Market Overview

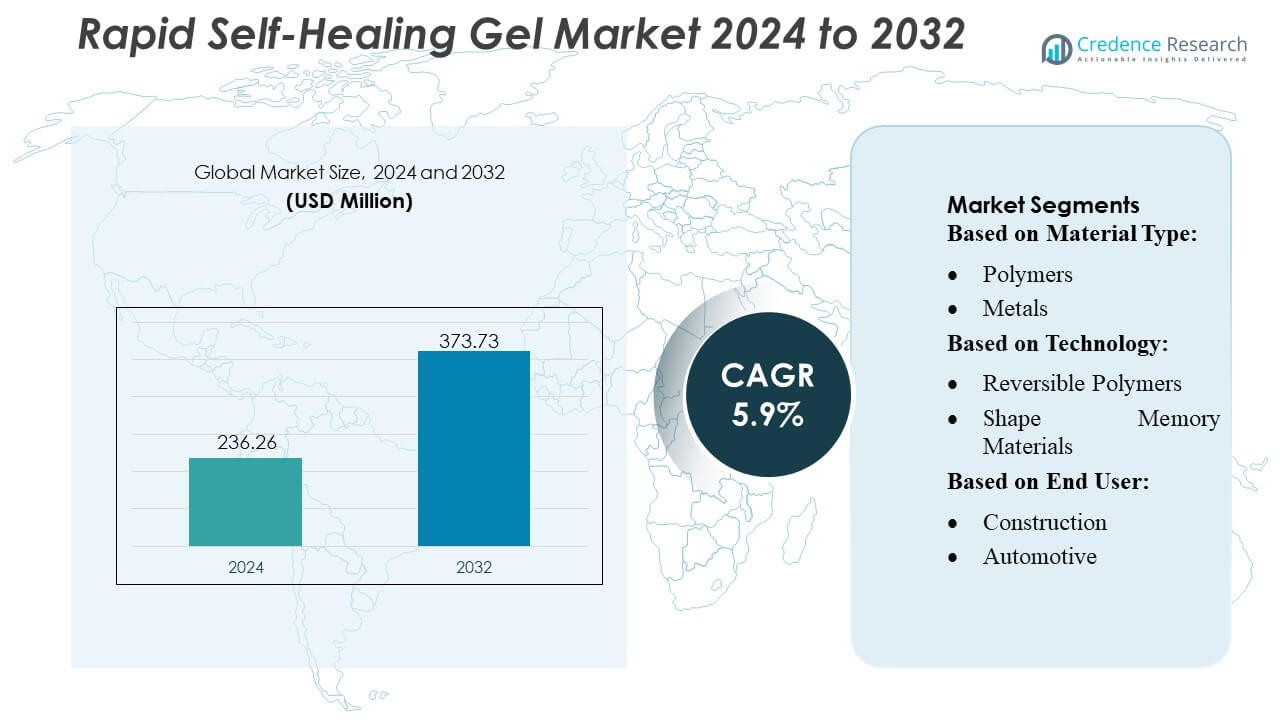

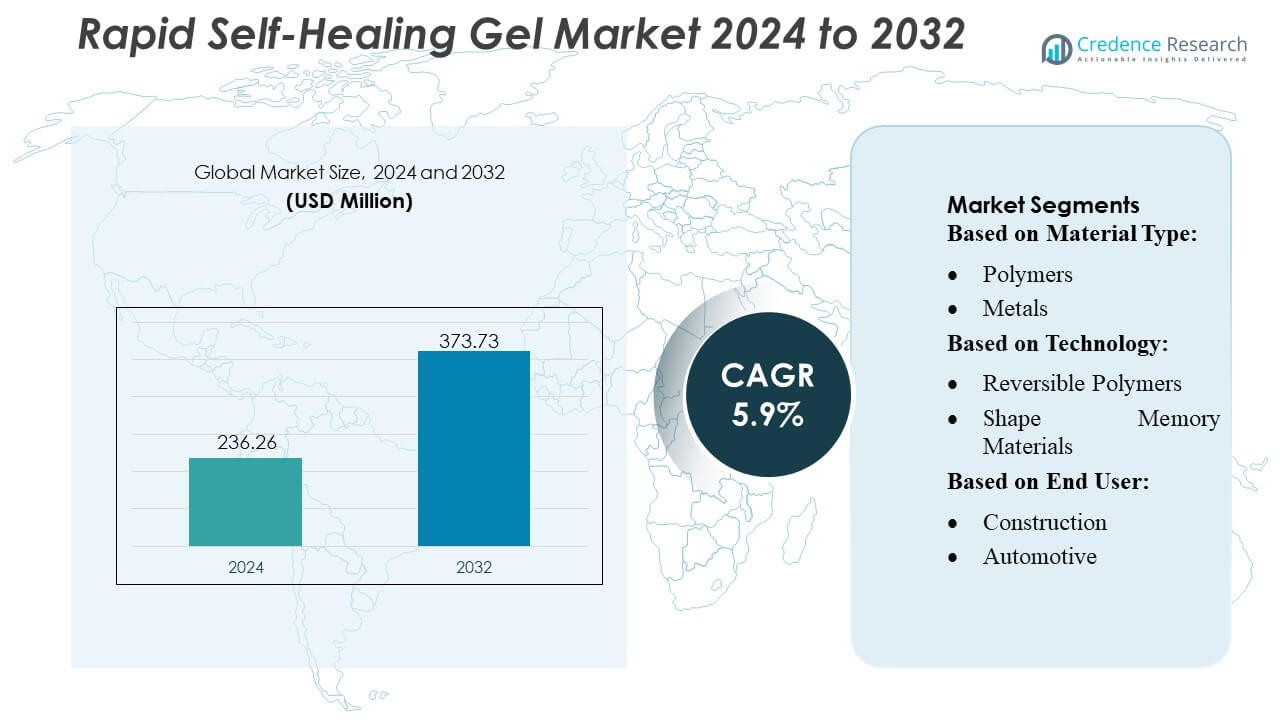

Rapid Self-Healing Gel Market size was valued USD 236.26 million in 2024 and is anticipated to reach USD 373.73 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rapid Self-Healing Gel Market Size 2024 |

USD 236.26 Million |

| Rapid Self-Healing Gel Market, CAGR |

5.9% |

| Rapid Self-Healing Gel Market Size 2032 |

USD 373.73 Million |

The Rapid Self-Healing Gel Market features a competitive environment shaped by material innovators that prioritize advanced polymer engineering, biomedical compatibility, and scalable manufacturing capabilities. Companies focus on developing gels with improved strength, rapid recovery behavior, and multifunctional performance to meet rising demand across healthcare, electronics, and industrial applications. Strategic collaborations with research institutes accelerate innovation and support commercialization in high-value therapeutic and engineering segments. Asia-Pacific leads the global market with an exact 30% share, driven by strong research activity, expanding healthcare investment, and rapid adoption of smart materials across electronics, robotics, and industrial manufacturing.

Market Insights

Market Insights

- The Rapid Self-Healing Gel Market was valued at USD 236.26 million in 2024 and is projected to reach USD 373.73 million by 2032, registering a CAGR of 5.9%.

- Growing demand for advanced wound care, regenerative therapies, and flexible electronic components drives market expansion, supported by rising adoption in healthcare and soft robotics.

- The market shows strong trends toward bio-based formulations, enhanced mechanical strength, and rapid recovery gels optimized for medical and industrial applications.

- Competition intensifies as manufacturers invest in scalable polymer engineering, multifunctional gel systems, and collaborations with research institutions to accelerate product innovation.

- Asia-Pacific leads with a 30% share, while healthcare applications hold the largest segment share due to high utilization in wound healing and tissue regeneration across hospitals and specialty clinics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type

Polymers dominate the Rapid Self-Healing Gel Market with an estimated 41% share, driven by their flexibility, tunable crosslinking density, and superior self-repair efficiency. Their ability to restore mechanical integrity within minutes supports adoption in wearable electronics, medical dressings, and soft robotics. Concrete-based self-healing gels also grow steadily as infrastructure developers seek materials that reduce maintenance cycles and extend structural lifespan. Metals and ceramics remain niche due to higher cost and limited commercial deployment, while other emerging materials gain traction through research investments targeting enhanced thermal stability and biocompatibility.

- For instance, NEI Corporation developed its NANOMYTE® MEND coatings that autonomously repair surface scratches within under one minute through a reversible polymer network, with scratch depths reduced by over 10 micrometers during self-healing cycles validated in laboratory evaluations.

By Technology

Reversible polymers lead this segment with approximately 38% share, supported by dynamic covalent bonds and supramolecular interactions that enable repeated self-repair without external activation. Their strong suitability for flexible electronics, biomedical implants, and consumer goods drives market expansion. Microencapsulation technologies gain momentum as manufacturers integrate healing agents into coatings and construction composites for durability in harsh environments. Shape memory materials advance through applications requiring thermal or mechanical triggers, while biological material systems evolve rapidly in wound care and tissue engineering due to natural regeneration capabilities.

- For instance, Michelin Group demonstrated measurable self-sealing performance in its elastomer systems used in MICHELIN Selfseal® tire technology, where the proprietary polymer matrix can seal punctures up to 6 millimeters in diameter without pressure loss, enabled by adaptive viscoelastic flow properties validated through controlled bench simulations.

By End-user

Healthcare emerges as the dominant end-user with nearly 36% share, propelled by rising adoption of self-healing gels in wound management, drug delivery systems, and regenerative therapies. The segment benefits from increasing demand for biocompatible, adaptive materials that accelerate healing and reduce clinical interventions. Construction follows closely as infrastructure projects incorporate self-healing solutions to mitigate crack propagation and lower lifecycle maintenance costs. Automotive and aerospace sectors adopt these gels to enhance safety and longevity of components, while electrical and electronics applications expand through integration into sensors, circuits, and protective coatings.

Key Growth Drivers

- Rising Demand for Advanced Wound Care and Regenerative Medicine

Rising demand for advanced wound care solutions drives strong adoption of rapid self-healing gels, particularly in chronic wound management, burn treatment, and postoperative healing. Their ability to provide moisture balance, accelerate tissue regeneration, and offer antimicrobial protection enhances clinical outcomes across hospitals and outpatient facilities. Increased prevalence of diabetes-associated ulcers and trauma injuries strengthens the market’s expansion. Healthcare providers prioritize gels with rapid recovery kinetics, biocompatible polymer networks, and reduced scarring potential, encouraging manufacturers to invest in next-generation hydrogel formulations for high-value therapeutic applications.

- For instance, Covestro AG developed a medical-grade polyurethane dispersion used in hydrogel wound dressings that delivers tensile strength values exceeding 25 megapascals and elongation at break reaching 600 millimeters per millimeter, enabling enhanced flexibility and structural recovery validated through biomechanical testing.

- Expanding Use in Soft Robotics and Flexible Electronics

Growing integration of soft robotics and flexible electronic devices significantly accelerates market development. Rapid self-healing gels play a crucial role in improving system durability, enabling autonomous damage repair, and enhancing lifespan in sensors, wearable devices, and actuators. Industries adopt these materials to maintain conductivity, elasticity, and structural continuity after mechanical rupture. Advancements in ionically crosslinked gels, conductive polymer networks, and energy-responsive healing mechanisms increase compatibility with next-generation electronic systems, supporting commercial adoption across consumer electronics, industrial automation, and biomedical engineering devices.

- For instance, MacDermid Autotype Ltd. engineered its Autotex® Soft Touch conductive film technology with a surface hardness of 1.5 newtons in pencil hardness testing and a measured flex endurance exceeding 200,000 bend cycles at a 5-millimeter radius, enabling reliable performance in flexible user-interface electronics validated through accelerated mechanical fatigue assessments.

- Increasing Material Innovation and R&D Investments

R&D investments accelerate the development of high-performance self-healing gels with optimized mechanical strength, environmental stability, and healing speed. Universities, research institutes, and material companies develop reversible bonding chemistries, microencapsulated healing agents, and hybrid polymer matrices to improve performance in demanding conditions. These innovations expand applicability in automotive sealing, aerospace coatings, and construction reinforcement. As manufacturers prioritize scalable synthesis, low-toxicity ingredients, and cost-efficient production, the market benefits from faster commercialization cycles and broader industrial acceptance of self-healing material platforms.

Key Trends & Opportunities

1. Growing Adoption of Bio-Based and Sustainable Gel Materials

A major trend involves the shift toward bio-based and eco-friendly self-healing gels made from natural polymers such as chitosan, alginate, hyaluronic acid, and collagen. Rising regulatory emphasis on green materials and sustainability goals strengthens this transition across healthcare, packaging, and consumer goods. Bio-derived gels reduce toxicity concerns, enhance biocompatibility, and improve degradability without compromising healing performance. Companies see strong opportunities to differentiate products through clean-label formulations, recyclable systems, and biomimetic properties inspired by natural self-repair mechanisms.

- For instance, Akzo Nobel N.V. commercialized its Eka® biopolymer technology derived from renewable cellulose sources which demonstrates a documented degree of polymerization of 1,100 and a molecular weight of 180,000 grams per mole, enabling stable hydrogel network formation validated in performance testing for sustainable coating and adhesive applications.

