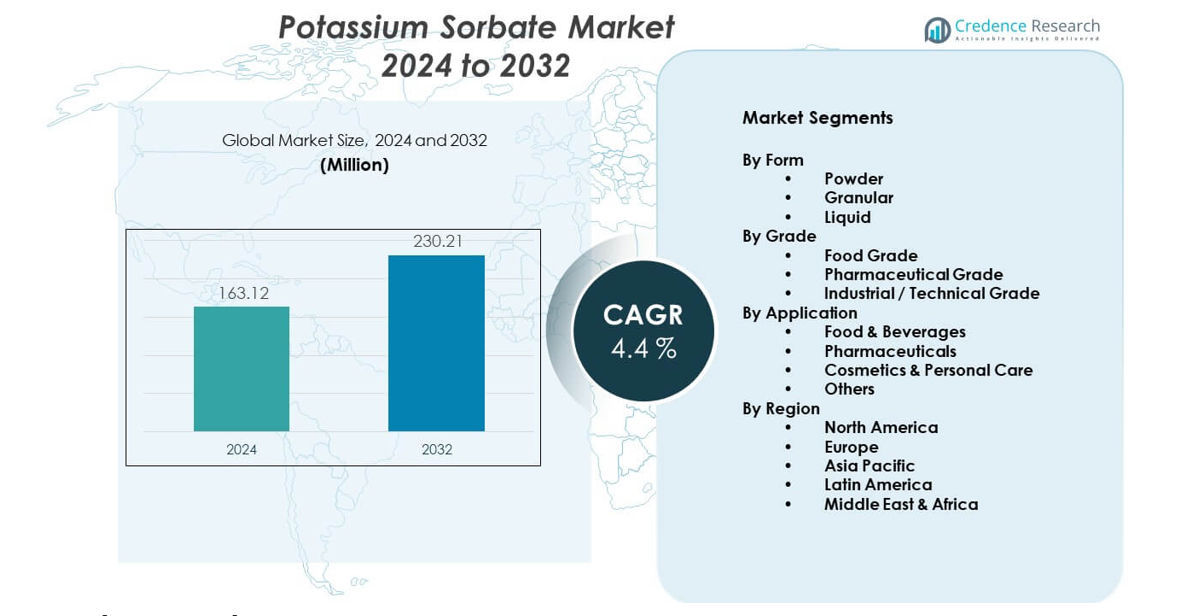

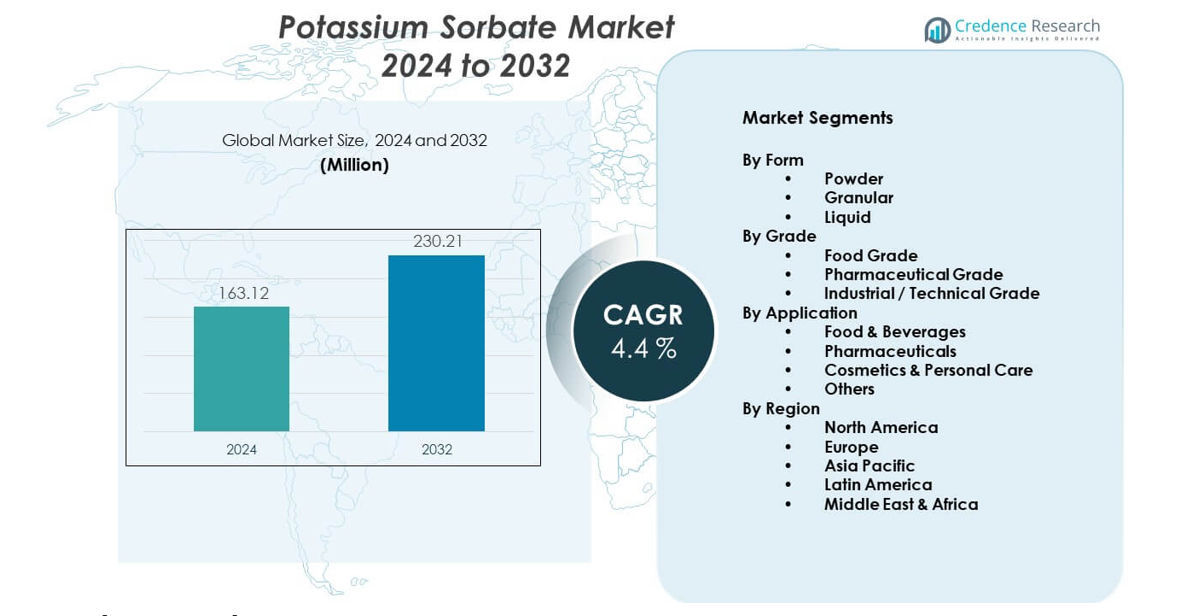

The Potassium Sorbate Market is projected to grow from USD 163.12 million in 2024 to an estimated USD 230.21 million by 2032, with a compound annual growth rate of 4.4% from 2024 to 2032. Potassium sorbate serves as a widely used food preservative due to strong antimicrobial performance.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Potassium Sorbate Market Size 2024 |

USD 163.12 million |

| Potassium Sorbate Market, CAGR |

4.4% |

| Potassium Sorbate Market Size 2032 |

USD 230.21 million |

Rising demand for packaged and processed food products drives the Potassium Sorbate Market. Food manufacturers rely on effective preservatives to prevent mold and yeast growth. Clean labeling trends encourage use of preservatives with proven safety profiles. Beverage producers use potassium sorbate to maintain flavor stability. Pharmaceutical formulations apply the compound to protect liquid medicines. Personal care brands adopt it in creams and lotions for microbial control. Expanding urban populations increase consumption of ready-to-eat products. Longer distribution chains raise shelf-life expectations. Regulatory approvals across major economies support sustained demand.

North America and Europe lead the Potassium Sorbate Market due to high processed food consumption. Strong food safety regulations support consistent preservative usage. The United States and Germany remain key production and consumption hubs. Asia-Pacific emerges as the fastest-growing region driven by food industry expansion. China and India see rising demand from bakery and beverage sectors. Growing middle-class populations boost packaged food intake. Latin America shows steady growth through dairy and beverage applications. Middle East and Africa expand gradually with improving food processing infrastructure.

Market Insights:

- The Potassium Sorbate Market reached USD 163.12 million in 2024 and is projected to reach USD 230.21 million by 2032, growing at a CAGR of 4.4% due to steady preservative demand.

- North America leads with about 32% share due to advanced food processing, Europe follows with 28% driven by strict regulations, and Asia Pacific holds 25% supported by rapid food industry expansion.

