Market Overview

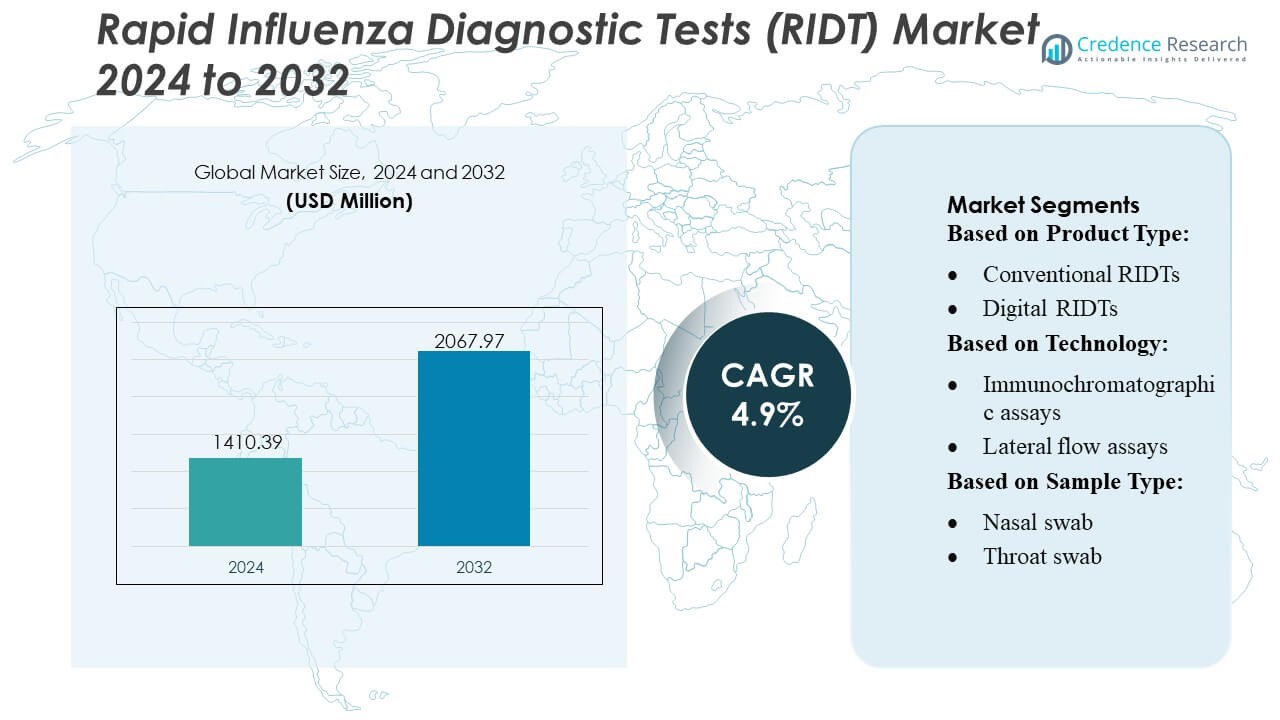

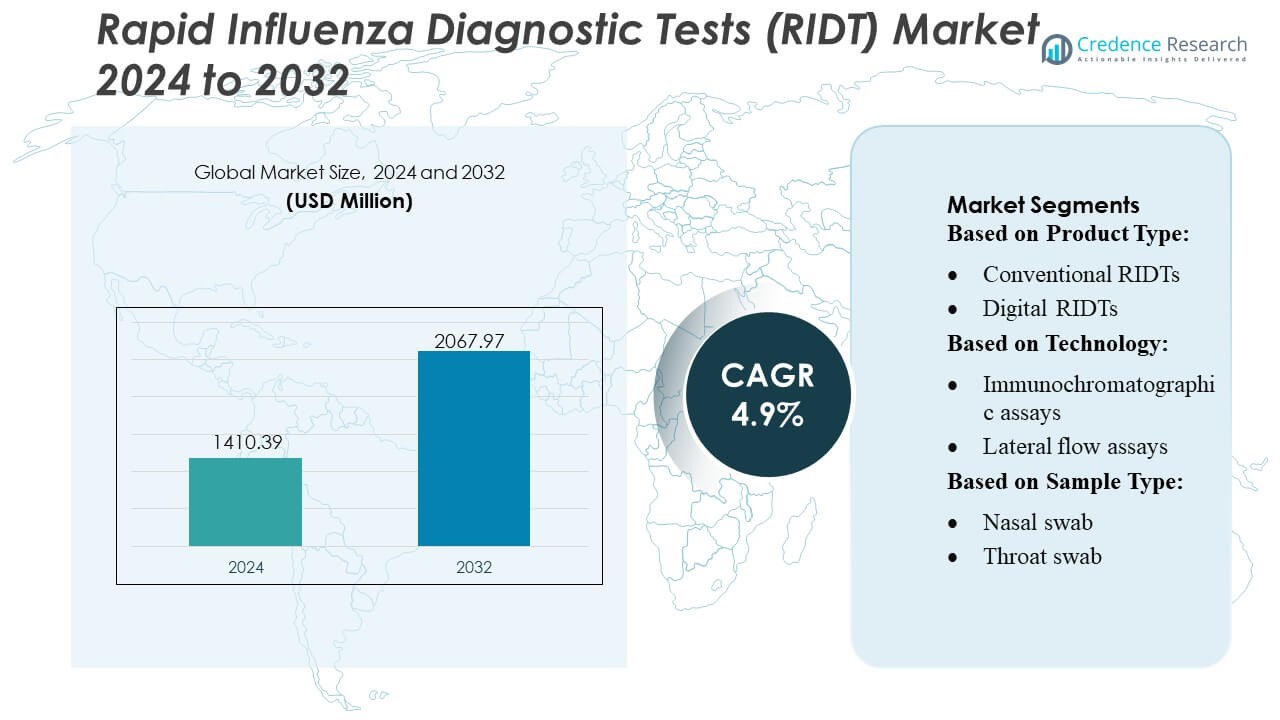

Rapid Influenza Diagnostic Tests (RIDT) Market size was valued USD 1410.39 million in 2024 and is anticipated to reach USD 2067.97 million by 2032, at a CAGR of 4.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rapid Influenza Diagnostic Tests (RIDT) Market Size 2024 |

USD 1410.39 Million |

| Rapid Influenza Diagnostic Tests (RIDT) Market, CAGR |

4.9% |

| Rapid Influenza Diagnostic Tests (RIDT) Market Size 2032 |

USD 2067.97 Million |

The Rapid Influenza Diagnostic Tests (RIDT) Market features strong competition among leading diagnostic manufacturers that focus on rapid antigen detection technologies, digital reader–based platforms, and decentralized testing solutions. These companies strengthen their portfolios through high-sensitivity assays, multiplex respiratory panels, and point-of-care kits designed for hospitals, retail clinics, and home testing. Continuous R&D investment, regulatory approvals, and expanded distribution networks enhance their market presence. North America leads the global RIDT market with an exact 38% share, supported by advanced healthcare infrastructure, high testing volumes, and strong adoption of connected diagnostic systems that improve influenza surveillance and clinical decision-making.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market was valued at USD 1410.39 million in 2024 and is projected to reach USD 2067.97 million by 2032, advancing at a 4.9% CAGR during the forecast period.

- Market growth is driven by rising influenza incidence, strong adoption of point-of-care screening, and increasing demand for rapid, high-accuracy antigen detection kits across hospitals and retail clinics.

- Key trends include the expansion of digital reader–based RIDTs, development of multiplex respiratory panels, and broader availability of home and OTC rapid influenza tests.

- Competitive activity intensifies as companies enhance assay sensitivity, pursue regulatory approvals, and expand distribution networks for decentralized testing environments.

