Market Overview:

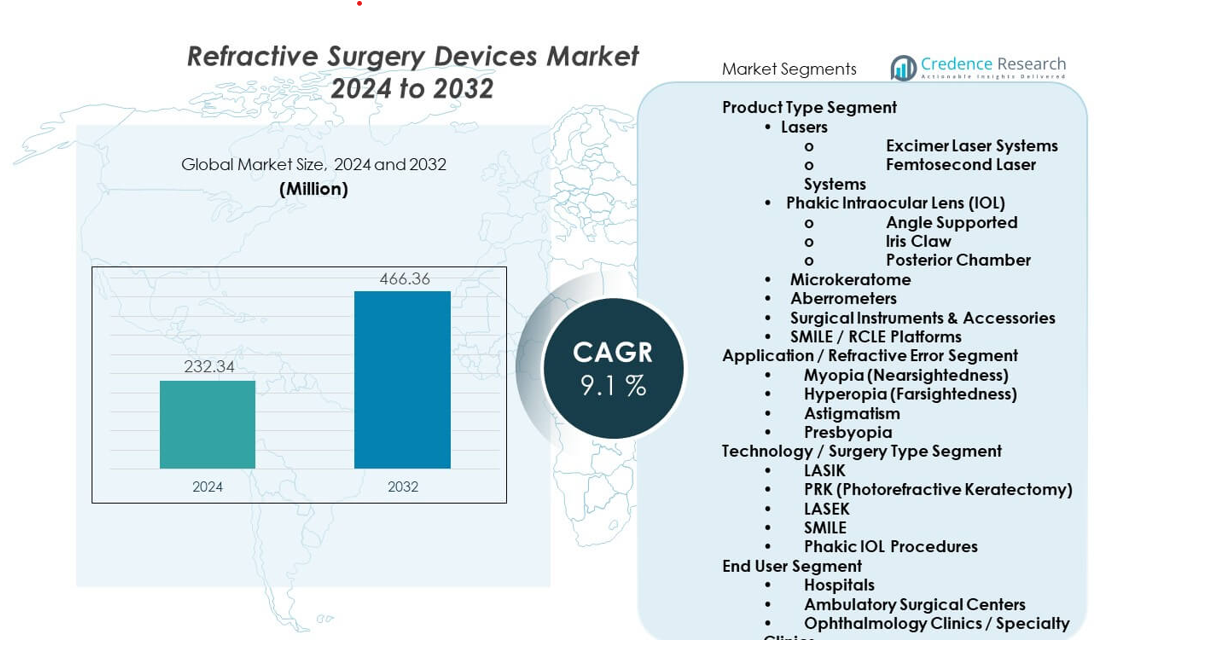

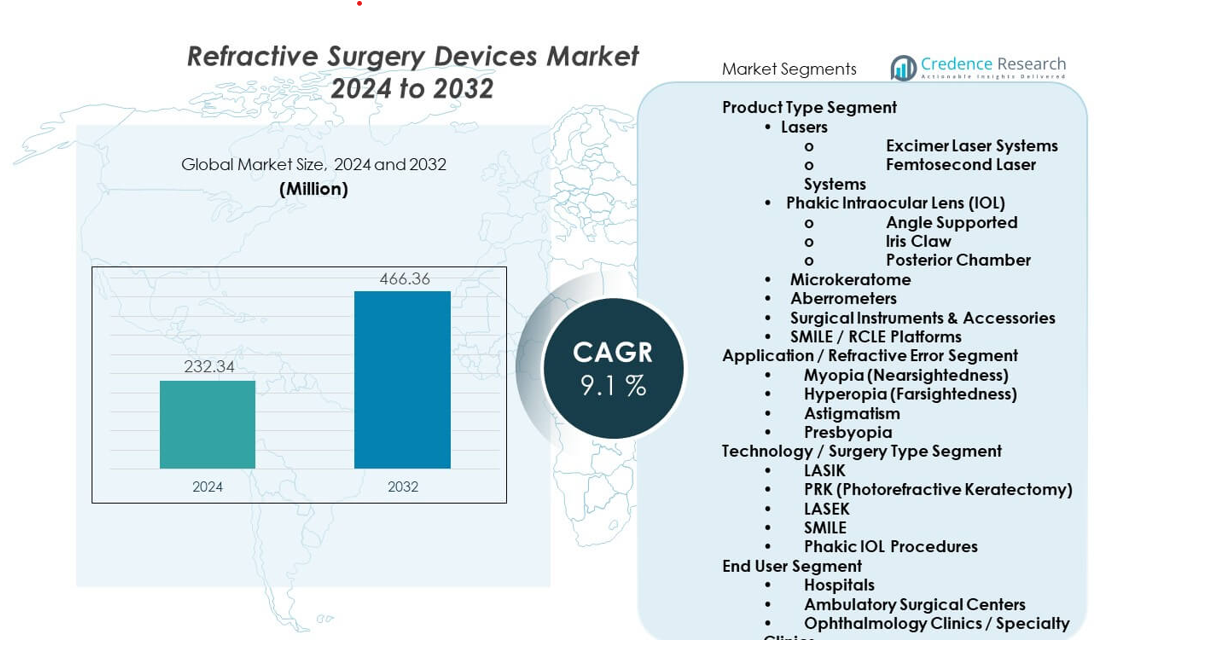

The Refractive Surgery Devices Market is projected to grow from USD 232.34 million in 2024 to an estimated USD 466.36 million by 2032, with a compound annual growth rate (CAGR) of 9.1% from 2024 to 2032. Demand grows due to rising preference for laser-based vision correction and steady adoption of femtosecond platforms across surgical centers. Clinics expand advanced treatment capacity to meet growing patient volumes seeking long-term refractive correction.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| PVC Shrink Films Market Size 2024 |

USD 232.34 million |

| PVC Shrink Films Market, CAGR |

9.1% |

| PVC Shrink Films Market Size 2032 |

USD 466.36 million |

Growing focus on precision-driven ophthalmic procedures strengthens market activity. Surgeons adopt wavefront-guided and topography-guided systems because these platforms support improved outcomes with lower complication rates. Rising awareness of elective vision correction boosts patient footfall in urban hospitals. Strong investment in LASIK and SMILE-based technologies supports innovation. Manufacturers upgrade systems with enhanced ablation control, faster scanning speeds, and improved safety features. These efforts encourage wider use of next-generation devices across high-volume centers.

North America leads due to strong device penetration and a large base of refractive surgeons with access to advanced technology. Europe maintains steady adoption because clinics invest in premium systems supported by favorable clinical standards. Asia Pacific emerges as a high-growth region, driven by rising demand in China and India where expanding private hospitals introduce modern refractive platforms. Latin America and the Middle East show rising interest as more centers integrate high-precision laser systems to address unmet surgical needs.

