Market Overview:

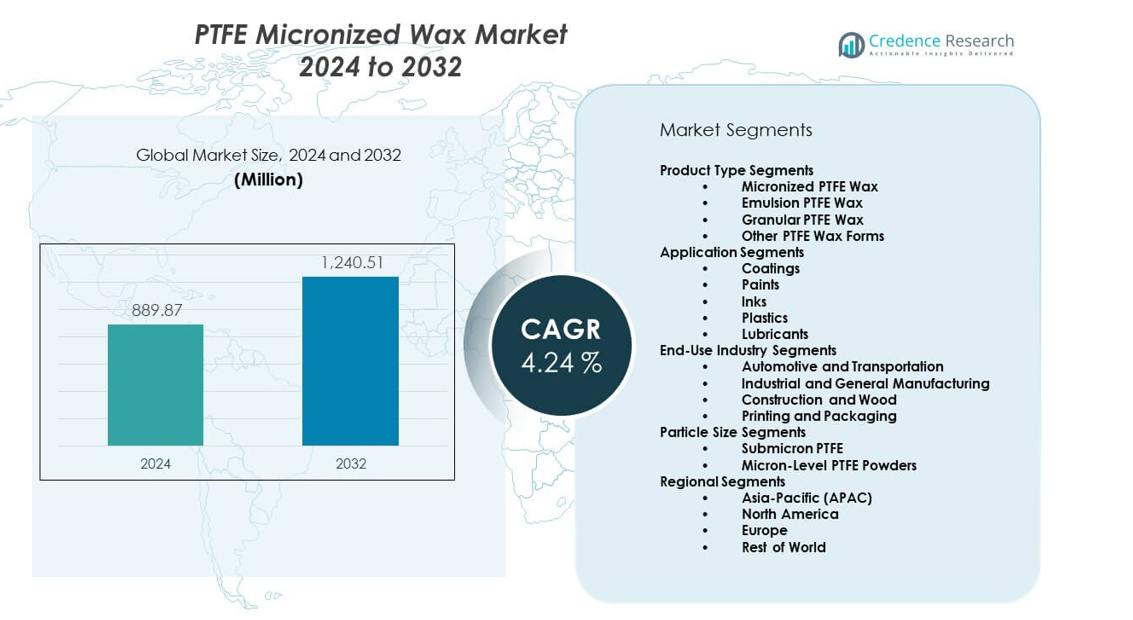

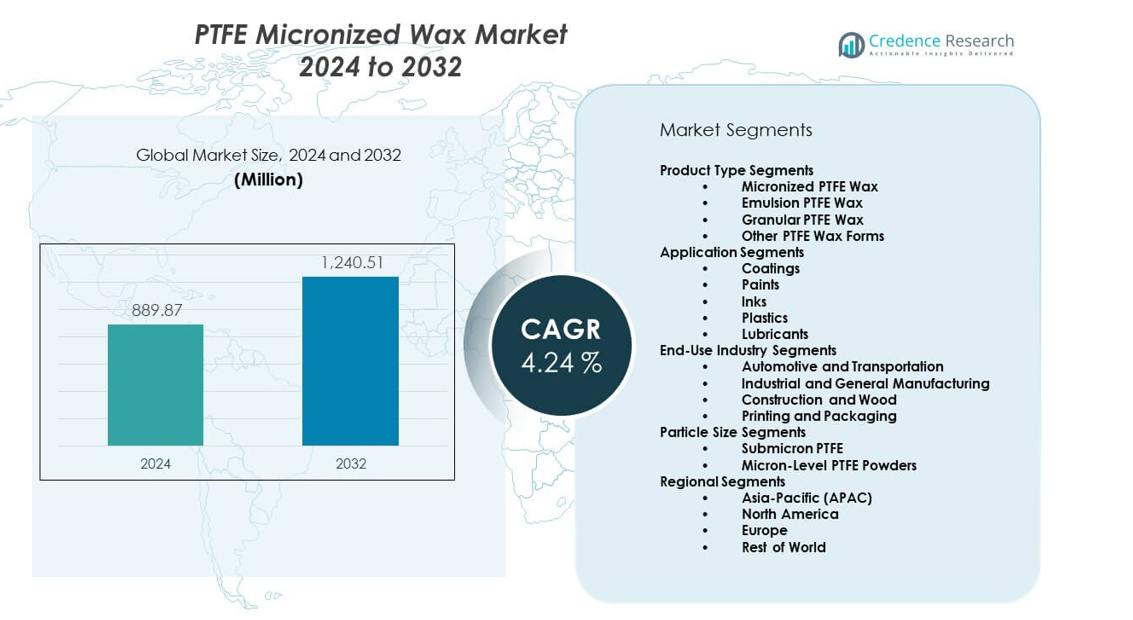

The PTFE Micronized Wax Market is projected to grow from USD 889.87 million in 2024 to an estimated USD 1,240.51 million by 2032, with a compound annual growth rate (CAGR) of 4.24% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PTFE Micronized Wax Market Size 2024 |