- Asia Pacific is the fastest-growing region with around 25% share, driven by urbanization, rising packaged food consumption, and expanding beverage production.

- By application, food and beverages account for nearly 58% share due to widespread use in bakery, dairy, and drinks.

- By grade, food grade holds around 62% share, supported by safety approvals and high demand from processed food manufacturers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand From Processed And Packaged Food Production

The Potassium Sorbate Market benefits from steady growth in processed food output. Food brands need reliable preservatives for shelf stability. Potassium sorbate controls mold and yeast effectively. Bakery, dairy, and beverage sectors rely on this compound. Urban lifestyles increase demand for packaged foods. Retail chains require longer product shelf life. Manufacturers value predictable performance across formulations. Regulatory approval supports wide food application use.

- For instance, FDA permits potassium sorbate up to 0.1% by weight in food products.

Expansion Of Beverage And Liquid Food Applications

The Potassium Sorbate Market gains strength from beverage sector expansion. Soft drinks require microbial stability during storage. Fruit juices depend on preservatives to maintain freshness. Alcoholic beverages use sorbate for fermentation control. It supports flavor consistency across distribution cycles. Bottled drinks face extended transport timelines. Producers seek cost-efficient preservation solutions. Potassium sorbate meets these operational needs.

- For instance, Coca-Cola uses sorbates (such as potassium sorbate) to support yeast control in acidic beverages, where the low pH enhances the preservative’s effectiveness.

Growing Use In Pharmaceutical And Nutraceutical Formulations

The Potassium Sorbate Market sees demand from liquid pharmaceuticals. Syrups require protection against microbial growth. Nutraceutical liquids also depend on preservation. Shelf stability ensures product safety for consumers. Drug manufacturers prioritize compliant additives. Potassium sorbate fits approved excipient lists. Global healthcare demand supports steady usage. Reliable sourcing strengthens adoption across regions.

