Market Overview:

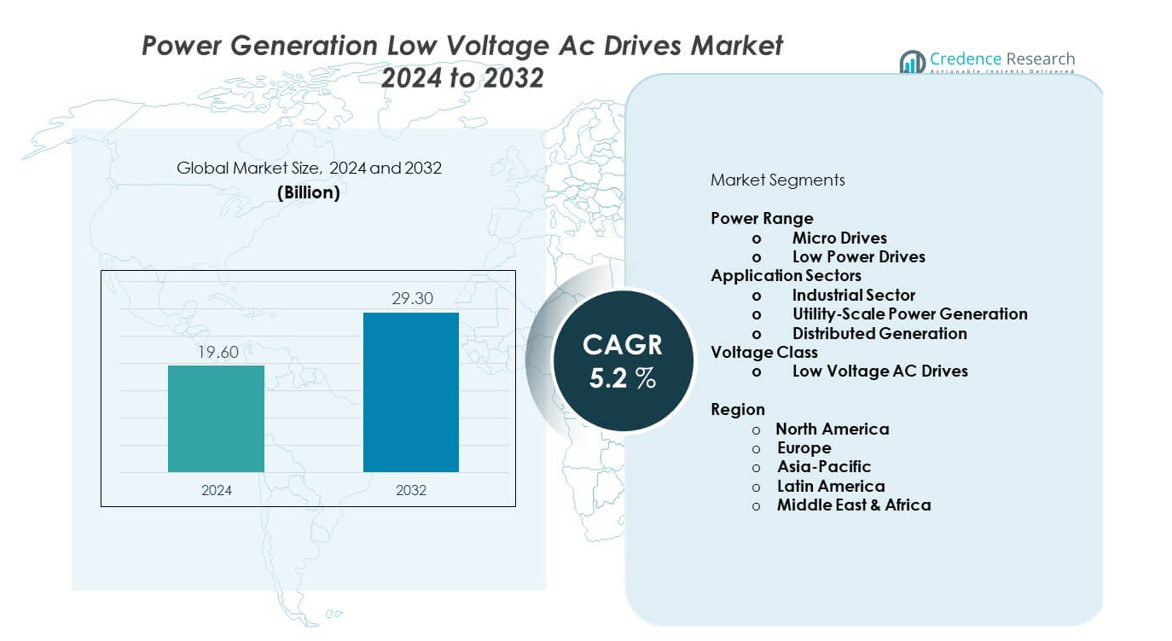

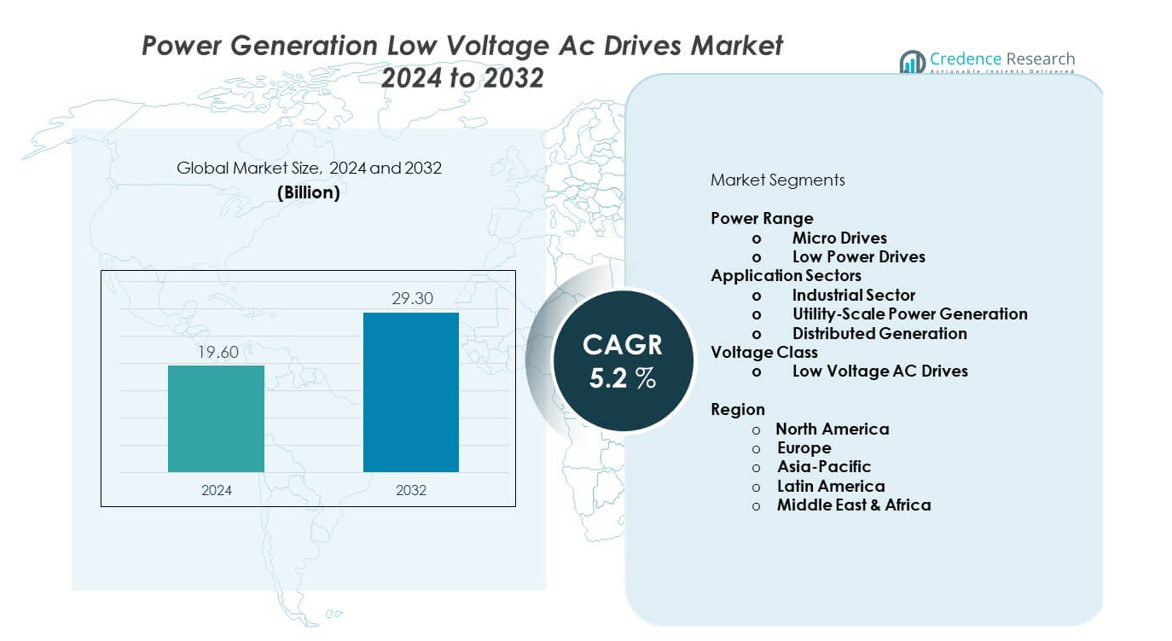

The power generation low voltage AC drives market is projected to grow from USD 19.6 billion in 2024 to an estimated USD 29.3 billion by 2032, reflecting a compound annual growth rate (CAGR) of 5.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Power Generation Low Voltage AC Drives Market Size 2024 |

USD 19.6 billion |

| Power Generation Low Voltage AC Drives Market, CAGR |

5.2% |

| Power Generation Low Voltage AC Drives Market Size 2032 |

USD 29.3 billion |

The market growth is fueled by rising demand for energy-efficient systems, modernization of power plants, and stricter environmental regulations. Operators are increasingly adopting low voltage AC drives to reduce maintenance costs, optimize motor control, and extend equipment lifespan. The growing transition toward renewable energy sources further supports adoption, as these drives enable better grid integration and flexibility. Increasing digitalization and the integration of smart technologies in power generation are also driving significant market expansion.

Regional Analysis, North America leads the power generation low voltage AC drives market due to strong investment in upgrading power infrastructure and early adoption of automation. Europe follows closely, driven by stringent efficiency standards and the push for decarbonization. Asia Pacific is emerging as the fastest-growing region, fueled by rapid industrialization, growing energy demand, and expanding renewable power projects in China and India. Latin America and the Middle East & Africa are also witnessing rising adoption, supported by infrastructure modernization and efforts to reduce reliance on conventional power systems.

Market Insights:

- The power generation low voltage AC drives market was valued at USD 19.6 billion in 2024 and is projected to reach USD 29.3 billion by 2032, growing at a CAGR of 5.2%.

- Growing demand for energy efficiency and sustainability in power plants drives adoption of low voltage AC drives.

- Rising integration of renewable energy sources with conventional grids boosts the need for efficient motor control systems.

- High initial investment costs and complex technical requirements remain major restraints for market growth.

- North America leads due to strong infrastructure modernization, while Europe follows with strict efficiency regulations.

- Asia Pacific shows fastest growth, supported by industrialization, energy demand, and renewable power expansion in China and India.

- Latin America and Middle East & Africa are emerging markets with opportunities driven by infrastructure upgrades and grid expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Energy Efficiency and Sustainable Power Generation Systems:

The power generation low voltage AC drives market is expanding due to the pressing need for energy efficiency in power plants and industrial operations. Governments and regulatory bodies enforce stringent energy conservation standards, encouraging operators to adopt low voltage AC drives. These drives enable precise motor control and reduce overall energy losses across applications. Industries view them as cost-effective tools to optimize production and comply with environmental norms. Growing awareness about carbon reduction further accelerates their adoption. Power producers increasingly prefer systems that offer better lifecycle value. The role of efficiency in achieving sustainability targets cannot be overstated. It positions low voltage AC drives as critical tools for modern energy management.

- For instance, Siemens’ SIRIUS soft starters incorporate hybrid switching technology that reduces power losses by up to 92%, demonstrating significant energy savings and better thermal management in industrial applications.

Integration with Renewable Power Sources and Grid Stability Requirements:

A strong driver for the market is the integration of renewable power sources into national grids. Renewable plants require efficient and adaptable systems to manage fluctuating energy outputs. Low voltage AC drives offer enhanced control and improve grid stability under varying loads. It enables seamless synchronization between renewable sources and conventional systems. This flexibility reduces downtime and boosts overall grid resilience. Utilities and independent power producers recognize their importance for uninterrupted supply. The growth of solar and wind installations fuels demand further. Governments also incentivize modern power technologies to maintain system balance. It creates strong prospects for adoption in renewable-based grids.

- For instance, Siemens SINAMICS variable frequency drives cover a wide range from 0.12 kW up to 6840 kW, including special models for pumps and fans that enhance integration stability and adaptability in renewable energy settings.

