Market Overview

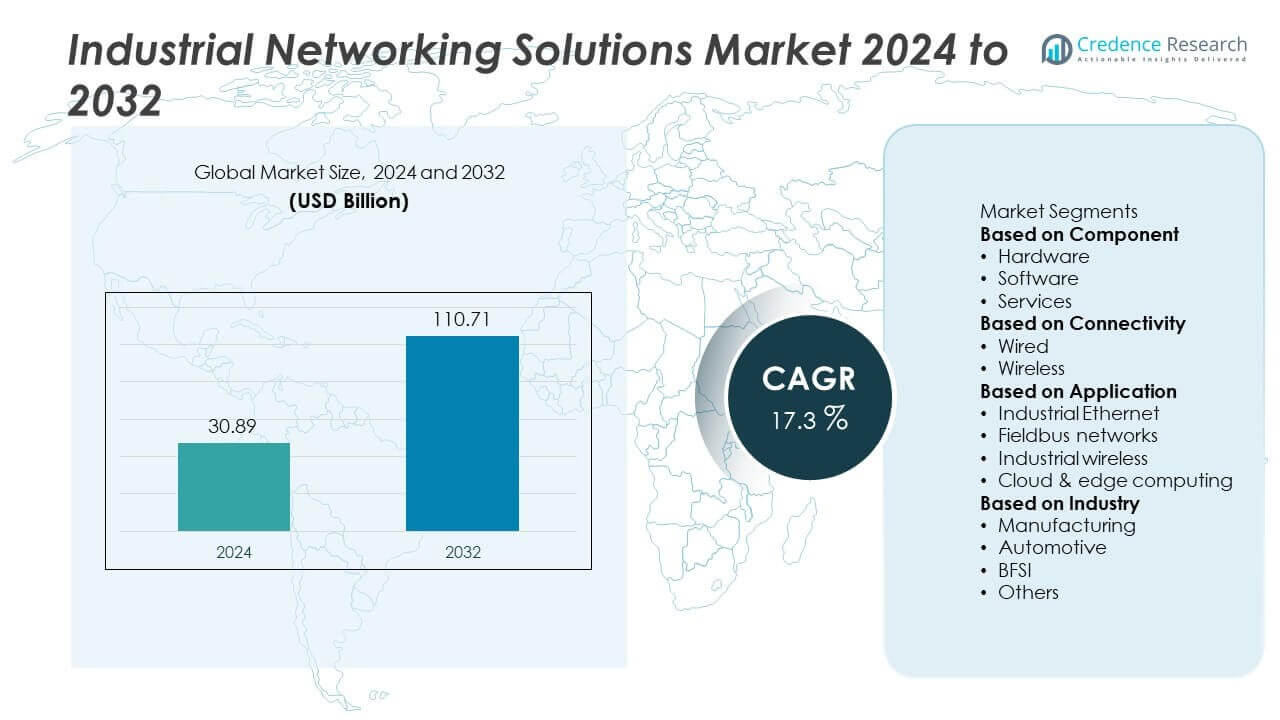

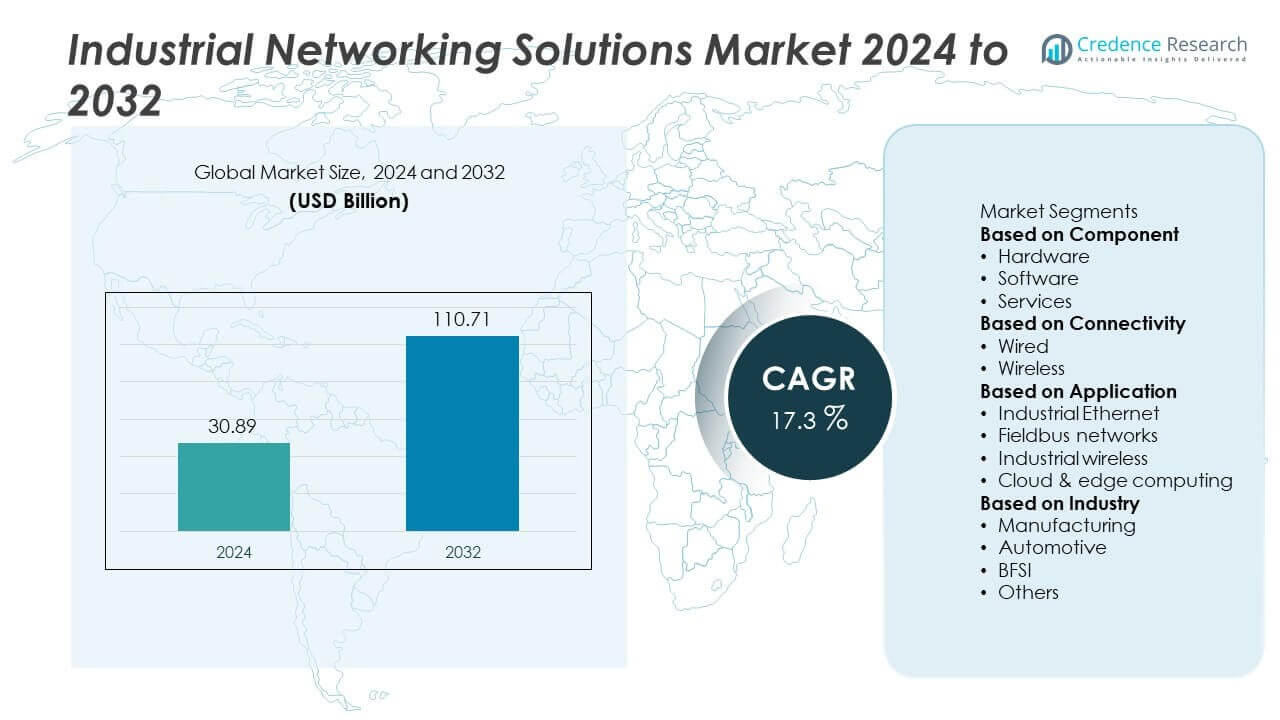

The Industrial Networking Solutions market was valued at USD 30.89 billion in 2024 and is projected to reach USD 110.71 billion by 2032, growing at a CAGR of 17.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Networking Solutions Market Size 2024 |

USD 30.89 Billion |

| Industrial Networking Solutions Market, CAGR |

17.3% |

| Industrial Networking Solutions Market Size 2032 |

USD 110.71 Billion |

The Industrial Networking Solutions Market grows rapidly due to rising adoption of Industry 4.0, IoT integration, and smart factory initiatives. Companies deploy advanced networking platforms to improve efficiency, enable real-time monitoring, and support predictive maintenance.

Geographically, the Industrial Networking Solutions Market demonstrates strong growth across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each driven by distinct industrial priorities. North America leads in digital adoption with advanced automation and smart factory deployment, while Europe emphasizes regulatory compliance, energy transition, and cybersecurity integration. Asia-Pacific shows the fastest expansion, fueled by rapid industrialization, government-backed infrastructure programs, and 5G adoption in countries like China, Japan, and India. Latin America and the Middle East & Africa increasingly invest in smart city projects and oil and gas modernization, strengthening regional demand. Key players shaping the market include Siemens AG, Cisco Systems, Inc., Honeywell International Inc., and Schneider Electric, all of whom focus on innovative solutions that integrate IoT, edge computing, and secure connectivity. Their continuous investments in R&D and global partnerships highlight the competitive landscape and reinforce their positions as industry leaders.

Market Insights

- The Industrial Networking Solutions Market was valued at USD 30.89 billion in 2024 and is projected to reach USD 110.71 billion by 2032, at a CAGR of 17.3%.

- Strong drivers include rising adoption of Industry 4.0, IoT-enabled devices, and smart factory initiatives that demand reliable, scalable, and secure networking infrastructure across industrial sectors.

- Key trends shaping the market are the integration of edge computing, AI-driven analytics, 5G-enabled wireless platforms, and digital twin technologies, which transform operations and improve decision-making.

- Competitive analysis highlights leading companies such as Siemens AG, Cisco Systems, Inc., Schneider Electric, Honeywell International Inc., and Huawei Technologies Co., Ltd., who focus on innovation, global partnerships, and secure connectivity solutions to maintain market leadership.

- Major restraints include high implementation costs, complex integration with legacy systems, and growing cybersecurity risks that limit adoption among small and medium enterprises.

- Regional analysis shows North America leading in advanced adoption supported by strong digital infrastructure, while Europe emphasizes compliance and energy transition. Asia-Pacific emerges as the fastest-growing region, supported by rapid industrialization, 5G expansion, and government initiatives, with Latin America and the Middle East & Africa gradually strengthening demand.

- The market outlook remains positive, with opportunities arising from global smart city projects, energy transition goals, and infrastructure digitization, reinforcing the role of industrial networking solutions in enabling resilient, connected, and sustainable industrial operations worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Adoption of Industry 4.0 and Smart Manufacturing

The Industrial Networking Solutions Market benefits from the global push toward Industry 4.0. Companies deploy connected devices, automation platforms, and IoT systems to increase efficiency. It enables real-time communication between machines, predictive maintenance, and streamlined workflows. Industries such as automotive, energy, and electronics adopt smart factories to reduce downtime. Governments promote digital manufacturing with funding and policy frameworks. This transformation fuels long-term demand for advanced networking platforms.

- For instance, Mitsubishi Electric upgraded its MELSERVO-J5 series with EtherNet/IP protocol support via a firmware update, enabling existing units to integrate with multi-network smart factory environments without hardware replacement.

Expanding Role of IoT and Connected Devices in Industrial Operations

Rising integration of IoT devices drives significant demand for secure and reliable networking solutions. The Industrial Networking Solutions Market supports real-time data transfer across multiple systems. It allows manufacturers to track equipment performance and reduce operational risks. Remote monitoring and process control improve decision-making speed. Growing deployment of connected sensors in logistics, utilities, and oil and gas sectors creates fresh opportunities. The reliance on seamless connectivity strengthens the market’s growth outlook.

- For instance, Cisco offers its Catalyst IR8100/IR8300 Series rugged industrial routers with integrated SD-WAN for monitoring IoT endpoints in harsh environments like manufacturing plants and utility grids. These modular routers are designed for remote management and secure connectivity of industrial assets, distinct from Cisco’s enterprise 8100–8500 series routers used for secure branch operations.

Rising Focus on Cybersecurity and Data Protection Standards

Heightened risks of cyberattacks increase the adoption of secure networking platforms. The Industrial Networking Solutions Market addresses the need for advanced security layers. It integrates firewalls, encryption, and threat detection to safeguard industrial assets. Companies prioritize solutions that meet strict compliance standards such as NIST and IEC 62443. Growing digitalization in energy grids, transport networks, and factories raises security concerns. The shift toward resilient infrastructures drives investment in secure industrial networking systems.

Government Initiatives and Infrastructure Modernization Efforts

Global infrastructure upgrades create significant growth opportunities for advanced networking systems. The Industrial Networking Solutions Market gains traction from government-backed smart city and industrial corridor projects. It provides essential backbone connectivity for energy distribution, rail systems, and water management networks. Strong investment in 5G and edge computing expands coverage and reliability. Governments in Asia-Pacific, North America, and Europe emphasize digital industrial transformation. Supportive policies ensure rapid adoption of industrial networking across public and private sectors.

Market Trends

Market Trends

Integration of Artificial Intelligence and Edge Computing in Network Infrastructure

The Industrial Networking Solutions Market is shaped by the integration of AI and edge computing. It supports faster data processing and reduces dependence on centralized systems. Manufacturers deploy AI-driven analytics to optimize production and reduce downtime. Edge computing ensures real-time control for sensitive industrial processes. The demand for localized decision-making grows across energy, transportation, and healthcare industries. This trend accelerates the shift toward intelligent and autonomous networks.

- For instance, Mitsubishi Electric developed a compact Maisart® edge AI model that is capable of running on limited hardware, enabling real-time anomaly detection in factory production lines.

Growing Preference for Wireless and 5G-Enabled Industrial Connectivity

Wireless technologies are transforming industrial communication strategies at scale. The Industrial Networking Solutions Market adapts to the expansion of 5G networks that deliver low latency and higher bandwidth. It enables factories to operate more flexibly with reduced cabling requirements. Wireless platforms support mobile robotics, AGVs, and automated warehouses. The scalability of 5G fosters adoption across diverse industrial ecosystems. Enterprises value faster deployment and enhanced connectivity reliability in complex operations.

- For instance, Siemens has deployed private 5G networks in its own plants for industrial automation, while Deutsche Telekom has partnered with industrial clients and built campus networks for them, including one at the Werner-von-Siemens Centre in Berlin for research and testing.

Rising Use of Digital Twins and Predictive Analytics for Operations

Industries are investing heavily in digital twin technologies to replicate physical assets virtually. The Industrial Networking Solutions Market provides the backbone for seamless data integration between real and digital environments. It allows companies to forecast equipment behavior and prevent unplanned failures. Predictive analytics drives efficiency in maintenance scheduling and supply chain planning. Energy plants and transportation systems adopt these tools for optimized operations. This trend highlights the growing fusion of networking and simulation technologies.

Shift Toward Cloud-Based and Hybrid Networking Models

Cloud platforms are increasingly central to industrial operations worldwide. The Industrial Networking Solutions Market evolves with growing preference for hybrid cloud models that balance flexibility and security. It allows manufacturers to scale resources quickly while maintaining local control where needed. Cloud-based solutions support data-driven decision-making through centralized platforms. Hybrid models reduce risks tied to downtime and connectivity failures. This trend demonstrates how digital transformation strategies rely on adaptable networking ecosystems.

Market Challenges Analysis

High Implementation Costs and Complex Integration with Legacy Systems

The Industrial Networking Solutions Market faces hurdles from high upfront investment and integration challenges. It requires significant capital for infrastructure, software, and skilled workforce. Many industries rely on outdated legacy systems that complicate deployment of modern networking platforms. It often demands system redesign, hardware upgrades, and extended downtime, which increases costs. Small and medium enterprises hesitate to adopt advanced solutions due to financial constraints. These barriers slow adoption despite clear efficiency benefits.

Growing Vulnerability to Cyber Threats and Data Privacy Issues

Rising digital connectivity introduces higher risks of data breaches and system disruptions. The Industrial Networking Solutions Market must address complex cybersecurity challenges. It demands constant upgrades to protect industrial assets from ransomware and malware attacks. Companies face regulatory pressure to comply with strict data protection frameworks across regions. It often requires heavy investment in security tools, training, and compliance audits. Persistent concerns over vulnerabilities and financial risks hinder smooth adoption across industries.

Market Opportunities

Expansion of Smart Cities and Infrastructure Digitization Projects

The Industrial Networking Solutions Market gains strong opportunities from global smart city programs and infrastructure upgrades. Governments and private investors focus on digital utilities, transportation systems, and connected public services. It creates demand for reliable, scalable, and secure industrial networking frameworks. Smart grids, automated traffic systems, and intelligent water management depend on these solutions. Rapid urbanization in Asia-Pacific and the Middle East accelerates investment in such projects. The sector benefits from its role as a backbone of urban digitization.

Rising Demand for Energy Transition and Sustainable Industrial Operations

Global energy transition goals open fresh growth avenues for advanced networking solutions. The Industrial Networking Solutions Market supports integration of renewable energy plants, distributed generation, and smart grid systems. It ensures stable data flow between diverse energy assets and control platforms. Industrial firms also adopt green initiatives that rely on efficient digital monitoring. It provides opportunities to optimize energy use and reduce carbon footprints. This growing alignment with sustainability agendas strengthens long-term adoption across industries.

Market Segmentation Analysis:

By Component

The Industrial Networking Solutions Market is segmented by components into hardware, software, and services. Hardware, including switches, routers, and gateways, holds a leading role due to its critical function in establishing connectivity. It supports data transfer across manufacturing plants, utilities, and energy networks. Software solutions gain momentum with rising adoption of cloud platforms, AI-driven analytics, and network management tools. Services, such as integration, consulting, and maintenance, grow steadily as enterprises seek expert guidance to optimize network performance. The combination of these components creates a comprehensive ecosystem that ensures operational reliability.