- North America leads with a 38% share, while digital rapid tests capture a growing segment share globally; Asia-Pacific follows with rising adoption supported by expanding diagnostic infrastructure and seasonal outbreak management needs.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The Rapid Influenza Diagnostic Tests (RIDT) Market is led by conventional RIDTs, capturing an estimated 58% share due to their low cost, broad clinical adoption, and ability to deliver results within 10–15 minutes at point-of-care settings. Hospitals and urgent-care centers favor these kits for high-volume seasonal testing, supporting their continued dominance. Digital RIDTs gain traction as integrated readers improve result accuracy and reduce user-dependent interpretation errors. Adoption rises in clinics implementing connectivity-enabled devices that support electronic health record integration and remote infectious-disease monitoring, but their higher cost limits immediate large-scale uptake.

- For instance, Thermo Fisher Scientific’s Accula™ Flu A/Flu B test integrates RT-PCR technology into a portable, palm-sized platform and typically delivers confirmed results in 30 minutes, while its instrumentation supports automated onboard controls and digital readouts that significantly reduce manual variability associated with visual interpretation tests.

By Technology

Immunochromatographic assays dominate the market with an approximate 52% share, driven by their rapid turnaround time, simplified workflows, and compatibility with decentralized testing environments. These assays remain the standard for frontline influenza screening in community healthcare centers. Lateral flow assays expand in outpatient and pharmacy-based testing owing to ease of use, while PCR-based RIDTs experience strong growth as molecular platforms achieve faster processing times under 20 minutes with higher sensitivity. Increased development of multiplex molecular panels and automated cartridge-based systems further accelerates adoption across high-acuity care settings.

- For instance, SEKISUI Diagnostics’ OSOM® Ultra Flu A&B test is an instrument-free, rapid immunoassay that delivers visual results in 10 minutes and incorporates a proprietary monoclonal antibody system designed to improve antigen binding affinity.

By Sample Type

Nasal swabs hold the leading position with nearly 64% market share, supported by higher viral load recovery, better diagnostic sensitivity, and widespread clinical guideline recommendations for influenza testing. Their non-invasive collection method makes them preferred in pediatric and adult populations, driving consistent demand across hospitals and ambulatory centers. Throat swabs maintain niche use but face lower sensitivity constraints, limiting broader adoption. Other sample types, including nasopharyngeal aspirates and washes, remain relevant in specialized diagnostic labs where enhanced detection accuracy is required, particularly for severe infections or immunocompromised patient assessments.

Key Growth Drivers

- Rising Global Influenza Burden and Demand for Rapid Detection

The increasing incidence of seasonal and pandemic influenza strongly drives demand for Rapid Influenza Diagnostic Tests (RIDTs), as healthcare providers prioritize early detection to reduce transmission and complications. High patient influx in outpatient clinics, urgent care centers, and emergency departments accelerates adoption of fast point-of-care screening. Clear benefits such as rapid turnaround time, simplified sampling, and immediate clinical decision-making enhance market penetration. Government-led influenza surveillance programs and vaccination campaigns further reinforce the need for quick, reliable diagnostic tools to manage annual influenza spikes.

- For instance, F. Hoffmann-La Roche Ltd reports that its cobas® Liat® Influenza A/B assay provides fully automated RT-PCR results in 20 minutes, with an onboard sample preparation system processing swab specimens using a closed-tube architecture that minimizes contamination risk and supports a hands-on time of less than 1 minute.

- Technological Advancements Enhancing Diagnostic Accuracy

Advances in immunochromatographic assays, digital readers, and molecular amplification technologies significantly improve the sensitivity and specificity of RIDTs. Manufacturers focus on developing platforms that deliver near-PCR accuracy while maintaining point-of-care usability, enabling better identification of influenza A and B strains. Integration of digital analyzers minimizes human interpretation errors and supports data connectivity for clinical decision support. Continuous R&D investments, improved antigen detection materials, and enhanced reagent stability expand clinical confidence in RIDTs, driving broader adoption across hospitals, pharmacies, and decentralized testing sites.

- For instance, Abbott Laboratories reports that its ID NOW™ Influenza A & B 2 assay uses isothermal nucleic-acid amplification to deliver confirmed results in 13 minutes, with positive detections often flagged in under 6 minutes, and its portable instrument executes automated internal control checks at each run to maintain analytical integrity.

- Expansion of Decentralized and Home-Based Testing

Growing adoption of decentralized testing models propels the market as patients increasingly rely on rapid tests outside traditional healthcare settings. The expansion of retail clinics, home-based diagnostics, and OTC test availability strengthens accessibility and encourages early testing behavior. Rising consumer awareness of self-screening post-COVID-19 supports acceptance of intuitive RIDTs with simple sampling methods. Manufacturers innovate compact, user-friendly kits that deliver instant results and meet regulatory standards, accelerating market growth. This shift toward convenient, distributed testing ecosystems complements telehealth services and boosts overall RIDT consumption.

Key Trends & Opportunities

- Rising Integration of Digital and Connected Diagnostic Platforms

A major trend centers on the development of digitally connected RIDT systems that capture, store, and transmit diagnostic data in real time. These platforms support automated result interpretation, improving clinical accuracy while enabling remote monitoring and influenza surveillance. Connectivity with electronic health records and public health databases enhances outbreak tracking and resource allocation. The trend presents opportunities for manufacturers to integrate artificial intelligence, smartphone-based readers, and cloud-linked solutions, strengthening the role of RIDTs in precision diagnostics and population-level infection monitoring.

- For instance, Meridian Bioscience, Inc. offers the Alethia® molecular platform, which digitally archives assay run data and delivers influenza A/B results in approximately 1 hour via loop-mediated isothermal amplification (LAMP).

- Growing Opportunity in Pharmacies and Retail Clinics

The rapid expansion of retail healthcare infrastructure creates strong commercial opportunities for RIDTs. Pharmacies and walk-in clinics increasingly offer influenza screening as part of point-of-care diagnostic services. Their high accessibility, extended operating hours, and lower consultation costs attract patients seeking immediate testing. As regulatory agencies continue to support pharmacist-led diagnostic protocols, the demand for compact, fast-read RIDTs rises. This shift opens avenues for manufacturers to collaborate with retail chains, co-develop workflow-optimized test kits, and expand market reach in urban and suburban areas.

- For instance, Hologic, Inc. provides the Panther Fusion® Flu A/B/RSV assay, which processes samples using fully automated PCR with results in 2.5 hours and features continuous sample loading of up to 120 specimens, enabling pharmacies and clinic networks to scale influenza testing throughput while maintaining traceable digital reporting across interconnected sites.

- Development of Multiplex and Multi-Pathogen Test Panels

A key opportunity emerges from rising demand for multiplex assays capable of detecting influenza alongside RSV, SARS-CoV-2, and other respiratory pathogens in a single test. Healthcare systems favor these panels for their efficiency, comprehensive diagnostic output, and reduced resource burden. Combining multiple analytes boosts clinical decision-making accuracy and aligns with respiratory season variability. Manufacturers investing in compact, multi-target RIDTs stand to gain significant competitive advantage, especially in acute care settings and high-volume testing environments.

Key Challenges

- Limited Sensitivity Compared to Molecular Diagnostics

Despite improvements, many conventional RIDTs still exhibit lower sensitivity relative to molecular assays, especially during early infection stages or low viral load conditions. This limitation increases the risk of false negatives, affecting clinical decision accuracy and leading some institutions to rely on confirmatory PCR tests. Variability in specimen collection quality further impacts test performance. These challenges restrict RIDT adoption in high-risk clinical settings, compelling manufacturers to invest in enhanced reagent chemistry, digital readers, and hybrid platforms to improve diagnostic reliability.

- Regulatory Compliance and Performance Standard Pressures

Strengthening global regulatory frameworks, including stricter accuracy requirements and quality validation protocols, pose challenges for manufacturers. Compliance with updated performance benchmarks, emergency-use authorizations, and post-market surveillance demands increases development costs and timelines. Smaller companies face greater barriers in meeting analytical sensitivity standards and ensuring consistency across production batches. Additionally, rapid technology evolution requires continuous upgrades to maintain regulatory alignment. These pressures complicate market entry and long-term competitiveness, especially for emerging players in the diagnostic testing ecosystem.

Regional Analysis

North America

North America holds the dominant position in the Rapid Influenza Diagnostic Tests (RIDT) Market with an estimated 38% share, supported by advanced healthcare infrastructure, strong adoption of decentralized testing, and robust influenza surveillance programs. High testing volumes in hospitals, urgent care centers, and retail clinics amplify product demand, while favorable reimbursement structures encourage widespread clinical use. The region benefits from strong regulatory oversight, rapid technology uptake, and sustained R&D investments that enhance diagnostic accuracy. Rising awareness of self-testing and integration of digital reader-based rapid kits further strengthen market expansion across the United States and Canada.

Europe

Europe accounts for approximately 27% of the RIDT market, driven by coordinated public health policies, high influenza vaccination coverage, and strong emphasis on early respiratory infection detection. Countries such as Germany, the U.K., and France lead adoption due to well-established diagnostic networks and increasing penetration of digital rapid testing platforms. Seasonal flu outbreaks and aging populations contribute to elevated testing demand. The region’s focus on high-performance diagnostics and stringent quality standards fuels manufacturer innovation. Expanding pharmacy-led point-of-care testing programs and improved reimbursement pathways support continued market growth across Western and Eastern Europe.

Asia-Pacific

Asia-Pacific captures nearly 24% of the RIDT market, supported by rising influenza prevalence, expanding diagnostic infrastructure, and rapid urbanization. Major markets such as China, Japan, South Korea, and India invest heavily in rapid testing platforms to address high population density and seasonal outbreak risks. Growing awareness of early diagnosis, increased healthcare expenditure, and government surveillance programs accelerate adoption across primary care and community-level facilities. Manufacturers benefit from strong demand for low-cost, high-throughput RIDTs tailored to diverse clinical settings. The region’s large patient base and evolving retail clinic models continue to expand market penetration.

Latin America

Latin America represents roughly 7% of the RIDT market, driven by increasing emphasis on infectious disease management and rising influenza testing rates across Brazil, Mexico, Argentina, and Chile. Growth accelerates as governments strengthen respiratory illness surveillance and improve diagnostic accessibility across public and private healthcare facilities. Urban hospitals lead adoption, while community clinics gradually expand usage of rapid immunochromatographic tests. Limited laboratory infrastructure in rural areas increases reliance on affordable point-of-care RIDTs. Economic constraints remain a challenge, yet expanded procurement programs and partnerships with international diagnostic companies support steady market development.

