Market Overview

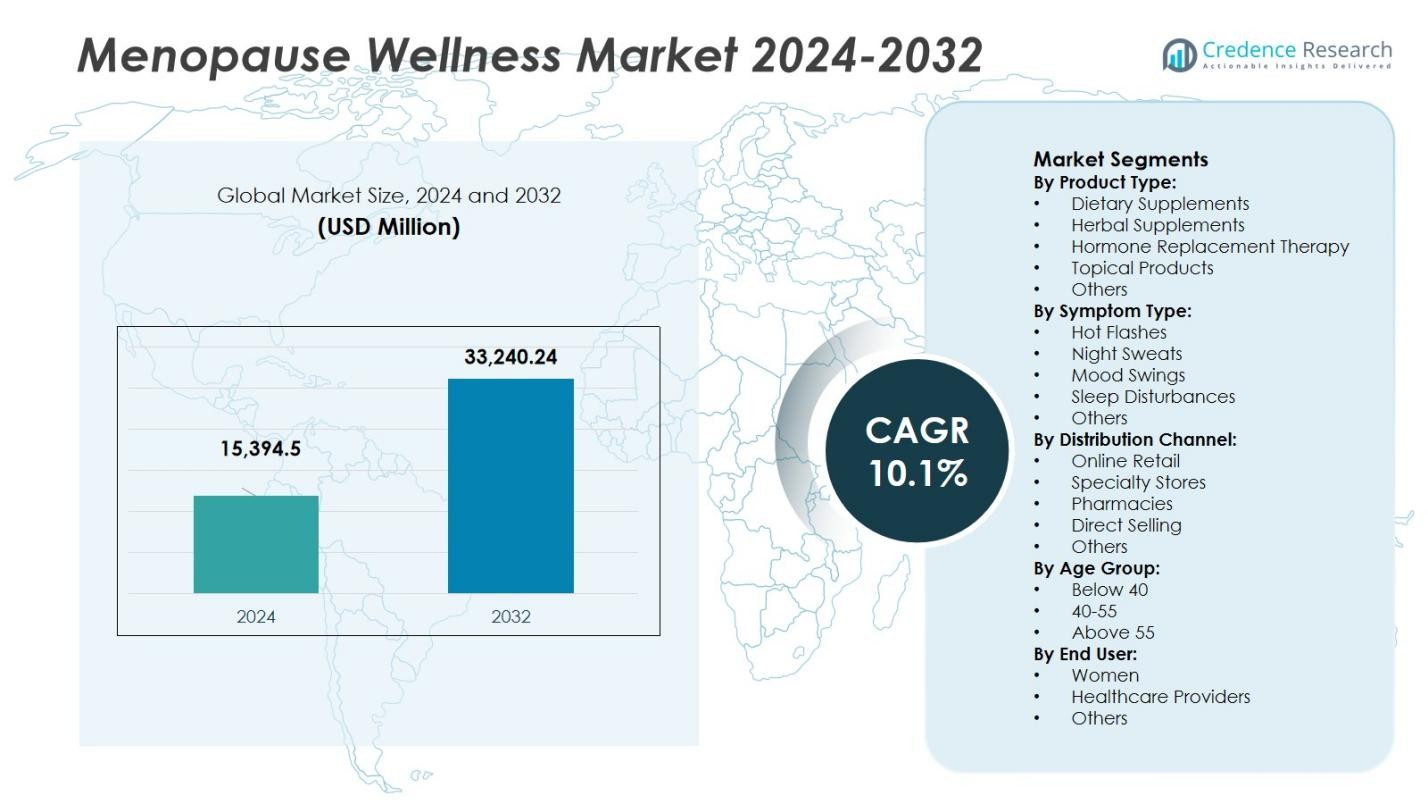

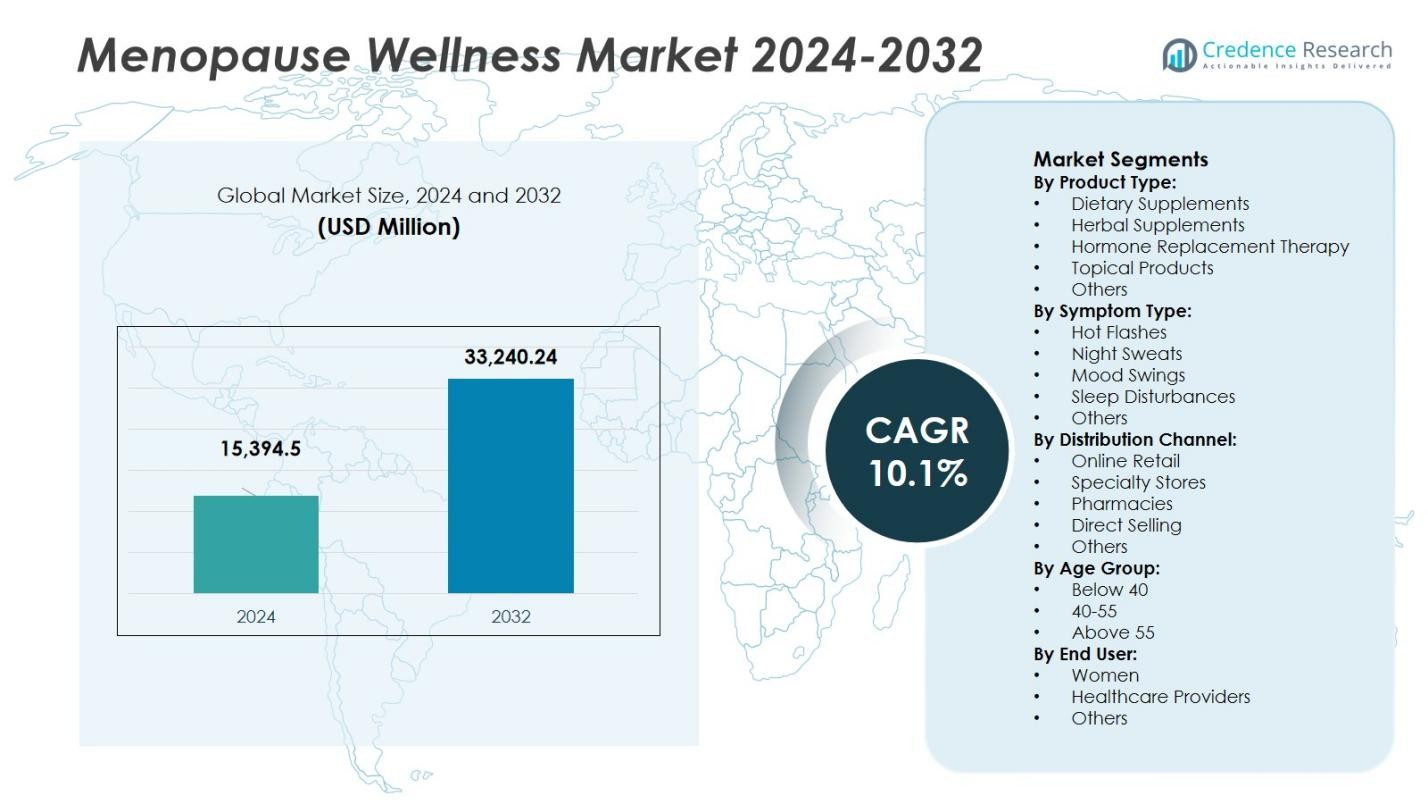

The Menopause Wellness Market size was valued at USD 15,394.5 million in 2024 and is anticipated to reach USD 33,240.24 million by 2032, at a CAGR of 10.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Menopause Wellness Market Size 2024 |

USD 15,394.5 Million |

| Menopause Wellness Market, CAGR |

10.1% |

| Menopause Wellness Market Size 2032 |

USD 33,240.24 Million |

The Menopause Wellness Market includes prominent players such as Wellness Women 360, Menopause Matters, Gennev, Femarelle, Amberen, Estroven, Equelle, MenoLabs, Replens, and Remifemin. These companies are leaders in providing solutions ranging from dietary supplements and hormone replacement therapies to topical products aimed at managing menopause symptoms. North America holds the largest market share, accounting for 37.40% in 2024. This dominance is driven by a strong healthcare infrastructure, heightened awareness of menopause, and a wide range of available products. In addition, North America benefits from a growing preference for natural and non‑hormonal remedies, along with the increasing use of e-commerce platforms for purchasing wellness products. The region’s position is strengthened by consumer-focused education and widespread access to menopause-related health solutions, ensuring continued growth and market leadership.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Menopause Wellness Market reached USD 15,394.5 million in 2024 and is projected to grow at a CAGR of 10.1% through 2032.

- Rising awareness of menopause symptoms and increasing demand for natural, non-hormonal solutions continue to drive strong adoption of supplements, herbal remedies and symptom-focused therapies.

- Key trends include personalized wellness products, digital health integration and growing focus on emotional and mental well-being, which are reshaping product innovation and consumer engagement.

- Leading brands such as Wellness Women 360, Gennev, Estroven, Amberen, Equelle and MenoLabs strengthen market activity through diversified portfolios, while challenges remain around regulatory hurdles and lack of product standardization.

- North America leads the market with 37.40% share, followed by Europe, while the hot flashes segment holds the largest share at 40% and online retail dominates distribution with 45%, highlighting strong digital-driven regional and segment growth.

Market Segmentation Analysis:

By Product Type:

The Menopause Wellness Market is segmented into dietary supplements, herbal supplements, hormone replacement therapy (HRT), topical products, and others. Among these, dietary supplements dominate the market, accounting for a significant share of approximately 35% in 2024. This growth is driven by the increasing consumer preference for non-invasive, natural solutions to manage menopause symptoms. Dietary supplements, including vitamins, minerals, and plant-based extracts, offer a holistic approach, addressing multiple menopause-related symptoms, such as hot flashes and mood swings, contributing to their widespread adoption.

- For instance, Pulmuone, a South Korean dietary supplement company, launched a product in April 2021 containing soybean and hop extracts aimed at alleviating menopause symptoms such as hot flashes and mood swings, which reflects the ongoing innovation in this space.

By Symptom Type:

The Menopause Wellness Market is further divided by symptom type, including hot flashes, night sweats, mood swings, sleep disturbances, and others. Hot flashes are the dominant sub-segment, holding the largest market share of 40% in 2024. This prevalence is driven by the fact that hot flashes are the most common and disruptive symptom of menopause, affecting a significant portion of the female population. As a result, products aimed at alleviating hot flashes, such as HRT and supplements, are in high demand, propelling the segment’s growth.

- For instance, Emcure Pharmaceuticals has launched a specialized product range targeting hot flashes and related symptoms, aiming to support women’s menopausal health with scientifically based formulations.

By Distribution Channel:

The Menopause Wellness Market is segmented by distribution channel, including online retail, specialty stores, pharmacies, direct selling, and others. Online retail is the dominant channel, capturing 45% of the market share in 2024. The convenience of purchasing products from the comfort of home, along with the increasing trend of e-commerce and the availability of a wide range of products, drives this channel’s growth. Additionally, the rise in health-conscious consumers and the ability to access detailed product reviews further contribute to the growing popularity of online retail.

Key Growth Drivers

Increasing Awareness of Menopause Symptoms

The growing awareness about menopause symptoms, such as hot flashes, mood swings, and sleep disturbances, is one of the primary drivers of the Menopause Wellness Market. More women are recognizing the importance of managing their health during menopause, leading to increased demand for wellness products. This heightened awareness is fueled by campaigns, healthcare professionals, and media outlets promoting education on menopause. As a result, women are more proactive about seeking products that help alleviate symptoms, driving market growth.

- For instance, Menopause Foundation of Canada’s “Menopause Works HereTM” campaign, which encourages employers to support women during menopause by providing workplace resources and education.

Rise in Demand for Natural and Non-Hormonal Solutions

There is a significant shift toward natural and non-hormonal solutions in the Menopause Wellness Market, particularly dietary and herbal supplements. Many women are seeking alternatives to traditional hormone replacement therapy (HRT) due to concerns over side effects and long-term risks. Natural remedies are viewed as safer and are gaining popularity for managing menopause symptoms. This growing preference for herbal and plant-based solutions is encouraging the development of new wellness products, driving the market forward.

- For instance, Vitabiotics, the UK’s leading supplement brand, offers Menopace®, a comprehensive menopause supplement range that includes soy isoflavones, red clover, and active botanicals to support women’s hormonal balance and alleviate symptoms naturally.

Increased Adoption of E-commerce Platforms

The convenience of online shopping is a key driver for the Menopause Wellness Market. E-commerce platforms offer a wide variety of products, allowing consumers to browse, compare, and purchase products from the comfort of their homes. The growth of online retail channels, along with easy access to customer reviews and product information, has made it easier for women to find and purchase menopause wellness products. The expansion of e-commerce is expected to continue fueling the market’s growth as more consumers opt for digital purchasing.

Key Trends & Opportunities

Personalized Menopause Wellness Products

One of the emerging trends in the Menopause Wellness Market is the development of personalized wellness products. With advances in technology and an increased focus on individualized care, companies are creating solutions tailored to a woman’s specific health needs. Personalized supplements and treatments that address unique symptoms or genetic factors are gaining traction. This trend presents an opportunity for companies to differentiate themselves by offering products that cater to the growing demand for personalized care in menopause management.

- For instance, Sirio Pharma’s “MenoBalance” gummy, launched with a patented soy isoflavone ingredient (Novasoy®), designed to reduce hot flashes and support bone health during menopause.

Growing Focus on Mental and Emotional Health

The growing recognition of the mental and emotional challenges associated with menopause presents an opportunity for companies to expand their product offerings. As symptoms such as mood swings, anxiety, and depression become more widely acknowledged, wellness products that address mental health are in higher demand. Companies can seize this opportunity by developing supplements and therapies that focus on mood regulation, stress relief, and cognitive well-being, opening new avenues for market growth and product innovation.

- For instance, Emcure Pharmaceuticals recently launched the Arth range of products designed to support women through menopause by alleviating symptoms such as hot flashes, night sweats, and mood swings, combining scientific research with an understanding of women’s health needs.

Key Challenges

Regulatory and Safety Concerns

One of the major challenges in the Menopause Wellness Market is navigating the regulatory landscape for supplements and hormone therapies. The approval process for new products can be lengthy and complex, and varying regulations across different regions can create barriers for manufacturers. Additionally, safety concerns regarding certain ingredients or therapies, especially those with hormonal components, can affect consumer trust and hinder market growth. Companies need to ensure their products meet regulatory standards to gain consumer confidence and avoid legal complications.

Lack of Standardization in Products

Another significant challenge in the Menopause Wellness Market is the lack of standardization in products. The variety of wellness solutions, including dietary supplements and herbal remedies, often lacks uniformity in formulation, dosage, and effectiveness. This inconsistency makes it difficult for consumers to identify the most reliable products, leading to confusion and hesitation in purchasing. To address this challenge, manufacturers must focus on standardizing product formulations and providing clear, evidence-backed information about product efficacy.

Regional Analysis

North America

In 2024, North America commanded the largest share of the global market at 37.40 %. This dominance is underpinned by advanced healthcare infrastructure, significant presence of leading market players, and heightened awareness of menopause‑related wellness solutions. The region benefits from strong reimbursement mechanisms, widespread adoption of both hormonal and non‑hormonal therapies, and digital health platforms that enhance consumer access. These factors drive accelerated product launches and consumer uptake, reinforcing North America’s leadership position and placing it well ahead of other regions in the market development cycle.

Europe

Europe occupies the second position in the menopause wellness market, driven by sizeable mature patient populations and robust healthcare systems in key countries. Consumers in Western Europe increasingly favour holistic, non-hormonal wellness remedies, while regulatory frameworks support safe product roll-out and clinical studies. With aging demographics and rising female health awareness, Europe captures 32% of the global market share in 2024, and serves as a strategic zone for product diversification and premium wellness offerings. Healthcare professionals and wellness brands are collaborating to convert medical need into commercial growth.

Asia-Pacific

The Asia-Pacific region is emerging as a major growth arena, supported by a surge in awareness of menopause symptoms, growing middle-class spending power, and expansion of healthcare access. Nations such as China, India, Japan, and Australia are witnessing rising demand for dietary supplements, herbal therapy, and wellness services. Although Asia-Pacific held a smaller share relative to North America in 2024 23%, its high compound annual growth potential positions the region as a key future contributor. Manufacturers and brands are actively tailoring formulations and marketing to regional cultural sensitivities and lifestyle trends.

Latin America

Latin America is experiencing steady progress in the menopause wellness domain, with Brazil and Mexico leading dissemination of awareness campaigns, product launches, and distribution improvements. While its share remains moderate 12%, adoption of natural remedies and online retail channels is accelerating. Investments in women’s health and supportive wellness infrastructure are gradually converting latent demand into consumer uptake. Challenges such as variable regulatory regimes and infrastructure gaps persist but offer opportunities for market entrants with local insight.

Middle East & Africa (MEA)

The MEA region currently represents the smallest share among major regions, yet it is poised for expansion as health-awareness improves and wellness-oriented spending climbs. Cultural shifts, increasing female workforce participation, and growing availability of menopause-specific products through e-commerce are supporting market momentum. While MEA’s share in 2024 remains modest 6%, the region presents a strategic frontier for wellness companies offering localized and affordable solutions. Tailored marketing and education initiatives will be essential for unlocking MEA growth potential.

Market Segmentations:

By Product Type:

- Dietary Supplements

- Herbal Supplements

- Hormone Replacement Therapy

- Topical Products

- Others

By Symptom Type:

- Hot Flashes

- Night Sweats

- Mood Swings

- Sleep Disturbances

- Others

By Distribution Channel:

- Online Retail

- Specialty Stores

- Pharmacies

- Direct Selling

- Others

By Age Group:

By End User:

- Women

- Healthcare Providers

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Menopause Wellness Market is robust, with leading players including Pfizer Inc., Bayer AG, Herbalife Nutrition Ltd., Amway Corp., and GlaxoSmithKline plc spearheading innovation and market reach. These companies command substantial shares through diversified portfolios spanning dietary supplements, hormone therapies, and topical solutions, thereby establishing strong barriers to entry for smaller brands. Strategic initiatives such as product launches tailored to symptom‑specific needs, partnerships with digital wellness platforms, and geographic expansion into emerging markets further strengthen their positions. The stringent regulatory frameworks and high development costs contribute to industry consolidation, offering larger firms economies of scale and marketing leverage. As consumer demands evolve toward personalized and holistic menopause wellness solutions, leaders in the market continue to invest in evidence‑based formulations, leveraging clinical research data and professional endorsements to build brand trust and maintain competitive advantage.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In January 2024, Dr. Reddy’s Laboratories acquired the women’s wellness portfolio of MenoLabs (from organization”,”Amyris Inc.”,0]), which includes seven branded products designed for perimenopause and menopause symptoms as well as the “MenoLife” health‑tracker app.

- In October 2025, Menoveda announced its U.S. launch — a plant‑based, Ayurveda‑inspired menopause wellness brand founded by Tamanna Singh and Gautam Singh.

- In September 2023, Pierre Fabre Laboratories acquired a stake in MiYé (a start‑up focusing on hormonal balance and wellness, including menopausal women’s care).

Report Coverage

The research report offers an in-depth analysis based on Product Type, Symptom Type, Distribution Channel, Age group, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing numbers of women entering perimenopause and menopause will drive sustained demand for symptom‑relief and wellness solutions.

- Rising consumer preference for non‑hormonal, natural and plant‑based remedies will increasingly shape product portfolios and innovation pipelines.

- Expansion of digital health, telemedicine, symptom‑tracking apps and personalized wellness platforms will enhance access and consumer engagement.

- Manufacturers and wellness brands will intensify focus on holistic solutions addressing physical, emotional and cognitive aspects of menopause.

- Emerging markets in Asia‑Pacific, Latin America and MEA will present high‑growth opportunities as awareness, income levels and distribution infrastructure improve.

- Tailored marketing and education campaigns will remove stigma, increase diagnosis and fuel uptake of menopause‑specific products and services.

- Partnerships across pharma, digital health, femtech and retail channels will accelerate product development and omnichannel distribution.

- Increasing regulatory scrutiny and need for clinical validation will drive brands to invest more in evidence‑based formulations and transparent efficacy claims.

- Segmented offerings for niche symptom types (e.g., sleep disturbances, mood swings, urogenital health) will expand beyond traditional hot‑flash relief.

- Sustainability, premiumization and lifestyle‑driven wellness (including bone‑health, cardiovascular support and longevity) will emerge as differentiators in the market.