Increasing Adoption In Personal Care And Cosmetics

The Potassium Sorbate Market expands within personal care products. Creams and lotions need microbial protection. Brands prefer mild preservatives with proven safety. Potassium sorbate suits sensitive skin formulations. Rising skincare awareness boosts product launches. Natural-focused brands accept this preservative. Stable performance supports consistent texture quality. Cosmetic regulations favor controlled preservative use.

Market Trends:

Shift Toward Clean Label And Mild Preservation Solutions

The Potassium Sorbate Market reflects clean label product strategies. Brands simplify ingredient lists for transparency. Potassium sorbate holds a recognized safety image. Consumers prefer familiar preservative names. Food companies reduce complex chemical blends. It supports minimal formulation changes. Regulatory clarity improves consumer trust. Clean positioning strengthens long-term acceptance.

- For instance, EFSA reaffirmed potassium sorbate safety within approved food limits.

Increasing Preference For Standardized Food Grade Quality

The Potassium Sorbate Market shows focus on grade consistency. Buyers demand uniform purity levels. Food processors require batch reliability. Quality audits increase across supply chains. Producers invest in refined production controls. Certification compliance becomes a purchase factor. Standardized quality reduces formulation risk. Global trade favors consistent specifications.

- For instance, Kerry Group supplies food-grade potassium sorbate meeting FCC and E-number standards.

Growth Of Global Food Trade And Cold Chain Logistics

The Potassium Sorbate Market aligns with expanding food exports. Cold chain logistics extend product travel distance. Preservatives support stability during transit. Exporters prioritize shelf-life assurance. International food standards encourage approved additives. Potassium sorbate supports cross-border distribution. Longer storage cycles increase preservative need. Trade growth sustains volume demand.

Rising Demand For Cost-Efficient Preservation Systems

The Potassium Sorbate Market benefits from cost control strategies. Manufacturers seek effective low-dose preservatives. Potassium sorbate delivers strong antimicrobial action. It reduces overall formulation cost pressure. Price stability supports procurement planning. Producers avoid frequent ingredient switching. Efficient preservation improves margin control. Cost focus drives continued adoption.

Market Challenges Analysis:

Regulatory Compliance And Labeling Complexity Across Regions

The Potassium Sorbate Market faces varied regional regulations. Labeling rules differ across countries. Compliance increases administrative workload for producers. Exporters manage multiple documentation standards. Regulatory updates require frequent review. Smaller firms face higher compliance costs. Market entry barriers rise for new suppliers. Regulatory scrutiny affects formulation decisions.

Availability Of Alternative Preservatives And Substitutes

The Potassium Sorbate Market competes with alternative preservatives. Natural extracts gain attention in premium foods. Fermentation-based solutions attract niche demand. Some brands reduce preservative usage claims. Substitutes increase buyer negotiation power. Performance comparison affects procurement choices. R&D costs rise to defend market share. Competitive pressure challenges long-term pricing stability.

Market Opportunities:

Expansion In Emerging Food Processing Markets

The Potassium Sorbate Market holds opportunity in emerging economies. Food processing capacity expands rapidly. Urban populations increase packaged food demand. Local manufacturers seek proven preservatives. Potassium sorbate offers easy formulation integration. Cost efficiency suits developing market needs. Distribution networks improve steadily. Emerging regions support volume growth.

Product Innovation And Application-Specific Formulations

The Potassium Sorbate Market can expand through tailored solutions. Customized grades suit specific food applications. Beverage-focused variants improve solubility performance. Cosmetic blends address formulation compatibility. Pharmaceutical grades support strict compliance needs. Innovation strengthens supplier differentiation. Value-added products improve margins. Application focus drives future growth paths.

Market Segmentation Analysis:

By Form

The Potassium Sorbate Market shows clear differentiation across product forms. Powder form dominates due to easy handling and long shelf life. Food and pharmaceutical producers prefer powder for dry blends. Granular form supports controlled dosing in industrial processes. It improves flow properties during large-scale production. Liquid form serves beverage and liquid pharmaceutical applications. Liquid variants dissolve faster in aqueous systems. This form suits formulations that require uniform dispersion. Form selection depends on process efficiency and end-use needs.

- For instance, DSM-Firmenich supplies powder sorbate with moisture content below 1%.

By Grade

Food grade potassium sorbate holds the largest share due to strict safety standards. Food processors rely on this grade for preservative stability. Pharmaceutical grade supports syrups, suspensions, and liquid medicines. It meets purity and compliance requirements. Industrial or technical grade serves non-food uses with cost focus. Applications include coatings and chemical processing. Grade choice reflects regulatory demands and application sensitivity. Higher-grade products support premium pricing strategies.

- For instance, Merck provides pharmaceutical-grade potassium sorbate compliant with USP specifications.

By Application

Food and beverages represent the primary application segment. Bakery, dairy, and drinks depend on microbial control. Pharmaceuticals use potassium sorbate to protect liquid formulations. Cosmetics and personal care products apply it for shelf stability. Creams and lotions benefit from mild preservation. Other applications include specialty chemicals and niche industrial uses. Application diversity supports demand stability. End-user requirements shape formulation and grade selection.

Segmentation:

By Form

By Grade

- Food Grade

- Pharmaceutical Grade

- Industrial / Technical Grade

By Application

- Food & Beverages

- Pharmaceuticals

- Cosmetics & Personal Care

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America Dominates With Mature Food And Beverage Industries

The Potassium Sorbate Market in North America accounts for nearly 32% of global share. The United States leads due to strong packaged food consumption. Advanced food safety standards drive preservative usage. Beverage and dairy industries rely on stable shelf-life solutions. Pharmaceutical formulations support consistent demand. Personal care brands also contribute to volume growth. Established distribution networks sustain regional leadership.

Europe Maintains Strong Position Through Regulatory Compliance

Europe holds around 28% share in the Potassium Sorbate Market. Countries such as Germany, France, and the United Kingdom lead consumption. Strict food regulations encourage approved preservatives. Clean-label trends support potassium sorbate adoption. Bakery and processed meat sectors remain key users. Pharmaceutical manufacturing strengthens demand stability. Cross-border trade supports steady regional volume.

Asia Pacific Leads Growth While Other Regions Expand Gradually

Asia Pacific represents about 25% of the Potassium Sorbate Market and grows fastest. China and India drive demand through food processing expansion. Urbanization increases packaged food consumption. Beverage production rises across Southeast Asia. Latin America holds nearly 9% share, led by Brazil and Mexico. Middle East & Africa account for around 6%, supported by improving food infrastructure. Emerging markets strengthen long-term regional balance.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Celanese Corporation

- Shandong Kunda Biological Technology Co., Ltd.

- Merck

- Titan Biotech

- Hunan Huari Pharmaceutical Co., Ltd.

Competitive Analysis:

The Potassium Sorbate Market features moderate competition with global and regional suppliers. Large players focus on scale, quality control, and regulatory compliance. Established firms benefit from long-term contracts with food processors. Product consistency remains a key competitive factor. Companies invest in purity improvement and process efficiency. Regional manufacturers compete through cost advantages. Distribution reach influences buyer preference across regions. Strategic partnerships support market access. Brand reputation strengthens trust among pharmaceutical and food clients. Competitive intensity remains stable due to standardized product nature.

Recent Developments:

- In April 2025, Merck KGaA announced a definitive agreement to acquire SpringWorks Therapeutics for an equity value of USD 3.9 billion. The acquisition was officially completed on July 1, 2025, for an enterprise value of €3 billion (USD 3.4 billion). This represents the largest acquisition by Merck’s Healthcare sector in nearly 20 years.

- In June 2023, Celanese Corporation signed a definitive agreement to form a strategic joint venture with Mitsui & Co. for its Nutrinova functional food ingredients business. Under the terms of the agreement, Mitsui acquired a 70% equity stake in Nutrinova Netherlands B.V., while Celanese retained a 30% ownership stake.

Report Coverage:

The research report offers an in-depth analysis based on form, grade, and application segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand from processed food production will remain strong

- Beverage sector expansion will support stable consumption

- Pharmaceutical applications will gain steady traction

- Cosmetic formulations will increase preservative usage

- Clean-label positioning will influence product selection

- Asia Pacific will drive volume growth

- Cost efficiency will shape supplier strategies

- Quality certification will gain importance

- Supply chain localization will expand

- Innovation will focus on application-specific grades