Market Overview

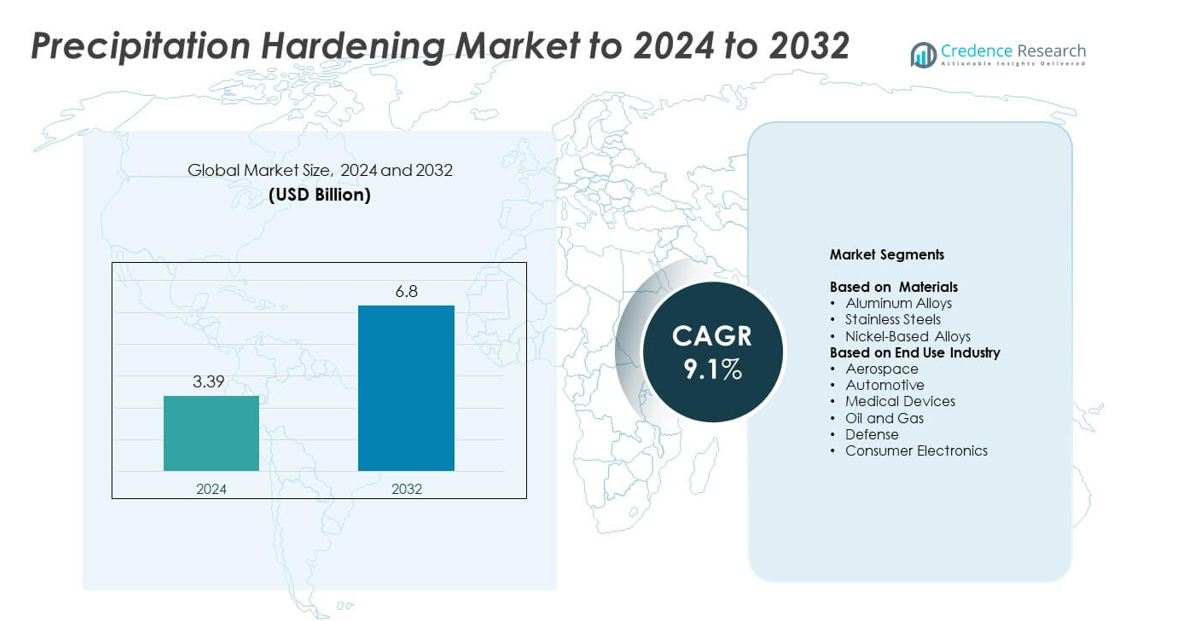

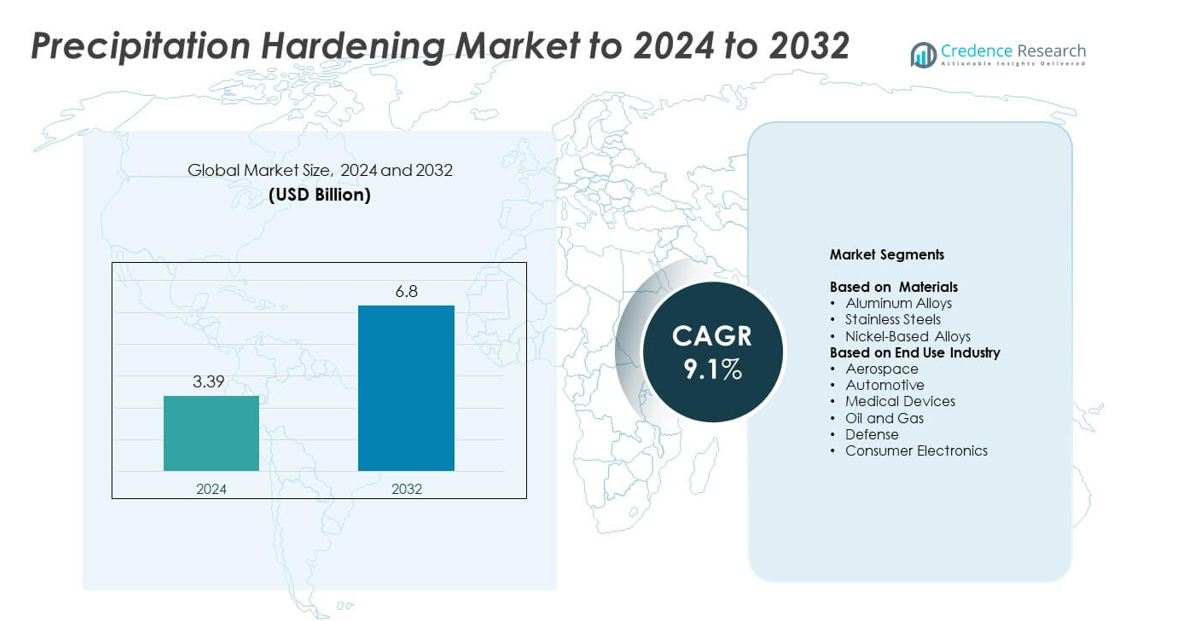

Precipitation Hardening Market size was valued at USD 3.39 Billion in 2024 and is anticipated to reach USD 6.8 Billion by 2032, at a CAGR of 9.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Precipitation Hardening Market Size 2024 |