Market Insights:

- The Refractive surgery devices market is valued at USD 232.34 million in 2024 and is projected to reach USD 466.36 million by 2032, supported by a 1% CAGR driven by rising demand for laser-based refractive correction.

- North America (38%), Europe (30%), and Asia-Pacific (24%) dominate due to advanced surgical infrastructure, strong surgeon expertise, and growing patient awareness in high-volume refractive centers.

- Asia-Pacific, holding 24%, remains the fastest-growing region due to rising myopia prevalence, expanding private eye hospitals, and strong interest in SMILE and phakic IOL procedures.

- Laser systems maintain the largest product share at over 40%, supported by high adoption of excimer and femtosecond platforms across hospitals and clinics.

- Myopia correction holds the leading application share at over 45%, driven by digital strain, urban lifestyle factors, and increasing demand for permanent vision correction among younger patients.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Precision Vision Correction Technologies

The Refractive surgery devices market expands due to strong patient demand for accurate and predictable outcomes. Laser platforms improve treatment reliability and help surgeons reduce retreatment risk across large patient groups. Clinics prefer systems that deliver stable corneal reshaping with high control. It supports improved vision outcomes that encourage more patients to consider elective procedures. Rising myopia prevalence drives major investment in advanced corrective tools. Femtosecond systems strengthen safety standards and help hospitals upgrade surgical capabilities. Awareness campaigns increase patient confidence in laser-based correction. Expanding private clinics reinforce adoption in both mature and emerging regions.

- For instance, Alcon Inc.’ WaveLight EX500 excimer laser system features a 500 Hz ablation rate and a 1050 Hz eye-tracker used by over 6,000 surgeons in more than 80 countries.

Advancement in Laser Platforms and Treatment Personalization

Rapid innovation in excimer and femtosecond technologies supports wider acceptance. The Refractive surgery devices market benefits from platforms that provide faster ablation, smoother corneal surfaces, and better tissue preservation. New systems integrate AI-driven mapping tools that deepen treatment customization. It helps surgeons tailor correction to unique corneal profiles. Hospitals value devices that reduce operation time and enhance procedural predictability. Wavefront and topography-guided technologies improve long-term stability. Clinics invest in high-end platforms to meet rising expectations for premium visual outcomes. Adoption grows in regions where advanced diagnostics pair well with surgical tools.

- For instance, Carl Zeiss Meditec AG’ VisuMax femtosecond laser operates at a 500 kHz pulse rate and supports SMILE lenticule extraction with minimal flap disruption, improving biomechanical stability.

Expansion of Elective Vision Correction Adoption

Elective eye procedures gain stronger acceptance among young professionals seeking improved lifestyle convenience. Demand rises as clinics promote LASIK, SMILE, and PRK with modern safety assurances. The Refractive surgery devices market benefits from active marketing by specialized centers. It helps patients understand recovery timelines and success rates. Rising screen-related strain encourages more individuals to seek permanent correction. Private hospitals increase procedure volumes due to strong urban demand. New financing models make treatments accessible to broader income groups. Upgraded patient experience supports higher conversion rates across major cities.

Improved Clinical Infrastructure and Surgeon Training

Hospitals expand ophthalmic departments with advanced surgical suites designed for laser procedures. The Refractive surgery devices market gains momentum as training programs improve surgeon confidence with modern tools. New certification pathways strengthen operational quality and reduce learning curves. It encourages clinics to adopt high-tech platforms faster. Industry partnerships support continuous training on new features and protocols. Enhanced diagnostic systems pair with surgical platforms to deliver integrated treatment planning. Hospitals upgrade workflow automation to support higher procedure throughput. Better-trained surgeons result in stronger patient satisfaction and repeat referrals.

Market Trends:

Shift Toward Minimally Invasive and Flapless Procedures

Growing preference for flapless treatments shapes platform development. The Refractive surgery devices market observes strong momentum toward SMILE and other tissue-sparing procedures. Clinics highlight shorter recovery periods and reduced risk profiles. It encourages younger patients to view refractive correction as a safe option. Platforms with micro-incision capability gain significant attention. Device makers refine laser accuracy to support advanced corneal modelling. Surgeons use minimally invasive tools to expand candidate eligibility. Demand strengthens for systems that ensure stable healing and lower complication rates.

- For instance, the VisuMax platform uses a curved docking interface that avoids corneal applanation and enables small incision lenticule extraction with high precision.

Integration of AI and Real-Time Imaging in Surgical Platforms

AI-enabled systems optimize treatment planning through real-time data analytics. The Refractive surgery devices market benefits from automated mapping and predictive outcome modelling. Surgeons gain precise guidance for complex procedures. It supports consistent results across varied corneal conditions. Real-time imaging enhances safety and helps minimize procedural deviations. Clinics adopt platforms that combine diagnostics and surgery in one workflow. AI tools raise accuracy in refractive calculations. Hospitals view integrated systems as a path to higher operational efficiency.

- For instance, the WaveLight EX500 system’s documentation indicates a treatment time of around 1.3 seconds per diopter while maintaining precise spot control through a small 0.95 mm beam diameter.

Growing Adoption of Hybrid Surgical Suites and Digital Workflow Systems

Hospitals invest in digital workflow systems that synchronize diagnostics, planning, and surgical execution. The Refractive surgery devices market tracks strong interest in hybrid suites that combine multiple refractive technologies. Surgeons use digital platforms to streamline patient flow and planning steps. It improves treatment precision and lowers manual intervention. Clinics embrace cloud-linked systems for record management. Fully connected workflows support multi-device compatibility. Adoption rises in centers that manage high surgical volumes. Hybrid platforms create new opportunities for upgraded patient experience.

Rise of Premium Refractive Packages and Technology-Linked Service Models

Premium service packages gain strong traction in private clinics. The Refractive surgery devices market benefits from patient interest in high-end refractive solutions paired with advanced diagnostics. Clinics develop tiered treatment plans that highlight technology benefits. It drives demand for upgraded surgical platforms. Premium services attract clients seeking personalized care. Hospitals use technology-linked models to differentiate their offerings. New pricing structures strengthen margin potential for providers. Expanding premium segments increase platform adoption in competitive markets.

Market Challenges Analysis:

High Device Costs and Limited Accessibility in Developing Regions

High equipment prices restrict adoption in cost-sensitive regions. The Refractive surgery devices market faces challenges when clinics struggle to justify investment without strong patient volumes. It slows expansion in rural and semi-urban areas where elective procedures remain underpenetrated. Maintenance costs further impact operational budgets. Hospitals hesitate to upgrade platforms without predictable revenue. Financing barriers limit adoption for small clinics. Import duties raise acquisition costs in several countries. Limited reimbursement deepens the accessibility gap for large patient groups. Slow infrastructure growth constrains advanced technology deployment.

Surgeon Skill Gaps and Variable Patient Awareness Levels

Skill gaps create operational challenges for new technology integration. The Refractive surgery devices market experiences slower adoption in centers where surgeons lack exposure to the latest platforms. It increases procedural variability and affects outcome consistency. Patient awareness gaps limit market expansion in regions with low outreach. Misconceptions about safety discourage potential candidates. Clinics invest heavily in education to build trust. Slow adoption of advanced diagnostics affects precision outcomes. Limited training programs reduce market penetration in developing countries. Variability in regulatory approvals further delays technology upgrades.

Market Opportunities:

Rising Demand for Personalized Refractive Treatments and Advanced Diagnostics

Personalized vision correction gains stronger acceptance among younger demographics. The Refractive surgery devices market can leverage demand for tailored procedures supported by advanced mapping. It creates strong opportunities for platforms that integrate deep imaging with AI-driven algorithms. Hospitals expand their diagnostic suites to provide premium assessments. Clinics can position personalized treatments as a premium upgrade. Growth in digital screening supports wider patient engagement. Markets with rising myopia prevalence offer strong expansion potential. Faster technology cycles open opportunities for new entrants.

Expansion of Refractive Centers in Emerging Asian and Middle Eastern Markets

Emerging markets invest heavily in ophthalmic infrastructure. The Refractive surgery devices market gains opportunities as private hospitals expand specialized refractive units. It encourages technology suppliers to enter high-growth regions. Rising disposable income supports elective procedure adoption. Governments invest in eye-care modernization programs. Medical tourism strengthens interest in premium refractive packages. Clinics upgrade surgical capabilities to attract global patients. Demand for high-precision laser devices grows as awareness improves.

Market Segmentation Analysis:

Product Type Segment

The Refractive surgery devices market shows strong dominance of laser systems as clinics adopt excimer and femtosecond platforms for high-precision corneal reshaping. Excimer systems support controlled tissue removal, while femtosecond lasers deliver tighter incision accuracy. Phakic intraocular lenses gain steady acceptance, with posterior chamber models preferred for long-term stability. Angle-supported and iris-claw lenses serve specific refractive profiles. Microkeratomes maintain relevance in budget-sensitive centers. Aberrometers support wave front planning that improves correction accuracy. Surgical accessories enhance workflow, while SMILE and RCLE platforms expand flapless procedure options.

- For instance, Alcon’s WaveLight excimer platform maintains over 6,000 installed users worldwide, reinforcing its global leadership in laser adoption.

Application / Refractive Error Segment

Myopia leads global demand due to rising digital strain and increasing diagnosis rates. Hyperopia treatments grow at a moderate pace, driven by improved screening and wider access to corrective tools. Astigmatism procedures rise as advanced mapping supports precise correction. Presbyopia solutions expand as aging populations seek long-term options. Clinics integrate multi-error platforms to handle diverse patient needs. Enhanced diagnostics improve treatment suitability across all categories. Greater awareness helps expand corrective volumes.

Technology / Surgery Type Segment

LASIK remains the most widely adopted due to strong safety records and predictable outcomes. PRK holds demand in cases unsuitable for corneal flaps. LASEK offers an alternative for thin-cornea groups. SMILE expands due to flapless benefits and stable healing. Phakic IOL procedures gain traction for high refractive errors. Clinics adopt multimodal platforms to serve broader patient segments. Technology diversity supports higher procedure conversions.

End User Segment

Hospitals lead usage due to advanced infrastructure and skilled surgeons. Ambulatory surgical centers gain traction with faster turnaround times and lower overheads. Ophthalmology clinics strengthen demand through specialized care models. Direct sales support large-volume buyers, while distributors serve smaller centers seeking flexible procurement.

Segmentation:

Product Type Segment

- Lasers

- Excimer Laser Systems

- Femtosecond Laser Systems

- Phakic Intraocular Lens (IOL)

- Angle Supported

- Iris Claw

- Posterior Chamber

- Microkeratome

- Aberrometers / Wavefront Aberrometry

- Surgical Instruments & Accessories

- SMILE / RCLE Platforms

Application / Refractive Error Segment

- Myopia (Nearsightedness)

- Hyperopia (Farsightedness)

- Astigmatism

- Presbyopia

Technology / Surgery Type Segment

- LASIK (Laser-Assisted in Situ Keratomileusis)

- PRK (Photorefractive Keratectomy)

- LASEK

- SMILE (Small Incision Lenticule Extraction)

- Phakic IOL Procedures

End User Segment

- Hospitals

- Ambulatory Surgical Centers

- Ophthalmology Clinics / Specialty Clinics

Regional Segment

- North America

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Thailand

- Middle East & Africa

- Saudi Arabia

- UAE

- Kuwait

- South Africa

- Latin America

Regional Analysis:

North America

The Refractive surgery devices market shows strong leadership in North America, holding the largest share at 38%. The region benefits from advanced surgical infrastructure and high adoption of premium laser platforms across major ophthalmic centers. It supports strong demand due to a large pool of trained refractive surgeons and high patient awareness. Hospitals invest in excimer and femtosecond systems to maintain competitive service portfolios. Private clinics drive elective procedure volumes through targeted vision-correction programs. Technology upgrades remain frequent in the United States, while Canada maintains steady growth through expanding specialty centers. High income levels further support continuous demand for personalized refractive solutions.

Europe

Europe remains the second-largest region, accounting for 30% of the Refractive surgery devices market. Strong regulatory standards help clinics adopt reliable and proven refractive systems. It gains sustained demand as countries like Germany, the United Kingdom, France, Italy, and Spain invest in better ophthalmic equipment. The region also benefits from expanding SMILE and PRK adoption, supported by robust surgeon training. Older demographics increase interest in presbyopia-related treatments. Hospitals enhance digital diagnostics that support refractive planning. Northern European countries maintain higher per-capita procedure volumes due to strong healthcare access.

Asia-Pacific

Asia-Pacific stands as the fastest-growing region with a 24% share supported by rapid infrastructure expansion. The Refractive surgery devices market gains momentum across China, India, Japan, and South Korea due to rising myopia prevalence and higher treatment awareness. It benefits from an expanding network of private eye hospitals that invest in advanced laser suites. Growing middle-income populations support elective treatment growth across urban centers. SMILE and phakic IOL procedures gain strong acceptance among younger consumers. Surgeons adopt multimodal technologies to address diverse refractive errors. Medical tourism in Southeast Asia strengthens surgical volumes across specialized vision centers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Alcon Inc.

- Johnson & Johnson Vision

- Carl Zeiss Meditec AG

- Bausch + Lomb

- NIDEK Co., Ltd.

- STAAR Surgical Company

- Ziemer Ophthalmic Systems AG

- SCHWIND eye-tech-solutions

- Topcon Corporation

- HOYA Corporation / HOYA Surgical Optics

- Quantel Medical

- Essilor

- Abbott Medical Optics

- Glaukos (Avedro)

- LENSAR, Inc.

- Rayner

- iVIS Technologies

Competitive Analysis:

The Refractive surgery devices market remains moderately concentrated, with a strong group of global leaders. Alcon, Johnson & Johnson Vision, Carl Zeiss Meditec, Bausch + Lomb, STAAR Surgical, NIDEK, HOYA, and Ziemer compete on technology depth and portfolio breadth. It features intense product differentiation around excimer and femtosecond platforms, SMILE systems, and phakic IOLs. Vendors focus on integrated suites that link diagnostics, planning, and laser delivery. Premium positioning targets high-volume refractive centers and ophthalmology clinics. Partnerships with hospitals and training institutes strengthen surgeon loyalty. Companies also invest in AI tools and digital workflow solutions. Price, service quality, and upgrade paths remain key decision factors for providers worldwide.

Recent Developments:

- In September 2025, Alcon Inc. launched wavelight plus, the first fully personalized LASIK treatment in the US and Canada. This innovative system leverages ray tracing technology through the Sightmap diagnostic device to create a “Digital Eye Twin,” enabling highly tailored refractive procedures for each patient. Clinical studies have shown significant improvements in visual acuity, with many patients achieving 20/20 vision or better post-surgery. The launch marks a major advancement in refractive surgery, allowing surgeons to offer premium, individualized treatments that surpass standard LASIK outcomes. Alcon’s wavelight plus is now available in North America, following successful rollouts in China and several European and Asia-Pacific markets earlier in the year.

- In September 2025, Ziemer Ophthalmic Systems AG unveiled several new innovations at ESCRS 2025, including the CLEAR Supra personalized lenticule extraction system and the FEMTO-CAIRS platform for fully customized corneal surgery. CLEAR Supra sets new standards in precision and natural vision quality, while FEMTO-CAIRS combines all features of Ziemer’s femtosecond laser into a single, versatile platform. The company also introduced AQUA LASIK with AQUARIUZ, a new standard in LASIK surgery that operates without gas and preserves corneal water content, enhancing patient comfort. These launches reflect Ziemer’s commitment to advancing refractive surgery with cutting-edge technology and improved patient outcomes.

- In September 2025, HOYA Corporation launched VisuPro™ All Day and VisuPro™ Flex advanced focus spectacle lenses for younger presbyopes. These lenses are designed to support individuals aged 36–44 who are beginning to experience early signs of presbyopia. VisuPro lenses use HOYA’s proprietary Binocular Harmonization Technology™ to harmonize prescriptions for both eyes, delivering effortless focusing, stability, and enhanced depth of vision. The launch addresses the needs of non-spectacle wearers and patients who require near vision support after refractive surgery. VisuPro lenses are now available in the US, with plans to expand to Canada later in the year.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application/Refractive Error, Technology/Surgery Type, End User, Distribution Channel, and Regional segments. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for personalized laser treatments will increase across urban refractive centers worldwide.

- Adoption of SMILE and other flapless procedures will rise among younger candidates.

- AI-assisted planning and imaging will become standard in high-volume surgical suites.

- Phakic IOL procedures will gain share in high myopia and complex refractive cases.

- Emerging markets in Asia-Pacific will drive strong expansion of private eye hospitals.

- Integration of diagnostics and laser platforms will improve workflow efficiency and outcomes.

- Training programs and digital simulators will reduce surgeon learning curves on new systems.

- Premium refractive packages will support higher revenue per procedure for clinics.

- Medical tourism hubs will invest in the latest laser suites to attract global patients.

- Sustainability and device lifecycle management will influence procurement and upgrade decisions.