Market Overview:

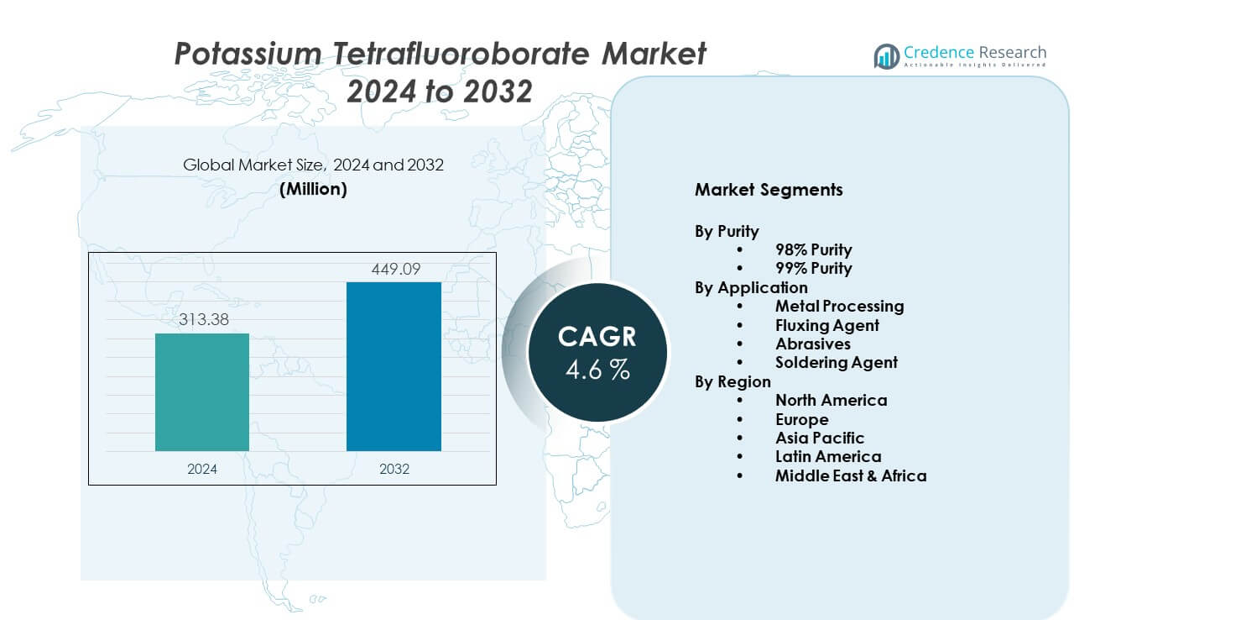

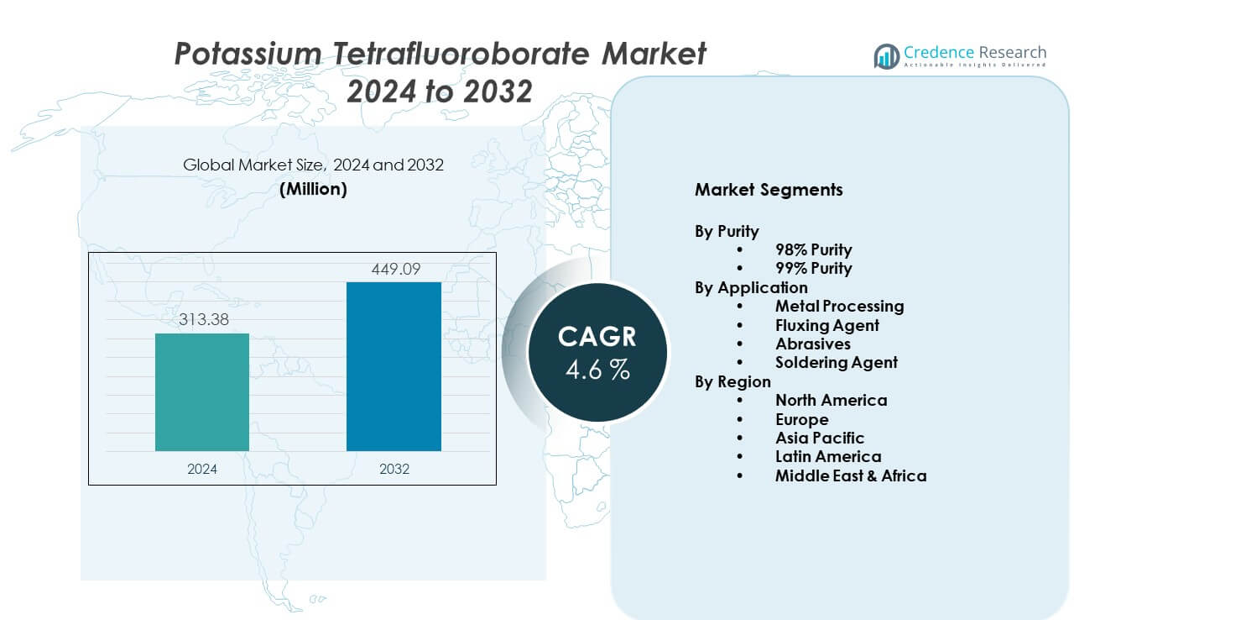

The Potassium Tetrafluoroborate Market is projected to grow from USD 313.38 million in 2024 to an estimated USD 449.09 million by 2032. The market is expected to expand at a compound annual growth rate of 4.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Potassium Tetrafluoroborate Market Size 2024 |

USD 313.38 million |

| Potassium Tetrafluoroborate Market, CAGR |

4.6% |

| Potassium Tetrafluoroborate Market Size 2032 |

USD 449.09 million |

Market growth is driven by rising demand from aluminum brazing and flux applications. Potassium tetrafluoroborate improves bonding strength and surface cleanliness. Metal fabrication industries adopt it to enhance joint quality and reduce defects. Electronics manufacturing also supports demand through precision soldering needs. Chemical processing industries rely on the compound for consistent reaction performance. Industrial expansion sustains volume demand. Manufacturers invest in process efficiency to maintain cost stability and product purity.

Asia-Pacific leads the market due to strong metal processing and electronics manufacturing bases. China and India drive consumption through large-scale industrial output. North America holds a stable position supported by aerospace and advanced manufacturing sectors. Europe maintains steady demand from automotive and industrial fabrication industries. Emerging regions include Southeast Asia and parts of the Middle East. Industrialization and infrastructure development support adoption. Regional growth aligns with expanding manufacturing capacity and technology upgrades.

Market Insights:

- The Potassium Tetrafluoroborate Market was valued at USD 313.38 million in 2024 and is projected to reach USD 449.09 million by 2032, growing at a CAGR of 4.6% during the forecast period.

- Asia Pacific leads with about 40% share due to strong metal processing and electronics output, followed by North America at 25% from aerospace and automotive demand, and Europe at 22% driven by industrial fabrication and quality standards.

- Latin America is the fastest-growing region with nearly 8% share, supported by expanding fabrication industries, infrastructure projects, and rising adoption of standardized industrial chemicals.

- By purity, 99% purity holds the largest share at around 55% due to demand from electronics, precision soldering, and high-quality brazing applications.

- By application, metal processing dominates with close to 45% share, supported by wide use in brazing, welding, and industrial fabrication activities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Demand From Aluminum Brazing And Metallurgical Processing Industries

The Potassium Tetrafluoroborate Market benefits from steady demand in aluminum brazing activities. Manufacturers rely on the compound to improve metal joint quality. The material supports clean surface preparation during brazing operations. Industrial fabricators value stable thermal behavior during high-temperature processes. Automotive and appliance sectors drive volume demand. Metal workshops adopt standardized flux materials for quality control. Production scale expansion sustains long-term consumption. Repeat industrial use supports demand stability.