USD 3.39 Billion |

| Precipitation Hardening Market, CAGR |

9.1% |

| Precipitation Hardening Market Size 2032 |

USD 6.8 Billion |

The Precipitation Hardening Market is shaped by leading players such as Pacific Metallurgical Inc, Bodycote, Hauck Heat Treatment Ltd, Unitherm Group (Indo-German Vacu Treat Pvt Ltd), Thermex Metal Treating, Bluewater Thermal Solutions, Pilkington Metal Finishing, Wallwork Heat Treatment Ltd, Paulo, Irwin Automation Inc, MSL Heat Treatment Limited, and Specialty Steel Treating. These companies expanded capabilities in age-hardening, vacuum processing, and precision heat treatment to serve aerospace, automotive, and industrial clients. North America led the market in 2024 with about 34% share, supported by strong aerospace production and defense activity, while Asia Pacific followed closely with rising demand from automotive, electronics, and emerging aerospace programs.

Market Insights

- The Precipitation Hardening Market reached USD 3.39 Billion in 2024 and is projected to hit USD 6.8 Billion by 2032, growing at a CAGR of 9.1%.

- Demand grew as aerospace and automotive manufacturers increased use of high-strength aluminum alloys, which held about 46% share of the material segment in 2024.

- Key trends include wider adoption of advanced alloy grades and rising opportunities in additive manufacturing for complex lightweight components.

- Competitive activity intensified as major heat-treatment providers upgraded vacuum furnaces, automation systems, and quality controls to meet aerospace and defense standards.

- North America led with nearly 34% share, followed by Asia Pacific at about 29% and Europe at roughly 28%, supported by strong aerospace output, automotive production, and industrial growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Materials

Aluminum alloys held the dominant share in 2024 with about 46% of the Precipitation Hardening Market. Manufacturers favored these alloys due to their strong strength-to-weight ratio, easy machinability, and wide use in aerospace frames and automotive body structures. Adoption rose as aircraft programs increased production rates and electric-vehicle makers sought lighter components to boost driving range. Stainless steels and nickel-based alloys also grew at a steady pace because industries needed high-temperature stability and corrosion resistance for turbines, medical tools, and energy-sector parts.

- For instance, Airbus reports using GLARE laminate in the A380 upper fuselage skin. This design saved about 794 kilograms compared with a conventional aluminum structure.

By End Use Industry

Aerospace led the end-use segment in 2024 with nearly 38% share of the Precipitation Hardening Market. Aircraft builders relied on precipitation-hardened aluminum and nickel alloys to achieve high fatigue strength and weight reduction across wings, fuselage sections, and engine parts. Growth accelerated as global aircraft deliveries increased and defense aviation programs expanded fleet upgrades. Automotive, medical devices, oil and gas, defense, and consumer electronics also contributed steady demand due to rising use of precision-engineered, high-strength components.

- For instance, Rolls-Royce states its Trent 1000 engines power Boeing 787 aircraft worldwide. The Trent 1000 fleet has logged 21 million flying hours and carried 350 million passengers.

Key Growth Drivers

Rising Demand for Lightweight High-Strength Materials

Aerospace and automotive manufacturers pushed demand for precipitation-hardened alloys as they sought lighter and stronger components for higher performance and fuel savings. Precipitation-hardened aluminum and nickel alloys offered superior strength-to-weight ratios that supported structural integrity in aircraft frames, EV platforms, and defense systems. Production growth in commercial aviation and large-scale EV programs expanded the use of these materials across critical load-bearing parts. This shift toward lighter systems created consistent demand across both OEM and aftermarket applications.

- For instance, GE Aerospace’s LEAP jet engine uses a ceramic matrix composite turbine shroud. This shroud operates in the hottest region at temperatures up to 2400 degrees Fahrenheit.