USD 889.87 million |

| PTFE Micronized Wax Market, CAGR |

4.24% |

| PTFE Micronized Wax Market Size 2032 |

USD 1,240.51 million |

Growing demand comes from coatings, engineered plastics, lubricants, and printing inks. Manufacturers prefer PTFE micronized wax because it improves wear resistance and surface gloss. It supports better anti-blocking behavior in films and enhances durability across high-use components. Producers adopt advanced micronization methods to deliver uniform particle sizes for stable performance. Automotive and electronics sectors use the material for tougher surfaces that handle friction. Packaging firms adopt it for smooth film processing. Rising focus on high-performance additives drives steady adoption across global industries.

North America leads due to strong coatings, automotive, and industrial production systems that rely on high-performance additives. Europe follows with wide acceptance across printing inks and engineered materials supported by strict quality norms. Asia Pacific emerges quickly as China, India, South Korea, and Southeast Asia expand manufacturing output and invest in advanced surface technologies. These countries boost adoption due to rising plastics production and fast growth in packaging and electronics. Latin America and the Middle East show gradual progress as local industries modernize material systems and improve product performance standards.

Market Insights:

- The PTFE Micronized Wax Market is valued at USD 889.87 million in 2024 and is projected to reach USD 1,240.51 million by 2032, registering a 24% CAGR driven by rising demand across coatings, plastics, inks, and lubricants.

- Asia Pacific (45–48%), North America (23–25%), and Europe (20–22%) hold the top regional shares due to strong manufacturing bases, strict quality requirements, and advanced coating technologies that support wide additive adoption.

- Asia Pacific stands as the fastest-growing region, supported by expanding automotive, electronics, and packaging industries that rely on high-performance PTFE additives for durable surfaces and efficient processing.

- Coatings segment leads the application landscape with about 40–45% share, driven by demand for friction control, scratch resistance, and stable surface performance.

- Submicron PTFE grades dominate the particle-size category with nearly 55–60% share due to their enhanced dispersion, improved surface finish, and strong use in premium coatings and digital printing systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Need for High-Performance Additives Across Coatings and Industrial Systems

The PTFE Micronized Wax Market grows through strong demand for surface protection across coatings and industrial products. Many users select the material for its friction control features that improve part durability. It supports enhanced scratch resistance in automotive and wood coatings. Manufacturers rely on uniform particle distribution to maintain consistent finish quality. The additive helps improve chemical resistance across harsh-use environments. Production teams adopt it to meet higher performance standards in protective layers. Strong focus on cleaner surfaces expands long-term demand. Wider use across commercial and industrial settings strengthens the global need for advanced wax additives.

- For instance, Micro Powders Inc. offers Polyfluo® or Fluo micropowders with particle sizes as fine as 3–6 microns, improving mar and abrasion resistance in high-performance coatings. Wider use across commercial and industrial settings strengthens the global need for advanced wax additives.

Growing Use in Plastics, Films, and Packaging Applications Driven by Quality Needs

The market gains steady traction through rising plastic and film production that requires controlled slip features. Many processors use PTFE micronized wax to improve mold release and reduce surface defects. It helps create smoother films used in food and industrial packaging. Resin makers depend on the additive to reduce wear in high-speed processing systems. Growing demand for durable films increases focus on controlled friction management. Producers choose PTFE grades that support better dispersion and long-term stability. Packaging firms upgrade formulations to meet stricter performance standards. Wider adoption across emerging factories strengthens the industrial relevance of the material.

- For instance, Shamrock Technologies supplies PTFE micropowders used in film processing that deliver COF reduction and improved abrasion resistance, enabled by engineered particle sizes in the 1–10 micron range.