Middle East & Africa

The Middle East & Africa region accounts for an estimated 4% share, reflecting gradual improvements in healthcare capacity and growing awareness of influenza screening. Gulf countries such as Saudi Arabia and the UAE invest in advanced diagnostic technologies and expand rapid testing capabilities across hospitals, airports, and occupational health facilities. In Africa, demand is driven by the need for affordable, easy-to-use RIDTs due to limited molecular testing infrastructure. International health initiatives support distribution in primary clinics, while increasing private-sector investment accelerates adoption. However, budget limitations and supply-chain inconsistencies moderate overall market growth.

Market Segmentations:

By Product Type:

- Conventional RIDTs

- Digital RIDTs

By Technology:

- Immunochromatographic assays

- Lateral flow assays

By Sample Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Rapid Influenza Diagnostic Tests (RIDT) Market players such as Thermo Fisher Scientific, Inc., SEKISUI Diagnostics, F. Hoffmann-La Roche Ltd, Abbott Laboratories, Meridian Bioscience, Inc., Hologic, Inc., Quidel Corporation, SA Scientific Ltd, Becton, Dickinson and Company (BD), and 3M Company. the Rapid Influenza Diagnostic Tests (RIDT) Market is defined by continuous advancements in rapid antigen detection technologies, expanding point-of-care testing capabilities, and increasing integration of digital diagnostic platforms. Companies focus on improving test sensitivity, enabling faster clinical decisions, and supporting large-scale influenza surveillance programs. Product differentiation centers on enhanced assay accuracy, user-friendly formats, and compatibility with decentralized testing environments such as pharmacies, urgent care centers, and home settings. Robust R&D investments, regulatory approvals for next-generation rapid kits, and strategic collaborations with healthcare providers strengthen market positioning. As respiratory disease management evolves, manufacturers prioritize scalable production, expanded distribution channels, and data-connected solutions to meet global demand.

Key Player Analysis

- Thermo Fisher Scientific, Inc.

- SEKISUI Diagnostics

- Hoffmann-La Roche Ltd

- Abbott Laboratories

- Meridian Bioscience, Inc.

- Hologic, Inc.

- Quidel Corporation

- SA Scientific Ltd

- Becton, Dickinson and Company (BD)

- 3M Company

Recent Developments

- In October 2024, the FDA approved the Healgen Rapid Check COVID-19/Flu A&B Antigen Test for marketing. This at-home test, which uses a nasal swab, can detect both COVID-19 and influenza A & B. It’s available without a prescription and delivers results in just 15 minutes. This is the first over-the-counter flu test to receive marketing authorization outside of emergency use.

- In June 2024, NIH through its RADx Tech Independent Test Assessment Program (ITAP), worked with diagnostic manufacturers to speed up the review and approval of multiplex tests that detect both COVID-19 and flu A/B. This effort aims to increase the availability of rapid, point-of-care (POC), and at-home tests, which are essential for quick diagnosis and treatment.

- In May 2024, Danaher collaborated with John Hopkins University to develop new methods to diagnose Traumatic Brain Injury. The scientists at the John Hopkins University would focus on evaluating new blood-based biomarkers leveraging highly sensitive technology from Beckmann Coulter.

- In March 2024, Co-Diagnostics, Inc.’s joint venture, CoSara, received approval from Indian regulators for its Influenza Multiplex PCR Test. This test can detect multiple influenza strains at the same time, making it a more efficient diagnostic tool for healthcare providers. This approval is a significant step toward improving access to advanced diagnostic testing in India.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Sample Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as healthcare systems prioritize fast, accurate detection of seasonal and pandemic influenza.

- Adoption of digital and reader-based RIDTs will increase to improve interpretation accuracy and data connectivity.

- Multiplex respiratory panels will gain traction as clinicians prefer single-sample detection of multiple pathogens.

- Home-based and OTC rapid influenza tests will see strong growth driven by rising self-diagnosis trends.

- Pharmacies and retail clinics will play a larger role in influenza testing through point-of-care expansion.

- Manufacturers will invest in higher-sensitivity assays to compete with molecular testing alternatives.

- Governments will strengthen influenza surveillance programs, driving higher test procurement volumes.

- Emerging markets will accelerate adoption as diagnostic infrastructure and awareness improve.

- Strategic collaborations between diagnostic developers and healthcare networks will increase.

- Sustainability and cost-efficient production will become important as demand shifts toward mass-market rapid kits.

Market Segmentation Analysis:

Market Segmentation Analysis: