Market Overview

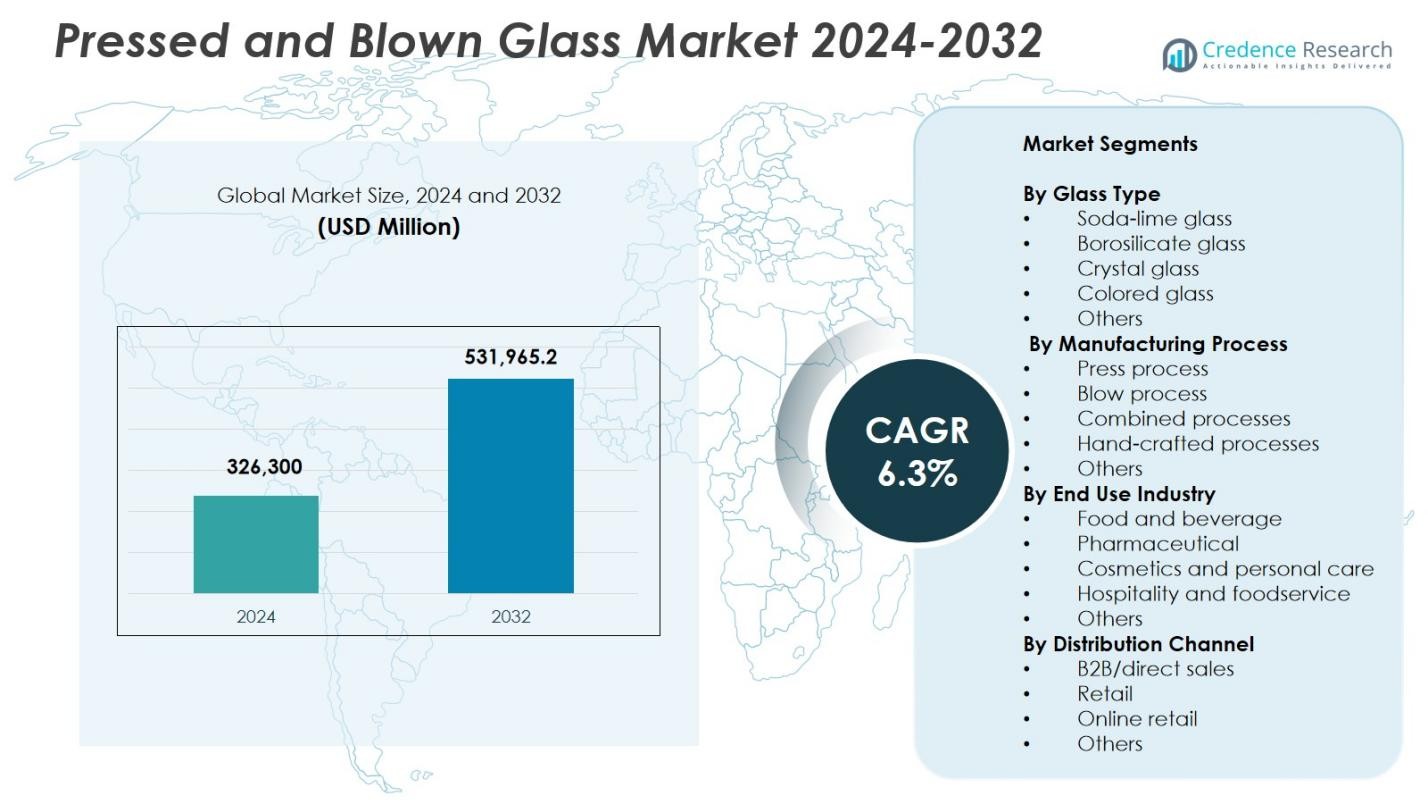

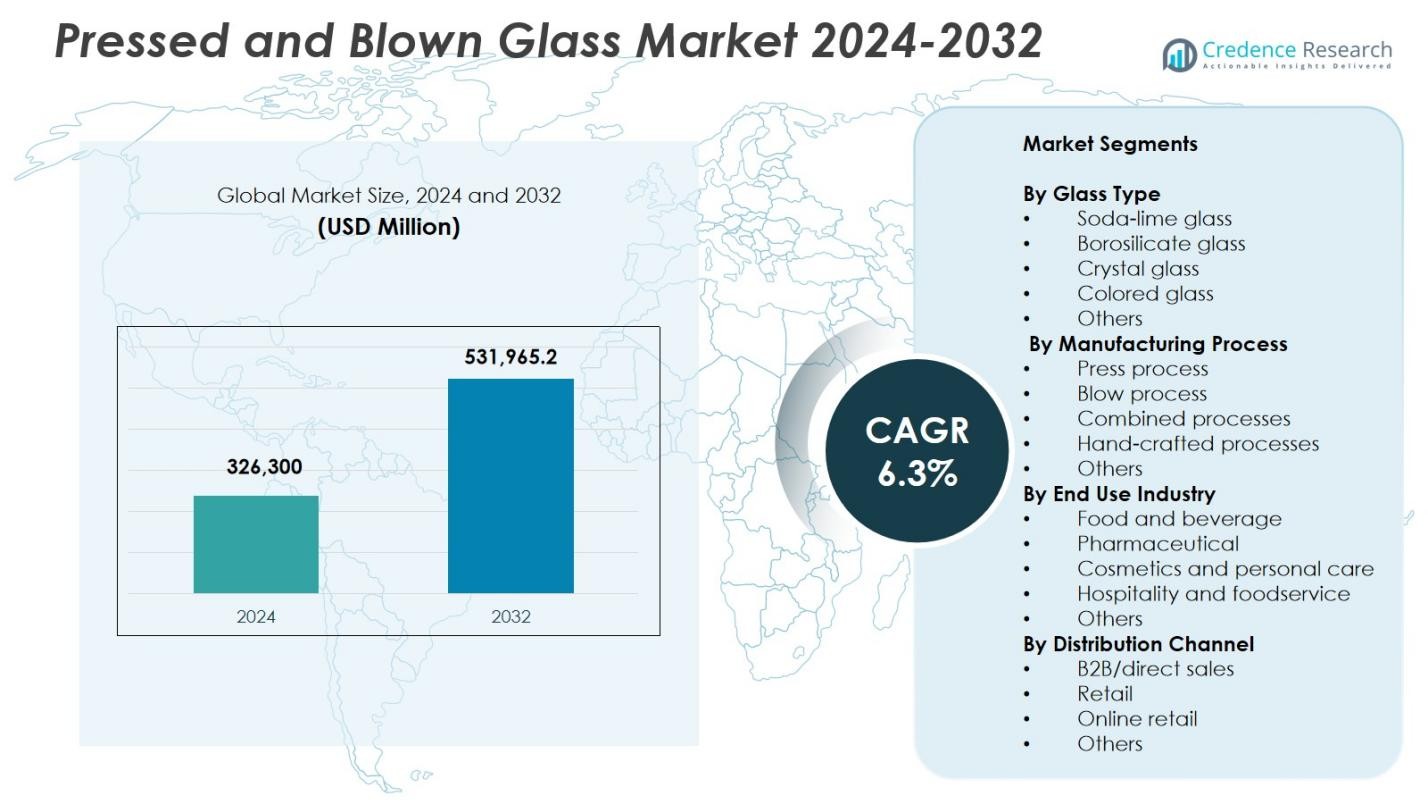

Pressed And Blown Glass Market size was valued at USD 326,300 Million in 2024 and is anticipated to reach USD 531,965.2 Million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Pressed And Blown Glass Market Size 2024 |

USD 326,300 Million |

| Pressed And Blown Glass Market, CAGR |

6.3% |

| Pressed And Blown Glass Market Size 2032 |

USD 531,965.2 Million |

Pressed and Blown Glass Market is shaped by leading players such as Owens-Illinois Inc., Ardagh Group S.A., Verallia S.A., Gerresheimer AG, BA Glass International, Vetropack Holding, Bormioli Rocco S.p.A., Libbey Inc., Krosno Glass S.A., and Corning Incorporated, each strengthening their presence through advanced forming technologies, product innovation, and expanded production capabilities. These companies cater to rising demand across packaging, tableware, décor, and specialty applications. Europe emerged as the leading region with 32.7% share in 2024, driven by strong manufacturing infrastructure, high consumption of premium glassware, and established recycling systems that reinforce sustained market growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Pressed and Blown Glass Market reached USD 326,300 Million in 2024 and will grow at a CAGR of 6.3% through 2032, supported by rising demand across packaging and premium product segments.

- Market growth is driven by strong consumption in food and beverage applications, where the segment held 51.6% share, supported by recyclability, product protection, and premium appeal.

- Key trends include increasing adoption of sustainable and circular glass production methods, rising demand for customized premium glassware, and broader use of specialty glass compositions in pharmaceuticals and cosmetics.

- Major players such as Owens-Illinois, Ardagh Group, Verallia, and Gerresheimer expand capacity and product portfolios, focusing on energy-efficient furnaces, lightweighting technologies, and advanced forming processes.

- Europe led with 32.7% share in 2024, followed by North America at 28.4% and Asia-Pacific at 26.9%, reflecting strong regional demand diversification, with Latin America and Middle East & Africa contributing steady growth.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Glass Type

The By Glass Type segment is dominated by Soda-lime glass, which held 42.8% share in 2024, driven by its widespread use in containers, tableware, windows, and packaging due to its cost efficiency, chemical stability, and ease of forming. Growing consumption of packaged foods and beverages continues to strengthen demand for soda-lime products. Borosilicate glass gains traction in laboratoryware and cookware, while crystal and colored glass expand in premium décor applications. The Others category benefits from rising adoption of specialty compositions for niche industrial and aesthetic uses.

- For instance, Hwa Hsia Glass produces low-iron soda-lime glass decanters, spice jars, and storage canisters valued for their exceptional clarity and food-safe properties.

By Manufacturing Process

The By Manufacturing Process segment is led by the Blow process, accounting for 46.3% share in 2024, supported by its extensive use in producing bottles, jars, vials, and decorative items requiring precise shapes and lightweight structures. High adoption across beverage, pharmaceutical, and cosmetics packaging industries drives the prominence of the blow process. The press process retains relevance in tableware and heavy-duty applications, while combined and hand-crafted processes cater to premium, customized, and artisanal glass products. The Others category grows with advancements in hybrid forming technologies and automated production lines.

- For instance, SGD Pharma employs the Blow & Blow process to form pharmaceutical vials in two steps, starting with a preform or blank shaped by compressed air, followed by final blowing for narrow-neck containers.

By End Use Industry

The By End Use Industry segment is dominated by Food and beverage, which commanded 51.6% share in 2024, driven by strong global demand for glass bottles, jars, and specialty packaging that offer superior product protection, recyclability, and premium shelf appeal. Expanding consumption of alcoholic beverages, gourmet foods, and ready-to-drink products reinforces segment leadership. Pharmaceutical applications grow due to rising production of vials and ampoules, while cosmetics and personal care increasingly adopt premium glass packaging. The hospitality and foodservice segment benefits from durable tableware demand, with Others contributing additional niche requirements.

Key Growth Drivers

Rising Demand from Food, Beverage, and Premium Packaging Industries

The Pressed and Blown Glass Market experiences strong growth due to accelerating demand from the food, beverage, and premium product packaging sectors. Glass packaging remains favored for its recyclability, chemical inertness, and premium aesthetic appeal, supporting its use in alcoholic beverages, gourmet foods, and luxury cosmetics. Growing consumer preference for sustainable packaging materials further fuels adoption, as brands shift toward environmentally responsible solutions. Increasing production of ready-to-drink beverages and niche artisanal products continues to expand market volumes, reinforcing the long-term growth trajectory of glass packaging.

- For instance, Visy incorporates an average of 70% recycled glass content into its bottles and jars produced for New Zealand food and beverage companies, enabling sustainable packaging that reduces greenhouse gas emissions by up to 30% compared to non-recycled glass.

Advancements in Manufacturing Technologies and Automation

Technological advancements such as high-speed forming machines, precision molding systems, automated inspection technologies, and digital process control enable manufacturers to enhance productivity, reduce defects, and optimize energy consumption. The integration of robotics and smart sensors enhances consistency in forming processes, while improved furnace designs lower emissions and operating costs. These innovations support large-scale production, help manufacturers meet rising global demand, and expand their ability to deliver complex shapes and lightweight structures. As automation becomes more widespread, operational efficiency improves, driving broader adoption of pressed and blown glass solutions.

- For instance, Heye International’s HiPERFORM IS machines incorporate servo technology and closed-loop solutions for the NNPB process, delivering high speeds with consistent quality and short job change times.

Growing Use of Specialty and High-Performance Glass

Increasing reliance on specialty glasses such as borosilicate, crystal, and colored variants drives market expansion across high-value applications. Demand rises in laboratory equipment, pharmaceuticals, premium home décor, luxury drinkware, and high-temperature cookware, where performance characteristics such as durability, clarity, and thermal resistance are essential. Consumer preference for aesthetic and customizable glass products further accelerates segment growth. Manufacturers increasingly invest in innovative formulations and advanced melting technologies, enabling differentiated product lines tailored to specific industrial needs and premium consumer markets.

Key Trends & Opportunities

Shift Toward Sustainable and Circular Glass Production

Sustainability-driven initiatives present a major opportunity as manufacturers adopt recycled cullet, energy-efficient furnaces, and low-carbon production methods. Governments and global brands emphasize circular economy models, prompting rapid growth in closed-loop recycling programs for glass packaging. This shift not only reduces environmental impact but also lowers production costs and enhances brand positioning. Opportunities emerge for companies offering eco-friendly glass compositions, lightweight containers, and refillable packaging systems, aligning with increasing consumer preference for ethically produced and environmentally sustainable products.

- For instance, O-I’s Glass4Good program operates collection sites in communities like Danville, VA, and Greeley, CO, processing glass into high-quality cullet for direct reintroduction into its manufacturing stream.

Premiumization and Growth of Custom-Designed Glass Products

Rising consumer interest in premium, personalized, and aesthetically distinctive products drives strong opportunities for customized pressed and blown glass solutions. Luxury beverage brands, high-end fragrance companies, and home décor manufacturers increasingly invest in bespoke shapes, textured finishes, and artistic designs to differentiate their offerings. Advancements in 3D modeling, precision molds, and artisanal techniques support this premiumization trend. As experiential retail and brand storytelling gain prominence, custom-designed glass packaging and décor pieces become key value creators, strengthening demand in the luxury and lifestyle markets.

- For instance, Clase Azul Reposado tequila uses hand-painted 750ml bottles with blue-and-white splashes over copper glazes on white stoneware, making each one a unique piece of art.

Key Challenges

High Energy Consumption and Cost Pressures

The production of pressed and blown glass requires significant energy inputs for melting and forming, making the industry vulnerable to fluctuating fuel and electricity costs. Rising global energy prices and stricter environmental regulations intensify operational pressures, especially for manufacturers operating older furnace systems. Energy-intensive processes also increase carbon emissions, prompting investments in costly upgrades such as electric furnaces, waste-heat recovery systems, and advanced insulation. These financial and regulatory burdens challenge profitability and demand careful optimization across the production lifecycle.

Competition from Alternative Packaging Materials

Glass packaging continues to face strong competition from lightweight and cost-effective alternatives such as plastics, aluminum, and composite materials. These substitutes offer advantages including lower transportation costs, flexibility, and high durability, prompting some industries to shift away from glass. The fragility of glass further limits its adoption in certain applications, especially where logistics or handling risks are high. To remain competitive, glass manufacturers must focus on innovation in lightweighting, improved impact resistance, and value-added designs that reinforce the unique sustainability and premium attributes of glass.

Regional Analysis

North America

North America held 28.4% share in 2024, supported by strong consumption of glass packaging across food, beverage, and pharmaceutical industries. The growing shift toward recyclable and sustainable materials accelerates glass adoption, especially among premium beverage and cosmetics brands. Technological advancements in automated forming and inspection systems strengthen manufacturing efficiency across the U.S. and Canada. Rising demand for high-quality tableware and home décor products further contributes to regional growth. Expansion of craft beverage markets, including wine, spirits, and specialty drinks, reinforces long-term opportunities for pressed and blown glass producers.

Europe

Europe commanded 32.7% share in 2024, driven by mature glass manufacturing clusters, advanced production technologies, and strong regulatory support for circular packaging systems. Countries such as Germany, France, and Italy maintain high consumption of premium glassware, luxury spirits bottles, and crystal products. Strict sustainability mandates and well-established recycling programs increase reliance on glass as a preferred packaging substrate. The region also benefits from strong demand in pharmaceuticals and cosmetics, where glass ensures product purity and long shelf life. Continuous investments in energy-efficient furnaces and low-emission melting technologies reinforce Europe’s leadership in the global market.

Asia-Pacific

Asia-Pacific accounted for 26.9% share in 2024, supported by rapid industrialization, expanding packaging demand, and strong growth in food, beverage, and cosmetics sectors. China and India drive large-scale production due to their extensive manufacturing bases and rising domestic consumption. Increasing demand for premium packaging solutions, especially in alcoholic beverages and beauty products, accelerates market expansion. The region also benefits from cost-efficient manufacturing and rising investments in automated forming technologies. Growing urbanization and changing lifestyle patterns contribute to higher use of glass tableware and home décor products, strengthening the long-term outlook for pressed and blown glass.

Latin America

Latin America captured 7.4% share in 2024, driven by rising beverage consumption, growth of regional spirits brands, and expanding food packaging requirements. Countries such as Brazil, Mexico, and Argentina fuel demand for glass bottles, jars, and artisanal glassware. Increasing adoption of sustainable packaging solutions supports market penetration as brands shift toward recyclable materials. The region also benefits from growing tourism and hospitality sectors, which elevate demand for premium drinkware and decorative glass products. However, manufacturing capacity remains concentrated, prompting greater investment in modernization and efficiency improvements to meet evolving domestic and export requirements.

Middle East & Africa

The Middle East & Africa region held 4.6% share in 2024, supported by rising investments in food and beverage manufacturing, increasing pharmaceutical packaging needs, and expanding hospitality infrastructure. The Gulf countries experience growing demand for luxury fragrance bottles and premium glass décor items, aligning with regional consumer preferences for high-end products. South Africa and Nigeria drive demand in beverages, particularly in beer, wine, and soft drinks. Despite relatively limited local production capabilities, the region sees increasing investments in energy-efficient furnaces and modern forming technologies to reduce dependency on imports and support long-term market development.

Market Segmentations:

By Glass Type

- Soda-lime glass

- Borosilicate glass

- Crystal glass

- Colored glass

- Others

By Manufacturing Process

- Press process

- Blow process

- Combined processes

- Hand-crafted processes

- Others

By End Use Industry

- Food and beverage

- Pharmaceutical

- Cosmetics and personal care

- Hospitality and foodservice

- Others

By Distribution Channel

- B2B/direct sales

- Retail

- Online retail

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis in the Pressed and Blown Glass Market is shaped by leading players including Owens-Illinois Inc., Ardagh Group S.A., Verallia S.A., Gerresheimer AG, BA Glass International, Vetropack Holding, Bormioli Rocco S.p.A., Libbey Inc., Krosno Glass S.A., and Corning Incorporated. These companies strengthen their positions through investments in advanced forming technologies, lightweight glass solutions, and high-efficiency furnaces that reduce energy consumption and enhance product quality. The market features a balanced mix of large-scale global manufacturers and specialized regional producers, enabling broad product availability across packaging, tableware, décor, and industrial applications. Strategic initiatives such as capacity expansions, mergers, and long-term supply partnerships with beverage, pharmaceutical, and cosmetics brands drive competitive advantage. Sustainability commitments also influence market differentiation, with major companies adopting recycled cullet, low-emission melting technologies, and circular packaging models. Continuous innovation in customization, premium glass design, and specialty compositions reinforces competition and elevates market performance.

Key Player Analysis

- Owens-Illinois, Inc. (O-I Glass)

- Ardagh Group S.A.

- Verallia S.A.

- Vetropack Holding Ltd.

- BA Glass International

- Gerresheimer AG

- Bormioli Rocco S.p.A.

- Krosno Glass S.A.

- Libbey Inc.

- Corning Incorporated

Recent Developments

- In April 2025, Ardagh Glass Packaging-North America entered a long-term partnership with CAP Glass to establish glass recycling services across the U.S., enabling collection, sorting, and recycling of used bottles into cullet for new glass containers.

- In November 2025, Verallia partnered with Penn State University to develop and test a new low-carbon glass called “LionGlass,” which melts at significantly lower temperatures and reduces CO₂ emissions and energy usage in glass manufacturing.

- In August 2025, SGD Pharma announced an agreement to acquire Alphial, an Italy-based manufacturer of tubular vials, ampoules, and ready-to-use glass products, to expand its tubular glass capacity in Europe for pharmaceutical packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Glass Type, Manufacturing Process, End Use Industry, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily as demand for sustainable and recyclable packaging materials continues to rise across major industries.

- Adoption of lightweight glass technologies will increase as manufacturers aim to reduce transportation costs and emissions.

- Premium and customized glass products will gain momentum due to strong growth in luxury beverages, cosmetics, and home décor.

- Automation and digital manufacturing technologies will improve production efficiency and strengthen global supply capabilities.

- Pharmaceutical and laboratory glassware demand will grow with rising investments in healthcare and biotechnology.

- Emerging economies will contribute significantly to market expansion as industrialization and consumption patterns evolve.

- Sustainability regulations will accelerate the shift toward circular glass production and higher recycled content usage.

- Expansion of artisanal and handcrafted glass segments will create niche growth opportunities in décor and hospitality.

- Technological innovations in melting and forming processes will reduce energy consumption and operational costs.

- Strategic collaborations between glass manufacturers and major consumer brands will support long-term product innovation and market stability.

Market Segmentation Analysis:

Market Segmentation Analysis: