Market Overview:

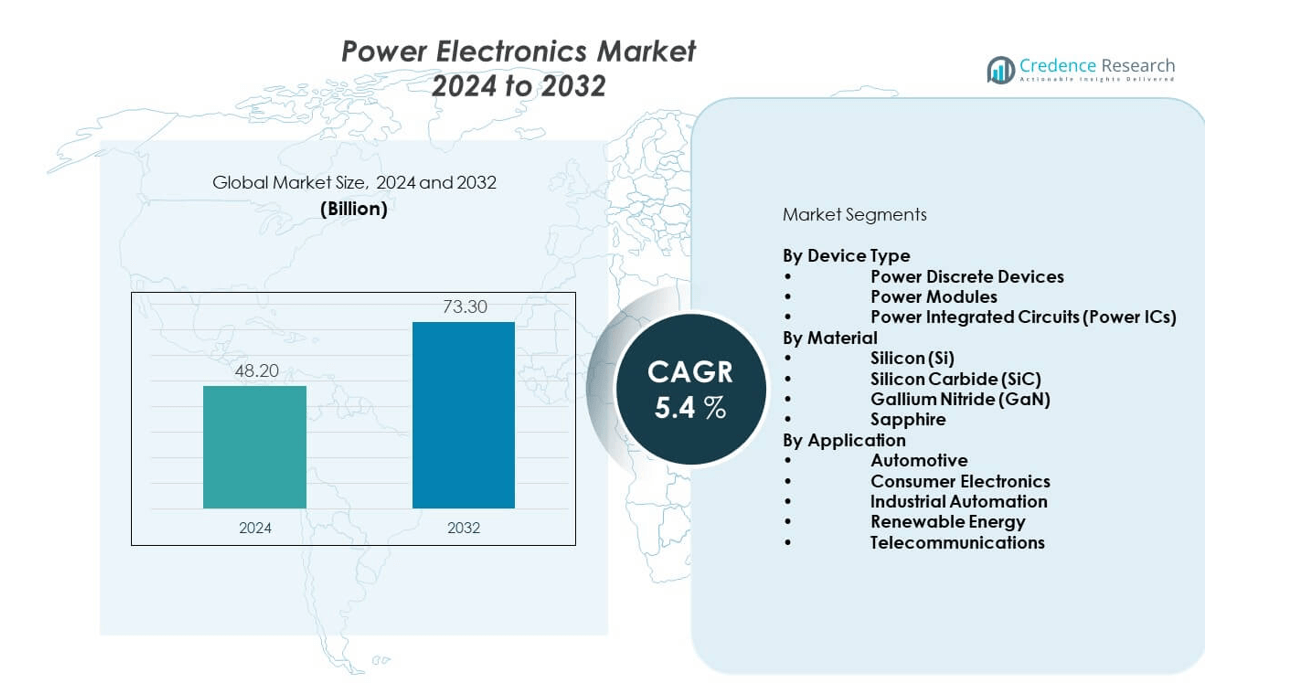

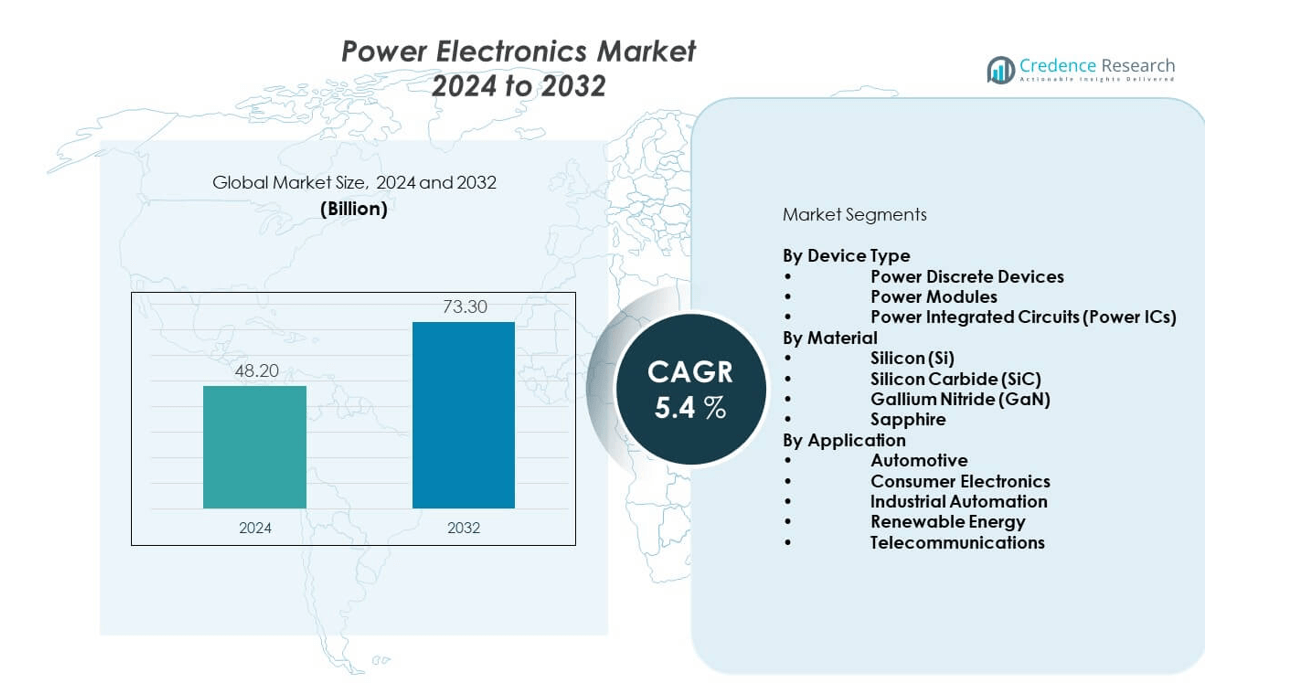

The power electronics market is projected to grow from USD 48.2 billion in 2024 to an estimated USD 73.3 billion by 2032, with a compound annual growth rate (CAGR) of 5.4% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Electronics Market Size 2024 |

USD 48.2 billion |

| Power Electronics Market, CAGR |

5.4% |

| Power Electronics Market Size 2032 |

USD 73.3 billion |

Growing demand for energy efficiency, electrification of transportation, and rising use of renewable energy sources are driving the power electronics market. Governments are pushing for stricter emission norms and sustainable energy policies, which boost the use of advanced power modules. The expansion of electric vehicles and charging infrastructure, along with industrial automation, creates further momentum. Increasing reliance on high-performance consumer electronics and smart devices also adds to market growth, supported by rapid R&D investments from key players.

North America leads the power electronics market due to strong adoption in automotive electrification, renewable projects, and industrial applications. Europe follows closely, supported by government initiatives for green energy transition and electric vehicle adoption. Asia Pacific is the fastest-growing region, fueled by rapid industrialization, high demand for consumer electronics, and expanding renewable energy capacity in China, Japan, and India. Emerging economies in Latin America and the Middle East are also adopting power electronics technologies for grid modernization and energy-efficient infrastructure development, though growth remains at a gradual pace compared to developed markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The power electronics market is projected to grow from USD 48.2 billion in 2024 to USD 73.3 billion by 2032, at a CAGR of 5.4%.

- A key market driver is the rising demand for energy-efficient systems across automotive, industrial, and consumer applications.

- Electrification of transportation and the rapid growth of electric vehicles continue to strengthen adoption of advanced power modules.

- A major restraint lies in the high manufacturing costs of wide bandgap semiconductors such as silicon carbide and gallium nitride.

- Complex design requirements and frequent need for technology upgrades create barriers for smaller manufacturers.

