Market overview

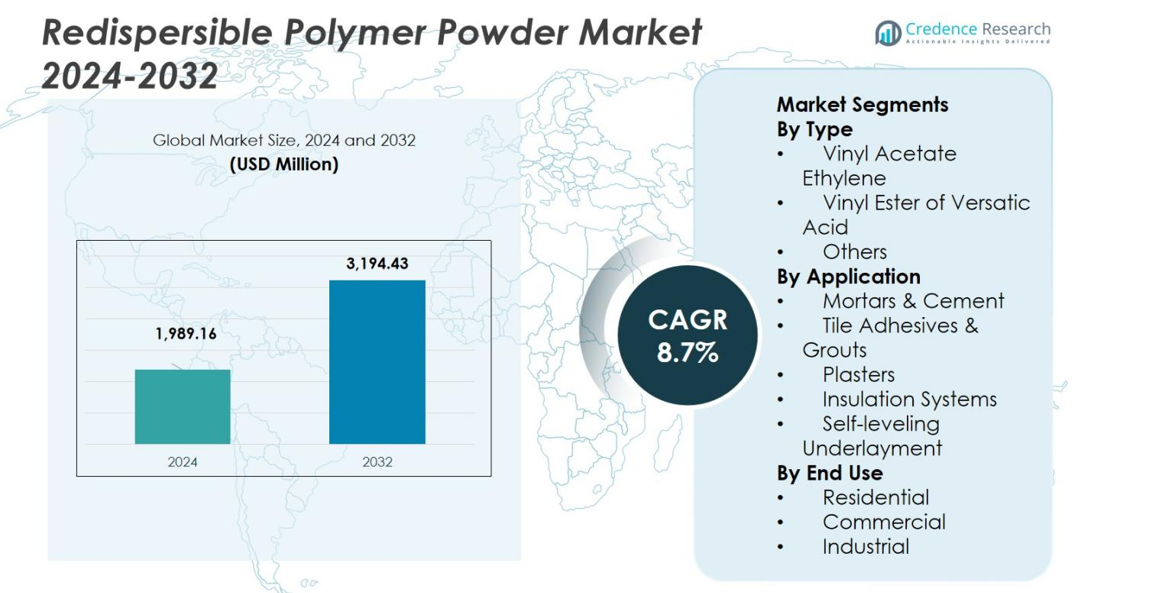

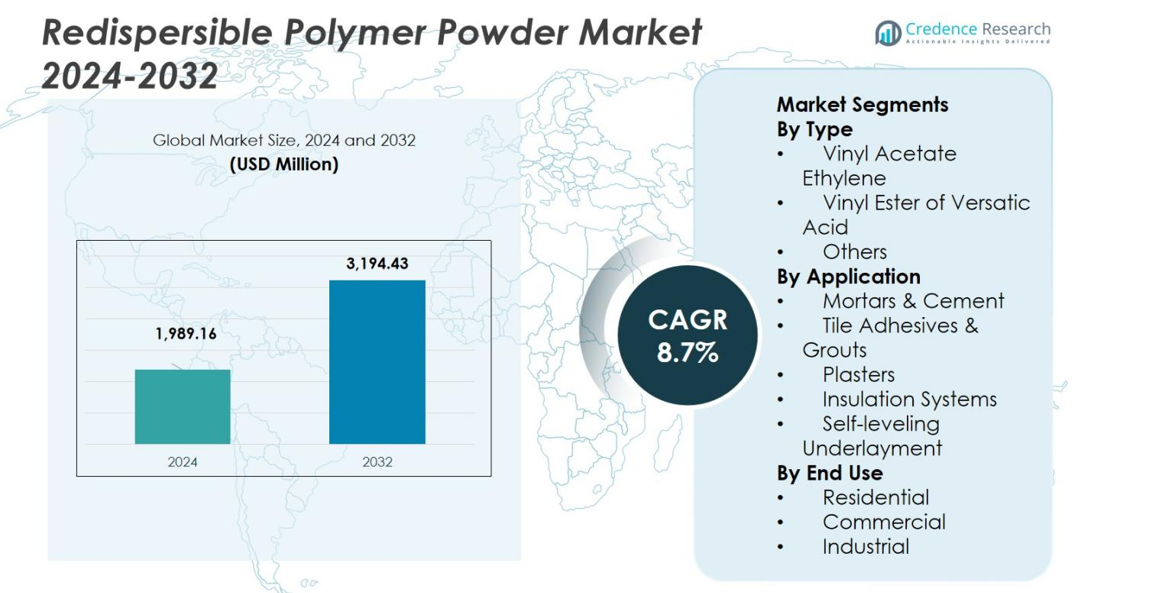

The Redispersible Polymer Powder Market size was valued at USD 1,989.16 Million in 2024 and is anticipated to reach USD 3,194.43 Million by 2032, at a CAGR of 6.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Redispersible Polymer Powder Market Size 2024 |