- For instance, Stella Chemifa supplies potassium tetrafluoroborate grades used in aluminum brazing fluxes operating above 560 °C, supporting stable joint formation in industrial furnaces.

Rising Application In Electronics Assembly And Precision Soldering Processes

Electronics manufacturers require reliable flux materials for soldering accuracy. Potassium tetrafluoroborate supports clean solder joints and low defect rates. Circuit board assembly benefits from predictable chemical behavior. Consumer electronics output growth supports usage. Manufacturers prefer proven compounds for process reliability. Industrial electronics plants adopt uniform soldering standards. Production automation increases consistency needs. This driver supports steady market penetration.

- For instance, Morita Chemical Industries provides high-purity inorganic fluorides, such as semiconductor-grade hydrofluoric acid (HF) and potassium fluoride (KF), used for essential processes in the electronics industry, including the cleaning and etching of semiconductor wafers and in fluxes for advanced soldering applications. These materials support the manufacturing of miniaturized electronic components required by cutting-edge technologies.

Growth In Chemical Processing And Specialty Industrial Applications

Chemical producers use potassium tetrafluoroborate in controlled reactions. The compound offers predictable performance under regulated conditions. Specialty chemical synthesis depends on stable inorganic salts. Industrial users favor materials with defined purity levels. Process engineers value system compatibility. Demand rises from niche chemical formulations. Supply consistency remains critical for repeat operations. This supports sustained industrial demand.

Expansion Of Global Manufacturing And Infrastructure Development Activities

Manufacturing expansion increases consumption of industrial chemicals. Infrastructure projects raise demand for fabricated metal components. Welding and brazing materials see higher usage rates. Developing economies invest in industrial capacity upgrades. Equipment manufacturers standardize material inputs for efficiency. Industrial clusters drive bulk procurement patterns. Stable supply chains encourage long-term contracts. Demand aligns with industrial growth trends.

Market Trends:

Shift Toward High-Purity Grades For Performance-Sensitive Applications

Manufacturers prefer high-purity potassium tetrafluoroborate grades. Precision industries require consistent chemical composition. Electronics and aerospace segments emphasize material quality. Suppliers invest in refined production processes. Quality assurance becomes a competitive focus. End users reduce process variability through purer inputs. Certification needs influence purchasing decisions. This trend reshapes supplier differentiation.

- For instance, Honeywell Fine Chemicals supplies laboratory and electronics-grade fluoroborates with impurity levels controlled below trace metal thresholds required for aerospace component fabrication.

Increased Focus On Process Efficiency And Material Yield Optimization

Industrial users seek better material utilization rates. Potassium tetrafluoroborate supports controlled application volumes. Manufacturers aim to reduce waste during brazing cycles. Process optimization improves cost management. Automated systems require predictable material behavior. Suppliers ensure consistent particle size. Production efficiency becomes a procurement priority. This trend supports standardized specifications.

- For instance, Solvay applies controlled crystallization technology to maintain uniform particle distribution, improving flux spread consistency across automated brazing lines.

Growing Preference For Reliable Long-Term Supply Partnerships

Buyers prioritize stable supplier relationships. Consistent availability reduces production disruptions. Long-term contracts support price stability planning. Suppliers expand regional distribution networks. Industrial customers value dependable logistics performance. Bulk procurement agreements gain traction. Trust-based supplier selection increases. This trend strengthens market discipline.

Rising Adoption In Emerging Manufacturing Regions

Emerging economies expand metal fabrication capacity. Local industries adopt established industrial compounds. Potassium tetrafluoroborate gains acceptance in new plants. Technology transfer supports standardized material use. Regional suppliers enter distribution channels. Demand spreads beyond mature markets. Industrial training supports safe handling. This trend broadens geographic reach.

Market Challenges Analysis:

Supply Chain Sensitivity And Dependence On Raw Material Availability

The Potassium Tetrafluoroborate Market faces raw material supply risks. Production depends on consistent input availability. Disruptions affect delivery schedules and pricing stability. Industrial buyers require reliable procurement planning. Logistics delays impact manufacturing timelines. Suppliers manage inventory buffers to reduce risk. Global trade shifts affect sourcing strategies. These factors challenge operational consistency.

Regulatory Compliance And Handling Requirements Across Industrial Markets

Chemical handling regulations affect production and distribution. Manufacturers must meet safety and storage standards. Compliance costs influence operational margins. End users require proper handling training. Regulatory variation complicates cross-border trade. Documentation needs increase administrative effort. Smaller suppliers face higher compliance pressure. This challenge affects market entry dynamics.

Market Opportunities:

Expansion Of Advanced Manufacturing And High-Precision Industrial Segments

Advanced manufacturing increases demand for reliable flux materials. High-precision industries value chemical performance stability. Potassium tetrafluoroborate supports quality-focused production lines. Aerospace and electronics growth creates new demand avenues. Suppliers develop tailored grades for specialized use. Technology upgrades encourage material standardization. This opportunity supports value-added product strategies. Market players can strengthen technical support roles.

Rising Industrialization In Developing Economies And New End-Use Adoption

Developing regions expand fabrication and assembly capacity. New industrial plants adopt proven chemical compounds. Potassium tetrafluoroborate gains use in local manufacturing lines. Government-backed industrial zones support chemical demand. Equipment imports drive standardized material needs. Local distributors expand supply access. Industrial skill development improves adoption rates. This opportunity supports long-term regional growth.

Market Segmentation Analysis:

By Purity

The Potassium Tetrafluoroborate Market shows clear demand differences across purity levels. The 98% purity segment serves standard industrial applications where cost control remains important. Metal workshops and general fabrication units favor this grade for routine operations. The 99% purity segment targets performance-sensitive uses that require higher chemical stability. Electronics, aerospace, and precision soldering rely on this grade for consistent results. Buyers select higher purity to reduce defects and process variation. Demand for refined grades grows with tighter quality standards.

- For instance, American Elements supplies 99% purity potassium tetrafluoroborate for electronics and aerospace customers requiring controlled moisture and trace impurity limits.

By Application

Metal processing represents a core application due to wide use in brazing and surface treatment. The compound supports clean metal joints and controlled thermal behavior. Fluxing agent usage remains strong in welding and brazing operations across industries. Manufacturers value reliable flux performance during high-temperature cycles. Abrasives applications use the compound for controlled material interaction. Soldering agent demand grows from electronics and electrical assembly sectors. The compound supports uniform solder flow and joint strength. Application diversity supports balanced market demand.

- For instance, Madras Fluorine Ltd. supplies potassium tetrafluoroborate grades used across metal fabrication and soldering processes supporting industrial-scale production lines.

Segmentation:

By Purity

By Application

- Metal Processing

- Fluxing Agent

- Abrasives

- Soldering Agent

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Holds The Largest Market Share

Asia Pacific accounts for the largest share of the global demand, holding nearly 40% of the market. The Potassium Tetrafluoroborate Market benefits from strong metal processing and electronics manufacturing activity in this region. China leads regional consumption due to large-scale brazing and welding operations. India follows with rising use in industrial fabrication and soldering applications. Japan and South Korea support demand through precision electronics and advanced manufacturing. Industrial expansion and cost-efficient production support regional dominance.

North America And Europe Maintain Strong Industrial Demand

North America represents around 25% of the global market share, supported by aerospace and automotive manufacturing. The Potassium Tetrafluoroborate Market gains strength from stable demand across metal processing and specialty chemical applications. The United States leads regional consumption with consistent industrial output. Europe holds close to 22% market share, driven by automotive, machinery, and industrial fabrication sectors. Germany, France, and Italy remain key contributors. Strong quality standards support demand for higher-purity grades.