- North America leads the market, driven by strong EV adoption and renewable integration, while Europe follows with green energy initiatives.

- Asia Pacific is the fastest-growing region due to industrial expansion, consumer electronics demand, and renewable capacity growth in China, Japan, and India.

Market Drivers:

Rising Demand for Energy Efficiency Across Industries:

The power electronics market is driven strongly by the global need for energy-efficient systems across industrial, automotive, and consumer applications. Companies prioritize power-saving technologies to meet sustainability goals and comply with government regulations. It supports renewable energy adoption by ensuring efficient energy conversion and transmission. Electric vehicles demand efficient power modules to improve range and reliability. Growing dependence on consumer electronics further accelerates the demand for compact, energy-efficient devices. Technological upgrades in semiconductors enhance power density and performance. Industrial automation requires robust electronic systems, increasing dependence on reliable components. The focus on lowering carbon emissions is making energy efficiency an unavoidable driver for this industry.

- For instance, Infineon Technologies’ research project ALL2GaN aims to improve energy efficiency by 30% in various applications through the development of gallium nitride (GaN) power semiconductors, which can reduce energy losses and lower CO2 emissions significantly. This innovation supports telecommunications, e-mobility, renewable energies, and smart grid solutions by delivering highly efficient, compact power management components that contribute to sustainability and energy savings.

Electrification of Transportation and Growing EV Ecosystem:

The power electronics market benefits significantly from the electrification of transportation, particularly the adoption of electric vehicles and hybrid models. Automakers invest heavily in advanced inverters, converters, and onboard chargers to improve performance. Governments worldwide support EV development through subsidies, charging infrastructure, and policy frameworks. Power electronics play a critical role in enabling faster charging and extended battery life. It also supports heavy transport electrification, including buses and trucks. Expansion of public charging stations further drives demand for efficient power management technologies. Innovation in wide bandgap materials such as silicon carbide and gallium nitride enhances adoption. The EV ecosystem is projected to remain one of the most vital drivers in this market.

- For instance, Infineon has developed a new type of energy-saving silicon carbide (SiC) module, recognized for its role in increasing energy efficiency in electric locomotives and other large electric drives. Supporting automotive and heavy transport electrification with improved power conversion efficiency and durability.

Rapid Expansion of Renewable Energy and Grid Modernization:

The power electronics market is supported by the rapid growth of renewable energy projects, including solar and wind power. These sources require efficient inverters and converters for energy integration into grids. Governments enforce ambitious renewable targets, creating demand for advanced power solutions. It helps stabilize energy flows and improve power quality. Grid modernization initiatives rely heavily on electronic systems for real-time control and energy management. Rising global electricity demand adds further urgency for efficiency and reliability. Energy storage systems also depend on high-performance converters to balance supply and demand. The synergy between renewable growth and advanced electronics strengthens market expansion.

Industrial Automation and Growing Digital Infrastructure:

The power electronics market gains momentum from the surge in industrial automation and advanced digital infrastructure. Factories adopt robotics, AI-driven systems, and smart equipment requiring reliable electronic control. High-performance modules manage power distribution across data centers and telecommunication networks. The demand for seamless connectivity and reduced downtime elevates investment in efficient systems. It enables precise control of manufacturing operations with minimal energy loss. Rising use of 5G networks increases reliance on advanced semiconductors. Smart grid infrastructure deployment is fueling further dependence on reliable solutions. Continuous development in industrial sectors strengthens demand for robust power management. This driver ensures long-term sustainability of growth across multiple industries.

Market Trends:

Adoption of Wide Bandgap Semiconductors for Performance Gains:

The power electronics market is witnessing a strong trend of adopting wide bandgap semiconductors such as silicon carbide and gallium nitride. These materials enhance efficiency, reduce energy losses, and enable higher power density. Industries prefer them for their ability to support compact device designs. It also improves thermal performance and lowers cooling requirements. Electric vehicles and renewable energy systems benefit most from these innovations. Companies are expanding investments in production and R&D for wide bandgap devices. The trend is reshaping manufacturing priorities across major players. Rising demand ensures that these advanced semiconductors become mainstream in the coming years.

Integration of Power Electronics into Smart Consumer Devices:

The power electronics market is evolving through deeper integration into consumer devices like smartphones, laptops, and wearables. Compact power modules enable longer battery life and efficient energy use. Consumer demand for high-performance and lightweight gadgets supports this trend. It improves user experience while supporting sustainability goals. Companies focus on miniaturization and multifunctional chips for broader adoption. The rise of IoT devices further accelerates integration. Manufacturers align strategies with growing interest in connected lifestyles. This trend highlights the importance of embedding efficient electronics across personal technology ecosystems.

- For instance, Infineon’s ultra-thin silicon wafer technology reduces substrate resistance, directly impacting energy consumption and extending battery life in compact consumer electronics and AI data centers. Such advances support the trend toward miniaturization and multifunctional power modules that enhance device performance and energy efficiency.

Growth of Power Electronics in Data Centers and Cloud Infrastructure:

The power electronics market is observing rapid adoption within data centers and cloud systems. Rising internet traffic and data generation require robust and efficient power systems. Power modules ensure reliable operations and reduce overall energy costs. It supports cooling systems and stabilizes large-scale operations. Hyperscale data centers invest heavily in advanced electronics to meet sustainability standards. Increasing reliance on AI and machine learning raises power demand. Companies adopt next-generation semiconductors to optimize system efficiency. This trend reflects the vital role of power electronics in modern digital economies.

Advancements in High-Power Wireless Charging Systems:

The power electronics market is experiencing innovation in wireless charging for industrial and automotive use. High-power charging systems aim to deliver convenience and speed to users. Automakers explore dynamic wireless charging for electric vehicles on roads. It improves efficiency and reduces dependence on plug-in stations. Consumer applications also expand with higher capacity charging pads. Manufacturers invest in R&D to improve safety and performance. Standards are evolving to support interoperability and scalability. This trend is reshaping how energy is transferred across sectors, creating long-term opportunities.

Market Challenges Analysis:

High Manufacturing Costs and Complex Design Requirements:

The power electronics market faces significant challenges related to high manufacturing costs and complex design requirements. Advanced semiconductors such as silicon carbide and gallium nitride demand costly raw materials and production processes. Companies struggle to balance affordability with technological performance. It impacts adoption rates across emerging economies with limited budgets. Complex design integration further raises barriers for small-scale manufacturers. Rapid technological change forces companies to upgrade processes frequently. Short product lifecycles make long-term cost recovery difficult. Maintaining competitiveness under these conditions is a persistent challenge for players.

Supply Chain Vulnerabilities and Lack of Skilled Workforce:

The power electronics market encounters supply chain vulnerabilities due to reliance on semiconductor availability. Global shortages disrupt production schedules and delay product launches. It exposes industries to risks in procurement and delivery. Rising geopolitical tensions add uncertainty to supply reliability. Manufacturers face difficulties sourcing critical raw materials. In parallel, the lack of skilled engineers and technicians limits innovation capacity. Training programs and talent development remain insufficient in many regions. Without addressing these challenges, the market’s ability to sustain growth will remain under pressure.

Market Opportunities:

Expanding Role in Renewable Storage and Grid Stability:

The power electronics market offers strong opportunities in renewable energy storage and grid stability solutions. Advanced converters and inverters help balance fluctuating energy supplies. It supports seamless integration of solar, wind, and hybrid systems. Growing investments in smart grids enhance adoption potential. Companies develop modular systems for easier scalability. This area is projected to become one of the most profitable segments. Governments’ emphasis on clean energy provides further backing. The opportunity strengthens long-term industry resilience and growth.

Rising Applications in Healthcare and Emerging Smart Mobility:

The power electronics market holds opportunities through rising applications in healthcare and smart mobility solutions. Hospitals increasingly adopt advanced power systems for imaging devices and monitoring equipment. It ensures uninterrupted power for critical medical functions. Emerging mobility solutions such as drones and electric aircraft expand demand. Companies innovate to meet safety and performance standards. Growth in urban mobility projects highlights this opportunity. Governments invest in developing modern transport systems with reliable energy infrastructure. These factors create profitable prospects for new and existing market players.

Market Segmentation Analysis:

By Device Type

The power electronics market is segmented into discrete devices, modules, and integrated circuits. Power discrete devices, including diodes, transistors, and thyristors, are widely used for basic switching and rectification across consumer and industrial systems. Power modules such as FETs, IGBTs, and intelligent power modules dominate high-power applications, especially in electric vehicles, renewable projects, and industrial automation. Power integrated circuits (Power ICs) enable compact, efficient solutions for consumer electronics and telecommunications, where miniaturization and performance are critical.

- For example, Infineon’s development efforts focus on smaller, highly efficient chips used in automotive and manufacturing sectors. Their power modules and power ICs provide robust solutions for industrial automation and consumer electronics with enhanced switching performance and compact design.

By Material

The market uses materials like silicon, silicon carbide, gallium nitride, and sapphire. Silicon remains the most common choice due to cost-effectiveness and mature manufacturing processes. Silicon carbide is rapidly growing in adoption, driven by demand in automotive and renewable sectors for high-voltage and energy-efficient solutions. Gallium nitride offers fast switching, higher efficiency, and compact designs, making it suitable for consumer and telecom applications. Sapphire serves niche roles in optoelectronics and high-frequency devices, reflecting its specialized application scope.

- For instance, Infineon’s SiC modules have been nominated for the 2024 Deutscher Zukunftspreis (German Future Prize) for contributing to energy efficiency in solar, wind power, and train drives, showcasing the technological achievements and growing preference for SiC in high-voltage power conversion.

By Application

Applications include automotive, consumer electronics, industrial automation, renewable energy, and telecommunications. Automotive holds a leading role with rising electric and hybrid vehicle adoption. Consumer electronics benefit from compact, efficient power solutions in smartphones, laptops, and IoT devices. Industrial automation requires reliable modules for robotics, smart factories, and energy management. Renewable energy projects, including solar and wind, depend on converters and inverters for grid integration. Telecommunications leverage advanced materials for 5G deployment, data centers, and high-speed communication systems.

Segmentation:

By Device Type

- Power Discrete Devices (Diodes, Transistors, Thyristors)

- Power Modules (FET, IGBT, Intelligent Power Modules)

- Power Integrated Circuits (Power ICs)

By Material

- Silicon (Si)

- Silicon Carbide (SiC)

- Gallium Nitride (GaN)

- Sapphire

By Application

- Automotive

- Consumer Electronics

- Industrial Automation

- Renewable Energy

- Telecommunications

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

North America holds a strong position in the power electronics market, accounting for 32% of the global share. The region benefits from early adoption of electric vehicles, renewable energy projects, and advanced industrial automation. The United States leads with investments in clean energy, smart grid upgrades, and EV infrastructure. Canada supports market growth through its renewable energy expansion and demand for energy-efficient systems. Mexico adds strength with growing manufacturing bases and automotive production. It continues to attract investment in semiconductor technology and advanced materials. Strong government initiatives supporting sustainability provide further momentum.

Europe

Europe represents 27% of the power electronics market, supported by strong regulatory frameworks and rapid electrification of transportation. Germany remains a key hub, leading in automotive innovation and renewable energy integration. France and the UK contribute through investments in EV charging networks and digital infrastructure. Southern Europe strengthens the market with increased renewable energy adoption, particularly in solar power. It benefits from the European Union’s aggressive climate policies and carbon reduction goals. Research and development investments drive innovation in wide bandgap semiconductors. The focus on sustainable energy and digitalization keeps Europe at the forefront of adoption.

Asia Pacific and Other Regions

Asia Pacific dominates the power electronics market with 34% of the global share, driven by industrial expansion and consumer electronics demand. China leads with strong semiconductor manufacturing capabilities and large-scale renewable projects. Japan and South Korea contribute through innovation in automotive and consumer electronics. India shows rapid growth through EV adoption and grid modernization. Latin America holds 4% of the market, driven by infrastructure development and renewable investments. The Middle East and Africa account for 3%, supported by grid projects and growing digital infrastructure. It highlights significant potential for future adoption as energy demand increases globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Infineon Technologies AG (Germany)

- Texas Instruments Incorporated (US)

- Semiconductor Components Industries, LLC (Onsemi) (US)

- STMicroelectronics N.V. (Switzerland)

- Analog Devices, Inc. (US)

- Mitsubishi Electric Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- NXP Semiconductors N.V. (Netherlands)

- Renesas Electronics Corporation (Japan)

- Toshiba Corporation (Japan)

- Vishay Intertechnology, Inc. (US)

Competitive Analysis:

The power electronics market is highly competitive, shaped by global semiconductor giants and specialized manufacturers. Infineon Technologies, Texas Instruments, STMicroelectronics, and Onsemi lead through broad product portfolios and strong R&D investment. Japanese players such as Mitsubishi Electric, Fuji Electric, Renesas, and Toshiba focus on automotive and industrial solutions. NXP Semiconductors and Analog Devices expand through innovation in communication and consumer electronics. It shows a balance between established leaders and emerging innovators, with wide bandgap semiconductors like SiC and GaN driving differentiation. Strategic alliances, product launches, and geographic expansion define the competition.

Recent Developments:

- In June 2025, Mitsubishi Electric announced it developed the world’s first compact 7GHz band gallium nitride (GaN) power amplifier module (PAM) with the highest power efficiency for 5G-Advanced base stations. This innovation supports enhanced installation ease and energy efficiency for next-generation communication infrastructure and is expected to bolster 6G developments.

- In January 2025, NXP Semiconductors launched its ultra-low-power MCX L series microcontrollers featuring a dual-core architecture designed for challenging battery-limited industrial and IoT applications. These MCUs offer power consumption as low as 24 µA/MHz and support longer battery life and continuous data processing even in low-power modes.

- In January 2025, Infineon introduced new EiceDRIVER™ isolated gate driver ICs optimized for traction inverters in electric vehicles. These drivers support both IGBT and silicon carbide technologies, offer output stages up to 20A, and enhance inverter performance up to 300 kW, emphasizing safety and efficiency in modern xEV platforms.

Market Concentration & Characteristics:

The power electronics market displays a moderately concentrated structure, with top global companies accounting for a significant share of revenue. It is characterized by continuous innovation in semiconductor materials and strong demand across automotive, industrial, and consumer applications. Entry barriers are high due to capital-intensive manufacturing, specialized expertise, and technology-intensive processes. Strong regional players complement multinational corporations, creating competitive diversity. Long product lifecycles in industrial applications contrast with shorter cycles in consumer markets. It reflects a blend of stability and rapid innovation, keeping competitive dynamics intense.

Report Coverage:

The research report offers an in-depth analysis based on device type, material, application, and region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Wide bandgap semiconductors will play a central role in next-generation applications.

- EV adoption will create strong demand for advanced modules and charging systems.

- Renewable energy integration will push inverter and converter innovations.

- Industrial automation and robotics will expand adoption in manufacturing.

- Consumer electronics will drive miniaturization and compact IC development.

- Data centers and 5G expansion will increase demand for efficient solutions.

- Government sustainability policies will accelerate industry transformation.

- Healthcare equipment will emerge as a new growth avenue for applications.

- Supply chain diversification will remain a priority for manufacturers.

- Strategic collaborations will shape innovation and market positioning.