Advancement in Micronization Technology Enhancing Product Consistency and Application Control

Technology upgrades improve material consistency and expand use across advanced industries. It benefits from micronization systems that create tight particle size ranges for predictable behavior. Many suppliers invest in precision milling to deliver highly stable performance across various substrates. Coating makers use the additive to control gloss and surface texture with higher accuracy. Strong focus on product uniformity supports usage in printing inks and engineered plastics. New grades help reduce abrasion damage in parts subject to repeated motion. Industrial firms seek reliable additives that support sustainability targets. The need for improved formulation control strengthens long-term demand.

Increasing Application in Electronics, Automotive, and High-Durability Manufacturing Lines

The market expands across sectors that need protective surfaces for complex components. It supports low-friction performance in electronics with rising device miniaturization. Automotive suppliers use the additive to reinforce coating durability on interior and exterior parts. Growing demand for premium finish quality encourages broader use across high-volume plants. Many producers adopt the wax to improve resistance to repeated handling. It helps strengthen wear properties in moving assemblies. New material grades support better bonding in advanced coatings. Strong industrial diversification elevates the strategic role of PTFE-based additives.

Market Trends:

Shift Toward Eco-Focused Formulations and Low-Emission Coating Technologies

The PTFE Micronized Wax Market observes a transition toward eco-focused production that supports lower emissions across coating lines. Many manufacturers develop grades optimized for water-based systems. It supports reduced VOC output in sectors with strict environmental rules. Coating suppliers integrate the additive into greener material portfolios. Demand rises for high-performance waxes that align with global sustainability goals. New formulations help maintain durability without harming environmental compliance. Packaging and wood finishing sectors adopt low-impact grades for broader use. This shift pushes suppliers to expand innovation across cleaner product lines.

Rising Focus on Ultra-Fine Particle Engineering for Advanced Industrial Applications

The market moves toward ultra-fine particle design to meet strict performance targets. It supports improved texture control across premium coatings and inks. New processing tools help create narrower particle distributions for better stability. Industrial users demand consistent performance for complex manufacturing tasks. Electronics and precision components rely on finer grades for friction control. The trend encourages suppliers to refine milling and classification technology. Several industries use the material to enhance micro-surface protection. The push for controlled particle engineering expands high-value product tiers.

- For instance, 3M™ Dyneon™ PTFE Micropowders offer median particle sizes under 10 microns and maintain performance up to 260°C, supporting electronics and precision coating applications that require engineered ultra-fine powders.

Growing Integration in High-Speed Printing, Flexible Packaging, and Digital Ink Systems

The market expands in printing and packaging through strong demand for smooth and durable surfaces. It supports rub resistance and controlled slip behavior in digital inks. Many printers rely on the additive to improve run quality in high-speed lines. Packaging makers need stable performance under fast film movement. It enhances abrasion resistance across labels and flexible pouches. The trend gains strength as e-commerce pushes packaging innovations. Ink formulators adopt new grades to improve drying behavior. Growing output across packaging ecosystems drives further adoption.

Increased Adoption in Metal Processing, Lubricant Systems, and Wear-Resistant Compounds

Industrial sectors integrate PTFE micronized wax to enhance lubrication and wear resistance. It helps protect metal surfaces during high-friction tasks. Many producers use it to improve performance in specialty greases. Metalworking fluids adopt the additive to reduce surface damage. It supports smoother tool movement across machining lines. Rising need for long-lasting components drives new demand. The trend connects with broader automation growth. Industrial upgrades strengthen long-term material adoption across large facilities.

Market Challenges Analysis:

High Production Costs, Complex Processing Needs, and Rising Pressure on Raw Material Systems

The PTFE Micronized Wax Market faces high cost levels linked to complex processing needs. It requires specialized tools that increase operational load on manufacturers. Many users seek stable supply chains, yet raw material constraints create risk. Producers manage strict quality control steps that raise expenses. Several industries hesitate to adopt premium grades due to budget limits. Competing additives challenge market penetration in cost-sensitive sectors. Manufacturers work to improve yields while protecting technical performance. Scaling production remains a significant barrier for new suppliers entering global networks.

Regulatory Pressures, Compatibility Issues, and Technical Barriers Across Multiple Application Fields

The market encounters strict regulatory demands across coatings, plastics, and food-contact surfaces. It must align with evolving standards that differ across regions. Many formulators face challenges when blending PTFE wax with complex chemistries. It can present dispersion issues in certain systems if not processed correctly. Compatibility gaps delay adoption in new application fields. Suppliers invest in testing methods to address performance limitations. Several industries demand higher safety assurance for long-term use. These factors influence product development cycles and slow broader adoption.