- For instance, Belden launched its Hirschmann OCTOPUS switches with expanded TSN (Time-Sensitive Networking) capabilities, enabling deterministic Ethernet communication with cycle times below 1 ms for automotive and rail production networks.

By Connectivity

Segmentation by connectivity highlights wired, wireless, and hybrid solutions. Wired networks maintain strong relevance due to their stability and high-speed capabilities, especially in large-scale industrial operations. It ensures consistent performance in environments requiring secure and uninterrupted data flow. Wireless connectivity grows rapidly with the expansion of IoT devices, mobile robotics, and 5G-enabled platforms. Hybrid models, combining wired and wireless, appeal to industries aiming for flexibility without compromising reliability. This mix of options provides enterprises with tailored solutions for diverse operational demands.

- For instance, at China’s Tianjin Port, Huawei, working with China Mobile and Tianjin Port Group, deployed a private 5G network to support the port’s automated operations. This enabled the port to automate processes like remote-controlled gantry cranes and driverless container trucks.

By Application

Applications span across manufacturing, energy and utilities, transportation, oil and gas, and other sectors. The Industrial Networking Solutions Market sees strong adoption in manufacturing due to smart factory initiatives and predictive maintenance programs. It enhances production efficiency through seamless integration of machines and control systems. Energy and utilities rely on networking platforms to support smart grid deployment and renewable energy integration. Transportation benefits from reliable communication systems for logistics, railways, and autonomous vehicles. Oil and gas operations use secure networks to manage exploration, pipelines, and safety systems. This broad application base reinforces the market’s role in enabling digital transformation across industries.

Segments:

Based on Component

- Hardware

- Software

- Services

Based on Connectivity

Based on Application

- Industrial Ethernet

- Fieldbus networks

- Industrial wireless

- Cloud & edge computing

Based on Industry

- Manufacturing

- Automotive

- BFSI

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Industrial Networking Solutions Market with nearly 35% in 2024. The region benefits from strong adoption of Industry 4.0, automation, and digital transformation across manufacturing, oil and gas, and utilities. It demonstrates leadership in integrating IoT platforms and deploying secure industrial networks supported by advanced technologies such as 5G and edge computing. The United States drives most of the regional demand with its focus on smart factories, cloud-based platforms, and high cybersecurity standards. Canada also contributes with large investments in energy grid modernization and infrastructure digitization. Government policies that encourage industrial efficiency and sustainability further strengthen growth in the region, making it a consistent leader in the market.

Europe

Europe accounts for around 28% of the Industrial Networking Solutions Market share in 2024. The region is characterized by strong regulatory frameworks that support digital transformation and cybersecurity compliance across industrial sectors. It places emphasis on automation in automotive, aerospace, and energy industries, driving demand for reliable networking platforms. Germany, France, and the United Kingdom remain leading adopters, supported by significant smart factory initiatives and industrial automation strategies. The region’s commitment to sustainability and renewable energy integration also requires advanced networking systems to manage distributed energy resources effectively. Investment in hybrid and cloud-based models is expanding, giving Europe a strong position in driving innovation within the global market.

Asia-Pacific

Asia-Pacific represents close to 25% of the Industrial Networking Solutions Market share in 2024, with the fastest projected growth over the forecast period. The region’s rapid industrialization, coupled with heavy government investment in digital infrastructure, fuels adoption across multiple industries. China leads with extensive smart manufacturing programs, followed by Japan and South Korea with advanced robotics and factory automation. India is emerging as a strong growth market due to increasing demand for industrial IoT solutions in manufacturing and utilities. The adoption of wireless networking technologies, supported by growing 5G rollouts, accelerates market expansion. Rising energy transition goals and the growth of smart city projects in Southeast Asia further enhance opportunities in the region.

Latin America

Latin America holds about 7% of the Industrial Networking Solutions Market share in 2024. The region shows steady progress as industries adopt digital platforms to modernize operations. Brazil drives most of the demand with its large manufacturing base and investments in renewable energy integration. Mexico follows with strong adoption in automotive and logistics industries. The region is gradually shifting from legacy systems to hybrid and wireless networking models to enhance efficiency. Growing interest in industrial IoT and government-backed digital infrastructure initiatives are creating a supportive environment for long-term adoption. However, high implementation costs and cybersecurity challenges continue to limit faster growth compared to other regions.

Middle East and Africa

The Middle East and Africa together account for nearly 5% of the Industrial Networking Solutions Market share in 2024. The region shows potential growth driven by smart city projects, oil and gas modernization, and digital utility management. Countries such as the United Arab Emirates and Saudi Arabia lead adoption through large-scale investment in industrial automation and energy diversification. South Africa represents a key market in Africa with strong interest in renewable energy integration and digital infrastructure upgrades. The adoption of secure and reliable networking platforms supports oil and gas exploration, logistics, and industrial operations in the region. While growth is steady, challenges linked to cost and skilled workforce availability may restrict faster penetration in the near term.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Mitsubishi Electric Corporation

- Cisco Systems, Inc.

- Emerson Electric Co.

- Siemens AG

- Huawei Technologies Co., Ltd.

- Belden Inc.

- Advantech Co., Ltd.

- Eaton Corporation

- Schneider Electric

- Honeywell International Inc.

Competitive Analysis

The competitive landscape of the Industrial Networking Solutions Market is shaped by leading players such as Siemens AG, Cisco Systems, Inc., Schneider Electric, Honeywell International Inc., Huawei Technologies Co., Ltd., Emerson Electric Co., Mitsubishi Electric Corporation, Belden Inc., Eaton Corporation, and Advantech Co., Ltd. These companies compete through continuous innovation, strong product portfolios, and global reach across industrial sectors. They focus on integrating IoT, edge computing, and 5G-enabled solutions to strengthen connectivity and improve operational efficiency for diverse applications in manufacturing, energy, utilities, and transportation. Strategic partnerships, mergers, and acquisitions remain central to expanding market presence and enhancing technology capabilities. Investment in cybersecurity, cloud-based platforms, and digital twin solutions demonstrates their commitment to addressing rising industrial demands for secure and scalable networking infrastructure. Each player differentiates itself through tailored offerings, regional expansion strategies, and long-term investments in research and development, driving growth in a highly competitive global market environment.

Recent Developments

- In June 2025, Mitsubishi Electric Corporation Announced that its MELSERVO-J5 servo amplifier series now supports two industrial Ethernet protocols (EtherNet/IP and EtherCAT) via a firmware update, allowing existing users to enable new networking capabilities without hardware changes.

- In June 2025, Mitsubishi Electric Corporation Developed an edge-device language model under its Maisart® AI brand, fine-tuned with internal manufacturing data. The model is compact to run on limited hardware and optimized with data augmentation for domain-specific applications.

- In June 2025, Cisco Systems, Inc. Unveiled a new secure network architecture to support campus, branch, and industrial networks. It includes next-generation high-capacity and low-latency devices, unified management platform, and quantum-resistant security features.

- In May 2025, Mitsubishi Electric Corporation, NTT Com, and SK C&C Started a pilot project (from June to October 2025) for industrial networks and supply chains. They established a system-to-system data communication environment in line with Catena-X standards, enabling visualization of product carbon footprints across supply chains.

Report Coverage

The research report offers an in-depth analysis based on Component, Connectivity, Application, Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for Industry 4.0 and smart factories.

- Adoption of IoT devices will increase, creating higher need for secure connectivity.

- Edge computing will gain momentum to support real-time decision-making in industries.

- 5G deployment will accelerate wireless adoption across manufacturing and logistics.

- Digital twins will become mainstream tools for predictive maintenance and asset management.

- Cybersecurity investments will rise to counter growing risks in connected operations.

- Cloud and hybrid networking models will dominate due to scalability and flexibility.

- Asia-Pacific will emerge as the fastest-growing region supported by industrialization and 5G.

- Government-backed smart city and infrastructure programs will strengthen global opportunities.

- Sustainability goals and energy transition will drive demand for efficient networking systems.

Market Trends

Market Trends