Market Overview:

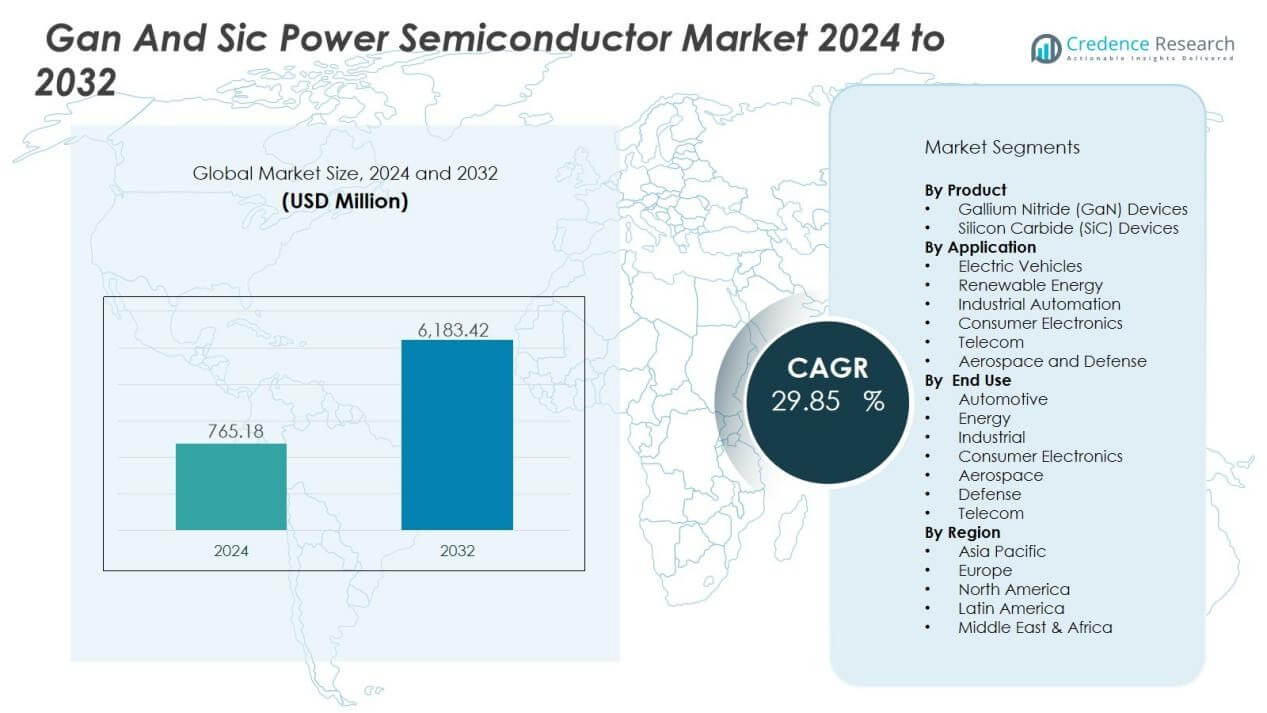

The gan and sic power semiconductor market size was valued at USD 765.18 million in 2024 and is anticipated to reach USD 6,183.42 million by 2032, at a CAGR of 29.85 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gan And Sic Power Semiconductor Market Size 2024 |

USD 765.18 Million |

| Gan And Sic Power Semiconductor Market, CAGR |

6.5% |

| Gan And Sic Power Semiconductor Market Size 2032 |

USD 6,183.42 Million |

Market growth is fueled by several key drivers. The accelerating transition toward electric vehicles, renewable energy systems, and smart grid infrastructure is increasing demand for high-performance power semiconductors. Industries are investing in GaN and SiC technologies for their ability to reduce energy loss, enhance power density, and improve overall system reliability. Furthermore, government initiatives promoting clean energy and stricter efficiency standards are supporting wider adoption. Continuous R&D efforts, falling production costs, and partnerships between semiconductor manufacturers and automotive or energy firms are further advancing the market.

Regionally, Asia-Pacific leads the market, supported by strong manufacturing bases in China, Japan, and South Korea, alongside growing EV adoption. North America follows, driven by early technology adoption, strong renewable energy programs, and key semiconductor innovators. Europe maintains a significant share due to its stringent energy-efficiency regulations and rapid EV market growth. Emerging markets in Latin America and the Middle East & Africa are gradually adopting GaN and SiC solutions, particularly in renewable energy and industrial sectors.

Market Insights:

- The GaN and SiC power semiconductor market was valued at USD 765.18 million in 2024 and is projected to reach USD 6,183.42 million by 2032, growing at a CAGR of 29.85%.

- Electric vehicles drive strong demand as GaN and SiC enable fast charging, higher power density, and extended ranges.

- Renewable energy and smart grid projects adopt wide bandgap devices to improve efficiency, reliability, and energy conversion rates.

- Industrial automation, aerospace, defense, and 5G networks increasingly use GaN and SiC for compact, high-performance power solutions.

- Cost efficiency improves as these semiconductors lower energy losses, extend device lifespans, and reduce maintenance needs.

- Challenges remain with high production costs, limited wafer availability, and technical complexities slowing widespread adoption.

- Asia-Pacific led with 48% share in 2024, followed by North America at 26% and Europe at 19%, each supported by EV expansion, renewable energy integration, and strong policy frameworks.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Demand for Electric Vehicles and Charging Infrastructure:

The GaN and SiC power semiconductor market benefits from the rapid growth of electric vehicles worldwide. Automakers prefer these semiconductors for their ability to support fast charging and higher power densities. It enables extended driving ranges and reduced energy loss in EV systems. Expanding charging infrastructure further amplifies demand, as utilities and manufacturers integrate wide bandgap solutions for efficiency and reliability.

- For Instance, In 2021, the Tesla Model S Plaid powertrain was released with integrated SiC (silicon carbide) MOSFET modules, which help enable DC fast-charging rates of up to 250kW at Supercharger V3 stations

Strong Push from Renewable Energy and Smart Grid Expansion:

Renewable energy projects, including solar and wind, rely on efficient power conversion technologies. GaN and SiC devices deliver superior switching speeds and higher efficiency, making them ideal for inverters and grid systems. Governments support renewable energy adoption with strict efficiency standards, pushing industries toward advanced semiconductors. It helps utilities reduce energy waste, improve grid reliability, and handle fluctuating renewable output effectively.

- For instance, Infineon’s breakthrough 300mm GaN wafer technology enables 2.3 times more chips per wafer compared to 200mm wafers, significantly improving manufacturing efficiency

Growing Industrial Automation and High-Performance Applications:

The GaN and SiC power semiconductor market gains traction from industrial automation and advanced electronics. These materials support compact, high-efficiency devices in robotics, aerospace, defense, and consumer electronics. Manufacturers leverage them for applications demanding durability, thermal performance, and minimal power losses. It supports innovation in 5G networks, data centers, and advanced medical devices requiring stable, high-power solutions.

Cost Efficiency Through Improved Performance and Lower Operational Expenses:

Organizations focus on GaN and SiC adoption to cut long-term energy and maintenance costs. Devices built with these semiconductors run cooler, last longer, and reduce system complexity. It lowers total cost of ownership in industries such as automotive, renewable energy, and power distribution. Continued R&D investments and scaling production also drive down costs, making advanced power semiconductors more accessible across markets.

Market Trends:

Market Trends:

Wider Adoption Across Electric Mobility, Energy, and Industrial Ecosystems:

The GaN and SiC power semiconductor market is witnessing rapid adoption across electric vehicles, renewable energy, and industrial automation. Automakers integrate GaN and SiC devices to achieve faster charging, higher energy efficiency, and extended driving ranges. It also plays a vital role in renewable energy systems, where advanced inverters and converters improve energy conversion rates and grid stability. Industrial automation benefits from compact, high-efficiency designs that reduce energy loss in robotics, data centers, and aerospace applications. Semiconductor companies form partnerships with automotive OEMs and energy providers to accelerate commercialization of wide bandgap technologies. Strong government policies for clean energy and zero-emission mobility further accelerate this adoption trend.

- For Instance, Fact Check This and Give me Final Verdict “For Instance, In August 2024, BYD introduced an updated version of its Seal EV, built on its e-Platform 3.0 EVO with an 800V architecture.

Advancements in Manufacturing Processes and Expanding Supply Chains:

Continuous progress in manufacturing processes supports broader use of GaN and SiC devices across industries. It includes improvements in wafer quality, scalability, and production yields that reduce costs and enable mass-market deployment. Foundries and equipment suppliers invest heavily in advanced fabrication technologies to meet rising demand. The GaN and SiC power semiconductor market also benefits from diversified global supply chains, ensuring wider availability of devices for automotive and industrial sectors. Strong R&D pipelines drive innovation in device structures, packaging, and integration with digital control systems. Industry collaborations and mergers strengthen supply chain resilience and promote technology standardization across regions. These advancements position GaN and SiC semiconductors as the cornerstone of next-generation power electronics.

- For Instance, Wolfspeed announced that its Mohawk Valley Fab in New York had reached 20% wafer start utilization, a milestone toward ramping up production. The fab officially began operations in April 2022, not June 2024. The facility is the world’s first and largest 200mm silicon carbide (SiC) wafer fabrication plant, though it was still in a ramp-up phase and had not achieved its full annual capacity by June 2024.

