Market Overview

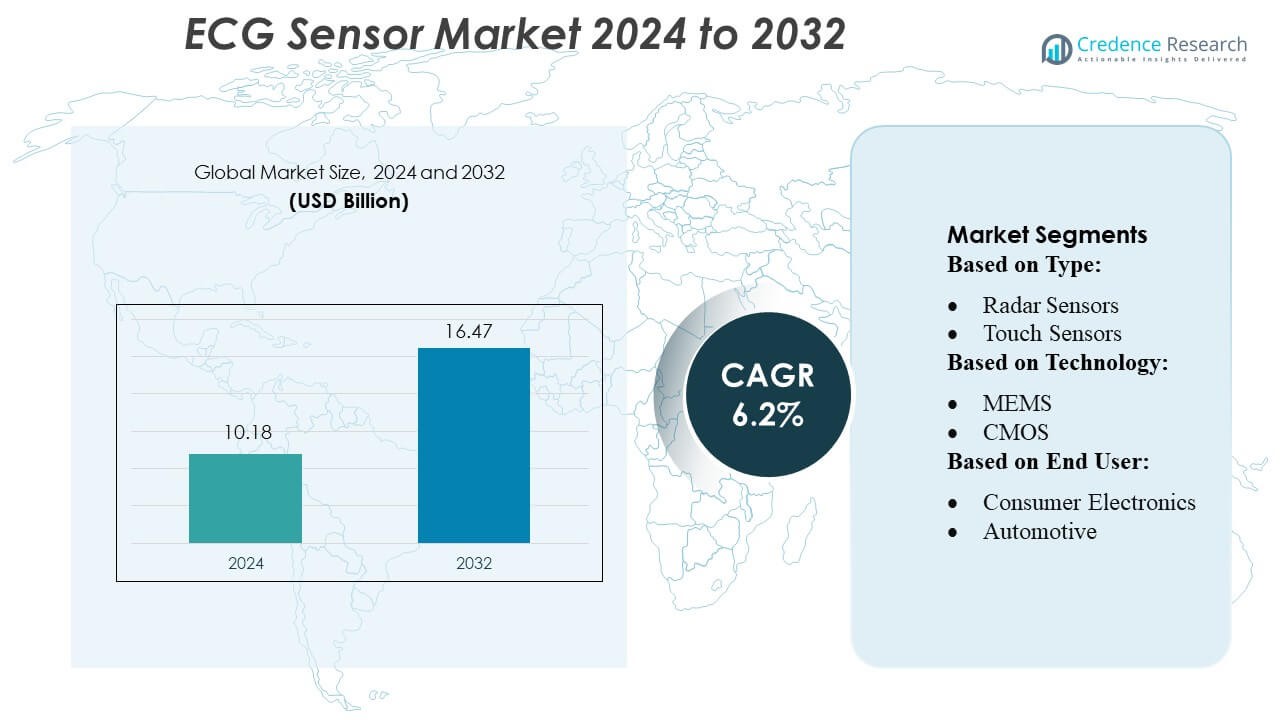

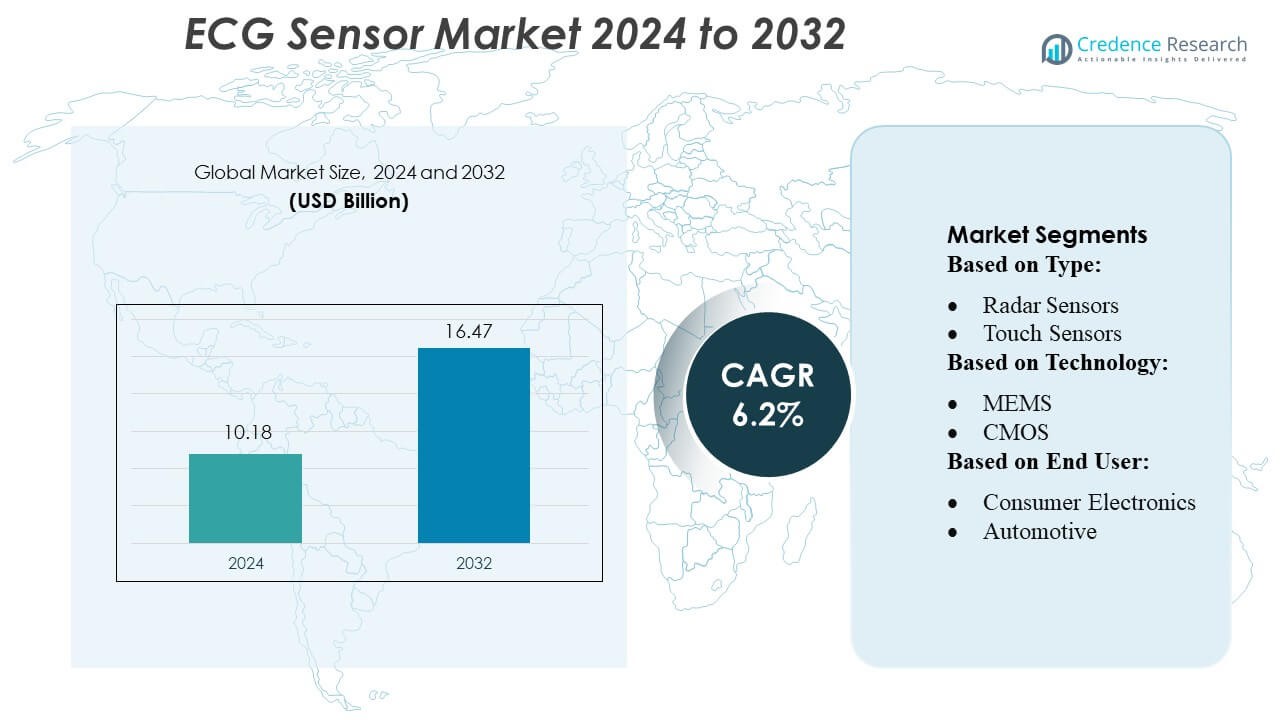

ECG Sensor Market size was valued USD 10.18 billion in 2024 and is anticipated to reach USD 16.47 billion by 2032, at a CAGR of 6.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| ECG Sensor Market Size 2024 |

USD 10.18 Billion |

| ECG Sensor Market, CAGR |

6.2% |

| ECG Sensor Market Size 2032 |

USD 16.47 Billion |

The ECG sensor market is shaped by major players such as Medtronic, Philips Healthcare, GE Healthcare, Analog Devices, Texas Instruments, and NXP Semiconductors, all of which focus on developing high-accuracy, low-power biosensing technologies for clinical and wearable applications. These companies strengthen their positions through innovations in MEMS-based sensors, flexible monitoring patches, and AI-enhanced cardiac analytics. North America leads the global market with approximately 40% share, supported by strong healthcare infrastructure, rapid adoption of remote monitoring devices, and a high concentration of advanced medical technology manufacturers, making it the most dominant and mature regional market for ECG sensor solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The ECG Sensor Market was valued at USD 10.18 billion in 2024 and is expected to reach USD 16.47 billion by 2032, registering a CAGR of 6.2%, driven by rising demand for continuous cardiac monitoring and integration of ECG features in wearables.

- Increasing adoption of remote patient monitoring, growth in smartwatches with ECG capabilities, and wider use of MEMS-based biosensors are shaping major market trends.

- Competitive dynamics are defined by companies such as Medtronic, Philips, GE Healthcare, Analog Devices, Texas Instruments, and NXP Semiconductors, each investing in low-power, high-accuracy ECG technologies and AI-driven analytics.

- Market restraints include signal noise challenges in wearables, high regulatory compliance requirements, and limited access to advanced diagnostic devices in emerging economies.

- North America leads with around 40% share, while biosensors hold the dominant segment share, supported by strong clinical adoption and expanding use in digital health platforms.

Market Segmentation Analysis:

By Type

Biosensors dominate the ECG sensor market within the broader sensor type classification, accounting for the largest share due to their direct role in capturing electrical cardiac signals with high precision. Their growth is driven by rising cardiovascular disease prevalence, increased adoption of wearable health devices, and continuous advancements in miniaturized, low-power biomedical components. While radar, optical, and image sensors support auxiliary monitoring features in advanced systems, biosensors remain the core technology integrated into ECG patches, chest straps, and medical-grade diagnostic tools, reinforcing their leadership position across clinical and consumer applications.

- For instance, Robert Bosch LLC’s sensing division (Bosch Sensortec) has advanced ultra-low-power physiological monitoring platforms such as the BHI260AP, which supports advanced activity-recognition algorithms on-chip with a typical power draw of around 249 µA at 1.8 V in self-learning mode (25 Hz), enabling continuous biometric monitoring in compact wearables.

By Technology

MEMS technology holds the dominant share in the ECG sensor market, supported by its extensive use in compact, low-noise, and energy-efficient biomedical sensing modules. MEMS-based ECG components enable high signal accuracy and stable long-term monitoring, driving their adoption in wearables, portable diagnostic systems, and remote patient-monitoring platforms. CMOS-based designs are gaining traction for integration into multifunctional chips, but MEMS maintains leadership due to its reliability, manufacturing maturity, and compatibility with flexible health-monitoring devices, sustaining strong demand across both clinical and consumer device ecosystems.

- For instance, Membrapor’s recent electrochemical sensor platforms—such as its CO-S and O₂-S series in miniature “S” housing—feature micro-structured sensing layers with the capability for fast response times (some models can achieve a T90 response time of <10 seconds), and a consistent expected long-term output or baseline drift of below 2% signal loss per month for many models, demonstrating the company’s capability in producing highly stable, miniaturized sensor architectures.

By End Users

Biomedical and healthcare applications represent the largest end-user segment, capturing the dominant market share as hospitals, diagnostic centers, and remote-care platforms increasingly deploy ECG monitoring solutions for continuous cardiac assessment. Growth is propelled by expanding telehealth adoption, higher diagnostic accuracy requirements, and the need for long-duration ambulatory monitoring in chronic cardiac conditions. Consumer electronics follow closely with rapid integration of ECG features into smartwatches and fitness devices, but the biomedical segment remains the primary driver due to clinical validation standards and strong demand for medical-grade cardiac monitoring technologies.

Key Growth Drivers

- Rising Prevalence of Cardiovascular Diseases

Growing global incidence of arrhythmias, heart failure, and ischemic heart disease drives strong demand for accurate and continuous cardiac monitoring, positioning ECG sensors as essential diagnostic components. Healthcare systems increasingly emphasize early detection, remote supervision, and long-term monitoring, boosting adoption in both clinical equipment and wearable medical devices. The shift toward preventive care and home-based monitoring further accelerates purchases of high-precision ECG patches, electrodes, and integrated biosensors, making cardiovascular disease burden a primary driver of sustained market expansion.

- For instance, Siemens Healthineers integrates advanced ECG-gated cardiac monitoring into its SOMATOM Force platform, achieving temporal resolution as low as 66 ms, enabling highly precise rhythm-synchronized cardiac imaging that supports early detection of electrical abnormalities.

- Rapid Expansion of Wearable and Remote Health Technologies

The widespread adoption of smartwatches, fitness bands, and connected health devices significantly enhances the market for compact ECG sensors. Wearables now integrate multi-parameter health tracking, pushing manufacturers to develop ultra-low-power, miniaturized ECG modules with improved signal accuracy. Remote patient-monitoring programs and telehealth platforms increasingly rely on continuous ECG data to support real-time diagnostics and post-treatment follow-ups. This transition from episodic, clinic-based monitoring to everyday health tracking strengthens demand for embedded ECG sensing technologies across consumer and medical applications.

- For instance, Nemoto & Co. Ltd. demonstrates advanced micro-sensor engineering through its NAP-505 and NAP-508 electrochemical sensor series, which operate with virtually no power consumption (drawing current from the electrochemical reaction itself) and deliver typical T90 response times of <30 seconds (for the NAP-505 and NAP-508) or even <10 seconds for specific catalytic models like the NAP-50A, reflecting the company’s capability in precision miniaturized sensing technologies.

- Advancements in Sensor Miniaturization and Integration

Progress in MEMS, flexible electronics, and low-power signal-processing technologies fuels the development of highly integrated ECG sensors suitable for compact and unobtrusive devices. Manufacturers are designing thin, skin-conformal sensors and multi-sensor modules that collect higher-quality data while reducing noise and power consumption. These innovations enable broader deployment in wearable medical patches, implantables, and portable diagnostic systems. Increasing R&D investments in integrated SoC-based biosensing platforms further enhance device efficiency, making technological advancement a major growth catalyst in the ECG sensor market.

Key Trends & Opportunities

- Growing Adoption of AI-Enabled Cardiac Analytics

AI-based algorithms are increasingly integrated with ECG sensors to improve arrhythmia detection, automate signal interpretation, and support predictive cardiac risk assessment. Device manufacturers collaborate with digital health platforms to pair ECG hardware with cloud-based analytics, enabling faster decision-making and personalized treatment plans. This trend opens new opportunities for advanced diagnostic wearables, remote monitoring tools, and intelligent home-care systems. As healthcare ecosystems shift toward data-driven care models, AI-supported ECG sensing solutions become central to next-generation cardiac monitoring.

- For instance, Figaro Engineering Inc. demonstrates strong capability in ultra-low-power signal-detection hardware through its MEMS-based TGS8100 gas sensor, which operates with a typical heater power consumption of only 15 mW and provides a “quick response” characteristic suitable for intermittent power applications.

- Expansion of ECG Functionality in Consumer Electronics

Smartwatches, earbuds, fitness trackers, and connected patches increasingly incorporate ECG sensing features, expanding the market beyond traditional medical devices. Consumer adoption accelerates as users seek real-time cardiac insights and wellness monitoring, offering substantial revenue opportunities for sensor makers. The trend drives demand for miniaturized, low-energy ECG modules compatible with multifunctional consumer platforms. Continuous product innovation and regulatory approvals for consumer-grade ECG wearables strengthen the segment, creating long-term growth potential in lifestyle and preventive-health markets.

- For instance, GfG Gas Detection UK Ltd, although primarily a gas detection firm, showcases its prowess in compact electrochemical sensing technology: their fixed gas sensor supports a standard 4–20 mA analog output (or 0.2–1 mA), operates on a 12–30 V DC supply, and typically offers a T90 response time of less than 30 seconds (depending on the specific gas type), demonstrating its ability to deliver reliable measurements from a small, robust device.

- Rising Demand for Flexible and Skin-Conformal Sensors

Advances in soft materials and printed electronics allow manufacturers to develop flexible ECG sensors that adhere comfortably to the body for extended monitoring. These next-generation sensors provide superior mobility, high-fidelity signal capture, and reduced motion artifacts, enabling opportunities in athletic performance tracking, neonatal monitoring, and chronic disease management. Their lightweight design supports multi-day monitoring without discomfort, making them attractive for hospitals and home-care environments. Increasing research investments in stretchable electronics and biosensing films further accelerate this opportunity.

Key Challenges

- Signal Noise and Motion Artifacts in Wearable Devices

Despite technology improvements, wearable ECG sensors still struggle with motion-induced noise, inconsistent skin contact, and environmental interference, affecting signal accuracy. These limitations complicate arrhythmia detection and reduce diagnostic reliability in non-clinical settings. Ensuring stable signal acquisition during daily activities requires advanced filtering algorithms, improved electrode materials, and more robust mechanical design. Manufacturers face continued pressure to balance device comfort with high-precision performance, making signal consistency a major technical challenge in expanding wearable ECG applications.

- Regulatory Compliance and Clinical Validation Requirements

ECG sensors used in medical-grade devices must meet stringent regulatory approvals and undergo rigorous clinical validation, extending development timelines and increasing product costs. Manufacturers need to comply with safety, accuracy, and biocompatibility standards across multiple regions, which challenges smaller companies with limited resources. Continuous updates to global medical device regulations also create compliance complexities. These regulatory barriers may slow market entry for innovative products, making certification and validation requirements a critical challenge in scaling ECG sensor technologies.

Regional Analysis

North America

North America holds the largest share of the ECG sensor market, accounting for around 40%. Strong healthcare infrastructure, high prevalence of heart disease, and widespread use of digital health tools drive the region’s dominance. The U.S. leads with rapid adoption of wearable ECG devices, strong investments in remote monitoring, and continuous product innovation by major technology and medical device companies. Supportive reimbursement systems and rising demand for home-based cardiac monitoring further strengthen market growth. Canada also contributes through expanding telehealth programs and growing use of connected diagnostic devices.

Europe

Europe captures about 20–25% of the ECG sensor market, supported by advanced healthcare systems and strong regulatory backing for digital health adoption. Countries such as Germany, the UK, and France drive demand with increasing use of remote cardiac monitoring, rising awareness of preventive care, and growing elderly populations. Wearable ECG devices gain traction as consumers shift toward proactive health tracking. Investments in telemedicine and digital diagnostics continue to expand, helping the region maintain its position as a major market for both clinical-grade and consumer-grade ECG sensor solutions.

Asia Pacific

Asia Pacific accounts for nearly 30% of the global ECG sensor market and remains the fastest-growing region. Rising cardiovascular disease cases, expanding healthcare access, and rapid growth of wearable technology adoption are major drivers. China and India lead with increasing demand for affordable and portable monitoring solutions, while Japan drives market growth through advanced medical technologies and aging demographics. Governments across the region are investing in digital health platforms, boosting the adoption of remote monitoring and ECG-enabled wearables across urban and rural populations.

Latin America

Latin America holds around 5–7% of the ECG sensor market, with growth led by Brazil and Mexico. Rising awareness of cardiac health, improving healthcare infrastructure, and expanding telemedicine access support market development. Wearable ECG devices are gradually gaining popularity as consumers show greater interest in continuous health tracking. Although reimbursement and technological adoption challenges persist, ongoing healthcare reforms and increasing private-sector investments create steady opportunities for ECG sensor manufacturers in the region.

Middle East & Africa

The Middle East and Africa account for about 5–6% of the ECG sensor market, driven by growing healthcare modernization and rising cases of lifestyle-related cardiac disorders. The Gulf countries lead in adoption due to strong investments in hospital infrastructure and digital health technologies. Wearable monitoring devices and remote diagnostic tools are gaining interest as governments promote digital transformation. While much of Africa remains early in adoption, increasing access to connected healthcare solutions and expanding urban populations offer long-term potential for ECG sensor market growth.

Market Segmentations:

By Type:

- Radar Sensors

- Touch Sensors

By Technology:

By End User:

- Consumer Electronics

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the ECG sensor market includes key players such as Dynament, Robert Bosch LLC, Membrapor, Siemens, Nemoto & Co. Ltd., Figaro Engineering Inc., GfG Gas Detection UK Ltd., AlphaSense Inc., ABB Ltd., and City Technology Ltd. The ECG sensor market features a growing mix of established medical device manufacturers, semiconductor companies, and emerging health-tech innovators. Competition intensifies as firms focus on developing miniaturized, low-power ECG sensors that offer higher signal accuracy, improved biocompatibility, and better integration with wearable and remote-monitoring platforms. Companies increasingly invest in AI-driven analytics to enhance arrhythmia detection and real-time cardiac insights, strengthening the value of their sensor offerings. Partnerships with telehealth providers, cloud-based monitoring platforms, and consumer electronics brands also shape the market, enabling broader adoption across clinical diagnostics, home-care monitoring, and fitness applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dynament

- Robert Bosch LLC

- Membrapor

- Siemens

- Nemoto & Co. Ltd.

- Figaro Engineering Inc.

- GfG Gas Detection UK Ltd.

- AlphaSense Inc.

- ABB Ltd.

- City Technology Ltd.

Recent Developments

- In January 2025, Bosch Sensortec’s sensors are evolving to be smarter – by integrating MEMS technology with embedded microcontrollers, software, and AI runs inside the sensor. CEO Stefan Finkbeiner noted that these solutions supported applications in consumer health, smart homes, and smart cities, with AI and intelligent software as the core enablers.

- In October 2024, AlphaSense introduced PIDX, a new PID (Photoionization Detector) sensor technology designed to improve gas detection capabilities. The sensor offers higher sensitivity and accuracy, particularly for detecting volatile organic compounds (VOCs) at low concentrations.

- In February 2024, Thyracore acquires Think Health a key industry player in home ECG services. As a result, Thyrocare has now positioned itself as one of the leading providers of at-home healthcare services in India.

Report Coverage

The research report offers an in-depth analysis based on Type, Technology, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The ECG sensor market will continue expanding as demand rises for continuous cardiac monitoring in both clinical and home-care settings.

- Wearable devices will integrate more advanced ECG sensing capabilities as consumers seek real-time heart health insights.

- AI-driven analytics will enhance early detection of cardiac abnormalities and improve diagnostic accuracy.

- Flexible and skin-conformal ECG sensors will gain traction for long-duration and comfortable monitoring.

- Remote patient-monitoring programs will accelerate adoption of compact, low-power ECG modules.

- Integration of ECG sensors into multi-parameter health platforms will become more common across smart devices.

- Sensor miniaturization will advance further, enabling seamless use in fitness wearables and medical patches.

- Regulatory approvals for consumer-grade ECG devices will expand, broadening market access.

- Cloud-connected ECG systems will support faster data sharing between patients and healthcare professionals.

- Growing focus on preventive healthcare will drive wider adoption of ECG-enabled digital health solutions.