Market Opportunities:

Expanding Use in High-Value Coatings, Engineering Plastics, and Precision Manufacturing Lines

The PTFE Micronized Wax Market holds strong opportunities across premium industrial systems. It supports advanced coatings that require strict surface durability. Many engineering plastics gain value from controlled friction performance. The material strengthens use in electronics, automotive trims, and packaging films. New manufacturing lines adopt the additive for higher output quality. Demand rises across sectors seeking long-term part reliability. It creates openings for suppliers focused on quality-driven customization. Growth opportunities widen with new industrial modernization projects worldwide.

Innovation in Eco-Friendly Grades, Surface Engineering, and High-Performance Micronization

The market benefits from innovation that targets sustainability and precision engineering. It supports cleaner production techniques that reduce emissions. Many producers develop grades for water-based coatings and low-toxicity systems. Advanced milling tools help create consistent particle structures. It enhances adoption across printing inks and flexible packaging. New applications in metal finishing unlock fresh commercial potential. Suppliers focused on technology-driven upgrades gain a competitive advantage. Continuous innovation strengthens the long-term growth landscape.

Market Segmentation Analysis:

Product Type Overview

The PTFE Micronized Wax Market shows strong use of micronized PTFE wax due to its fine particle structure and reliable performance across coatings and plastics. Emulsion PTFE wax gains traction in water-based systems that require stable dispersion. Granular PTFE wax supports durable industrial applications where higher melt strength is needed. Other PTFE wax forms serve niche uses across specialized formulations. Each product type supports unique performance needs and strengthens adoption across multiple industries seeking wear and scratch resistance.

Application Assessment

Coatings remain the dominant segment due to demand for abrasion resistance and controlled slip features. Paints and inks rely on PTFE wax to achieve smoother surfaces and stronger rub resistance. Plastics integrate the additive to improve mold release and reduce friction across moving parts. Lubricants use PTFE grades to enhance long-term stability in machinery. It supports consistent performance across high-stress applications that require durable surface modification.

- For instance, Chemours Zonyl™ MP PTFE micropowders enhance lubricity and reduce wear in plastics and elastomers, backed by controlled particle sizes around 5–10 microns, enabling stable dispersion across molded and extruded parts.

End-Use Industry Evaluation

Automotive and transportation sectors lead due to high reliance on OEM coatings, refinish layers, and lubricant systems. Industrial and general manufacturing adopt PTFE wax to reinforce protective coatings and metal packaging inks. Construction and wood coatings gain value from stronger weatherability and mar resistance. Printing and packaging use the additive for smoother overprint varnishes and improved label durability.

Particle Size Dynamics

Submicron PTFE grades drive growth with strong demand for finer surface quality and enhanced scratch resistance. Nanosized options broaden use across premium coatings and high-performance inks. Micron-level powders remain important for applications that require controlled slip and stable dispersion. Each particle size category supports different performance goals across expanding industrial needs.

Segmentation:

Product Type Segments

- Micronized PTFE Wax

- Emulsion PTFE Wax

- Granular PTFE Wax

- Other PTFE Wax Forms

Application Segments

- Coatings

- Paints

- Inks

- Plastics

- Lubricants

End-Use Industry Segments

- Automotive and Transportation

- Industrial and General Manufacturing

- Construction and Wood

- Printing and Packaging

Particle Size Segments

- Submicron PTFE

- Micron-Level PTFE Powders

Regional Segments

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific Leading Position

The PTFE Micronized Wax Market records the highest share in Asia Pacific, holding roughly 48% of global demand. Strong manufacturing bases in China, India, South Korea, and Southeast Asia drive large-scale consumption across coatings, plastics, and packaging. It benefits from rapid industrialization that supports wider use of high-performance additives. Regional producers expand capacity to serve fast-growing automotive and electronics sectors. Strong export activity strengthens product movement across supply chains. Rising investment in premium coatings supports long-term market leadership in the region.

North America Growth Outlook

North America maintains a market share of about 25%, driven by advanced industrial production and strict quality standards. The region adopts PTFE micronized wax across automotive coatings, industrial lubricants, and high-performance inks. It benefits from a mature coatings ecosystem that prioritizes durability and friction control. Strong R&D capabilities encourage adoption of new particle-size innovations. Manufacturers rely on PTFE additives to support premium finish requirements across consumer and industrial goods. Demand grows steadily as end users upgrade to high-efficiency formulations.

Europe and Rest of World Expansion

Europe accounts for roughly 22% of the global market, supported by strict environmental rules and high adoption of water-based coatings. The region values PTFE wax for scratch resistance and gloss control in automotive, wood, and architectural coatings. It gains demand from packaging inks and engineered plastics used in industrial goods. Latin America and the Middle East & Africa together hold about 10% share, driven by expanding construction and industrial activity. These regions show rising interest in durable coatings, protective finishes, and printing applications. Growing investment in local manufacturing strengthens long-term opportunity spaces across emerging economies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Sasol

- Honeywell International Inc.

- Lubrizol Corporation

- Clariant

- MÜNZING

- Sika AG

- Westlake Corporation

- 3M

- The Chemours Company

- DAIKIN INDUSTRIES, Ltd.

- AGC Chemicals

- Syensqo

- Shamrock Technologies Inc.

- Micro Powders Inc. (MPI)

- DEUREX AG

- Nanjing Tianshi New Material

- Shanghai Jiao’er Wax

- Jiangxi Longhai Chemical

Competitive Analysis:

The PTFE Micronized Wax Market features strong competition among global chemical players, fluoropolymer specialists, and micronized wax producers. Leading companies expand portfolios with specialized grades that support coatings, inks, plastics, and lubricant applications. It gains competitive momentum through advances in micronization technology and improved dispersion control. Global suppliers focus on product purity, particle size stability, and application-specific performance. Smaller producers strengthen regional presence with cost-efficient offerings. Strategic partnerships help companies secure raw materials and scale production. Continuous innovation shapes competitive positioning across high-value industries.

Recent Developments:

- BASF announced a strategic partnership focused on enzyme and polymer innovation. In October 2025, BASF announced a strategic collaboration with International Flavors & Fragrances Inc. (IFF) to accelerate the development of next-generation enzyme and polymer technologies for fabric, dish, personal care, and industrial cleaning applications. This collaboration aims to develop high-performance, sustainable solutions combining BASF’s advanced chemical capabilities with IFF’s expertise in biotechnology and protein engineering. The partnership focuses on innovative enzyme systems and biobased polymers, enabling customers to achieve superior performance while reducing resource consumption.

- Clariant launched Ceridust 1310, an innovative wax solution in April 2025. In April 2025, Clariant announced the launch of Ceridust 1310, a micronised rice bran wax-based blend designed to address increasing supply chain complexities in the printing ink industry. This product provides formulators with reliable alternatives to carnauba wax, which faces seasonal harvesting limitations and labour-intensive collection processes. Ceridust 1310 works effectively in common systems at low dosage levels (0.2–1% for printing inks) and offers scratch and abrasion resistance properties for industrial coatings and printing inks applications.

- Sasol introduced lower-carbon wax products with significant environmental improvements. In February 2025, Sasol Chemicals expanded its product line of micronised waxes with the launch of SASOLWAX LC Spray 30 G and LC Spray 30 G-EF. These innovative products achieve a 32% reduction in Product Carbon Footprint (PCF) compared to Sasol’s existing Spray 30 G and 30-EF offerings. This advancement resulted from enhancements to the Gas-to-Liquid Fischer-Tropsch manufacturing process. The products deliver exceptional surface protection, slip resistance, rub resistance, and gloss control for inks, paints, and coatings applications, allowing manufacturers to create high-quality products while significantly decreasing CO2 emissions. Additionally, in August 2024, Sasol introduced SASOLWAX LC100, an industrial wax grade with a 35% lower carbon footprint for packaging adhesives.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, End-Use Industry, Particle Size, and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand will grow across coatings and packaging applications with rising quality needs.

- Water-based formulations will gain traction due to tighter environmental rules.

- Submicron PTFE powders will expand in high-performance coatings and digital inks.

- Producers will invest in advanced micronization to improve particle uniformity.

- Automotive and electronics sectors will drive adoption of durable surface modifiers.

- Manufacturers will strengthen supply chains to support global distribution growth.

- New PTFE blends will enter plastics and lubricant applications for better stability.

- Regulatory shifts will influence formulation strategies across major regions.

- Local production in APAC will expand to serve fast-growing industries.

- Innovation will remain central to competitive differentiation and long-term value.