Market Challenges Analysis:

High Production Costs and Limited Manufacturing Capacity:

The GaN and SiC power semiconductor market faces challenges related to high production costs and limited fabrication capacity. Wide bandgap materials require specialized equipment, advanced wafer processing, and precise quality control, all of which raise costs. It creates barriers for small and mid-sized companies that lack access to capital-intensive facilities. Supply chain constraints, particularly in wafer availability, further slow down mass adoption. Manufacturers must also deal with yield issues that affect large-scale production efficiency. These factors limit price competitiveness against traditional silicon-based alternatives.

Technical Complexities and Slow Standardization Across Applications:

Integration of GaN and SiC devices into existing systems presents technical challenges for engineers and end users. It demands specialized design expertise, new testing protocols, and system-level adjustments to ensure reliability. The lack of standardized guidelines across industries creates uncertainty in adoption, particularly in automotive and energy sectors. Customers face longer validation cycles and increased development costs, delaying product launches. Concerns about long-term reliability in harsh operating conditions also affect confidence in these devices. Companies must invest heavily in R&D and industry collaborations to address these technical complexities. Standardization efforts remain crucial to unlocking the full potential of wide bandgap semiconductors.

Market Opportunities:

Expanding Role in Electric Mobility and Renewable Energy Systems:

The GaN and SiC power semiconductor market holds strong opportunities in electric mobility and renewable energy. Automakers increasingly rely on these devices to improve battery efficiency, charging speed, and power density. It enables extended driving ranges and supports compact designs in electric vehicles. Renewable energy applications such as solar inverters and wind turbines also benefit from higher conversion efficiency and lower energy loss. Governments promoting zero-emission transport and clean energy further drive adoption. Strong investments in EV infrastructure and renewable projects expand the addressable market for wide bandgap semiconductors.

Growing Demand from Data Centers, 5G, and Industrial Automation:

Rising global data consumption and digital transformation create opportunities for GaN and SiC in data centers and telecom. It supports efficient power supplies, advanced cooling systems, and high-frequency operations required in 5G networks. Industrial automation, aerospace, and defense also require high-performance devices with superior durability and reliability. These semiconductors enable compact, energy-efficient solutions that reduce operating costs in critical systems. Expanding adoption in consumer electronics and medical devices further broadens their scope. Partnerships between technology providers and end-user industries strengthen commercialization, opening new growth avenues across sectors.

Market Segmentation Analysis:

By Product:

The GaN and SiC power semiconductor market is segmented by product into GaN devices and SiC devices. GaN products are widely adopted in high-frequency and low-voltage applications such as fast chargers, telecom, and consumer electronics. It offers superior switching performance and compact design advantages. SiC devices dominate in high-voltage and high-power sectors such as electric vehicles, renewable energy, and industrial equipment. Their durability and ability to handle high temperatures make them the preferred choice in demanding environments. Both product categories continue to expand, driven by growing end-user requirements for energy efficiency and reliability.

- For Instance, Beginning in 2018 with the Model 3, STMicroelectronics supplied Silicon Carbide (SiC) MOSFETs for Tesla’s main inverter. While the exact vehicle-level efficiency gain can vary, research published in September 2022 confirmed that switching from silicon to SiC inverters can increase a vehicle’s range by 3-5%.

By Application:

The market is segmented by application into electric vehicles, renewable energy, industrial automation, consumer electronics, and telecom. Electric vehicles represent a key demand driver, with automakers adopting wide bandgap devices for faster charging and improved efficiency. It also plays a significant role in renewable energy systems, enabling efficient solar inverters and wind converters. Industrial automation, aerospace, and defense rely on GaN and SiC for their high power density and reliability. Consumer electronics and telecom adopt GaN for compact, high-frequency applications, particularly in chargers and 5G infrastructure. Each segment strengthens overall adoption with unique performance requirements.

- For instance, Tesla equipped its Model 3 with silicon carbide (SiC) MOSFETs supplied by STMicroelectronics, enabling its inverter to operate at up to 96% efficiency and supporting fast charging that can deliver 250 kW peak power per vehicle.

By End User:

End users include automotive, energy, industrial, consumer electronics, aerospace, defense, and telecom sectors. The automotive sector remains the largest, supported by the global push toward electrification. It benefits from improved power density, efficiency, and durability in EV systems. The energy sector drives demand through large-scale renewable integration projects. Industrial users value reliability in automation and robotics. Aerospace and defense focus on high-performance power solutions for mission-critical applications. Consumer electronics and telecom complete the demand spectrum with fast-growing, high-volume use cases.

