Market Overview

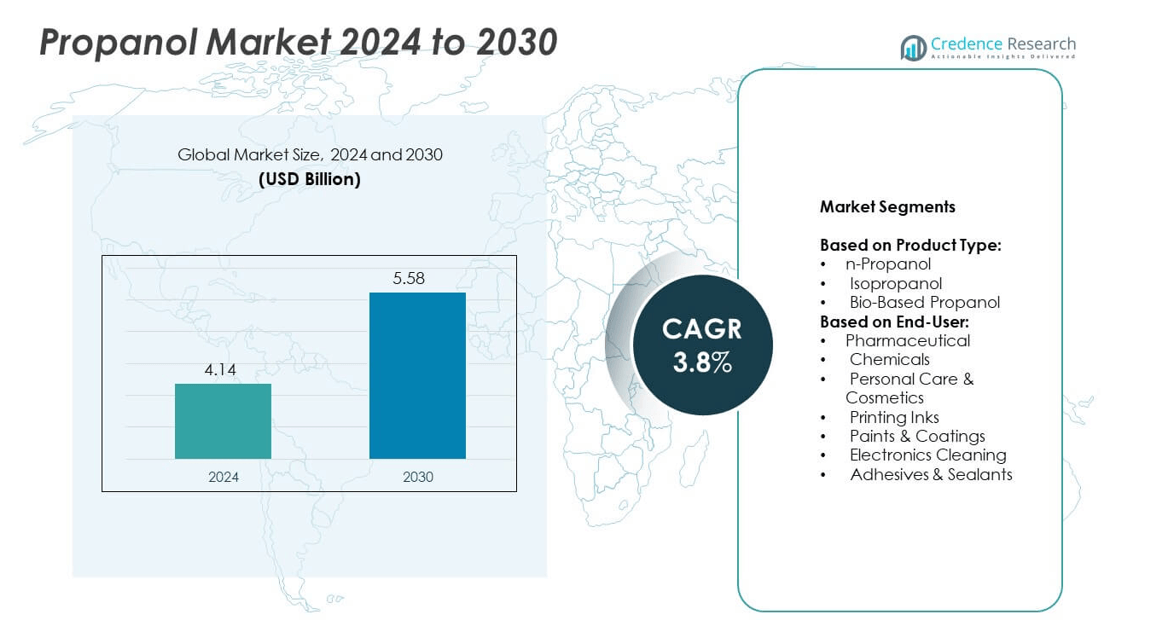

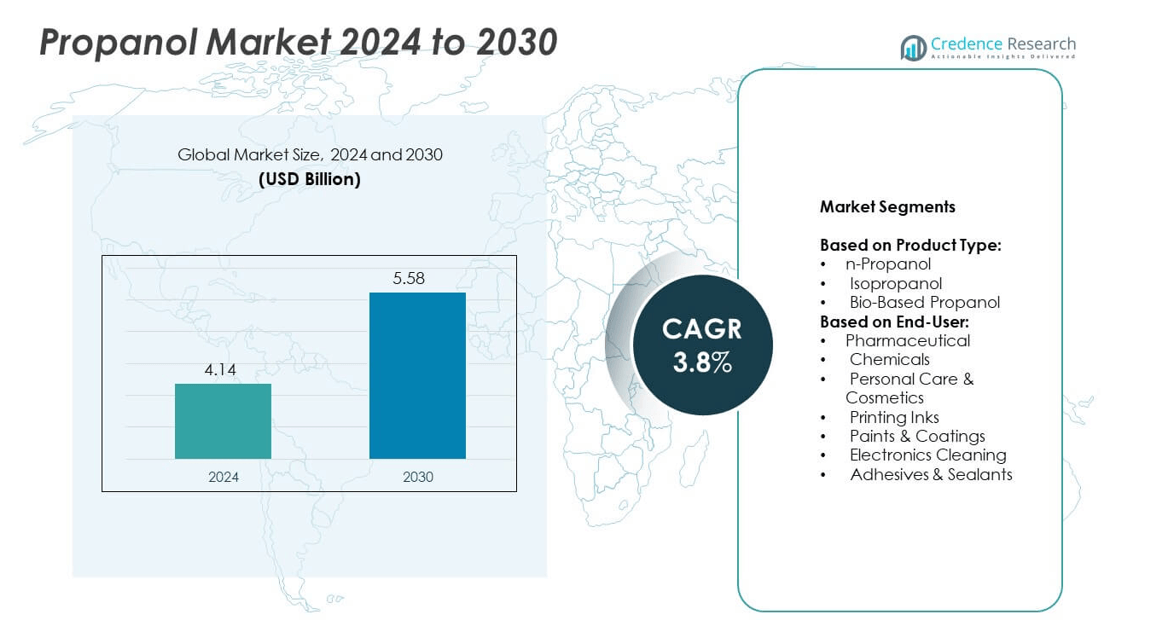

The Propanol Market size was valued at USD 4.14 Billion in 2024 and is expected to reach USD 5.58 Billion by 2032, growing at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Propanol Market Size 2024 |

USD 4.14 Billion |

| Propanol Market, CAGR |

3.8% |

| Propanol Market Size 2032 |

USD 5.58 Billion |

The Propanol market grows with rising demand from pharmaceuticals, paints, coatings, and personal care industries. It benefits from increasing use in sanitizers, electronics cleaning, and specialty chemicals. Growing focus on bio-based production supports sustainability goals and regulatory compliance. Expansion of industrial infrastructure and urbanization boosts solvent and adhesive consumption. Technological advancements in manufacturing improve efficiency and reduce costs. Digital monitoring and supply chain optimization ensure consistent quality and timely delivery, strengthening market competitiveness and long-term growth potential globally.

The Propanol market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with Asia-Pacific witnessing the fastest growth due to rapid industrialization and rising demand in pharmaceuticals, coatings, and electronics cleaning. North America and Europe remain key markets supported by advanced manufacturing and strict regulatory standards. Leading players include Dow Inc., BASF SE, Shell Chemicals, and Mitsui Chemicals Inc., who focus on innovation, capacity expansion, and sustainable production to strengthen their market position.

Market Insights

- The Propanol market was valued at USD 4.14 Billion in 2024 and is projected to reach USD 5.58 Billion by 2032, growing at a CAGR of 3.8% during the forecast period.

- Rising demand from pharmaceuticals, paints and coatings, and personal care sectors drives steady consumption globally.

- Growing focus on bio-based production and sustainable solvents aligns with regulatory goals and attracts eco-conscious industries.

- Competitive landscape features players such as Dow Inc., BASF SE, Shell Chemicals, Mitsui Chemicals Inc., and ExxonMobil, focusing on innovation and capacity expansion.

- Fluctuating raw material prices and stringent environmental regulations act as key restraints for market growth and profitability.

- North America leads in demand due to strong healthcare and coatings production, while Asia-Pacific records fastest growth driven by industrial expansion.

- Companies adopt digital monitoring and automation in production to ensure quality consistency, optimize supply chains, and improve market responsiveness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Pharmaceutical and Healthcare Sector

The Propanol market gains traction from increasing use in pharmaceutical manufacturing. It is widely used as a solvent in drug formulation and cleaning processes. Rising production of over-the-counter medicines and vaccines supports consistent demand. Pharmaceutical companies prefer propanol for its quick evaporation rate and low toxicity profile. Expanding healthcare infrastructure in emerging economies further strengthens market growth. It ensures reliable supply for pharmaceutical production and research facilities worldwide.

- For instance, OQ Chemicals announced a price increase of €150 per metric ton for n-propanol in Europe effective February 1, 2025

Rising Consumption in Paints, Coatings, and Industrial Applications

The Propanol market benefits from expanding paints and coatings production across automotive and construction sectors. It enhances drying time and improves adhesion properties, making coatings more efficient. Growth in infrastructure projects worldwide drives coating consumption. Industrial users adopt propanol for cleaning and degreasing operations in precision manufacturing. It also plays a key role in producing inks, adhesives, and specialty chemicals. The demand remains stable even during moderate fluctuations in raw material prices.

- For instance, Ningbo Juhua Chemical put a 1-propanol plant into operation in September 2023 with an annual capacity of 50 kilotons.

Increased Adoption in Personal Care and Cosmetics Formulations

The Propanol market sees rising adoption in personal care products such as perfumes, deodorants, and sanitizers. It helps achieve desired consistency and supports fragrance stability in formulations. Growing consumer spending on grooming and hygiene products drives consistent uptake. Global cosmetics brands use propanol to ensure product performance and safety compliance. It provides a balance between effective solubility and minimal residue. Market players invest in refining production processes to meet high-purity standards.

Technological Advancements and Production Capacity Expansion

The Propanol market benefits from advancements in production technologies aimed at energy efficiency. Modern plants optimize feedstock utilization and reduce operational costs. Companies expand capacity to meet increasing global demand and secure market position. It enables continuous supply for end-use sectors without disruption. Producers focus on sustainable manufacturing methods to reduce environmental impact. Strategic partnerships and regional investments strengthen distribution networks and improve customer reach.

Market Trends

Shift Toward Bio-Based and Sustainable Production Methods

The Propanol market observes a clear move toward bio-based production routes. Companies invest in renewable feedstocks to reduce carbon footprint and meet sustainability goals. It aligns with regulatory requirements promoting green chemistry practices. Bio-based propanol helps manufacturers cater to eco-conscious customers. Growing demand from industries adopting circular economy principles supports this transition. Producers focus on developing scalable processes to make bio-propanol cost competitive.

- For instance, Jiangsu Yongtaihua Chemical Co., Ltd. has an annual production capacity of 200,000 tonnes of isopropyl alcohol.

Rising Demand from Electronics and Specialty Chemical Sectors

The Propanol market experiences growth from its use in electronics manufacturing and specialty chemicals. It serves as a cleaning agent for circuit boards and precision components. Rising production of smartphones and consumer electronics boosts consumption. Specialty chemical makers use propanol as a key intermediate for various formulations. It improves efficiency in coatings and polymers designed for high-performance applications. Global expansion of electronics assembly units drives regional demand.

- For instance, Cepsa ( Moeve) is constructing Spain’s first isopropyl alcohol (IPA) plant with a planned capacity of 80,000 tonnes/year.

Expansion of Pharmaceutical and Sanitizer Applications

The Propanol market records steady adoption in pharmaceutical and hygiene products. Demand increased after higher awareness of infection control practices. It remains a preferred choice for surface disinfectants and sanitizing solutions. Pharmaceutical companies rely on propanol for consistent quality in drug manufacturing. It supports sterile environments critical for sensitive operations. Investments in healthcare infrastructure and R&D enhance future application scope.

Technological Integration and Supply Chain Optimization

The Propanol market benefits from adoption of digital monitoring and automation in production facilities. Advanced process controls help optimize yield and reduce waste. It allows producers to maintain consistent product quality and meet global standards. Supply chains improve through better logistics planning and inventory management systems. Companies integrate predictive analytics to anticipate demand fluctuations. This trend strengthens resilience and ensures timely product availability.

Market Challenges Analysis

Fluctuating Raw Material Prices and Supply Chain Constraints

The Propanol market faces pressure from volatility in propylene and other feedstock prices. It impacts production costs and reduces profit margins for manufacturers. Disruptions in global supply chains create delivery delays and inventory challenges. Import and export restrictions during geopolitical tensions further strain availability. Producers must manage pricing strategies carefully to remain competitive. It forces companies to secure long-term contracts or explore alternative sourcing options.

Stringent Environmental Regulations and Health Concerns

The Propanol market is challenged by strict regulations on volatile organic compound emissions. It requires producers to invest in compliance technologies and cleaner processes. Exposure risks demand strict workplace safety measures and monitoring systems. Regulatory shifts in key regions can increase operational costs unexpectedly. It limits growth opportunities for smaller manufacturers with fewer resources. Companies must adapt operations to maintain market access while meeting environmental goals.

Market Opportunities

Growth Potential in Emerging Economies and Industrial Expansion

The Propanol market holds significant opportunity in rapidly industrializing regions such as Asia-Pacific and Latin America. Expanding manufacturing hubs in China, India, and Brazil drive strong demand for solvents and intermediates. It supports sectors like automotive, construction, and packaging that rely on propanol-based applications. Rising urbanization and infrastructure development create long-term consumption prospects. Companies can benefit from establishing local production facilities to reduce logistics costs. It allows faster response to regional demand and strengthens supply security.