USD 1,989.16 Million |

| Redispersible Polymer Powder Market, CAGR |

6.1% |

| Redispersible Polymer Powder Market Size 2032 |

USD 3,194.43 Million |

The Redispersible Polymer Powder Market is led by established chemical manufacturers such as Celanese Corporation, Dow Inc., Wacker Chemie AG, Ashland Inc., Synthomer plc and Organik Kimya San. Tic. A.S., which utilise strong manufacturing footprints, global distribution networks and targeted innovation in redispersible polymer powder formulations to consolidate their positions. Regionally, North America commands 60.0% of the market share, driven by mature infrastructure and renovation activity, while Asia Pacific holds 37.0%, benefitting from rapid urbanisation and large‑scale construction projects.

Market Insights

- The Redispersible Polymer Powder Market size was valued at USD 1,989.16 Million in 2024 and is projected to reach USD 3,194.43 Million by 2032, growing at a CAGR of 6.1% during the forecast period.

- The demand for high-performance construction materials in both residential and commercial construction is a key driver, particularly in emerging markets where infrastructure development is accelerating.

- A major trend is the shift toward eco-friendly and sustainable building materials, with increasing adoption of low-VOC and high-performance polymer powders that meet environmental regulations.

- The market is highly competitive, with leading players like Celanese Corporation, Dow Inc., Wacker Chemie AG, and Synthomer plc dominating through innovation and strategic collaborations.

- North America holds the largest market share at 60.0%, followed by Asia Pacific at 37.0%, driven by urbanization, increased construction activity, and a growing demand for durable and high-quality materials in residential, commercial, and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

The Redispersible Polymer Powder Market is primarily segmented into Vinyl Acetate Ethylene (VAE), Vinyl Ester of Versatic Acid, and others. Among these, Vinyl Acetate Ethylene holds the dominant share, accounting for 65.4% in 2024. VAE is widely favored for its superior bonding properties and flexibility, making it ideal for a variety of applications, particularly in construction materials like adhesives and coatings. The growth of construction activities, especially in emerging markets, further drives demand for VAE, as it enhances the durability and workability of construction products, contributing to its market dominance.

- For instance, Dow’s ELVAX™ 460 Ethylene Vinyl Acetate Copolymer is designed to increase flexibility and toughness in polymer compounds, significantly enhancing crack resistance in films used in construction applications.

By Application

The Redispersible Polymer Powder Market is segmented by application into Mortars & Cement, Tile Adhesives & Grouts, Plasters, Insulation Systems, and Self-leveling Underlayment. Tile Adhesives & Grouts dominate the application segment, holding a 39.2% market share in 2024. The increasing demand for efficient and durable bonding solutions in residential and commercial construction projects fuels the growth of this sub-segment. Tile adhesives are essential for ensuring long-lasting and strong tile installations, driving significant adoption in the construction industry, particularly in regions with robust construction activity.

- For instance, Celotech Chemical’s Vinabond® redispersible polymer powder significantly improves adhesion, flexural strength, and deformability in tile adhesives, enhancing durability and ease of processing in both residential and commercial constructions.

By End Use

The Redispersible Polymer Powder Market by end-use is divided into Residential, Commercial, and Industrial segments. The Residential segment holds the largest share, accounting for 55.7% of the market in 2024. This dominance is driven by the growing trend of home renovation and new residential construction, as well as the increasing consumer preference for high-quality building materials. As homeowners seek to improve the durability and aesthetic appeal of their properties, the demand for products such as adhesives, mortars, and plasters continues to rise, significantly contributing to the growth of the residential end-use segment.

Key Growth Drivers

Rising Demand in the Construction Industry

The growing construction industry, particularly in emerging economies, is a major driver for the Redispersible Polymer Powder Market. The expansion of residential, commercial, and infrastructure projects globally leads to increased demand for construction chemicals such as adhesives, mortars, and plasters. Redispersible polymer powders enhance the strength, flexibility, and durability of these materials, making them indispensable in modern construction. As urbanization and infrastructure development continue to accelerate, the demand for high-performance construction materials supported by polymer powders is expected to rise significantly.

- For instance, Wacker Chemie AG utilizes RDP in tile adhesives, improving bond strength and flexibility, which is essential for durability on various surfaces including concrete and drywall.

Shift Toward Eco-friendly Construction Materials

The increasing emphasis on sustainability and environmentally friendly construction practices is driving the demand for Redispersible Polymer Powders. Manufacturers are focusing on producing low-VOC and eco-friendly versions of these powders to align with global sustainability trends. This shift is particularly prominent in developed markets, where environmental regulations are stricter. As green building certifications and sustainable construction practices become more prevalent, the adoption of Redispersible Polymer Powders in eco-friendly formulations is expected to grow, further contributing to market expansion.

- For instance, BASF launched a new eco-friendly redispersible polymer powder line in April 2025, specifically designed for 1K cementitious waterproofing applications, enhancing sustainability in construction materials.

Technological Advancements in Polymer Powder Manufacturing

Ongoing innovations in the manufacturing processes of Redispersible Polymer Powders are contributing to the market’s growth. Advances in polymer chemistry have enabled the development of powders with enhanced properties such as better dispersion, improved adhesion, and superior performance in extreme conditions. These technological improvements result in higher-quality products that meet the evolving demands of the construction industry. With enhanced performance characteristics, these powders are being increasingly adopted in high-demand applications, bolstering the overall market growth.

Key Trends & Opportunities

Rise of Smart and Sustainable Buildings

The growing trend of smart and sustainable buildings presents significant opportunities for the Redispersible Polymer Powder Market. As construction practices evolve toward smart technologies, there is a rising demand for advanced materials that support energy efficiency, automation, and sustainability. Redispersible polymer powders, which enhance the performance of insulation systems, adhesives, and coatings, play a critical role in these applications. With increasing investments in smart homes and energy-efficient buildings, there is a clear opportunity for manufacturers to develop specialized products that cater to the needs of this growing market segment.

- For instance, Owens Corning has developed extruded polystyrene foam insulation incorporating recycled materials, which significantly reduces the environmental footprint of building insulation.

Expansion of Residential Renovation Projects

The surge in residential renovation activities, particularly in developed markets, presents an opportunity for the Redispersible Polymer Powder Market. Homeowners are increasingly investing in the renovation and refurbishment of existing properties, driving demand for construction materials like adhesives, grouts, and plasters. Redispersible polymer powders improve the performance and longevity of these materials, making them a popular choice in renovation projects. As disposable incomes rise and consumer preferences shift toward high-quality and long-lasting materials, the market for these powders is expected to witness substantial growth.

- For instance, lightweight RDP-modified repair mortars used in hotel and multifamily housing refurbishments allow for rapid, durable floor and wall repairs with improved water resistance and reduced shrinkage, supporting faster project turnaround without compromising performance.

Key Challenges

Volatility in Raw Material Prices

A significant challenge facing the Redispersible Polymer Powder Market is the volatility in raw material prices. The cost of key ingredients used in the production of polymer powders, such as vinyl acetate and ethylene, can fluctuate due to supply chain disruptions, geopolitical factors, and raw material shortages. These price fluctuations can increase production costs, affecting the overall profitability of manufacturers. As a result, maintaining stable prices while ensuring consistent product quality remains a key challenge for companies in the market.

Stringent Regulatory Requirements

The Redispersible Polymer Powder Market is also impacted by stringent environmental and safety regulations across various regions. Regulatory standards for construction chemicals, including low-VOC content and compliance with sustainable manufacturing practices, can create challenges for manufacturers. Adhering to these regulations often requires significant investment in product development and certification processes. Companies must continually adapt to changing regulations, which can increase costs and time-to-market, presenting a challenge to industry players looking to maintain competitiveness and market share.

Regional Analysis

Asia Pacific

The Asia Pacific region accounted for 37.0% of the global Redispersible Polymer Powder market share in 2024. This dominance stems from rapid urbanisation, extensive infrastructure development, and heightened residential and commercial construction activity across key countries such as China, India, and Southeast Asia. The rising demand for durable, high-performance building materials underpins product uptake in tile adhesives, mortars, and insulation systems. Growth-oriented government initiatives for smart cities and affordable housing further drive the utilisation of redispersible polymer powders with enhanced adhesion and flexibility properties.

North America

North America held 60.0% of the redispersible polymer powder market share in 2024, reflecting the region’s mature construction sector, strong renovation activity, and stringent regulations for building materials. Manufacturers benefit from advanced infrastructure, a well-established supply chain, and demand for sustainable, high-performance materials. These factors collectively boost usage of redispersible polymer powders in tiling, self-levelling underlayments, and external insulation finishing systems (EIFS) in residential and commercial end-uses.

Europe

Europe held 23.2% of the redispersible polymer powder market share in 2024, underpinned by its established construction industry, rigorous building quality standards, and rising emphasis on sustainability. The region’s manufacturers leverage a strong chemical base to develop advanced powder formulations enhancing durability, adhesion, and water-resistance in mortars, tile adhesives, and plaster systems. European demand is further stimulated by renovation of legacy buildings and upgrading of insulation systems in both residential and commercial segments.

Middle East & Africa

The Middle East & Africa region captured 7.8% of the redispersible polymer powder market share in 2024, witnessing steady growth in redispersible polymer powder adoption, propelled by infrastructure expansion, new residential developments, and rising commercial construction across Gulf countries. High-performance construction materials are increasingly sought for projects in harsh climatic conditions, boosting demand for powders that enhance workability, water-resistance, and adhesion of mortars and insulation systems. While its market share remains smaller compared to other regions, the region offers significant potential due to price-sensitive yet growing construction markets.

South America

South America held 5.3% of the redispersible polymer powder market share in 2024, gaining traction as urbanisation accelerates and governments allocate resources toward infrastructure and housing development. The region captures a modest share of the global market, yet demand is rising for cost-effective, high-performance building materials in residential refurbishments and commercial projects. Enhanced construction of tile adhesives, self-levelling underlayments, and external insulation systems is playing a key role. Economic volatility and supply chain challenges temper growth, but long-term opportunities persist.

Market Segmentations:

By Type

- Vinyl Acetate Ethylene

- Vinyl Ester of Versatic Acid

- Others

By Application

- Mortars & Cement

- Tile Adhesives & Grouts

- Plasters

- Insulation Systems

- Self-leveling Underlayment

By End Use

- Residential

- Commercial

- Industrial

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Redispersible Polymer Powder Market is characterized by a competitive landscape comprising key players such as Celanese Corporation, Dow Inc., Wacker Chemie AG, Ashland Inc., Synthomer plc, and Organik Kimya San. Tic. A.S. These companies dominate the market by leveraging their strong manufacturing capabilities, extensive distribution networks, and ongoing investments in product innovation. Competition in the market is driven by the continuous development of high-performance redispersible polymer powders with enhanced properties, such as improved dispersion, adhesion, and flexibility. Additionally, these players focus on strategic collaborations, mergers, and acquisitions to expand their product portfolios and strengthen their market positions globally. To maintain a competitive edge, companies are increasingly focusing on sustainable and eco-friendly products in response to growing demand for environmentally responsible building materials. The market is also witnessing increasing competition from regional players offering cost-effective solutions to cater to price-sensitive markets, especially in Asia Pacific and South America.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dairen Chemical Corporation

- Ashland Inc.

- VINAVIL S.p.A.

- Shanxi Sanwei Group Co., Ltd

- Synthomer plc

- Wacker Chemie AG

- Celanese Corporation

- Dow Inc.

- Bosson Union Tech (Beijing) Co., Ltd

- Organik Kimya San. Tic. A.S

Recent Developments

- In April 2025, BASF SE launched a new eco‑friendly redispersible polymer powder line targeted at 1K cementitious waterproofing applications.

- In March 2025, JSC Pigment launched a new production facility for redispersible polymer powders for dry‑construction mixtures at its workshop No. 31 in Tambov Region, Russia

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Redispersible Polymer Powder Market is expected to witness steady growth due to the increasing demand for high-performance building materials in both residential and commercial construction.

- Technological advancements in polymer chemistry will lead to the development of powders with enhanced properties, such as improved dispersion, water-resistance, and adhesion.

- Growing emphasis on sustainability will drive the demand for eco-friendly redispersible polymer powders, which align with green building certifications and environmental regulations.

- The rise of smart cities and infrastructure development projects, particularly in emerging economies, will contribute to the increased adoption of redispersible polymer powders in construction applications.

- Residential renovation and refurbishment projects will continue to be a key growth driver, with increasing demand for durable and high-quality adhesives, plasters, and insulation systems.

- The shift towards energy-efficient and sustainable construction will create opportunities for redispersible polymer powders in insulation systems and other energy-saving materials.

- North America and Europe will remain dominant regions, but the Asia Pacific and Latin American markets are expected to experience rapid growth due to urbanization and increased infrastructure investments.

- Key players in the market will focus on strategic mergers, acquisitions, and collaborations to strengthen their product offerings and expand their market presence globally.

- Competition will intensify as more regional manufacturers introduce cost-effective solutions, particularly in price-sensitive markets such as Asia Pacific and South America.

- Regulatory pressures around environmental sustainability and building safety will continue to shape the market, prompting innovation and adaptation from manufacturers to meet evolving industry standards.