Segmentations:

By Product:

- Gallium Nitride (GaN) Devices

- Silicon Carbide (SiC) Devices

By Application:

- Electric Vehicles

- Renewable Energy

- Industrial Automation

- Consumer Electronics

- Telecom

- Aerospace and Defense

By End User:

- Automotive

- Energy

- Industrial

- Consumer Electronics

- Aerospace

- Defense

- Telecom

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific:

Asia-Pacific held 48% market share in the GaN and SiC power semiconductor market in 2024. It remains the leading region due to strong manufacturing bases in China, Japan, and South Korea. Governments actively support EV adoption, renewable energy expansion, and industrial modernization, driving large-scale deployments of wide bandgap devices. China leads with significant demand from electric mobility and solar power projects, while Japan and South Korea emphasize innovation in consumer electronics and telecom. Strong semiconductor supply chains further strengthen regional dominance. Collaboration between automotive OEMs and power device manufacturers accelerates commercialization of GaN and SiC technologies.

North America:

North America accounted for 26% market share in the GaN and SiC power semiconductor market in 2024. It benefits from early adoption of advanced technologies, strong renewable energy programs, and leadership in semiconductor R&D. The United States drives growth with heavy investments in EV infrastructure, aerospace, and defense applications. Companies such as Wolfspeed and Texas Instruments expand local manufacturing capacity to reduce import reliance. It also benefits from federal initiatives supporting clean energy and electrification. High penetration of data centers and 5G deployment further increases demand for wide bandgap devices across the region.

Europe:

Europe secured 19% market share in the GaN and SiC power semiconductor market in 2024. It continues to expand due to stringent energy efficiency regulations and rapid growth in electric mobility. Germany, France, and the United Kingdom lead adoption with strong automotive industries investing in EV development. The European Union enforces policies that promote clean energy, supporting solar, wind, and smart grid projects. It strengthens regional demand for high-performance semiconductors with superior thermal and power capabilities. Local companies partner with global semiconductor players to ensure a secure supply chain. Continuous investments in R&D and EV infrastructure position Europe as a vital growth hub.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- SiTime

- STMicroelectronics

- Texas Instruments

- Sanken Electric

- ON Semiconductor

- Nexperia

- Infineon Technologies

- ROHM Semiconductor

- Cree

- Qorvo

- Power Integrations

- Broadcom

Competitive Analysis:

The GaN and SiC power semiconductor market is highly competitive, with global and regional players investing in innovation and capacity expansion. Key companies include SiTime, STMicroelectronics, Texas Instruments, Sanken Electric, ON Semiconductor, Nexperia, Infineon Technologies, and ROHM Semiconductor. These firms compete through advanced product portfolios, integration of wide bandgap technologies, and strategic partnerships with automotive and energy sectors. It focuses on delivering superior performance in efficiency, power density, and thermal management to address growing demand in electric vehicles, renewable energy, and industrial applications. Companies expand manufacturing capabilities and strengthen supply chains to secure long-term growth. Continuous R&D in material quality, packaging, and cost reduction drives competitive advantage, while collaborations with OEMs ensure faster adoption across industries. The market remains dynamic, shaped by technology leadership, aggressive expansion strategies, and the ability to meet rising demand from high-growth applications.

Recent Developments:

- In June 2025, SiTime launched the TimeFabric software suite, delivering up to 9 times more accurate time synchronization than quartz-based solutions for AI data centers, networking, and communication systems.

- In March 2025, Texas Instruments introduced the world’s smallest microcontroller (MCU) expanding its MSPM0 MCU portfolio for compact applications.

- In July 2025, STMicroelectronics agreed to acquire NXP Semiconductors’ MEMS sensor business for up to $950 million, aiming to enhance its MEMS sensor capabilities with the deal expected to close in the first half of 2026.

Report Coverage:

The research report offers an in-depth analysis based on Product, Application, End User and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The GaN and SiC power semiconductor market will expand with rising demand from electric mobility worldwide.

- It will see increasing integration in renewable energy systems such as solar inverters and wind turbines.

- Manufacturers will focus on scaling production capacity to reduce costs and improve accessibility.

- Data centers and 5G infrastructure will drive strong adoption of GaN and SiC devices for efficiency and speed.

- Industrial automation and aerospace applications will continue to create opportunities for high-performance semiconductors.

- It will benefit from supportive government policies encouraging electrification and clean energy investments.

- Collaborations between semiconductor firms and automotive OEMs will accelerate technology commercialization.

- Ongoing R&D will improve material quality, packaging, and system-level performance across industries.

- It will face competition from silicon in low-cost applications but gain share in high-efficiency segments.

- Global supply chain development will play a critical role in meeting future demand.