Innovation in Green Chemistry and High-Value Applications

The Propanol market can leverage opportunities from bio-based production and specialty chemical applications. Growing focus on sustainability encourages investment in low-carbon manufacturing technologies. It opens pathways to serve premium segments such as pharmaceuticals, electronics, and personal care. Development of high-purity grades enables use in critical formulations with strict quality standards. Partnerships with research institutions accelerate innovation and product differentiation. It positions market players to capture emerging demand in regulated and high-growth industries.

Market Segmentation Analysis:

By Product Type:

The Propanol market is segmented by product type into n-Propanol, isopropanol, and bio-based propanol. N-Propanol dominates demand due to its strong solvency power and wide use in coatings, inks, and cleaners. It is preferred in applications requiring quick evaporation and high-purity performance. Isopropanol holds significant share, driven by its use in pharmaceuticals, sanitizers, and electronics cleaning solutions. It benefits from strong demand in healthcare and semiconductor manufacturing. Bio-based propanol emerges as a key growth segment with rising focus on sustainable production methods. It helps companies meet regulatory compliance and appeal to environmentally conscious industries.

- For instance, INEOS’s 2024 environmental declaration mentions that the production facilities of INEOS Solvents Germany GmbH and INEOS Solvents Marl GmbH in Moers, Herne, and Marl have a total capacity exceeding 800,000 metric tons per year.

By End-User:

The Propanol market serves diverse sectors including pharmaceuticals, chemicals, personal care and cosmetics, printing inks, paints and coatings, electronics cleaning, and adhesives and sealants. The pharmaceutical segment leads adoption, supported by its use as a solvent in drug synthesis and medical disinfectants. It plays a vital role in producing sanitizers and cleaning solutions for sterile facilities. Chemicals account for steady consumption due to applications in intermediates and specialty chemical production. Personal care and cosmetics rely on propanol for fragrances, hair care, and deodorant formulations. Printing inks and paints & coatings sectors use propanol to improve viscosity control and drying speed. Electronics cleaning applications grow with expanding consumer electronics and PCB manufacturing. Adhesives and sealants benefit from propanol’s ability to enhance bonding performance and surface preparation. This diverse end-user base ensures balanced demand across industrial, commercial, and consumer markets, supporting stable growth prospects for producers worldwide.

- For instance, ISU Chemical reported 4,000–5,000 t/month IPA capacity, used for sanitizer supply.

Segments:

Based on Product Type:

- n-Propanol

- Isopropanol

- Bio-Based Propanol

Based on End-User:

- Pharmaceutical

- Chemicals

- Personal Care & Cosmetics

- Printing Inks

- Paints & Coatings

- Electronics Cleaning

- Adhesives & Sealants

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 35% share of the Propanol market, making it the largest regional contributor. Strong demand comes from pharmaceutical manufacturing, where propanol is used as a solvent and cleaning agent. It supports the production of drugs, vaccines, and sanitizing solutions in large-scale facilities across the United States and Canada. The paints and coatings sector also drives significant consumption, supported by infrastructure development and construction activities. It benefits from the presence of major coatings producers and a mature industrial base. Growth in electronics and semiconductor manufacturing, particularly in the U.S., creates additional demand for high-purity isopropanol used in cleaning processes. Regulatory focus on quality and safety standards keeps demand consistent, while local production ensures steady supply.

Europe

Europe accounts for 28% share of the Propanol market, supported by strong chemical manufacturing and strict environmental regulations. Major countries such as Germany, France, and the U.K. lead demand with extensive industrial production. It finds wide use in pharmaceuticals, personal care, and coatings industries that thrive across the region. The European Union’s push toward green and sustainable solvents is encouraging adoption of bio-based propanol. Stringent VOC regulations in paints and adhesives create opportunities for high-purity and eco-friendly grades. Growth in specialty chemicals and research facilities further strengthens market prospects. Local players invest in innovation to stay competitive and comply with evolving regulations.

Asia-Pacific

Asia-Pacific holds 30% share of the Propanol market and shows the fastest growth potential. Rising industrialization in China, India, and Southeast Asia fuels consumption across multiple sectors. It supports the production of paints, inks, adhesives, and pharmaceuticals needed for expanding urban populations. Rapid construction activity and infrastructure investments drive coatings and solvent demand. Local chemical producers scale up production capacity to meet both domestic and export requirements. The region also benefits from increasing electronics manufacturing, especially in China, South Korea, and Taiwan, which boosts demand for isopropanol in precision cleaning applications. Growing preference for cost-effective raw materials and rising R&D efforts make Asia-Pacific a competitive hub for propanol production.

Latin America

Latin America represents 5% share of the Propanol market, with growth concentrated in Brazil, Mexico, and Argentina. Demand is driven by paints and coatings for infrastructure projects and automotive manufacturing. It also serves chemical and pharmaceutical production hubs in Brazil and Mexico. Adoption in adhesives and printing inks is growing as packaging industries expand. The region faces supply chain challenges, but investments in local production are improving availability. It offers opportunities for international players to establish partnerships with distributors and strengthen regional presence. Rising consumer spending supports steady growth in personal care and hygiene product applications.

Middle East & Africa

Middle East & Africa account for 2% share of the Propanol market, making it the smallest but steadily expanding region. Demand is supported by construction, oil and gas, and chemicals sectors. It is used in coatings, cleaning agents, and chemical formulations required for infrastructure and industrial projects. Growth in pharmaceutical manufacturing, particularly in Gulf countries, adds to regional consumption. Local governments encourage diversification of chemical industries, which creates new opportunities for propanol suppliers. Improved trade networks and distribution channels support better product access across African markets. The region is expected to grow steadily as industrialization and healthcare investments expand.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tokuyama Corporation

- KH Chemicals

- Dow Inc.

- Mitsui Chemicals Inc.

- Solvay

- Sasol Limited

- Lyonellbasell

- Shell Chemicals

- BASF SE

- Dairen Chemical Corporation

- Eastman Chemical Company

- ExxonMobil

Competitive Analysis

The Propanol market is shaped by leading players including Tokuyama Corporation, KH Chemicals, Dow Inc., Mitsui Chemicals Inc., Solvay, Sasol Limited, Lyonellbasell, Shell Chemicals, BASF SE, Dairen Chemical Corporation, Eastman Chemical Company, and ExxonMobil. These companies focus on expanding production capacity and optimizing feedstock integration to secure cost advantages. Many invest in research and development to produce high-purity grades suitable for pharmaceutical and electronic applications. Strategic alliances and joint ventures help improve market reach and strengthen regional supply chains. Companies adopt sustainable manufacturing practices and explore bio-based propanol production to comply with tightening environmental regulations. Mergers and acquisitions remain a key strategy to consolidate market share and access advanced technologies. Players also emphasize digital monitoring and automation in production to maintain consistent product quality and operational efficiency. Expanding presence in high-growth regions such as Asia-Pacific and Latin America ensures proximity to end-users and reduces logistics costs. Competitive intensity remains high, driving continuous innovation and pricing strategies aimed at maintaining profitability. This dynamic landscape supports a balanced mix of global giants and regional suppliers contributing to steady market growth.

Recent Developments

- In 2025, Dow released its 2024 sustainability progress report, detailing efforts to reduce greenhouse gas emissions and invest in sustainable materials.

- In 2025, ExxonMobil is expanding its isopropyl alcohol (IPA) portfolio, announcing it will start producing 99.999% ultra-pure IPA at its Baton Rouge facility by 2027, supporting high-purity solvent needs for advanced tech manufacturing.

- In 2024, BASF company announced expansions for different product lines and locations, such as polymer dispersions in China, water-based dispersions in the Netherlands.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Propanol market will grow steadily with rising demand from pharmaceuticals and healthcare industries.

- Bio-based propanol production will gain momentum due to sustainability initiatives and regulatory support.

- Expansion of electronics manufacturing will boost demand for high-purity isopropanol in cleaning applications.

- Investments in advanced production technologies will enhance efficiency and lower operational costs.

- Rising construction and infrastructure projects will support consumption in paints, coatings, and adhesives.

- Global players will focus on capacity expansion to meet growing regional demand.

- Personal care and cosmetics applications will see higher adoption driven by premium product launches.

- Strategic collaborations will strengthen supply chain resilience and improve regional availability.

- Compliance with stricter environmental norms will drive innovation in eco-friendly formulations.

- Digitalization and process automation will improve quality control and market competitiveness.