Latin America And Middle East & Africa Show Emerging Potential

Latin America contributes nearly 8% of the global market share. Brazil and Mexico drive regional demand through expanding fabrication and repair industries. Industrial modernization supports gradual adoption across applications. The Middle East & Africa region accounts for about 5% of total demand. Infrastructure development and metal fabrication projects support consumption growth. Regional demand remains moderate but shows steady expansion. Industrial investment improves long-term market presence.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- American Elements

- Solvay S.A.

- Morita Chemical Industries

- Honeywell Fine Chemicals

- Hunan Merits New Materials Co. Ltd.

- Foshan Nanhai Fluoride Chemical Co. Ltd.

- Stella Chemifa Corporation

- Madras Fluorine Ltd.

- B. Chemicals

- Derivados del Flúor (DDF)

Competitive Analysis:

The Potassium Tetrafluoroborate Market shows moderate competitive intensity with a mix of global and regional suppliers. Key players compete on product purity, supply reliability, and application-specific performance. Established chemical producers leverage integrated production and strong distribution networks. Regional manufacturers focus on cost efficiency and proximity to end users. Product differentiation remains limited, which increases price sensitivity among buyers. Companies invest in quality control to meet strict industrial standards. Long-term supply contracts strengthen customer retention. Strategic focus remains on stable volumes rather than aggressive expansion. The Potassium Tetrafluoroborate Market favors players with consistent output and regulatory compliance capabilities.

Recent Developments:

- In November 2025, Morita Chemical Industries achieved a significant milestone through a landmark joint venture with Neogen Ionics Limited, an Indian chemical manufacturer. The partnership, formally concluded on November 28, 2025, established Neogen Morita New Materials Limited (NML), which is strategically positioned to produce solid lithium hexafluorophosphate (LiPF6) salt, a critical electrolyte ingredient for lithium-ion batteries. Neogen Ionics holds an 80% majority stake in the new entity, while Morita Investment Limited holds 20%, with a capital contribution of $20 million from the Japanese partner. This joint venture represents one of the first Indo-Japanese collaborations in the lithium battery materials sector and leverages Morita’s extensive expertise spanning three decades in lithium salt manufacturing technology to enhance India’s domestic value addition and support the nation’s “Aatmanirbhar Bharat” self-reliance mission.

- In November 2025, Solvay S.A. forged a strategic partnership with Noveon Magnetics, an American rare earth magnet manufacturer, through a supply agreement for light and heavy rare earth oxides. The partnership, announced on November 11, 2025, commits Solvay to supply Noveon with neodymium-praseodymium (NdPr), dysprosium (Dy), and terbium (Tb) oxides beginning in 2026. This collaboration aims to establish a sustainable and domestically sourced supply chain for rare earth permanent magnets by combining Solvay’s chemistry expertise with Noveon’s manufacturing capabilities, addressing rising demand for domestically produced rare earth magnets in the United States. The oxides will be sourced from end-of-life (EOL) materials and other sources, supporting the creation of high-performance permanent magnets for defense, aerospace, and automotive applications.

- In May 2025, the Potassium Tetrafluoroborate Market demonstrated robust growth driven by its expanding application as an electrolyte in lithium-ion batteries. Market analysts reported that the compound is increasingly being adopted across metallurgical, electronics, and automotive sectors, with approximately 50% of its industrial use dedicated to fluxing and refining applications in aluminum and magnesium alloy production. Technological progress and product innovation account for nearly 25% of ongoing industry developments, with manufacturers focusing on optimizing purity levels and enhancing industrial performance characteristics.

Report Coverage:

The research report offers an in-depth analysis based on purity level and application type. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand remains stable across metal processing industries

- High-purity grades gain wider industrial acceptance

- Electronics manufacturing supports soldering applications

- Asia Pacific continues as the primary demand center

- Supply chain efficiency becomes a key competitive factor

- Regulatory compliance influences supplier selection

- Long-term contracts strengthen buyer–supplier relations

- Process optimization improves cost control

- Emerging regions add incremental demand

- Product standardization supports market stability