2. Integration of AI-Driven Material Design and Predictive Modeling

A growing opportunity emerges from the integration of AI-driven molecular modeling, machine learning algorithms, and predictive design tools to accelerate the formulation of next-generation self-healing gels. Computational platforms help optimize crosslink density, healing kinetics, and mechanical properties, reducing experimental costs and development timelines. AI enables rapid screening of polymer combinations, facilitating tailor-made solutions for medical devices, robotics, and high-stress engineering applications. This trend enhances product reliability, supports customization, and increases innovation throughput across commercial R&D pipelines.

- For instance, Huntsman International LLC implemented an AI-assisted simulation workflow in its polyurethane R&D programs that reduced formulation trial iterations from 180 tests to 35 tests and enabled prediction of tensile modulus values within a deviation margin of under 5 megapascals, verified through controlled mechanical benchmarking of prototype materials.

3. Expansion into High-Performance Industrial and Structural Applications

Growing interest in structural self-healing gels for automotive, aerospace, and construction sectors creates new commercial opportunities. Advanced gels offer high toughness, temperature resistance, and repeated healing capability, enabling use in sealants, coatings, vibration absorbers, and crack-repair systems. Improving compatibility with composites, alloys, and concrete enhances market expansion into heavy-duty applications. As industries seek materials that extend service life, reduce maintenance cost, and improve safety, rapid self-healing gels gain prominence as part of next-generation smart material strategies.

Key Challenges

1. High Production Costs and Limited Large-Scale Manufacturing

High synthesis costs and complex production processes remain major challenges for widespread adoption. Many rapid self-healing gels require specialized polymers, functional additives, and multi-step fabrication methods that increase material pricing. Large-scale manufacturing also faces issues related to batch consistency, purification requirements, and long-term storage stability. These constraints hinder commercialization in cost-sensitive sectors such as consumer goods and automotive components. Companies must optimize raw material choices, streamline production workflows, and invest in scalable chemistries to reduce expenses.

2. Performance Limitations Under Extreme Environmental Conditions

Despite strong healing capabilities, many gels face performance degradation under extreme temperature, humidity, or mechanical stress. Reduced healing rates, brittleness, or loss of adhesion in harsh environments limit adoption in aerospace, industrial machinery, and outdoor infrastructure. Ensuring stable properties such as tensile strength, conductivity, and repeatable healing cycles remains technically challenging. Manufacturers must address issues related to durability, environmental resistance, and long-term reliability to enable broader integration into high-performance engineered systems.

Regional Analysis

North America

North America holds an estimated 34% share of the Rapid Self-Healing Gel Market, driven by advanced biomedical research, strong investment in regenerative medicine, and early adoption of smart materials. The region benefits from robust clinical infrastructure and high expenditure on chronic wound care, burns, and tissue repair therapies. Rapid integration of self-healing gels in wearable sensors, flexible electronics, and soft robotics strengthens demand from technology developers. Government-funded innovation programs and collaboration between universities and biotech firms enhance commercialization. Growth accelerates as manufacturers expand biodegradable, biocompatible, and performance-optimized gel formulations tailored for medical and industrial applications.

Europe

Europe accounts for roughly 28% of the market, supported by strong regulatory emphasis on biocompatibility, sustainable materials, and medical device innovation. The region witnesses rising adoption of rapid self-healing gels in drug delivery systems, orthopedic applications, and advanced wound care. Leading research institutions and chemical manufacturers drive breakthroughs in reversible polymer systems and bio-based gels. Demand grows across soft robotics and smart manufacturing programs aligned with Industry 4.0 objectives. Strict quality standards enhance product development, while government-funded R&D initiatives accelerate technology transfer for industrial, healthcare, and consumer sectors, reinforcing Europe’s competitive position.

Asia-Pacific

Asia-Pacific holds nearly 30% of the market and represents the fastest-growing region due to expanding healthcare spending, rapid industrialization, and strong government backing for advanced material innovation. China, Japan, and South Korea lead research in polymer chemistry, soft robotics, and bio-engineered gels, enabling large-scale commercialization. Growing adoption in flexible electronics, wound management products, and construction reinforcement materials strengthens regional demand. Manufacturing advantages, growing start-up ecosystems, and favorable funding environments support accelerated product development. Increasing chronic disease prevalence and demand for affordable regenerative solutions further expand APAC’s market footprint.

Latin America

Latin America captures about 5% of the Rapid Self-Healing Gel Market, with growth driven by rising healthcare modernization, expanding medical device imports, and improving adoption of advanced wound care therapies. Brazil and Mexico lead the regional market due to their better-developed clinical infrastructure and supportive regulatory pathways. Increasing awareness of regenerative treatments boosts interest in self-healing gels for surgical recovery, burns, and trauma injuries. Industrial applications grow gradually as manufacturers explore gels for coatings, sealants, and protective layers. Cost sensitivity, limited R&D capacity, and slower technology transfer remain barriers to faster expansion.

Middle East & Africa

The Middle East & Africa region holds approximately 3% of the market, supported by gradual improvements in healthcare infrastructure, rising chronic disease burden, and increasing government investments in medical innovation. Demand centers on wound care, orthopedic support gels, and moisture-retentive treatments in hospitals. The UAE and Saudi Arabia drive adoption through partnerships with global biotech firms and modernization initiatives. Industrial applications expand modestly in construction and protective coatings. However, limited manufacturing capability, higher import dependence, and inconsistent regulatory frameworks restrict large-scale commercialization, keeping growth moderate but steadily advancing.

Market Segmentations:

By Material Type:

By Technology:

- Reversible Polymers

- Shape Memory Materials

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Rapid Self-Healing Gel Market players such as NEI Corporation, Michelin Group, Covestro AG, MacDermid Autotype Ltd., Akzo Nobel N.V., Huntsman International LLC, Evonik Industries Corporation, High Impact Technology, LLC, BASF SE, and The Dow Chemical Company. the Rapid Self-Healing Gel Market continues to evolve as companies increase their focus on advanced material engineering, scalable production technologies, and application-specific innovation. Industry participants invest heavily in polymer chemistry enhancements, reversible bonding mechanisms, and hybrid gel structures to improve mechanical resilience, healing speed, and long-term stability. Collaboration between research institutes, medical device developers, and technology manufacturers accelerates the translation of laboratory breakthroughs into commercial solutions. Companies also expand into high-growth areas such as regenerative medicine, soft robotics, flexible electronics, and industrial protective coatings. Rising emphasis on sustainability, biocompatibility, and low-toxicity formulations strengthens differentiation strategies while competitive pricing, intellectual property development, and regulatory compliance shape market positioning.

Key Player Analysis

- NEI Corporation

- Michelin Group

- Covestro AG

- MacDermid Autotype Ltd.

- Akzo Nobel N.V.

- Huntsman International LLC

- Evonik Industries Corporation

- High Impact Technology, LLC

- BASF SE

- The Dow Chemical Company

Recent Developments

- In June 2025, MicroBioGen Australian biotech firm MicroBioGen and French giant Lesaffre signed a global deal to use MicroBioGen’s yeast tech with Lesaffre’s expertise for better baking, food, and biochemical solutions, combining MicroBioGen’s strains with Lesaffre’s R&D and production power for sustainable innovation.

- In December 2024, Yeastup AG, a Swiss food tech firm, raised in Series A funding to build a major facility converting spent brewer’s yeast into proteins and fibers, using a former dairy site to process over 20,000 tons annually, adding value to brewery byproducts for food, nutraceuticals, and cosmetics.

- In October 2023, DuPont and U.S. Steel launched COASTALUME™, a durable, self-healing metal roofing and siding product combining U.S. Steel’s GALVALUME® with DuPont™ Tedlar® film for superior resistance to salt, UV, and corrosion, specifically designed for harsh coastal building environments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Material Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as demand for advanced wound care and regenerative therapies continues to rise.

- Manufacturers will develop gels with faster healing speeds and improved mechanical strength for medical and industrial use.

- Adoption in soft robotics and flexible electronics will accelerate as engineers seek durable self-repairing materials.

- Bio-based and biodegradable gel formulations will gain traction as sustainability priorities strengthen globally.

- AI-driven material design will support faster innovation cycles and customized gel performance.

- Integration into wearable sensors and smart healthcare devices will enhance commercial adoption.

- Structural applications in automotive, aerospace, and construction will create new growth opportunities.

- Companies will invest in scalable production systems to reduce costs and improve material consistency.

- Regulatory support for biocompatible and safe gel materials will facilitate quicker market approvals.

- Partnerships between industry and research institutions will intensify to accelerate commercialization of high-performance gels.

Market Insights

Market Insights