Expansion of Aerospace and Defense Programs

Growth in global aircraft production and defense modernization programs strengthened adoption of precipitation-hardening alloys. Aerospace suppliers relied on these alloys for fatigue resistance, thermal stability, and reliability in turbine parts, landing gear, wings, and fuselage structures. Defense programs increased procurement of advanced aircraft and missile systems that required high-strength materials able to withstand extreme environments. Expansion of maintenance, repair, and overhaul operations also boosted alloy consumption across replacement parts and component refurbishment.

- For instance, Rolls-Royce performs a rigorous 150-hour endurance test, a standard requirement for engine certification by regulatory bodies like EASA and the FAA.

Increasing Use in High-Performance Industrial Applications

Energy, oil and gas, and medical device sectors used precipitation-hardened stainless steel and nickel alloys for their corrosion resistance and durability in demanding environments. Growth in offshore drilling, advanced surgical tools, and precision industrial components expanded material demand. Manufacturers adopted these alloys to improve product lifespan and reliability under high pressure, temperature, and chemical exposure. Rising global investments in refining, drilling, power generation, and medical equipment production further pushed adoption across diverse applications.

Key Trends and Opportunities

Shift Toward Advanced Alloy Formulations

Producers developed new precipitation-hardening alloy grades combining improved thermal resistance, longer fatigue life, and better corrosion control. These materials supported next-generation aerospace engines, EV powertrains, and high-performance industrial systems. Research programs focused on optimizing heat-treatment cycles and enhancing precipitation kinetics to achieve tighter property control. This shift created opportunities for suppliers offering specialized alloy solutions tailored for extreme environments and high-precision engineering needs.

- For instance, Haynes International markets HAYNES 282 nickel superalloy for high-temperature turbine components. Data sheets report high strength at temperatures up to about 982 degrees Celsius. Creep performance studies show alloy retaining creep resistance in 649 to 927 Celsius range.

Growth of Additive Manufacturing in Metals

Metal 3D printing expanded opportunities for precipitation-hardened alloys due to rising demand for lightweight, complex, and custom-designed components. Aerospace, defense, and medical manufacturers adopted additive manufacturing to reduce material waste and accelerate prototyping using precipitation-hardened stainless steels and nickel alloys. Advances in powder metallurgy and laser-based printing improved part density and mechanical strength, enabling wider use in high-stress applications. This trend opened new revenue prospects for alloy suppliers targeting additive-grade materials.

- For instance, EOS markets its EOS NickelAlloy IN718 as a precipitation-hardening nickel-chromium alloy.

Key Challenges

High Production and Processing Costs

Precipitation-hardening alloys required precise heat treatment, advanced machining, and controlled manufacturing environments, which raised production costs. High energy consumption and multi-stage processing increased overall part prices, limiting adoption in cost-sensitive sectors. Manufacturers also faced challenges in maintaining consistency across batches, adding operational expenses. These cost pressures restricted wider use in industries with lower performance requirements, reducing market penetration in mass-volume applications.

Supply Chain Constraints for Critical Elements

Nickel, chromium, and other alloying elements faced supply fluctuations due to mining limitations, geopolitical risks, and volatile global demand. These disruptions affected raw material availability and pricing, creating uncertainty for manufacturers dependent on stable feedstock supplies. Energy market instability and refinery bottlenecks further tightened access to high-purity materials. Such constraints slowed production planning, increased lead times, and forced companies to diversify sourcing strategies or shift to alternative alloys when feasible.

Regional Analysis

North America

North America held about 34% share in the Precipitation Hardening Market in 2024. The region benefited from strong aerospace production, defense procurement, and stable demand from oil and gas equipment manufacturers. Aircraft builders used high-strength aluminum and nickel alloys in engines and structural parts, while automotive programs expanded adoption for lightweight components. Medical device makers added steady growth through surgical tools and implants that require durability and corrosion resistance. Ongoing investment in defense aviation and industrial machinery supported long-term demand across the United States and Canada.

Europe

Europe accounted for nearly 28% share of the Precipitation Hardening Market in 2024. The presence of major aircraft manufacturers, turbine producers, and automotive suppliers increased the use of advanced alloys across structural and engine components. Demand rose as the region pushed lightweight design in electric vehicles and strengthened production of aerospace parts for commercial and military fleets. Industrial machinery and medical device manufacturing also contributed meaningful consumption. Strict quality standards and strong engineering capabilities supported wider adoption of precipitation-hardened materials across multiple industries.

Asia Pacific

Asia Pacific captured about 29% share in the Precipitation Hardening Market in 2024, driven by rapid growth in automotive manufacturing, electronics, and emerging aerospace programs. China, Japan, South Korea, and India increased usage of precipitation-hardened aluminum and stainless steel in transportation, defense systems, and electronic housings. Expanding EV production and rising aircraft component manufacturing supported material demand. Industrial expansion in precision tools, energy systems, and medical equipment also contributed to wider adoption. The region’s fast industrialization and strong investment in metal manufacturing boosted overall market momentum.

Latin America

Latin America held around 5% share of the Precipitation Hardening Market in 2024. Growth came from moderate demand in automotive components, oil and gas operations, and industrial machinery. Brazil and Mexico increased adoption of precipitation-hardened alloys in energy equipment and transportation parts due to rising durability requirements. Investment in offshore exploration and refinery upgrades supported the use of corrosion-resistant stainless and nickel alloys. Although production volumes remained lower than major regions, steady industrial development continued to support market expansion.

Middle East and Africa

Middle East and Africa accounted for nearly 4% share of the Precipitation Hardening Market in 2024. Demand was driven mainly by oil and gas applications, where high-strength and corrosion-resistant alloys were required for drilling, refining, and petrochemical equipment. Defense programs and aviation maintenance activities in Gulf countries added further growth. Industrial machinery, power generation, and emerging manufacturing activities in parts of Africa also contributed to adoption. Although the region remained smaller in size, consistent infrastructure and energy investments sustained material consumption.

Market Segmentations:

By Materials

- Aluminum Alloys

- Stainless Steels

- Nickel-Based Alloys

By End Use Industry

- Aerospace

- Automotive

- Medical Devices

- Oil and Gas

- Defense

- Consumer Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Precipitation Hardening Market features key players such as Pacific Metallurgical Inc, Bodycote, Hauck Heat Treatment Ltd, Unitherm Group (Indo-German Vacu Treat Pvt Ltd), Thermex Metal Treating, Bluewater Thermal Solutions, Pilkington Metal Finishing, Wallwork Heat Treatment Ltd, Paulo, Irwin Automation Inc, MSL Heat Treatment Limited, and Specialty Steel Treating. Companies strengthened their market positions by expanding heat-treatment capacities, enhancing process automation, and improving metallurgical consistency to meet rising aerospace, automotive, and industrial requirements. Vendors focused on advanced precipitation-hardening cycles, including vacuum hardening, age-hardening, and controlled quenching, to deliver uniform mechanical performance across critical components. Investments in digital monitoring, furnace upgrades, and quality-assurance systems improved reliability for sectors requiring tight tolerance and high fatigue strength. Collaboration with OEMs, defense suppliers, and medical manufacturers supported long-term contracts and custom treatment specifications. Growing demand for lightweight and high-strength alloys encouraged further expansion into regional service centers and specialized metallurgical services.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Pacific Metallurgical Inc

- Bodycote

- Hauck Heat Treatment Ltd

- Unitherm Group (Indo-German Vacu Treat Pvt Ltd)

- Thermex Metal Treating

- Bluewater Thermal Solutions

- Pilkington Metal Finishing

- Wallwork Heat Treatment Ltd

- Paulo

- Irwin Automation Inc

- MSL Heat Treatment Limited

- Specialty Steel Treating

Recent Developments

- In 2025, Wallwork installed an additional hot isostatic press at its Bury site in the UK.

- In December 2024, Aalberts NV agreed to acquire the Paulo Products Company, the largest privately owned thermal processing platform in North America. This acquisition added five U.S. heat-treat plants and one plant in Mexico to Aalberts’ surface-technologies network, a transaction that was completed in May 2025 after receiving all necessary regulatory approvals.

- In 2024, Bodycote acquired Lake City Heat Treating in the US to broaden its aerospace and defense thermal-processing portfolio

Report Coverage

The research report offers an in-depth analysis based on Materials, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow as aerospace and defense programs expand aircraft and engine production.

- Automotive manufacturers will increase adoption to improve lightweight design and boost vehicle efficiency.

- Demand will rise in medical devices due to higher use of durable and corrosion-resistant components.

- Oil and gas projects will drive consumption of high-performance nickel and stainless alloys.

- Additive manufacturing will widen opportunities for precipitation-hardening grades in complex metal parts.

- New alloy formulations will enhance strength, fatigue life, and thermal stability for advanced systems.

- Industrial machinery producers will adopt these alloys for higher reliability under extreme conditions.

- Supply chain diversification will become important due to rising pressure on critical minerals.

- Heat-treatment innovation will improve processing efficiency and material performance consistency.

- Global EV expansion will support long-term demand for lightweight structural and drivetrain components.