Advancements in Automation and Digitalization of Power Infrastructure:

Automation in power generation drives the adoption of low voltage AC drives across facilities. These drives support predictive maintenance, remote monitoring, and smart diagnostics. It allows operators to minimize downtime and enhance reliability. Utilities now prefer systems that integrate with digital platforms for efficiency. This driver is supported by rising adoption of Industry 4.0 and smart grid technologies. Real-time data helps optimize motor performance and reduce operational costs. The role of automation extends to renewable and conventional power plants alike. Power producers prioritize equipment that adapts to digital transformation. It ensures improved transparency and operational excellence in the energy sector.

Cost Savings, Long-Term Reliability, and Reduced Maintenance Efforts:

Operators increasingly invest in solutions that reduce lifecycle costs while ensuring consistent performance. Low voltage AC drives extend equipment life and lower the frequency of repairs. It reduces operational expenses in highly competitive markets. The ability to minimize sudden failures is attractive for power utilities. Investors and plant managers prefer technologies offering predictable returns. The market benefits from the growing shift toward sustainable cost management. Reliability plays a decisive role in vendor selection. Long-term cost benefits continue to influence decision-making. It reinforces the importance of these drives in competitive energy markets.

Market Trends:

Adoption of Smart Grid Technologies and Digital Power Systems:

The power generation low voltage AC drives market is witnessing rapid adoption of smart grid solutions. These grids rely on digital infrastructure for real-time control. Low voltage AC drives align with such systems by providing adaptive energy management. It enhances visibility across the grid and boosts resilience. Utilities incorporate drives into smart substations and automated distribution networks. The trend strengthens as digitalization reshapes traditional power systems. Increased focus on dynamic load management makes these drives critical. It links innovation with the future of intelligent energy distribution.

- For instance, Siemens SINAMICS drives offer advanced digital controls that can reduce energy consumption by as much as 70%, enabling quick ROI and supporting real-time grid management.

Shift Toward Compact and Modular Drive Designs:

A growing trend is the demand for compact, modular, and flexible drive designs. The market responds to power facilities seeking space-efficient solutions. Modular drives simplify installation and reduce downtime during maintenance. It enables rapid scaling in large and small power plants. Vendors focus on product designs that improve adaptability. This trend benefits facilities modernizing without expanding physical footprints. Compact designs also align with renewable energy sites where space is limited. It sets the stage for innovative configurations tailored to evolving power needs.

- For instance, Siemens offers high-performance modular drives like the SINAMICS S120 series, known for compact design and high accuracy control in motor operations.

Increased Use of Drives in Decentralized and Microgrid Applications:

The rise of microgrids and decentralized power generation drives adoption of low voltage AC drives. It supports localized energy management in industrial parks and remote communities. Decentralization requires precise control over smaller, distributed systems. Low voltage drives offer stability and flexible operation. Utilities deploy them in hybrid systems combining diesel, solar, and wind power. The trend is amplified by demand for energy independence. Strong emphasis on microgrid resilience pushes investment in drives. It reflects a broader movement toward localized power autonomy.

Emphasis on Eco-Friendly Materials and Sustainable Manufacturing:

Sustainability trends influence product design and manufacturing in this market. Vendors prioritize recyclable materials and lower-emission processes. It reflects the alignment with corporate environmental responsibility goals. Manufacturers invest in eco-certified supply chains to attract eco-conscious buyers. Energy-efficient production methods reduce overall carbon footprints. Customers increasingly demand sustainable options in procurement. This trend influences product differentiation strategies among leading vendors. The move toward green technology integration shapes market competitiveness. It underscores how sustainability drives product evolution.

Market Challenges Analysis:

High Initial Costs and Capital Expenditure Barriers for Adoption:

The power generation low voltage AC drives market faces the challenge of high initial investment costs. Operators and utilities, especially in developing regions, hesitate to allocate large capital toward advanced drive systems. It limits penetration among small-scale plants and budget-sensitive industries. Vendors often struggle to demonstrate short-term financial returns despite long-term savings. High upfront costs also affect renewable projects with constrained budgets. Financing barriers hinder widespread adoption across various power segments. Lack of flexible financing options intensifies the problem. The challenge remains a significant restraint on growth momentum in price-sensitive regions.

Technical Complexity and Skills Gap in Emerging Regions:

Another challenge is the technical expertise required for effective deployment of low voltage AC drives. Operators must invest in training programs for staff to ensure proper use and maintenance. It becomes a barrier in regions lacking skilled technical workforces. Complexities around system integration often discourage adoption. Utilities fear increased downtime if expertise is unavailable. Vendors need to offer comprehensive after-sales support to bridge the gap. The lack of local service networks increases maintenance delays. Regional disparities in skills highlight the importance of training and knowledge transfer. It places constraints on smooth deployment and long-term reliability.

Market Opportunities:

Expansion of Renewable Energy Projects and Modernization of Power Infrastructure:

The power generation low voltage AC drives market benefits from rising renewable energy investments. Governments and private firms push for modernization of power plants to meet efficiency targets. It creates strong opportunities for vendors offering innovative solutions. Integration with renewable projects drives sustained demand. The modernization wave across aging power infrastructure strengthens growth prospects. Utilities seek technologies that reduce energy waste and support flexible operations. This opportunity is reinforced by public funding and regulatory support. Vendors can secure long-term contracts by aligning with decarbonization goals.

Rising Adoption of IoT, Remote Monitoring, and Predictive Maintenance Technologies:

A growing opportunity lies in the adoption of IoT and digital monitoring systems. Utilities and industrial players prioritize predictive maintenance to reduce downtime. It positions low voltage AC drives as integral parts of smart power ecosystems. Remote connectivity enables real-time updates and diagnostics. Demand for connected solutions is increasing across developed and emerging regions. Vendors that integrate IoT with drive systems secure competitive advantage. The market opportunity grows with the shift toward digital transformation. It highlights the role of smart technologies in shaping adoption.

Market Segmentation Analysis:

Power Range

The power generation low voltage AC drives market is segmented into micro drives and low power drives. Micro drives are primarily used in low-power applications, including pumps, fans, and conveyors, where energy savings and compact design are key requirements. Low power drives serve larger-scale motor control needs in industrial facilities, offering reliability, scalability, and improved performance. This segmentation highlights how power range options address distinct operational requirements across industries, from small equipment to heavy-duty processes.

- For instance, Siemens’ SINAMICS portfolio includes micro and low-power drives capable of managing loads from 0.12 kW to over 2500 kW, ensuring tailored solutions for varying industrial needs.

Application Sectors

The industrial sector holds the largest share, supported by widespread use of drives in compressors, pumps, conveyors, and electric fans. It relies heavily on efficient motor control systems to sustain productivity and reduce operational costs. Utility-scale power generation deploys low voltage AC drives to improve energy efficiency and ensure reliable grid-level operations. Distributed generation also contributes to adoption, as low voltage AC drives offer flexibility and improved energy management for localized systems. This range of applications underscores the versatility of drive solutions across sectors.

- For instance, Siemens SINAMICS G120X drives are widely adopted in industrial compressor and pump applications, delivering robust control and energy savings validated through extensive field deployments.

Voltage Class

Low voltage AC drives dominate the market, recognized for their ability to deliver high energy efficiency in small to medium power applications. It remains the preferred choice for industries and utilities seeking cost-effective and adaptable solutions. These drives reduce power consumption, enhance operational control, and extend equipment life. Their dominance across voltage class segmentation reflects the growing emphasis on sustainability, affordability, and reliability. This positioning ensures low voltage AC drives remain central to the evolution of energy infrastructure in the power generation low voltage AC drives market.

Segmentation:

Power Range

- Micro Drives: Used in low-power applications such as pumps, fans, and conveyors.

- Low Power Drives: Designed for larger-scale motor control in industrial facilities.

Application Sectors

- Industrial Sector: Holds the largest share with wide use in compressors, pumps, conveyors, and electric fans.

- Utility-Scale Power Generation: Supports grid-level operations with efficiency and reliability.

- Distributed Generation: Applied in smaller, localized power systems for flexible energy supply.

Voltage Class

- Low Voltage AC Drives: Dominate the market due to energy efficiency and suitability for small to medium power applications.

Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America and Europe Lead with Strong Market Presence

North America holds a significant share of the power generation low voltage AC drives market, accounting for nearly 30% of global revenue. The region benefits from modernized power infrastructure, early adoption of automation technologies, and high investments in energy efficiency. Utilities and industrial sectors across the United States and Canada drive steady demand for these systems. It also benefits from government regulations focused on reducing emissions and encouraging energy-efficient solutions. Europe closely follows with about 25% share, supported by stringent efficiency standards, sustainability targets, and growing reliance on renewable integration. Countries like Germany, the UK, and France dominate adoption in the region due to their advanced energy frameworks.

Asia Pacific Emerges as the Fastest Growing Market

Asia Pacific accounts for around 32% of the market share, making it the largest and fastest-growing region. Rapid industrialization in China and India, combined with rising energy demand, fuels adoption across sectors. Governments in the region support renewable energy projects, strengthening the need for efficient motor control technologies. It benefits from large-scale utility investments and expanding distributed generation systems. Emerging economies such as Indonesia and Vietnam also contribute to regional momentum by modernizing power infrastructure. The availability of cost-competitive manufacturing further accelerates adoption, making Asia Pacific central to global market expansion.

Latin America and Middle East & Africa Show Emerging Opportunities

Latin America captures nearly 7% of the market share, driven by modernization of grid infrastructure and industrial growth in Brazil and Mexico. Demand for efficient solutions in localized and distributed generation setups supports steady growth. The Middle East & Africa represent about 6% share, with countries like Saudi Arabia, UAE, and South Africa leading adoption. Investments in renewable energy and power diversification strategies create opportunities for market players. It shows potential for growth as utilities push for improved operational efficiency and reduced reliance on traditional power methods. Both regions remain attractive due to rising energy demand and ongoing infrastructure development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Siemens AG

- General Electric (GE)

- ABB Ltd.

- Fuji Electric Co., Ltd.

- Schneider Electric SE

- Rockwell Automation, Inc.

- Eaton Corporation plc

- Yaskawa Electric Corporation

- Mitsubishi Electric Corporation

Competitive Analysis:

The power generation low voltage AC drives market is highly competitive, with global leaders such as Siemens, ABB, Schneider Electric, Rockwell Automation, and Mitsubishi Electric dominating. These players focus on innovation, energy efficiency, and digital integration to strengthen their presence. It benefits from companies competing through product diversification, strategic partnerships, and regional expansion. Vendors invest in R&D to develop drives compatible with smart grid and renewable projects. Price competitiveness and strong distribution networks remain key differentiators. Regional players also contribute by offering cost-effective solutions tailored to local demand. The competitive landscape emphasizes reliability, performance, and lifecycle cost savings.

Recent Developments:

- In May 2023, ABB completed its acquisition of Siemens’ low voltage NEMA motor business. This acquisition strengthens ABB’s position as a leading industrial motor manufacturer and allows ABB to better serve its global customers by integrating Siemens’ well-regarded product portfolio, which was rebranded under ABB and reintroduced to the market in the second quarter of 2023.

- In 2024, Siemens launched its SINAMICS variable frequency drives, which cater to a wide range of applications from low voltage to direct current (DC) drives. These drives offer increased efficiency and versatility, tailored for digital and sustainable applications, marking a significant product advancement in their drive solutions.

- In May 2024, Fuji Electric introduced the FRENIC-HVAC, the first slim-type inverter specialized in energy saving for fans and pumps. This product contributes significantly to cost reduction by cutting power consumption, reinforcing Fuji Electric’s commitment to energy-efficient drive technology..

Market Concentration & Characteristics:

The power generation low voltage AC drives market is moderately concentrated, with a few multinational corporations capturing a significant share. It reflects dominance by established vendors such as Siemens, ABB, and Schneider Electric, supported by their extensive global networks and product portfolios. The market demonstrates high barriers to entry due to technological expertise and capital requirements. Regional players compete by targeting niche applications and offering cost-effective alternatives. Demand is steady across industries and utilities, driven by efficiency regulations and digital transformation initiatives. The market is characterized by innovation, sustainability, and the ongoing shift toward automation.

Report Coverage:

The research report offers an in-depth analysis based on power range, application sectors, and voltage class. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising adoption of drives in renewable integration projects will strengthen long-term demand.

- Expansion of digital power systems will increase the need for advanced monitoring features.

- Modular and compact drive designs will become preferred across industrial and utility setups.

- IoT-enabled drives will gain traction for predictive maintenance and reduced downtime.

- Asia Pacific will continue to lead growth, driven by industrialization and infrastructure expansion.

- North America and Europe will sustain strong demand through modernization and efficiency regulations.

- Partnerships between global vendors and regional players will boost product accessibility.

- Vendors will prioritize eco-friendly designs to align with sustainability targets.

- Distributed generation and microgrids will emerge as key adoption areas for low voltage drives.\

- \Continuous R&D investment will enhance performance, adaptability, and cost efficiency